Deck 16: Decreases in Ownership Interest

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/4

Play

Full screen (f)

Deck 16: Decreases in Ownership Interest

1

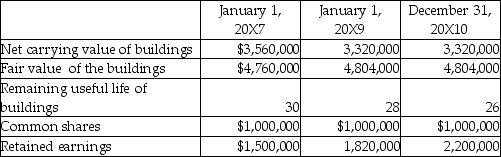

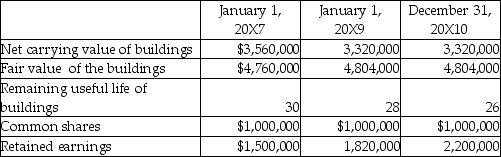

On January 1,20X7,Water Limited purchased 700,000 shares of Bottle Inc.for $2.8 million.On January 1,20X9,Water sold 150,000 shares of Bottle for $700,000.During the entire period Bottle had 1,000,000 shares outstanding.Water accounts for its investment in Bottle under the equity method.The following information was extracted from the financial records of Bottle:

All net identifiable assets had a fair value equal to their carrying value on the date of acquisition except the buildings.There is no goodwill reported on the separate entity financial statements of Water or Bottle.There have been no intercompany transactions between Water and Bottle.

Required:

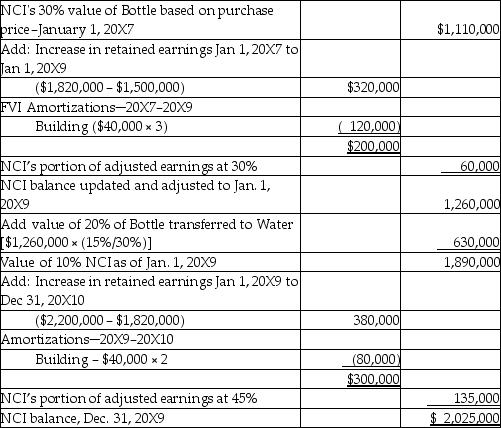

Calculate the balances of following accounts on the consolidated statement of financial position at December 31,20X10,under the parent-company extension method:

a.Goodwill

b.NCI

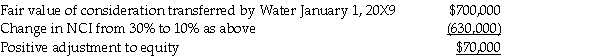

Determine the adjustment to equity required.

All net identifiable assets had a fair value equal to their carrying value on the date of acquisition except the buildings.There is no goodwill reported on the separate entity financial statements of Water or Bottle.There have been no intercompany transactions between Water and Bottle.

Required:

Calculate the balances of following accounts on the consolidated statement of financial position at December 31,20X10,under the parent-company extension method:

a.Goodwill

b.NCI

Determine the adjustment to equity required.

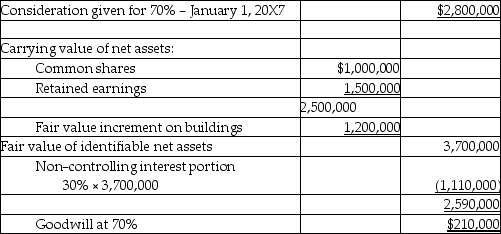

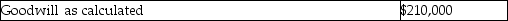

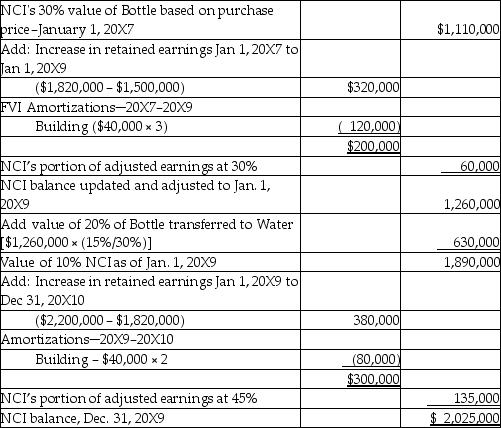

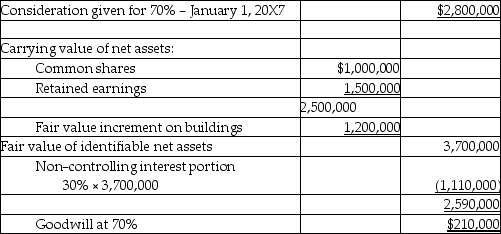

Measure: Determine goodwill

Building Fair value increment Amortization per year:

Building Fair value increment Amortization per year:

Fair value increment = $1,200,000 / 30 = $40,000 annually.

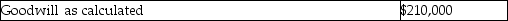

a.

Note- this balance will not change as percentage ownership is added as long as control is maintained.

Note- this balance will not change as percentage ownership is added as long as control is maintained.

b)

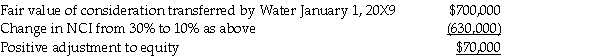

Adjustment to equity:

Adjustment to equity:

Building Fair value increment Amortization per year:

Building Fair value increment Amortization per year:Fair value increment = $1,200,000 / 30 = $40,000 annually.

a.

Note- this balance will not change as percentage ownership is added as long as control is maintained.

Note- this balance will not change as percentage ownership is added as long as control is maintained.b)

Adjustment to equity:

Adjustment to equity:

2

Frey Ltd.acquired 70% of Sabo Ltd.several years ago.On January 1,20X8,Frey reduced its holding in Sabo by 10%.The shares were sold for $160,000.At December 31,20X7,under the entity method,the balance of Frey's share of Sabo's net assets was $84,000.What adjustment should be made to the consolidated shareholders' equity to reflect Frey's reduction in interest in Sabo to 60%?

A)$76,000

B)$84,000

C)$148,000

D)$160,000

A)$76,000

B)$84,000

C)$148,000

D)$160,000

A

3

Gumble Ltd.has owned 65% of the common shares of Lopez for several years.This year,Gumble reduced its interest in Lopez to 10%.Which of the following statements is true?

A)Gumble must change from reporting under consolidation to the equity method.

B)Gumble must change from reporting under consolidation to the cost method.

C)Gumbel must change from reporting under the equity method to the cost method.

D)Gumble is not required to change its reporting method.

A)Gumble must change from reporting under consolidation to the equity method.

B)Gumble must change from reporting under consolidation to the cost method.

C)Gumbel must change from reporting under the equity method to the cost method.

D)Gumble is not required to change its reporting method.

B

4

When a subsidiary issues shares,________.

A)no gain or loss is recognized

B)a gain or loss is always recognized

C)this reduces minority interest

D)this may increase minority interest

A)no gain or loss is recognized

B)a gain or loss is always recognized

C)this reduces minority interest

D)this may increase minority interest

Unlock Deck

Unlock for access to all 4 flashcards in this deck.

Unlock Deck

k this deck