Deck 15: Options Markets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/88

Play

Full screen (f)

Deck 15: Options Markets

1

A down-and-in option _______________.

A) provides a payoff if the firm's stock price falls below some specified percentage of what it was at the beginning of the option term

B) provides a payoff if the firm's stock price falls below some specified dollar amount during the term of the option

C) expires worthless if the firm's stock price falls below some specified percentage of what it was at the beginning of the option term

D) expires worthless if the firm's stock price falls below some specified dollar amount during the term of the option

A) provides a payoff if the firm's stock price falls below some specified percentage of what it was at the beginning of the option term

B) provides a payoff if the firm's stock price falls below some specified dollar amount during the term of the option

C) expires worthless if the firm's stock price falls below some specified percentage of what it was at the beginning of the option term

D) expires worthless if the firm's stock price falls below some specified dollar amount during the term of the option

B

2

A lookback option provides its holder with _______________.

A) a payoff determined by either the maximum or minimum price of the underlying stock during the life of the option

B) a payoff determined by the difference between the maximum and minimum price of the underlying stock during the life of the option

C) a payoff if the firm's stock price falls below some specified dollar amount during the term of the option

D) a payoff based on the average price of the underlying stock over the life of the option

A) a payoff determined by either the maximum or minimum price of the underlying stock during the life of the option

B) a payoff determined by the difference between the maximum and minimum price of the underlying stock during the life of the option

C) a payoff if the firm's stock price falls below some specified dollar amount during the term of the option

D) a payoff based on the average price of the underlying stock over the life of the option

A

3

A futures call option provides its holder with the right to ___________.

A) purchase a particular stock at some time in the future at a specified price

B) purchase a futures contract for the delivery of options on a particular stock

C) purchase a futures contract at a specified price for a specified period of time

D) deliver a futures contract and receive a specified price at a specific date in the future

A) purchase a particular stock at some time in the future at a specified price

B) purchase a futures contract for the delivery of options on a particular stock

C) purchase a futures contract at a specified price for a specified period of time

D) deliver a futures contract and receive a specified price at a specific date in the future

C

4

Longer term American style options with maturities of up to three years are called __________.

A) warrants

B) LEAPS

C) GICs

D) CATs

A) warrants

B) LEAPS

C) GICs

D) CATs

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

5

You purchase one IBM July 125 call contract for a premium of $5.You hold the option until the expiration date when IBM stock sells for $123 per share.You will realize a ______ on the investment.

A) $200 profit

B) $200 loss

C) $500 profit

D) $500 loss

A) $200 profit

B) $200 loss

C) $500 profit

D) $500 loss

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

6

All else the same,an ______ style option will be ______ valuable than a ______ style option.

A) American, more, European

B) American, less, European

C) American, more, Canadian

D) American, less, Canadian

A) American, more, European

B) American, less, European

C) American, more, Canadian

D) American, less, Canadian

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

7

You purchase one IBM July 120 put contract for a premium of $3.You hold the option until the expiration date when IBM stock sells for $123 per share.You will realize a ______ on the investment.

A) $300 profit

B) $300 loss

C) $500 loss

D) $200 profit

A) $300 profit

B) $300 loss

C) $500 loss

D) $200 profit

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

8

An Asian call option gives its holder the right to ____________.

A) buy the underlying asset at the exercise price on or before the expiration date

B) buy the underlying asset at a price determined by the average stock price during some specified portion of the option's life

C) sell the underlying asset at the exercise price on or before the expiration date

D) sell the underlying asset at a price determined by the average stock price during some specified portion of the option's life

A) buy the underlying asset at the exercise price on or before the expiration date

B) buy the underlying asset at a price determined by the average stock price during some specified portion of the option's life

C) sell the underlying asset at the exercise price on or before the expiration date

D) sell the underlying asset at a price determined by the average stock price during some specified portion of the option's life

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

9

You write a put option on a stock.The profit at contract maturity of the option position is ___________ where X equals the option's strike price,ST is the stock price at contract expiration and P0 is the original premium of the put option.

A) Max(P0, X - ST - P0)

B) Min(-P0, X - ST - P0)

C) Min(P0, ST - X + P0)

D) Max(0, ST - X - P0)

A) Max(P0, X - ST - P0)

B) Min(-P0, X - ST - P0)

C) Min(P0, ST - X + P0)

D) Max(0, ST - X - P0)

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

10

You purchase a call option on a stock.The profit at contract maturity of the option position is ___________ where X equals the option's strike price,ST is the stock price at contract expiration and C0 is the original purchase price of the option.

A) Max(-C0, ST - X - C0)

B) Min(-C0, ST - X - C0)

C) Max(C0, ST - X + C0)

D) Max(0, ST - X - C0)

A) Max(-C0, ST - X - C0)

B) Min(-C0, ST - X - C0)

C) Max(C0, ST - X + C0)

D) Max(0, ST - X - C0)

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

11

The initial maturities of most exchange traded options are generally __________.

A) less than a year

B) less than 2 years

C) between 1 and 2 years

D) between 1 and 3 years

A) less than a year

B) less than 2 years

C) between 1 and 2 years

D) between 1 and 3 years

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

12

At contract maturity the value of a put option is ___________ where X equals the option's strike price and ST is the stock price at contract expiration.

A) Max(0, ST - X)

B) Min(0, ST - X)

C) Max(0, X - ST)

D) Min(0, X - ST)

A) Max(0, ST - X)

B) Min(0, ST - X)

C) Max(0, X - ST)

D) Min(0, X - ST)

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

13

A quanto provides its holder with ______________.

A) the right to participate in the payoffs from a portfolio of gambling casino stocks

B) the right to exchange a fixed amount of a foreign currency for dollars at a specified exchange rate

C) the right to participate in the investment performance of a foreign security

D) the right to exchange the payoff from a foreign investment for dollars at a fixed exchange rate

A) the right to participate in the payoffs from a portfolio of gambling casino stocks

B) the right to exchange a fixed amount of a foreign currency for dollars at a specified exchange rate

C) the right to participate in the investment performance of a foreign security

D) the right to exchange the payoff from a foreign investment for dollars at a fixed exchange rate

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

14

An American put option gives its holder the right to _________.

A) buy the underlying asset at the exercise price on or before the expiration date

B) buy the underlying asset at the exercise price only at the expiration date

C) sell the underlying asset at the exercise price on or before the expiration date

D) sell the underlying asset at the exercise price only at the expiration date

A) buy the underlying asset at the exercise price on or before the expiration date

B) buy the underlying asset at the exercise price only at the expiration date

C) sell the underlying asset at the exercise price on or before the expiration date

D) sell the underlying asset at the exercise price only at the expiration date

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

15

You purchase one IBM July 120 call contract for a premium of $5.You hold the option until the expiration date when IBM stock sells for $123 per share.You will realize a ______ on the investment.

A) $200 profit

B) $200 loss

C) $300 profit

D) $300 loss

A) $200 profit

B) $200 loss

C) $300 profit

D) $300 loss

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

16

You write one IBM July 120 call contract for a premium of $4.You hold the option until the expiration date when IBM stock sells for $121 per share.You will realize a ______ on the investment.

A) $300 profit

B) $200 loss

C) $600 loss

D) $200 profit

A) $300 profit

B) $200 loss

C) $600 loss

D) $200 profit

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

17

A(n)______ option can only be exercised on the expiration date.

A) Mexican

B) Asian

C) American

D) European

A) Mexican

B) Asian

C) American

D) European

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

18

A down-and-out option _______________.

A) provides a payoff if the firm's stock price falls below some specified percentage of what it was at the beginning of the option term

B) provides a payoff if the firm's stock price falls below some specified dollar amount during the term of the option

C) expires worthless if the firm's stock price falls below some specified percentage of what it was at the beginning of the option term

D) expires worthless if the firm's stock price falls below some specified dollar amount during the term of the option

A) provides a payoff if the firm's stock price falls below some specified percentage of what it was at the beginning of the option term

B) provides a payoff if the firm's stock price falls below some specified dollar amount during the term of the option

C) expires worthless if the firm's stock price falls below some specified percentage of what it was at the beginning of the option term

D) expires worthless if the firm's stock price falls below some specified dollar amount during the term of the option

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

19

An Asian put option gives its holder the right to ____________.

A) buy the underlying asset at the exercise price on or before the expiration date

B) buy the underlying asset at a price determined by the average stock price during some specified portion of the option's life

C) sell the underlying asset at the exercise price on or before the expiration date

D) sell the underlying asset at a price determined by the average stock price during some specified portion of the option's life

A) buy the underlying asset at the exercise price on or before the expiration date

B) buy the underlying asset at a price determined by the average stock price during some specified portion of the option's life

C) sell the underlying asset at the exercise price on or before the expiration date

D) sell the underlying asset at a price determined by the average stock price during some specified portion of the option's life

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

20

At contract maturity the value of a call option is ___________ where X equals the option's strike price and ST is the stock price at contract expiration.

A) Max(0, ST - X)

B) Min(0, ST - X)

C) Max(0, X - ST)

D) Min(0, X - ST)

A) Max(0, ST - X)

B) Min(0, ST - X)

C) Max(0, X - ST)

D) Min(0, X - ST)

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

21

The writer of a put option _______________.

A) agrees to sell shares at a set price if the option holder desires

B) agrees to buy shares at a set price if the option holder desires

C) has the right to buy shares at a set price

D) has the right to sell shares at a set price

A) agrees to sell shares at a set price if the option holder desires

B) agrees to buy shares at a set price if the option holder desires

C) has the right to buy shares at a set price

D) has the right to sell shares at a set price

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

22

You buy a call option and a put option on General Electric.Both the call option and the put option have the same exercise price and expiration date.This strategy is called a _________.

A) time spread

B) long straddle

C) short straddle

D) money spread

A) time spread

B) long straddle

C) short straddle

D) money spread

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

23

The value of a listed put option on a stock is lower when _______________.

I)the exercise price is higher

II)the contract approaches maturity

III)the stock decreases in value

IV)a stock split occurs

A) II only

B) II and IV only

C) I, II and III only

D) I, II, III and IV

I)the exercise price is higher

II)the contract approaches maturity

III)the stock decreases in value

IV)a stock split occurs

A) II only

B) II and IV only

C) I, II and III only

D) I, II, III and IV

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

24

You buy a call option on Summit Corp.with an exercise price of $40 and an expiration date in September and write a call option on Summit Corp.with an exercise price of $40 and an expiration date in October.This strategy is called a _________.

A) time spread

B) long straddle

C) short straddle

D) money spread

A) time spread

B) long straddle

C) short straddle

D) money spread

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

25

A European call option gives the buyer the right to _________.

A) buy the underlying asset at the exercise price on or before the expiration date

B) buy the underlying asset at the exercise price only at the expiration date

C) sell the underlying asset at the exercise price on or before the expiration date

D) sell the underlying asset at the exercise price only at the expiration date

A) buy the underlying asset at the exercise price on or before the expiration date

B) buy the underlying asset at the exercise price only at the expiration date

C) sell the underlying asset at the exercise price on or before the expiration date

D) sell the underlying asset at the exercise price only at the expiration date

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

26

Exercise prices for listed stock options usually occur in increments of ____,and bracket the current stock price.

A) $1

B) $5

C) $20

D) $25

A) $1

B) $5

C) $20

D) $25

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

27

A put option on Snapple Beverage has an exercise price of $30.The current stock price of Snapple Beverage is $24.25.The put option is _________.

A) at the money

B) in the money

C) out of the money

D) knocked out

A) at the money

B) in the money

C) out of the money

D) knocked out

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

28

Advantages of exchange traded options over OTC options include all but which one of the following?

A) Ease and low cost of trading

B) Anonymity of participants

C) Contracts that are tailored to meet the needs of market participants

D) No concerns about counterparty credit risk

A) Ease and low cost of trading

B) Anonymity of participants

C) Contracts that are tailored to meet the needs of market participants

D) No concerns about counterparty credit risk

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

29

Each listed stock option contract gives the holder the right to buy or sell __________ shares of stock.

A) 1

B) 10

C) 100

D) 1,000

A) 1

B) 10

C) 100

D) 1,000

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

30

The value of a listed call option on a stock is lower when _______________.

I)the exercise price is higher

II)the contract approaches maturity

III)the stock decreases in value

IV)a stock split occurs

A) II, III and IV only

B) I, III and IV only

C) I, II and III only

D) I, II, III and IV

I)the exercise price is higher

II)the contract approaches maturity

III)the stock decreases in value

IV)a stock split occurs

A) II, III and IV only

B) I, III and IV only

C) I, II and III only

D) I, II, III and IV

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

31

The maximum loss a buyer of a stock call option can suffer is the _________.

A) call premium

B) stock price

C) stock price minus the value of the call

D) strike price minus the stock price

A) call premium

B) stock price

C) stock price minus the value of the call

D) strike price minus the stock price

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

32

You invest in the stock of Valleyview Corp.and purchase a put option on Valleyview Corp.This strategy is called a _________.

A) long straddle

B) naked put

C) protective put

D) short stroll

A) long straddle

B) naked put

C) protective put

D) short stroll

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

33

In 1973,trading of standardized options on a national exchange started on the _________.

A) AMEX

B) CBOE

C) NYSE

D) CFTC

A) AMEX

B) CBOE

C) NYSE

D) CFTC

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

34

A call option on Brocklehurst Corp.has an exercise price of $30.The current stock price of Brocklehurst Corp.is $32.The call option is _________.

A) at the money

B) in the money

C) out of the money

D) knocked in

A) at the money

B) in the money

C) out of the money

D) knocked in

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

35

You buy a call option on Merritt Corp.with an exercise price of $50 and an expiration date in July and write a call option on Merritt Corp.with an exercise price of $55 with an expiration date in July.This is called a ________.

A) time spread

B) long straddle

C) short straddle

D) money spread

A) time spread

B) long straddle

C) short straddle

D) money spread

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

36

You invest in the stock of Rayleigh Corp.and write a call option on Rayleigh Corp.This strategy is called a _________.

A) covered call

B) long straddle

C) naked call

D) money spread

A) covered call

B) long straddle

C) naked call

D) money spread

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

37

Exchange traded stock options expire on the _______________ of the expiration month.

A) second Monday

B) third Wednesday

C) second Thursday

D) third Friday

A) second Monday

B) third Wednesday

C) second Thursday

D) third Friday

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

38

An American call option gives the buyer the right to _________.

A) buy the underlying asset at the exercise price on or before the expiration date

B) buy the underlying asset at the exercise price only at the expiration date

C) sell the underlying asset at the exercise price on or before the expiration date

D) sell the underlying asset at the exercise price only at the expiration date

A) buy the underlying asset at the exercise price on or before the expiration date

B) buy the underlying asset at the exercise price only at the expiration date

C) sell the underlying asset at the exercise price on or before the expiration date

D) sell the underlying asset at the exercise price only at the expiration date

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

39

The Option Clearing Corporation is owned by _________.

A) the exchanges on which stock options are traded

B) the Federal Deposit Insurance Corporation

C) the Federal Reserve system

D) major U.S. banks

A) the exchanges on which stock options are traded

B) the Federal Deposit Insurance Corporation

C) the Federal Reserve system

D) major U.S. banks

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

40

Which one of the statements about margin requirements on option positions is not correct?

A) The margin required will be higher if the option is in the money.

B) If the required margin exceeds the posted margin the option writer will receive a margin call.

C) A buyer of a put or call option does not have to post margin.

D) Even if the writer of a call option owns the stock the writer will have to meet the margin requirement in cash.

A) The margin required will be higher if the option is in the money.

B) If the required margin exceeds the posted margin the option writer will receive a margin call.

C) A buyer of a put or call option does not have to post margin.

D) Even if the writer of a call option owns the stock the writer will have to meet the margin requirement in cash.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

41

A put on Sanders stock with a strike price of $35 is priced at $2 per share while a call with a strike price of $35 is priced at $3.50.The maximum per share loss to the writer of an uncovered put is __________ and the maximum per share gain to the writer of an uncovered call is _________.

A) $33.00; $3.50

B) $33.00; $31.50

C) $35.00; $3.50

D) $35.00; $35.00

A) $33.00; $3.50

B) $33.00; $31.50

C) $35.00; $3.50

D) $35.00; $35.00

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

42

An option with a payoff that depends on the average price of the underlying asset during at least some portion of the life of the option is called an ______ option.

A) American

B) European

C) Asian

D) Australian

A) American

B) European

C) Asian

D) Australian

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

43

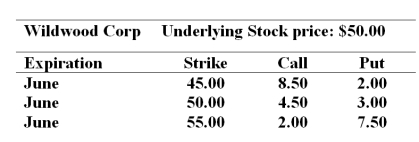

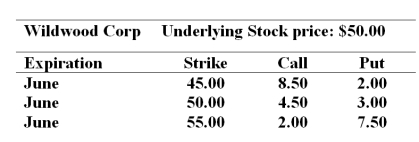

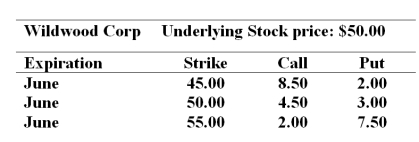

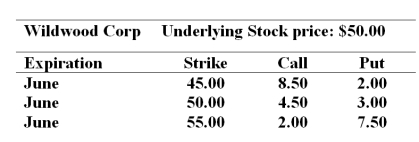

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:

To establish a bull money spread with puts you would _______________.

A) sell the 55 put and buy the 45 put

B) buy the 45 put and buy the 55 put

C) buy the 55 put and sell the 45 put

D) sell the 45 put and sell the 55 put

To establish a bull money spread with puts you would _______________.

A) sell the 55 put and buy the 45 put

B) buy the 45 put and buy the 55 put

C) buy the 55 put and sell the 45 put

D) sell the 45 put and sell the 55 put

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

44

The potential loss for a writer of a naked call option on a stock is _________.

A) equal to the call premium

B) larger the lower the stock price

C) limited

D) unlimited

A) equal to the call premium

B) larger the lower the stock price

C) limited

D) unlimited

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

45

Buyers of listed options __________ required to post margins and writers of naked listed options __________ required to post margins.

A) are; are not

B) are; are

C) are not; are

D) are not; are not

A) are; are not

B) are; are

C) are not; are

D) are not; are not

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

46

A "bet" option is also called a ____ option.

A) barrier

B) lookback

C) digital

D) foreign exchange

A) barrier

B) lookback

C) digital

D) foreign exchange

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

47

You buy one Hewlett Packard August 50 call contract and one Hewlett Packard August 50 put contract.The call premium is $1.25 and the put premium is $4.50.Your highest potential loss from this position is _________.

A) $125

B) $450

C) $575

D) unlimited

A) $125

B) $450

C) $575

D) unlimited

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

48

A down-and-out option is one type of ________ option.

A) barrier

B) lookback

C) digital

D) Asian

A) barrier

B) lookback

C) digital

D) Asian

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

49

Suppose you purchase one Texas Instruments August 75 call contract quoted at $8.50 and write one Texas Instruments August 80 call contract quoted at $6.If,at expiration,the price of a share of Texas Instruments stock is $79,your profit would be _________.

A) $150

B) $400

C) $600

D) $1,850

A) $150

B) $400

C) $600

D) $1,850

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

50

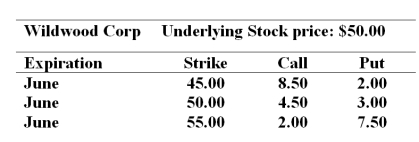

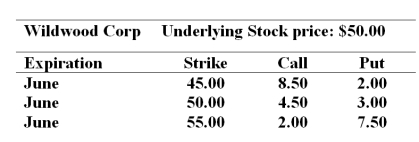

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:

To establish a bull money spread with calls you would _______________.

A) buy the 55 call and sell the 45 call

B) buy the 45 call and buy the 55 call

C) buy the 45 call and sell the 55 call

D) sell the 45 call and sell the 55 call

To establish a bull money spread with calls you would _______________.

A) buy the 55 call and sell the 45 call

B) buy the 45 call and buy the 55 call

C) buy the 45 call and sell the 55 call

D) sell the 45 call and sell the 55 call

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

51

Which one of the following is the ticker symbol for the CBOE option contract on the S&P100 index?

A) SPX

B) DJX

C) CME

D) OEX

A) SPX

B) DJX

C) CME

D) OEX

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

52

A writer of a call option will want the value of the underlying asset to __________ and a buyer of a put option will want the value of the underlying asset to _________.

A) decrease, decrease

B) decrease, increase

C) increase, decrease

D) increase, increase

A) decrease, decrease

B) decrease, increase

C) increase, decrease

D) increase, increase

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

53

You sell one Hewlett Packard August 50 call contract and sell one Hewlett Packard August 50 put contract.The call premium is $1.25 and the put premium is $4.50.Your strategy will pay off __________ in August.

A) only if the stock price is either lower than $44.25 or higher than $55.75

B) only if the stock price is between $44.25 and $55.75

C) only if the stock price is higher than $55.75

D) only if the stock price is lower than $44.25

A) only if the stock price is either lower than $44.25 or higher than $55.75

B) only if the stock price is between $44.25 and $55.75

C) only if the stock price is higher than $55.75

D) only if the stock price is lower than $44.25

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

54

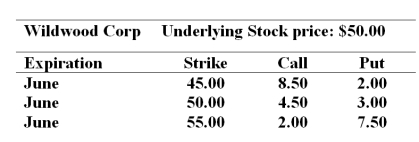

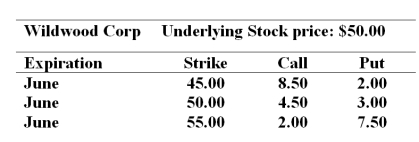

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:

Ignoring commissions,the cost to establish the bull money spread with calls would be _______.

A) $1,050

B) $650

C) $400

D) $400 income rather than cost

Ignoring commissions,the cost to establish the bull money spread with calls would be _______.

A) $1,050

B) $650

C) $400

D) $400 income rather than cost

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

55

A European put option gives its holder the right to _________.

A) buy the underlying asset at the exercise price on or before the expiration date

B) buy the underlying asset at the exercise price only at the expiration date

C) sell the underlying asset at the exercise price on or before the expiration date

D) sell the underlying asset at the exercise price only at the expiration date

A) buy the underlying asset at the exercise price on or before the expiration date

B) buy the underlying asset at the exercise price only at the expiration date

C) sell the underlying asset at the exercise price on or before the expiration date

D) sell the underlying asset at the exercise price only at the expiration date

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

56

You purchase one IBM March 120 put contract for a put premium of $10.The maximum profit that you could gain from this strategy is _________.

A) $120

B) $1,000

C) $11,000

D) $12,000

A) $120

B) $1,000

C) $11,000

D) $12,000

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

57

__________ is the most risky transaction to undertake in the stock index option markets if the stock market is expected to fall substantially after the transaction is completed.

A) Writing an uncovered call option

B) Writing an uncovered put option

C) Buying a call option

D) Buying a put option

A) Writing an uncovered call option

B) Writing an uncovered put option

C) Buying a call option

D) Buying a put option

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

58

Which one of the following is a correct statement?

A) Exercise of warrants results in more outstanding shares of stock, while exercise of listed call options does not.

B) A convertible bond consists of a straight bond plus a specified number of detachable warrants.

C) Call options always have an initial maturity greater than one year while warrants have an initial maturity less than one year.

D) Call options may be convertible into the stock while warrants are not convertible into the stock.

A) Exercise of warrants results in more outstanding shares of stock, while exercise of listed call options does not.

B) A convertible bond consists of a straight bond plus a specified number of detachable warrants.

C) Call options always have an initial maturity greater than one year while warrants have an initial maturity less than one year.

D) Call options may be convertible into the stock while warrants are not convertible into the stock.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

59

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:

If in June the stock price is $53 your net profit on the bull money spread would be ________.

A) $300

B) -$400

C) $150

D) $50

If in June the stock price is $53 your net profit on the bull money spread would be ________.

A) $300

B) -$400

C) $150

D) $50

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

60

The September 14,2009 price quotation for a Boeing call option with a strike price of $50 due to expire in November is $3.50 while the stock price of Boeing is $51.The premium on one Boeing November 50 call contract is _________.

A) $1

B) $2.50

C) $250.00

D) $350.00

A) $1

B) $2.50

C) $250.00

D) $350.00

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

61

The common stock of the Avalon Corporation has been trading in a narrow range around $40 per share for months, and you believe it is going to stay in that range for the next three months. The price of a three-month put option with an exercise price of $40 is $3, and a call with the same expiration date and exercise price sells for $4.

Suppose you write a strap and the stock price winds up to be $42 at contract expiration.What was your net profit on the strap?

A) $200

B) $300

C) $700

D) $400

Suppose you write a strap and the stock price winds up to be $42 at contract expiration.What was your net profit on the strap?

A) $200

B) $300

C) $700

D) $400

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

62

The common stock of the Avalon Corporation has been trading in a narrow range around $40 per share for months, and you believe it is going to stay in that range for the next three months. The price of a three-month put option with an exercise price of $40 is $3, and a call with the same expiration date and exercise price sells for $4.

Selling a straddle would generate total premium income of _____.

A) $300

B) $400

C) $500

D) $700

Selling a straddle would generate total premium income of _____.

A) $300

B) $400

C) $500

D) $700

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

63

What combination of puts and calls can simulate a long stock investment?

A) Long call and short put

B) Long call and long put

C) Short call and short put

D) Short call and long put

A) Long call and short put

B) Long call and long put

C) Short call and short put

D) Short call and long put

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

64

A stock is trading at $50.You believe there is a 60% chance the price of the stock will increase by 10% over the next three months.You believe there is a 30% chance the stock will drop by 5% and you think there is only a 10% chance of a major drop in price of 20%.At the money 3 month puts are available at a cost of $650 per contract.What is the expected dollar profit for a writer of a naked put at the end of three months?

A) $300

B) $200

C) $475

D) $0

A) $300

B) $200

C) $475

D) $0

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

65

A convertible bond is deep in the money.This means the bond price will closely track the __________.

A) straight debt value of the bond

B) conversion value of the bond

C) straight debt value of the bond minus the conversion value

D) straight debt value of the bond plus the conversion value

A) straight debt value of the bond

B) conversion value of the bond

C) straight debt value of the bond minus the conversion value

D) straight debt value of the bond plus the conversion value

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

66

Which strategy benefits from upside price movement and has some protection should the price of the security fall?

A) Bull spread

B) Long put

C) Short call

D) Straddle

A) Bull spread

B) Long put

C) Short call

D) Straddle

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

67

A covered call strategy benefits from what environment?

A) Falling interest rates

B) Price stability

C) Price volatility

D) Unexpected events

A) Falling interest rates

B) Price stability

C) Price volatility

D) Unexpected events

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

68

An investor purchases a long call at a price of $2.50.The expiration price is $35.00.If the current stock price is $35.10,what is the break even point for the investor?

A) $32.50

B) $35.00

C) $37.50

D) $37.60

A) $32.50

B) $35.00

C) $37.50

D) $37.60

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

69

What strategy is designed to ensure a value within the bounds of two different stock prices?

A) Collar

B) Covered Call

C) Protective put

D) Straddle

A) Collar

B) Covered Call

C) Protective put

D) Straddle

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

70

When issued most convertible bonds are issued _____________.

A) deep in the money

B) deep out of the money

C) slightly out of the money

D) slightly in the money

A) deep in the money

B) deep out of the money

C) slightly out of the money

D) slightly in the money

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following strategies makes a profit if the stock price stays stable?

A) Long call and short put

B) Long call and long put

C) Short call and short put

D) Short call and long put

A) Long call and short put

B) Long call and long put

C) Short call and short put

D) Short call and long put

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

72

If you combine a long stock position with buying an at the money put option the resulting net payoff profile will resemble the payoff profile of a _______.

A) long call

B) short call

C) short put

D) long put

A) long call

B) short call

C) short put

D) long put

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

73

The common stock of the Avalon Corporation has been trading in a narrow range around $40 per share for months, and you believe it is going to stay in that range for the next three months. The price of a three-month put option with an exercise price of $40 is $3, and a call with the same expiration date and exercise price sells for $4.

What would be a simple options strategy using a put and a call to exploit your conviction about the stock price's future movement?

A) Sell a call

B) Purchase a put

C) Sell a straddle

D) Buy a straddle

What would be a simple options strategy using a put and a call to exploit your conviction about the stock price's future movement?

A) Sell a call

B) Purchase a put

C) Sell a straddle

D) Buy a straddle

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

74

You are convinced that a stock's price will move by at least 15% over the next three months.You are not sure which way the price will move,but you believe that the results of a patent hearing are definitely going to have a major effect on the stock price.You are somewhat more bullish than bearish however.Which one of the following options strategies best fits this scenario?

A) Buy a strip

B) Buy a strap

C) Buy a straddle

D) Write a straddle

A) Buy a strip

B) Buy a strap

C) Buy a straddle

D) Write a straddle

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

75

What strategy could be considered insurance for an investment in a portfolio of stocks?

A) Covered call

B) Protective put

C) Short put

D) Straddle

A) Covered call

B) Protective put

C) Short put

D) Straddle

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

76

An investor is bearish on a particular stock and decided to buy a put with a strike price of $25.Ignoring commissions,if the option was purchased for a price of $0.85,what is the break even point for the investor?

A) $24.15

B) $25.00

C) $25.87

D) $27.86

A) $24.15

B) $25.00

C) $25.87

D) $27.86

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

77

The common stock of the Avalon Corporation has been trading in a narrow range around $40 per share for months, and you believe it is going to stay in that range for the next three months. The price of a three-month put option with an exercise price of $40 is $3, and a call with the same expiration date and exercise price sells for $4.

How can you create a position involving a put,a call,and riskless lending that would have the same payoff structure as the stock at expiration?

A) Buy the call, sell the put; lend the present value of $40

B) Sell the call, buy the put; lend the present value of $40

C) Buy the call, sell the put; borrow the present value of $40

D) Sell the call, buy the put; borrow the present value of $40

How can you create a position involving a put,a call,and riskless lending that would have the same payoff structure as the stock at expiration?

A) Buy the call, sell the put; lend the present value of $40

B) Sell the call, buy the put; lend the present value of $40

C) Buy the call, sell the put; borrow the present value of $40

D) Sell the call, buy the put; borrow the present value of $40

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following strategies makes a profit if the stock price declines and loses money when the stock price increases?

A) Long call and short put

B) Long call and long put

C) Short call and short put

D) Short call and long put

A) Long call and short put

B) Long call and long put

C) Short call and short put

D) Short call and long put

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

79

If you combine a long stock position with selling an at the money call option the resulting net payoff profile will resemble the payoff profile of a _______.

A) long call

B) short call

C) short put

D) long put

A) long call

B) short call

C) short put

D) long put

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

80

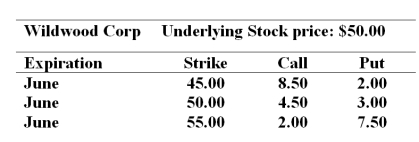

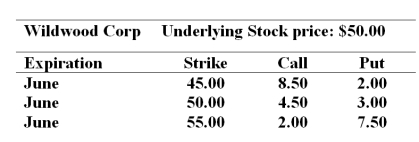

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:

Suppose you establish a bullish money spread with the puts.In June the stock's price turns out to be $52.Ignoring commissions the net profit on your position is __.

A) $500

B) $700

C) $200

D) $250

Suppose you establish a bullish money spread with the puts.In June the stock's price turns out to be $52.Ignoring commissions the net profit on your position is __.

A) $500

B) $700

C) $200

D) $250

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck