Deck 6: Bonds

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/110

Play

Full screen (f)

Deck 6: Bonds

1

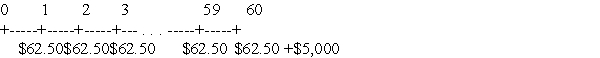

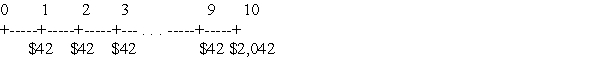

A corporation issues a bond that generates the above cash flows.If the periods shown are 3 months,which of the following best describes that bond?

A)a 15-year bond with a notional value of $5000 and a coupon rate of 5% paid quarterly

B)a 15-year bond with a notional value of $5000 and a coupon rate of 1.25% paid annually

C)a 30-year bond with a notional value of $5000 and a coupon rate of 3.75% paid semiannually

D)a 60- year bond with a notional value of $5000 and a coupon rate of 5% paid quarterly

A

2

A bond is said to mature on the date when the issuer repays its notional value.

True

3

How are the cash flows of a coupon bond different from an amortizing loan?

A coupon bond pays interest over the life of the bond and returns the principal at the end of the term.Thus the cash flows are smaller over the life of the bond with a lump-sum payment at the end.In contrast,an amortizing loan has identical cash flows over its life with a part of the cash flow going toward interest and the balance as return of principal.

4

Which of the following statements is FALSE?

A)Bonds are a securities sold by governments and corporations to raise money from investors today in exchange for promised future payments.

B)By convention the coupon rate is expressed as an effective annual rate.

C)Bonds typically make two types of payments to their holders.

D)The time remaining until the repayment date is known as the term of the bond.

A)Bonds are a securities sold by governments and corporations to raise money from investors today in exchange for promised future payments.

B)By convention the coupon rate is expressed as an effective annual rate.

C)Bonds typically make two types of payments to their holders.

D)The time remaining until the repayment date is known as the term of the bond.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

5

How much will the coupon payments be of a 20-year $500 bond with a 8% coupon rate and quarterly payments?

A)$3.33

B)$10.00

C)$20.00

D)$40.00

A)$3.33

B)$10.00

C)$20.00

D)$40.00

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

6

A bond certificate indicates:

A)the amounts and dates of all payments to be made.

B)the individual to whom payments will be made.

C)the yield to maturity of the bond.

D)the price of the bond

A)the amounts and dates of all payments to be made.

B)the individual to whom payments will be made.

C)the yield to maturity of the bond.

D)the price of the bond

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

7

The only cash payment an investor in a zero-coupon bond receives is the face value of the bond on its maturity date.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is true about the face value of a bond?

A)It is the notional amount we use to compute coupon payments.

B)It is the amount that is repaid at maturity.

C)It is usually denominated in standard increments,such as $1,000.

D)All of the above are true.

A)It is the notional amount we use to compute coupon payments.

B)It is the amount that is repaid at maturity.

C)It is usually denominated in standard increments,such as $1,000.

D)All of the above are true.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

9

How much will the coupon payments be of a 30-year $10,000 bond with a 4.5% coupon rate and semiannual payments?

A)$30

B)$225

C)$350

D)$450

A)$30

B)$225

C)$350

D)$450

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

10

How are investors in zero-coupon bonds compensated for making such an investment?

A)Such bonds are purchased at their face value and sold at a premium at a later date.

B)The bond makes regular interest payments.

C)Such bonds are purchased at a discount to their face value.

D)The face value of these bonds is less than the value of the bond when the bond matures.

A)Such bonds are purchased at their face value and sold at a premium at a later date.

B)The bond makes regular interest payments.

C)Such bonds are purchased at a discount to their face value.

D)The face value of these bonds is less than the value of the bond when the bond matures.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

11

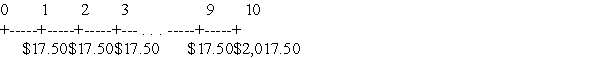

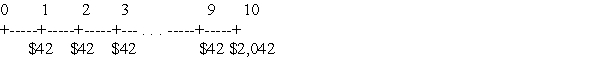

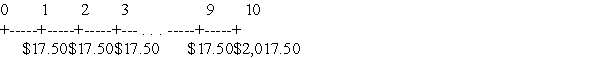

Which of the following best shows the timeline for cash flows from a five-year bond with a face value of $2,000,a coupon rate of 4.2%,and semiannual payments?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following best illustrates why a bond is a type of loan?

A)The issuers of bonds regularly pay interest on the face value of the bond to the buyers of those bonds.

B)When a company issues a bond,the buyer of that bond becomes a part owner of the issuing company.

C)Federal and local governments issue bonds to finance long-term projects.

D)When an investor buys a bond from an issuer,the investor is giving money to the issuer,with the assurance it will be repaid at a date in the future.

A)The issuers of bonds regularly pay interest on the face value of the bond to the buyers of those bonds.

B)When a company issues a bond,the buyer of that bond becomes a part owner of the issuing company.

C)Federal and local governments issue bonds to finance long-term projects.

D)When an investor buys a bond from an issuer,the investor is giving money to the issuer,with the assurance it will be repaid at a date in the future.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

13

What is the yield to maturity of a one-year,risk-free,zero-coupon bond with a $10,000 face value and a price of $9600 when released?

A)3.212%

B)4.000%

C)4.167%

D)9.600%

A)3.212%

B)4.000%

C)4.167%

D)9.600%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

14

A university issues a bond with a face value of $10,000 and a coupon rate of 5.65% that matures on 07/15/2015.The holder of such a bond receives coupon payments of $282.50.How frequently are coupon payments made in this case?

A)monthly

B)quarterly

C)semiannually

D)annually

A)monthly

B)quarterly

C)semiannually

D)annually

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

15

A corporate bond makes payments of $9.67 every month for ten years with a final payment of $2009.67.Which of the following best describes this bond?

A)a 10-year bond with a face value of $2000 and a coupon rate of 4.8% with monthly payments

B)a 10-year bond with a face value of $2000 and a coupon rate of 5.8% with monthly payments

C)a 10-year bond with a face value of $2009.67 and a coupon rate of 4.8% with monthly payments

D)a 10-year bond with a face value of $2009.67 and a coupon rate of 5.8% with monthly payments

A)a 10-year bond with a face value of $2000 and a coupon rate of 4.8% with monthly payments

B)a 10-year bond with a face value of $2000 and a coupon rate of 5.8% with monthly payments

C)a 10-year bond with a face value of $2009.67 and a coupon rate of 4.8% with monthly payments

D)a 10-year bond with a face value of $2009.67 and a coupon rate of 5.8% with monthly payments

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

16

The coupon value of a bond is the face value of that bond.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

17

An investor holds a Ford bond with a face value of $5000,a coupon rate of 4%,and semiannual payments that matures on 01/15/2009.How much will the investor receive on 01/15/2009?

A)$200

B)$5000

C)$5100

D)$5200

A)$200

B)$5000

C)$5100

D)$5200

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

18

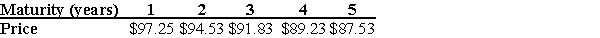

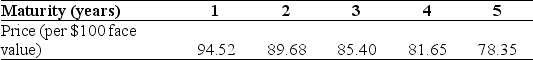

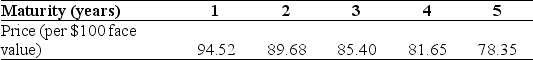

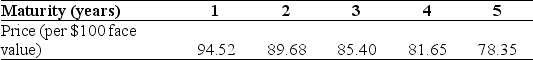

The above table shows the price per $100 face value of several risk-free,zero-coupon bonds.What is the yield to maturity of the three-year,zero-coupon,risk-free bond shown?

A)2.83%

B)2.85%

C)2.86%

D)2.88%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

19

Why is the yield to maturity of a zero-coupon,risk-free bond that matures at the end of a given period the risk-free interest rate for that period?

A)Since such a bond provides a risk-free return over that period,the Law of One Price guarantees the risk-free interest rate be equal to this yield.

B)Since a bond's price will converge on its face value as the bond approaches the maturity date,the Law of One Price dictates that the risk-free interest rate will reflect this convergence.

C)Since interest rates will rise and fall in response to the movement in bond prices.

D)Since there is,by definition,no risk in investing in such bonds,the return from such bonds is the best that can be expected from any investment over the period.

A)Since such a bond provides a risk-free return over that period,the Law of One Price guarantees the risk-free interest rate be equal to this yield.

B)Since a bond's price will converge on its face value as the bond approaches the maturity date,the Law of One Price dictates that the risk-free interest rate will reflect this convergence.

C)Since interest rates will rise and fall in response to the movement in bond prices.

D)Since there is,by definition,no risk in investing in such bonds,the return from such bonds is the best that can be expected from any investment over the period.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

20

Prior to its maturity date,the price of a zero-coupon bond is its face value.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

21

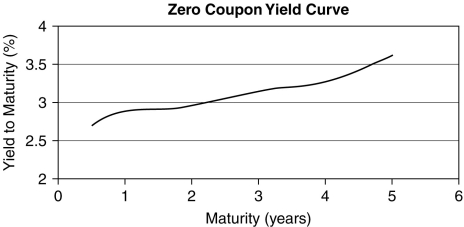

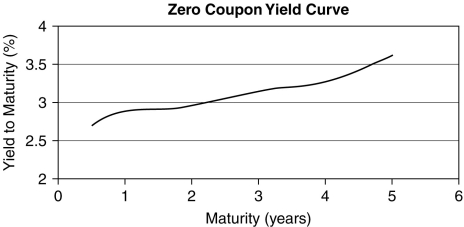

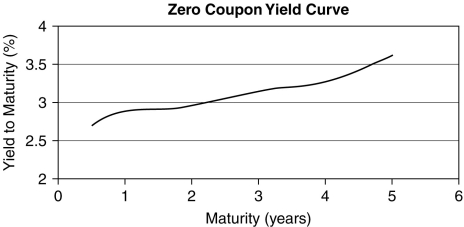

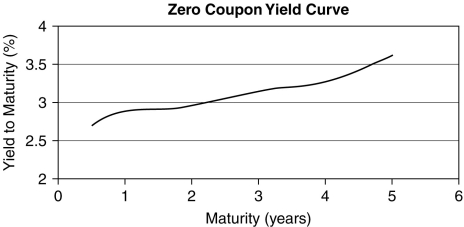

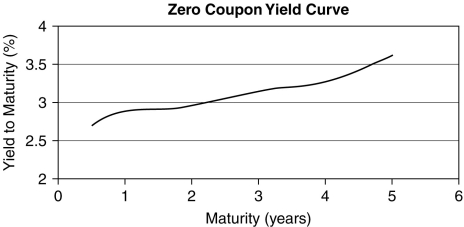

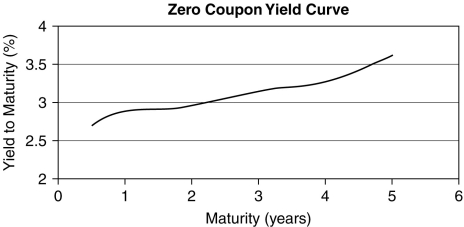

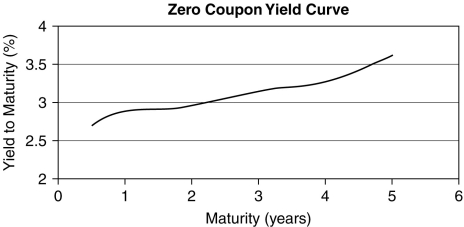

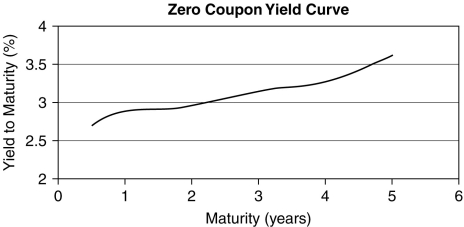

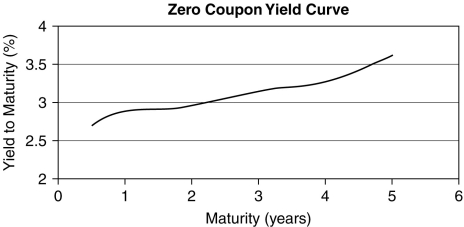

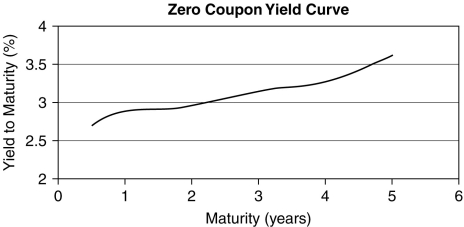

Use the figure for the question(s)below.

A risk-free,zero-coupon bond has 15 years to maturity.Which of the following is closest to the price per $100 of face value that the bond will trade at if the YTM is 7%?

A)$29.55

B)$32.68

C)$36.24

D)$38.78

A risk-free,zero-coupon bond has 15 years to maturity.Which of the following is closest to the price per $100 of face value that the bond will trade at if the YTM is 7%?

A)$29.55

B)$32.68

C)$36.24

D)$38.78

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

22

Consider a zero-coupon bond with a $1000 face value and ten years left until maturity.If the YTM of this bond is 10.4%,then the price of this bond is closest to:

A)$1000

B)$602

C)$1040

D)$372

A)$1000

B)$602

C)$1040

D)$372

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

23

Under what situation can a zero-coupon bond be selling at par to its face value?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following statements is FALSE?

A)Zero-coupon bonds are also called pure discount bonds.

B)The internal rate of return (IRR)of an investment opportunity is the discount rate at which the net present value (NPV)of the investment opportunity is equal to zero.

C)The yield to maturity for a zero-coupon bond is the return you will earn as an investor from holding the bond to maturity and receiving the promised face value payment.

D)When prices are quoted in the bond market,they are conventionally quoted in increments of $1000.

A)Zero-coupon bonds are also called pure discount bonds.

B)The internal rate of return (IRR)of an investment opportunity is the discount rate at which the net present value (NPV)of the investment opportunity is equal to zero.

C)The yield to maturity for a zero-coupon bond is the return you will earn as an investor from holding the bond to maturity and receiving the promised face value payment.

D)When prices are quoted in the bond market,they are conventionally quoted in increments of $1000.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following risk-free,zero-coupon bonds could be bought for the lowest price?

A)one with a face value of $1000,a YTM of 4.8%,and 5 years to maturity

B)one with a face value of $1000,a YTM of 3.2%,and 8 years to maturity

C)one with a face value of $1000,a YTM of 6.8%,and 10 years to maturity

D)one with a face value of $1000,a YTM of 5.9%,and 20 years to maturity

A)one with a face value of $1000,a YTM of 4.8%,and 5 years to maturity

B)one with a face value of $1000,a YTM of 3.2%,and 8 years to maturity

C)one with a face value of $1000,a YTM of 6.8%,and 10 years to maturity

D)one with a face value of $1000,a YTM of 5.9%,and 20 years to maturity

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

26

Use the figure for the question(s)below.

A risk-free,zero-coupon bond with a face value of $1,000 has 15 years to maturity.If the YTM is 5.8%,which of the following would be closest to the price this bond will trade at?

A)$721

B)$686

C)$525

D)$429

A risk-free,zero-coupon bond with a face value of $1,000 has 15 years to maturity.If the YTM is 5.8%,which of the following would be closest to the price this bond will trade at?

A)$721

B)$686

C)$525

D)$429

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

27

Use the figure for the question(s)below.

The current zero-coupon yield curve for risk-free bonds is shown above.What is the price per $100 face value of a four-year,zero-coupon,risk-free bond?

A)$85.64

B)$87.99

C)$92.15

D)$96.67

The current zero-coupon yield curve for risk-free bonds is shown above.What is the price per $100 face value of a four-year,zero-coupon,risk-free bond?

A)$85.64

B)$87.99

C)$92.15

D)$96.67

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

28

Use the figure for the question(s)below.

A risk-free,zero-coupon bond with a $5000 face value has ten years to maturity.The bond currently trades at $3650.What is the yield to maturity of this bond?

A)3.197%

B)3.284%

C)3.465%

D)3.699%

A risk-free,zero-coupon bond with a $5000 face value has ten years to maturity.The bond currently trades at $3650.What is the yield to maturity of this bond?

A)3.197%

B)3.284%

C)3.465%

D)3.699%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following statements is FALSE?

A)The bond certificate typically specifies that the coupons will be paid periodically until the maturity date of the bond.

B)The bond certificate indicates the amounts and dates of all payments to be made.

C)The only cash payments the investor will receive from a zero-coupon bond are the interest payments that are paid up until the maturity date.

D)Usually the face value of a bond is repaid at maturity.

A)The bond certificate typically specifies that the coupons will be paid periodically until the maturity date of the bond.

B)The bond certificate indicates the amounts and dates of all payments to be made.

C)The only cash payments the investor will receive from a zero-coupon bond are the interest payments that are paid up until the maturity date.

D)Usually the face value of a bond is repaid at maturity.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

30

Consider a zero-coupon bond with $1,000 face value and 20 years to maturity.The price will this bond trade if the YTM is 6% is closest to:

A)$215

B)$312

C)$335

D)$306

A)$215

B)$312

C)$335

D)$306

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following statements is FALSE?

A)The amount of each coupon payment is determined by the coupon rate of the bond.

B)Prior to its maturity date,the price of a zero-coupon bond is always greater than its face value.

C)The simplest type of bond is a zero-coupon bond.

D)Treasury bills are U.S.government bonds with a maturity of up to one year.

A)The amount of each coupon payment is determined by the coupon rate of the bond.

B)Prior to its maturity date,the price of a zero-coupon bond is always greater than its face value.

C)The simplest type of bond is a zero-coupon bond.

D)Treasury bills are U.S.government bonds with a maturity of up to one year.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

32

Use the figure for the question(s)below.

The current zero-coupon yield curve for risk-free bonds is shown above.What is the risk-free interest rate on a 3-year maturity?

A)3.00%

B)3.15%

C)3.25%

D)6.34%

The current zero-coupon yield curve for risk-free bonds is shown above.What is the risk-free interest rate on a 3-year maturity?

A)3.00%

B)3.15%

C)3.25%

D)6.34%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

33

Treasury bonds have original maturities from one to ten years,while Treasury notes have original maturities of more than ten years.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

34

Consider a zero-coupon bond with a $1000 face value and ten years left until maturity.If the bond is currently trading for $459,then the yield to maturity on this bond is closest to:

A)7.5%

B)10.4%

C)9.7%

D)8.1%

A)7.5%

B)10.4%

C)9.7%

D)8.1%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

35

What is the yield to maturity of a five-year,$5000 bond with a 4.5% coupon rate and semiannual coupons if this bond is currently trading for a price of $4876?

A)4.30%

B)5.07%

C)6.30%

D)8.60%

A)4.30%

B)5.07%

C)6.30%

D)8.60%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

36

How are the cash flows of a zero-coupon bond different from those of a coupon bond?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following statements is FALSE?

A)One advantage of quoting the yield to maturity rather than the price is that the yield is independent of the face value of the bond.

B)Unlike the case of bonds that pay coupons,for zero-coupon bonds,there is no simple formula to solve for the yield to maturity directly.

C)Because we can convert any bond price into a yield,and vice versa,bond prices and yields are often used interchangeably.

D)The internal rate of return (IRR)of an investment in a bond is given a special name,the yield to maturity (YTM).

A)One advantage of quoting the yield to maturity rather than the price is that the yield is independent of the face value of the bond.

B)Unlike the case of bonds that pay coupons,for zero-coupon bonds,there is no simple formula to solve for the yield to maturity directly.

C)Because we can convert any bond price into a yield,and vice versa,bond prices and yields are often used interchangeably.

D)The internal rate of return (IRR)of an investment in a bond is given a special name,the yield to maturity (YTM).

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following statements is FALSE?

A)The internal rate of return (IRR)of an investment in a zero-coupon bond is the rate of return that investors will earn on their money if they buy a default free bond at its current price and hold it to maturity.

B)The yield to maturity of a bond is the discount rate that sets the future value (FV)of the promised bond payments equal to the current market price of the bond.

C)Financial professionals also use the term spot interest rates to refer to the default-free zero-coupon yields.

D)When we calculate a bond's yield to maturity by solving the formula, Price of an n-period bond =

+

+

+ ...+

+ ...+

,1 + YTM)

,1 + YTM)

The yield we compute will be a rate per coupon interval.

A)The internal rate of return (IRR)of an investment in a zero-coupon bond is the rate of return that investors will earn on their money if they buy a default free bond at its current price and hold it to maturity.

B)The yield to maturity of a bond is the discount rate that sets the future value (FV)of the promised bond payments equal to the current market price of the bond.

C)Financial professionals also use the term spot interest rates to refer to the default-free zero-coupon yields.

D)When we calculate a bond's yield to maturity by solving the formula, Price of an n-period bond =

+

+ + ...+

+ ...+ ,1 + YTM)

,1 + YTM)The yield we compute will be a rate per coupon interval.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

39

Under what situation can a zero-coupon bond be selling at a premium?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

40

Bond traders generally quote bond yields rather than bond prices,since yield to maturity depends on the face value of the bond.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

41

A $5000 bond with a coupon rate of 6.4% paid semiannually has four years to maturity and a yield to maturity of 6.2%.If interest rates fall and the yield to maturity decreases by 0.8%,what will happen to the price of the bond?

A)fall by $98.64

B)fall by $40.49

C)rise by $84.46

D)rise by $142.78

A)fall by $98.64

B)fall by $40.49

C)rise by $84.46

D)rise by $142.78

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

42

Assuming that this bond trades for $1112,then the YTM for this bond is closest to:

A)8.0%

B)3.4%

C)6.8%

D)9.2%

A)8.0%

B)3.4%

C)6.8%

D)9.2%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

43

Assuming that this bond trades for $903,then the YTM for this bond is closest to:

A)8.0%

B)6.8%

C)9.9%

D)9.2%

A)8.0%

B)6.8%

C)9.9%

D)9.2%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

44

What is the coupon rate of a two-year,$10,000 bond with semiannual coupons and a price of $9543.45,if it has a yield to maturity of 6.8%?

A)4.32%

B)5.60%

C)6.25%

D)8.44%

A)4.32%

B)5.60%

C)6.25%

D)8.44%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

45

What must be the price of a $1000 bond with a 5.8% coupon rate,annual coupons,and 30 years to maturity if YTM is 7.5% APR?

A)$114.22

B)$685.00

C)$799.22

D)$1005.26

A)$114.22

B)$685.00

C)$799.22

D)$1005.26

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

46

What is the yield to maturity of a ten-year,$1000 bond with a 5.2% coupon rate and semiannual coupons if this bond is currently trading for a price of $884?

A)5.02%

B)6.23%

C)6.82%

D)12.46%

A)5.02%

B)6.23%

C)6.82%

D)12.46%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

47

Assuming the appropriate YTM on the Sisyphean bond is 9.0%,then the price that this bond trades for will be closest to:

A)$946

B)$919

C)$1086

D)$1000

A)$946

B)$919

C)$1086

D)$1000

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

48

Use the table for the question(s)below.

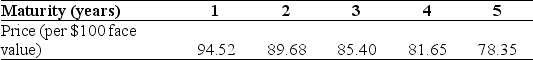

The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of face value):

The yield to maturity for the three year zero-coupon bond is closest to:

A)5.4%

B)5.8%

C)5.6%

D)6.0%

The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of face value):

The yield to maturity for the three year zero-coupon bond is closest to:

A)5.4%

B)5.8%

C)5.6%

D)6.0%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

49

Use the table for the question(s)below.

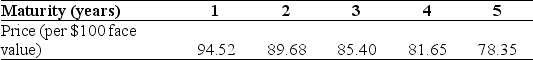

The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of face value):

Based upon the information provided in the table above,you can conclude

A)that the yield curve is flat.

B)nothing about the shape of the yield curve.

C)that the yield curve is downward sloping.

D)that the yield curve is upward sloping.

The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of face value):

Based upon the information provided in the table above,you can conclude

A)that the yield curve is flat.

B)nothing about the shape of the yield curve.

C)that the yield curve is downward sloping.

D)that the yield curve is upward sloping.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

50

A bond has three years to maturity,a $2000 face value,and a 6.3% coupon rate with annual coupons.What is its yield to maturity if it is currently trading at $1801?

A)6.30%

B)8.48%

C)9.22%

D)10.32%

A)6.30%

B)8.48%

C)9.22%

D)10.32%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

51

Use the information for the question(s)below.

The Sisyphean Company has a bond outstanding with a face value of $1000 that reaches maturity in 15 years.The bond certificate indicates that the stated coupon rate for this bond is 8% and that the coupon payments are to be made semiannually.

How much are each of the semiannual coupon payments? Assuming the appropriate YTM on the Sisyphean bond is 8.8%,then at what price should this bond trade for?

The Sisyphean Company has a bond outstanding with a face value of $1000 that reaches maturity in 15 years.The bond certificate indicates that the stated coupon rate for this bond is 8% and that the coupon payments are to be made semiannually.

How much are each of the semiannual coupon payments? Assuming the appropriate YTM on the Sisyphean bond is 8.8%,then at what price should this bond trade for?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

52

Use the information to answer the question(s)below.

Shown above is information from FINRA regarding one of Caterpillar Financial Services' bonds.How much would the holder of such a bond earn each coupon payment for each $100 in face value if coupons are paid annually?

A)$1.38

B)$3.95

C)$4.30

D)$4.36

Shown above is information from FINRA regarding one of Caterpillar Financial Services' bonds.How much would the holder of such a bond earn each coupon payment for each $100 in face value if coupons are paid annually?

A)$1.38

B)$3.95

C)$4.30

D)$4.36

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

53

What must be the price of a $10,000 bond with a 6.5% coupon rate,semiannual coupons,and two years to maturity if it has a yield to maturity of 8% APR?

A)$9727.76

B)$9819.74

C)$10,619.63

D)$10,754.44

A)$9727.76

B)$9819.74

C)$10,619.63

D)$10,754.44

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

54

Assuming the appropriate YTM on the Sisyphean bond is 7.5%,then this bond will trade at

A)par.

B)a discount.

C)a premium.

D)none of the above

A)par.

B)a discount.

C)a premium.

D)none of the above

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

55

Use the information for the question(s)below.

Shown above is information from FINRA regarding one of Bank of America's bonds.How much would the holder of such a bond earn each coupon payment for each $100 in face value if coupons are paid semiannually?

A)$1.49

B)$2.15

C)$2.32

D)$4.30

Shown above is information from FINRA regarding one of Bank of America's bonds.How much would the holder of such a bond earn each coupon payment for each $100 in face value if coupons are paid semiannually?

A)$1.49

B)$2.15

C)$2.32

D)$4.30

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

56

Use the table for the question(s)below.

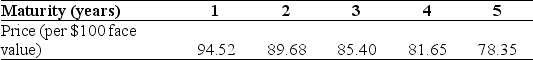

The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of face value):

The yield to maturity for the two year zero-coupon bond is closest to:

A)6.0%

B)5.8%

C)5.6%

D)5.5%

The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of face value):

The yield to maturity for the two year zero-coupon bond is closest to:

A)6.0%

B)5.8%

C)5.6%

D)5.5%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

57

A $1000 bond with a coupon rate of 5.4% paid semiannually has five years to maturity and a yield to maturity of 7.5%.If interest rates rise and the yield to maturity increases to 7.8%,what will happen to the price of the bond?

A)fall by $9.82

B)fall by $11.59

C)rise by $12.16

D)The price of the bond will not change.

A)fall by $9.82

B)fall by $11.59

C)rise by $12.16

D)The price of the bond will not change.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

58

Assuming the appropriate YTM on the Sisyphean bond is 9%,then this bond will trade at

A)a premium.

B)a discount.

C)par.

D)none of the above

A)a premium.

B)a discount.

C)par.

D)none of the above

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

59

Use the information for the question(s)below.

The Sisyphean Company has a bond outstanding with a face value of $1000 that reaches maturity in 15 years.The bond certificate indicates that the stated coupon rate for this bond is 8% and that the coupon payments are to be made semiannually.

How much will each semiannual coupon payment be?

A)$60

B)$40

C)$120

D)$80

The Sisyphean Company has a bond outstanding with a face value of $1000 that reaches maturity in 15 years.The bond certificate indicates that the stated coupon rate for this bond is 8% and that the coupon payments are to be made semiannually.

How much will each semiannual coupon payment be?

A)$60

B)$40

C)$120

D)$80

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

60

Assuming the appropriate YTM on the Sisyphean bond is 7.5%,then the price that this bond trades for will be closest to:

A)$1045

B)$691

C)$1000

D)$957

A)$1045

B)$691

C)$1000

D)$957

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

61

If the yield to maturity of all of the following bonds is 6%,which trades at the greatest premium per $100 face value?

A)a bond with a $10,000 face value,four years to maturity and 6.2% semiannual coupon payments

B)a bond with a $500 face value,ten years to maturity and 5.2% annual coupon payments

C)a bond with a $5000 face value,several years to maturity and 5.5% annual coupon payments

D)a bond with a $1000 face value,five years to maturity and 6.3% annual coupon payments

A)a bond with a $10,000 face value,four years to maturity and 6.2% semiannual coupon payments

B)a bond with a $500 face value,ten years to maturity and 5.2% annual coupon payments

C)a bond with a $5000 face value,several years to maturity and 5.5% annual coupon payments

D)a bond with a $1000 face value,five years to maturity and 6.3% annual coupon payments

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

62

A bond is currently trading below par.Which of the following must be true about that bond?

A)The bond's yield to maturity is less than its coupon rate.

B)The bond is a zero-coupon bond.

C)The bond's yield to maturity is greater than its coupon rate.

D)B and C above

A)The bond's yield to maturity is less than its coupon rate.

B)The bond is a zero-coupon bond.

C)The bond's yield to maturity is greater than its coupon rate.

D)B and C above

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following statements are true?

A)A fall in bond prices causes interest rates to fall.

B)A fall in interest rates causes a fall in bond prices.

C)A rise in interest rates causes bond prices to fall.

D)Bond prices and interest rates are not connected.

A)A fall in bond prices causes interest rates to fall.

B)A fall in interest rates causes a fall in bond prices.

C)A rise in interest rates causes bond prices to fall.

D)Bond prices and interest rates are not connected.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

64

What issues should one be careful of when calculating the bond price from its yield to maturity using the "cash flow" (CF)keys of a financial calculator?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following bonds is trading at par?

A)a bond with a $2000 face value trading at $1987

B)a bond with a $1000 face value trading at $999

C)a bond with a $1000 face value trading at $1000

D)a bond with a $2000 face value trading at $2012

A)a bond with a $2000 face value trading at $1987

B)a bond with a $1000 face value trading at $999

C)a bond with a $1000 face value trading at $1000

D)a bond with a $2000 face value trading at $2012

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

66

What care,if any,should be taken regarding the timing of the cash flows while drawing the timeline and associated cash flows of a coupon bond?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

67

A company releases a five-year bond with a face value of $1000 and coupons paid semiannually.If market interest rates imply a YTM of 6%,which of the following coupon rates will cause the bond to be issued at a premium?

A)3%

B)4%

C)6%

D)8%

A)3%

B)4%

C)6%

D)8%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

68

What issues should one be careful of when calculating the bond price from its yield to maturity using the "time value of money" (TVM)keys of a financial calculator?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

69

A bond has a $1000 face value,ten years to maturity,and 7% semiannual coupon payments.What would be the expected difference in this bond's price immediately before and immediately after the next coupon payment?

A)$18

B)$35

C)$70

D)$84

A)$18

B)$35

C)$70

D)$84

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

70

An investor purchases a 30-year,zero-coupon bond with a face value of $1000 and a yield to maturity of 6.5%.He sells this bond ten years later.What is the rate of return on his investment,assuming yield to maturity does not change?

A)6.04%

B)6.24%

C)6.50%

D)6.62%

A)6.04%

B)6.24%

C)6.50%

D)6.62%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

71

Assuming that this bond trades for $1035.44,then the YTM for this bond is equal to:

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

72

A ten-year,zero-coupon bond with a yield to maturity of 6% has a face value of $1000.An investor purchases the bond when it is initially traded,and then sells it four years later.What is the rate of return of this investment,assuming the yield to maturity does not change?

A)0.26%

B)3.07%

C)6.00%

D)7.65%

A)0.26%

B)3.07%

C)6.00%

D)7.65%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following bonds will be most sensitive to a change in interest rates?

A)a ten-year bond with a $2000 face value whose yield to maturity is 5.8% and coupon rate is 5.8% APR paid semiannually

B)a 15-year bond with a $5000 face value whose yield to maturity is 7.4% and coupon rate is 6.2% APR paid annually

C)a 20-year bond with a $3000 face value whose yield to maturity is 6.0% and coupon rate is 5.4% APR paid semiannually

D)a 30-year bond with a $1000 face value whose yield to maturity is 5.5% and coupon rate is 6.4% APR paid annually

A)a ten-year bond with a $2000 face value whose yield to maturity is 5.8% and coupon rate is 5.8% APR paid semiannually

B)a 15-year bond with a $5000 face value whose yield to maturity is 7.4% and coupon rate is 6.2% APR paid annually

C)a 20-year bond with a $3000 face value whose yield to maturity is 6.0% and coupon rate is 5.4% APR paid semiannually

D)a 30-year bond with a $1000 face value whose yield to maturity is 5.5% and coupon rate is 6.4% APR paid annually

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following bonds is trading at a premium?

A)a five-year bond with a $2000 face value whose yield to maturity is 7.0% and coupon rate is 7.2% APR paid semiannually

B)a ten-year bond with a $4000 face value whose yield to maturity is 6.0% and coupon rate is 5.9% APR paid semiannually

C)a 15-year bond with a $10,000 face value whose yield to maturity is 8.0% and coupon rate is 7.8% APR paid semiannually

D)a two-year bond with a $50,000 face value whose yield to maturity is 5.2% and coupon rate is 5.2% APR paid monthly

A)a five-year bond with a $2000 face value whose yield to maturity is 7.0% and coupon rate is 7.2% APR paid semiannually

B)a ten-year bond with a $4000 face value whose yield to maturity is 6.0% and coupon rate is 5.9% APR paid semiannually

C)a 15-year bond with a $10,000 face value whose yield to maturity is 8.0% and coupon rate is 7.8% APR paid semiannually

D)a two-year bond with a $50,000 face value whose yield to maturity is 5.2% and coupon rate is 5.2% APR paid monthly

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

75

What care,if any,should be taken regarding the sign of the cash flows while drawing the timeline and associated cash flows of a coupon bond?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

76

How can the financial calculator be used to calculate the price of a coupon bond from its yield to maturity?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

77

A bond will trade at a discount if its coupon rate is less than its yield to maturity.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

78

A company releases a five-year bond with a face value of $1000 and coupons paid semiannually.If market interest rates imply a YTM of 6%,what should be the coupon rate offered if the bond is to trade at par?

A)3%

B)4%

C)6%

D)8%

A)3%

B)4%

C)6%

D)8%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

79

Before it matures,the price of any bond is always less than its face value.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following bonds will be least sensitive to a change in interest rates?

A)a ten-year bond with a $2000 face value whose yield to maturity is 5.8% and coupon rate is 5.8% APR paid semiannually

B)a 15-year bond with a $5000 face value whose yield to maturity is 7.4% and coupon rate is 6.2% APR paid annually

C)a 20-year bond with a $3000 face value whose yield to maturity is 6.0% and coupon rate is 5.4% APR paid semiannually

D)a 30-year bond with a $1000 face value whose yield to maturity is 5.5% and coupon rate is 6.4% APR paid annually

A)a ten-year bond with a $2000 face value whose yield to maturity is 5.8% and coupon rate is 5.8% APR paid semiannually

B)a 15-year bond with a $5000 face value whose yield to maturity is 7.4% and coupon rate is 6.2% APR paid annually

C)a 20-year bond with a $3000 face value whose yield to maturity is 6.0% and coupon rate is 5.4% APR paid semiannually

D)a 30-year bond with a $1000 face value whose yield to maturity is 5.5% and coupon rate is 6.4% APR paid annually

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck