Deck 11: Calculating the Cost of Capital

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/130

Play

Full screen (f)

Deck 11: Calculating the Cost of Capital

1

Which of the following is a principle of capital budgeting which states that the calculations of cash flows should remain independent of financing?

A)Generally accepted accounting principle

B)Financing principle

C)Separation principle

D)WACC principle

A)Generally accepted accounting principle

B)Financing principle

C)Separation principle

D)WACC principle

Separation principle

2

Which statement makes this a false statement? When a firm pays commissions to underwriting firms that float the issuance of new stock:

A)the component cost will need to be integrated to figure project WACCs.

B)the component cost will need to be integrated only for the firm's WACC.

C)the firm can increase the project's WACC to incorporate the flotation costs' impact.

D)the firm can leave the WACC alone and adjust the project's initial investment upwards.

A)the component cost will need to be integrated to figure project WACCs.

B)the component cost will need to be integrated only for the firm's WACC.

C)the firm can increase the project's WACC to incorporate the flotation costs' impact.

D)the firm can leave the WACC alone and adjust the project's initial investment upwards.

the component cost will need to be integrated to figure project WACCs.

3

Which of the following statements is true?

A)If the new project is riskier than the firm's existing projects, then it should be charged a higher cost of capital.

B)If the new project is riskier than the firm's existing projects, then it should be charged a lower cost of capital.

C)If the new project is riskier than the firm's existing projects, then it should be charged the firm's cost of capital.

D)The new project's risk is not a factor in determining its cost of capital.

A)If the new project is riskier than the firm's existing projects, then it should be charged a higher cost of capital.

B)If the new project is riskier than the firm's existing projects, then it should be charged a lower cost of capital.

C)If the new project is riskier than the firm's existing projects, then it should be charged the firm's cost of capital.

D)The new project's risk is not a factor in determining its cost of capital.

If the new project is riskier than the firm's existing projects, then it should be charged a higher cost of capital.

4

An objective approach to calculating divisional WACCs would be done by:

A)simply considering the project's risk relative to the firm's lines of business and adjusting upward or downward to account for subjective opinions of project risk.

B)computing the average beta for the firm, the firm's CAPM formula, and the firm's WACC.

C)computing the average beta per division, using these figures for each division in the CAPM formula, and then constructing divisional WACCs.

D)simply averaging out all the WACCs for all the firm's projects.

A)simply considering the project's risk relative to the firm's lines of business and adjusting upward or downward to account for subjective opinions of project risk.

B)computing the average beta for the firm, the firm's CAPM formula, and the firm's WACC.

C)computing the average beta per division, using these figures for each division in the CAPM formula, and then constructing divisional WACCs.

D)simply averaging out all the WACCs for all the firm's projects.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following makes this a true statement? Ideally,when searching for a beta for a new line of business:

A)one could find other firms engaged in the proposed new line of business and use their betas as proxies to estimate the project's risk.

B)one would like to find at least three or four pure-play proxies.

C)two (or even one) proxies might represent a suitable sample if their line of business resembles the proposed new project closely enough.

D)All the answers make this a true statement.

A)one could find other firms engaged in the proposed new line of business and use their betas as proxies to estimate the project's risk.

B)one would like to find at least three or four pure-play proxies.

C)two (or even one) proxies might represent a suitable sample if their line of business resembles the proposed new project closely enough.

D)All the answers make this a true statement.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

6

Which of these is an estimated WACC computed using some sort of proxy for the average equity risk of the projects in a particular division?

A)Average WACC

B)Divisional WACC

C)Proxy WACC

D)Pure-play WACC

A)Average WACC

B)Divisional WACC

C)Proxy WACC

D)Pure-play WACC

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

7

Any debt and preferred stock components of capital should:

A)use project-specific, not firmwide, WACC figures.

B)use firmwide, not project-specific, WACC figures.

C)use project-specific figures.

D)not be issued.

A)use project-specific, not firmwide, WACC figures.

B)use firmwide, not project-specific, WACC figures.

C)use project-specific figures.

D)not be issued.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following makes this a true statement? If the new project does significantly increase the firm's overall risk:

A)the increased risk will be borne equally amongst the bond holders, preferred stockholders, and common stockholders.

B)the increased risk will be borne disproportionately by bond holders.

C)the increased risk will be borne disproportionately by preferred stockholders.

D)the increased risk will be borne disproportionately by common stockholders.

A)the increased risk will be borne equally amongst the bond holders, preferred stockholders, and common stockholders.

B)the increased risk will be borne disproportionately by bond holders.

C)the increased risk will be borne disproportionately by preferred stockholders.

D)the increased risk will be borne disproportionately by common stockholders.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is a true statement regarding the appropriate tax rate to be used in the WACC?

A)One would use the marginal tax rate that the firm paid the prior year.

B)One would use the average tax rate that the firm paid the prior year.

C)One would use the weighted average of the marginal tax rates that would have been paid on the taxable income shielded by the interest deduction.

D)One would use the marginal tax rates that would have been paid on the taxable income shielded by the interest deduction.

A)One would use the marginal tax rate that the firm paid the prior year.

B)One would use the average tax rate that the firm paid the prior year.

C)One would use the weighted average of the marginal tax rates that would have been paid on the taxable income shielded by the interest deduction.

D)One would use the marginal tax rates that would have been paid on the taxable income shielded by the interest deduction.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

10

When calculating the weighted average cost of capital,weights are based on:

A)book values.

B)book weights.

C)market values.

D)market betas.

A)book values.

B)book weights.

C)market values.

D)market betas.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

11

Which of these makes this a true statement? The WACC formula:

A)is not impacted by taxes.

B)uses the after-tax costs of capital to compute the firm's weighted average cost of debt financing.

C)uses the pre-tax costs of capital to compute the firm's weighted average cost of debt financing.

D)focuses on operating costs only to keep them separate from financing costs.

A)is not impacted by taxes.

B)uses the after-tax costs of capital to compute the firm's weighted average cost of debt financing.

C)uses the pre-tax costs of capital to compute the firm's weighted average cost of debt financing.

D)focuses on operating costs only to keep them separate from financing costs.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

12

When firms use multiple sources of capital,they need to calculate the appropriate discount rate for valuing their firm's cash flows as:

A)a simple average of the capital components costs.

B)a sum of the capital components costs.

C)a weighted average of the capital components costs.

D)they apply to each asset as they are purchased with their respective forms of debt or equity.

A)a simple average of the capital components costs.

B)a sum of the capital components costs.

C)a weighted average of the capital components costs.

D)they apply to each asset as they are purchased with their respective forms of debt or equity.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

13

Which of these makes this a true statement? When determining the appropriate weights used in calculating a WACC,it should reflect:

A)the relative sizes of the total book capitalizations for each kind of security that the firm issues.

B)the relative sizes of the total market capitalizations for each kind of security that the firm issues.

C)only the market after-tax cost of debt.

D)only the market after-tax cost of equity.

A)the relative sizes of the total book capitalizations for each kind of security that the firm issues.

B)the relative sizes of the total market capitalizations for each kind of security that the firm issues.

C)only the market after-tax cost of debt.

D)only the market after-tax cost of equity.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

14

Which of these are fees paid by firms to investment bankers for issuing new securities?

A)Flotation costs

B)Interest expense

C)Seller financing charges

D)User fees

A)Flotation costs

B)Interest expense

C)Seller financing charges

D)User fees

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

15

Which of these completes this statement to make it true? The constant growth model is:

A)always going to have assumptions that will hold true.

B)adjustable for stocks that don't expect constant growth without sizeable errors.

C)only going to be appropriate for the limited number of stocks that just happen to expect constant growth.

D)only going to be appropriate for the limited number of stocks that just happen to expect nonconstant growth.

A)always going to have assumptions that will hold true.

B)adjustable for stocks that don't expect constant growth without sizeable errors.

C)only going to be appropriate for the limited number of stocks that just happen to expect constant growth.

D)only going to be appropriate for the limited number of stocks that just happen to expect nonconstant growth.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

16

Which of these statements is true regarding calculating weights for WACC?

A)If we are calculating WACC for the firm, then equity, preferred stock and debt would be the entire book value of each source of capital.

B)If we are calculating WACC for the firm, then equity, preferred stock and debt would be the entire market value of each source of capital.

C)If we are calculating WACC for a project, then equity, preferred stock and debt would be the entire book value of each source of capital.

D)If we are calculating WACC for a project, then equity, preferred stock and debt would be the entire market value of each source of capital.

A)If we are calculating WACC for the firm, then equity, preferred stock and debt would be the entire book value of each source of capital.

B)If we are calculating WACC for the firm, then equity, preferred stock and debt would be the entire market value of each source of capital.

C)If we are calculating WACC for a project, then equity, preferred stock and debt would be the entire book value of each source of capital.

D)If we are calculating WACC for a project, then equity, preferred stock and debt would be the entire market value of each source of capital.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

17

Which of these statements is true regarding divisional WACC?

A)Using a divisional WACC versus a WACC for the firm's current operations will result in quite a few incorrect decisions.

B)Using a simple firmwide WACC to evaluate new projects would give an unfair advantage to projects that present more risk than the firm's average beta.

C)Using a simple firmwide WACC to evaluate new projects would give an unfair advantage to projects that present less risk than the firm's average beta.

D)Using a firmwide WACC to evaluate new projects would have no impact on projects that present less risk than the firm's average beta.

A)Using a divisional WACC versus a WACC for the firm's current operations will result in quite a few incorrect decisions.

B)Using a simple firmwide WACC to evaluate new projects would give an unfair advantage to projects that present more risk than the firm's average beta.

C)Using a simple firmwide WACC to evaluate new projects would give an unfair advantage to projects that present less risk than the firm's average beta.

D)Using a firmwide WACC to evaluate new projects would have no impact on projects that present less risk than the firm's average beta.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is a true statement?

A)To estimate the before-tax cost of debt, we need to solve for the Yield to Maturity (YTM) on the firm's existing debt.

B)To estimate the before-tax cost of debt, we need to solve for the Yield to Call (YTC) on the firm's existing debt.

C)To estimate the before-tax cost of debt, we use the coupon rate on the firm's existing debt.

D)To estimate the before-tax cost of debt, we use the average rate on the firm's existing debt.

A)To estimate the before-tax cost of debt, we need to solve for the Yield to Maturity (YTM) on the firm's existing debt.

B)To estimate the before-tax cost of debt, we need to solve for the Yield to Call (YTC) on the firm's existing debt.

C)To estimate the before-tax cost of debt, we use the coupon rate on the firm's existing debt.

D)To estimate the before-tax cost of debt, we use the average rate on the firm's existing debt.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

19

When we adjust the WACC to reflect flotation costs,this approach:

A)raises each capital source's effective cost.

B)raises only the cost of external equity.

C)reduces the cost of debt.

D)reduces each capital source's effective cost.

A)raises each capital source's effective cost.

B)raises only the cost of external equity.

C)reduces the cost of debt.

D)reduces each capital source's effective cost.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

20

An average of which of the following will give a fairly accurate estimate of what a project's beta will be?

A)Flotation beta

B)Proxy beta

C)Pure-play proxies

D)Weighted average beta

A)Flotation beta

B)Proxy beta

C)Pure-play proxies

D)Weighted average beta

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

21

CJ Co.stock has a beta of 0.9,the current risk-free rate is 5.6,and the expected return on the market is 13 percent.What is CJ Co's cost of equity?

A)12.26 percent

B)17.30 percent

C)19.50 percent

D)22.34 percent

A)12.26 percent

B)17.30 percent

C)19.50 percent

D)22.34 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

22

Suppose that Glamour Nails,Inc.'s capital structure features 30 percent equity,70 percent debt,and that its before-tax cost of debt is 4 percent,while its cost of equity is 10 percent.If the appropriate weighted average tax rate is 34 percent,what will be Glamour Nails' WACC?

A)4.78 percent

B)4.85 percent

C)5.80 percent

D)7.00 percent

A)4.78 percent

B)4.85 percent

C)5.80 percent

D)7.00 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

23

FlavR Co.stock has a beta of 2.0,the current risk-free rate is 2,and the expected return on the market is 9 percent.What is FlavR Co's cost of equity?

A)11 percent

B)13 percent

C)16 percent

D)20 percent

A)11 percent

B)13 percent

C)16 percent

D)20 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

24

TJ Co.stock has a beta of 1.45,the current risk-free rate is 5.75,and the expected return on the market is 14 percent.What is TJ Co's cost of equity?

A)17.71 percent

B)21.20 percent

C)26.05 percent

D)28.64 percent

A)17.71 percent

B)21.20 percent

C)26.05 percent

D)28.64 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

25

IVY has preferred stock selling for 98 percent of par that pays a 7 percent annual coupon.What would be IVY's component cost of preferred stock?

A)6.86 percent

B)7.00 percent

C)7.14 percent

D)14.00 percent

A)6.86 percent

B)7.00 percent

C)7.14 percent

D)14.00 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

26

WC Inc.has a $10 million (face value),10-year bond issue selling for 99 percent of par that pays an annual coupon of 9 percent.What would be WC's before-tax component cost of debt?

A)9.00 percent

B)9.10 percent

C)9.16 percent

D)18.32 percent

A)9.00 percent

B)9.10 percent

C)9.16 percent

D)18.32 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

27

TellAll has 10 million shares of common stock outstanding,20 million shares of preferred stock outstanding,and 100 thousand bonds.If the common shares are selling for $32 per share,the preferred shares are selling for $20 per share,and the bonds are selling for 106 percent of par,what would be the weight used for preferred stock in the computation of TellAll's WACC?

A)33.33 percent

B)48.43 percent

C)55.55 percent

D)66.45 percent

A)33.33 percent

B)48.43 percent

C)55.55 percent

D)66.45 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

28

Sports Corp.has 10 million shares of common stock outstanding,5 million shares of preferred stock outstanding,and 1 million bonds.If the common shares are selling for $25 per share,the preferred share are selling for $12.50 per share,and the bonds are selling for 97 percent of par,what would be the weight used for equity in the computation of Sports' WACC?

A)18.59 percent

B)19.49 percent

C)62.50 percent

D)79.75 percent

A)18.59 percent

B)19.49 percent

C)62.50 percent

D)79.75 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

29

Bill's Boards has 20 million shares of common stock outstanding,4 million shares of preferred stock outstanding,and 20 thousand bonds.If the common shares are selling for $30 per share,the preferred shares are selling for $17 per share,and the bonds are selling for 96 percent of par,what would be the weight used for debt in the computation of Bill's WACC?

A)0.83 percent

B)2.79 percent

C)2.87 percent

D)3.33 percent

A)0.83 percent

B)2.79 percent

C)2.87 percent

D)3.33 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

30

Fern has preferred stock selling for 95 percent of par that pays an 8 percent annual coupon.What would be Fern's component cost of preferred stock?

A)7.60 percent

B)8.00 percent

C)8.42 percent

D)9.00 percent

A)7.60 percent

B)8.00 percent

C)8.42 percent

D)9.00 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

31

Suppose that Model Nails,Inc.'s capital structure features 60 percent equity,40 percent debt,and that its before-tax cost of debt is 6 percent,while its cost of equity is 10 percent.If the appropriate weighted average tax rate is 28 percent,what will be Model Nails' WACC?

A)7.73 percent

B)8.00 percent

C)8.40 percent

D)16.00 percent

A)7.73 percent

B)8.00 percent

C)8.40 percent

D)16.00 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

32

Suppose that Hanna Nails,Inc.'s capital structure features 45 percent equity,55 percent debt,and that its before-tax cost of debt is 5 percent,while its cost of equity is 9 percent.If the appropriate weighted average tax rate is 40 percent,what will be Hanna Nails' WACC?

A)5.18 percent

B)5.70 percent

C)6.80 percent

D)7.00 percent

A)5.18 percent

B)5.70 percent

C)6.80 percent

D)7.00 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

33

JackITs has 5 million shares of common stock outstanding,1 million shares of preferred stock outstanding,and 20 thousand bonds.If the common shares are selling for $28 per share,the preferred share are selling for $13.50 per share,and the bonds are selling for 98 percent of par,what would be the weight used for equity in the computation of JackITs' WACC?

A)33.33 percent

B)80.88 percent

C)83.08 percent

D)91.19 percent

A)33.33 percent

B)80.88 percent

C)83.08 percent

D)91.19 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

34

TJ Industries has 7 million shares of common stock outstanding with a market price of $20.00 per share.The company also has outstanding preferred stock with a market value of $10 million,and 100,000 bonds outstanding,each with face value $1,000 and selling at 95 percent of par value.The cost of equity is 12 percent,the cost of preferred is 10 percent,and the cost of debt is 6.45 percent.If TJ's tax rate is 34 percent,what is the WACC?

A)8.92 percent

B)9.76 percent

C)12.59 percent

D)13.43 percent

A)8.92 percent

B)9.76 percent

C)12.59 percent

D)13.43 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

35

Town Crier has 10 million shares of common stock outstanding,2 million shares of preferred stock outstanding,and 10 thousand bonds.If the common shares are selling for $28 per share,the preferred shares are selling for $15.50 per share,and the bonds are selling for 97 percent of par,what would be the weight used for debt in the computation of Town Crier's WACC?

A)3.02 percent

B)3.12 percent

C)3.20 percent

D)3.33 percent

A)3.02 percent

B)3.12 percent

C)3.20 percent

D)3.33 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

36

Solar Shades has 8 million shares of common stock outstanding,4 million shares of preferred stock outstanding,and 10 thousand bonds.If the common shares are selling for $13 per share,the preferred shares are selling for $30 per share,and the bonds are selling for 105 percent of par,what would be the weight used for equity in the computation of Solar Shades' WACC?

A)33.33 percent

B)44.35 percent

C)46.42 percent

D)66.61 percent

A)33.33 percent

B)44.35 percent

C)46.42 percent

D)66.61 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

37

Rose has preferred stock selling for 99 percent of par that pays a 9 percent annual coupon.What would be Rose's component cost of preferred stock?

A)4.55 percent

B)8.91 percent

C)9.00 percent

D)9.09 percent

A)4.55 percent

B)8.91 percent

C)9.00 percent

D)9.09 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

38

Carrie D's has 6 million shares of common stock outstanding,2 million shares of preferred stock outstanding,and 10 thousand bonds.If the common shares are selling for $15 per share,the preferred shares are selling for $28 per share,and the bonds are selling for 109 percent of par,what would be the weight used for equity in the computation of Carrie D's WACC?

A)33.33 percent

B)57.36 percent

C)61.64 percent

D)75.00 percent

A)33.33 percent

B)57.36 percent

C)61.64 percent

D)75.00 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

39

Paper Exchange has 80 million shares of common stock outstanding,60 million shares of preferred stock outstanding,and 50 thousand bonds.If the common shares are selling for $20 per share,the preferred shares are selling for $10 per share,and the bonds are selling for 105 percent of par,what would be the weight used for preferred stock in the computation of Paper's WACC?

A)26.64 percent

B)27.27 percent

C)33.33 percent

D)42.84 percent

A)26.64 percent

B)27.27 percent

C)33.33 percent

D)42.84 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

40

Suppose that TipsNToes,Inc.'s capital structure features 40 percent equity,60 percent debt,and that its before-tax cost of debt is 9 percent,while its cost of equity is 15 percent.If the appropriate weighted average tax rate is 34 percent,what will be TipsNToes' WACC?

A)9.36 percent

B)9.56 percent

C)11.40 percent

D)24.00 percent

A)9.36 percent

B)9.56 percent

C)11.40 percent

D)24.00 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

41

Suppose that TW,Inc.has a capital structure of 25 percent equity,15 percent preferred stock,and 60 percent debt.If the before-tax component costs of equity,preferred stock and debt are 13.5 percent,9.5 percent and 4 percent,respectively,what is TW's WACC if the firm faces an average tax rate of 30 percent?

A)6.19 percent

B)6.48 percent

C)7.2 percent

D)9.0 percent

A)6.19 percent

B)6.48 percent

C)7.2 percent

D)9.0 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

42

XYZ Industries has 10 million shares of stock outstanding selling at $10 per share and an issue of $30 million in 8.5 percent,annual coupon bonds with a maturity of 25 years,selling at 102 percent of par ($1,000).If XYZ's weighted average tax rate is 40 percent and its cost of equity is 15 percent,what is XYZ's WACC?

A)8.06 percent

B)11.75 percent

C)12.65 percent

D)13.43 percent

A)8.06 percent

B)11.75 percent

C)12.65 percent

D)13.43 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

43

Suppose that Tan Lines' common shares sell for $20 per share,are expected to set their next annual dividend at $1.00 per share,and that all future dividends are expected to grow by 5 percent per year,indefinitely.If Tan Lines faces a flotation cost of 10 percent on new equity issues,what will be the flotation-adjusted cost of equity?

A)5.06 percent

B)5.50 percent

C)10.00 percent

D)10.56 percent

A)5.06 percent

B)5.50 percent

C)10.00 percent

D)10.56 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

44

PAW Industries has 5 million shares of common stock outstanding with a market price of $8.00 per share.The company also has outstanding preferred stock with a market value of $10 million,and 100,000 bonds outstanding,each with face value $1,000 and selling at 96 percent of par value.The cost of equity is 19 percent,the cost of preferred is 15 percent,and the cost of debt is 9 percent.If PAW's tax rate is 34 percent,what is the WACC?

A)10.14 percent

B)10.38 percent

C)12.51 percent

D)14.33 percent

A)10.14 percent

B)10.38 percent

C)12.51 percent

D)14.33 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

45

PNB Industries has 20 million shares of common stock outstanding with a market price of $18.00 per share.The company also has outstanding preferred stock with a market value of $50 million,and 500,000 bonds outstanding,each with face value $1,000 and selling at 97 percent of par value.The cost of equity is 15 percent,the cost of preferred is 12 percent,and the cost of debt is 8.50 percent.If PNB's tax rate is 40 percent,what is the WACC?

A)7.05 percent

B)9.47 percent

C)11.31 percent

D)11.83 percent

A)7.05 percent

B)9.47 percent

C)11.31 percent

D)11.83 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

46

Suppose that Beach Blanket's common shares sell for $55 per share,are expected to set their next annual dividend at $3.00 per share,and that all future dividends are expected to grow by 8 percent per year,indefinitely.If Beach faces a flotation cost of 10 percent on new equity issues,what will be the flotation-adjusted cost of equity?

A)5.45 percent

B)8.06 percent

C)13.45 percent

D)14.06 percent

A)5.45 percent

B)8.06 percent

C)13.45 percent

D)14.06 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

47

A firm has 4,000,000 shares of common stock outstanding,each with a market price of $12.00 per share.It has 25,000 bonds outstanding,each selling for $980.The bonds mature in 20 years,have a coupon rate of 9 percent,and pay coupons semi-annually.The firm's equity has a beta of 1.5,and the expected market return is 15 percent.The tax rate is 30 percent and the WACC is 15 percent.What is the risk-free rate?

A)6.28 percent

B)8.00 percent

C)9.22 percent

D)19.36 percent

A)6.28 percent

B)8.00 percent

C)9.22 percent

D)19.36 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

48

Suppose that Wave Runners' common shares sell for $35 per share,are expected to set their next annual dividend at $2.00 per share,and that all future dividends are expected to grow by 10 percent per year,indefinitely.If Wave faces a flotation cost of 15 percent on new equity issues,what will be the flotation-adjusted cost of equity?

A)6.73 percent

B)10.07 percent

C)15.71 percent

D)16.72 percent

A)6.73 percent

B)10.07 percent

C)15.71 percent

D)16.72 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

49

Suppose that TNT,Inc.has a capital structure of 43 percent equity,23 percent preferred stock,and 34 percent debt.If the before-tax component costs of equity,preferred stock and debt are 15.4 percent,10 percent and 7 percent,respectively,what is TNT's WACC if the firm faces an average tax rate of 28 percent?

A)9.45 percent

B)10.64 percent

C)10.80 percent

D)11.30 percent

A)9.45 percent

B)10.64 percent

C)10.80 percent

D)11.30 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

50

Cup Cake Ltd.has 20 million shares of stock outstanding selling at $25 per share and an issue of $30 million in 8 percent,annual coupon bonds with a maturity of 16 years,selling at 98 percent of par ($1,000).If Cup Cake's weighted average tax rate is 34 percent,its next dividend is expected to be $2.00 per share,and all future dividends are expected to grow at 4 percent per year,indefinitely,what is its WACC?

A)7.94 percent

B)10.00 percent

C)11.64 percent

D)11.79 percent

A)7.94 percent

B)10.00 percent

C)11.64 percent

D)11.79 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

51

Suppose that Tan Lotion's common shares sell for $18 per share,are expected to set their next annual dividend at $1.00 per share,and that all future dividends are expected to grow by 7 percent per year,indefinitely.If Tan Lotion faces a flotation cost of 12 percent on new equity issues,what will be the flotation-adjusted cost of equity?

A)6.37 percent

B)7.06 percent

C)12.56 percent

D)13.31 percent

A)6.37 percent

B)7.06 percent

C)12.56 percent

D)13.31 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

52

Accessory Industries has 2 million shares of common stock outstanding,1 million shares of preferred stock outstanding,and 100 thousand bonds.If the common shares are selling for $22 per share,the preferred shares are selling for $10.50 per share,and the bonds are selling for 96 percent of par ($1,000),what would be the weights used in the calculation of Accessory's WACC for common stock,preferred stock,and bonds,respectively?

A)33.33 percent, 33.33 percent, 33.33 percent

B)29.23 percent, 6.98 percent, 63.79 percent

C)64.52 percent, 32.26 percent, 3.22 percent

D)17.12 percent, 8.17 percent, 74.71 percent

A)33.33 percent, 33.33 percent, 33.33 percent

B)29.23 percent, 6.98 percent, 63.79 percent

C)64.52 percent, 32.26 percent, 3.22 percent

D)17.12 percent, 8.17 percent, 74.71 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

53

Rings N Things Industries has 40 million shares of common stock outstanding,20 million shares of preferred stock outstanding,and 50 thousand bonds.If the common shares are selling for $25 per share,the preferred shares are selling for $15 per share,and the bonds are selling for 100 percent of par ($1,000),what would be the weights used in the calculation of Rings' WACC for common stock,preferred stock,and bonds,respectively?

A)33.33 percent, 33.33 percent, 33.33 percent

B)74.07 percent, 22.22 percent, 3.71 percent

C)66.61 percent, 33.31 percent, 0.08 percent

D)17.86 percent, 10.71 percent, 71.43 percent

A)33.33 percent, 33.33 percent, 33.33 percent

B)74.07 percent, 22.22 percent, 3.71 percent

C)66.61 percent, 33.31 percent, 0.08 percent

D)17.86 percent, 10.71 percent, 71.43 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

54

Suppose that PAW,Inc.has a capital structure of 60 percent equity,10 percent preferred stock,and 30 percent debt.If the before-tax component costs of equity,preferred stock and debt are 17.5 percent,12 percent and 6.5 percent,respectively,what is PAW's WACC if the firm faces an average tax rate of 28 percent?

A)10.71 percent

B)12.00 percent

C)13.10 percent

D)13.65 percent

A)10.71 percent

B)12.00 percent

C)13.10 percent

D)13.65 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

55

Sea Shell Industries has 50 million shares of common stock outstanding,10 million shares of preferred stock outstanding,and 100 thousand bonds.If the common shares are selling for $19 per share,the preferred shares are selling for $8.50 per share,and the bonds are selling for 97 percent of par ($1,000),what would be the weights used in the calculation of Sea Shell's WACC for common stock,preferred stock,and bonds,respectively?

A)33.33 percent, 33.33 percent, 33.33 percent

B)83.19 percent, 16.64 percent, 0.17 percent

C)15.26 percent, 6.83 percent, 77.91 percent

D)82.92 percent, 7.51 percent, 8.57 percent

A)33.33 percent, 33.33 percent, 33.33 percent

B)83.19 percent, 16.64 percent, 0.17 percent

C)15.26 percent, 6.83 percent, 77.91 percent

D)82.92 percent, 7.51 percent, 8.57 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

56

FDR Industries has 50 million shares of stock outstanding selling at $30 per share and an issue of $200 million in 9.5 percent,annual coupon bonds with a maturity of 10 years,selling at 105 percent of par ($1,000).If FDR's weighted average tax rate is 28 percent and its cost of equity is 16 percent,what is FDR's WACC?

A)12.75 percent

B)14.81 percent

C)14.88 percent

D)15.11 percent

A)12.75 percent

B)14.81 percent

C)14.88 percent

D)15.11 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

57

Pumpkin Pie Industries has 5 million shares of common stock outstanding,1 million shares of preferred stock outstanding,and 10 thousand bonds.If the common shares are selling for $50 per share,the preferred shares are selling for $31 per share,and the bonds are selling for 98 percent of par ($1,000),what would be the weights used in the calculation of Pumpkin Pie's WACC for common stock,preferred stock,and bonds,respectively?

A)33.33 percent, 33.33 percent, 33.33 percent

B)83.19 percent, 16.64 percent, 0.17 percent

C)85.97 percent, 10.67 percent, 3.38 percent

D)27.93 percent, 17.32 percent, 54.75 percent

A)33.33 percent, 33.33 percent, 33.33 percent

B)83.19 percent, 16.64 percent, 0.17 percent

C)85.97 percent, 10.67 percent, 3.38 percent

D)27.93 percent, 17.32 percent, 54.75 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

58

Crab Cakes Ltd.has 5 million shares of stock outstanding selling at $15 per share and an issue of $10 million in 10 percent,annual coupon bonds with a maturity of 25 years,selling at 97 percent of par ($1,000).If Crab Cakes' weighted average tax rate is 30 percent,its next dividend is expected to be $1.00 per share,and all future dividends are expected to grow at 5 percent per year,indefinitely,what is its WACC?

A)8.42 percent

B)10.84 percent

C)11.16 percent

D)11.52 percent

A)8.42 percent

B)10.84 percent

C)11.16 percent

D)11.52 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

59

JAK Industries has 5 million shares of stock outstanding selling at $25 per share and an issue of $40 million in 8 percent,annual coupon bonds with a maturity of 15 years,selling at 108 percent of par ($1000).If JAK's weighted average tax rate is 34 percent and its cost of equity is 15 percent,what is JAK's WACC?

A)9.19 percent

B)12.36 percent

C)12.50 percent

D)12.98 percent

A)9.19 percent

B)12.36 percent

C)12.50 percent

D)12.98 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

60

A firm has 1,000,000 shares of common stock outstanding,each with a market price of $10.00 per share.It has 15,000 bonds outstanding,each selling for $900 (with a face value of $1,000).The bonds mature in 15 years,have a coupon rate of 10 percent,and pay coupons semi-annually.The firm's equity has a beta of 1.5,and the expected market return is 20 percent.The tax rate is 35 percent and the WACC is 16 percent.What is the risk-free rate?

A)4.8 percent

B)11.4 percent

C)27.6 percent

D)30.0 percent

A)4.8 percent

B)11.4 percent

C)27.6 percent

D)30.0 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

61

JaiLai Cos.stock has a beta of 1.7,the current risk-free rate is 6.2 percent,and the expected return on the market is 11 percent.What is JaiLai's cost of equity?

A)13.81 percent

B)15.19 percent

C)13.41 percent

D)14.36 percent

A)13.81 percent

B)15.19 percent

C)13.41 percent

D)14.36 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

62

OMG Inc.has 4 million shares of common stock outstanding,3 million shares of preferred stock outstanding,and 5 thousand bonds.If the common shares sell for $17 per share,the preferred shares sell for $126 per share,and the bonds sell for 117 percent of par ($1,000),what weight should you use for preferred stock in the computation of OMG's WACC?

A)28.91 percent

B)31.58 percent

C)47.91 percent

D)83.66 percent

A)28.91 percent

B)31.58 percent

C)47.91 percent

D)83.66 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

63

FarCry Industries,a maker of telecommunications equipment,has 26 million shares of common stock outstanding,1 million shares of preferred stock outstanding,and 10 thousand bonds.If the common shares sell for $12 per share,the preferred shares sell for $114.50 per share,and the bonds sell for 98 percent of par ($1,000),what weight should you use for preferred stock in the computation of FarCry's WACC?

A)28.52 percent

B)27.51 percent

C)26.24 percent

D)25.01 percent

A)28.52 percent

B)27.51 percent

C)26.24 percent

D)25.01 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

64

Diddy Corp.stock has a beta of 1.0,the current risk-free rate is 5 percent,and the expected return on the market is 15.5 percent.What is Diddy's cost of equity?

A)15.50 percent

B)14.20 percent

C)18.50 percent

D)16.30 percent

A)15.50 percent

B)14.20 percent

C)18.50 percent

D)16.30 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

65

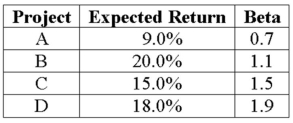

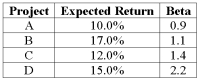

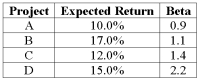

An all-equity firm is considering the projects shown as follows.The T-bill rate is 4 percent and the market risk premium is 8 percent.If the firm uses its current WACC of 13 percent to evaluate these projects,which project(s)will be incorrectly accepted?

A)Project A

B)Project C

C)Project D

D)Projects C and D

A)Project A

B)Project C

C)Project D

D)Projects C and D

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

66

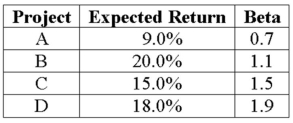

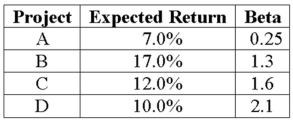

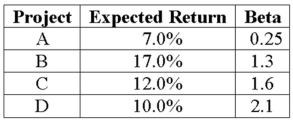

An all-equity firm is considering the projects shown as follows.The T-bill rate is 3 percent and the market risk premium is 6 percent.If the firm uses its current WACC of 12 percent to evaluate these projects,which project(s),if any,will be incorrectly rejected?

A)Only Project A would be incorrectly rejected.

B)Both Projects A and C would be incorrectly rejected.

C)Projects A, B, and C would be incorrectly rejected.

D)None of the projects would be incorrectly rejecteD.Step 1: Find Project Required Returns using CAPM.Project A: 7.8 percent; Project B: 10.2 percent; Project C: 11.4 percent; Project D: 12 percent; only Project A would be incorrectly rejected since its required return is only 7.8 percent given its risk and it is expected to return 9 percent.

A)Only Project A would be incorrectly rejected.

B)Both Projects A and C would be incorrectly rejected.

C)Projects A, B, and C would be incorrectly rejected.

D)None of the projects would be incorrectly rejecteD.Step 1: Find Project Required Returns using CAPM.Project A: 7.8 percent; Project B: 10.2 percent; Project C: 11.4 percent; Project D: 12 percent; only Project A would be incorrectly rejected since its required return is only 7.8 percent given its risk and it is expected to return 9 percent.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

67

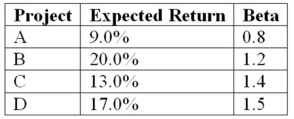

An all-equity firm is considering the projects shown as follows.The T-bill rate is 3 percent and the market risk premium is 6 percent.If the firm uses its current WACC of 12 percent to evaluate these projects,which project(s)will be incorrectly rejected?

A)Project A

B)Projects B and C

C)Project D

D)Project B

A)Project A

B)Projects B and C

C)Project D

D)Project B

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

68

OMG Inc.has 4 million shares of common stock outstanding,3 million shares of preferred stock outstanding,and 50 thousand bonds.If the common shares are selling for $21 per share,the preferred shares are selling for $10 per share,and the bonds are selling for 111 percent of par ($1,000),what weight should you use for debt in the computation of OMG's WACC?

A)32.74 percent

B)29.86 percent

C)25.79 percent

D)21.86 percent

A)32.74 percent

B)29.86 percent

C)25.79 percent

D)21.86 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

69

FarCry Industries,a maker of telecommunications equipment,has 26 million shares of common stock outstanding,1 million shares of preferred stock outstanding,and 10 thousand bonds.If the common shares sell for $15 per share,the preferred shares sell for $114.50 per share,and the bonds sell for 101 percent of par ($1,000),what weight should you use for preferred stock in the computation of FarCry's WACC?

A)28.52 percent

B)27.51 percent

C)26.24 percent

D)22.25 percent

A)28.52 percent

B)27.51 percent

C)26.24 percent

D)22.25 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

70

A firm has 5,000,000 shares of common stock outstanding,each with a market price of $8.00 per share.It has 25,000 bonds outstanding,each selling for $1,100 with a $1,000 face value.The bonds mature in 12 years,have a coupon rate of 9 percent,and pay coupons semi-annually.The firm's equity has a beta of 1.4,and the expected market return is 15 percent.The tax rate is 35 percent and the WACC is 14 percent.Calculate the risk-free rate.

A)2.05 percent

B)15.27 percent

C)20.18 percent

D)1.19 percent

A)2.05 percent

B)15.27 percent

C)20.18 percent

D)1.19 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

71

TAFKAP Industries has 8 million shares of stock outstanding selling at $17 per share and an issue of $20 million in 7.5 percent,annual coupon bonds with a maturity of 15 years,selling at 109 percent of par ($1,000).If TAFKAP's weighted average tax rate is 34% and its cost of equity is 12.5 percent,what is TAFKAP's WACC?

A)11.02 percent

B)11.37 percent

C)12.16 percent

D)12.83 percent

A)11.02 percent

B)11.37 percent

C)12.16 percent

D)12.83 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

72

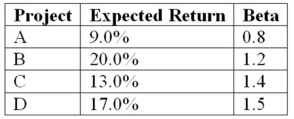

An all-equity firm is considering the projects shown as follows.The T-bill rate is 4 percent and the market risk premium is 9 percent.If the firm uses its current WACC of 14 percent to evaluate these projects,which project(s)will be incorrectly rejected?

A)Project A

B)Project B

C)Project C

D)Project D

A)Project A

B)Project B

C)Project C

D)Project D

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

73

KatyDid Clothes has a $150 million ($1,000 face value)15-year bond issue selling for 86 percent of par that carries a coupon rate of 8 percent,paid semi-annually.What would be KatyDid's before-tax component cost of debt?

A)4.90 percent

B)8.13 percent

C)9.80 percent

D)7.09 percent

A)4.90 percent

B)8.13 percent

C)9.80 percent

D)7.09 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

74

JLP Industries has 6.5 million shares of common stock outstanding with a market price of $20.00 per share.The company also has outstanding preferred stock with a market value of $10 million,and 25,000 bonds outstanding,each with face value $1,000 and selling at 90 percent of par value.The cost of equity is 14 percent,the cost of preferred is 10 percent,and the cost of debt is 6.25 percent.If JLP's tax rate is 34 percent,what is the WACC?

A)12.39 percent

B)12.98 percent

C)13.13 percent

D)13.72 percent

A)12.39 percent

B)12.98 percent

C)13.13 percent

D)13.72 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

75

Marme Inc.has preferred stock selling for 137 percent of par that pays an 11 percent annual dividend.What would be Marme's component cost of preferred stock?

A)11.00 percent

B)8.03 percent

C)8.17 percent

D)10.16 percent

A)11.00 percent

B)8.03 percent

C)8.17 percent

D)10.16 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

76

Oberon Inc.has a $20 million ($1,000 face value)10-year bond issue selling for 99 percent of par that pays an annual coupon of 7.25 percent.What would be Oberon's before-tax component cost of debt?

A)6.12 percent

B)7.02 percent

C)7.40 percent

D)8.15 percent

A)6.12 percent

B)7.02 percent

C)7.40 percent

D)8.15 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

77

FarCry Industries,a maker of telecommunications equipment,has 6 million shares of common stock outstanding,1 million shares of preferred stock outstanding,and 10 thousand bonds.If the common shares are selling for $27 per share,the preferred shares are selling for $15 per share,and the bonds are selling for 119 percent of par ($1,000),what weight should you use for debt in the computation of FarCry's WACC?

A)4.93 percent

B)5.07 percent

C)5.81 percent

D)6.30 percent

A)4.93 percent

B)5.07 percent

C)5.81 percent

D)6.30 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

78

Johnny Cake Ltd.has 10 million shares of stock outstanding selling at $20 per share and an issue of $50 million in 8 percent,annual coupon bonds with a maturity of 13 years,selling at 93.5 percent of par ($1,000).If Johnny Cake's weighted average tax rate is 34 percent,its next dividend is expected to be $2.00 per share,and all future dividends are expected to grow at 5 percent per year,indefinitely,what is its WACC?

A)12.64 percent

B)13.18 percent

C)13.26 percent

D)14.06 percent

A)12.64 percent

B)13.18 percent

C)13.26 percent

D)14.06 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

79

KatyDid Clothes has a $150 million ($1,000 face value)15-year bond issue selling for 106 percent of par that carries a coupon rate of 8 percent,paid semi-annually.What would be KatyDid's before-tax component cost of debt?

A)3.67 percent

B)7.34 percent

C)8.12 percent

D)7.09 percent

A)3.67 percent

B)7.34 percent

C)8.12 percent

D)7.09 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

80

A firm has 5,000,000 shares of common stock outstanding,each with a market price of $10.00 per share.It has 55,000 bonds outstanding,each selling for $990 with a $1,000 face value.The bonds mature in 15 years,have a coupon rate of 8 percent,and pay coupons semi-annually.The firm's equity has a beta of 2.0,and the expected market return is 15 percent.The tax rate is 35 percent and the WACC is 16 percent.Calculate the risk-free rate.

A)27.68 percent

B)1.79 percent

C)2.32 percent

D)2.12 percent

A)27.68 percent

B)1.79 percent

C)2.32 percent

D)2.12 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck