Deck 30: Risk Management

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/49

Play

Full screen (f)

Deck 30: Risk Management

1

Use the following information to answer the question(s)below.

Rearden Metal imports ore from South America. Rearden Metal is worried that the South American mines may enter into a long-term contract with the Chinese to sell all of their ore output to China, hence cutting off Rearden Metal's supply. In the event of such a contract with the Chinese, Rearden Metal will face much higher costs for its raw materials causing its operating profits to decline substantially and its marginal tax rate to fall from its current level of 35% down to 10%. An insurance firm has agreed to write a trade insurance policy that will pay Rearden Metal $2,500,000 in the event of the South American supply of ore being cut off. The chance of the South American supply being cut off is estimated to be 20%, with a beta of -2.0. The risk-free rate of interest is 4% and the return on the market is estimated to be 12%.

To insure their assets against hazards such as fire, storm damage, vandalism, earthquakes, and other natural and environmental risks firms commonly purchase:

A)key personnel insurance.

B)business liability insurance.

C)business interruption insurance.

D)property insurance.

Rearden Metal imports ore from South America. Rearden Metal is worried that the South American mines may enter into a long-term contract with the Chinese to sell all of their ore output to China, hence cutting off Rearden Metal's supply. In the event of such a contract with the Chinese, Rearden Metal will face much higher costs for its raw materials causing its operating profits to decline substantially and its marginal tax rate to fall from its current level of 35% down to 10%. An insurance firm has agreed to write a trade insurance policy that will pay Rearden Metal $2,500,000 in the event of the South American supply of ore being cut off. The chance of the South American supply being cut off is estimated to be 20%, with a beta of -2.0. The risk-free rate of interest is 4% and the return on the market is estimated to be 12%.

To insure their assets against hazards such as fire, storm damage, vandalism, earthquakes, and other natural and environmental risks firms commonly purchase:

A)key personnel insurance.

B)business liability insurance.

C)business interruption insurance.

D)property insurance.

property insurance.

2

Use the following information to answer the question(s)below.

Rearden Metal imports ore from South America. Rearden Metal is worried that the South American mines may enter into a long-term contract with the Chinese to sell all of their ore output to China, hence cutting off Rearden Metal's supply. In the event of such a contract with the Chinese, Rearden Metal will face much higher costs for its raw materials causing its operating profits to decline substantially and its marginal tax rate to fall from its current level of 35% down to 10%. An insurance firm has agreed to write a trade insurance policy that will pay Rearden Metal $2,500,000 in the event of the South American supply of ore being cut off. The chance of the South American supply being cut off is estimated to be 20%, with a beta of -2.0. The risk-free rate of interest is 4% and the return on the market is estimated to be 12%.

Which of the following statements is FALSE?

A)Because insurance reduces the risk of financial distress, it can relax this tradeoff and allow the firm to increase its use of debt financing.

B)By lowering the volatility of the stock, insurance discourage concentrated ownership by an outside director or investor who will monitor the firm and its management.

C)When a firm is subject to graduated income tax rates, insurance can produce a tax savings if the firm is in a higher tax bracket when it pays the premium than the tax bracket it is in when it receives the insurance payment in the event of a loss.

D)In a perfect market without other frictions, insurance companies should compete until they are just earning a fair return and the NPV from selling insurance is zero. The NPV is zero if the price of insurance equals the present value of the expected payment; in that case, we say the price is actuarially fair.

Rearden Metal imports ore from South America. Rearden Metal is worried that the South American mines may enter into a long-term contract with the Chinese to sell all of their ore output to China, hence cutting off Rearden Metal's supply. In the event of such a contract with the Chinese, Rearden Metal will face much higher costs for its raw materials causing its operating profits to decline substantially and its marginal tax rate to fall from its current level of 35% down to 10%. An insurance firm has agreed to write a trade insurance policy that will pay Rearden Metal $2,500,000 in the event of the South American supply of ore being cut off. The chance of the South American supply being cut off is estimated to be 20%, with a beta of -2.0. The risk-free rate of interest is 4% and the return on the market is estimated to be 12%.

Which of the following statements is FALSE?

A)Because insurance reduces the risk of financial distress, it can relax this tradeoff and allow the firm to increase its use of debt financing.

B)By lowering the volatility of the stock, insurance discourage concentrated ownership by an outside director or investor who will monitor the firm and its management.

C)When a firm is subject to graduated income tax rates, insurance can produce a tax savings if the firm is in a higher tax bracket when it pays the premium than the tax bracket it is in when it receives the insurance payment in the event of a loss.

D)In a perfect market without other frictions, insurance companies should compete until they are just earning a fair return and the NPV from selling insurance is zero. The NPV is zero if the price of insurance equals the present value of the expected payment; in that case, we say the price is actuarially fair.

By lowering the volatility of the stock, insurance discourage concentrated ownership by an outside director or investor who will monitor the firm and its management.

3

Use the information for the question(s)below.

Your firm faces an 8% chance of a potential loss of $50 million next year. If your firm implements new safety policies, it can reduce the chance of this loss to 3%, but the new safety policies have an upfront cost of $250,000. Suppose that the beta of the loss is 0 and the risk-free rate of interest is 5%.

Farmville Industries is a major agricultural firm and is concerned about the possibility of drought impacting corn production. In the event of a drought, Farmville Industries anticipates a loss of $75 million. Suppose the likelihood of a drought is 10% per year, and the beta associated with such a loss is 0.4. If the risk-free interest rate is 5% and the expected return on the market is 10%, then what is the actuarially fair insurance premium?

Your firm faces an 8% chance of a potential loss of $50 million next year. If your firm implements new safety policies, it can reduce the chance of this loss to 3%, but the new safety policies have an upfront cost of $250,000. Suppose that the beta of the loss is 0 and the risk-free rate of interest is 5%.

Farmville Industries is a major agricultural firm and is concerned about the possibility of drought impacting corn production. In the event of a drought, Farmville Industries anticipates a loss of $75 million. Suppose the likelihood of a drought is 10% per year, and the beta associated with such a loss is 0.4. If the risk-free interest rate is 5% and the expected return on the market is 10%, then what is the actuarially fair insurance premium?

The expected loss = $75 million × .10 = $7.5 million

Since the beta of the loss is not equal to zero we need to calculate the appropriate discount rate for the loss using the CAPM:

r = rf + b (rM - rf)

r = .05 + .4(.10 - .05)= .07

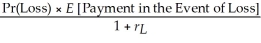

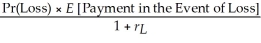

Insurance Premium = So the actuarially fair cost of full insurance =

So the actuarially fair cost of full insurance =  = $7.01 million

= $7.01 million

Since the beta of the loss is not equal to zero we need to calculate the appropriate discount rate for the loss using the CAPM:

r = rf + b (rM - rf)

r = .05 + .4(.10 - .05)= .07

Insurance Premium =

So the actuarially fair cost of full insurance =

So the actuarially fair cost of full insurance =  = $7.01 million

= $7.01 million 4

Use the information for the question(s)below.

Your firm faces an 8% chance of a potential loss of $50 million next year. If your firm implements new safety policies, it can reduce the chance of this loss to 3%, but the new safety policies have an upfront cost of $250,000. Suppose that the beta of the loss is 0 and the risk-free rate of interest is 5%.

What is the actuarially fair cost of full insurance?

Your firm faces an 8% chance of a potential loss of $50 million next year. If your firm implements new safety policies, it can reduce the chance of this loss to 3%, but the new safety policies have an upfront cost of $250,000. Suppose that the beta of the loss is 0 and the risk-free rate of interest is 5%.

What is the actuarially fair cost of full insurance?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

5

Use the information for the question(s)below.

Your firm faces an 8% chance of a potential loss of $50 million next year. If your firm implements new safety policies, it can reduce the chance of this loss to 3%, but the new safety policies have an upfront cost of $250,000. Suppose that the beta of the loss is 0 and the risk-free rate of interest is 5%.

Assuming that your firm will purchase insurance, what is the minimum-size deductible that would leave your firm with an incentive to implement the new safety policies?

Your firm faces an 8% chance of a potential loss of $50 million next year. If your firm implements new safety policies, it can reduce the chance of this loss to 3%, but the new safety policies have an upfront cost of $250,000. Suppose that the beta of the loss is 0 and the risk-free rate of interest is 5%.

Assuming that your firm will purchase insurance, what is the minimum-size deductible that would leave your firm with an incentive to implement the new safety policies?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

6

Use the following information to answer the question(s)below.

Rearden Metal imports ore from South America. Rearden Metal is worried that the South American mines may enter into a long-term contract with the Chinese to sell all of their ore output to China, hence cutting off Rearden Metal's supply. In the event of such a contract with the Chinese, Rearden Metal will face much higher costs for its raw materials causing its operating profits to decline substantially and its marginal tax rate to fall from its current level of 35% down to 10%. An insurance firm has agreed to write a trade insurance policy that will pay Rearden Metal $2,500,000 in the event of the South American supply of ore being cut off. The chance of the South American supply being cut off is estimated to be 20%, with a beta of -2.0. The risk-free rate of interest is 4% and the return on the market is estimated to be 12%.

To cover the costs that result if some aspect of the business causes harm to a third party or someone else's property a firm would purchase:

A)business interruption insurance.

B)property insurance.

C)business liability insurance.

D)key personnel insurance.

Rearden Metal imports ore from South America. Rearden Metal is worried that the South American mines may enter into a long-term contract with the Chinese to sell all of their ore output to China, hence cutting off Rearden Metal's supply. In the event of such a contract with the Chinese, Rearden Metal will face much higher costs for its raw materials causing its operating profits to decline substantially and its marginal tax rate to fall from its current level of 35% down to 10%. An insurance firm has agreed to write a trade insurance policy that will pay Rearden Metal $2,500,000 in the event of the South American supply of ore being cut off. The chance of the South American supply being cut off is estimated to be 20%, with a beta of -2.0. The risk-free rate of interest is 4% and the return on the market is estimated to be 12%.

To cover the costs that result if some aspect of the business causes harm to a third party or someone else's property a firm would purchase:

A)business interruption insurance.

B)property insurance.

C)business liability insurance.

D)key personnel insurance.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

7

Use the following information to answer the question(s)below.

d'Anconia Copper expects to produce 500 million pounds of copper next year, with production costs of $0.75 per pound. Depending upon the economic conditions over the next year, d'Anconia Copper expects the price of copper next year to be either $1.40, $1.50, or $1.60 per pound, with each outcome being equally likely. d'Anconia Copper expects to sell all of its copper at the going price.

Which of the following statements is FALSE?

A)Horizontal integration entails the merger of a firm and its supplier or a firm and its customer.

B)Like insurance, hedging involves contracts or transactions that provide the firm with cash flows that offset its losses from price changes.

C)For many firms, changes in the market prices of the raw materials they use and the goods they produce may be the most important source of risk to their profitability.

D)Because an increase in the price of the commodity raises the firm's costs and the supplier's revenues, these firms can offset their risks by merging.

d'Anconia Copper expects to produce 500 million pounds of copper next year, with production costs of $0.75 per pound. Depending upon the economic conditions over the next year, d'Anconia Copper expects the price of copper next year to be either $1.40, $1.50, or $1.60 per pound, with each outcome being equally likely. d'Anconia Copper expects to sell all of its copper at the going price.

Which of the following statements is FALSE?

A)Horizontal integration entails the merger of a firm and its supplier or a firm and its customer.

B)Like insurance, hedging involves contracts or transactions that provide the firm with cash flows that offset its losses from price changes.

C)For many firms, changes in the market prices of the raw materials they use and the goods they produce may be the most important source of risk to their profitability.

D)Because an increase in the price of the commodity raises the firm's costs and the supplier's revenues, these firms can offset their risks by merging.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

8

Use the following information to answer the question(s)below.

d'Anconia Copper expects to produce 500 million pounds of copper next year, with production costs of $0.75 per pound. Depending upon the economic conditions over the next year, d'Anconia Copper expects the price of copper next year to be either $1.40, $1.50, or $1.60 per pound, with each outcome being equally likely. d'Anconia Copper expects to sell all of its copper at the going price.

The risk that the firm will not have, or be able to raise, the cash required to meet the margin calls on its hedges is called:

A)liquidity risk.

B)basis risk.

C)commodity price risk.

D)speculation risk.

d'Anconia Copper expects to produce 500 million pounds of copper next year, with production costs of $0.75 per pound. Depending upon the economic conditions over the next year, d'Anconia Copper expects the price of copper next year to be either $1.40, $1.50, or $1.60 per pound, with each outcome being equally likely. d'Anconia Copper expects to sell all of its copper at the going price.

The risk that the firm will not have, or be able to raise, the cash required to meet the margin calls on its hedges is called:

A)liquidity risk.

B)basis risk.

C)commodity price risk.

D)speculation risk.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

9

Use the following information to answer the question(s)below.

d'Anconia Copper expects to produce 500 million pounds of copper next year, with production costs of $0.75 per pound. Depending upon the economic conditions over the next year, d'Anconia Copper expects the price of copper next year to be either $1.40, $1.50, or $1.60 per pound, with each outcome being equally likely. d'Anconia Copper expects to sell all of its copper at the going price.

If the going price next year is $1.40 per pound, d'Anconia Copper's operating profit next year will be closest to:

A)$325 million

B)$365 million

C)$375 million

D)$425 million

d'Anconia Copper expects to produce 500 million pounds of copper next year, with production costs of $0.75 per pound. Depending upon the economic conditions over the next year, d'Anconia Copper expects the price of copper next year to be either $1.40, $1.50, or $1.60 per pound, with each outcome being equally likely. d'Anconia Copper expects to sell all of its copper at the going price.

If the going price next year is $1.40 per pound, d'Anconia Copper's operating profit next year will be closest to:

A)$325 million

B)$365 million

C)$375 million

D)$425 million

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

10

Use the following information to answer the question(s)below.

d'Anconia Copper expects to produce 500 million pounds of copper next year, with production costs of $0.75 per pound. Depending upon the economic conditions over the next year, d'Anconia Copper expects the price of copper next year to be either $1.40, $1.50, or $1.60 per pound, with each outcome being equally likely. d'Anconia Copper expects to sell all of its copper at the going price.

If the going price next year is $1.60 per pound, d'Anconia Copper's operating profit next year will be closest to:

A)$365 million

B)$375 million

C)$425 million

D)$800 million

d'Anconia Copper expects to produce 500 million pounds of copper next year, with production costs of $0.75 per pound. Depending upon the economic conditions over the next year, d'Anconia Copper expects the price of copper next year to be either $1.40, $1.50, or $1.60 per pound, with each outcome being equally likely. d'Anconia Copper expects to sell all of its copper at the going price.

If the going price next year is $1.60 per pound, d'Anconia Copper's operating profit next year will be closest to:

A)$365 million

B)$375 million

C)$425 million

D)$800 million

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

11

Use the following information to answer the question(s)below.

d'Anconia Copper expects to produce 500 million pounds of copper next year, with production costs of $0.75 per pound. Depending upon the economic conditions over the next year, d'Anconia Copper expects the price of copper next year to be either $1.40, $1.50, or $1.60 per pound, with each outcome being equally likely. d'Anconia Copper expects to sell all of its copper at the going price.

The risk that arises because the value of the futures contract will not be perfectly correlated with the firm's exposure is called:

A)commodity price risk.

B)basis risk.

C)liquidity risk.

D)speculation risk.

d'Anconia Copper expects to produce 500 million pounds of copper next year, with production costs of $0.75 per pound. Depending upon the economic conditions over the next year, d'Anconia Copper expects the price of copper next year to be either $1.40, $1.50, or $1.60 per pound, with each outcome being equally likely. d'Anconia Copper expects to sell all of its copper at the going price.

The risk that arises because the value of the futures contract will not be perfectly correlated with the firm's exposure is called:

A)commodity price risk.

B)basis risk.

C)liquidity risk.

D)speculation risk.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

12

Use the information for the question(s)below.

Your firm faces an 8% chance of a potential loss of $50 million next year. If your firm implements new safety policies, it can reduce the chance of this loss to 3%, but the new safety policies have an upfront cost of $250,000. Suppose that the beta of the loss is 0 and the risk-free rate of interest is 5%.

If your firm is fully insured, the NPV of implementing the new safety policies is closest to:

A)$2.15 million

B)$2.5 million

C)$2.25 million

D)-$.25 million

Your firm faces an 8% chance of a potential loss of $50 million next year. If your firm implements new safety policies, it can reduce the chance of this loss to 3%, but the new safety policies have an upfront cost of $250,000. Suppose that the beta of the loss is 0 and the risk-free rate of interest is 5%.

If your firm is fully insured, the NPV of implementing the new safety policies is closest to:

A)$2.15 million

B)$2.5 million

C)$2.25 million

D)-$.25 million

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

13

Use the following information to answer the question(s)below.

Rearden Metal imports ore from South America. Rearden Metal is worried that the South American mines may enter into a long-term contract with the Chinese to sell all of their ore output to China, hence cutting off Rearden Metal's supply. In the event of such a contract with the Chinese, Rearden Metal will face much higher costs for its raw materials causing its operating profits to decline substantially and its marginal tax rate to fall from its current level of 35% down to 10%. An insurance firm has agreed to write a trade insurance policy that will pay Rearden Metal $2,500,000 in the event of the South American supply of ore being cut off. The chance of the South American supply being cut off is estimated to be 20%, with a beta of -2.0. The risk-free rate of interest is 4% and the return on the market is estimated to be 12%.

Which of the following statements is FALSE?

A)Not all insurable risks have a beta of zero. Some risks, such as hurricanes and earthquakes, create losses of tens of billions of dollars and may be difficult to diversify completely.

B)When a firm buys insurance, it transfers the risk of the loss to an insurance company. The insurance company charges an upfront premium to take on that risk.

C)By its very nature, insurance for non-diversifiable hazards is generally a positive beta asset; the insurance payment to the firm tends to be larger when total losses are low and the market portfolio is high.

D)Because insurance provides cash to the firm to offset losses, it can reduce the firm's need for external capital and thus reduce issuance costs.

Rearden Metal imports ore from South America. Rearden Metal is worried that the South American mines may enter into a long-term contract with the Chinese to sell all of their ore output to China, hence cutting off Rearden Metal's supply. In the event of such a contract with the Chinese, Rearden Metal will face much higher costs for its raw materials causing its operating profits to decline substantially and its marginal tax rate to fall from its current level of 35% down to 10%. An insurance firm has agreed to write a trade insurance policy that will pay Rearden Metal $2,500,000 in the event of the South American supply of ore being cut off. The chance of the South American supply being cut off is estimated to be 20%, with a beta of -2.0. The risk-free rate of interest is 4% and the return on the market is estimated to be 12%.

Which of the following statements is FALSE?

A)Not all insurable risks have a beta of zero. Some risks, such as hurricanes and earthquakes, create losses of tens of billions of dollars and may be difficult to diversify completely.

B)When a firm buys insurance, it transfers the risk of the loss to an insurance company. The insurance company charges an upfront premium to take on that risk.

C)By its very nature, insurance for non-diversifiable hazards is generally a positive beta asset; the insurance payment to the firm tends to be larger when total losses are low and the market portfolio is high.

D)Because insurance provides cash to the firm to offset losses, it can reduce the firm's need for external capital and thus reduce issuance costs.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

14

Use the following information to answer the question(s)below.

Rearden Metal imports ore from South America. Rearden Metal is worried that the South American mines may enter into a long-term contract with the Chinese to sell all of their ore output to China, hence cutting off Rearden Metal's supply. In the event of such a contract with the Chinese, Rearden Metal will face much higher costs for its raw materials causing its operating profits to decline substantially and its marginal tax rate to fall from its current level of 35% down to 10%. An insurance firm has agreed to write a trade insurance policy that will pay Rearden Metal $2,500,000 in the event of the South American supply of ore being cut off. The chance of the South American supply being cut off is estimated to be 20%, with a beta of -2.0. The risk-free rate of interest is 4% and the return on the market is estimated to be 12%.

Rearden's NPV for purchasing this policy is closest to:

A)$32,500

B)$56,750

C)$142,000

D)$156,250

Rearden Metal imports ore from South America. Rearden Metal is worried that the South American mines may enter into a long-term contract with the Chinese to sell all of their ore output to China, hence cutting off Rearden Metal's supply. In the event of such a contract with the Chinese, Rearden Metal will face much higher costs for its raw materials causing its operating profits to decline substantially and its marginal tax rate to fall from its current level of 35% down to 10%. An insurance firm has agreed to write a trade insurance policy that will pay Rearden Metal $2,500,000 in the event of the South American supply of ore being cut off. The chance of the South American supply being cut off is estimated to be 20%, with a beta of -2.0. The risk-free rate of interest is 4% and the return on the market is estimated to be 12%.

Rearden's NPV for purchasing this policy is closest to:

A)$32,500

B)$56,750

C)$142,000

D)$156,250

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

15

Use the following information to answer the question(s)below.

d'Anconia Copper expects to produce 500 million pounds of copper next year, with production costs of $0.75 per pound. Depending upon the economic conditions over the next year, d'Anconia Copper expects the price of copper next year to be either $1.40, $1.50, or $1.60 per pound, with each outcome being equally likely. d'Anconia Copper expects to sell all of its copper at the going price.

If d'Anconia Copper enters into a contract to supply copper to end users at an average price of $1.48 per pound, then d'Anconia Copper's operating profit next year will be closest to:

A)$325 million

B)$365 million

C)$375 million

D)$425 million

d'Anconia Copper expects to produce 500 million pounds of copper next year, with production costs of $0.75 per pound. Depending upon the economic conditions over the next year, d'Anconia Copper expects the price of copper next year to be either $1.40, $1.50, or $1.60 per pound, with each outcome being equally likely. d'Anconia Copper expects to sell all of its copper at the going price.

If d'Anconia Copper enters into a contract to supply copper to end users at an average price of $1.48 per pound, then d'Anconia Copper's operating profit next year will be closest to:

A)$325 million

B)$365 million

C)$375 million

D)$425 million

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

16

Use the following information to answer the question(s)below.

Rearden Metal imports ore from South America. Rearden Metal is worried that the South American mines may enter into a long-term contract with the Chinese to sell all of their ore output to China, hence cutting off Rearden Metal's supply. In the event of such a contract with the Chinese, Rearden Metal will face much higher costs for its raw materials causing its operating profits to decline substantially and its marginal tax rate to fall from its current level of 35% down to 10%. An insurance firm has agreed to write a trade insurance policy that will pay Rearden Metal $2,500,000 in the event of the South American supply of ore being cut off. The chance of the South American supply being cut off is estimated to be 20%, with a beta of -2.0. The risk-free rate of interest is 4% and the return on the market is estimated to be 12%.

The actuarially fair premium for this insurance policy is closest to:

A)$417,000

B)$446,000

C)$500,000

D)$568,000

Rearden Metal imports ore from South America. Rearden Metal is worried that the South American mines may enter into a long-term contract with the Chinese to sell all of their ore output to China, hence cutting off Rearden Metal's supply. In the event of such a contract with the Chinese, Rearden Metal will face much higher costs for its raw materials causing its operating profits to decline substantially and its marginal tax rate to fall from its current level of 35% down to 10%. An insurance firm has agreed to write a trade insurance policy that will pay Rearden Metal $2,500,000 in the event of the South American supply of ore being cut off. The chance of the South American supply being cut off is estimated to be 20%, with a beta of -2.0. The risk-free rate of interest is 4% and the return on the market is estimated to be 12%.

The actuarially fair premium for this insurance policy is closest to:

A)$417,000

B)$446,000

C)$500,000

D)$568,000

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

17

Use the following information to answer the question(s)below.

Rearden Metal imports ore from South America. Rearden Metal is worried that the South American mines may enter into a long-term contract with the Chinese to sell all of their ore output to China, hence cutting off Rearden Metal's supply. In the event of such a contract with the Chinese, Rearden Metal will face much higher costs for its raw materials causing its operating profits to decline substantially and its marginal tax rate to fall from its current level of 35% down to 10%. An insurance firm has agreed to write a trade insurance policy that will pay Rearden Metal $2,500,000 in the event of the South American supply of ore being cut off. The chance of the South American supply being cut off is estimated to be 20%, with a beta of -2.0. The risk-free rate of interest is 4% and the return on the market is estimated to be 12%.

Insurance that compensates for the loss or unavoidable absence of crucial employees in the firm is called:

A)key personnel insurance.

B)business liability insurance.

C)property insurance.

D)business interruption insurance.

Rearden Metal imports ore from South America. Rearden Metal is worried that the South American mines may enter into a long-term contract with the Chinese to sell all of their ore output to China, hence cutting off Rearden Metal's supply. In the event of such a contract with the Chinese, Rearden Metal will face much higher costs for its raw materials causing its operating profits to decline substantially and its marginal tax rate to fall from its current level of 35% down to 10%. An insurance firm has agreed to write a trade insurance policy that will pay Rearden Metal $2,500,000 in the event of the South American supply of ore being cut off. The chance of the South American supply being cut off is estimated to be 20%, with a beta of -2.0. The risk-free rate of interest is 4% and the return on the market is estimated to be 12%.

Insurance that compensates for the loss or unavoidable absence of crucial employees in the firm is called:

A)key personnel insurance.

B)business liability insurance.

C)property insurance.

D)business interruption insurance.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

18

Use the information for the question(s)below.

Your firm faces an 8% chance of a potential loss of $50 million next year. If your firm implements new safety policies, it can reduce the chance of this loss to 3%, but the new safety policies have an upfront cost of $250,000. Suppose that the beta of the loss is 0 and the risk-free rate of interest is 5%.

If your firm is uninsured, the NPV of implementing the new safety policies is closest to:

A)$2.25 million

B)-$.25 million

C)$2.5 million

D)$2.15 million

Your firm faces an 8% chance of a potential loss of $50 million next year. If your firm implements new safety policies, it can reduce the chance of this loss to 3%, but the new safety policies have an upfront cost of $250,000. Suppose that the beta of the loss is 0 and the risk-free rate of interest is 5%.

If your firm is uninsured, the NPV of implementing the new safety policies is closest to:

A)$2.25 million

B)-$.25 million

C)$2.5 million

D)$2.15 million

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

19

Use the following information to answer the question(s)below.

Rearden Metal imports ore from South America. Rearden Metal is worried that the South American mines may enter into a long-term contract with the Chinese to sell all of their ore output to China, hence cutting off Rearden Metal's supply. In the event of such a contract with the Chinese, Rearden Metal will face much higher costs for its raw materials causing its operating profits to decline substantially and its marginal tax rate to fall from its current level of 35% down to 10%. An insurance firm has agreed to write a trade insurance policy that will pay Rearden Metal $2,500,000 in the event of the South American supply of ore being cut off. The chance of the South American supply being cut off is estimated to be 20%, with a beta of -2.0. The risk-free rate of interest is 4% and the return on the market is estimated to be 12%.

In reality market imperfections exist that can raise the cost of insurance above the actuarially fair price and offset some of these benefits. These insurance market imperfections include all of the following EXCEPT:

A)adverse selection.

B)agency costs.

C)administrative and overhead costs.

D)taxation of insurance payments.

Rearden Metal imports ore from South America. Rearden Metal is worried that the South American mines may enter into a long-term contract with the Chinese to sell all of their ore output to China, hence cutting off Rearden Metal's supply. In the event of such a contract with the Chinese, Rearden Metal will face much higher costs for its raw materials causing its operating profits to decline substantially and its marginal tax rate to fall from its current level of 35% down to 10%. An insurance firm has agreed to write a trade insurance policy that will pay Rearden Metal $2,500,000 in the event of the South American supply of ore being cut off. The chance of the South American supply being cut off is estimated to be 20%, with a beta of -2.0. The risk-free rate of interest is 4% and the return on the market is estimated to be 12%.

In reality market imperfections exist that can raise the cost of insurance above the actuarially fair price and offset some of these benefits. These insurance market imperfections include all of the following EXCEPT:

A)adverse selection.

B)agency costs.

C)administrative and overhead costs.

D)taxation of insurance payments.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

20

Use the following information to answer the question(s)below.

Rearden Metal imports ore from South America. Rearden Metal is worried that the South American mines may enter into a long-term contract with the Chinese to sell all of their ore output to China, hence cutting off Rearden Metal's supply. In the event of such a contract with the Chinese, Rearden Metal will face much higher costs for its raw materials causing its operating profits to decline substantially and its marginal tax rate to fall from its current level of 35% down to 10%. An insurance firm has agreed to write a trade insurance policy that will pay Rearden Metal $2,500,000 in the event of the South American supply of ore being cut off. The chance of the South American supply being cut off is estimated to be 20%, with a beta of -2.0. The risk-free rate of interest is 4% and the return on the market is estimated to be 12%.

To protect the firm against the loss of earnings if the business operations are disrupted due to fire, accident, or some other insured peril a firm would purchase:

A)property insurance.

B)key personnel insurance.

C)business liability insurance.

D)business interruption insurance.

Rearden Metal imports ore from South America. Rearden Metal is worried that the South American mines may enter into a long-term contract with the Chinese to sell all of their ore output to China, hence cutting off Rearden Metal's supply. In the event of such a contract with the Chinese, Rearden Metal will face much higher costs for its raw materials causing its operating profits to decline substantially and its marginal tax rate to fall from its current level of 35% down to 10%. An insurance firm has agreed to write a trade insurance policy that will pay Rearden Metal $2,500,000 in the event of the South American supply of ore being cut off. The chance of the South American supply being cut off is estimated to be 20%, with a beta of -2.0. The risk-free rate of interest is 4% and the return on the market is estimated to be 12%.

To protect the firm against the loss of earnings if the business operations are disrupted due to fire, accident, or some other insured peril a firm would purchase:

A)property insurance.

B)key personnel insurance.

C)business liability insurance.

D)business interruption insurance.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

21

The cash-and-carry strategy consists of all of the following simultaneous trades EXCEPT:

A)borrow euros today using a one-year loan with the interest rate r€.

B)exchange the euros for dollars today at the spot exchange rate S $/€.

C)purchase a forward contract to convert $ to €.

D)invest the dollars today for one year at the interest rate r$.

A)borrow euros today using a one-year loan with the interest rate r€.

B)exchange the euros for dollars today at the spot exchange rate S $/€.

C)purchase a forward contract to convert $ to €.

D)invest the dollars today for one year at the interest rate r$.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

22

Use the following information to answer the question(s)below.

You are a risk manager for Security First Trust Savings and Loan (SFTSL). SFTSL's balance sheet is as follows (in millions of dollars): The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.

The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.

If interest rates are currently 5%, but fall to 4%, your estimate of the approximate change in SFTSL equity is closest to:

A)8% decrease

B)12% decrease

C)8% increase

D)14% increase

You are a risk manager for Security First Trust Savings and Loan (SFTSL). SFTSL's balance sheet is as follows (in millions of dollars):

The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.

The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.If interest rates are currently 5%, but fall to 4%, your estimate of the approximate change in SFTSL equity is closest to:

A)8% decrease

B)12% decrease

C)8% increase

D)14% increase

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following statements is FALSE?

A)Currency options allow firms to lock in a future exchange rate; currency forward contracts allow firms to insure themselves against the exchange rate moving beyond a certain level.

B)Generally speaking, cash-and-carry strategies are used primarily by large banks, which can borrow easily and face low transaction costs.

C)Currency options, like the stock options, give the holder the right-but not the obligation-to exchange currency at a given exchange rate.

D)Many managers want the firm to benefit if the exchange rate moves in their favor, rather than being stuck paying an above-market rate.

A)Currency options allow firms to lock in a future exchange rate; currency forward contracts allow firms to insure themselves against the exchange rate moving beyond a certain level.

B)Generally speaking, cash-and-carry strategies are used primarily by large banks, which can borrow easily and face low transaction costs.

C)Currency options, like the stock options, give the holder the right-but not the obligation-to exchange currency at a given exchange rate.

D)Many managers want the firm to benefit if the exchange rate moves in their favor, rather than being stuck paying an above-market rate.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

24

Suppose the current exchange rate is $1.42/€, the interest rate in the United States is 4.0%, the interest rate in the EU is 6%, and the volatility of the $/€ exchange rate is 20%. Using the Black-Scholes formula, the price of a three-month European call option on the Euro with a strike price of $1.45/€ will be closest to:

A)$0.040/€

B)$0.059/€

C)$0.078/€

D)$0.097/€

A)$0.040/€

B)$0.059/€

C)$0.078/€

D)$0.097/€

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

25

Use the following information to answer the question(s)below.

You are a risk manager for Security First Trust Savings and Loan (SFTSL). SFTSL's balance sheet is as follows (in millions of dollars): The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.

The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.

Because of a new program called Kash for Klunkers, SFTSL experiences a rash of auto loan prepayments, reducing the size of the auto loan portfolio from $200 million to $100 million and increasing the cash reserves to $200 million. After these prepayments, the duration of SFTSL's equity is closest to:

A)6 years

B)8 years

C)10 years

D)14 years

You are a risk manager for Security First Trust Savings and Loan (SFTSL). SFTSL's balance sheet is as follows (in millions of dollars):

The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.

The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.Because of a new program called Kash for Klunkers, SFTSL experiences a rash of auto loan prepayments, reducing the size of the auto loan portfolio from $200 million to $100 million and increasing the cash reserves to $200 million. After these prepayments, the duration of SFTSL's equity is closest to:

A)6 years

B)8 years

C)10 years

D)14 years

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

26

In December 2005, the spot exchange rate for the British Pound was $1.7188/£ and the one-year forward rate was $1.8675/£. Suppose that at the same time Luther Industries entered into a contract to purchase goods with a price of £375,000 to be delivered in one year. Simultaneously Luther entered into a one-year forward contract to purchase £375,000. What is the amount of the payment in U.S. dollars that Luther Industries will have to make in one year to pay for their goods?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following statements is FALSE?

A)The most common method firms use to reduce the risk that results from changes in exchange rates is to hedge the transaction using currency forward contracts.

B)Fluctuating exchanges rates cause a problem known as the importer-exporter dilemma for firms doing business in international markets.

C)Exchange rate risk naturally arises whenever transacting parties use different currencies: Both of the parties will be at risk if exchange rates fluctuate.

D)Because the supply and demand for currencies varies with global economic conditions, exchange rates are volatile.

A)The most common method firms use to reduce the risk that results from changes in exchange rates is to hedge the transaction using currency forward contracts.

B)Fluctuating exchanges rates cause a problem known as the importer-exporter dilemma for firms doing business in international markets.

C)Exchange rate risk naturally arises whenever transacting parties use different currencies: Both of the parties will be at risk if exchange rates fluctuate.

D)Because the supply and demand for currencies varies with global economic conditions, exchange rates are volatile.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

28

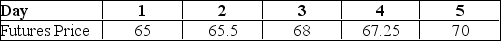

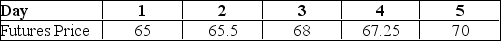

Your oil refinery will need to buy 250,000 barrels of crude oil in one week and it is worried about crude oil prices. Suppose you go long 250 crude oil futures contracts, each for 1000 barrels of crude oil, at the current futures price of $68 per barrel. Suppose futures prices change each day over the next week as follows:

What is the daily and cumulative mark to market profit or loss (in dollars)that you will have on each of the next five days?

What is the daily and cumulative mark to market profit or loss (in dollars)that you will have on each of the next five days?

What is the daily and cumulative mark to market profit or loss (in dollars)that you will have on each of the next five days?

What is the daily and cumulative mark to market profit or loss (in dollars)that you will have on each of the next five days?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

29

Use the following information to answer the question(s)below.

d'Anconia Copper expects to produce 500 million pounds of copper next year, with production costs of $0.75 per pound. Depending upon the economic conditions over the next year, d'Anconia Copper expects the price of copper next year to be either $1.40, $1.50, or $1.60 per pound, with each outcome being equally likely. d'Anconia Copper expects to sell all of its copper at the going price.

Which of the following statements is FALSE?

A)Firms generally do not possess better information than outside investors regarding the risk of future commodity price changes, nor can they influence that risk through their actions.

B)Cash flows are exchanged on a monthly basis, rather than waiting until the end of the contract, through a procedure called marking to market.

C)The firm may speculate by entering into contracts that do not offset its actual risks.

D)When a firm authorizes managers to trade contracts to hedge, it opens the door to the possibility of speculation.

d'Anconia Copper expects to produce 500 million pounds of copper next year, with production costs of $0.75 per pound. Depending upon the economic conditions over the next year, d'Anconia Copper expects the price of copper next year to be either $1.40, $1.50, or $1.60 per pound, with each outcome being equally likely. d'Anconia Copper expects to sell all of its copper at the going price.

Which of the following statements is FALSE?

A)Firms generally do not possess better information than outside investors regarding the risk of future commodity price changes, nor can they influence that risk through their actions.

B)Cash flows are exchanged on a monthly basis, rather than waiting until the end of the contract, through a procedure called marking to market.

C)The firm may speculate by entering into contracts that do not offset its actual risks.

D)When a firm authorizes managers to trade contracts to hedge, it opens the door to the possibility of speculation.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

30

A currency forward contract specifies all of the following EXCEPT:

A)the amount of currency to exchange.

B)the spot exchange rate.

C)the delivery date on which the exchange will take place.

D)the currencies to be exchanged.

A)the amount of currency to exchange.

B)the spot exchange rate.

C)the delivery date on which the exchange will take place.

D)the currencies to be exchanged.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

31

Suppose the current exchange rate is $1.62/£, the interest rate in the united states is 5.25%, the interest rate in the United Kingdom is 4%, and the volatility of the $/£ exchange rate is 18%. Using the Black-Scholes formula, the price of a six-month European call option on the British pound with a strike price of $1.60/£ will be closest to:

A)$0.040/£

B)$0.059/£

C)$0.078/£

D)$0.097/£

A)$0.040/£

B)$0.059/£

C)$0.078/£

D)$0.097/£

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

32

Like most foreign exchange rates, the dollar/euro rate is a floating rate, which means it changes constantly depending on the quantity supplied and demanded for each currency in the market. The supply and demand for each currency is driven directly by all of the following factors EXCEPT:

A)relative inflation.

B)firms trading goods.

C)investors trading securities.

D)the actions of central banks in each country.

A)relative inflation.

B)firms trading goods.

C)investors trading securities.

D)the actions of central banks in each country.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

33

Use the following information to answer the question(s)below.

d'Anconia Copper expects to produce 500 million pounds of copper next year, with production costs of $0.75 per pound. Depending upon the economic conditions over the next year, d'Anconia Copper expects the price of copper next year to be either $1.40, $1.50, or $1.60 per pound, with each outcome being equally likely. d'Anconia Copper expects to sell all of its copper at the going price.

Which of the following statements regarding long-term supply contracts is FALSE?

A)The market value of the contract at any point in time may not be easy to determine, making it difficult to track gains and losses.

B)Long-term supply contracts are designed to eliminate credit risk.

C)Long-term supply contracts insulate the firms from commodity price risk.

D)Long-term supply contracts are bilateral contracts negotiated by a buyer and a seller.

d'Anconia Copper expects to produce 500 million pounds of copper next year, with production costs of $0.75 per pound. Depending upon the economic conditions over the next year, d'Anconia Copper expects the price of copper next year to be either $1.40, $1.50, or $1.60 per pound, with each outcome being equally likely. d'Anconia Copper expects to sell all of its copper at the going price.

Which of the following statements regarding long-term supply contracts is FALSE?

A)The market value of the contract at any point in time may not be easy to determine, making it difficult to track gains and losses.

B)Long-term supply contracts are designed to eliminate credit risk.

C)Long-term supply contracts insulate the firms from commodity price risk.

D)Long-term supply contracts are bilateral contracts negotiated by a buyer and a seller.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following statements regarding currency options is FALSE?

A)Firms often prefer forward contracts to currency options if the transaction they are hedging might not take place.

B)Currency options are another method that firms commonly use to manage exchange rate risk. Currency options, like the stock options, give the holder the right-but not the obligation-to exchange currency at a given exchange rate.

C)Currency forward contracts allow firms to lock in a future exchange rate; currency options allow firms to insure themselves against the exchange rate moving beyond a certain level.

D)Many managers want the firm to benefit if the exchange rate moves in their favor, rather than being stuck paying an above-market rate.

A)Firms often prefer forward contracts to currency options if the transaction they are hedging might not take place.

B)Currency options are another method that firms commonly use to manage exchange rate risk. Currency options, like the stock options, give the holder the right-but not the obligation-to exchange currency at a given exchange rate.

C)Currency forward contracts allow firms to lock in a future exchange rate; currency options allow firms to insure themselves against the exchange rate moving beyond a certain level.

D)Many managers want the firm to benefit if the exchange rate moves in their favor, rather than being stuck paying an above-market rate.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

35

In December 2005, the spot exchange rate for the British Pound was $1.7188/£. Suppose that at the same time the on-year interest rate in the United States was 4.85% and the one-year interest rate in Great Britain was 3.15%. Based on these rates, what forward exchange rate is consistent with no arbitrage.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following statements is FALSE?

A)The covered interest parity equation states that the difference between the forward and spot exchange rates is related to the interest rate differential between the currencies.

B)By entering into a currency forward contract, a firm can lock in an exchange rate in advance and reduce or eliminate its exposure to fluctuations in a currency's value.

C)When the interest rate differs across countries, investors have an incentive to borrow in the low-interest rate currency and invest in the high interest rate currency.

D)A currency forward is usually written between two firms, and it fixes a currency exchange rate for a transaction that will occur at a future date.

A)The covered interest parity equation states that the difference between the forward and spot exchange rates is related to the interest rate differential between the currencies.

B)By entering into a currency forward contract, a firm can lock in an exchange rate in advance and reduce or eliminate its exposure to fluctuations in a currency's value.

C)When the interest rate differs across countries, investors have an incentive to borrow in the low-interest rate currency and invest in the high interest rate currency.

D)A currency forward is usually written between two firms, and it fixes a currency exchange rate for a transaction that will occur at a future date.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

37

Use the following information to answer the question(s)below.

d'Anconia Copper expects to produce 500 million pounds of copper next year, with production costs of $0.75 per pound. Depending upon the economic conditions over the next year, d'Anconia Copper expects the price of copper next year to be either $1.40, $1.50, or $1.60 per pound, with each outcome being equally likely. d'Anconia Copper expects to sell all of its copper at the going price.

What are some of the disadvantages of long-term supply contracts?

d'Anconia Copper expects to produce 500 million pounds of copper next year, with production costs of $0.75 per pound. Depending upon the economic conditions over the next year, d'Anconia Copper expects the price of copper next year to be either $1.40, $1.50, or $1.60 per pound, with each outcome being equally likely. d'Anconia Copper expects to sell all of its copper at the going price.

What are some of the disadvantages of long-term supply contracts?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

38

Use the following information to answer the question(s)below.

d'Anconia Copper expects to produce 500 million pounds of copper next year, with production costs of $0.75 per pound. Depending upon the economic conditions over the next year, d'Anconia Copper expects the price of copper next year to be either $1.40, $1.50, or $1.60 per pound, with each outcome being equally likely. d'Anconia Copper expects to sell all of its copper at the going price.

Which of the following statements regarding futures contracts is FALSE?

A)Both the buyer and the seller can get out of the contract at any time by selling it to a third party at the current market price.

B)Futures prices are not prices that are paid today. Rather, they are prices agreed to today, to be paid in the future.

C)Futures contracts are traded anonymously on an exchange at a publicly observed market price and are generally very illiquid.

D)Traders are required to post collateral, called margin, when buying or selling commodities using futures contracts.

d'Anconia Copper expects to produce 500 million pounds of copper next year, with production costs of $0.75 per pound. Depending upon the economic conditions over the next year, d'Anconia Copper expects the price of copper next year to be either $1.40, $1.50, or $1.60 per pound, with each outcome being equally likely. d'Anconia Copper expects to sell all of its copper at the going price.

Which of the following statements regarding futures contracts is FALSE?

A)Both the buyer and the seller can get out of the contract at any time by selling it to a third party at the current market price.

B)Futures prices are not prices that are paid today. Rather, they are prices agreed to today, to be paid in the future.

C)Futures contracts are traded anonymously on an exchange at a publicly observed market price and are generally very illiquid.

D)Traders are required to post collateral, called margin, when buying or selling commodities using futures contracts.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

39

Use the following information to answer the question(s)below.

d'Anconia Copper expects to produce 500 million pounds of copper next year, with production costs of $0.75 per pound. Depending upon the economic conditions over the next year, d'Anconia Copper expects the price of copper next year to be either $1.40, $1.50, or $1.60 per pound, with each outcome being equally likely. d'Anconia Copper expects to sell all of its copper at the going price.

Which of the following statements is FALSE?

A)Long-term supply contracts such contracts cannot be entered into anonymously; the buyer and seller know each other's identity. This lack of anonymity may have strategic disadvantages.

B)A futures contract is an agreement to trade an asset on some future date, at a price that is locked in today.

C)An alternative to vertical integration or storage is a long-term supply contract.

D)Long-term supply contracts are unilateral contracts negotiated by a seller.

d'Anconia Copper expects to produce 500 million pounds of copper next year, with production costs of $0.75 per pound. Depending upon the economic conditions over the next year, d'Anconia Copper expects the price of copper next year to be either $1.40, $1.50, or $1.60 per pound, with each outcome being equally likely. d'Anconia Copper expects to sell all of its copper at the going price.

Which of the following statements is FALSE?

A)Long-term supply contracts such contracts cannot be entered into anonymously; the buyer and seller know each other's identity. This lack of anonymity may have strategic disadvantages.

B)A futures contract is an agreement to trade an asset on some future date, at a price that is locked in today.

C)An alternative to vertical integration or storage is a long-term supply contract.

D)Long-term supply contracts are unilateral contracts negotiated by a seller.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

40

Use the following information to answer the question(s)below.

You are a risk manager for Security First Trust Savings and Loan (SFTSL). SFTSL's balance sheet is as follows (in millions of dollars): The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.

The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.

The duration of SFTSL's equity is closest to:

A)6 years

B)8 years

C)10 years

D)14 years

You are a risk manager for Security First Trust Savings and Loan (SFTSL). SFTSL's balance sheet is as follows (in millions of dollars):

The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.

The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.The duration of SFTSL's equity is closest to:

A)6 years

B)8 years

C)10 years

D)14 years

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

41

Use the following information to answer the question(s)below.

You are a risk manager for Security First Trust Savings and Loan (SFTSL). SFTSL's balance sheet is as follows (in millions of dollars): The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.

The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.

Which of the following statements is FALSE?

A)Interest rate swaps are an alternative means of modifying the firm's interest rate risk exposure without buying or selling assets.

B)A portfolio with a negative duration is called a duration-neutral portfolio or an immunized portfolio, which means that for small interest rate fluctuations, the value of equity should remain unchanged.

C)Maintaining a duration-neutral portfolio will require constant adjustment as interest rates change.

D)A duration-neutral portfolio is only protected against interest rate changes that affect all yields identically.

You are a risk manager for Security First Trust Savings and Loan (SFTSL). SFTSL's balance sheet is as follows (in millions of dollars):

The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.

The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.Which of the following statements is FALSE?

A)Interest rate swaps are an alternative means of modifying the firm's interest rate risk exposure without buying or selling assets.

B)A portfolio with a negative duration is called a duration-neutral portfolio or an immunized portfolio, which means that for small interest rate fluctuations, the value of equity should remain unchanged.

C)Maintaining a duration-neutral portfolio will require constant adjustment as interest rates change.

D)A duration-neutral portfolio is only protected against interest rate changes that affect all yields identically.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

42

Use the following information to answer the question(s)below.

You are a risk manager for Security First Trust Savings and Loan (SFTSL). SFTSL's balance sheet is as follows (in millions of dollars): The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.

The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.

The duration of a five-year bond with 8% annual coupons trading at par is closest to:

A)2.5 Years

B)4.3 Years

C)5.0 Years

D)6.2 Years

You are a risk manager for Security First Trust Savings and Loan (SFTSL). SFTSL's balance sheet is as follows (in millions of dollars):

The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.

The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.The duration of a five-year bond with 8% annual coupons trading at par is closest to:

A)2.5 Years

B)4.3 Years

C)5.0 Years

D)6.2 Years

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

43

Luther Industries needs to borrow $50 million in cash. Currently long-term AAA rates are 9%. Luther can borrow at 9.75% given its current credit rating. Luther is expecting interest rates to fall over the next few years, so it would prefer to borrow at the short-term rates and refinance after rates have dropped. Luther management is afraid, however, that its credit rating may fall which could greatly increase the spread the firm must pay on new borrowings. How can Luther benefit from the expected decline in future interest rates without exposure to the risk of the potential future changes to its credit ratings bring?

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

44

Use the following information to answer the question(s)below.

You are a risk manager for Security First Trust Savings and Loan (SFTSL). SFTSL's balance sheet is as follows (in millions of dollars): The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.

The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.

Which of the following statements is FALSE?

A)As interest rates change, the market values of the securities and cash flows in the portfolio change as well, which in turn alters the weights used when computing the duration as the value-weighted average maturity.

B)The duration of a portfolio of investments is the simple average of the durations of each investment in the portfolio.

C)Adjusting a portfolio to make its duration neutral is sometimes referred to as immunizing the portfolio, a term that indicates it is being protected against interest rate changes.

D)When the durations of a firm's assets and liabilities are significantly different, the firm has a duration mismatch.

You are a risk manager for Security First Trust Savings and Loan (SFTSL). SFTSL's balance sheet is as follows (in millions of dollars):

The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.

The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.Which of the following statements is FALSE?

A)As interest rates change, the market values of the securities and cash flows in the portfolio change as well, which in turn alters the weights used when computing the duration as the value-weighted average maturity.

B)The duration of a portfolio of investments is the simple average of the durations of each investment in the portfolio.

C)Adjusting a portfolio to make its duration neutral is sometimes referred to as immunizing the portfolio, a term that indicates it is being protected against interest rate changes.

D)When the durations of a firm's assets and liabilities are significantly different, the firm has a duration mismatch.

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

45

Use the following information to answer the question(s)below.

You are a risk manager for Security First Trust Savings and Loan (SFTSL). SFTSL's balance sheet is as follows (in millions of dollars): The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.

The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.

What is the duration of a five-year zero-coupon bond?

A)2.5 Years

B)1 Year

C)5 Years

D)0 Years

You are a risk manager for Security First Trust Savings and Loan (SFTSL). SFTSL's balance sheet is as follows (in millions of dollars):

The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.

The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.What is the duration of a five-year zero-coupon bond?

A)2.5 Years

B)1 Year

C)5 Years

D)0 Years

Unlock Deck

Unlock for access to all 49 flashcards in this deck.

Unlock Deck

k this deck

46

Use the following information to answer the question(s)below.

You are a risk manager for Security First Trust Savings and Loan (SFTSL). SFTSL's balance sheet is as follows (in millions of dollars): The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.

The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.

Which of the following statements is FALSE?

A)Corporations use interest rate swaps routinely to alter their exposure to interest rate fluctuations. Firms can use interest rate swaps with duration-hedging strategies.

B)The value of a swap, while initially zero, will fluctuate over time as interest rates change.

C)An interest rate that adjusts to current market conditions is called a floating rate.

D)When interest rates rise, the swap's value will rise for the party receiving the fixed rate; conversely, it will fall for the party paying the fixed rate.

You are a risk manager for Security First Trust Savings and Loan (SFTSL). SFTSL's balance sheet is as follows (in millions of dollars):

The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.

The duration of the auto loans is three years and the duration of the mortgages is eight years. Both cash reserves and checking and savings have zero duration. The CDs have a duration of two years and the long-term financing has a ten year duration.Which of the following statements is FALSE?

A)Corporations use interest rate swaps routinely to alter their exposure to interest rate fluctuations. Firms can use interest rate swaps with duration-hedging strategies.

B)The value of a swap, while initially zero, will fluctuate over time as interest rates change.

C)An interest rate that adjusts to current market conditions is called a floating rate.