Deck 13: Payout Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

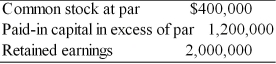

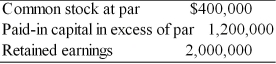

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/130

Play

Full screen (f)

Deck 13: Payout Policy

1

By purchasing shares through a firm's dividend reinvestment plan (or DRIP), shareholders typically can acquire shares at a value that is above the prevailing market price.

False

2

Dividends provide information about the firm's current and future performance.

True

3

Dividends are the only means by which firms can distribute cash to shareholders.

False

4

The Jobs Growth Tax Relief Reconciliation Act of 2003 significantly changed the tax treatment of corporate dividends for most taxpayers by dropping the tax rate to the rate applicable on capital gains, which is a maximum rate of 15%.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

5

The Jobs Growth Tax Relief Reconciliation Act of 2003 significantly changed the tax treatment of corporate dividends for most taxpayers by dropping the tax rate to the rate applicable on capital gains, which is a maximum rate of 25%.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

6

Date of record (dividends) is the actual date on which the company will mail the dividend payment to the holders of record.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

7

The dividend decisions can significantly affect the firm's share price and external financing requirements.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

8

The payment date is five days after the date of record, on which the company will mail the dividend to the holders of record.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

9

At a firm's quarterly dividend meeting held April 9, the directors declared a $0.50 per share cash dividend for the holders of record on Monday, May 1. The firm's stock will sell ex-dividends on

A) April 9.

B) May 5.

C) April 25.

D) April 27.

A) April 9.

B) May 5.

C) April 25.

D) April 27.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

10

The ex-dividend period begins four business days prior to the payment date during which a stock will be sold without paying the current dividend.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

11

The payment of cash dividends to corporate stockholders is decided by the firm's chief financial officer.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

12

Because retained earnings are a form of internal financing, the dividend decision can significantly affect the firm's external financing requirements.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

13

Holders of record are stockholders whose names are recorded on the date of record.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

14

Purchasers of a stock selling ex-dividend receive the current dividend.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

15

Ignoring general market fluctuations, the stock's price would be expected to drop by the amount of the declared dividend on the ex-dividend date.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

16

Dividends provide information about the firm's current performance but no information about the firm's future performance.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

17

The dividend payment date is set by the firm's chief executive officer and represents the actual date on which the firm mails the dividend payment to the holders of record.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

18

The dividend payment date is set by the firm's board of directors and represents the actual date on which the firm mails the dividend payment to the holders of record.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

19

By purchasing shares through a firm's dividend reinvestment plan (or DRIP), shareholders typically can acquire shares at a value that is below the prevailing market price.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

20

Dividend reinvestment plans (DRIPs) enable stockholders to use dividends received on the firm's stock to acquire additional shares or fractional shares at little or no transaction (brokerage) cost.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

21

The bird-in-the-hand argument espousing the importance of dividends or dividend relevance suggests that investors view a current (certain) dividend as less risky than future (uncertain) dividends or capital gains; nevertheless, proponents of this theory argue that this will have no significant impact on share price.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

22

Paying a stock dividend ________ the retained earnings account.

A) decreases

B) has no effect on

C) increases

D) reorganizes

A) decreases

B) has no effect on

C) increases

D) reorganizes

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

23

According to the bird-in-the-hand argument, current dividend payments reduce investor uncertainty and result in a higher value for the firm's stock.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

24

As a result of the Jobs and Growth Tax Relief Reconciliation Act of 2003, early studies showed that the percentage of firms paying quarterly dividends

A) increased.

B) decreased.

C) did not change.

D) none of the above.

A) increased.

B) decreased.

C) did not change.

D) none of the above.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

25

According to Modigliani and Miller, a firm's value is determined solely by the earning power and risk of its assets and that the manner in which it splits its earnings stream between dividends and internally retained funds does not affect this value.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

26

A dividend reinvestment plan ________ on the security.

A) decreases the return

B) has no effect on the return

C) increases the return

D) has an undetermined effect

A) decreases the return

B) has no effect on the return

C) increases the return

D) has an undetermined effect

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

27

The residual theory of dividends tends to suggest that the required return of investors is not influenced by the firm's dividend policy and, thus, dividend policy is irrelevant.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following types of firms are most likely NOT to payout cash dividends?

A) Rapidly growing firms

B) Firms with modest growth

C) Large, mature firms

D) International corporations

A) Rapidly growing firms

B) Firms with modest growth

C) Large, mature firms

D) International corporations

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

29

In the dividend relevance arguments, current dividend payments are believed to reduce investor's uncertainty, therebyall else being equalplacing a higher value on the firm's stock.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

30

The residual theory of dividends implies that if the firm cannot earn a return (IRR) from investment of its earnings that is in excess of cost (WMCC), it should distribute the earnings by paying dividends to stockholders.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

31

A dividend reinvestment plan enables stockholders to

A) reinvest the dividends in money market instruments which are risk free.

B) reinvest all dividends in the firm with no accompanying increase in equity.

C) acquire additional dividends through redemption of stock.

D) acquire shares at little or no transaction costs.

A) reinvest the dividends in money market instruments which are risk free.

B) reinvest all dividends in the firm with no accompanying increase in equity.

C) acquire additional dividends through redemption of stock.

D) acquire shares at little or no transaction costs.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

32

Under the Jobs and Growth Tax Relief Reconciliation Act of 2003, the maximum rate of taxation on dividends received by shareholders was set at

A) 18%.

B) 20%.

C) 25%.

D) none of the above.

A) 18%.

B) 20%.

C) 25%.

D) none of the above.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

33

Due to clientele effect, Modigliani and Miller argue that the shareholders get what they expect and, thus, the value of the firm's stock is unaffected by dividend policy.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

34

At the quarterly meeting of Tangshan Mining Corporation, held on September 10th, the directors declared a $1.00 per share dividend for the firm's 100,000 shares of common stock outstanding. The net effect of declaring and paying this dividend would be to

A) decrease total assets by $100,000 and increase stockholders equity by $100,000.

B) decrease total assets by $100,000 and decrease stockholders equity by $100,000.

C) increase total assets by $100,000 and increase stockholders equity by $100,000.

D) increase total assets by $100,000 and decrease stockholders equity by $100,000.

A) decrease total assets by $100,000 and increase stockholders equity by $100,000.

B) decrease total assets by $100,000 and decrease stockholders equity by $100,000.

C) increase total assets by $100,000 and increase stockholders equity by $100,000.

D) increase total assets by $100,000 and decrease stockholders equity by $100,000.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

35

The payment of cash dividends to corporate stockholders is decided by the

A) management.

B) stockholders.

C) SEC.

D) board of directors.

A) management.

B) stockholders.

C) SEC.

D) board of directors.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

36

The residual theory of dividends, as espoused by Modigliani and Miller, suggests that dividends represent an earnings residual rather than an active decision variable that affects firm value; this means that a firm's decision to pay dividends or not will not have any impact on a firm's share price.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

37

Stockholders dislike dividends that

A) are fixed.

B) fluctuate with earnings.

C) are continuous.

D) increase.

A) are fixed.

B) fluctuate with earnings.

C) are continuous.

D) increase.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

38

The clientele effect is the argument that a firm attracts shareholders whose preferences with respect to the payment and stability of dividends corresponds to the payment pattern and stability of the firm itself.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

39

The representative theory of dividends, as espoused by Modigliani and Miller, suggests that dividends represent a significant, active decision variable that affects firm value; this means that a firm's decision to pay dividends can have a significant impact on a firm's share price.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

40

The bird-in-the-hand argument espousing the importance of dividends or dividend relevance suggests that investors view a current (certain) dividend as less risky than future (uncertain) dividends or capital gains; this suggests that whether a firm pays a dividend or not can have a significant impact on share price.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

41

In establishing a dividend policy, a firm should retain funds for investment in projects yielding higher returns than the owners could obtain from external investments of equal risk.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

42

According to the residual theory of dividends, if the firm's equity need is less than the amount of retained earnings, the firm would

A) borrow to pay the cash dividend.

B) declare a dividend equal to the remaining balance.

C) pay no cash dividends.

D) not need to consider its dividend policy.

A) borrow to pay the cash dividend.

B) declare a dividend equal to the remaining balance.

C) pay no cash dividends.

D) not need to consider its dividend policy.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

43

Modigliani and Miller suggest that the value of the firm is not affected by the firm's dividend policy, due to

A) the relevance of dividends.

B) the clientele effect.

C) the informational content.

D) the optimal capital structure.

A) the relevance of dividends.

B) the clientele effect.

C) the informational content.

D) the optimal capital structure.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

44

Dividend policy is a form of

A) capital budgeting policy.

B) financing policy.

C) working capital policy.

D) dividend reinvestment policy.

A) capital budgeting policy.

B) financing policy.

C) working capital policy.

D) dividend reinvestment policy.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

45

Proponents of the dividend irrelevance theory argue that, all else being equal, an investor's required return and the value of the firm are unaffected by dividend policy, for all of the following reasons, EXCEPT

A) the firm's value is determined solely by the earning power and risk of its assets.

B) investor's are generally risk averse and attach less risk to current as opposed to future dividends or capital gains.

C) if dividends do affect value, they do so solely because of their information content, which signals managements' earnings expectations.

D) a clientele effect exists which causes a firm's shareholders to receive the dividends that they expect.

A) the firm's value is determined solely by the earning power and risk of its assets.

B) investor's are generally risk averse and attach less risk to current as opposed to future dividends or capital gains.

C) if dividends do affect value, they do so solely because of their information content, which signals managements' earnings expectations.

D) a clientele effect exists which causes a firm's shareholders to receive the dividends that they expect.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

46

Generally, legal constraints prohibit the payment of cash dividends until a certain level of earnings has been achieved or limit the amount of dividends paid to a certain dollar amount or percentage of earnings.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

47

The residual theory of dividends suggests that dividends are ________ to the value of the firm.

A) residual

B) relevant

C) irrelevant

D) integral

A) residual

B) relevant

C) irrelevant

D) integral

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

48

Tangshan Mining has common stock at par of $200,000, paid in capital in excess of par of $400,000, and retained earnings of $280,000. In states where the firm's legal capital is defined as the total of par value and paid-in-capital of common stock, the firm could pay out ________ in cash dividends without impairing its capital.

A) $280,000

B) $400,000

C) $480,000

D) $600,000

A) $280,000

B) $400,000

C) $480,000

D) $600,000

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

49

In most states, legal capital is measured either by the par value of common stock; other states, however, define legal capital to include not only the par value of the stock, but also any paid in capital in excess of par.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

50

Gordon's "bird-in-the-hand" argument suggests that

A) dividends are irrelevant.

B) firms should have a 100 percent payout policy.

C) shareholders are generally risk averse and attach less risk to current dividends.

D) the market value of the firm is unaffected by dividend policy.

A) dividends are irrelevant.

B) firms should have a 100 percent payout policy.

C) shareholders are generally risk averse and attach less risk to current dividends.

D) the market value of the firm is unaffected by dividend policy.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

51

Shareholder wealth considerations in the payment of dividends include all of the following EXCEPT

A) the tax status of the firm's owners.

B) the criminal status of the firm's owners.

C) the investment opportunities of the firm's owners.

D) the potential dilution of ownership on behalf of the firm's owners.

A) the tax status of the firm's owners.

B) the criminal status of the firm's owners.

C) the investment opportunities of the firm's owners.

D) the potential dilution of ownership on behalf of the firm's owners.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

52

According to the residual theory of dividends, if the firm's equity need exceeds the amount of retained earnings, the firm would

A) borrow to pay the cash dividend.

B) sell additional stock to pay the cash dividend.

C) pay no cash dividends.

D) not need to consider its dividend policy.

A) borrow to pay the cash dividend.

B) sell additional stock to pay the cash dividend.

C) pay no cash dividends.

D) not need to consider its dividend policy.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

53

The clientele effect refers to

A) the relevance of dividend policy on share value.

B) the firm's ability to attract stockholders whose dividend preferences are similar to the firm's dividend policy.

C) the informational content of dividends.

D) the "bird-in-the-hand" argument.

A) the relevance of dividend policy on share value.

B) the firm's ability to attract stockholders whose dividend preferences are similar to the firm's dividend policy.

C) the informational content of dividends.

D) the "bird-in-the-hand" argument.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

54

The information content of dividends refers to

A) nonpayment of dividends by corporations.

B) dividend changes as indicators of a firm's future.

C) a stable and continuous dividend.

D) a dividend paid as a percent of current earnings.

A) nonpayment of dividends by corporations.

B) dividend changes as indicators of a firm's future.

C) a stable and continuous dividend.

D) a dividend paid as a percent of current earnings.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

55

While an earnings requirement limiting the amount of dividends paid is sometimes imposed, the firm is not prohibited from paying more in dividends than its current earnings.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

56

Since lenders are generally reluctant to make loans to a firm to pay dividends, the firm's ability to pay cash dividends is generally constrained by the amount of excess cash available.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

57

Modigliani and Miller argue that when the firm has no acceptable investment opportunities, it should

A) close its doors.

B) distribute the unneeded funds to the owners.

C) lower its cost of capital.

D) retain the funds until an acceptable project arises.

A) close its doors.

B) distribute the unneeded funds to the owners.

C) lower its cost of capital.

D) retain the funds until an acceptable project arises.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

58

If a firm pays out a higher percentage of earnings, new equity capital will have to be raised with common stock, which will result in higher control and earnings for the existing owners.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

59

Tangshan Mining has common stock at par of $200,000, paid in capital in excess of par of $400,000, and retained earnings of $280,000. In states where the firm's legal capital is defined as the par value of common stock, the firm could pay out ________ in cash dividends without impairing its capital.

A) $200,000

B) $480,000

C) $600,000

D) $880,000

A) $200,000

B) $480,000

C) $600,000

D) $880,000

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

60

Modigliani and Miller, recognizing that dividends do somehow affect stock prices, suggest that positive effects of dividend increases are attributable

A) directly to the dividend policy.

B) directly to the optimal capital structure.

C) not to the informational content but to the consistency in the payment of dividends.

D) not to the dividend itself but to the informational content of the dividends with respect to future earnings.

A) directly to the dividend policy.

B) directly to the optimal capital structure.

C) not to the informational content but to the consistency in the payment of dividends.

D) not to the dividend itself but to the informational content of the dividends with respect to future earnings.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

61

Among owner considerations in the establishment of dividend policy, any of the following may enter into the decision EXCEPT

A) the tax status of the owners.

B) the owners' investment opportunities.

C) the potential dilution of ownership.

D) restrictive constraints on the preferred stock.

A) the tax status of the owners.

B) the owners' investment opportunities.

C) the potential dilution of ownership.

D) restrictive constraints on the preferred stock.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

62

Firms are usually prohibited by state law from distributing

A) retained earnings as dividends.

B) paid-in capital as dividends.

C) dividends in a year the firm has a net loss.

D) assets as dividends.

A) retained earnings as dividends.

B) paid-in capital as dividends.

C) dividends in a year the firm has a net loss.

D) assets as dividends.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

63

Because dividends are taxed at the same rate as capital gains under the 2003 Tax Act, a firm's strategy of paying low or no dividends primarily offers tax advantages to wealthy stockholders through tax deferral rather than as a result of a lower tax rate on current income.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

64

In general, the market rewards firms that adopt a fixed or increasing level of dividends rather than a fixed dividend payout policy through higher share prices.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

65

Regular dividend policy is a dividend policy based on the payment of a certain percentage of earnings to owners in each dividend period.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

66

The level of dividends a firm expects to pay is generally unrelated to how rapidly it expects to grow as well as the level of asset investments required.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

67

A firm that has a large percentage of ________ investors may pay out a lower percentage of its earnings as dividends.

A) wealthy

B) pension fund

C) middle-income

D) business

A) wealthy

B) pension fund

C) middle-income

D) business

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

68

A firm has the following stockholders' equity balances:  In states where the firm's legal capital is defined as the par value of its common stock, the maximum cash dividend the firm could pay is

In states where the firm's legal capital is defined as the par value of its common stock, the maximum cash dividend the firm could pay is

A) $3,600,000.

B) $400,000.

C) $3,200,000.

D) $1,600,000.

In states where the firm's legal capital is defined as the par value of its common stock, the maximum cash dividend the firm could pay is

In states where the firm's legal capital is defined as the par value of its common stock, the maximum cash dividend the firm could pay isA) $3,600,000.

B) $400,000.

C) $3,200,000.

D) $1,600,000.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

69

In general, with regard to dividend payments, the contractual constraints imposed by loan agreements can include all of the following EXCEPT

A) prohibit the payment of cash dividends until a certain level of earnings has been achieved.

B) limit the percentage of earnings that can be paid out in dividends.

C) limit the actual dollar amount of dividends that can be paid out.

D) require the payment of a common stock dividend.

A) prohibit the payment of cash dividends until a certain level of earnings has been achieved.

B) limit the percentage of earnings that can be paid out in dividends.

C) limit the actual dollar amount of dividends that can be paid out.

D) require the payment of a common stock dividend.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

70

In most states, legal capital is measured not only by the par value and paid in capital of the stock, but also by any accumulated retained earnings.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

71

The factors involved in setting a dividend policy include all of the following EXCEPT

A) restrictive covenants in a bond indenture.

B) growth prospects.

C) the legal prohibition on paying dividends which exceed current earnings.

D) capital impairment restrictions.

A) restrictive covenants in a bond indenture.

B) growth prospects.

C) the legal prohibition on paying dividends which exceed current earnings.

D) capital impairment restrictions.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

72

A constant-payout-ratio dividend policy is a dividend policy based on the payment to existing owners of a dividend in the form of stock as a certain percentage of the firm's total number of stocks outstanding in each dividend period.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

73

In general, the market rewards firms that adopt a constant dividend payout policy rather than a fixed or increasing level of dividends through higher share prices.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

74

The factors involved in setting a dividend policy include all of the following EXCEPT

A) operating constraints.

B) legal constraints.

C) contractual constraints.

D) internal constraints.

A) operating constraints.

B) legal constraints.

C) contractual constraints.

D) internal constraints.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

75

The regular dividend policy provides the owners with generally positive information, indicating that the firm is okay and thereby minimizing their uncertainty.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

76

The dividend policy must be formulated considering two basic objectives, namely

A) delaying the tax liability of the stockholder and information content.

B) maximizing shareholder wealth and delaying the tax liability of the stockholder.

C) maximizing shareholder wealth and providing for sufficient financing.

D) maintaining liquidity and minimizing the weighted average cost of capital.

A) delaying the tax liability of the stockholder and information content.

B) maximizing shareholder wealth and delaying the tax liability of the stockholder.

C) maximizing shareholder wealth and providing for sufficient financing.

D) maintaining liquidity and minimizing the weighted average cost of capital.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

77

An excess earnings accumulation tax is levied when

A) shareholders receive dividends which exceed the firm's earnings.

B) firms do not pay dividends in order to delay the owner's tax liability.

C) firms do not pay dividends to reinvest in the firm.

D) earnings exceed dividends.

A) shareholders receive dividends which exceed the firm's earnings.

B) firms do not pay dividends in order to delay the owner's tax liability.

C) firms do not pay dividends to reinvest in the firm.

D) earnings exceed dividends.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

78

If a firm has overdue liabilities or is legally insolvent or bankrupt, most states prohibit its payment of cash dividends.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

79

The capital impairment restrictions are established to

A) reduce dividends equal to or below the current earnings level.

B) constrain the firm to paying dividends which do not require additional borrowing.

C) protect the shareholder.

D) provide a sufficient base to protect creditors' claims.

A) reduce dividends equal to or below the current earnings level.

B) constrain the firm to paying dividends which do not require additional borrowing.

C) protect the shareholder.

D) provide a sufficient base to protect creditors' claims.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

80

The level of dividends a firm expects to pay is often directly related to how rapidly it expects to grow as well as the level of asset investments required.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck