Deck 2: Principles of Consolidation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/42

Play

Full screen (f)

Deck 2: Principles of Consolidation

1

During August 20X5,Atticus Ltd acquired the share capital of Finch Pty Ltd in exchange for 1,000,000 shares in Atticus Ltd with a fair value of $10 per share.Share issue costs amounted to $400,000 and an amount of $400,000 was paid to consultants.Atticus Ltd also took over the loans payable to the shareholders of Finch Pty Ltd by that company of $2,000,000.The cost of the investment is:

A) $12,400,000

B) $ 8,400,000

C) $12,800,000

D) None of the above.

A) $12,400,000

B) $ 8,400,000

C) $12,800,000

D) None of the above.

A

2

Consolidation worksheet adjusting journal entries are recorded:

A) A in the general ledger of the parent entity

B) B in the general ledger of the subsidiary

C) C in the consolidation working papers

D) D none of the above

A) A in the general ledger of the parent entity

B) B in the general ledger of the subsidiary

C) C in the consolidation working papers

D) D none of the above

C

3

The general purpose financial statements (GPFS)of a parent entity are prepared from the viewpoint of:

A) the group

B) the parent entity

C) the subsidiary

D) the non controlling interest

A) the group

B) the parent entity

C) the subsidiary

D) the non controlling interest

A

4

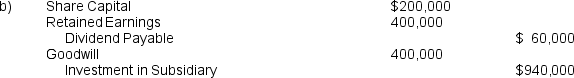

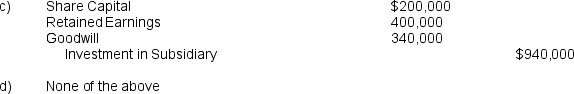

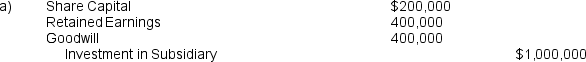

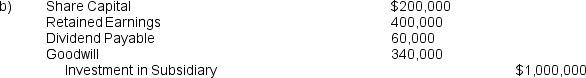

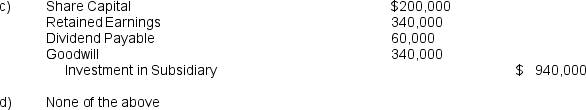

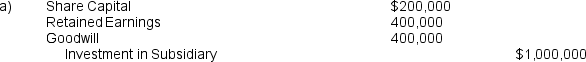

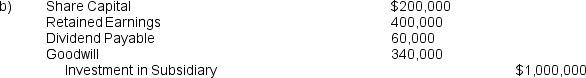

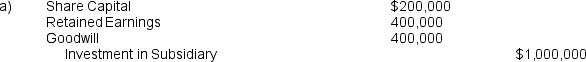

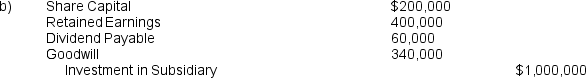

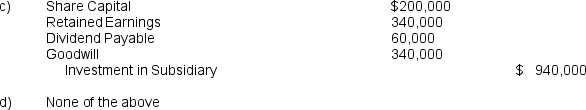

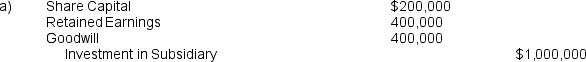

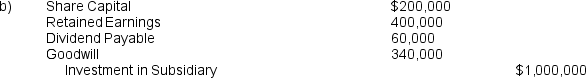

Assume the same data as in Question 17.In preparing the consolidated financial statements in the year ended June 30 20X6,the consolidation adjustment to eliminate the investment in the subsidiary would be:

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

5

Goodwill on acquisition is recorded when:

A) the cost of the acquisition of the subsidiary is less than the fair value of the subsidiary equity

B) the cost of the acquisition is more than the fair value of the subsidiary equity

C) the cost of the acquisition is equal to the fair value of the subsidiary equity

D) none of the above

A) the cost of the acquisition of the subsidiary is less than the fair value of the subsidiary equity

B) the cost of the acquisition is more than the fair value of the subsidiary equity

C) the cost of the acquisition is equal to the fair value of the subsidiary equity

D) none of the above

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

6

Under current accounting standards a dividend declared by a subsidiary from pre-acquisition equity will be recognised by the parent company as:

A) revenue

B) a reduction in the investment in subsidiary asset

C) not recognised

D) none of the above

A) revenue

B) a reduction in the investment in subsidiary asset

C) not recognised

D) none of the above

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

7

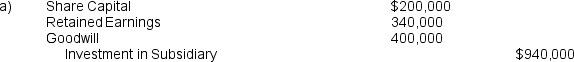

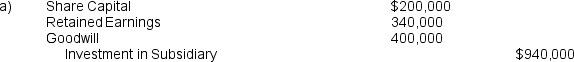

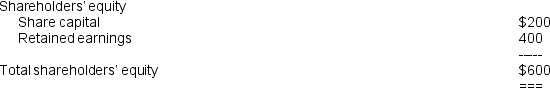

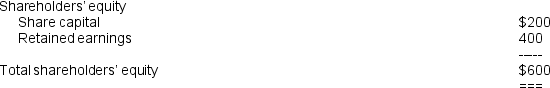

On July 1 20X5,Helios Ltd acquired all of the share capital of Havers Pty Ltd (100,000 shares)for $10 per share.During the year ended June 30 20X6,Helios Ltd received a dividend from Havers Ltd of $60,000; a dividend which had been declared by the directors of Havers Ltd in the year ended June 30 20X5 and was not subject to ratification by the shareholders of Havers Ltd.During the year ended June 30 20X6,Helios Ltd received an interim dividend of $40,000 from Havers Ltd and the directors of Havers Ltd declared a final dividend of $60,000.At June 30 20X6,The directors estimated that the fair value of the shares in Havers Ltd was only $9 per share at that date,but the estimated fall in value was considered to be only temporary and the carrying amount of the investment had not been impaired. At the date of acquisition,July 1 20X5,the shareholders' equity of Havers Ltd was (amounts in thousands):

At the date of acquisition,the carrying amounts of the net assets of Havers Ltd approximated fair value.If a consolidated balance sheet were to be prepared for Helios Ltd and its subsidiaries at the date of acquisition,the consolidation adjustment to eliminate the investment in the subsidiary would be:

At the date of acquisition,the carrying amounts of the net assets of Havers Ltd approximated fair value.If a consolidated balance sheet were to be prepared for Helios Ltd and its subsidiaries at the date of acquisition,the consolidation adjustment to eliminate the investment in the subsidiary would be:

At the date of acquisition,the carrying amounts of the net assets of Havers Ltd approximated fair value.If a consolidated balance sheet were to be prepared for Helios Ltd and its subsidiaries at the date of acquisition,the consolidation adjustment to eliminate the investment in the subsidiary would be:

At the date of acquisition,the carrying amounts of the net assets of Havers Ltd approximated fair value.If a consolidated balance sheet were to be prepared for Helios Ltd and its subsidiaries at the date of acquisition,the consolidation adjustment to eliminate the investment in the subsidiary would be:

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

8

In August 20X6,Caesar Ltd acquired the issued ordinary shares of Alesia Ltd in a one-for-one share exchange.Immediately prior to the acquisition,the shares of Caesar Ltd and Alesia Ltd were being traded on the ASX for $12 and $10 per share respectively.Immediately following the offer to purchase the shares,the shares in Alesia Ltd were being traded at $13 per share.From this information,the cost of acquisition would be recorded at:

A) $12 per share since this the market assessment of the fair value of the shares issued by Caesar Ltd.

B) $10 per share since this is the fair value of the shares of Alesia Ltd and thus a reliable measure of the fair value of the shares issued by Caesar Ltd.

C) $13 per share since the shareholders of Alesia Ltd have a choice between accepting the offer of Caesar Ltd or selling their shares in the market, so that $13 per share is the most objective measure of the fair value of the shares in Caesar Ltd.

D) None of the above.

A) $12 per share since this the market assessment of the fair value of the shares issued by Caesar Ltd.

B) $10 per share since this is the fair value of the shares of Alesia Ltd and thus a reliable measure of the fair value of the shares issued by Caesar Ltd.

C) $13 per share since the shareholders of Alesia Ltd have a choice between accepting the offer of Caesar Ltd or selling their shares in the market, so that $13 per share is the most objective measure of the fair value of the shares in Caesar Ltd.

D) None of the above.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

9

During August 20X5,Tiberius Ltd acquired the share capital of Capri Ltd in exchange for 1,000,000 shares in Tiberius Ltd with a fair value of $10 per share.Share issue costs amounted to $400,000.Tiberius Ltd also took over the loan payable by Capri Ltd to Ethereal Finance Ltd of $2,000,000.The cost of the investment is:

A) $10,000,000

B) $10,300,000

C) $12,000,000

D) None of the above.

A) $10,000,000

B) $10,300,000

C) $12,000,000

D) None of the above.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

10

Where a subsidiary has declared but not paid a dividend on a cum div basis on acquisition date,the amount of the dividend must be recorded by the parent company as:

A) revenue

B) a reduction in the cost of the investment

C) a reduction in the amount of goodwill on consolidation

D) none of the above

A) revenue

B) a reduction in the cost of the investment

C) a reduction in the amount of goodwill on consolidation

D) none of the above

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

11

It is important to distinguish between pre and post acquisition equity of a subsidiary to allow:

A) post acquisition equity to be eliminated on consolidation

B) goodwill or gain on bargain purchase to be calculated

C) avoidance of double counting of pre acquisition equity

D) none of the above

A) post acquisition equity to be eliminated on consolidation

B) goodwill or gain on bargain purchase to be calculated

C) avoidance of double counting of pre acquisition equity

D) none of the above

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

12

When a dividend declared by a subsidiary results in an adjustment for impairment of the parent company investment in subsidiary asset,the following consolidation worksheet adjustment is required:

A) DR Impairment loss Investment in Subsidiary CR Accum. Impairment Loss

B) DR Accum Impairment Loss CR Impairment Loss Investment in Subsidiary

C) DR Impairment Loss Investment in Subsidiary CR Investment in Subsidiary

D) none of the above

A) DR Impairment loss Investment in Subsidiary CR Accum. Impairment Loss

B) DR Accum Impairment Loss CR Impairment Loss Investment in Subsidiary

C) DR Impairment Loss Investment in Subsidiary CR Investment in Subsidiary

D) none of the above

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

13

A company with a constitution that provides for the declaration of dividends will recognise a liability for dividends payable if:

A) the dividend is recommended before the balance date but not declared

B) the dividend is declared before the balance date

C) the dividend is recommended and declared after the balance date

D) none of the above

A) the dividend is recommended before the balance date but not declared

B) the dividend is declared before the balance date

C) the dividend is recommended and declared after the balance date

D) none of the above

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

14

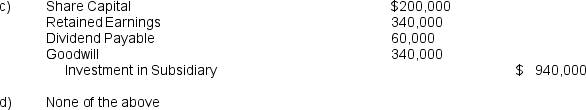

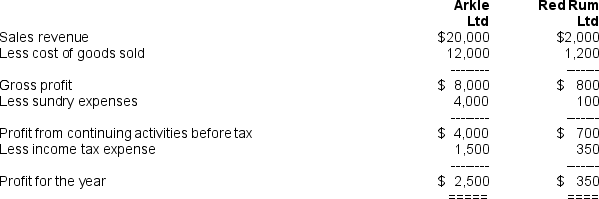

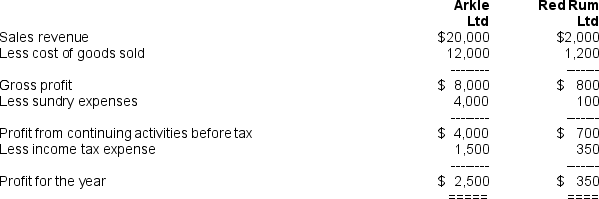

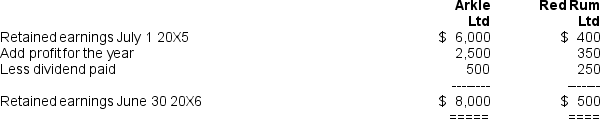

For the year ended June 30 20X6,the following financial statements were prepared for the two companies Arkle Ltd and Red Rum Ltd (amounts in thousands).At that date,the net assets of Red Rum Ltd approximated their fair value. Balance Sheets as at June 30 20X6

Income Statements for the Year ended June 30 20X6

Income Statements for the Year ended June 30 20X6

Statements of Movements in Retained Earnings Year ended June 30 20X6

Statements of Movements in Retained Earnings Year ended June 30 20X6

On July 1 20X5,Arkle Ltd acquired all of the share capital for $2,250,000 cash.Immediately subsequent to acquisition,Red Rum Ltd paid a dividend of $250,000 out of retained earnings at July 1 20X5.The goodwill paid on the investment was:

On July 1 20X5,Arkle Ltd acquired all of the share capital for $2,250,000 cash.Immediately subsequent to acquisition,Red Rum Ltd paid a dividend of $250,000 out of retained earnings at July 1 20X5.The goodwill paid on the investment was:

A) $850,000

B) $750,000

C) $600,000

D) None of the above.

Income Statements for the Year ended June 30 20X6

Income Statements for the Year ended June 30 20X6 Statements of Movements in Retained Earnings Year ended June 30 20X6

Statements of Movements in Retained Earnings Year ended June 30 20X6 On July 1 20X5,Arkle Ltd acquired all of the share capital for $2,250,000 cash.Immediately subsequent to acquisition,Red Rum Ltd paid a dividend of $250,000 out of retained earnings at July 1 20X5.The goodwill paid on the investment was:

On July 1 20X5,Arkle Ltd acquired all of the share capital for $2,250,000 cash.Immediately subsequent to acquisition,Red Rum Ltd paid a dividend of $250,000 out of retained earnings at July 1 20X5.The goodwill paid on the investment was:A) $850,000

B) $750,000

C) $600,000

D) None of the above.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

15

A company adopting the replaceable rules included in the Corporations Act announces a dividend to be paid after balance date.The company:

A) must recognise a liability in its financial statements

B) must not recognise a liability

C) has the choice of whether to recognise a liability or not

D) none of the above

A) must recognise a liability in its financial statements

B) must not recognise a liability

C) has the choice of whether to recognise a liability or not

D) none of the above

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

16

A parent and its subsidiary adopt different bases for measuring property plant and equipment assets.On consolidation the financial statements must reflect:

A) the accounting policy of the group

B) the accounting policy of the subsidiary

C) either the accounting policy of the parent or the subsidiary

D) none of the above

A) the accounting policy of the group

B) the accounting policy of the subsidiary

C) either the accounting policy of the parent or the subsidiary

D) none of the above

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

17

During June 20X5,Cassius Ltd acquired all of the share capital of Cicero Ltd in exchange for 1,000,000 shares with a market value of $10 per share,$5,000,000 cash payable on June 30 20X5 plus a further $6,050,000 payable on June 30 20X7.Assume an interest rate of 10%.A consultation fee of $1,000,000 was paid to an independent firm for their assistance in the acquisition.A special department was set up in Cassius Ltd to oversee the acquisition and the estimated costs of this department that were reliably attributable to the acquisition amounted to $300,000.The cost of acquisition was (rounded to nearest $'000):

A) $21,000,000

B) $22,350,000

C) $22,050,000

D) $21,300,000

A) $21,000,000

B) $22,350,000

C) $22,050,000

D) $21,300,000

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

18

Any goodwill arising on a business combination is required to be tested at least annually for impairment.This requirement arises from the operation of:

A) AASB116 Property Plant and Equipment

B) AASB3 Business Combinations

C) AASB138 Intangible Assets

D) AASB 136 Impairment

A) AASB116 Property Plant and Equipment

B) AASB3 Business Combinations

C) AASB138 Intangible Assets

D) AASB 136 Impairment

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

19

Assume the same data as in Question 14.Any goodwill element in the cost of acquisition had not been impaired.The consolidated shareholders' equity of Arkle Ltd and its subsidiary at June 30 20X6 is:

A) $10,080,000

B) $10,100,000

C) $10,350,000

D) None of the above.

A) $10,080,000

B) $10,100,000

C) $10,350,000

D) None of the above.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

20

A subsidiary which is identified as a single cash generating unit (CGU)has property plant and equipment assets with a carrying amount of $100,000 and a recoverable amount of $80,000.On acquisition of the subsidiary goodwill of $60,000 was recognised.The amount to be identified as goodwill impairment loss is:

A) $100,000

B) $80,000

C) $20,000

D) $60,000

A) $100,000

B) $80,000

C) $20,000

D) $60,000

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

21

Explain why the existence of goodwill enables an entity to generate higher future cash flows or profits than would otherwise occur.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

22

Changes in fair value of contingent consideration in a business combination will affect the calculation of goodwill/gain on bargain purchase

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

23

The investment date and the acquisition date of a subsidiary will always be the same.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

24

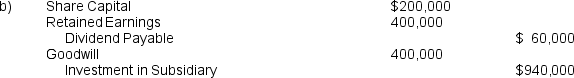

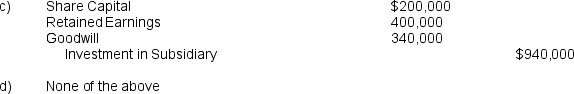

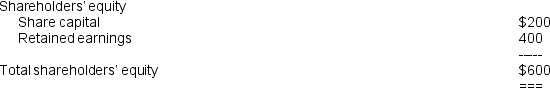

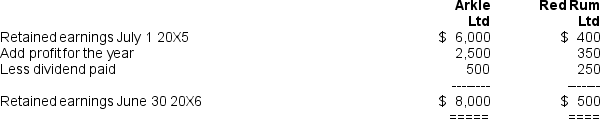

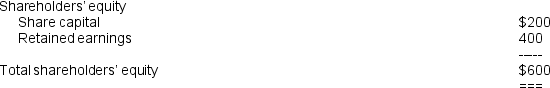

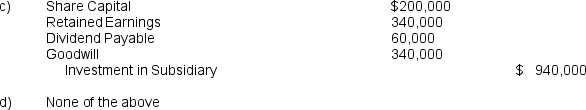

On July 1 20X5,Helios Ltd acquired all of the share capital of Havers Pty Ltd (100,000 shares)for $10 per share.Immediately subsequent to acquisition,the directors of Havers Ltd declared and paid a dividend of $60,000 from the retained earnings at June 30 20X5.During the year ended June 30 20X6,Helios Ltd received an interim dividend of $40,000 from Havers Ltd and the directors of Havers Ltd declared a final dividend of $60,000.At the date of acquisition,July 1 20X5,the shareholders' equity of Havers Ltd was (amounts in thousands):  At the date of acquisition,the carrying amounts of the net assets of Havers Ltd approximated fair value.If a consolidated balance sheet were to be prepared for Helios Ltd and its subsidiaries at the date of acquisition,the consolidation adjustment to eliminate the investment in the subsidiary would be:

At the date of acquisition,the carrying amounts of the net assets of Havers Ltd approximated fair value.If a consolidated balance sheet were to be prepared for Helios Ltd and its subsidiaries at the date of acquisition,the consolidation adjustment to eliminate the investment in the subsidiary would be:

At the date of acquisition,the carrying amounts of the net assets of Havers Ltd approximated fair value.If a consolidated balance sheet were to be prepared for Helios Ltd and its subsidiaries at the date of acquisition,the consolidation adjustment to eliminate the investment in the subsidiary would be:

At the date of acquisition,the carrying amounts of the net assets of Havers Ltd approximated fair value.If a consolidated balance sheet were to be prepared for Helios Ltd and its subsidiaries at the date of acquisition,the consolidation adjustment to eliminate the investment in the subsidiary would be:

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

25

Discuss the changes in the accounting rules for recognition of liabilities for dividends payable after 1 January 2005.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

26

In a consolidation it would be double counting to record the net assets of a subsidiary and the parent company's investment in subsidiary asset

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

27

Explain the consequences of distinguishing between pre and post acquisition equity of a subsidiary in the consolidation process.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

28

Dividends payable by a subsidiary on an ex-dividend basis will be ignored for the purposes of consolidation

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

29

Post acquisition changes in the composition of pre acquisition equity can be ignored for the purposes of consolidation adjustments

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

30

The declaration date of a dividend determines whether it will be recorded as a liability in the financial statements

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

31

All consolidation adjusting entries must be repeated in subsequent accounting periods

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

32

A gain on bargain purchase will be recognised in the financial statements of the acquiring company in a business combination relating to the acquisition of a controlling interest in a company.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

33

The purpose of consolidated financial statements is to provide information to shareholders of the parent company

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

34

Where a subsidiary's financial reporting period ends on a different date to that of the parent company the subsidiary must prepare additional financial statements

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

35

The investment elimination entry to eliminate the investment in subsidiary asset is a 'standing consolidation worksheet adjustment' and will not alter from year to year.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

36

A dividend paid by a subsidiary out of pre-acquisition profits will always result in the parent company's investment in subsidiary asset being impaired.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

37

There is no limit to the amount of impairment loss write down of the assets of a cash generating unit (CGU)

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

38

Totals and subtotals in a consolidation worksheet are derived by adding/subtracting down the group column.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

39

In a business combination share issue costs are not included as part of the cost of acquisition.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

40

Goodwill is not an identifiable intangible asset because it is not separable.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

41

Explain why dividends paid by subsidiaries out of pre-acquisition profits will result in impairment of the parent company's investment in subsidiary asset.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck

42

Outline the regulatory basis for the requirement to measure goodwill at cost less accumulated impairment losses.

Unlock Deck

Unlock for access to all 42 flashcards in this deck.

Unlock Deck

k this deck