Deck 9: Budgeting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/137

Play

Full screen (f)

Deck 9: Budgeting

1

Modesto Company produces and sells Product AlphaB.To guard against stockouts,the company requires that 20% of the next month's sales be on hand at the end of each month.Budgeted sales of Product AlphaB over the next four months are:

What would be the budgeted production for August?

A) 50,000 units.

B) 58,000 units.

C) 62,000 units.

D) 70,000 units.

What would be the budgeted production for August?

A) 50,000 units.

B) 58,000 units.

C) 62,000 units.

D) 70,000 units.

58,000 units.

2

Fairmont Inc.uses an accounting system that charges costs to the manager who has been delegated the authority to make decisions concerning the costs.For example,if the sales manager accepts a rush order that will result in higher than normal manufacturing costs,these additional costs are charged to the sales manager because the authority to accept or decline the rush order was given to the sales manager.What best describes this type of an accounting system?

A) Responsibility accounting.

B) Contribution accounting.

C) Absorption accounting.

D) Operational budgeting.

A) Responsibility accounting.

B) Contribution accounting.

C) Absorption accounting.

D) Operational budgeting.

A

3

The master budget process usually begins with which of the following?

A) Production budget.

B) Operating budget.

C) Sales budget.

D) Cash budget.

A) Production budget.

B) Operating budget.

C) Sales budget.

D) Cash budget.

C

4

What is a continuous (or perpetual)budget?

A) It is prepared for a range of activity so that the budget can be adjusted for changes in activity.

B) It is a plan that is updated monthly or quarterly, dropping one period and adding another.

C) It is a strategic plan that does not change.

D) It is used in companies that experience no change in sales.

A) It is prepared for a range of activity so that the budget can be adjusted for changes in activity.

B) It is a plan that is updated monthly or quarterly, dropping one period and adding another.

C) It is a strategic plan that does not change.

D) It is used in companies that experience no change in sales.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

5

Orion Corporation is preparing a cash budget for the six months beginning January 1.Shown below are the company's expected collection pattern and the budgeted sales for the period:

Expected collection pattern:

65% collected in the month of sale

20% collected in the month after sale

10% collected in the second month after sale

4% collected in the third month after sale

1% uncollectible

Budgeted Sales:

What would be the estimated total cash collections during April from sales and accounts receivables?

A) $155,900.

B) $167,000.

C) $171,666.

D) $173,400.

Expected collection pattern:

65% collected in the month of sale

20% collected in the month after sale

10% collected in the second month after sale

4% collected in the third month after sale

1% uncollectible

Budgeted Sales:

What would be the estimated total cash collections during April from sales and accounts receivables?

A) $155,900.

B) $167,000.

C) $171,666.

D) $173,400.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following best describes a method of budgeting in which the cost of each program must be justified every year?

A) Operational budgeting.

B) Zero-based budgeting.

C) Continuous budgeting.

D) Responsibility accounting.

A) Operational budgeting.

B) Zero-based budgeting.

C) Continuous budgeting.

D) Responsibility accounting.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following variances in a comprehensive performance report using the flexible budget concept is the most appropriate for measuring efficiency of operations?

A) Sales volume variance.

B) Contribution margin variance.

C) Flexible budget variance.

D) Total static budget variance.

A) Sales volume variance.

B) Contribution margin variance.

C) Flexible budget variance.

D) Total static budget variance.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

8

The PDQ Company makes collections on credit sales according to the following schedule:

25% in month of sale

70% in month following sale

4% in second month following sale

1% uncollectible

The following sales have been budgeted:

What would be the cash collections in June?

A) $110,000.

B) $111,500.

C) $113,400.

D) $115,500.

25% in month of sale

70% in month following sale

4% in second month following sale

1% uncollectible

The following sales have been budgeted:

What would be the cash collections in June?

A) $110,000.

B) $111,500.

C) $113,400.

D) $115,500.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

9

Parlee Company's sales are 30% in cash and 70% on credit.Sixty percent of the credit sales are collected in the month of sale,25% in the month following sale,and 12% in the second month following sale.The remainder is uncollectible.The following are budgeted sales data:

What would be the budgeted total cash receipts in April?

A) $27,230.

B) $36,230.

C) $38,900.

D) $47,900.

What would be the budgeted total cash receipts in April?

A) $27,230.

B) $36,230.

C) $38,900.

D) $47,900.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following best describes the direct materials purchase budget?

A) It is the beginning point in the budget process.

B) It must provide for the desired ending inventory as well as for production.

C) It is accompanied by a schedule of cash collections.

D) It is completed after the cash budget.

A) It is the beginning point in the budget process.

B) It must provide for the desired ending inventory as well as for production.

C) It is accompanied by a schedule of cash collections.

D) It is completed after the cash budget.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following best describes a typical participative budget?

A) It is NOT subject to review by higher levels of management since to do so would contradict the participative aspect of the budgeting processing.

B) It is NOT subject to review by higher levels of management except in specific cases where the input of higher management is required.

C) It is subject to review by higher levels of management in order to prevent the budgets from becoming too loose.

D) It is NOT critical to the success of a budgeting program.

A) It is NOT subject to review by higher levels of management since to do so would contradict the participative aspect of the budgeting processing.

B) It is NOT subject to review by higher levels of management except in specific cases where the input of higher management is required.

C) It is subject to review by higher levels of management in order to prevent the budgets from becoming too loose.

D) It is NOT critical to the success of a budgeting program.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

12

The cash budget must be prepared before you can complete which of the following?

A) Production budget.

B) Budgeted balance sheet.

C) Raw materials purchases budget.

D) Schedule of cash disbursements.

A) Production budget.

B) Budgeted balance sheet.

C) Raw materials purchases budget.

D) Schedule of cash disbursements.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

13

There are various budgets within the master budget.One of these budgets is the production budget.Which of the following best describes the production budget?

A) It details the required direct labour hours.

B) It details the required raw materials purchases.

C) It is calculated based on the sales budget and the desired ending inventory.

D) It summarizes the costs of producing units for the budget period.

A) It details the required direct labour hours.

B) It details the required raw materials purchases.

C) It is calculated based on the sales budget and the desired ending inventory.

D) It summarizes the costs of producing units for the budget period.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

14

What is the budget or schedule that provides necessary input data for the direct labour budget?

A) Raw materials purchases budget.

B) Production budget.

C) Schedule of cash collections.

D) Cash budget.

A) Raw materials purchases budget.

B) Production budget.

C) Schedule of cash collections.

D) Cash budget.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

15

Walsh Company expects sales of Product W to be 60,000 units in April,75,000 units in May,and 70,000 units in June.The company desires that the inventory on hand at the end of each month be equal to 40% of the next month's expected unit sales.Due to excessive production during March,there were 25,000 units of Product W in the ending inventory on March 31.Given this information,what should be Walsh Company's production of Product W for the month of April?

A) 60,000 units.

B) 65,000 units.

C) 66,000 units.

D) 75,000 units.

A) 60,000 units.

B) 65,000 units.

C) 66,000 units.

D) 75,000 units.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

16

Friden Company has budgeted sales and production over the next quarter as follows:

On April 1,the company has 20,000 units of product on hand.A minimum of 20% of the next month's sales needs (in units)must be on hand at the end of each month.July sales are expected to be 140,000 units.What would be the budgeted sales for June (in units)?

A) 128,000 units.

B) 160,000 units.

C) 184,000 units.

D) 188,000 units.

On April 1,the company has 20,000 units of product on hand.A minimum of 20% of the next month's sales needs (in units)must be on hand at the end of each month.July sales are expected to be 140,000 units.What would be the budgeted sales for June (in units)?

A) 128,000 units.

B) 160,000 units.

C) 184,000 units.

D) 188,000 units.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

17

Budgeted sales in Allen Company over the next four months are given below:

Twenty-five percent of the company's sales are for cash,and 75% are on account.Collections for sales on account follow a stable pattern as follows: 50% of a month's sales are collected in the month of sale,30% are collected in the month following sale,and 15% are collected in the second month following sale.The remainder is uncollectible.Given these data,what should be cash collections for December?

A) $133,500.

B) $120,000.

C) $138,000.

D) $153,000.

Twenty-five percent of the company's sales are for cash,and 75% are on account.Collections for sales on account follow a stable pattern as follows: 50% of a month's sales are collected in the month of sale,30% are collected in the month following sale,and 15% are collected in the second month following sale.The remainder is uncollectible.Given these data,what should be cash collections for December?

A) $133,500.

B) $120,000.

C) $138,000.

D) $153,000.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

18

Superior Industries' sales budget shows quarterly sales for the next year as follows:

Company policy is to have a finished goods inventory at the end of each quarter equal to 20% of the next quarter's sales.What should be the budgeted production for the second quarter?

A) 7,200 units.

B) 8,000 units.

C) 8,400 units.

D) 8,800 units.

Company policy is to have a finished goods inventory at the end of each quarter equal to 20% of the next quarter's sales.What should be the budgeted production for the second quarter?

A) 7,200 units.

B) 8,000 units.

C) 8,400 units.

D) 8,800 units.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is NOT a benefit of budgeting?

A) It uncovers potential bottlenecks before they occur.

B) It coordinates the activities of the entire organization by integrating the plans and objectives of the various parts.

C) It ensures that records comply with generally accepted accounting principles.

D) It provides benchmarks for evaluating subsequent performance.

A) It uncovers potential bottlenecks before they occur.

B) It coordinates the activities of the entire organization by integrating the plans and objectives of the various parts.

C) It ensures that records comply with generally accepted accounting principles.

D) It provides benchmarks for evaluating subsequent performance.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

20

Pardee Company plans to sell 12,000 units during the month of August.If the company has 2,500 units on hand at the start of the month,and plans to have 2,000 units on hand at the end of the month,how many units must be produced during the month?

A) 11,500 units.

B) 12,000 units.

C) 12,500 units.

D) 14,000 units.

A) 11,500 units.

B) 12,000 units.

C) 12,500 units.

D) 14,000 units.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

21

nformation on the actual sales and inventory purchases of the Law Company for the first quarter follow:

Collections from Law Company's customers are normally 60% in the month of sale, 30% in the month following sale, and 8% in the second month following sale. The balance is uncollectible. Law Company takes full advantage of the 3% discount allowed on purchases paid for by the end of the following month.

The company expects sales in April of $150,000 and inventory purchases of $100,000. Operating expenses for the month of April are expected to be $38,000, of which $15,000 is salaries and $8,000 is depreciation. The remaining operating expenses are variable with respect to the amount of sales in dollars. Those operating expenses requiring a cash outlay are paid for during the month incurred. Law Company's cash balance on March 1 was $43,000, and on April 1 was $35,000.

-What would be the expected cash disbursements during April for inventory purchases?

A) $87,300.

B) $90,000.

C) $97,000.

D) $100,000.

Collections from Law Company's customers are normally 60% in the month of sale, 30% in the month following sale, and 8% in the second month following sale. The balance is uncollectible. Law Company takes full advantage of the 3% discount allowed on purchases paid for by the end of the following month.

The company expects sales in April of $150,000 and inventory purchases of $100,000. Operating expenses for the month of April are expected to be $38,000, of which $15,000 is salaries and $8,000 is depreciation. The remaining operating expenses are variable with respect to the amount of sales in dollars. Those operating expenses requiring a cash outlay are paid for during the month incurred. Law Company's cash balance on March 1 was $43,000, and on April 1 was $35,000.

-What would be the expected cash disbursements during April for inventory purchases?

A) $87,300.

B) $90,000.

C) $97,000.

D) $100,000.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

22

Justin's Plant Store, a retailer, started operations on January 1. On that date, the only assets were $16,000 in cash and $3,500 in merchandise inventory. For purposes of budget preparation, assume that the company's cost of goods sold is 60% of sales. Expected sales for the first four months appear below: The company desires that the merchandise inventory on hand at the end of each month be equal to 50% of the next month's merchandise sales (stated at cost). All purchases of merchandise inventory must be paid in the month of purchase. Sixty percent of all sales should be for cash; the balance will be on credit. Seventy-five percent of the credit sales should be collected in the month following the month of sale, with the balance collected in the following month. Variable operating expenses should be 10% of sales, and fixed expenses (all depreciation) should be $3,000 per month. Cash payments for the variable operating expenses are made during the month the expenses are incurred.

-In a budgeted balance sheet,what would be the merchandise inventory on February 28?

A) $3,200.

B) $4,800.

C) $7,500.

D) $9,600.

-In a budgeted balance sheet,what would be the merchandise inventory on February 28?

A) $3,200.

B) $4,800.

C) $7,500.

D) $9,600.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

23

Justin's Plant Store, a retailer, started operations on January 1. On that date, the only assets were $16,000 in cash and $3,500 in merchandise inventory. For purposes of budget preparation, assume that the company's cost of goods sold is 60% of sales. Expected sales for the first four months appear below: The company desires that the merchandise inventory on hand at the end of each month be equal to 50% of the next month's merchandise sales (stated at cost). All purchases of merchandise inventory must be paid in the month of purchase. Sixty percent of all sales should be for cash; the balance will be on credit. Seventy-five percent of the credit sales should be collected in the month following the month of sale, with the balance collected in the following month. Variable operating expenses should be 10% of sales, and fixed expenses (all depreciation) should be $3,000 per month. Cash payments for the variable operating expenses are made during the month the expenses are incurred.

-In a budget of cash disbursements for March,what would be the total cash disbursements?

A) $11,200.

B) $13,900.

C) $16,900.

D) $22,300.

-In a budget of cash disbursements for March,what would be the total cash disbursements?

A) $11,200.

B) $13,900.

C) $16,900.

D) $22,300.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

24

ABC Company has a cash balance of $9,000 on April 1.The company must maintain a minimum cash balance of $6,000.During April,expected cash receipts are $45,000.Expected cash disbursements during the month total $52,000.What amount will the company need to borrow during April?

A) $2,000.

B) $4,000.

C) $6,000.

D) $8,000.

A) $2,000.

B) $4,000.

C) $6,000.

D) $8,000.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

25

The Stacy Company makes and sells a single product: Product R.Budgeted sales for April are $300,000.Gross margin is budgeted at 30% of sales dollars.If the net income for April is budgeted at $40,000,what are the budgeted selling and administrative expenses?

A) $50,000.

B) $78,000.

C) $102,000.

D) $133,333.

A) $50,000.

B) $78,000.

C) $102,000.

D) $133,333.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

26

Marple Company's budgeted production in units and budgeted raw materials purchases over the next three months are given below:

Two kilograms of raw materials are required to produce one unit of product.The company wants raw materials on hand at the end of each month equal to 30% of the following month's production needs.The company is expected to have 36,000 kilograms of raw materials on hand on January 1.What should be the budgeted production for February?

A) 75,000 units.

B) 82,500 units.

C) 105,000 units.

D) 150,000 units.

Two kilograms of raw materials are required to produce one unit of product.The company wants raw materials on hand at the end of each month equal to 30% of the following month's production needs.The company is expected to have 36,000 kilograms of raw materials on hand on January 1.What should be the budgeted production for February?

A) 75,000 units.

B) 82,500 units.

C) 105,000 units.

D) 150,000 units.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

27

Justin's Plant Store, a retailer, started operations on January 1. On that date, the only assets were $16,000 in cash and $3,500 in merchandise inventory. For purposes of budget preparation, assume that the company's cost of goods sold is 60% of sales. Expected sales for the first four months appear below: The company desires that the merchandise inventory on hand at the end of each month be equal to 50% of the next month's merchandise sales (stated at cost). All purchases of merchandise inventory must be paid in the month of purchase. Sixty percent of all sales should be for cash; the balance will be on credit. Seventy-five percent of the credit sales should be collected in the month following the month of sale, with the balance collected in the following month. Variable operating expenses should be 10% of sales, and fixed expenses (all depreciation) should be $3,000 per month. Cash payments for the variable operating expenses are made during the month the expenses are incurred.

-In a budgeted income statement for the month of February,what would be the net income?

A) $0.

B) $1,800.

C) $4,200.

D) $9,000.

-In a budgeted income statement for the month of February,what would be the net income?

A) $0.

B) $1,800.

C) $4,200.

D) $9,000.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

28

nformation on the actual sales and inventory purchases of the Law Company for the first quarter follow:

Collections from Law Company's customers are normally 60% in the month of sale, 30% in the month following sale, and 8% in the second month following sale. The balance is uncollectible. Law Company takes full advantage of the 3% discount allowed on purchases paid for by the end of the following month.

The company expects sales in April of $150,000 and inventory purchases of $100,000. Operating expenses for the month of April are expected to be $38,000, of which $15,000 is salaries and $8,000 is depreciation. The remaining operating expenses are variable with respect to the amount of sales in dollars. Those operating expenses requiring a cash outlay are paid for during the month incurred. Law Company's cash balance on March 1 was $43,000, and on April 1 was $35,000.

-What would be the expected cash disbursements during April for operating expenses?

A) $15,000.

B) $23,000.

C) $30,000.

D) $38,000.

Collections from Law Company's customers are normally 60% in the month of sale, 30% in the month following sale, and 8% in the second month following sale. The balance is uncollectible. Law Company takes full advantage of the 3% discount allowed on purchases paid for by the end of the following month.

The company expects sales in April of $150,000 and inventory purchases of $100,000. Operating expenses for the month of April are expected to be $38,000, of which $15,000 is salaries and $8,000 is depreciation. The remaining operating expenses are variable with respect to the amount of sales in dollars. Those operating expenses requiring a cash outlay are paid for during the month incurred. Law Company's cash balance on March 1 was $43,000, and on April 1 was $35,000.

-What would be the expected cash disbursements during April for operating expenses?

A) $15,000.

B) $23,000.

C) $30,000.

D) $38,000.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

29

The Tobler Company has budgeted production for next year as follows:

Four kilograms of raw materials are required for each unit produced.At the start of the year,raw materials on hand total 4,000 kilograms.The raw materials inventory at the end of each quarter should equal 10% of the next quarter's production needs.What would be the budgeted purchases of raw materials in the third quarter?

A) 50,400 kilograms.

B) 56,800 kilograms.

C) 62,400 kilograms.

D) 63,200 kilograms.

Four kilograms of raw materials are required for each unit produced.At the start of the year,raw materials on hand total 4,000 kilograms.The raw materials inventory at the end of each quarter should equal 10% of the next quarter's production needs.What would be the budgeted purchases of raw materials in the third quarter?

A) 50,400 kilograms.

B) 56,800 kilograms.

C) 62,400 kilograms.

D) 63,200 kilograms.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

30

KAB Inc., a small retail store, had the following results for May. The budgets for June and July are also given.

Sales are collected 80% in the month of the sale and the balance in the month following the sale. (There are no bad debts.) The goods that are sold are purchased in the month prior to sale. Suppliers of the goods are paid in the month following the purchase. The operating expenses are paid in the month of the sale.

-What should be the cash disbursements during the month of June for goods purchased for resale and for operating expenses?

A) $40,000.

B) $41,000.

C) $42,500.

D) $43,500.

Sales are collected 80% in the month of the sale and the balance in the month following the sale. (There are no bad debts.) The goods that are sold are purchased in the month prior to sale. Suppliers of the goods are paid in the month following the purchase. The operating expenses are paid in the month of the sale.

-What should be the cash disbursements during the month of June for goods purchased for resale and for operating expenses?

A) $40,000.

B) $41,000.

C) $42,500.

D) $43,500.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

31

The LaPann Company has obtained the following sales forecast data:

The regular pattern of collection of credit sales is 20% in the month of sale, 70% in the month following the month of sale, and the remainder in the second month following the month of sale. There are no bad debts.

-What are the budgeted cash receipts for October?

A) $188,000.

B) $226,000.

C) $248,000.

D) $278,000.

The regular pattern of collection of credit sales is 20% in the month of sale, 70% in the month following the month of sale, and the remainder in the second month following the month of sale. There are no bad debts.

-What are the budgeted cash receipts for October?

A) $188,000.

B) $226,000.

C) $248,000.

D) $278,000.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

32

Justin's Plant Store, a retailer, started operations on January 1. On that date, the only assets were $16,000 in cash and $3,500 in merchandise inventory. For purposes of budget preparation, assume that the company's cost of goods sold is 60% of sales. Expected sales for the first four months appear below: The company desires that the merchandise inventory on hand at the end of each month be equal to 50% of the next month's merchandise sales (stated at cost). All purchases of merchandise inventory must be paid in the month of purchase. Sixty percent of all sales should be for cash; the balance will be on credit. Seventy-five percent of the credit sales should be collected in the month following the month of sale, with the balance collected in the following month. Variable operating expenses should be 10% of sales, and fixed expenses (all depreciation) should be $3,000 per month. Cash payments for the variable operating expenses are made during the month the expenses are incurred.

-What would be the accounts receivable balance that would appear in the March 31 budgeted balance sheet?

A) $8,800.

B) $12,400.

C) $15,000.

D) $16,000.

-What would be the accounts receivable balance that would appear in the March 31 budgeted balance sheet?

A) $8,800.

B) $12,400.

C) $15,000.

D) $16,000.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

33

Avril Company makes collections on sales according to the following schedule:

30% in the month of sale

60% in the month following sale

8% in the second month following sale

The following sales are expected:

What should be the budgeted cash collections in March?

A) $105,000.

B) $110,000.

C) $110,800.

D) $113,000.

30% in the month of sale

60% in the month following sale

8% in the second month following sale

The following sales are expected:

What should be the budgeted cash collections in March?

A) $105,000.

B) $110,000.

C) $110,800.

D) $113,000.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

34

KAB Inc., a small retail store, had the following results for May. The budgets for June and July are also given.

Sales are collected 80% in the month of the sale and the balance in the month following the sale. (There are no bad debts.) The goods that are sold are purchased in the month prior to sale. Suppliers of the goods are paid in the month following the purchase. The operating expenses are paid in the month of the sale.

-What should be the amount of cash collected during the month of June?

A) $32,000.

B) $40,000.

C) $40,400.

D) $41,000.

Sales are collected 80% in the month of the sale and the balance in the month following the sale. (There are no bad debts.) The goods that are sold are purchased in the month prior to sale. Suppliers of the goods are paid in the month following the purchase. The operating expenses are paid in the month of the sale.

-What should be the amount of cash collected during the month of June?

A) $32,000.

B) $40,000.

C) $40,400.

D) $41,000.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

35

nformation on the actual sales and inventory purchases of the Law Company for the first quarter follow:

Collections from Law Company's customers are normally 60% in the month of sale, 30% in the month following sale, and 8% in the second month following sale. The balance is uncollectible. Law Company takes full advantage of the 3% discount allowed on purchases paid for by the end of the following month.

The company expects sales in April of $150,000 and inventory purchases of $100,000. Operating expenses for the month of April are expected to be $38,000, of which $15,000 is salaries and $8,000 is depreciation. The remaining operating expenses are variable with respect to the amount of sales in dollars. Those operating expenses requiring a cash outlay are paid for during the month incurred. Law Company's cash balance on March 1 was $43,000, and on April 1 was $35,000.

-What would be the expected cash balance on April 30?

A) $19,700.

B) $28,700.

C) $54,700.

D) $62,700.

Collections from Law Company's customers are normally 60% in the month of sale, 30% in the month following sale, and 8% in the second month following sale. The balance is uncollectible. Law Company takes full advantage of the 3% discount allowed on purchases paid for by the end of the following month.

The company expects sales in April of $150,000 and inventory purchases of $100,000. Operating expenses for the month of April are expected to be $38,000, of which $15,000 is salaries and $8,000 is depreciation. The remaining operating expenses are variable with respect to the amount of sales in dollars. Those operating expenses requiring a cash outlay are paid for during the month incurred. Law Company's cash balance on March 1 was $43,000, and on April 1 was $35,000.

-What would be the expected cash balance on April 30?

A) $19,700.

B) $28,700.

C) $54,700.

D) $62,700.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

36

The Waverly Company has budgeted sales for next year as follows:

The ending inventory of finished goods for each quarter should equal 25% of the next quarter's budgeted sales in units.The finished goods inventory at the start of the year is 3,000 units.What should be the scheduled production for the third quarter?

A) 13,500 units.

B) 17,500 units.

C) 18,500 units.

D) 22,000 units.

The ending inventory of finished goods for each quarter should equal 25% of the next quarter's budgeted sales in units.The finished goods inventory at the start of the year is 3,000 units.What should be the scheduled production for the third quarter?

A) 13,500 units.

B) 17,500 units.

C) 18,500 units.

D) 22,000 units.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

37

Justin's Plant Store, a retailer, started operations on January 1. On that date, the only assets were $16,000 in cash and $3,500 in merchandise inventory. For purposes of budget preparation, assume that the company's cost of goods sold is 60% of sales. Expected sales for the first four months appear below: The company desires that the merchandise inventory on hand at the end of each month be equal to 50% of the next month's merchandise sales (stated at cost). All purchases of merchandise inventory must be paid in the month of purchase. Sixty percent of all sales should be for cash; the balance will be on credit. Seventy-five percent of the credit sales should be collected in the month following the month of sale, with the balance collected in the following month. Variable operating expenses should be 10% of sales, and fixed expenses (all depreciation) should be $3,000 per month. Cash payments for the variable operating expenses are made during the month the expenses are incurred.

-In a budget of cash receipts for March,what would be the total cash receipts?

A) $8,200.

B) $16,000.

C) $17,800.

D) $20,200.

-In a budget of cash receipts for March,what would be the total cash receipts?

A) $8,200.

B) $16,000.

C) $17,800.

D) $20,200.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

38

nformation on the actual sales and inventory purchases of the Law Company for the first quarter follow:

Collections from Law Company's customers are normally 60% in the month of sale, 30% in the month following sale, and 8% in the second month following sale. The balance is uncollectible. Law Company takes full advantage of the 3% discount allowed on purchases paid for by the end of the following month.

The company expects sales in April of $150,000 and inventory purchases of $100,000. Operating expenses for the month of April are expected to be $38,000, of which $15,000 is salaries and $8,000 is depreciation. The remaining operating expenses are variable with respect to the amount of sales in dollars. Those operating expenses requiring a cash outlay are paid for during the month incurred. Law Company's cash balance on March 1 was $43,000, and on April 1 was $35,000.

-What would be the expected cash collections from customers during April?

A) $117,600.

B) $137,000.

C) $139,000.

D) $150,000.

Collections from Law Company's customers are normally 60% in the month of sale, 30% in the month following sale, and 8% in the second month following sale. The balance is uncollectible. Law Company takes full advantage of the 3% discount allowed on purchases paid for by the end of the following month.

The company expects sales in April of $150,000 and inventory purchases of $100,000. Operating expenses for the month of April are expected to be $38,000, of which $15,000 is salaries and $8,000 is depreciation. The remaining operating expenses are variable with respect to the amount of sales in dollars. Those operating expenses requiring a cash outlay are paid for during the month incurred. Law Company's cash balance on March 1 was $43,000, and on April 1 was $35,000.

-What would be the expected cash collections from customers during April?

A) $117,600.

B) $137,000.

C) $139,000.

D) $150,000.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

39

The LaPann Company has obtained the following sales forecast data:

The regular pattern of collection of credit sales is 20% in the month of sale, 70% in the month following the month of sale, and the remainder in the second month following the month of sale. There are no bad debts.

-What is the budgeted accounts receivable balance on September 30?

A) $126,000.

B) $148,000.

C) $166,000.

D) $190,000.

The regular pattern of collection of credit sales is 20% in the month of sale, 70% in the month following the month of sale, and the remainder in the second month following the month of sale. There are no bad debts.

-What is the budgeted accounts receivable balance on September 30?

A) $126,000.

B) $148,000.

C) $166,000.

D) $190,000.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

40

The Willsey Merchandise Company has budgeted $40,000 in sales for the month of December.The company's cost of goods sold is 30% of sales.If the company has budgeted to purchase $18,000 in merchandise during December,what is the budgeted change in inventory levels over the month of December?

A) $6,000 increase.

B) $10,000 decrease.

C) $15,000 increase.

D) $22,000 decrease.

A) $6,000 increase.

B) $10,000 decrease.

C) $15,000 increase.

D) $22,000 decrease.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

41

Roberts Enterprises has budgeted sales in units for the next five months as follows: Past experience has shown that the ending inventory for each month must be equal to 10% of the next month's sales in units. The inventory on May 31 contained 410 units. The company needs to prepare a production budget for the second quarter of the year.

-What is the opening inventory in units for September?

A) 370 units.

B) 530 units.

C) 670 units.

D) 6,700 units.

-What is the opening inventory in units for September?

A) 370 units.

B) 530 units.

C) 670 units.

D) 6,700 units.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

42

The International Company makes and sells only one product, Product SW. The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

-If the company has budgeted to sell 20,000 units of Product SW in October,what will be the total budgeted variable selling and administrative expenses for October?

A) $40,000.

B) $45,000.

C) $56,250.

D) $78,000.

-If the company has budgeted to sell 20,000 units of Product SW in October,what will be the total budgeted variable selling and administrative expenses for October?

A) $40,000.

B) $45,000.

C) $56,250.

D) $78,000.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

43

Pardise Company plans the following beginning and ending inventory levels (in units) for July:

Two units of raw material are needed to produce each unit of finished product.

-If 500,000 finished units were to be manufactured during July,what would be the units of raw material needed to be purchased?

A) 900,000 units.

B) 1,000,000 units.

C) 1,010,000 units.

D) 1,020,000 units.

Two units of raw material are needed to produce each unit of finished product.

-If 500,000 finished units were to be manufactured during July,what would be the units of raw material needed to be purchased?

A) 900,000 units.

B) 1,000,000 units.

C) 1,010,000 units.

D) 1,020,000 units.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

44

Roberts Enterprises has budgeted sales in units for the next five months as follows: Past experience has shown that the ending inventory for each month must be equal to 10% of the next month's sales in units. The inventory on May 31 contained 410 units. The company needs to prepare a production budget for the second quarter of the year.

-What is the total number of units to be produced in July?

A) 6,920 units.

B) 7,100 units.

C) 7,280 units.

D) 7,630 units.

-What is the total number of units to be produced in July?

A) 6,920 units.

B) 7,100 units.

C) 7,280 units.

D) 7,630 units.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

45

Noel Enterprises has budgeted sales in units for the next five months as follows:

Past experience has shown that the ending inventory for each month must be equal to 10% of the next month's sales in units. The inventory on December 31 contained 400 units. The company needs to prepare a production budget for the second quarter of the year.

-What is the desired ending inventory for March?

A) 380 units.

B) 460 units.

C) 540 units.

D) 720 units.

Past experience has shown that the ending inventory for each month must be equal to 10% of the next month's sales in units. The inventory on December 31 contained 400 units. The company needs to prepare a production budget for the second quarter of the year.

-What is the desired ending inventory for March?

A) 380 units.

B) 460 units.

C) 540 units.

D) 720 units.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

46

Noel Enterprises has budgeted sales in units for the next five months as follows:

Past experience has shown that the ending inventory for each month must be equal to 10% of the next month's sales in units. The inventory on December 31 contained 400 units. The company needs to prepare a production budget for the second quarter of the year.

-What is the total number of units to be produced in February?

A) 5,220 units.

B) 5,400 units.

C) 5,580 units.

D) 6,120 units.

Past experience has shown that the ending inventory for each month must be equal to 10% of the next month's sales in units. The inventory on December 31 contained 400 units. The company needs to prepare a production budget for the second quarter of the year.

-What is the total number of units to be produced in February?

A) 5,220 units.

B) 5,400 units.

C) 5,580 units.

D) 6,120 units.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

47

The LFM Company makes and sells a single product: Product T. Each unit of Product T requires 1.3 hours of labour at a labour rate of $9.10 per hour. LFM Company needs to prepare a Direct Labour Budget for the second quarter of next year.

-What would be the budgeted direct labour cost per unit of Product T?

A) $7.00.

B) $9.10.

C) $10.40.

D) $11.83.

-What would be the budgeted direct labour cost per unit of Product T?

A) $7.00.

B) $9.10.

C) $10.40.

D) $11.83.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

48

Noel Enterprises has budgeted sales in units for the next five months as follows:

Past experience has shown that the ending inventory for each month must be equal to 10% of the next month's sales in units. The inventory on December 31 contained 400 units. The company needs to prepare a production budget for the second quarter of the year.

-What is the opening inventory in units for April?

A) 380 units.

B) 460 units.

C) 720 units.

D) 680 units.

Past experience has shown that the ending inventory for each month must be equal to 10% of the next month's sales in units. The inventory on December 31 contained 400 units. The company needs to prepare a production budget for the second quarter of the year.

-What is the opening inventory in units for April?

A) 380 units.

B) 460 units.

C) 720 units.

D) 680 units.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

49

Barley Enterprises has budgeted unit sales for the next four months as follows:

The ending inventory for each month should be equal to 15% of the next month's sales in units. The inventory on September 30 was below this level and contained only 600 units.

-What are the total units to be produced in October?

A) 4,530 units.

B) 5,070 units.

C) 5,670 units.

D) 5,890 units.

The ending inventory for each month should be equal to 15% of the next month's sales in units. The inventory on September 30 was below this level and contained only 600 units.

-What are the total units to be produced in October?

A) 4,530 units.

B) 5,070 units.

C) 5,670 units.

D) 5,890 units.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

50

The Culver Company is preparing its Manufacturing Overhead Budget for the third quarter of the year. Budgeted variable factory overhead is $3.00 per unit produced; budgeted fixed factory overhead is $75,000 per month, with $16,000 of this amount being factory depreciation.

-If the budgeted production for August is 5,000 units,what is the total budgeted factory overhead per unit?

A) $15.

B) $18.

C) $20.

D) $22.

-If the budgeted production for August is 5,000 units,what is the total budgeted factory overhead per unit?

A) $15.

B) $18.

C) $20.

D) $22.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

51

The LaGrange Company had the following budgeted sales for the first half of the current year: The company is in the process of preparing a cash budget and must determine the expected cash collections by month. To this end, the following information has been assembled:

Collections on sales:

60% in month of sale

30% in month following sale

10% in second month following sale

The accounts receivable balance on January 1 of the current year was $70,000, of which $50,000 represents uncollected December sales and $20,000 represents uncollected November sales.

-What is the budgeted accounts receivable balance on June 1 of the current year?

A) $56,000.

B) $64,000.

C) $76,000.

D) $132,000.

Collections on sales:

60% in month of sale

30% in month following sale

10% in second month following sale

The accounts receivable balance on January 1 of the current year was $70,000, of which $50,000 represents uncollected December sales and $20,000 represents uncollected November sales.

-What is the budgeted accounts receivable balance on June 1 of the current year?

A) $56,000.

B) $64,000.

C) $76,000.

D) $132,000.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

52

The LaGrange Company had the following budgeted sales for the first half of the current year: The company is in the process of preparing a cash budget and must determine the expected cash collections by month. To this end, the following information has been assembled:

Collections on sales:

60% in month of sale

30% in month following sale

10% in second month following sale

The accounts receivable balance on January 1 of the current year was $70,000, of which $50,000 represents uncollected December sales and $20,000 represents uncollected November sales.

-What would be the total cash collected by LaGrange Company during January?

A) $261,500.

B) $331,500.

C) $344,000.

D) $274,000.

Collections on sales:

60% in month of sale

30% in month following sale

10% in second month following sale

The accounts receivable balance on January 1 of the current year was $70,000, of which $50,000 represents uncollected December sales and $20,000 represents uncollected November sales.

-What would be the total cash collected by LaGrange Company during January?

A) $261,500.

B) $331,500.

C) $344,000.

D) $274,000.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

53

Barley Enterprises has budgeted unit sales for the next four months as follows:

The ending inventory for each month should be equal to 15% of the next month's sales in units. The inventory on September 30 was below this level and contained only 600 units.

-What is the desired ending inventory for December?

A) 690 units.

B) 780 units.

C) 870 units.

D) 960 units.

The ending inventory for each month should be equal to 15% of the next month's sales in units. The inventory on September 30 was below this level and contained only 600 units.

-What is the desired ending inventory for December?

A) 690 units.

B) 780 units.

C) 870 units.

D) 960 units.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

54

Roberts Enterprises has budgeted sales in units for the next five months as follows: Past experience has shown that the ending inventory for each month must be equal to 10% of the next month's sales in units. The inventory on May 31 contained 410 units. The company needs to prepare a production budget for the second quarter of the year.

-What is the desired ending inventory for August?

A) 370 units.

B) 530 units.

C) 670 units.

D) 710 units.

-What is the desired ending inventory for August?

A) 370 units.

B) 530 units.

C) 670 units.

D) 710 units.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

55

The International Company makes and sells only one product, Product SW. The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

-If the budgeted cash disbursements for selling and administrative expenses for November total $123,250,then how much was the total selling and administrative budget for November?

A) $123,250.

B) $134,250.

C) $168,250.

D) $187,250.

-If the budgeted cash disbursements for selling and administrative expenses for November total $123,250,then how much was the total selling and administrative budget for November?

A) $123,250.

B) $134,250.

C) $168,250.

D) $187,250.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

56

The International Company makes and sells only one product, Product SW. The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

-If the company has budgeted to sell 24,000 units of Product SW in September,what would be the total budgeted fixed selling and administrative expenses for September?

A) $48,000.

B) $54,000.

C) $67,000.

D) $78,000.

-If the company has budgeted to sell 24,000 units of Product SW in September,what would be the total budgeted fixed selling and administrative expenses for September?

A) $48,000.

B) $54,000.

C) $67,000.

D) $78,000.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

57

The LFM Company makes and sells a single product: Product T. Each unit of Product T requires 1.3 hours of labour at a labour rate of $9.10 per hour. LFM Company needs to prepare a Direct Labour Budget for the second quarter of next year.

-The company has budgeted to produce 25,000 units of Product T in June.The finished goods inventories on June 1 and June 30 were budgeted at 500 and 700 units,respectively.What would be the budgeted direct labour costs incurred in June?

A) $227,500.

B) $293,384.

C) $295,750.

D) $304,031.

-The company has budgeted to produce 25,000 units of Product T in June.The finished goods inventories on June 1 and June 30 were budgeted at 500 and 700 units,respectively.What would be the budgeted direct labour costs incurred in June?

A) $227,500.

B) $293,384.

C) $295,750.

D) $304,031.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

58

The International Company makes and sells only one product, Product SW. The company is in the process of preparing its Selling and Administrative Expense Budget for the last half of the year. The following budget data are available:

-If the company has budgeted to sell 25,000 units of Product SW in July,what will be the total budgeted selling and administrative expenses for July?

A) $56,250.

B) $78,000.

C) $123,250.

D) $134,250.

-If the company has budgeted to sell 25,000 units of Product SW in July,what will be the total budgeted selling and administrative expenses for July?

A) $56,250.

B) $78,000.

C) $123,250.

D) $134,250.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

59

The Culver Company is preparing its Manufacturing Overhead Budget for the third quarter of the year. Budgeted variable factory overhead is $3.00 per unit produced; budgeted fixed factory overhead is $75,000 per month, with $16,000 of this amount being factory depreciation.

-If the budgeted production for July is 6,000 units,what is the total budgeted factory overhead for July?

A) $18,000.

B) $75,000.

C) $93,000.

D) $109,000.

-If the budgeted production for July is 6,000 units,what is the total budgeted factory overhead for July?

A) $18,000.

B) $75,000.

C) $93,000.

D) $109,000.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

60

Pardise Company plans the following beginning and ending inventory levels (in units) for July:

Two units of raw material are needed to produce each unit of finished product.

-If Pardise Company plans to sell 480,000 units during July,what would be the number of units it would have to manufacture during July?

A) 440,000 units.

B) 450,000 units.

C) 480,000 units.

D) 510,000 units.

Two units of raw material are needed to produce each unit of finished product.

-If Pardise Company plans to sell 480,000 units during July,what would be the number of units it would have to manufacture during July?

A) 440,000 units.

B) 450,000 units.

C) 480,000 units.

D) 510,000 units.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

61

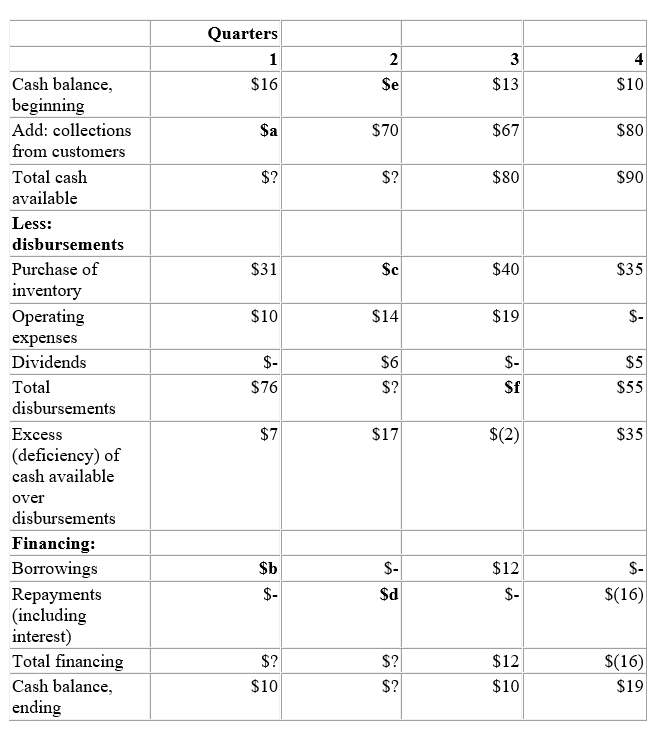

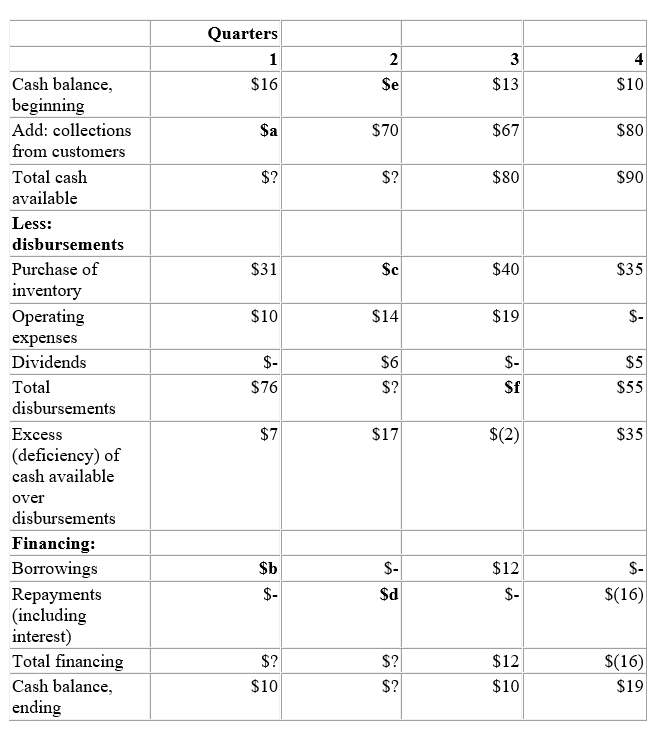

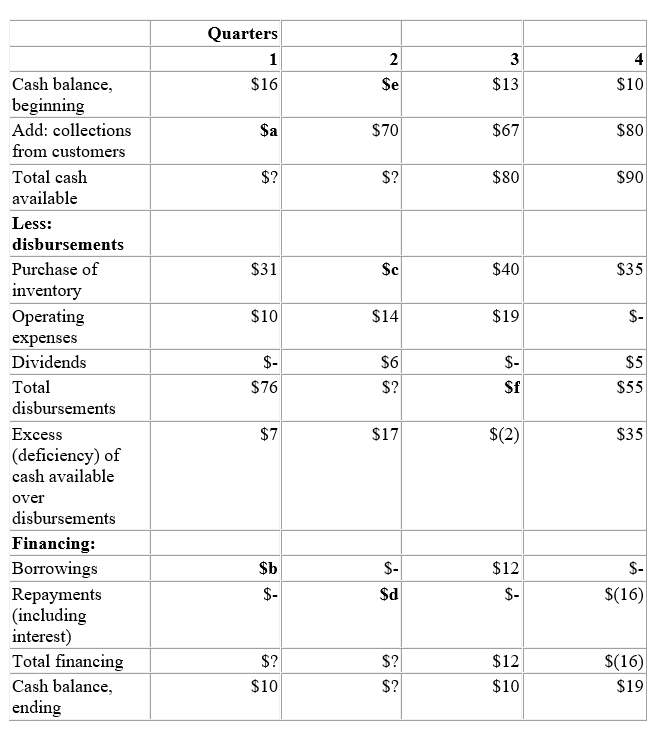

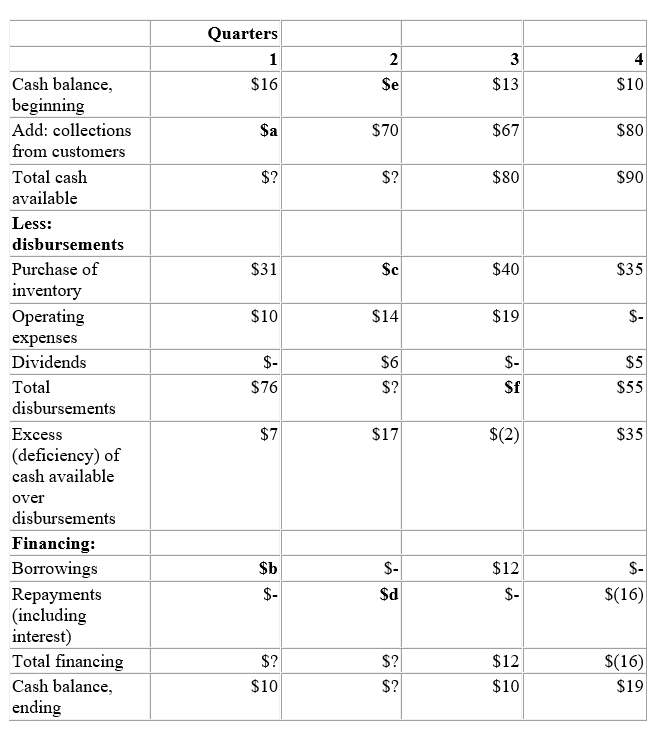

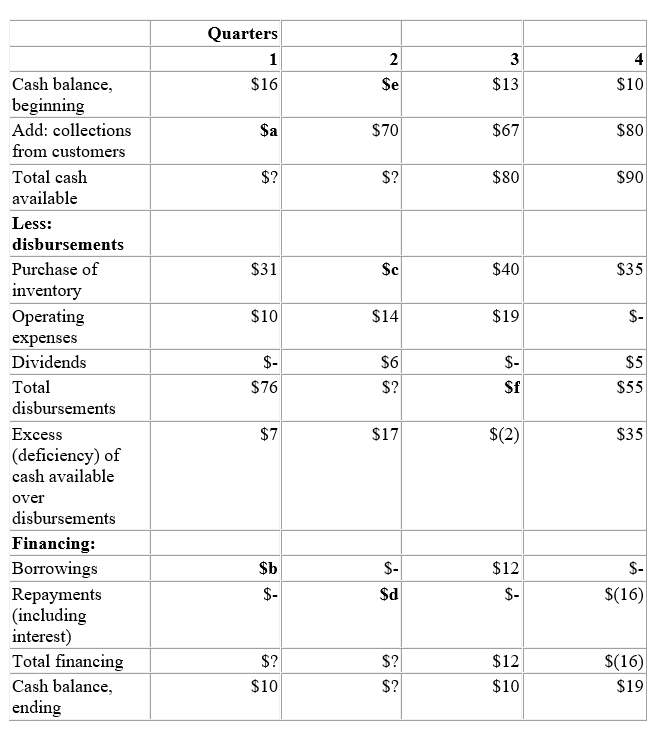

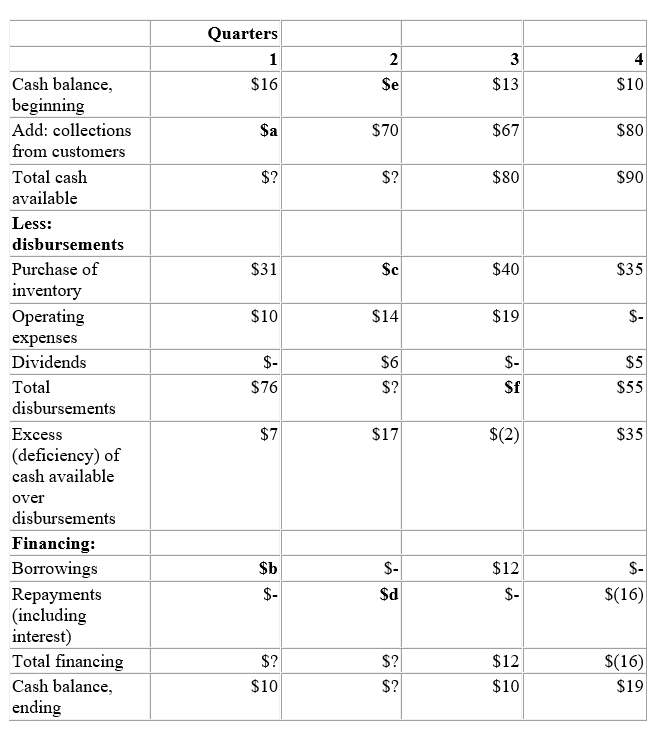

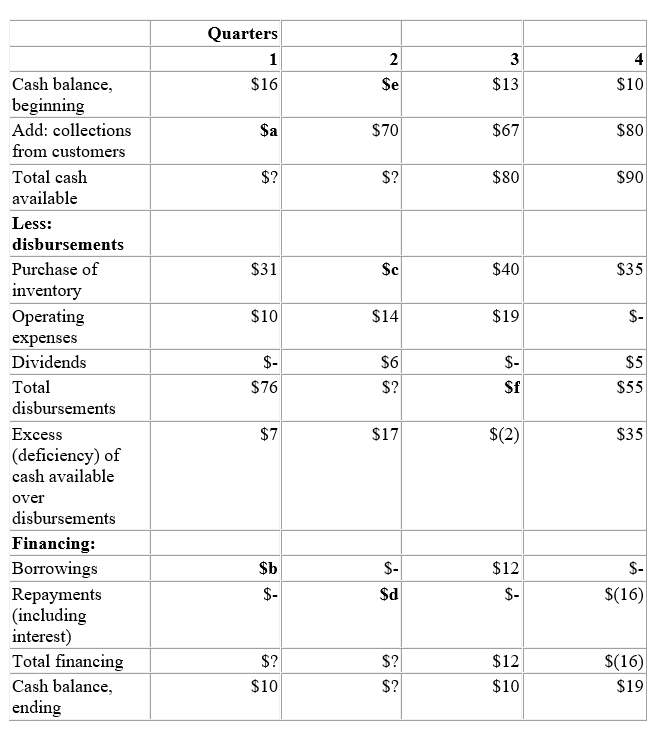

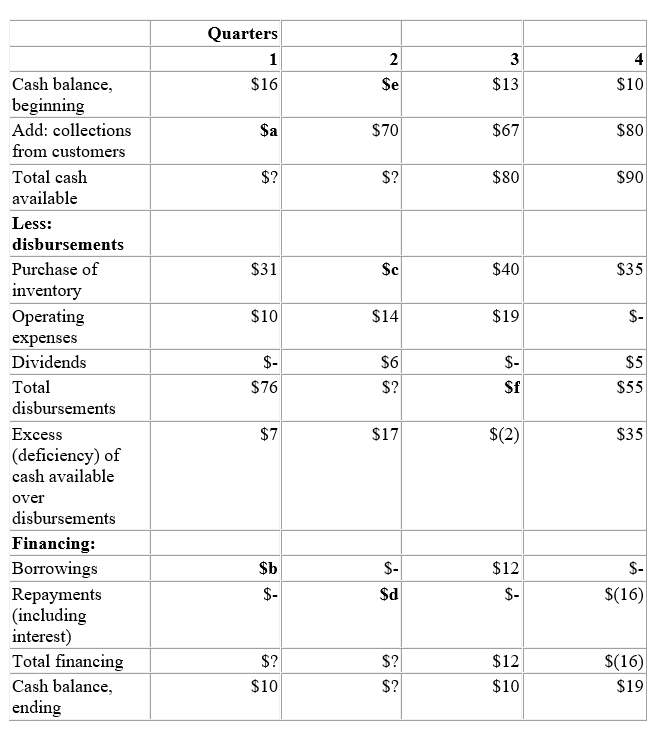

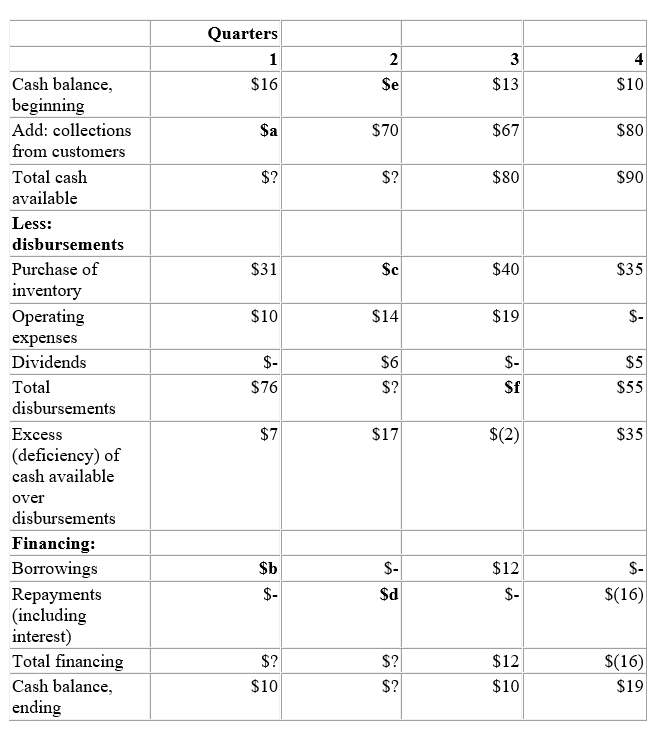

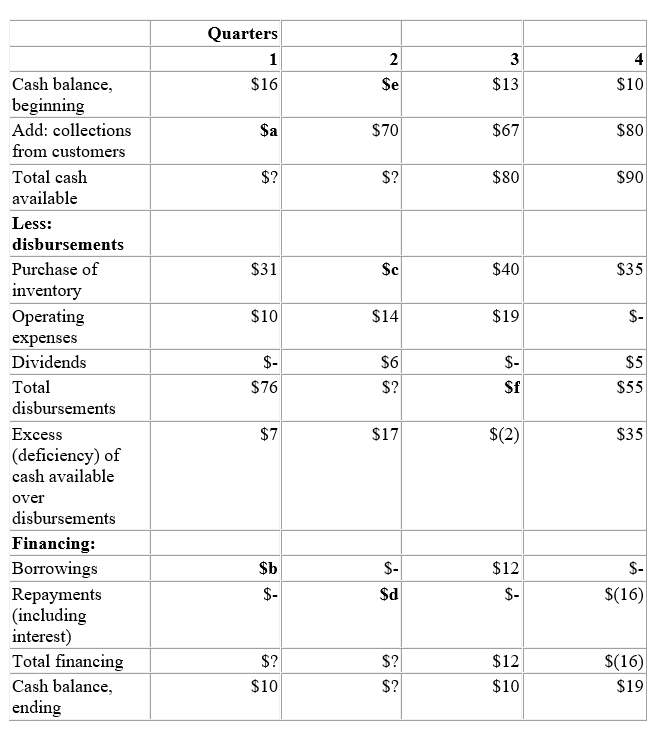

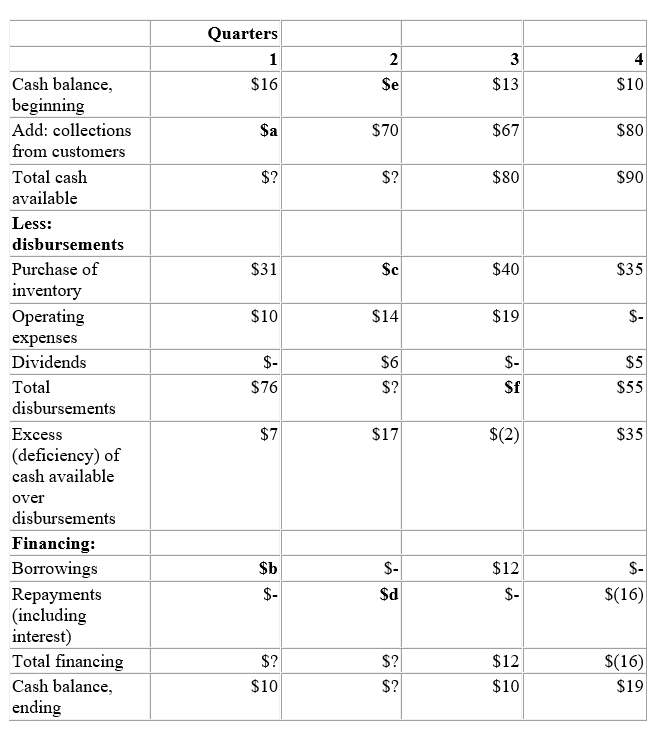

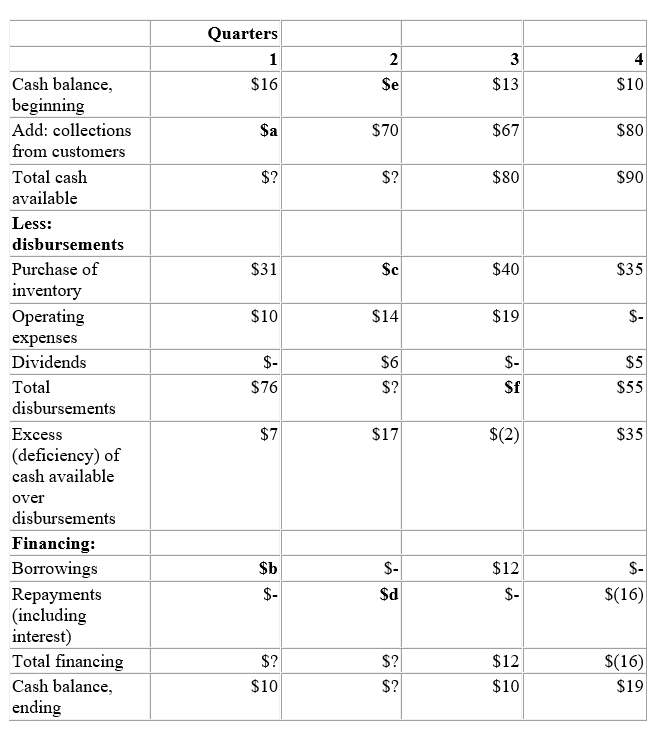

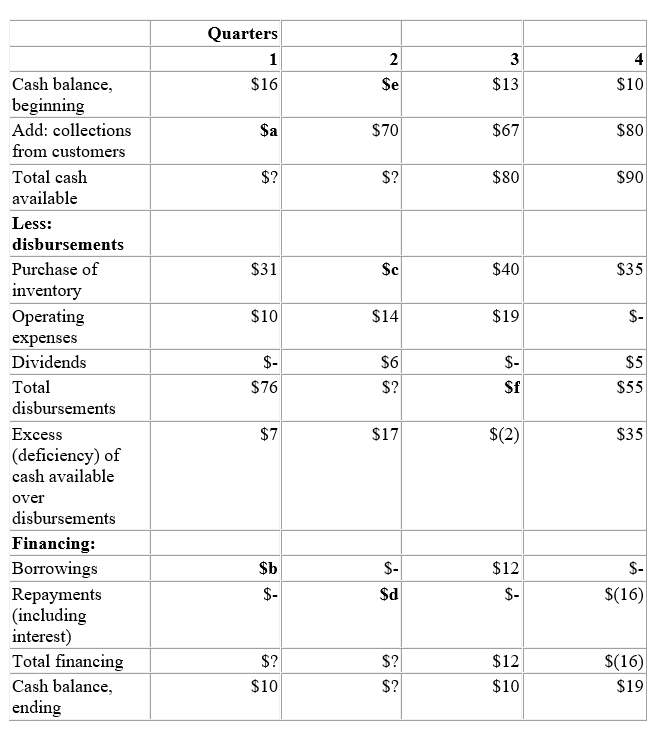

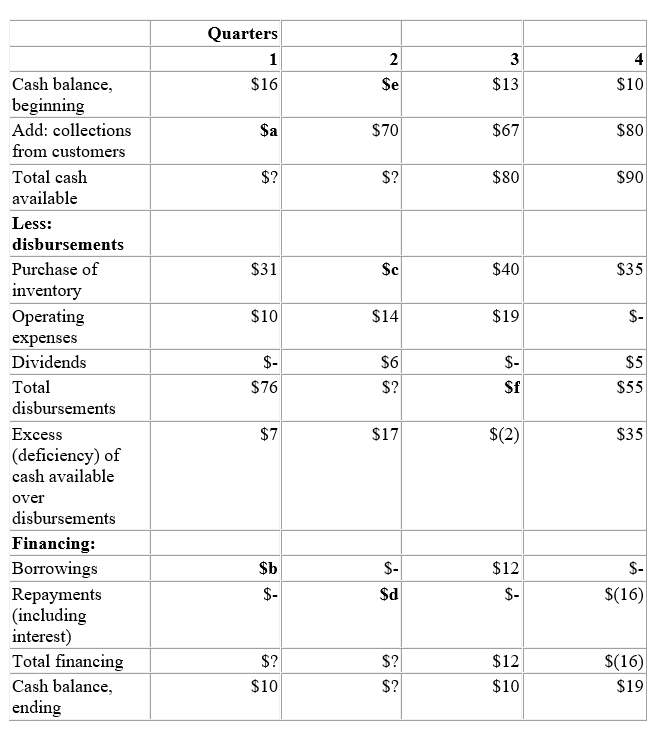

A cash budget by quarters for the Carney Company is given below (note that some data are missing). Missing data amounts have been keyed with either question marks or lowercase letters (a, b, c, etc.); these lowercase letters will be referred to in the questions that follow. (It may be necessary to calculate a value for items where a question mark appears.) A zero amount is designated by a dash (-). The company requires a minimum cash balance of at least $10,000 to start a quarter. All data are in thousands of dollars.

Carney Corporation

Cash Budget

-What is the cash disbursed for purchases during the second quarter (item c),in thousands of dollars?

A) $9.

B) $13.

C) $21.

D) $55.

Carney Corporation

Cash Budget

-What is the cash disbursed for purchases during the second quarter (item c),in thousands of dollars?

A) $9.

B) $13.

C) $21.

D) $55.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

62

A cash budget by quarters for the Carney Company is given below (note that some data are missing). Missing data amounts have been keyed with either question marks or lowercase letters (a, b, c, etc.); these lowercase letters will be referred to in the questions that follow. (It may be necessary to calculate a value for items where a question mark appears.) A zero amount is designated by a dash (-). The company requires a minimum cash balance of at least $10,000 to start a quarter. All data are in thousands of dollars.

Carney Corporation

Cash Budget

-What is the borrowing required during the first quarter to meet the minimum cash balance (item b),in thousands of dollars?

A) $0.

B) $3.

C) $7.

D) $10.

Carney Corporation

Cash Budget

-What is the borrowing required during the first quarter to meet the minimum cash balance (item b),in thousands of dollars?

A) $0.

B) $3.

C) $7.

D) $10.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

63

Pollitt Potato Packers has a flexible budget for manufacturing overhead that is based on direct labour hours. The following overhead costs appear on the flexible budget at the 200,000-hour level of activity:

-At an activity level of 180,000 direct labour hours,what amount would the flexible budget estimate for total budgeted fixed costs?

A) $100,000.

B) $144,000.

C) $150,000.

D) $160,000.

-At an activity level of 180,000 direct labour hours,what amount would the flexible budget estimate for total budgeted fixed costs?

A) $100,000.

B) $144,000.

C) $150,000.

D) $160,000.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

64

Pollitt Potato Packers has a flexible budget for manufacturing overhead that is based on direct labour hours. The following overhead costs appear on the flexible budget at the 200,000-hour level of activity:

-What amount would the flexible budget estimate for total variable overhead cost per direct labour hour?

A) $0.60.

B) $0.90.

C) $1.50.

D) $1.80.

-What amount would the flexible budget estimate for total variable overhead cost per direct labour hour?

A) $0.60.

B) $0.90.

C) $1.50.

D) $1.80.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

65

Mandalay Hotel bases its budgets on guest-days. The hotel's static budget for August appears below:

-What is the expected total fixed overhead cost at an activity level of 5,500 guest-days per month?

A) $139,700

B) $190,920

C) $244,200

D) $109,220

-What is the expected total fixed overhead cost at an activity level of 5,500 guest-days per month?

A) $139,700

B) $190,920

C) $244,200

D) $109,220

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

66

A cash budget by quarters for the Carney Company is given below (note that some data are missing). Missing data amounts have been keyed with either question marks or lowercase letters (a, b, c, etc.); these lowercase letters will be referred to in the questions that follow. (It may be necessary to calculate a value for items where a question mark appears.) A zero amount is designated by a dash (-). The company requires a minimum cash balance of at least $10,000 to start a quarter. All data are in thousands of dollars.

Carney Corporation

Cash Budget

-What is the repayment (including interest)of financing during the second quarter (item d),in thousands of dollars?

A) $0.

B) $4.

C) $7.

D) $17.

Carney Corporation

Cash Budget

-What is the repayment (including interest)of financing during the second quarter (item d),in thousands of dollars?

A) $0.

B) $4.

C) $7.

D) $17.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

67

Capelli Hospital bases its budgets on patient-visits. The hospital's static budget for August appears below:

-What should be the total fixed overhead cost at an activity level of 9,600 patient-visits per month?

A) $133,630.

B) $154,560.

C) $235,720.

D) $272,640.

-What should be the total fixed overhead cost at an activity level of 9,600 patient-visits per month?

A) $133,630.

B) $154,560.

C) $235,720.

D) $272,640.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

68

The Bandeiras Company, a merchandising firm, has budgeted its activity for December according to the following information:

I. Sales at $550,000, all for cash.

II. Merchandise inventory on November 30 was $300,000.

III. Budgeted depreciation for December is $35,000.

IV. The cash balance at December 1 was $25,000.

V. Selling and administrative expenses are budgeted at $60,000 for December and are paid in cash.

VI. The planned merchandise inventory on December 31 is $270,000.

VII. The invoice cost for merchandise purchases represents 75% of the sales price. All purchases are paid for in cash.

-What are the budgeted cash receipts for December?

A) $137,500.

B) $412,500.

C) $550,000.

D) $585,000.

I. Sales at $550,000, all for cash.

II. Merchandise inventory on November 30 was $300,000.

III. Budgeted depreciation for December is $35,000.

IV. The cash balance at December 1 was $25,000.

V. Selling and administrative expenses are budgeted at $60,000 for December and are paid in cash.

VI. The planned merchandise inventory on December 31 is $270,000.

VII. The invoice cost for merchandise purchases represents 75% of the sales price. All purchases are paid for in cash.

-What are the budgeted cash receipts for December?

A) $137,500.

B) $412,500.

C) $550,000.

D) $585,000.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

69

A cash budget by quarters for the Carney Company is given below (note that some data are missing). Missing data amounts have been keyed with either question marks or lowercase letters (a, b, c, etc.); these lowercase letters will be referred to in the questions that follow. (It may be necessary to calculate a value for items where a question mark appears.) A zero amount is designated by a dash (-). The company requires a minimum cash balance of at least $10,000 to start a quarter. All data are in thousands of dollars.

Carney Corporation

Cash Budget

-What are the total collections from customers for the year,in thousands of dollars?

A) $260.

B) $277.

C) $290.

D) $284.

Carney Corporation

Cash Budget

-What are the total collections from customers for the year,in thousands of dollars?

A) $260.

B) $277.

C) $290.

D) $284.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

70

Pollitt Potato Packers has a flexible budget for manufacturing overhead that is based on direct labour hours. The following overhead costs appear on the flexible budget at the 200,000-hour level of activity:

-At an activity level of 160,000 direct labour hours,what amount would the flexible budget estimate for the utilities?

A) $80,000.

B) $100,000.

C) $120,000.

D) $160,000.

-At an activity level of 160,000 direct labour hours,what amount would the flexible budget estimate for the utilities?

A) $80,000.

B) $100,000.

C) $120,000.

D) $160,000.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

71

The Bandeiras Company, a merchandising firm, has budgeted its activity for December according to the following information:

I. Sales at $550,000, all for cash.

II. Merchandise inventory on November 30 was $300,000.

III. Budgeted depreciation for December is $35,000.

IV. The cash balance at December 1 was $25,000.

V. Selling and administrative expenses are budgeted at $60,000 for December and are paid in cash.

VI. The planned merchandise inventory on December 31 is $270,000.

VII. The invoice cost for merchandise purchases represents 75% of the sales price. All purchases are paid for in cash.

-What are the budgeted cash disbursements for December?

A) $382,500.

B) $442,500.

C) $472,500.

D) $477,500.

I. Sales at $550,000, all for cash.

II. Merchandise inventory on November 30 was $300,000.

III. Budgeted depreciation for December is $35,000.

IV. The cash balance at December 1 was $25,000.

V. Selling and administrative expenses are budgeted at $60,000 for December and are paid in cash.

VI. The planned merchandise inventory on December 31 is $270,000.

VII. The invoice cost for merchandise purchases represents 75% of the sales price. All purchases are paid for in cash.

-What are the budgeted cash disbursements for December?

A) $382,500.

B) $442,500.

C) $472,500.

D) $477,500.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

72

Capelli Hospital bases its budgets on patient-visits. The hospital's static budget for August appears below:

-What should be the total variable overhead cost at an activity level of 9,300 patient-visits per month?

A) $114,390.

B) $149,730.

C) $102,090.

D) $133,630.

-What should be the total variable overhead cost at an activity level of 9,300 patient-visits per month?

A) $114,390.

B) $149,730.

C) $102,090.

D) $133,630.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

73

A cash budget by quarters for the Carney Company is given below (note that some data are missing). Missing data amounts have been keyed with either question marks or lowercase letters (a, b, c, etc.); these lowercase letters will be referred to in the questions that follow. (It may be necessary to calculate a value for items where a question mark appears.) A zero amount is designated by a dash (-). The company requires a minimum cash balance of at least $10,000 to start a quarter. All data are in thousands of dollars.

Carney Corporation

Cash Budget

-What are the collections from customers during the first quarter (item a),in thousands of dollars?

A) $43.

B) $67.

C) $60.

D) $73.

Carney Corporation

Cash Budget

-What are the collections from customers during the first quarter (item a),in thousands of dollars?

A) $43.

B) $67.

C) $60.

D) $73.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

74

A cash budget by quarters for the Carney Company is given below (note that some data are missing). Missing data amounts have been keyed with either question marks or lowercase letters (a, b, c, etc.); these lowercase letters will be referred to in the questions that follow. (It may be necessary to calculate a value for items where a question mark appears.) A zero amount is designated by a dash (-). The company requires a minimum cash balance of at least $10,000 to start a quarter. All data are in thousands of dollars.

Carney Corporation

Cash Budget

-What are the total disbursements during the third quarter (item f),in thousands of dollars?

A) $59.

B) $78.

C) $82.

D) $84.

Carney Corporation

Cash Budget

-What are the total disbursements during the third quarter (item f),in thousands of dollars?

A) $59.

B) $78.

C) $82.

D) $84.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

75

Mandalay Hotel bases its budgets on guest-days. The hotel's static budget for August appears below:

-What is the expected total variable overhead cost at an activity level of 5,000 guest-days per month?

A) $127,000

B) $109,220

C) $95,000

D) $81,700

-What is the expected total variable overhead cost at an activity level of 5,000 guest-days per month?

A) $127,000

B) $109,220

C) $95,000

D) $81,700

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

76

Capelli Hospital bases its budgets on patient-visits. The hospital's static budget for August appears below:

-What should be the total overhead cost at an activity level of 9,400 patient-visits per month?

A) $235,720

B) $249,250

C) $266,960

D) $250,640

-What should be the total overhead cost at an activity level of 9,400 patient-visits per month?

A) $235,720

B) $249,250

C) $266,960

D) $250,640

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

77

The Culver Company is preparing its Manufacturing Overhead Budget for the third quarter of the year. Budgeted variable factory overhead is $3.00 per unit produced; budgeted fixed factory overhead is $75,000 per month, with $16,000 of this amount being factory depreciation.

-If all cash expenses are paid for in the month incurred what is the budgeted cash disbursements for manufacturing overhead if 5,500 units are produced?

A) $16,500.

B) $75,500.

C) $91,500.

D) $99,000.

-If all cash expenses are paid for in the month incurred what is the budgeted cash disbursements for manufacturing overhead if 5,500 units are produced?

A) $16,500.

B) $75,500.

C) $91,500.

D) $99,000.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

78

A cash budget by quarters for the Carney Company is given below (note that some data are missing). Missing data amounts have been keyed with either question marks or lowercase letters (a, b, c, etc.); these lowercase letters will be referred to in the questions that follow. (It may be necessary to calculate a value for items where a question mark appears.) A zero amount is designated by a dash (-). The company requires a minimum cash balance of at least $10,000 to start a quarter. All data are in thousands of dollars.

Carney Corporation

Cash Budget

-What is the cash balance at the beginning of the second quarter (item e),in thousands of dollars?

A) $0.

B) $7.

C) $10.

D) $14.

Carney Corporation

Cash Budget

-What is the cash balance at the beginning of the second quarter (item e),in thousands of dollars?

A) $0.

B) $7.

C) $10.

D) $14.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

79

Pollitt Potato Packers has a flexible budget for manufacturing overhead that is based on direct labour hours. The following overhead costs appear on the flexible budget at the 200,000-hour level of activity:

-At an activity level of 180,000 direct labour hours,what amount would the flexible budget estimate for indirect labour cost?

A) $108,000.

B) $144,000.

C) $162,000.

D) $180,000.

-At an activity level of 180,000 direct labour hours,what amount would the flexible budget estimate for indirect labour cost?

A) $108,000.

B) $144,000.

C) $162,000.

D) $180,000.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck

80

The Bandeiras Company, a merchandising firm, has budgeted its activity for December according to the following information:

I. Sales at $550,000, all for cash.

II. Merchandise inventory on November 30 was $300,000.

III. Budgeted depreciation for December is $35,000.

IV. The cash balance at December 1 was $25,000.

V. Selling and administrative expenses are budgeted at $60,000 for December and are paid in cash.

VI. The planned merchandise inventory on December 31 is $270,000.

VII. The invoice cost for merchandise purchases represents 75% of the sales price. All purchases are paid for in cash.

-What is the budgeted net income for December?

A) $42,500.

B) $77,500.

C) $107,500.

D) $137,500.

I. Sales at $550,000, all for cash.

II. Merchandise inventory on November 30 was $300,000.

III. Budgeted depreciation for December is $35,000.

IV. The cash balance at December 1 was $25,000.

V. Selling and administrative expenses are budgeted at $60,000 for December and are paid in cash.

VI. The planned merchandise inventory on December 31 is $270,000.

VII. The invoice cost for merchandise purchases represents 75% of the sales price. All purchases are paid for in cash.

-What is the budgeted net income for December?

A) $42,500.

B) $77,500.

C) $107,500.

D) $137,500.

Unlock Deck

Unlock for access to all 137 flashcards in this deck.

Unlock Deck

k this deck