Deck 6: Accounting for Long-Term Operational Assets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/97

Play

Full screen (f)

Deck 6: Accounting for Long-Term Operational Assets

1

Which of the following intangible assets does not convey a specific legal right or privilege?

A) Copyrights

B) Franchises

C) Goodwill

D) Trademarks

A) Copyrights

B) Franchises

C) Goodwill

D) Trademarks

C

Explanation: Goodwill is a different type of intangible asset that results from the purchase of another company for an amount greater than the fair value of the company's net assets.

Explanation: Goodwill is a different type of intangible asset that results from the purchase of another company for an amount greater than the fair value of the company's net assets.

2

Laramie Co. paid $800,000 for a purchase that included land, building, and office furniture. An appraiser provided the following estimates of the market values of the assets if they had been purchased separately: Land, $100,000, Building, $740,000, and Office Furniture, $160,000. Based on this information the cost that would be allocated to the land is:

A) $80,000.

B) $70,000.

C) $100,000.

D) $107,000.

A) $80,000.

B) $70,000.

C) $100,000.

D) $107,000.

A

Explanation: $100,000 ÷ ($100,000 + $740,000 + $160,000) = 10% of market value; $800,000 purchase price × 10% = $80,000.

Explanation: $100,000 ÷ ($100,000 + $740,000 + $160,000) = 10% of market value; $800,000 purchase price × 10% = $80,000.

3

At the end of the current accounting period, Ringgold Co. recorded depreciation of $15,000 on its equipment. The effect of this entry on the company's balance sheet is to decrease:

A) assets and increase liabilities.

B) owners' equity and decrease assets.

C) assets and increase owners' equity.

D) owners' equity and increase liabilities.

A) assets and increase liabilities.

B) owners' equity and decrease assets.

C) assets and increase owners' equity.

D) owners' equity and increase liabilities.

B

Explanation: Depreciation decreases assets by increasing accumulated depreciation and increases expenses, which decreases owners' equity.

Explanation: Depreciation decreases assets by increasing accumulated depreciation and increases expenses, which decreases owners' equity.

4

Which of the following terms is used to identify the process of expense recognition for property, plant and equipment?

A) Amortization

B) Depreciation

C) Depletion

D) Revision

A) Amortization

B) Depreciation

C) Depletion

D) Revision

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

5

Which method of depreciation is used by most U. S. companies for financial reporting purposes?

A) Straight-line

B) Units-of-production

C) Double-declining-balance

D) None of these answer choices are correct

A) Straight-line

B) Units-of-production

C) Double-declining-balance

D) None of these answer choices are correct

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

6

Harding Corporation acquired real estate that contained land, building and equipment. The property cost Harding $1,900,000. Harding paid $350,000 and issued a note payable for the remainder of the cost. An appraisal of the property reported the following values: Land, $374,000; Building, $1,100,000 and Equipment, $726,000. What value will be recorded for the building?

A) $175,000

B) $950,000

C) $800,000

D) $1,100,000

A) $175,000

B) $950,000

C) $800,000

D) $1,100,000

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

7

Harding Corporation acquired real estate that contained land, building and equipment. The property cost Harding $1,900,000. Harding paid $350,000 and issued a note payable for the remainder of the cost. An appraisal of the property reported the following values: Land, $374,000; Building, $1,100,000 and Equipment, $726,000. Assume that Harding uses the units-of-production method when depreciating its equipment. Harding estimates that the purchased equipment will produce 1,000,000 units over its 5-year useful life and has salvage value of $34,000. Harding produced 265,000 units with the equipment by the end of the first year of purchase.

Which amount below is closest to the amount Harding will record for depreciation expense for the equipment in the first year?

A) $193,450

B) $125,200

C) $157,145

D) $165,890

Which amount below is closest to the amount Harding will record for depreciation expense for the equipment in the first year?

A) $193,450

B) $125,200

C) $157,145

D) $165,890

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

8

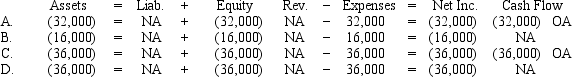

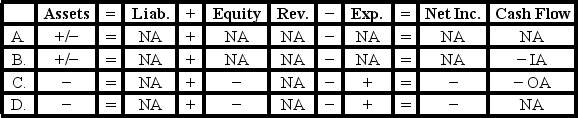

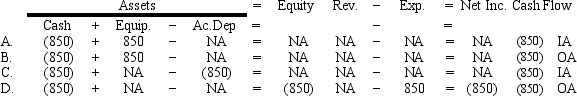

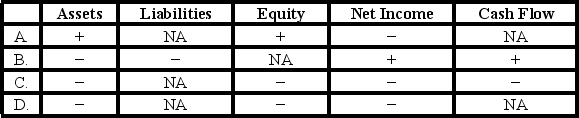

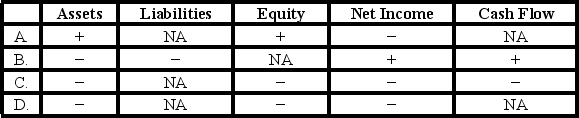

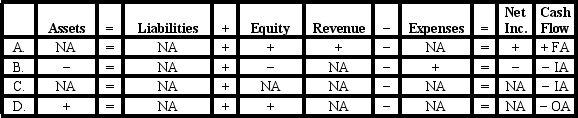

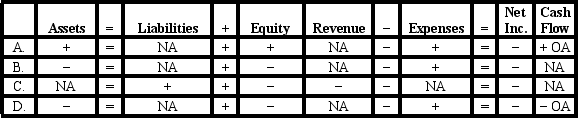

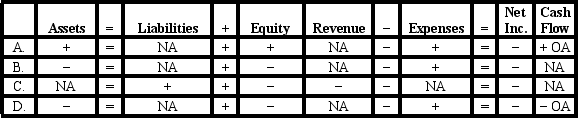

Flagler Company purchased equipment that cost $90,000. The equipment had a useful life of 5 years and a $10,000 salvage value. Flagler used the double-declining-balance method to depreciate its assets. Which of the following choices accurately reflects how the recognition of the first year's depreciation would affect the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following would not be classified as a tangible long-term asset?

A) Delivery truck

B) Timber reserve

C) Land

D) Copyright

A) Delivery truck

B) Timber reserve

C) Land

D) Copyright

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

10

On January 1, Year 1, Missouri Co. purchased a truck that cost $57,000. The truck had an expected useful life of 10 years and a $6,000 salvage value. The amount of depreciation expense recognized in Year 2 assuming that Missouri uses the double declining-balance method is:

A) $9,120.

B) $11,400.

C) $10,200.

D) $8,160.

A) $9,120.

B) $11,400.

C) $10,200.

D) $8,160.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

11

Anchor Company purchased a manufacturing machine with a list price of $160,000 and received a 2% cash discount on the purchase. The machine was delivered under terms FOB shipping point, and freight costs amounted to $2,400. Anchor paid $3,000 to have the machine installed and tested. Insurance costs to protect the asset from fire and theft amounted to $3,600 for the first year of operations. Based on this information, the amount of cost recorded in the asset account would be:

A) $156,800.

B) $159,200.

C) $165,800.

D) $162,200.

A) $156,800.

B) $159,200.

C) $165,800.

D) $162,200.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

12

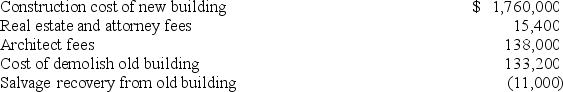

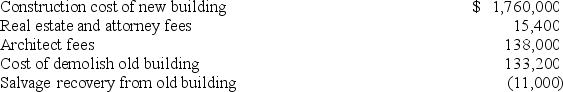

On January 6, Year 1, the Mount Jackson Corporation purchased a tract of land for a factory site for $1,500,000. An existing building on the site was demolished and the new factory was completed on October 11, Year 1. Additional cost data are shown below:  Which of the following correctly states the capitalized cost of the (a) land and (b) the new building, respectively?

Which of the following correctly states the capitalized cost of the (a) land and (b) the new building, respectively?

A) $1,637,600 and $1,898,000

B) $1,515,400 and $2,020,200

C) $1,648,600 and $1,887,000

D) $1,500,000 and $2,035,600

Which of the following correctly states the capitalized cost of the (a) land and (b) the new building, respectively?

Which of the following correctly states the capitalized cost of the (a) land and (b) the new building, respectively?A) $1,637,600 and $1,898,000

B) $1,515,400 and $2,020,200

C) $1,648,600 and $1,887,000

D) $1,500,000 and $2,035,600

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

13

Chico Company paid $950,000 for a basket purchase that included office furniture, a building and land. An appraiser provided the following estimates of the market values of the assets if they had been purchased separately: Office furniture - $190,000; Building - $740,000, Land - $132,000. Based on this information, and rounding allocations to two decimal places, the amount of cost that would be allocated to the office furniture is closest to:

A) $171,000.

B) $190,000.

C) $316,667.

D) $105,000.

A) $171,000.

B) $190,000.

C) $316,667.

D) $105,000.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

14

On January 1, Year 1, Milton Manufacturing Company purchased equipment with a list price of $88,000. A total of $4,000 was paid for installation and testing. During the first year, Milton paid $6,000 for insurance on the equipment and another $2,200 for routine maintenance and repairs. Milton uses the units-of-production method of depreciation. Useful life is estimated at 100,000 units, and estimated salvage value is $8,000. During Year 1, the equipment produced 13,000 units. What is closest to the amount of depreciation for the year?

A) $10,920

B) $11,960

C) $11,700

D) $12,740

A) $10,920

B) $11,960

C) $11,700

D) $12,740

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

15

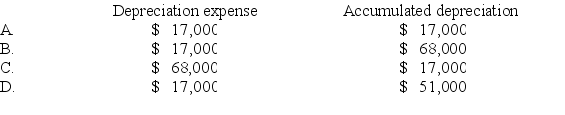

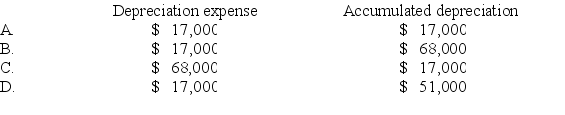

On January 1, Year 1, Phillips Company made a basket purchase including land, a building and equipment for $380,000. The appraised values of the assets are $20,000 for the land, $340,000 for the building and $40,000 for equipment. Phillips uses the double-declining-balance method of depreciation for the equipment which is estimated to have a useful life of four years and a salvage value of $5,000. The depreciation expense for Year 1 for the equipment is:

A) $17,000.

B) $20,000.

C) $9,500.

D) $19,000.

A) $17,000.

B) $20,000.

C) $9,500.

D) $19,000.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following would be classified as a tangible asset?

A) Land.

B) Goodwill.

C) Copyright.

D) Trademark.

A) Land.

B) Goodwill.

C) Copyright.

D) Trademark.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is considered an accelerated depreciation method?

A) Double-declining-balance

B) Units-of-production

C) Straight-line

D) Both double-declining-balance and units-of-production

A) Double-declining-balance

B) Units-of-production

C) Straight-line

D) Both double-declining-balance and units-of-production

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following would be classified as a long-term operational asset?

A) Notes receivable.

B) Trademark.

C) Inventory.

D) Accounts receivable.

A) Notes receivable.

B) Trademark.

C) Inventory.

D) Accounts receivable.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is not classified as property, plant and equipment?

A) Computers

B) Buildings

C) Land

D) Office furniture

A) Computers

B) Buildings

C) Land

D) Office furniture

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

20

On March 1, Bartholomew Company purchased a new stamping machine with a list price of $34,000. The company paid cash for the machine; therefore, it was allowed a 5% discount. Other costs associated with the machine were: transportation costs, $550; sales tax paid, $1,360; installation costs, $450; routine maintenance during the first month of operation, $500. The cost recorded for the machine was:

A) $34,210.

B) $32,300.

C) $35,160.

D) $34,660.

A) $34,210.

B) $32,300.

C) $35,160.

D) $34,660.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following statements is true with regard to depreciation expense?

A) Different companies in the same industry always depreciate similar assets by the same methods.

B) A company using straight-line will show a smaller book value for assets than if the same company uses double-declining-balance.

C) Choosing double-declining-balance over straight-line will produce a greater total depreciation expense over the asset's life.

D) A company should use the depreciation method that best matches expense recognition with the use of the asset.

A) Different companies in the same industry always depreciate similar assets by the same methods.

B) A company using straight-line will show a smaller book value for assets than if the same company uses double-declining-balance.

C) Choosing double-declining-balance over straight-line will produce a greater total depreciation expense over the asset's life.

D) A company should use the depreciation method that best matches expense recognition with the use of the asset.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

22

On January 1, Year 2, Ballard Company spent $12,000 on an asset to improve its quality. The asset had been purchased on January 1, Year 1, for $52,000. The asset had a $4,000 salvage value and a 6-year life. Ballard uses straight-line depreciation. What would be the book value of the asset on January 1, Year 5?

A) $24,800.

B) $20,800.

C) $10,400.

D) $24,000.

A) $24,800.

B) $20,800.

C) $10,400.

D) $24,000.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

23

On January 1, Year 1, Friedman Company purchased a truck that cost $48,000. The truck had an expected useful life of 8 years and an $8,000 salvage value. The book value of the truck at the end of Year 1, assuming that Friedman uses the double-declining-balance method, is:

A) $43,000.

B) $38,000.

C) $40,000.

D) $36,000.

A) $43,000.

B) $38,000.

C) $40,000.

D) $36,000.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

24

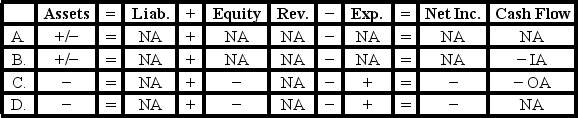

Anton Company paid cash to prolong the life of one of its assets. Which of the following choices accurately reflects how this event would affect Anton's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

25

Jing Company was started on January 1, Year 1 when it issued common stock for $50,000 cash. Also, on January 1, Year 1 the company purchased office equipment that cost $34,000 cash. The equipment was delivered under terms FOB shipping point, and transportation cost was $2,000. The equipment had a five-year useful life and a $12,000 expected salvage value. Assume that Jing Company earned $30,000 cash revenue and incurred $19,000 in cash expenses in Year 3. Using straight-line depreciation and assuming that the office equipment was sold on December 31, Year 3 for $16,000, the amount of net income or (loss) appearing on the December 31, Year 3 income statement would be:

A) ($6,600).

B) $6,600.

C) $600.

D) $5,400.

A) ($6,600).

B) $6,600.

C) $600.

D) $5,400.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

26

Jing Company was started on January 1, Year 1 when it issued common stock for $50,000 cash. Also, on January 1, Year 1 the company purchased office equipment that cost $34,000 cash. The equipment was delivered under terms FOB shipping point, and transportation cost was $2,000. The equipment had a five-year useful life and a $12,000 expected salvage value. At the end of Year 5, assuming the equipment had not been sold, the book value of the office equipment using straight-line depreciation and double-declining-balance depreciation, respectively, would be:

A) $12,000 and $1,680.

B) $12,000 and $12,000.

C) $0 and $0.

D) None of these answer choices are correct.

A) $12,000 and $1,680.

B) $12,000 and $12,000.

C) $0 and $0.

D) None of these answer choices are correct.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

27

On September 10, Year 5, Farmer Company sold a piece of equipment for $6,000. The equipment had an original cost of $34,000 and accumulated depreciation of $31,000 at the time of the sale. Which of the following correctly shows the effect of the sale on the Year 5 financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

28

Jing Company was started on January 1, Year 1 when it issued common stock for $50,000 cash. Also, on January 1, Year 1 the company purchased office equipment that cost $34,000 cash. The equipment was delivered under terms FOB shipping point, and transportation cost was $2,000. The equipment had a five-year useful life and a $12,000 expected salvage value. Using double-declining-balance depreciation, what the amount of depreciation expense and the amount of accumulated depreciation, respectively, that would appear on the December 31, Year 3 financial statements?

A) $0 and $24,000

B) $960 and $24,000

C) $8,640 and $23,040

D) $5,184 and $28,224

A) $0 and $24,000

B) $960 and $24,000

C) $8,640 and $23,040

D) $5,184 and $28,224

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

29

On January 1, Year 1, Li Company purchased an asset that cost $80,000. The asset had an expected useful life of five years and an estimated salvage value of $16,000. Li uses the straight-line method for the recognition of depreciation expense. At the beginning of the fourth year of usage, the company revised its estimated salvage value to $8,000. Based on this information, the amount of depreciation expense to be recognized at the end of Year 4 is:

A) $12,800.

B) $16,800.

C) $33,600.

D) $20,800.

A) $12,800.

B) $16,800.

C) $33,600.

D) $20,800.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

30

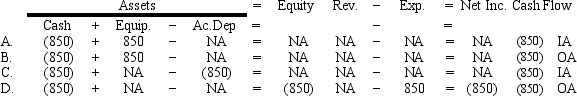

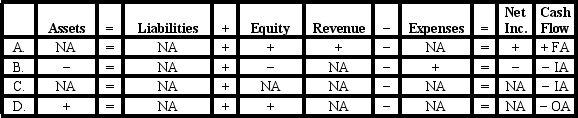

On January 1, Year 3, Ruiz Company spent $850 on a plant asset to improve its quality. The asset had been purchased on January 1, Year 1 for $8,400 and had an estimated salvage value of $1,200 and a useful life of five years. Ruiz uses the straight-line depreciation method. Which of the following correctly shows the effects of the Year 3 expenditure on the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

31

Farmer Company purchased equipment on January 1, Year 1 for $82,000. The equipment is estimated to have a 5-year life and a salvage value of $4,000. The company uses the straight-line depreciation method. If the original expected life remained the same (i.e., 5-years), but at the beginning of Year 4, the salvage value was revised to $8,000, the annual depreciation expense for each of the remaining years would be:

A) $5,440.

B) $27,200.

C) $13,600.

D) $14,800.

A) $5,440.

B) $27,200.

C) $13,600.

D) $14,800.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

32

A machine with a book value of $38,000 is sold for $32,000. Which of the following answers would accurately represent the effects of the sale on the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

33

Farmer Company purchased equipment on January 1, Year 1 for $82,000. The equipment is estimated to have a 5-year life and a salvage value of $4,000. The company uses the straight-line depreciation method. At the beginning of Year 4, Farmer revised the expected life to eight years. The annual amount of depreciation expense for each of the remaining years would be:

A) $6,240.

B) $4,400.

C) $7,040.

D) $3,900.

A) $6,240.

B) $4,400.

C) $7,040.

D) $3,900.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

34

On January 1, Year 1, the City Taxi Company purchased a new taxi cab for $36,000. The cab has an expected salvage value of $2,000. The company estimates that the cab will be driven 200,000 miles over its life. It uses the units-of-production method to determine depreciation expense. The cab was driven 45,000 miles the first year and 48,000 the second year. What would be the depreciation expense reported on the Year 2 income statement and the book value of the taxi, respectively, at the end of Year 2?

A) $8,640 and $19,260

B) $8,640 and $17,260

C) $8,160 and $20,190

D) $8,160 and $18,190

A) $8,640 and $19,260

B) $8,640 and $17,260

C) $8,160 and $20,190

D) $8,160 and $18,190

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

35

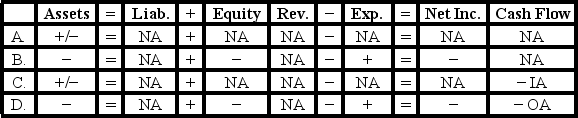

Chubb Company paid cash to purchase equipment on January 1, Year 1. Select the answer that shows how the recognition of depreciation expense in Year 2 would affect assets, liabilities, equity, net income, and cash flow (+ means increase, - decrease, and NA not affected).

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

36

Dinkins Company purchased a truck that cost $46,000. The company expected to drive the truck 100,000 miles over its 5-year useful life, and the truck had an estimated salvage value of $8,000. If the truck is driven 26,000 miles in the current accounting period, what would be the amount of depreciation expense for the year?

A) $11,960

B) $9,880

C) $9,200

D) $7,600

A) $11,960

B) $9,880

C) $9,200

D) $7,600

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

37

Madison Company owned an asset that had cost $44,000. The company sold the asset on January 1, Year 4, for $16,000. Accumulated depreciation on the day of sale amounted to $32,000. Based on this information, the sale would result in:

A) A $16,000 cash inflow in the investing activities section of the cash flow statement.

B) A $16,000 increase in total assets.

C) A $4,000 gain in the investing activities section of the statement of cash flows.

D) A $4,000 cash inflow in the financing activities section of the cash flow statement.

A) A $16,000 cash inflow in the investing activities section of the cash flow statement.

B) A $16,000 increase in total assets.

C) A $4,000 gain in the investing activities section of the statement of cash flows.

D) A $4,000 cash inflow in the financing activities section of the cash flow statement.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

38

On January 1, Year 1, Friedman Company purchased a truck that cost $48,000. The truck had an expected useful life of 100,000 miles over 8 years and an $8,000 salvage value. During Year 2, Friedman drove the truck 18,500 miles. The amount of depreciation expense recognized in Year 2 assuming that Friedman uses the units-of-production method is:

A) $8,880.

B) $7,400.

C) $6,000.

D) $5,000.

A) $8,880.

B) $7,400.

C) $6,000.

D) $5,000.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

39

Emir Company purchased equipment that cost $110,000 cash on January 1, Year 1. The equipment had an expected useful life of six years and an estimated salvage value of $8,000. Assuming that Emir depreciates its assets under the straight-line method, the amount of depreciation expense appearing on the Year 4 income statement and the amount of accumulated depreciation appearing on the December 31, Year 4, balance sheet would be:

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

40

On January 1, Year 1, Dinwiddie Company purchased a car that cost $45,000. The car had an expected useful life of 6 years and a $10,000 salvage value. Based on this information alone:

A) the total amount of depreciation expense recognized over the six year useful life will be greater under the double-declining-balance method than the straight-line method.

B) the amount of depreciation expense recognized in Year 4 would be greater if Dinwiddie depreciates the car under the straight-line method than if the double-declining-balance method is used.

C) at the end of Year 3, the amount in accumulated depreciation account will be less if the double-declining-balance method is used than it would be if the straight-line method is used.

D) None of these statements is true.

A) the total amount of depreciation expense recognized over the six year useful life will be greater under the double-declining-balance method than the straight-line method.

B) the amount of depreciation expense recognized in Year 4 would be greater if Dinwiddie depreciates the car under the straight-line method than if the double-declining-balance method is used.

C) at the end of Year 3, the amount in accumulated depreciation account will be less if the double-declining-balance method is used than it would be if the straight-line method is used.

D) None of these statements is true.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

41

On January 1, Year 1, the Vanguard Company purchased a copyright for $12,000. Vanguard estimated the remaining useful life of the copyright to be 6 years. Which of the following correctly shows the effect of Vanguard's purchase of the copyright on the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

42

Goodwill may be recorded in which of the following circumstances?

A) When the property, plant and equipment of a business increase in value.

B) When a business earns a very high net income.

C) When a business sells property for more than its book value.

D) When one business acquires another business.

A) When the property, plant and equipment of a business increase in value.

B) When a business earns a very high net income.

C) When a business sells property for more than its book value.

D) When one business acquires another business.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

43

The recognition of depletion expense:

A) decreases assets and equity and decreases cash flow from investing expenses under the direct approach.

B) decreases cash flow from operating activities, and does not affect the amount of total assets.

C) increases assets, equity, and cash flow from operating activities.

D) decreases assets and equity, and does not affect cash flow.

A) decreases assets and equity and decreases cash flow from investing expenses under the direct approach.

B) decreases cash flow from operating activities, and does not affect the amount of total assets.

C) increases assets, equity, and cash flow from operating activities.

D) decreases assets and equity, and does not affect cash flow.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

44

Good Company paid cash to purchase mineral rights on a large parcel of land. Which of the following choices accurately reflects how this event would affect Good's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

45

On April 1, Year 1, Fossil Energy Company purchased an oil producing well at a cash cost of $12,000,000. It is estimated that the oil well contains 600,000 barrels of oil, of which only 500,000 can be profitably extracted. By December 31, Year 1, 25,000 barrels of oil were produced and sold. The amount of depletion expense for Year 1 on this well would be:

A) $800,000.

B) $600,000.

C) $480,000.

D) $500,000.

A) $800,000.

B) $600,000.

C) $480,000.

D) $500,000.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

46

The Hoover Company acquired the Burgess Company for $1,200,000 cash. The fair value of Burgess's assets was $1,040,000, and the company had liabilities of $60,000. How much goodwill will be recorded in connection with the acquisition?

A) $220,000

B) $100,000

C) $160,000

D) $1,200,000

A) $220,000

B) $100,000

C) $160,000

D) $1,200,000

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

47

On January 1, Year 1, Eller Company purchased an asset that had cost $24,000. The asset had an 8-year useful life and an estimated salvage value of $1,000. Eller depreciates its assets on the straight-line basis. On January 1, Year 5, the company spent $6,000 to improve the quality of the asset. Based on this information, the recognition of depreciation expense in Year 5 would:

A) increase total assets by $4,375.

B) reduce total equity by $4,375.

C) reduce total assets by $4,625.

D) increase total equity by $4,625.

A) increase total assets by $4,375.

B) reduce total equity by $4,375.

C) reduce total assets by $4,625.

D) increase total equity by $4,625.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following terms is used to identify the expense recognition for intangible assets?

A) Allocation.

B) Depletion.

C) Depreciation.

D) Amortization.

A) Allocation.

B) Depletion.

C) Depreciation.

D) Amortization.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

49

The balance sheet of Flo's Restaurant showed total assets of $600,000, liabilities of $160,000 and equity of $540,000. An appraiser estimated the fair value of the restaurant assets at $680,000. If Alice Company pays $770,000 cash for the restaurant the amount of goodwill acquired would be:

A) $90,000.

B) $170,000.

C) $250,000.

D) $230,000.

A) $90,000.

B) $170,000.

C) $250,000.

D) $230,000.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

50

On January 1, Year 1, Stiller Company paid $80,000 to obtain a patent. Stiller expected to use the patent for 5 years before it became technologically obsolete. The remaining legal life of the patent was 8 years. Based on this information, the amount of amortization expense on the December 31, Year 3 income statement and the book value of the patent on the December 31, Year 3, balance sheet, respectively, would be:

A) $10,000 and $30,000

B) $16,000 and $48,000

C) $10,000 and $50,000

D) $16,000 and $32,000

A) $10,000 and $30,000

B) $16,000 and $48,000

C) $10,000 and $50,000

D) $16,000 and $32,000

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following terms is applied to long-term assets that have no physical substance and provide rights, privileges and special opportunities to businesses?

A) Tangible assets

B) Intangible assets

C) Natural resources

D) Property, plant and equipment

A) Tangible assets

B) Intangible assets

C) Natural resources

D) Property, plant and equipment

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

52

Monroe Minerals Company purchased a copper mine for $120,000,000. The mine was expected to produce 50,000 tons of copper over its useful life. During Year 1, the company extracted 6,000 tons of copper. The copper was sold for $4,500 per ton. Assume that the company incurred $8,040,000 in operating expenses during Year 1. Based on this information, how much net income would Monroe report in Year 1?

A) $12,600,000.

B) $4,560,000.

C) $6,360,000.

D) $14,400,000.

A) $12,600,000.

B) $4,560,000.

C) $6,360,000.

D) $14,400,000.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

53

What term is used to describe the situation where the value of an intangible asset may be significantly diminished?

A) Amortization

B) Impairment

C) Depletion

D) Depreciation

A) Amortization

B) Impairment

C) Depletion

D) Depreciation

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following statements is correct regarding accounting treatment of goodwill?

A) Goodwill is recorded as an asset and is not written off as an expense unless its value decreases.

B) Goodwill is recorded as an asset and amortized over 5 years regardless of any change in value.

C) Goodwill is recorded as an asset and amortized over 40 years unless its value decreases.

D) Goodwill is expensed immediately in the year acquired.

A) Goodwill is recorded as an asset and is not written off as an expense unless its value decreases.

B) Goodwill is recorded as an asset and amortized over 5 years regardless of any change in value.

C) Goodwill is recorded as an asset and amortized over 40 years unless its value decreases.

D) Goodwill is expensed immediately in the year acquired.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following assets does not have an indefinite useful live?

A) Goodwill

B) Patent

C) Renewable franchise

D) Trademark

A) Goodwill

B) Patent

C) Renewable franchise

D) Trademark

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

56

On January 1, Year 1, the Vanguard Company purchased a copyright for $12,000. Vanguard estimated the remaining useful life of the copyright to be 6 years. Which of the following correctly shows the effect of the first year's amortization of Vanguard's copyright?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

57

Glick Company purchased oil rights on July 1, Year 1 for $2,400,000. If 200,000 barrels of oil are expected to be extracted over the asset's life, and 30,000 barrels are extracted and sold in Year 1, the recognition of depletion expense on December 31, Year 1 would cause:

A) a reduction in equity of $200,000.

B) a reduction in assets of $360,000.

C) a reduction in assets of $300,000.

D) an increase in equity of $400,000.

A) a reduction in equity of $200,000.

B) a reduction in assets of $360,000.

C) a reduction in assets of $300,000.

D) an increase in equity of $400,000.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

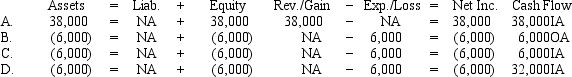

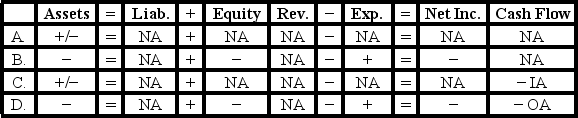

58

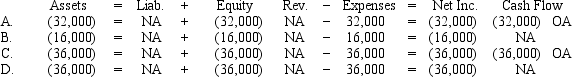

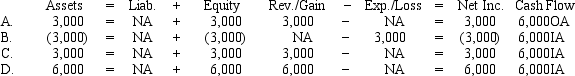

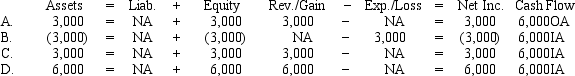

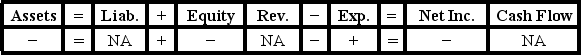

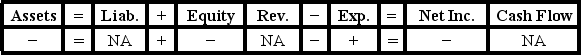

Byrd Company experienced an accounting event that affected its financial statements as indicated below:  Which of the following accounting events could have caused these effects on Byrd's statements?

Which of the following accounting events could have caused these effects on Byrd's statements?

A) Recognized depletion expense under the units-of-production method.

B) Recognized depreciation expense under the double-declining-balance method.

C) Amortized patent cost under the straight-line method.

D) All of these answer choices are correct.

Which of the following accounting events could have caused these effects on Byrd's statements?

Which of the following accounting events could have caused these effects on Byrd's statements?A) Recognized depletion expense under the units-of-production method.

B) Recognized depreciation expense under the double-declining-balance method.

C) Amortized patent cost under the straight-line method.

D) All of these answer choices are correct.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

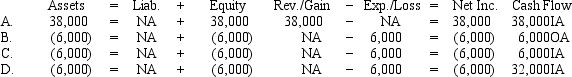

59

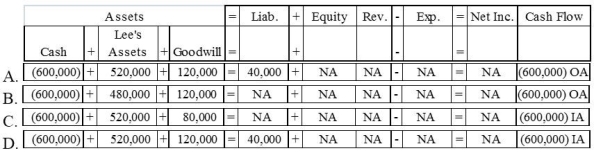

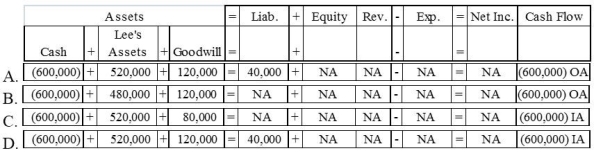

The Grant Company acquired the Lee Company for $600,000 cash. The fair value of Lee's assets was $520,000, and the company had $40,000 in liabilities. Which of the following choices would reflect the acquisition on Grant's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following would most likely not be expensed using the straight-line method?

A) A copyright.

B) A building.

C) A timber reserve.

D) A patent.

A) A copyright.

B) A building.

C) A timber reserve.

D) A patent.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

61

Title search and document costs incurred to purchase a building are expensed in the period the building is acquired.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

62

Indicate whether each of the following statements is true or false.

_____ a) Straight-line depreciation is the most widely used method in the U.S.

_____ b) An accelerated depreciation method provides a lower depreciation charge in the early years of an asset's life cycle than does the straight-line method.

_____ c) The units-of-production depreciation method allocates the cost of a plant asset in proportion to the asset's usage.

_____ d) Total depreciation expense recognized over the asset's life is not affected by the choice of depreciation methods.

_____ e) The entry to record depreciation affects the income statement and the statement of cash flows but not the balance sheet or statement of changes in stockholders' equity.

_____ a) Straight-line depreciation is the most widely used method in the U.S.

_____ b) An accelerated depreciation method provides a lower depreciation charge in the early years of an asset's life cycle than does the straight-line method.

_____ c) The units-of-production depreciation method allocates the cost of a plant asset in proportion to the asset's usage.

_____ d) Total depreciation expense recognized over the asset's life is not affected by the choice of depreciation methods.

_____ e) The entry to record depreciation affects the income statement and the statement of cash flows but not the balance sheet or statement of changes in stockholders' equity.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

63

The term used to recognize expense for property, plant, and equipment assets is depletion.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

64

The Ernie Company acquired the Bert Company in January of Year 1. Bert's balance sheet included $700,000 of assets, $250,000 of liabilities and equity of $450,000. Ernie agrees to assume the liabilities and pay $480,000 to acquire Bert. An independent appraiser assessed the fair value of Bert's assets to be $630,000. Indicate whether each of the following statements about this transaction is true or false.

_____ a) Ernie's entry to record the transaction includes a debit to the assets for $700,000.

_____ b) Ernie's entry to record the transaction includes a debit to liabilities for $250,000.

_____ c) Ernie will recognize $100,000 of goodwill in recording the acquisition of Bert.

_____ d) It is impossible for Ernie to estimate the length of life for goodwill.

_____ e) The goodwill will be amortized in the same manner as patents.

_____ a) Ernie's entry to record the transaction includes a debit to the assets for $700,000.

_____ b) Ernie's entry to record the transaction includes a debit to liabilities for $250,000.

_____ c) Ernie will recognize $100,000 of goodwill in recording the acquisition of Bert.

_____ d) It is impossible for Ernie to estimate the length of life for goodwill.

_____ e) The goodwill will be amortized in the same manner as patents.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

65

Indicate whether each of the following statements is true or false.

_____ a) A patent with a useful life of 5 years and a legal life of 10 years is amortized over 5 years.

_____ b) Intangible assets with indefinite useful lives must be tested each year for impairment.

_____ c) If it is determined that the original value recorded for goodwill is too high, then an entry is made directly to Retained Earnings, reducing the balance in this account.

_____d) The entry to recognize an impairment loss on goodwill includes a debit to Amortization Expense and a credit to Goodwill.

_____e) The recognition of an impairment loss involves a cash outflow classified as a financing activity.

_____ a) A patent with a useful life of 5 years and a legal life of 10 years is amortized over 5 years.

_____ b) Intangible assets with indefinite useful lives must be tested each year for impairment.

_____ c) If it is determined that the original value recorded for goodwill is too high, then an entry is made directly to Retained Earnings, reducing the balance in this account.

_____d) The entry to recognize an impairment loss on goodwill includes a debit to Amortization Expense and a credit to Goodwill.

_____e) The recognition of an impairment loss involves a cash outflow classified as a financing activity.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

66

Indicate whether each of the following statements is true or false.

_____ a) Plant assets are classified as long-term assets, while intangible assets are treated as current assets.

_____ b) Intangible assets include patents, copyrights, and natural resources.

_____ c) Intangible assets with indefinite useful lives will be not be amortized.

_____ d) The cost of land should be depleted over its useful life.

_____ e) The cost of a natural resource should be expensed (depleted) over its useful life.

_____ a) Plant assets are classified as long-term assets, while intangible assets are treated as current assets.

_____ b) Intangible assets include patents, copyrights, and natural resources.

_____ c) Intangible assets with indefinite useful lives will be not be amortized.

_____ d) The cost of land should be depleted over its useful life.

_____ e) The cost of a natural resource should be expensed (depleted) over its useful life.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

67

A copyright is an intangible asset with an indefinite useful life.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following should be the main determinant for selection of the allocation method for long-term operational assets?

A) The method that is most convenient to compute.

B) The method that best matches the pattern of asset use.

C) The method that provides the greatest return to the stockholders.

D) The method that provides the best tax advantage.

A) The method that is most convenient to compute.

B) The method that best matches the pattern of asset use.

C) The method that provides the greatest return to the stockholders.

D) The method that provides the best tax advantage.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

69

Tangible assets include land, equipment, and goodwill.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

70

On January 1, Year 1, Warren Co. purchased a machine for $120,000. Warren estimated the useful life of the machine to be 10 years and the salvage value to be $20,000. Indicate whether each of the following statements is true or false.

_____ a) Depreciation expense for Year 1 under the straight-line method would be $12,000.

_____ b) Depreciation expense for Year 1 under the double declining method would be $24,000.

_____ c) The accumulated depreciation at the end of Year 2 under the straight-line method would be $20,000.

_____ d) The accumulated depreciation at the end of Year 2 under the double declining method would be $48,000.

_____ e) The book value of the machine under both the double declining method and the straight-line method at the end of 10 years would be $20,000.

_____ a) Depreciation expense for Year 1 under the straight-line method would be $12,000.

_____ b) Depreciation expense for Year 1 under the double declining method would be $24,000.

_____ c) The accumulated depreciation at the end of Year 2 under the straight-line method would be $20,000.

_____ d) The accumulated depreciation at the end of Year 2 under the double declining method would be $48,000.

_____ e) The book value of the machine under both the double declining method and the straight-line method at the end of 10 years would be $20,000.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

71

Indicate whether each of the following statements is true or false.

_____ a) Long-term assets having no physical substance are called intangible assets.

_____ b) Trademarks are examples of an intangible asset.

_____ c) Natural resources are examples of tangible long-term assets.

_____ d) The reason that land is classified separately from other tangible assets is because the cost is normally much higher.

_____ e) Goodwill is classified as Plant, Property and Equipment.

_____ a) Long-term assets having no physical substance are called intangible assets.

_____ b) Trademarks are examples of an intangible asset.

_____ c) Natural resources are examples of tangible long-term assets.

_____ d) The reason that land is classified separately from other tangible assets is because the cost is normally much higher.

_____ e) Goodwill is classified as Plant, Property and Equipment.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

72

Intangible assets include patents, copyrights, and franchises.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

73

A trademark is a tangible asset with an indefinite useful life.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

74

Indicate whether each of the following statements is true or false.

_____ a) A trademark has an identifiable legal lifetime.

_____ b) U.S. GAAP requires that research and development costs be capitalized as assets and then expensed over a reasonable period of time.

_____ c) A patent is amortized over the longer of its legal life or useful life.

_____ d) The entry to record the amortization of a patent includes an increase to Amortization Expense, Patent and a decrease to Patent.

_____e) The capitalized cost of a trademark includes the cost to develop the trademark and to defend it.

_____ a) A trademark has an identifiable legal lifetime.

_____ b) U.S. GAAP requires that research and development costs be capitalized as assets and then expensed over a reasonable period of time.

_____ c) A patent is amortized over the longer of its legal life or useful life.

_____ d) The entry to record the amortization of a patent includes an increase to Amortization Expense, Patent and a decrease to Patent.

_____e) The capitalized cost of a trademark includes the cost to develop the trademark and to defend it.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

75

The Rupert Company purchased a delivery van on January 1, Year 1 for $45,000. Rupert uses straight-line depreciation for the asset, which has a five year estimated useful life and a salvage value estimated at $9,000. The asset was sold on January 1, Year 3 for $33,300 cash. Indicate whether each of the following items related to Rupert Company is true or false.

_____ a) Annual depreciation for Rupert's equipment was $9,000.

_____ b) Accumulated depreciation on January 1, Year 3 was $14,400.

_____ c) Book value on January 1, Year 3 was $30,600.

_____ d) On the date of the sale, Rupert will record a loss of $2,400.

_____ e) A gain or loss on the sale of a plant asset is reported on the balance sheet.

_____ a) Annual depreciation for Rupert's equipment was $9,000.

_____ b) Accumulated depreciation on January 1, Year 3 was $14,400.

_____ c) Book value on January 1, Year 3 was $30,600.

_____ d) On the date of the sale, Rupert will record a loss of $2,400.

_____ e) A gain or loss on the sale of a plant asset is reported on the balance sheet.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

76

Indicate whether each of the following statements is true or false.

_____ a) Sales taxes paid on the purchase of equipment would be expensed in the year of the purchase.

_____ b) Real estate fees and attorney's fees related to the purchase of a building would be added to the cost of the building.

_____ c) Payment of a fine for improper burning of a demolished building would be added to the land account.

_____ d) Delivery charges on equipment would be expensed in the year of the purchase.

_____ e) The matching concept requires that plant assets be recorded at the amount paid for the assets.

_____ a) Sales taxes paid on the purchase of equipment would be expensed in the year of the purchase.

_____ b) Real estate fees and attorney's fees related to the purchase of a building would be added to the cost of the building.

_____ c) Payment of a fine for improper burning of a demolished building would be added to the land account.

_____ d) Delivery charges on equipment would be expensed in the year of the purchase.

_____ e) The matching concept requires that plant assets be recorded at the amount paid for the assets.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

77

When a building is purchased simultaneously with land, the purchase price must be allocated between the building and the land.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

78

Schubert Co. owned equipment that originally cost $48,000. The company sold the equipment on January 1, Year 4, for $16,000 cash. Accumulated depreciation on the day of sale amounted to $34,000. Based on this information, indicate whether each of the following statements is true or false.

_____ a) The sale will increase Schubert's net income, but it will not affect the company's operating income.

_____ b) Schubert would show a $16,000 cash inflow in the operating activities section of the cash flow statement.

_____ c) The sale would result in a decrease in total assets.

_____ d) The sale would increase Schubert's equity by $2,000.

_____ e) The sale would be recorded as a debit to cash for $16,000, a credit to equipment for $14,000, and a credit to gain on sale of equipment for $2,000.

_____ a) The sale will increase Schubert's net income, but it will not affect the company's operating income.

_____ b) Schubert would show a $16,000 cash inflow in the operating activities section of the cash flow statement.

_____ c) The sale would result in a decrease in total assets.

_____ d) The sale would increase Schubert's equity by $2,000.

_____ e) The sale would be recorded as a debit to cash for $16,000, a credit to equipment for $14,000, and a credit to gain on sale of equipment for $2,000.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

79

Land differs from other property because it is not subject to depreciation.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

80

The depreciable cost of a long-term asset is the difference between the amount paid for the asset and its salvage value.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck