Deck 6: Internal Control and Accounting for Cash

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/141

Play

Full screen (f)

Deck 6: Internal Control and Accounting for Cash

1

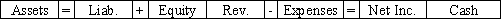

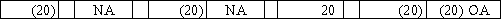

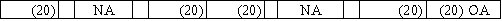

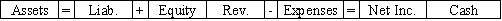

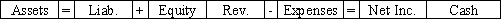

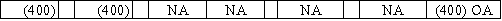

Use the following to answer questions

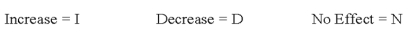

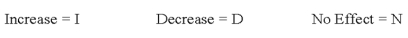

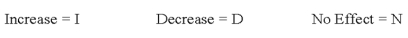

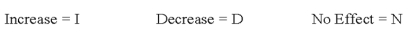

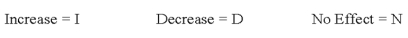

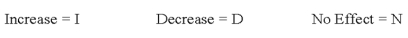

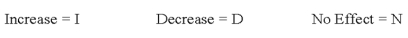

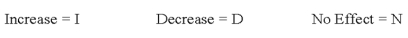

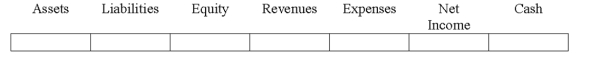

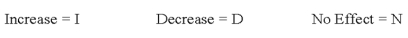

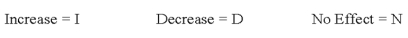

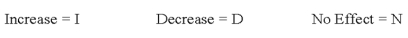

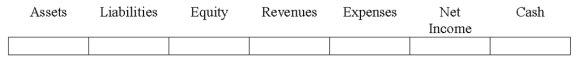

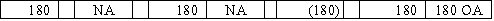

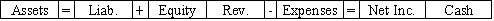

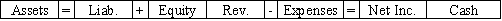

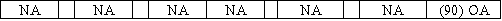

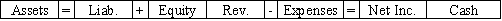

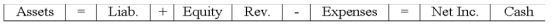

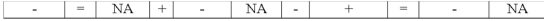

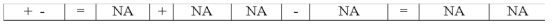

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

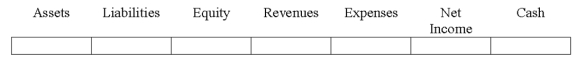

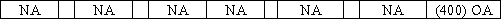

At Landau Company,the petty cash custodian used petty cash to pay for postage charges.

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

At Landau Company,the petty cash custodian used petty cash to pay for postage charges.

(N)(N)(N)(N)(N)(N)(N)

2

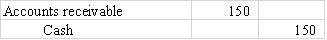

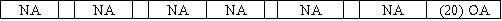

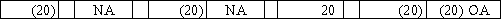

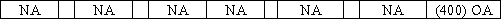

Use the following to answer questions

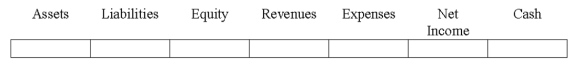

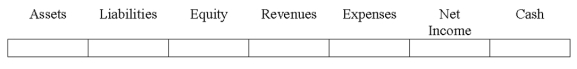

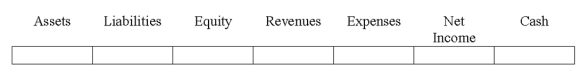

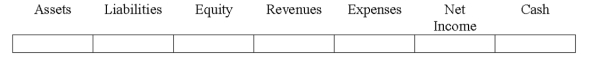

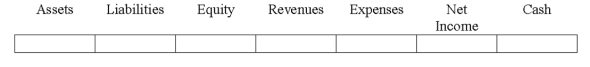

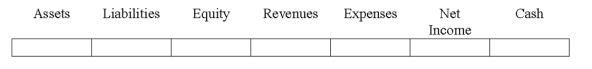

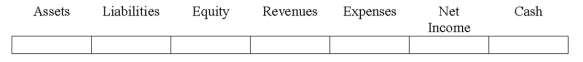

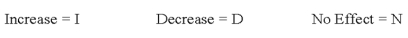

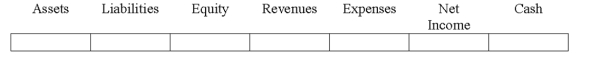

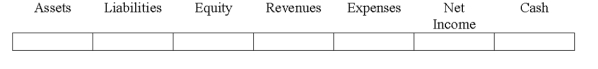

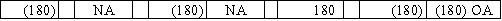

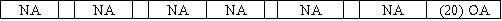

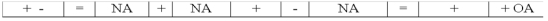

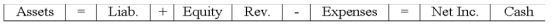

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

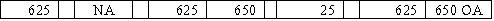

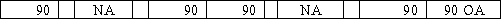

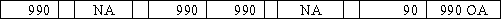

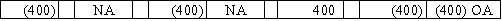

In preparing the bank reconciliation for Heath Company,an employee discovered an error.A $654 cash receipt for the collection of an account receivable was recorded in the company's books as $645.The deposit slip was correct,and the bank deposit had been correctly prepared.The error appeared only in the company's accounting records.

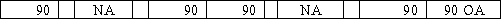

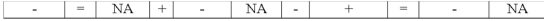

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

In preparing the bank reconciliation for Heath Company,an employee discovered an error.A $654 cash receipt for the collection of an account receivable was recorded in the company's books as $645.The deposit slip was correct,and the bank deposit had been correctly prepared.The error appeared only in the company's accounting records.

(N)(N)(N)(N)(N)(N)(I)

3

How do accounting controls differ from administrative controls?

Accounting controls are designed to safeguard company assets and ensure reliable accounting records.Administrative controls,on the other hand,are concerned with evaluating performance and assessing compliance with laws and company policies.

4

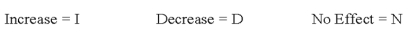

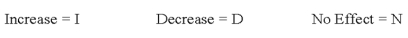

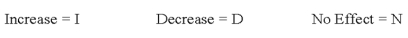

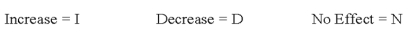

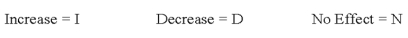

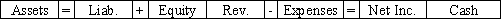

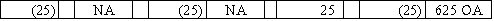

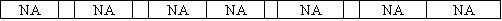

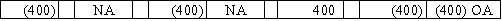

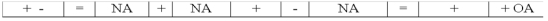

Use the following to answer questions

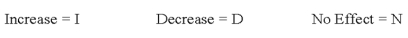

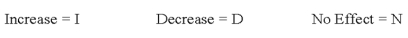

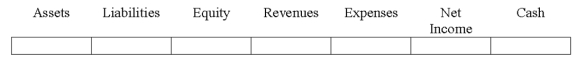

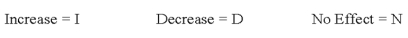

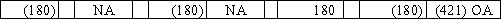

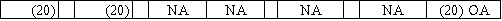

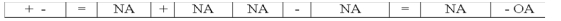

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

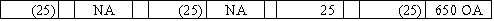

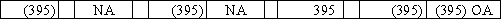

During the process of preparing the bank reconciliation,an employee for Heath Company discovered that Check #4261 for $65,used to pay an account payable,was recorded in the company books as $56.

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

During the process of preparing the bank reconciliation,an employee for Heath Company discovered that Check #4261 for $65,used to pay an account payable,was recorded in the company books as $56.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

5

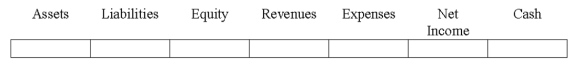

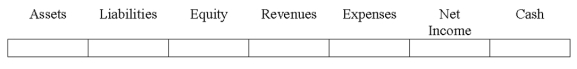

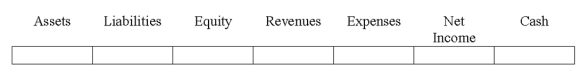

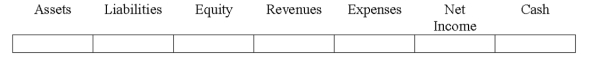

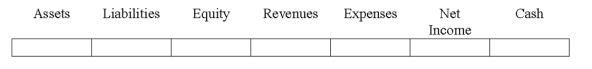

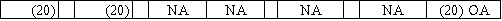

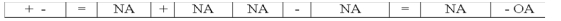

Use the following to answer questions

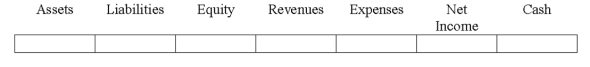

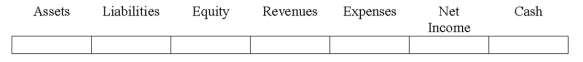

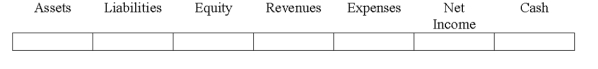

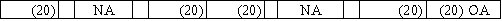

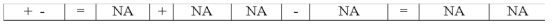

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

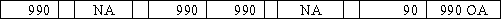

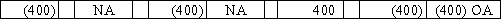

Landau Company established a petty cash fund by issuing a check in the amount of $500 to the petty cash custodian.

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

Landau Company established a petty cash fund by issuing a check in the amount of $500 to the petty cash custodian.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

6

Use the following to answer questions

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

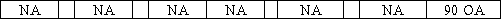

At June 30,2016,when Heath Company was preparing the bank reconciliation,the employee preparing the reconciliation found that the company had outstanding checks in the amount of $2,650.

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

At June 30,2016,when Heath Company was preparing the bank reconciliation,the employee preparing the reconciliation found that the company had outstanding checks in the amount of $2,650.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

7

List three of the five interrelated components of the internal control framework established by The Committee of Sponsoring Organizations of the Treadway Commission (COS0)that serve as the standards for Sarbanes-Oxley compliance.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

8

Use the following to answer questions

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

In preparing the bank reconciliation for Heath Company,an employee found that the bank statement reported a bank service charge of $50.

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

In preparing the bank reconciliation for Heath Company,an employee found that the bank statement reported a bank service charge of $50.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

9

What is a fidelity bond and what is its purpose?

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

10

Use the following to answer questions

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

During the process of preparing the bank reconciliation,an employee for Heath Company discovered that the bank deducted a check from the Hearst Company (a different company).

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

During the process of preparing the bank reconciliation,an employee for Heath Company discovered that the bank deducted a check from the Hearst Company (a different company).

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

11

Use the following to answer questions

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

In preparing the bank reconciliation for Heath Company,an employee found that a certified check that the company had used to settle an account payable remained outstanding.

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

In preparing the bank reconciliation for Heath Company,an employee found that a certified check that the company had used to settle an account payable remained outstanding.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

12

List five internal control procedures that should be followed to safeguard cash and reduce the likelihood of theft.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

13

Use the following to answer questions

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

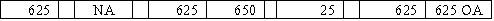

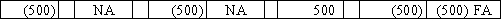

Landau Company replenished its petty cash fund.The expenditures of the fund included postage,office supplies,and other miscellaneous items.Indicate the effects of recognizing the expenditures on financial statements and the replenishment of the petty cash fund.

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

Landau Company replenished its petty cash fund.The expenditures of the fund included postage,office supplies,and other miscellaneous items.Indicate the effects of recognizing the expenditures on financial statements and the replenishment of the petty cash fund.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

14

Use the following to answer questions

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

In preparing the bank reconciliation for Heath Company,an employee discovered that the bank had collected one of the company's notes receivable in the amount of $20,000 and had deposited this amount in the company's account at the bank.This amount does not include interest.

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

In preparing the bank reconciliation for Heath Company,an employee discovered that the bank had collected one of the company's notes receivable in the amount of $20,000 and had deposited this amount in the company's account at the bank.This amount does not include interest.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

15

What asset is generally most susceptible to theft?

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

16

List three measures that a business can use to achieve strong internal controls.

Any three of the following:

Any three of the following:

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

17

Explain the meaning of "internal control" and distinguish between administrative controls and accounting controls.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

18

Use the following to answer questions

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

In preparing the bank reconciliation of Heath Company,an employee found that the company had deposits in transit of $2,200.

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

In preparing the bank reconciliation of Heath Company,an employee found that the company had deposits in transit of $2,200.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

19

For internal control purposes,what is meant by "separation of duties?"

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

20

Use the following to answer questions

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

In preparing the bank reconciliation for Heath Company,a company employee found that the bank statement included an NFS check that the company had received from a customer paying its account at Heath Company.

Indicate how each event affects the elements of financial statements.Use the following letters to record your answer in the box shown below each element.You do not need to enter amounts.Enter only one letter for each element.

In preparing the bank reconciliation for Heath Company,a company employee found that the bank statement included an NFS check that the company had received from a customer paying its account at Heath Company.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

21

What is a deposit in transit?

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

22

Is the establishment of a petty cash fund an asset source,asset use,asset exchange,or claims exchange transaction?

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following statements accurately describes a fidelity bond?

A)Procedures to provide reasonable assurance that the objectives of a company are accomplished.

B)Proper procedures for processing transactions.

C)Insurance that the company buys to protect itself from loss due to employee dishonesty.

D)Guidelines or policies that limit the actions of different levels of management.

A)Procedures to provide reasonable assurance that the objectives of a company are accomplished.

B)Proper procedures for processing transactions.

C)Insurance that the company buys to protect itself from loss due to employee dishonesty.

D)Guidelines or policies that limit the actions of different levels of management.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

24

In establishing a strong internal control system at Banks Company,management is concerned with administrative controls.Administrative controls include:

A)performance evaluation

B)accuracy of the recording procedures.

C)keeping cash in a safe.

D)maintenance of accurate inventory records.

A)performance evaluation

B)accuracy of the recording procedures.

C)keeping cash in a safe.

D)maintenance of accurate inventory records.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is not considered an accounting control?

A)Requiring employees to take vacations.

B)Performance evaluations.

C)Bonding of employees.

D)Use of prenumbered documents.

A)Requiring employees to take vacations.

B)Performance evaluations.

C)Bonding of employees.

D)Use of prenumbered documents.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following statements concerning internal controls is true?

A)Internal administrative controls are designed to limit the amount of funds spent on investments.

B)Strong internal controls provide reasonable assurance that the objectives of a company will be accomplished.

C)Internal accounting controls are limited to the policies and procedures used to protect the company from embezzlement.

D)The control procedure,separation of duties,prohibits the employment of a husband and wife or other closely related parties within the same company.

A)Internal administrative controls are designed to limit the amount of funds spent on investments.

B)Strong internal controls provide reasonable assurance that the objectives of a company will be accomplished.

C)Internal accounting controls are limited to the policies and procedures used to protect the company from embezzlement.

D)The control procedure,separation of duties,prohibits the employment of a husband and wife or other closely related parties within the same company.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

27

What are the primary roles of the independent auditor? What professional license is required of an independent auditor?

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

28

What is a disclaimer of audit opinion?

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

29

What are the three types of audit opinion,and what is the meaning of each? Which type of opinion is considered the best?

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

30

What is the purpose of establishing a petty cash fund?

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

31

Which internal control procedure addresses the idea that the likelihood of employee fraud or theft is reduced if collusion is required to accomplish it?

A)Separation of duties.

B)Physical controls.

C)Fidelity bonding.

D)Use of prenumbered documents.

A)Separation of duties.

B)Physical controls.

C)Fidelity bonding.

D)Use of prenumbered documents.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

32

Are outstanding checks an adjustment to the book balance,the bank balance,or not used in a bank reconciliation?

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

33

List three of the five primary roles of the independent auditor (CPA).

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following is not one of the purposes of an internal control system?

A)Safeguarding the company's assets.

B)The evaluation of performance.

C)The assessment of the degree of compliance with company policies and public laws.

D)Ensuring that the company is using the most effective marketing plan.

A)Safeguarding the company's assets.

B)The evaluation of performance.

C)The assessment of the degree of compliance with company policies and public laws.

D)Ensuring that the company is using the most effective marketing plan.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

35

What term is used for a customer's check that is returned by the bank on which it was drawn because the customer did not have enough funds to pay the check?

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

36

When a "debit memo" is included in a bank statement,what effect does that have on the cash balance?

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

37

Petty cash funds are maintained on an imprest basis.Explain the advantage of using the imprest basis in accounting for petty cash.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following is not a generally recognized internal control procedure?

A)Establishment of clear lines of authority.

B)Having employees covered by a fidelity bond.

C)Requiring regular vacations for certain employees.

D)Customer service comment cards.

A)Establishment of clear lines of authority.

B)Having employees covered by a fidelity bond.

C)Requiring regular vacations for certain employees.

D)Customer service comment cards.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

39

Chester Company has established internal control policies and procedures in order to achieve the following objectives:

1)Effective evaluation of management performance.

2)Assure that the accounting records contain reliable information.

3)Safeguard the company's assets.

4)Assure that employees comply with company policy.

Which of these objectives are achieved by accounting controls?

A)Objectives 1 and 2

B)Objectives 2 and 3

C)Objectives 3 and 4

D)All four objectives

1)Effective evaluation of management performance.

2)Assure that the accounting records contain reliable information.

3)Safeguard the company's assets.

4)Assure that employees comply with company policy.

Which of these objectives are achieved by accounting controls?

A)Objectives 1 and 2

B)Objectives 2 and 3

C)Objectives 3 and 4

D)All four objectives

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

40

What is meant by the term "materiality?"

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

41

Effective internal controls for cash include

A)disbursements made by prenumbered check.

B)cash deposited in the bank on a timely basis.

C)written cash receipts given to customers as evidence of payment.

D)all of these answer choices are correct.

A)disbursements made by prenumbered check.

B)cash deposited in the bank on a timely basis.

C)written cash receipts given to customers as evidence of payment.

D)all of these answer choices are correct.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

42

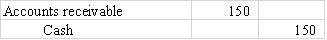

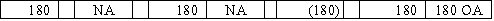

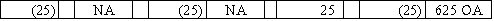

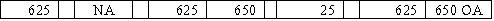

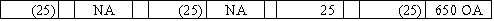

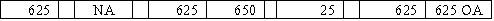

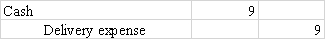

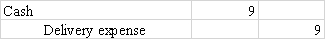

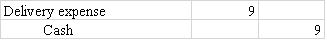

Following the February bank reconciliation,the accountant made the following entry in the journal of Kincaid Company:

This journal entry may have been used to record:

A)an NSF check received by Kincaid from a customer.

B)the collection of an account receivable by Kincaid that is part of a deposit in transit.

C)bank charges owed by Kincaid to the bank.

D)the collection of an account receivable by the bank that has been deposited in Kincaid's account.

This journal entry may have been used to record:

A)an NSF check received by Kincaid from a customer.

B)the collection of an account receivable by Kincaid that is part of a deposit in transit.

C)bank charges owed by Kincaid to the bank.

D)the collection of an account receivable by the bank that has been deposited in Kincaid's account.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

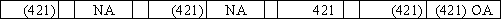

43

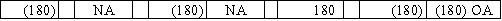

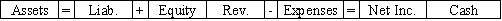

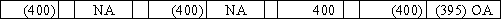

While performing its monthly bank reconciliation,the bookkeeper for the Mosaic Company discovered that a check written for $421 for advertising expense was recorded in the firm's books as $241.Which of the following shows the effect of the correcting entry on the financial statements?

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

44

While performing the monthly bank reconciliation,the bookkeeper for Avon Company made the journal entry for a bank service charge of $20.Which of the following correctly shows the effect of the entry on the financial statements?

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

45

The April 30,2016 bank statement for Trimble Corporation shows an ending balance of $34,351.The unadjusted cash account balance was $28,250.The accountant for Trimble gathered the following information:

1)There was a deposit in transit for $4,240

2)The bank statement reports a service charge of $39

3)A credit memo included in the bank statement shows interest earned of $95

4)Outstanding checks totaled $10,935

5)The bank statement included a $650 NSF check deposited in April

What is the true cash balance as of April 30,2016?

A)$27,656

B)$27,006

C)$31,801

D)$31,896

1)There was a deposit in transit for $4,240

2)The bank statement reports a service charge of $39

3)A credit memo included in the bank statement shows interest earned of $95

4)Outstanding checks totaled $10,935

5)The bank statement included a $650 NSF check deposited in April

What is the true cash balance as of April 30,2016?

A)$27,656

B)$27,006

C)$31,801

D)$31,896

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following is not a motive for the embezzlement of cash by employees?

A)Cash is the common unit of measurement.

B)Ownership of cash is difficult to prove.

C)Cash has universal appeal.

D)Small quantities of high denomination can represent significant amounts of value.

A)Cash is the common unit of measurement.

B)Ownership of cash is difficult to prove.

C)Cash has universal appeal.

D)Small quantities of high denomination can represent significant amounts of value.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

47

At March 31,Cummins Co.had a balance in its cash account of $10,400.At the end of March the company determined that it had outstanding checks of $900,deposits in transit of $600,a bank service charge of $20,and an NSF check from a customer for $200.The true cash balance at March 31 is:

A)$10,100

B)$10,180

C)$10,380

D)$9,880

A)$10,100

B)$10,180

C)$10,380

D)$9,880

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

48

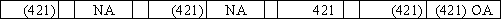

While preparing its bank reconciliation,Maynard Company determined that its bank had collected a $650 account receivable for the company and deducted a $25 collection fee.Which of the following shows the effect of this transaction on the financial statements?

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following is not a procedure to maintain internal controls over cash payments?

A)A receipt should be provided to each cash customer.

B)Checks should be properly authorized with approval signatures.

C)All checks should be prenumbered.

D)Voided checks should be defaced and retained.

A)A receipt should be provided to each cash customer.

B)Checks should be properly authorized with approval signatures.

C)All checks should be prenumbered.

D)Voided checks should be defaced and retained.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

50

For which of the following bank reconciliation adjustments would an adjusting journal entry not be necessary?

A)An error in which the company's accountant recorded a check as $235 that was written correctly for $253.

B)A check for $37 deposited during the month,but returned for non-sufficient funds.

C)An error in which the bank charged the company $83 for a check that had been written by another account holder.

D)All of these answer choices would require adjusting journal entries.

A)An error in which the company's accountant recorded a check as $235 that was written correctly for $253.

B)A check for $37 deposited during the month,but returned for non-sufficient funds.

C)An error in which the bank charged the company $83 for a check that had been written by another account holder.

D)All of these answer choices would require adjusting journal entries.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

51

Which document issued by a bank reflects a transaction that decreases a company's checking account balance?

A)A debit entry.

B)A debit memo.

C)A credit memo.

D)A reconciling entry.

A)A debit entry.

B)A debit memo.

C)A credit memo.

D)A reconciling entry.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

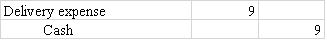

52

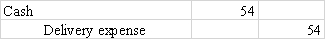

In preparing the April bank reconciliation for Oscar Company,it was discovered that on April 10 a check was written to pay delivery expense of $45 but the check was erroneously recorded as $54 in the company's books.The journal entry required to correct the error is

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

53

What documentation issued by a bank increases a company's checking account balance at the bank?

A)Credit memo

B)Debit memo

C)Balance sheet

D)Certified check

A)Credit memo

B)Debit memo

C)Balance sheet

D)Certified check

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

54

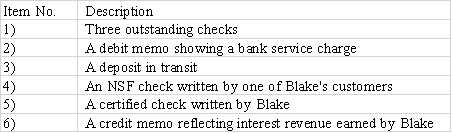

Use the following to answer questions

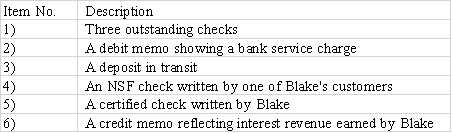

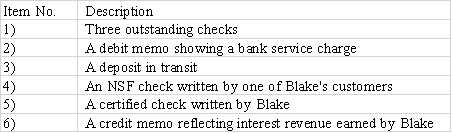

A review of the bank statement and accounting records of the Blake Company revealed the following items:

-Which of the item(s)would be subtracted from the company's unadjusted book balance to determine the true cash balance?

A)Item numbers 2 and 4.

B)Item numbers 2,4,and 5.

C)Item numbers 1 and 4.

D)Item numbers 1,2,4,and 5.

A review of the bank statement and accounting records of the Blake Company revealed the following items:

-Which of the item(s)would be subtracted from the company's unadjusted book balance to determine the true cash balance?

A)Item numbers 2 and 4.

B)Item numbers 2,4,and 5.

C)Item numbers 1 and 4.

D)Item numbers 1,2,4,and 5.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

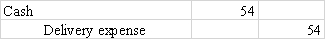

55

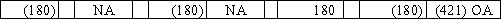

While performing its monthly bank reconciliation,the bookkeeper for the Grace Corporation noted that a deposit of $990 (received from a customer on account)was recorded in the company books as $900.Which of the following shows the effect of the correcting entry on the financial statements?

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following is not an internal control procedure for the control of cash receipts?

A)Immediate preparation of records of all cash receipts.

B)Customers should be given written receipts for all monies paid.

C)All cash should be deposited frequently.

D)Use of prenumbered checks.

A)Immediate preparation of records of all cash receipts.

B)Customers should be given written receipts for all monies paid.

C)All cash should be deposited frequently.

D)Use of prenumbered checks.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

57

The accountant for Ye Olde Bookstore balanced out the cash register for the day.The register indicates $1,031.50 in sales,the change fund at the beginning of the day was $125 and the actual cash in the register is $1,150.25 (including the change fund,previously accounted for).What is the effect on the financial statements of the entry to record the day's sales and any related overage or shortage?

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following is an internal control procedure used to safeguard a company's assets?

A)Timely deposits of cash receipts into a checking account.

B)Separation of duties.

C)Reconciliation of the bank statement.

D)All of these answer choices are correct.

A)Timely deposits of cash receipts into a checking account.

B)Separation of duties.

C)Reconciliation of the bank statement.

D)All of these answer choices are correct.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following is not a typical form associated with a bank checking account?

A)Signature card

B)Bank statement

C)Debit memo

D)Deposit ticket

A)Signature card

B)Bank statement

C)Debit memo

D)Deposit ticket

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

60

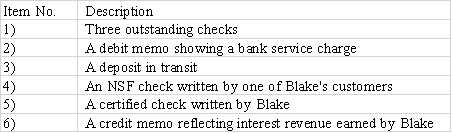

Use the following to answer questions

A review of the bank statement and accounting records of the Blake Company revealed the following items:

-Which of the item(s)would be added to the unadjusted bank balance to determine the true cash balance?

A)Item numbers 3 and 3.

B)Item number 2.

C)Item numbers 3,4,and 6.

D)Item number 3.

A review of the bank statement and accounting records of the Blake Company revealed the following items:

-Which of the item(s)would be added to the unadjusted bank balance to determine the true cash balance?

A)Item numbers 3 and 3.

B)Item number 2.

C)Item numbers 3,4,and 6.

D)Item number 3.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

61

How will a certified check be treated in a company's bank reconciliation?

A)As a deduction to the company's unadjusted book balance.

B)As an increase to the bank's unadjusted bank balance.

C)As a deduction to the bank's unadjusted bank balance.

D)There is no adjustment when preparing the bank reconciliation.

A)As a deduction to the company's unadjusted book balance.

B)As an increase to the bank's unadjusted bank balance.

C)As a deduction to the bank's unadjusted bank balance.

D)There is no adjustment when preparing the bank reconciliation.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

62

Rainey Company's true cash balance at October 31,2016 is $5,710.The following information is available for the bank reconciliation:

Outstanding checks,$600

Deposits in transit,$450

Bank service charges,$90

The bank had collected an account receivable for Rainey Company,$1,000

The bank statement included an NSF check written by one of Ramsey's customers for $600.

Based on this information Rainey's unadjusted book balance at October 31 is:

A)$5,870.

B)$5,400.

C)$6,400.

D)$5,490.

Outstanding checks,$600

Deposits in transit,$450

Bank service charges,$90

The bank had collected an account receivable for Rainey Company,$1,000

The bank statement included an NSF check written by one of Ramsey's customers for $600.

Based on this information Rainey's unadjusted book balance at October 31 is:

A)$5,870.

B)$5,400.

C)$6,400.

D)$5,490.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

63

On September 30,2016,the bank statement of Fine Company showed a balance of $7,800.The following information was revealed by comparing the bank statement to the cash balance in Fine's accounting records:

(1)deposits in transit amounted to $3,150

(2)outstanding checks amounted to $6,200

(3)a $550 check was incorrectly drawn on Fine's account

(4)NSF checks returned by the bank were $750

(5)bank service charge was $29

(6)credit memo for $75 for the collection of one of the company's account receivable

Based on the above information the true cash balance was:

A)$5,346.

B)$5,300.

C)$4,596.

D)$7,096.

(1)deposits in transit amounted to $3,150

(2)outstanding checks amounted to $6,200

(3)a $550 check was incorrectly drawn on Fine's account

(4)NSF checks returned by the bank were $750

(5)bank service charge was $29

(6)credit memo for $75 for the collection of one of the company's account receivable

Based on the above information the true cash balance was:

A)$5,346.

B)$5,300.

C)$4,596.

D)$7,096.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

64

The entry to replenish a petty cash fund includes:

A)A credit to Cash.

B)A credit to Petty Cash.

C)Credits to expenses.

D)A debit to Cash.

A)A credit to Cash.

B)A credit to Petty Cash.

C)Credits to expenses.

D)A debit to Cash.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

65

Use the following to answer questions

The bank statement for Tetra Company contained the following items: a bank service charge of $10;a credit memo for interest earned,$15;and a $50 NSF check from a customer.The company had outstanding checks of $100 and a deposit in transit of $300.

-The entry to record the customer's NSF check will:

A)increase the Accounts Receivable balance.

B)decrease the Cash account.

C)decrease equity.

D)increase the Accounts Receivable balance and decrease the Cash account balance.

The bank statement for Tetra Company contained the following items: a bank service charge of $10;a credit memo for interest earned,$15;and a $50 NSF check from a customer.The company had outstanding checks of $100 and a deposit in transit of $300.

-The entry to record the customer's NSF check will:

A)increase the Accounts Receivable balance.

B)decrease the Cash account.

C)decrease equity.

D)increase the Accounts Receivable balance and decrease the Cash account balance.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following internal control procedures does not ordinarily apply to the management of the petty cash fund?

A)Use of prenumbered documents.

B)Separation of duties.

C)Use of physical controls.

D)All of these answer choices apply to the management of a petty cash fund.

A)Use of prenumbered documents.

B)Separation of duties.

C)Use of physical controls.

D)All of these answer choices apply to the management of a petty cash fund.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

67

In a bank reconciliation,a customer's NSF check included with the bank statement is:

A)deducted from the company's cash balance to get the true cash balance.

B)added to the bank's cash balance to get the true cash balance.

C)deducted from the bank's cash balance to get the true cash balance.

D)added to the company's cash balance to get the true cash balance.

A)deducted from the company's cash balance to get the true cash balance.

B)added to the bank's cash balance to get the true cash balance.

C)deducted from the bank's cash balance to get the true cash balance.

D)added to the company's cash balance to get the true cash balance.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

68

Use the following to answer questions

The bank statement for Tetra Company contained the following items: a bank service charge of $10;a credit memo for interest earned,$15;and a $50 NSF check from a customer.The company had outstanding checks of $100 and a deposit in transit of $300.

-Assuming that the unadjusted bank balance was $500,determine the unadjusted book balance.

A)$745.

B)$455.

C)$700.

D)$800.

The bank statement for Tetra Company contained the following items: a bank service charge of $10;a credit memo for interest earned,$15;and a $50 NSF check from a customer.The company had outstanding checks of $100 and a deposit in transit of $300.

-Assuming that the unadjusted bank balance was $500,determine the unadjusted book balance.

A)$745.

B)$455.

C)$700.

D)$800.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

69

What account is used to record the amount of cash shortages or overages relative to a petty cash system?

A)Petty Cash Payable

B)Gain or Loss on Petty Cash

C)Petty Cash Expense

D)Cash Short and Over

A)Petty Cash Payable

B)Gain or Loss on Petty Cash

C)Petty Cash Expense

D)Cash Short and Over

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

70

Gross Company established a $250 petty cash fund on January 1,2016.On March 1,2016 the fund contained $160 in receipts for miscellaneous expenses and $85 in cash.The entries necessary to replenish the petty cash fund will

A)have no effect on total assets.

B)decrease equity by $160.

C)increase equity by $165.

D)decrease assets by $165.

A)have no effect on total assets.

B)decrease equity by $160.

C)increase equity by $165.

D)decrease assets by $165.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

71

Owen Company's unadjusted book balance at June 30,2016 is $9,700.The company's bank statement reveals bank service charges of $45.Two credit memos are included in the bank statement: one for $900,which represents a collection that the bank made for Owen,and one for $50,which represents the amount of interest that Owen had earned on its interest-bearing account in June.Based on this information,Owen's true cash balance is:

A)$9,700.

B)$10,695.

C)$10,550.

D)$10,605.

A)$9,700.

B)$10,695.

C)$10,550.

D)$10,605.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

72

Blake Company established a petty cash fund in the amount of $400.At the end of the accounting period,the petty cash box contained receipts for expenditures amounting to $180 and $215 in cash.What effect will the entries to replenish the fund have on assets and expenses?

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

73

On April 30,2016,Midwest Company established a petty cash fund of $1,000.On May 1,2016,a disbursement of $355 was made from the fund for payment of delivery expense.What entry should be made on May 1,2016 to record this disbursement?

A)Debit delivery expense,$355;credit cash,$355.

B)Debit petty cash,$355;credit cash,$355.

C)Debit delivery expense,$355;credit petty cash $355.

D)No entry is necessary on May 1.

A)Debit delivery expense,$355;credit cash,$355.

B)Debit petty cash,$355;credit cash,$355.

C)Debit delivery expense,$355;credit petty cash $355.

D)No entry is necessary on May 1.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

74

Peterson Company's petty cash fund was established on January 1,2016 with $500.On January 31,2016 a count of the fund revealed: $105 in cash remaining and vouchers for miscellaneous payments totaling $400.What effect will the necessary entries to replenish the fund have on the company's financial statements?

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

75

In the reconciliation of the June bank statement,a deposit made on June 30 did not appear on the June bank statement.In preparing the bank reconciliation,this deposit in transit should be:

A)subtracted from the unadjusted book balance.

B)added to the unadjusted book balance.

C)subtracted from the unadjusted bank balance.

D)added to the unadjusted bank balance.

A)subtracted from the unadjusted book balance.

B)added to the unadjusted book balance.

C)subtracted from the unadjusted bank balance.

D)added to the unadjusted bank balance.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

76

The owner of the Barnes Company established a petty cash fund amounting to $400.What is the effect on the financial statements of the entry to record this transaction?

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

77

Jasper Company accepted a check from Harp Company as payment for services rendered.Jasper's bank statement revealed that the Harp check was an NSF check.What effect will the entry to record the NSF check have on the accounting equation of Jasper Company?

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

78

Duke Company's unadjusted bank balance at March 31,2016 is $2,300.The bank reconciliation revealed outstanding checks amounting to $500 and deposits in transit of $400.Based on this information,Duke's true cash balance is:

A)$2,200.

B)$2,000.

C)$2,700.

D)$2,400.

A)$2,200.

B)$2,000.

C)$2,700.

D)$2,400.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

79

In a company's bank reconciliation,an outstanding check is a check that:

A)has been issued by the company but has not been presented to the bank for payment.

B)is guaranteed for payment by the bank.

C)has been presented to the bank for payment but has not been reported on the bank statement.

D)has been written for an amount that is greater than the balance in the account holder's bank account.

A)has been issued by the company but has not been presented to the bank for payment.

B)is guaranteed for payment by the bank.

C)has been presented to the bank for payment but has not been reported on the bank statement.

D)has been written for an amount that is greater than the balance in the account holder's bank account.

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck

80

Use the following to answer questions

The bank statement for Tetra Company contained the following items: a bank service charge of $10;a credit memo for interest earned,$15;and a $50 NSF check from a customer.The company had outstanding checks of $100 and a deposit in transit of $300.

-Keatts Company's bank statement included an NSF check written by one of its customers.What effect will the entry to recognize the NSF check have on the company's financial statements?

The bank statement for Tetra Company contained the following items: a bank service charge of $10;a credit memo for interest earned,$15;and a $50 NSF check from a customer.The company had outstanding checks of $100 and a deposit in transit of $300.

-Keatts Company's bank statement included an NSF check written by one of its customers.What effect will the entry to recognize the NSF check have on the company's financial statements?

Unlock Deck

Unlock for access to all 141 flashcards in this deck.

Unlock Deck

k this deck