Deck 10: Capital Budgeting Techniques

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

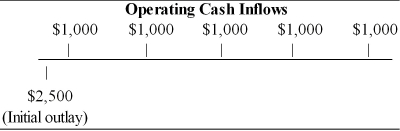

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/167

Play

Full screen (f)

Deck 10: Capital Budgeting Techniques

1

A $60,000 outlay for a new machine with a usable life of 15 years is an operating expenditure that would appear as a current asset on the firm's balance sheet.

False

2

Research and development is considered to be a motive for making capital expenditures.

True

3

In capital budgeting, the preferred approaches in assessing whether a project is acceptable are those that integrate time value procedures, risk and return considerations, and valuation concepts.

True

4

The basic motives for capital expenditures are to expand, replace, or renew fixed assets or to obtain some other, less tangible benefit over a long period.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

5

Capital budgeting is the process of evaluating and selecting short-term investments consistent with the firm's goal of owner wealth maximization.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

6

A capital expenditure is an outlay of funds invested only in fixed assets that is expected to produce benefits over a period of time less than one year.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

7

Capital budgeting techniques are used to evaluate the firm's fixed asset investments which provide the basis for the firm's earning power and value.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

8

Independent projects are projects that compete with one another for the firm's resources, so that the acceptance of one eliminates the others from further consideration.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

9

In capital budgeting, the preferred approaches in assessing whether a project is acceptable integrate time value procedures, risk and return considerations, valuation concepts, and the required payback period.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

10

If a firm has unlimited funds to invest in capital assets, all independent projects that meet its minimum investment criteria should be implemented.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

11

The primary motive for capital expenditures is to refurbish fixed assets.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

12

The following three projects would seem to compete with one another form the firm's resources and therefore would be examples of mutually exclusive projects.

(1) installing air conditioning in the plant

(2) acquiring a small supplier

(3) purchasing a new computer system

(1) installing air conditioning in the plant

(2) acquiring a small supplier

(3) purchasing a new computer system

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

13

The purchase of additional physical facilities, such as additional property or a new factory, is an example of a capital expenditure.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

14

If a firm has unlimited funds to invest, all the mutually exclusive projects that meet its minimum investment criteria can be implemented.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

15

An outlay for advertising and management consulting is considered to be a fixed asset expenditure.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

16

The capital budgeting process consists of four distinct but interrelated steps: proposal generation, review and analysis, decision making, and termination.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

17

Capital expenditure proposals are reviewed to assess their appropriateness in light of the firm's overall objectives and plans, and to evaluate their economic validity.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

18

Mutually exclusive projects are projects whose cash flows are unrelated to one another; the acceptance of one does not eliminate the others from further consideration.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

19

The capital budgeting process consists of five distinct but interrelated steps: proposal generation, review and analysis, decision making, implementation, and follow-up.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

20

A non-conventional cash flow pattern associated with capital investment projects consists of an initial outflow followed by a series of inflows.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

21

A conventional cash flow pattern is one in which an initial outflow is followed only by a series of inflows.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

22

Mutually exclusive projects are those whose cash flows compete with one another; the acceptance of one eliminates others from further consideration.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

23

If a firm has unlimited funds, it is able to accept all independent projects that provide an acceptable return.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

24

If a firm is subject to capital rationing, it has only a fixed number of dollars available for capital expenditures, and numerous projects compete for these dollars.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

25

The most common motive for adding fixed assets to the firm is

A) expansion.

B) replacement.

C) renewal.

D) transformation.

A) expansion.

B) replacement.

C) renewal.

D) transformation.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

26

A nonconventional cash flow pattern is one in which an initial outflow is followed by a series of both inflows and outflows.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

27

The ranking approach involves the ranking of capital expenditure projects on the basis of some predetermined measure such as the rate of return.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

28

The first step in the capital budgeting process is

A) review and analysis.

B) implementation.

C) decision-making.

D) proposal generation.

A) review and analysis.

B) implementation.

C) decision-making.

D) proposal generation.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

29

A nonconventional cash flow pattern is one in which an initial outflow is followed only by a series of inflows.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

30

To increase its production capacity, a firm is considering: 1) to expand its plant, 2) to acquire another company, or 3) to contract with another company for production. These three projects would appear to be good examples of independent projects.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

31

Independent projects are those whose cash flows are unrelated to one another; the acceptance of one does not eliminate any others from further consideration.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

32

Fixed assets that provide the basis for the firm's profit and value are often called

A) tangible assets.

B) non-current assets.

C) earning assets.

D) book assets.

A) tangible assets.

B) non-current assets.

C) earning assets.

D) book assets.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

33

The accept-reject approach involves the ranking of capital expenditure projects on the basis of some predetermined measure such as the rate of return.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

34

The final step in the capital budgeting process is

A) implementation.

B) follow-up.

C) re-evaluation.

D) education.

A) implementation.

B) follow-up.

C) re-evaluation.

D) education.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

35

Mutually exclusive projects are those whose cash flows are unrelated to one another; the acceptance of one does not eliminate any others from further consideration.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

36

________ is the process of evaluating and selecting long-term investments consistent with the firm's goal of owner wealth maximization.

A) Recapitalizing assets

B) Capital budgeting

C) Ratio analysis

D) Restructuring debt

A) Recapitalizing assets

B) Capital budgeting

C) Ratio analysis

D) Restructuring debt

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

37

A capital expenditure is all of the following EXCEPT

A) an outlay made for the earning assets of the firm.

B) expected to produce benefits over a period of time greater than one year.

C) an outlay for current asset expansion.

D) commonly used to expand the level of operations.

A) an outlay made for the earning assets of the firm.

B) expected to produce benefits over a period of time greater than one year.

C) an outlay for current asset expansion.

D) commonly used to expand the level of operations.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

38

Mutually exclusive projects are those whose cash flows compete with one another; the acceptance of one does not eliminate any others from further consideration.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

39

A $60,000 outlay for a new machine with a usable life of 15 years is called

A) capital expenditure.

B) operating expenditure.

C) replacement expenditure.

D) none of the above.

A) capital expenditure.

B) operating expenditure.

C) replacement expenditure.

D) none of the above.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

40

If a firm is subject to capital rationing, it is able to accept all independent projects that provide an acceptable return.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

41

A conventional cash flow pattern associated with capital investment projects consists of an initial

A) outflow followed by a broken cash series.

B) inflow followed by a broken series.

C) outflow followed by a series of inflows.

D) inflow followed by a series of outflows.

A) outflow followed by a broken cash series.

B) inflow followed by a broken series.

C) outflow followed by a series of inflows.

D) inflow followed by a series of outflows.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

42

By measuring how quickly the firm recovers its initial investment, the payback period gives implicit (though not explicit) consideration to the timing of cash flows and therefore to the time value of money.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

43

________ projects have the same function; the acceptance of one ________ the others from consideration.

A) Capital; eliminates

B) Independent; does not eliminate

C) Mutually exclusive; eliminates

D) Replacement; does not eliminate

A) Capital; eliminates

B) Independent; does not eliminate

C) Mutually exclusive; eliminates

D) Replacement; does not eliminate

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

44

One strength of payback period is that it fully accounts for the time value of money.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

45

The payback period is generally viewed as an unsophisticated capital budgeting technique, because it does not explicitly consider the time value of money by discounting cash flows to find present value.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

46

Table 10.1

The cash flow pattern depicted is associated with a capital investment and may be characterized as (See Table 10.1)

A) an annuity and conventional cash flow.

B) a mixed stream and non-conventional cash flow.

C) an annuity and non-conventional cash flow.

D) a mixed stream and conventional cash flow.

The cash flow pattern depicted is associated with a capital investment and may be characterized as (See Table 10.1)

A) an annuity and conventional cash flow.

B) a mixed stream and non-conventional cash flow.

C) an annuity and non-conventional cash flow.

D) a mixed stream and conventional cash flow.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

47

________ is a series of equal annual cash flows.

A) A mixed stream

B) A conventional

C) A non-conventional

D) An annuity

A) A mixed stream

B) A conventional

C) A non-conventional

D) An annuity

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

48

Projects that compete with one another, so that the acceptance of one eliminates the others from further consideration are called

A) independent projects.

B) mutually exclusive projects.

C) replacement projects.

D) none of the above.

A) independent projects.

B) mutually exclusive projects.

C) replacement projects.

D) none of the above.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

49

The payback period is the amount of time required for the firm to dispose of a replaced asset.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

50

In the case of annuity cash inflows, the payback period can be found by dividing the initial investment by the annual cash inflow.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

51

A firm with limited dollars available for capital expenditures is subject to

A) capital dependency.

B) mutually exclusive projects.

C) working capital constraints.

D) capital rationing.

A) capital dependency.

B) mutually exclusive projects.

C) working capital constraints.

D) capital rationing.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

52

The evaluation of capital expenditure proposals to determine whether they meet the firm's minimum acceptance criteria is called

A) the ranking approach.

B) an independent investment.

C) the accept-reject approach.

D) a mutually exclusive investment.

A) the ranking approach.

B) an independent investment.

C) the accept-reject approach.

D) a mutually exclusive investment.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

53

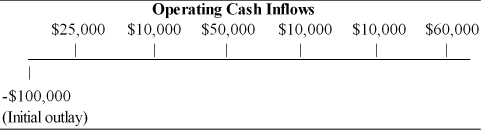

Table 10.2

The cash flow pattern depicted is associated with a capital investment and may be characterized as (See Table 10.2)

A) an annuity and conventional cash flow.

B) a mixed stream and non-conventional cash flow.

C) an annuity and non-conventional cash flow.

D) a mixed stream and conventional cash flow.

The cash flow pattern depicted is associated with a capital investment and may be characterized as (See Table 10.2)

A) an annuity and conventional cash flow.

B) a mixed stream and non-conventional cash flow.

C) an annuity and non-conventional cash flow.

D) a mixed stream and conventional cash flow.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

54

All of the following are motives for capital budgeting expenditures EXCEPT

A) expansion.

B) replacement.

C) renewal.

D) invention.

A) expansion.

B) replacement.

C) renewal.

D) invention.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

55

All of the following are steps in the capital budgeting process EXCEPT

A) implementation.

B) follow-up.

C) transformation.

D) decision-making.

A) implementation.

B) follow-up.

C) transformation.

D) decision-making.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

56

The cash flows of any project having a conventional pattern include all of the basic components EXCEPT

A) initial investment.

B) operating cash outflows.

C) operating cash inflows.

D) terminal cash flow.

A) initial investment.

B) operating cash outflows.

C) operating cash inflows.

D) terminal cash flow.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

57

A non-conventional cash flow pattern associated with capital investment projects consists of an initial

A) outflow followed by a series of both cash inflows and outflows.

B) inflow followed by a series of both cash inflows and outflows.

C) outflow followed by a series of inflows.

D) inflow followed by a series of outflows.

A) outflow followed by a series of both cash inflows and outflows.

B) inflow followed by a series of both cash inflows and outflows.

C) outflow followed by a series of inflows.

D) inflow followed by a series of outflows.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

58

Which pattern of cash flow stream is the most difficult to use when evaluating projects?

A) Mixed stream

B) Conventional flow

C) Nonconventional flow

D) Annuity

A) Mixed stream

B) Conventional flow

C) Nonconventional flow

D) Annuity

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

59

One weakness of payback is its failure to recognize cash flows that occur after the payback period.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

60

________ projects do not compete with each other; the acceptance of one ________ the others from consideration.

A) Capital; eliminates

B) Independent; does not eliminate

C) Mutually exclusive; eliminates

D) Replacement; does not eliminate

A) Capital; eliminates

B) Independent; does not eliminate

C) Mutually exclusive; eliminates

D) Replacement; does not eliminate

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

61

Many firms use the payback method as a guideline in capital investment decisions. Reasons they do so include all of the following EXCEPT

A) it gives an implicit consideration to the timing of cash flows.

B) it recognizes cash flows which occur after the payback period.

C) it is a measure of risk exposure.

D) it is easy to calculate.

A) it gives an implicit consideration to the timing of cash flows.

B) it recognizes cash flows which occur after the payback period.

C) it is a measure of risk exposure.

D) it is easy to calculate.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

62

The major weakness of payback period in evaluating projects is that it cannot specify the appropriate payback period in light of the wealth maximization goal.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

63

A project must be rejected if its payback period is less than the maximum acceptable payback period.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

64

Payback is considered an unsophisticated capital budgeting because it

A) gives explicit consideration to the timing of cash flows and therefore the time value of money.

B) gives explicit consideration to risk exposure due to the use of the cost of capital as a discount rate.

C) none of the above.

A) gives explicit consideration to the timing of cash flows and therefore the time value of money.

B) gives explicit consideration to risk exposure due to the use of the cost of capital as a discount rate.

C) none of the above.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

65

If a project's payback period is less than the maximum acceptable payback period, we would accept it.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

66

A firm is evaluating a proposal which has an initial investment of $35,000 and has cash flows of $10,000 in year 1, $20,000 in year 2, and $10,000 in year 3. The payback period of the project is

A) 1 year.

B) 2 years.

C) between 1 and 2 years.

D) between 2 and 3 years.

A) 1 year.

B) 2 years.

C) between 1 and 2 years.

D) between 2 and 3 years.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

67

Some firms use the payback period as a decision criterion or as a supplement to sophisticated decision techniques, because

A) it explicitly considers the time value of money.

B) it can be viewed as a measure of risk exposure because of its focus on liquidity.

C) the determination of the required payback period for a project is an objectively determined criteria.

D) none of the above.

A) it explicitly considers the time value of money.

B) it can be viewed as a measure of risk exposure because of its focus on liquidity.

C) the determination of the required payback period for a project is an objectively determined criteria.

D) none of the above.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following capital budgeting techniques ignores the time value of money?

A) Payback

B) Net present value

C) Internal rate of return

D) Two of the above

A) Payback

B) Net present value

C) Internal rate of return

D) Two of the above

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

69

If a project's payback period is greater than the maximum acceptable payback period, we would accept it.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

70

The payback period of a project that costs $1,000 initially and promises after-tax cash inflows of $300 each year for the next three years is 0.333 years.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

71

The ________ measures the amount of time it takes the firm to recover its initial investment.

A) average rate of return

B) internal rate of return

C) net present value

D) payback period

A) average rate of return

B) internal rate of return

C) net present value

D) payback period

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

72

If a project's payback period is less than the maximum acceptable payback period, we would reject it.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

73

If a project's payback period is greater than the maximum acceptable payback period, we would reject it.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

74

Since the payback period can be viewed as a measure of risk exposure, many firms use it as a supplement to sophisticated decision techniques.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

75

The payback period of a project that costs $1,000 initially and promises after-tax cash inflows of $3,000 each year for the next three years is 0.333 years.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

76

Unsophisticated capital budgeting techniques do not

A) examine the size of the initial outlay.

B) use net profits as a measure of return.

C) explicitly consider the time value of money.

D) take into account an unconventional cash flow pattern.

A) examine the size of the initial outlay.

B) use net profits as a measure of return.

C) explicitly consider the time value of money.

D) take into account an unconventional cash flow pattern.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

77

The payback period of a project that costs $1,000 initially and promises after-tax cash inflows of $300 for the next three years is 3.33 years.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

78

The payback period of a project that costs $1,000 initially and promises after-tax cash inflows of $3,000 each year for the next three years is 3.33 years.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

79

Examples of sophisticated capital budgeting techniques include all of the following EXCEPT

A) internal rate of return.

B) payback period.

C) annualized net present value.

D) net present value.

A) internal rate of return.

B) payback period.

C) annualized net present value.

D) net present value.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck

80

All of the following are weaknesses of the payback period EXCEPT

A) a disregard for cash flows after the payback period.

B) only an implicit consideration of the timing of cash flows.

C) the difficulty of specifying the appropriate payback period.

D) it uses cash flows, not accounting profits.

A) a disregard for cash flows after the payback period.

B) only an implicit consideration of the timing of cash flows.

C) the difficulty of specifying the appropriate payback period.

D) it uses cash flows, not accounting profits.

Unlock Deck

Unlock for access to all 167 flashcards in this deck.

Unlock Deck

k this deck