Deck 20: Financial Options

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/55

Play

Full screen (f)

Deck 20: Financial Options

1

As the seller of an option, you receive the:

A) exercise price.

B) strike price.

C) risk premium.

D) option premium.

A) exercise price.

B) strike price.

C) risk premium.

D) option premium.

option premium.

2

Which of the following statements is FALSE?

A) The option buyer, also called the option holder, holds the right to exercise the option and has a long position in the contract.

B) The market price of the option is also called the exercise price.

C) If the payoff from exercising an option immediately is positive, the option is said to be in-the-money.

D) As with other financial assets, options can be bought and sold. Standard stock options are traded on organized exchanges, while more specialized options are sold through dealers.

A) The option buyer, also called the option holder, holds the right to exercise the option and has a long position in the contract.

B) The market price of the option is also called the exercise price.

C) If the payoff from exercising an option immediately is positive, the option is said to be in-the-money.

D) As with other financial assets, options can be bought and sold. Standard stock options are traded on organized exchanges, while more specialized options are sold through dealers.

The market price of the option is also called the exercise price.

3

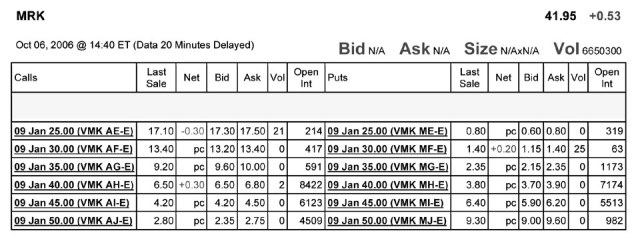

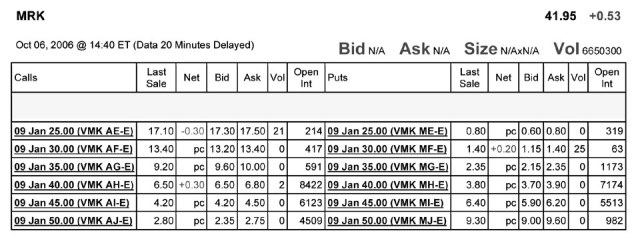

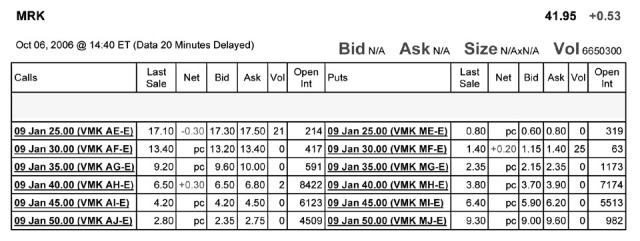

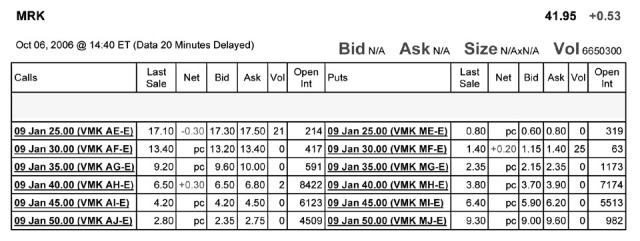

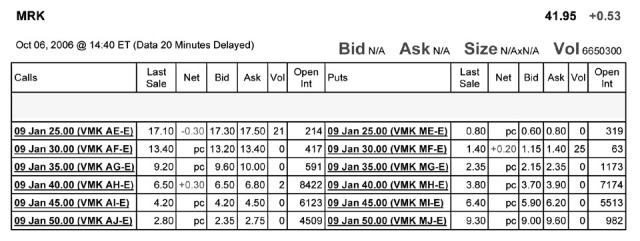

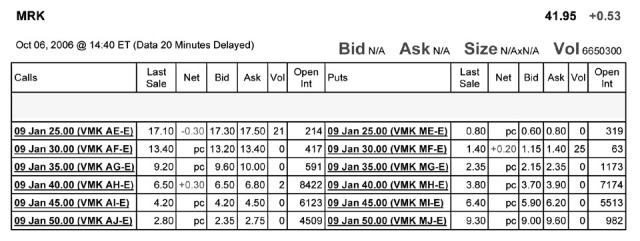

Use the table for the question(s) below.

Consider the following information on options from the CBOE for Merck:

You have decided to buy 10 January 2009 call options on Merck with an exercise price of $45 per share. How much will this transaction cost you and are these contracts in or out of the money?

Consider the following information on options from the CBOE for Merck:

You have decided to buy 10 January 2009 call options on Merck with an exercise price of $45 per share. How much will this transaction cost you and are these contracts in or out of the money?

If you buy 10 call option contracts you will pay 10 × 100 (shares per contract) × $4.50 (since you are buying you pay the ask price) = $4,500. These options are out of the money since the exercise price is greater than the current market price.

4

Using options to reduce risk is called:

A) speculation.

B) a naked position.

C) hedging.

D) a covered position.

A) speculation.

B) a naked position.

C) hedging.

D) a covered position.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following statements is FALSE?

A) Options also allow investors to speculate, or place a bet on the direction in which they believe the market is likely to move.

B) Options where the strike price and the stock price are very far apart are referred to as deep in-the-money or deep out of-the-money.

C) Call options with strike prices above the current stock price are in-the-money, as are put options with strike prices below the current stock price.

D) European options allow their holders to exercise the option only on the expiration date-holders cannot exercise before the expiration date.

A) Options also allow investors to speculate, or place a bet on the direction in which they believe the market is likely to move.

B) Options where the strike price and the stock price are very far apart are referred to as deep in-the-money or deep out of-the-money.

C) Call options with strike prices above the current stock price are in-the-money, as are put options with strike prices below the current stock price.

D) European options allow their holders to exercise the option only on the expiration date-holders cannot exercise before the expiration date.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

6

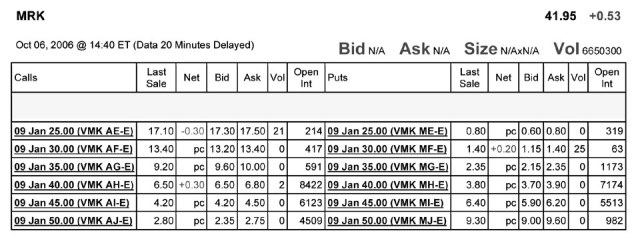

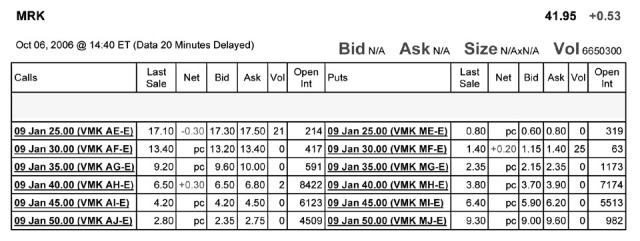

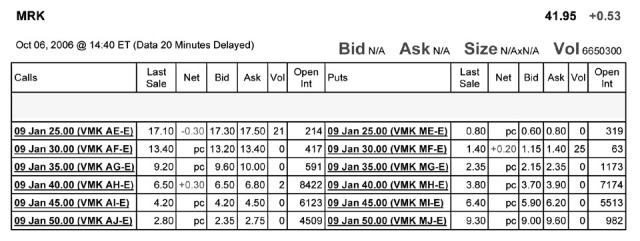

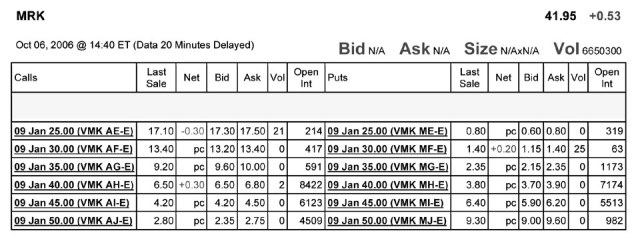

Use the table for the question(s) below.

Consider the following information on options from the CBOE for Merck:

How many of the January 2009 put options are in the money?

A) 1

B) 3

C) 2

D) 4

Consider the following information on options from the CBOE for Merck:

How many of the January 2009 put options are in the money?

A) 1

B) 3

C) 2

D) 4

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

7

The market price of an option is called the:

A) American premium.

B) European premium.

C) option premium.

D) exercising premium.

A) American premium.

B) European premium.

C) option premium.

D) exercising premium.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

8

Use the table for the question(s) below.

Consider the following information on options from the CBOE for Merck:

You have decided to sell (write) 5 January 2009 put options on Merck with an exercise price of $45 per share. How much money will you receive and are these contracts in or out of the money?

Consider the following information on options from the CBOE for Merck:

You have decided to sell (write) 5 January 2009 put options on Merck with an exercise price of $45 per share. How much money will you receive and are these contracts in or out of the money?

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following statements is FALSE?

A) When a holder of an option enforces the agreement and buys or sells a share of stock at the agreed-upon price, he is exercising the option.

B) There are two kinds of options. European options allow their holders to exercise the option on any date up to and including a final date called the expiration date.

C) Because an option is a contract between two parties, for every owner of a financial option, there is also an option writer, the person who takes the other side of the contract.

D) The price at which the holder buys or sells the share of stock when the option is exercised is called the strike price or exercise price.

A) When a holder of an option enforces the agreement and buys or sells a share of stock at the agreed-upon price, he is exercising the option.

B) There are two kinds of options. European options allow their holders to exercise the option on any date up to and including a final date called the expiration date.

C) Because an option is a contract between two parties, for every owner of a financial option, there is also an option writer, the person who takes the other side of the contract.

D) The price at which the holder buys or sells the share of stock when the option is exercised is called the strike price or exercise price.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following statements is FALSE?

A) A holder would not exercise an in-the-money option.

B) The option seller, also called the option writer, sells (or writes) the option and has a short position in the contract.

C) Because the long side has the option to exercise, the short side has an obligation to fulfill the contract.

D) When the exercise price of an option is equal to the current price of the stock, the option is said to be at-the-money.

A) A holder would not exercise an in-the-money option.

B) The option seller, also called the option writer, sells (or writes) the option and has a short position in the contract.

C) Because the long side has the option to exercise, the short side has an obligation to fulfill the contract.

D) When the exercise price of an option is equal to the current price of the stock, the option is said to be at-the-money.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

11

The payoff to the holder of a call option is given by:

A) C = max(S - K, 0)

B) C = min(K, 0)

C) C = max(K - S, 0)

D) C = min(K - S, 0)

A) C = max(S - K, 0)

B) C = min(K, 0)

C) C = max(K - S, 0)

D) C = min(K - S, 0)

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

12

The payoff to the holder of a put option is given by:

A) P = max(K - S, 0)

B) P= max(S - K, 0)

C) P = min(S - K, 0)

D) P = max(K, 0)

A) P = max(K - S, 0)

B) P= max(S - K, 0)

C) P = min(S - K, 0)

D) P = max(K, 0)

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

13

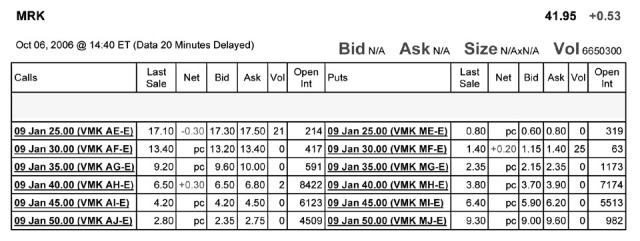

Use the table for the question(s) below.

Consider the following information on options from the CBOE for Merck:

Assume you want to buy one option contract that with an exercise price closest to being at-the-money and that expires January 2009. The current price that you would have to pay for such a contract is:

A) $680

B) $380

C) $650

D) $420

Consider the following information on options from the CBOE for Merck:

Assume you want to buy one option contract that with an exercise price closest to being at-the-money and that expires January 2009. The current price that you would have to pay for such a contract is:

A) $680

B) $380

C) $650

D) $420

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

14

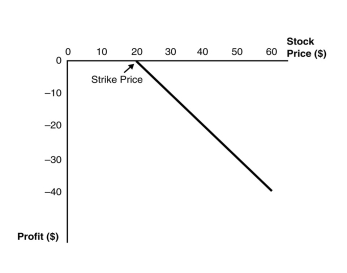

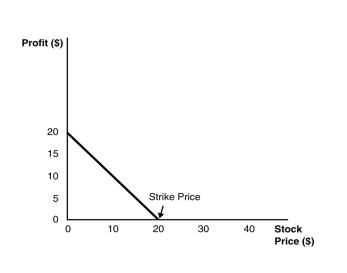

Use the figure for the question(s) below.

This graph depicts the payoffs of:

A) a short position in a put option at expiration.

B) a short position in a call option at expiration.

C) a long position in a put option at expiration.

D) a long position in a call option at expiration.

This graph depicts the payoffs of:

A) a short position in a put option at expiration.

B) a short position in a call option at expiration.

C) a long position in a put option at expiration.

D) a long position in a call option at expiration.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

15

The holder of a put option has:

A) the obligation to sell a security for a given price.

B) the right to buy a security for a given price.

C) the right to sell a security for a given price.

D) the obligation to buy a security for a given price.

A) the obligation to sell a security for a given price.

B) the right to buy a security for a given price.

C) the right to sell a security for a given price.

D) the obligation to buy a security for a given price.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following statements is FALSE?

A) A call option gives the owner the right to buy the asset.

B) A put option gives the owner the right to sell the asset.

C) A financial option contract gives the writer the right (but not the obligation) to purchase or sell an asset at a fixed price at some future date.

D) A stock option gives the holder the option to buy or sell a share of stock on or before a given date for a given price.

A) A call option gives the owner the right to buy the asset.

B) A put option gives the owner the right to sell the asset.

C) A financial option contract gives the writer the right (but not the obligation) to purchase or sell an asset at a fixed price at some future date.

D) A stock option gives the holder the option to buy or sell a share of stock on or before a given date for a given price.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

17

Using options to place a bet on the direction in which you believe the market is likely to move is called:

A) speculation.

B) hedging.

C) a covered position.

D) a naked position.

A) speculation.

B) hedging.

C) a covered position.

D) a naked position.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

18

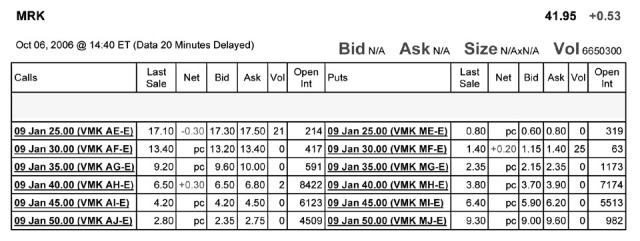

Use the table for the question(s) below.

Consider the following information on options from the CBOE for Merck:

The open interest for January 2009 put option that is closest to being at-the-money is:

A) 7174

B) 982

C) 319

D) 8422

Consider the following information on options from the CBOE for Merck:

The open interest for January 2009 put option that is closest to being at-the-money is:

A) 7174

B) 982

C) 319

D) 8422

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

19

Use the table for the question(s) below.

Consider the following information on options from the CBOE for Merck:

How many of the January 2009 call options are in the money?

A) 2

B) 4

C) 1

D) 3

Consider the following information on options from the CBOE for Merck:

How many of the January 2009 call options are in the money?

A) 2

B) 4

C) 1

D) 3

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

20

The writer of a call option has:

A) the obligation to sell a security for a given price.

B) the obligation to buy a security for a given price.

C) the right to sell a security for a given price.

D) the right to buy a security for a given price.

A) the obligation to sell a security for a given price.

B) the obligation to buy a security for a given price.

C) the right to sell a security for a given price.

D) the right to buy a security for a given price.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

21

Rose Industries is currently trading for $47 per share. The stock pays no dividends. A one-year European call option on Luther with a strike price of $45 is currently trading for $7.45. If the risk-free interest rate is 6% per year, then calculate the price of a one-year European put option on Luther with a strike price of $45.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following statements is FALSE?

A) Because a short position in an option is the other side of a long position, the profits from a short position in an option are just the negative of the profits of a long position.

B) The deeper out-of-the-money the put option is, the less negative its beta, and the higher is its expected return.

C) Although payouts on a long position in an option contract are never negative, the profit from purchasing an option and holding it to expiration could well be negative because the payout at expiration might be less than the initial cost of the option.

D) The put position has a higher return in states with low stock prices; that is, if the stock has a positive beta, the put has a negative beta.

A) Because a short position in an option is the other side of a long position, the profits from a short position in an option are just the negative of the profits of a long position.

B) The deeper out-of-the-money the put option is, the less negative its beta, and the higher is its expected return.

C) Although payouts on a long position in an option contract are never negative, the profit from purchasing an option and holding it to expiration could well be negative because the payout at expiration might be less than the initial cost of the option.

D) The put position has a higher return in states with low stock prices; that is, if the stock has a positive beta, the put has a negative beta.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

23

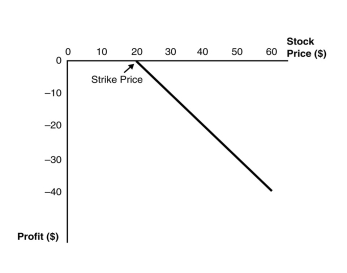

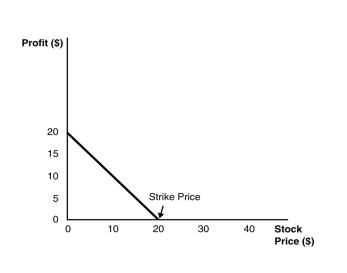

Use the figure for the question(s) below.

This graph depicts the payoffs of:

A) a long position in a put option at expiration.

B) a short position in a call option at expiration.

C) a short position in a put option at expiration.

D) a long position in a call option at expiration.

This graph depicts the payoffs of:

A) a long position in a put option at expiration.

B) a short position in a call option at expiration.

C) a short position in a put option at expiration.

D) a long position in a call option at expiration.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

24

Consider the following equation: C = P + S - PV(K) - PV(Div)

In this equation the term K refers to:

A) the value of the call option.

B) the strike price of the option.

C) the price of a zero coupon bond.

D) the stock's current price.

In this equation the term K refers to:

A) the value of the call option.

B) the strike price of the option.

C) the price of a zero coupon bond.

D) the stock's current price.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

25

An option strategy in which you hold a long position in both a put and a call option with the same strike price is called:

A) a strangle.

B) portfolio insurance.

C) a butterfly spread.

D) a straddle.

A) a strangle.

B) portfolio insurance.

C) a butterfly spread.

D) a straddle.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

26

KD Industries stock is currently trading at $32 per share. Consider a put option on KD stock with a strike price of $30. The intrinsic value of this put option is:

A) $0

B) -$2

C) $2

D) $30

A) $0

B) -$2

C) $2

D) $30

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

27

Suppose that Nielson Motors stock is trading for $50 per share and that Nielson pays no dividends. What is the maximum possible price for a call option on Nielson Motors?

A) $0

B) $20

C) $50

D) infinite

A) $0

B) $20

C) $50

D) infinite

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

28

Luther Industries is currently trading for $27 per share. The stock pays no dividends. A one-year European put option on Luther with a strike price of $30 is currently trading for $2.60. If the risk-free interest rate is 6% per year, then the price of a one-year European call option on Luther with a strike price of $30 will be closest to:

A) $1.30

B) $7.10

C) $2.60

D) $1.95

A) $1.30

B) $7.10

C) $2.60

D) $1.95

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

29

Use the following information to answer the question(s) below.

Consider an American put option on Rearden Metal stock with a strike price of $60 and one year to expiration. Assume that Rearden pays no dividends, is stock is currently trading at $15 per share, and the one year interest rate is 5%. Also assume that it is optimal to exercise this put option early.

The price of a one-year American put option on Rearden Metal with a strike price of $70 per share is closest to:

A) $45

B) $50

C) $55

D) $60

Consider an American put option on Rearden Metal stock with a strike price of $60 and one year to expiration. Assume that Rearden pays no dividends, is stock is currently trading at $15 per share, and the one year interest rate is 5%. Also assume that it is optimal to exercise this put option early.

The price of a one-year American put option on Rearden Metal with a strike price of $70 per share is closest to:

A) $45

B) $50

C) $55

D) $60

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

30

Consider the following equation: C = P + S - PV(K) - PV(Div)

In this equation the term S refers to:

A) the payoff of a zero coupon bond.

B) the strike price of the option.

C) the value of the call option.

D) the stock's current price.

In this equation the term S refers to:

A) the payoff of a zero coupon bond.

B) the strike price of the option.

C) the value of the call option.

D) the stock's current price.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

31

KD Industries stock is currently trading at $32 per share. Consider a put option on KD stock with a strike price of $30. The maximum value of this put option is:

A) $0

B) $32

C) $30

D) $2

A) $0

B) $32

C) $30

D) $2

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

32

You are long both a put option and a call option on Rockwood stock with the same expiration date. The exercise price of the call option is $40 and the exercise price of the put option is $30. Graph the payoff of the combination of options at expiration.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

33

Suppose that Nielson Motors stock is trading for $50 per share and that Nielson pays no dividends. What is the minimum possible price for an American put option on Nielson Motors with a strike price of $70?

A) $0

B) $20

C) $50

D) infinite

A) $0

B) $20

C) $50

D) infinite

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following statements is FALSE?

A) Put-call parity gives the price of a European call option in terms of the price of a European put, the underlying stock, and a zero-coupon bond.

B) For a given strike price, the value of a call option is higher if the current price of the stock is higher, as there is a greater likelihood the option will end up in-the-money.

C) The value of an otherwise identical call option is higher if the strike price the holder must pay to buy the stock is higher.

D) Because a put is the right to sell the stock, puts with a lower strike price are less valuable.

A) Put-call parity gives the price of a European call option in terms of the price of a European put, the underlying stock, and a zero-coupon bond.

B) For a given strike price, the value of a call option is higher if the current price of the stock is higher, as there is a greater likelihood the option will end up in-the-money.

C) The value of an otherwise identical call option is higher if the strike price the holder must pay to buy the stock is higher.

D) Because a put is the right to sell the stock, puts with a lower strike price are less valuable.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

35

Consider the following equation: C = P + S - PV(K) - PV(Div)

In this equation the term C refers to:

A) the value of the call option.

B) the stock's current price.

C) the payoff of a zero coupon bond.

D) the strike price of the option.

In this equation the term C refers to:

A) the value of the call option.

B) the stock's current price.

C) the payoff of a zero coupon bond.

D) the strike price of the option.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following statements is FALSE?

A) Because an American option cannot be worth less than its intrinsic value, it cannot have a negative time value.

B) An American option with a later exercise date cannot be worth less than an otherwise identical American option with an earlier exercise date.

C) The value of an option generally decreases with the volatility of the stock.

D) The intrinsic value is the amount by which the option is currently in-the money or 0 if the option is out-of-the-money.

A) Because an American option cannot be worth less than its intrinsic value, it cannot have a negative time value.

B) An American option with a later exercise date cannot be worth less than an otherwise identical American option with an earlier exercise date.

C) The value of an option generally decreases with the volatility of the stock.

D) The intrinsic value is the amount by which the option is currently in-the money or 0 if the option is out-of-the-money.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

37

Graph the payoff at expiration of a short position in a put option with a strike price of $20.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

38

You pay $3.25 for a call option on Luther Industries that expires in three months with a strike price of $40.00. Three months later, at expiration, Luther Industries is trading at $41.00 per share. Your profit per share on this transaction is closest to:

A) -$1.00

B) $1.00

C) -$2.25

D) $2.25

A) -$1.00

B) $1.00

C) -$2.25

D) $2.25

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following will NOT increase the value of a put option?

A) An increase in the time to maturity

B) A decrease in the stock price

C) A decrease in the stock's volatility

D) An increase in the exercise price

A) An increase in the time to maturity

B) A decrease in the stock price

C) A decrease in the stock's volatility

D) An increase in the exercise price

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements is FALSE?

A) The intrinsic value of an option is the value it would have if it expired immediately.

B) A European option cannot be worth less than its American counterpart.

C) Put options increase in value as the stock price falls.

D) A put option cannot be worth more than its strike price.

A) The intrinsic value of an option is the value it would have if it expired immediately.

B) A European option cannot be worth less than its American counterpart.

C) Put options increase in value as the stock price falls.

D) A put option cannot be worth more than its strike price.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

41

Use the following information to answer the question(s) below.

Consider an American put option on Rearden Metal stock with a strike price of $60 and one year to expiration. Assume that Rearden pays no dividends, is stock is currently trading at $15 per share, and the one year interest rate is 5%. Also assume that it is optimal to exercise this put option early.

The maximum value of a one-year American call option on Rearden Metal with a strike price of $60 per share is closest to:

A) $0

B) $1.84

C) $2.48

D) $2.86

Consider an American put option on Rearden Metal stock with a strike price of $60 and one year to expiration. Assume that Rearden pays no dividends, is stock is currently trading at $15 per share, and the one year interest rate is 5%. Also assume that it is optimal to exercise this put option early.

The maximum value of a one-year American call option on Rearden Metal with a strike price of $60 per share is closest to:

A) $0

B) $1.84

C) $2.48

D) $2.86

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

42

Consider the following equation: C = S - K + dis(K) + P

In this equation, S - K tells us:

A) the market value of the option.

B) the time value of the option.

C) the option spread.

D) the intrinsic value of the option.

In this equation, S - K tells us:

A) the market value of the option.

B) the time value of the option.

C) the option spread.

D) the intrinsic value of the option.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

43

Consider the following equation: C = S - K + dis(K) + P - PV(Div)

In this equation, dis(K) + P - PV(Div) tells us:

A) the market value of the option.

B) the difference in the price of an American option over a European option because of dividend capture.

C) the intrinsic value of the option.

D) the time value of the option.

In this equation, dis(K) + P - PV(Div) tells us:

A) the market value of the option.

B) the difference in the price of an American option over a European option because of dividend capture.

C) the intrinsic value of the option.

D) the time value of the option.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

44

Use the following information to answer the question(s) below.

Galt Industries is trading for $20 per share and has 25 million shares outstanding. Galt Industries has a debt-equity ratio of 0.4 and its debt is zero coupon debt with a ten year maturity and a yield to maturity of 8%.

In describing Galt's equity as a call option, the maturity of this option is:

A) 5 years

B) 10 years

C) 20 years

D) infinite

Galt Industries is trading for $20 per share and has 25 million shares outstanding. Galt Industries has a debt-equity ratio of 0.4 and its debt is zero coupon debt with a ten year maturity and a yield to maturity of 8%.

In describing Galt's equity as a call option, the maturity of this option is:

A) 5 years

B) 10 years

C) 20 years

D) infinite

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

45

A credit default swap is essentially a:

A) put option on the firm's assets.

B) call option on the firm's assets.

C) put option on the firm's debt.

D) call option on the firm's debt.

A) put option on the firm's assets.

B) call option on the firm's assets.

C) put option on the firm's debt.

D) call option on the firm's debt.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

46

Use the following information to answer the question(s) below.

Galt Industries is trading for $20 per share and has 25 million shares outstanding. Galt Industries has a debt-equity ratio of 0.4 and its debt is zero coupon debt with a ten year maturity and a yield to maturity of 8%.

Which of the following best describes Galt's debt using a put option?

A) Long $200 million in risk free debt and Short a put option on the firm's assets with a $200 strike price

B) Short $200 million in risk free debt and Long a put option on the firm's assets with a $200 strike price

C) Long $200 million in risk free debt and Short a put option on the firm's assets with a $700 strike price

D) Short $200 million in risk free debt and Long a put option on the firm's assets with a $700 strike price

Galt Industries is trading for $20 per share and has 25 million shares outstanding. Galt Industries has a debt-equity ratio of 0.4 and its debt is zero coupon debt with a ten year maturity and a yield to maturity of 8%.

Which of the following best describes Galt's debt using a put option?

A) Long $200 million in risk free debt and Short a put option on the firm's assets with a $200 strike price

B) Short $200 million in risk free debt and Long a put option on the firm's assets with a $200 strike price

C) Long $200 million in risk free debt and Short a put option on the firm's assets with a $700 strike price

D) Short $200 million in risk free debt and Long a put option on the firm's assets with a $700 strike price

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following statements is FALSE?

A) If the value of the firm's assets exceeds the required debt payment, debt holders are fully repaid.

B) Another way to view corporate debt: as a portfolio of riskless debt and a short position in a call option on the firm's assets with a strike price equal to the required debt payment.

C) Viewing debt as an option portfolio is useful as it provides insight into how credit spreads for risky debt are determined.

D) You can think of the debt holders as owning the firm and having sold a call option with a strike price equal to the required debt payment.

A) If the value of the firm's assets exceeds the required debt payment, debt holders are fully repaid.

B) Another way to view corporate debt: as a portfolio of riskless debt and a short position in a call option on the firm's assets with a strike price equal to the required debt payment.

C) Viewing debt as an option portfolio is useful as it provides insight into how credit spreads for risky debt are determined.

D) You can think of the debt holders as owning the firm and having sold a call option with a strike price equal to the required debt payment.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

48

Describe the conditions when it would be optimal to exercise an American Call and an American Put option prior to their expiration.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following statements is FALSE?

A) The option price is more sensitive to changes in volatility for at-the-money options than it is for in-the-money options.

B) A share of stock can be thought of as a put option on the assets of the firm with a strike price equal to the value of debt outstanding.

C) In the context of corporate finance, equity is at-the-money when a firm is close to bankruptcy.

D) Because the price of equity is increasing with the volatility of the firm's assets, equity holders benefit from a zero-NPV project that increases the volatility of the firm's assets.

A) The option price is more sensitive to changes in volatility for at-the-money options than it is for in-the-money options.

B) A share of stock can be thought of as a put option on the assets of the firm with a strike price equal to the value of debt outstanding.

C) In the context of corporate finance, equity is at-the-money when a firm is close to bankruptcy.

D) Because the price of equity is increasing with the volatility of the firm's assets, equity holders benefit from a zero-NPV project that increases the volatility of the firm's assets.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

50

Use the following information to answer the question(s) below.

Galt Industries is trading for $20 per share and has 25 million shares outstanding. Galt Industries has a debt-equity ratio of 0.4 and its debt is zero coupon debt with a ten year maturity and a yield to maturity of 8%.

In describing Galt's debt as a put option, the strike price of the put option is:

A) $200 million

B) $300 million

C) $500 million

D) $700 million

Galt Industries is trading for $20 per share and has 25 million shares outstanding. Galt Industries has a debt-equity ratio of 0.4 and its debt is zero coupon debt with a ten year maturity and a yield to maturity of 8%.

In describing Galt's debt as a put option, the strike price of the put option is:

A) $200 million

B) $300 million

C) $500 million

D) $700 million

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

51

Use the following information to answer the question(s) below.

Galt Industries is trading for $20 per share and has 25 million shares outstanding. Galt Industries has a debt-equity ratio of 0.4 and its debt is zero coupon debt with a ten year maturity and a yield to maturity of 8%.

In describing Galt's equity as a call option, the strike price of the call option is:

A) $200 million

B) $300 million

C) $500 million

D) $700 million

Galt Industries is trading for $20 per share and has 25 million shares outstanding. Galt Industries has a debt-equity ratio of 0.4 and its debt is zero coupon debt with a ten year maturity and a yield to maturity of 8%.

In describing Galt's equity as a call option, the strike price of the call option is:

A) $200 million

B) $300 million

C) $500 million

D) $700 million

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

52

With a(n) ________, the buyer pays a premium to the seller and receives a payment from the seller to make up for the loss if the underlying bond defaults.

A) equity option swap

B) credit default swap

C) risk-free swap

D) interest rate swap

A) equity option swap

B) credit default swap

C) risk-free swap

D) interest rate swap

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

53

Use the following information to answer the question(s) below.

Galt Industries is trading for $20 per share and has 25 million shares outstanding. Galt Industries has a debt-equity ratio of 0.4 and its debt is zero coupon debt with a ten year maturity and a yield to maturity of 8%.

In describing Galt's equity as a call option, the market value of the assets underlying the call option is:

A) $200 million

B) $300 million

C) $500 million

D) $700 million

Galt Industries is trading for $20 per share and has 25 million shares outstanding. Galt Industries has a debt-equity ratio of 0.4 and its debt is zero coupon debt with a ten year maturity and a yield to maturity of 8%.

In describing Galt's equity as a call option, the market value of the assets underlying the call option is:

A) $200 million

B) $300 million

C) $500 million

D) $700 million

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following statements is FALSE?

A) An American call on a non-dividend-paying stock has the same price as its European counterpart.

B) The price of any call option on a non-dividend-paying stock always exceeds its intrinsic value.

C) It is never optimal to exercise a call option on a dividend-paying stock early-you are always better off just selling the option.

D) If present value of the dividend payment is large enough, the time value of a European call option can be negative, implying that its price could be less than its intrinsic value.

A) An American call on a non-dividend-paying stock has the same price as its European counterpart.

B) The price of any call option on a non-dividend-paying stock always exceeds its intrinsic value.

C) It is never optimal to exercise a call option on a dividend-paying stock early-you are always better off just selling the option.

D) If present value of the dividend payment is large enough, the time value of a European call option can be negative, implying that its price could be less than its intrinsic value.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

55

Use the following information to answer the question(s) below.

Galt Industries is trading for $20 per share and has 25 million shares outstanding. Galt Industries has a debt-equity ratio of 0.4 and its debt is zero coupon debt with a ten year maturity and a yield to maturity of 8%.

Which of the following best describes Galt's debt using a call option?

A) Long $700 million in the firm's assets and Short a call option with a $700 strike price

B) Short $700 million in the firm's assets and Long a call option with a $700 strike price

C) Long $700 million in the firm's assets and Short a call option with a $200 strike price

D) Short $700 million in the firm's assets and Long a call option with a $200 strike price

Galt Industries is trading for $20 per share and has 25 million shares outstanding. Galt Industries has a debt-equity ratio of 0.4 and its debt is zero coupon debt with a ten year maturity and a yield to maturity of 8%.

Which of the following best describes Galt's debt using a call option?

A) Long $700 million in the firm's assets and Short a call option with a $700 strike price

B) Short $700 million in the firm's assets and Long a call option with a $700 strike price

C) Long $700 million in the firm's assets and Short a call option with a $200 strike price

D) Short $700 million in the firm's assets and Long a call option with a $200 strike price

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck