Deck 7: Inventories and Cost of Goods Sold

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

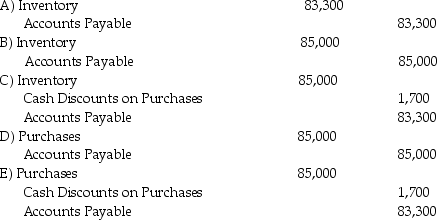

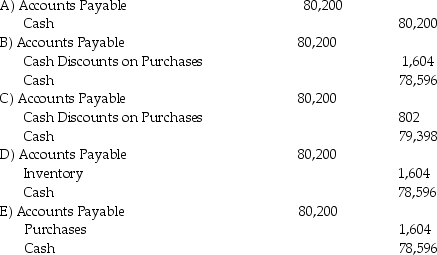

Question

Question

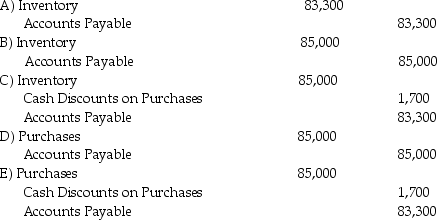

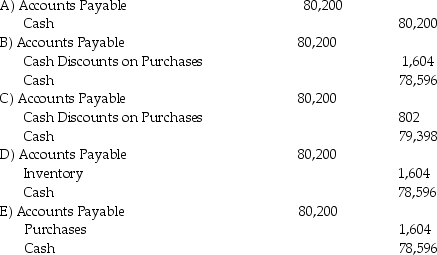

Question

Question

Question

Question

Question

Question

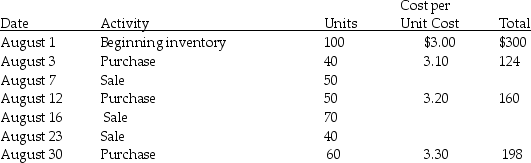

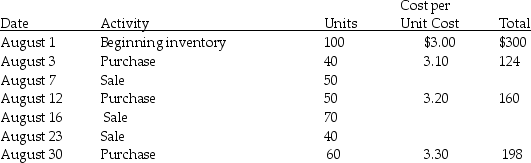

Question

Question

Question

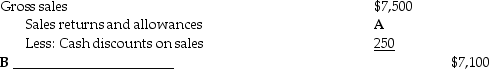

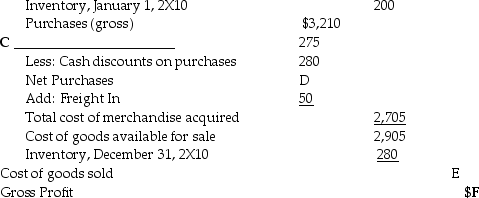

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/120

Play

Full screen (f)

Deck 7: Inventories and Cost of Goods Sold

1

Which of the following statements is FALSE?

A)Historically,the periodic system has been associated with low volume,high value items.

B)Historically,the perpetual system has been considered more expensive and cumbersome to maintain.

C)The perpetual system is better able to aid management in pricing and ordering inventory.

D)Computerized inventory systems and optical scanning equipment are examples of ways to implement a perpetual inventory system.

E)The perpetual inventory system is more likely than the periodic inventory system to isolate inventory shrinkage due to breakage,loss,or theft.

A)Historically,the periodic system has been associated with low volume,high value items.

B)Historically,the perpetual system has been considered more expensive and cumbersome to maintain.

C)The perpetual system is better able to aid management in pricing and ordering inventory.

D)Computerized inventory systems and optical scanning equipment are examples of ways to implement a perpetual inventory system.

E)The perpetual inventory system is more likely than the periodic inventory system to isolate inventory shrinkage due to breakage,loss,or theft.

A

2

In regards to physical inventory counts and valuations,it is not unusual

A)to use inventory counts to be able to journalize sales.

B)for firms to choose fiscal accounting periods to end when inventory levels are high.

C)to count inventory when inventory levels are high.

D)to count inventory twice per week.

E)for external auditors to use experts.

A)to use inventory counts to be able to journalize sales.

B)for firms to choose fiscal accounting periods to end when inventory levels are high.

C)to count inventory when inventory levels are high.

D)to count inventory twice per week.

E)for external auditors to use experts.

E

3

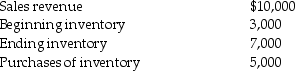

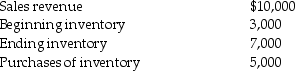

Given the following data,what is cost of goods sold?

A)$12,000

B)$ 9,000

C)$ 8,000

D)$ 7,000

E)$ 1,000

A)$12,000

B)$ 9,000

C)$ 8,000

D)$ 7,000

E)$ 1,000

E

4

The two main types of inventory systems are the periodic system and the gross margin method.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

5

If a company is using a periodic inventory system,the balance in its inventory account three-quarters of the way through an accounting period would be equal to the

A)amount of inventory on hand at that date.

B)inventory on hand at the beginning of the period.

C)total of the beginning inventory plus goods purchased during the accounting period.

D)amount of goods purchased during the period.

E)inventory on hand at the beginning of the period multiplied by 75%.

A)amount of inventory on hand at that date.

B)inventory on hand at the beginning of the period.

C)total of the beginning inventory plus goods purchased during the accounting period.

D)amount of goods purchased during the period.

E)inventory on hand at the beginning of the period multiplied by 75%.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

6

If a company using a periodic inventory system has beginning inventory of 15 units,purchases an additional 40 units,has ending inventory of 10 units,and sells 45 units,what is the company's number of units available for sale?

A)55 units

B)45 units

C)65 units

D)60 units

E)15 units

A)55 units

B)45 units

C)65 units

D)60 units

E)15 units

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

7

Inventory valuation is linked to gross profit because the inventory valuation involves allocating the cost of goods available for sale between cost of goods sold and ending inventory as of the balance sheet date.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

8

A perpetual inventory system offers all of the following characteristics except:

A)it is less expensive than a periodic system.

B)inventory balances are always current.

C)it helps salespeople determine whether there is a sufficient supply on hand to fill the customer orders.

D)it enhances internal control.

E)All of the above are characteristics of a perpetual inventory system.

A)it is less expensive than a periodic system.

B)inventory balances are always current.

C)it helps salespeople determine whether there is a sufficient supply on hand to fill the customer orders.

D)it enhances internal control.

E)All of the above are characteristics of a perpetual inventory system.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

9

In a periodic inventory system the quantity of ending inventory is determined by

A)subtracting units sold from units purchased.

B)a physical inventory count.

C)looking at the balance in the inventory account.

D)subtracting cost of goods sold from the beginning inventory balance.

E)adding units sold to the beginning inventory balance.

A)subtracting units sold from units purchased.

B)a physical inventory count.

C)looking at the balance in the inventory account.

D)subtracting cost of goods sold from the beginning inventory balance.

E)adding units sold to the beginning inventory balance.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

10

When using a perpetual inventory system,a business will debit inventory and credit cost of goods sold each time a sale is recorded.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

11

The calculation of cost of goods sold under the periodic system is

A)beginning inventory + purchases.

B)beginning inventory + ending inventory - purchases.

C)beginning inventory + ending inventory + purchases.

D)beginning inventory + purchases - ending inventory.

E)ending inventory + purchases - beginning inventory.

A)beginning inventory + purchases.

B)beginning inventory + ending inventory - purchases.

C)beginning inventory + ending inventory + purchases.

D)beginning inventory + purchases - ending inventory.

E)ending inventory + purchases - beginning inventory.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

12

Under a periodic inventory system,a business maintains a continual record of inventory on hand.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

13

If a company uses a perpetual inventory system,it will maintain all the following accounts except:

A)cost of goods sold.

B)inventory.

C)sales.

D)purchases.

E)All of the above accounts are used with a perpetual inventory system.

A)cost of goods sold.

B)inventory.

C)sales.

D)purchases.

E)All of the above accounts are used with a perpetual inventory system.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

14

Under a periodic inventory system,cost of goods available for sale is ending inventory plus purchases.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

15

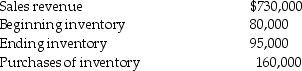

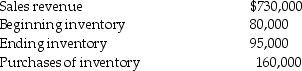

Given the following data,what is cost of goods sold?

A)$585,000

B)$145,000

C)$570,000

D)$175,000

E)$555,000

A)$585,000

B)$145,000

C)$570,000

D)$175,000

E)$555,000

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

16

The journal entry to sell merchandise on account under a periodic inventory system includes a

A)debit to Cost of Goods Sold.

B)debit to Inventory.

C)credit to Purchases.

D)credit to Sales.

E)credit to Accounts Receivable.

A)debit to Cost of Goods Sold.

B)debit to Inventory.

C)credit to Purchases.

D)credit to Sales.

E)credit to Accounts Receivable.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

17

The journal entry to purchase merchandise under a periodic inventory system includes a debit to

A)Cost of Goods Sold.

B)Inventory.

C)Purchases.

D)Accounts Receivable.

E)Accounts Payable.

A)Cost of Goods Sold.

B)Inventory.

C)Purchases.

D)Accounts Receivable.

E)Accounts Payable.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

18

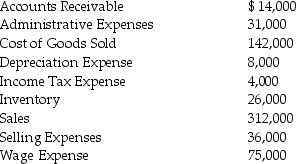

Given the following information,determine the gross profit.

A)$20,000

B)$ 16,000

C)$ 184,000

D)$156,000

E)$170,000

A)$20,000

B)$ 16,000

C)$ 184,000

D)$156,000

E)$170,000

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

19

The cost of goods available for sale is determined by taking the cost of inventory purchased during the year combined with the cost of goods sold.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

20

When comparing two companies with regard to profitability,it is not important to distinguish differences arising from accounting practices from differences caused by real economic conditions.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

21

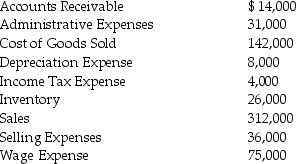

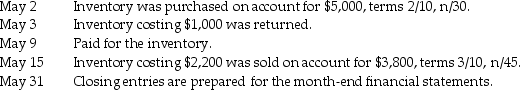

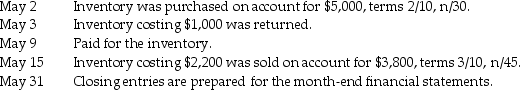

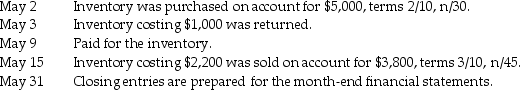

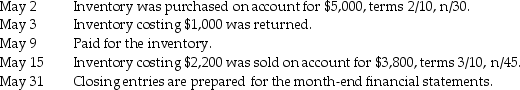

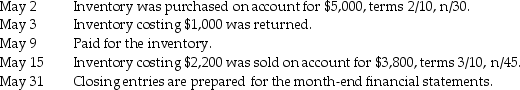

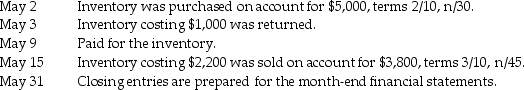

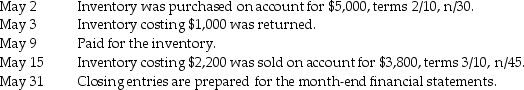

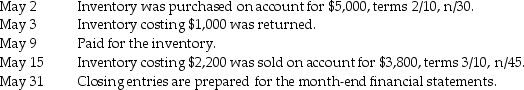

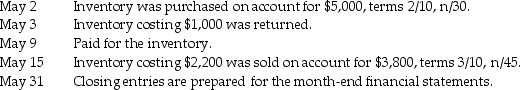

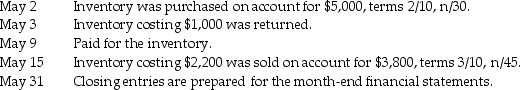

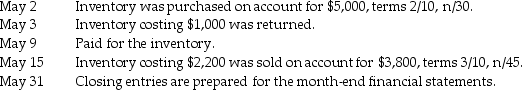

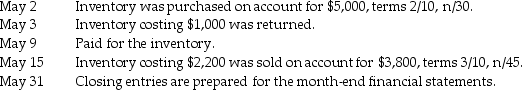

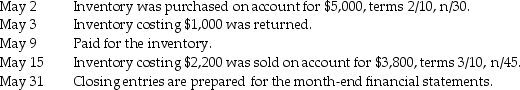

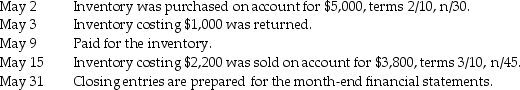

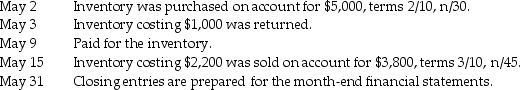

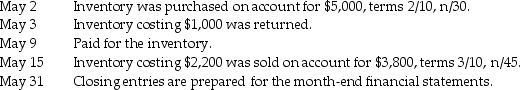

Queen Mattresses,Inc.had the following transactions occur during May 20X3.Assume there is no beginning inventory.  If Queen Mattresses,Inc.were using the perpetual inventory system,what is the journal entry for May 9?

If Queen Mattresses,Inc.were using the perpetual inventory system,what is the journal entry for May 9?

If Queen Mattresses,Inc.were using the perpetual inventory system,what is the journal entry for May 9?

If Queen Mattresses,Inc.were using the perpetual inventory system,what is the journal entry for May 9?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

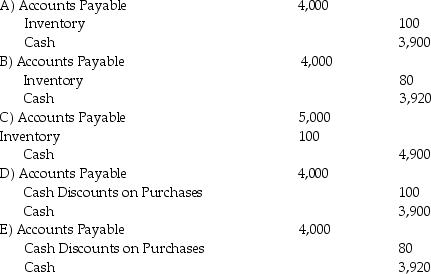

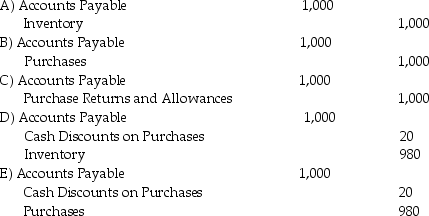

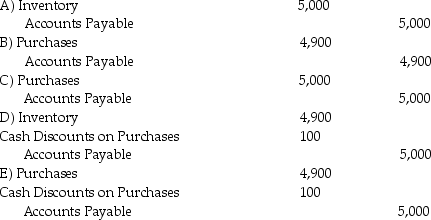

22

Queen Mattresses,Inc.had the following transactions occur during May 20X3.Assume there is no beginning inventory.  If Queen Mattresses,Inc.were using the periodic inventory system,what is the journal entry on May 3?

If Queen Mattresses,Inc.were using the periodic inventory system,what is the journal entry on May 3?

If Queen Mattresses,Inc.were using the periodic inventory system,what is the journal entry on May 3?

If Queen Mattresses,Inc.were using the periodic inventory system,what is the journal entry on May 3?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

23

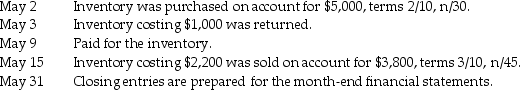

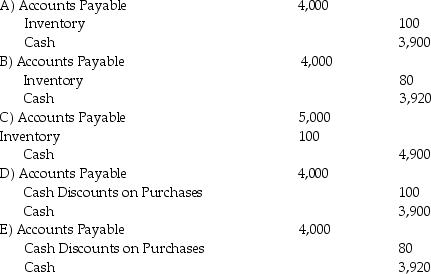

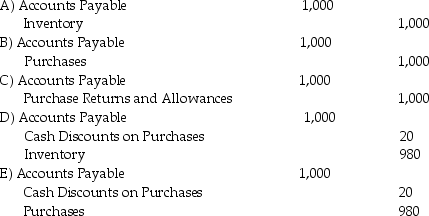

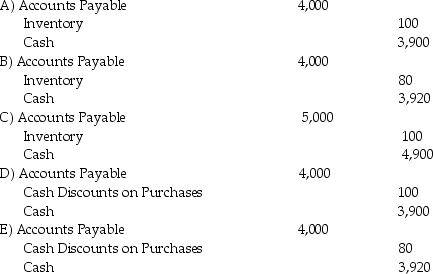

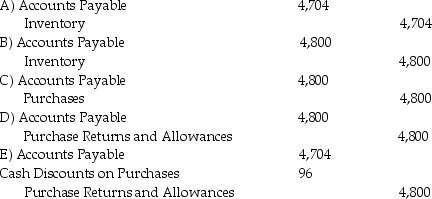

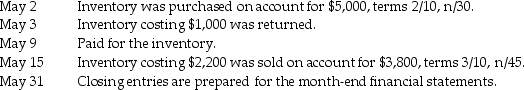

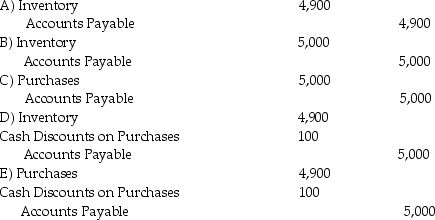

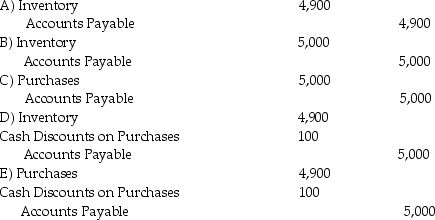

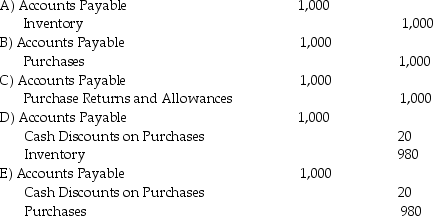

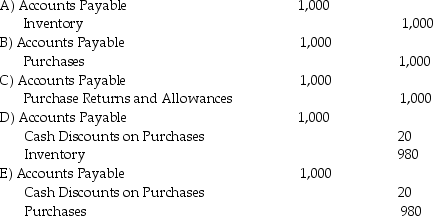

Queen Mattresses,Inc.had the following transactions occur during May 20X3.Assume there is no beginning inventory.  If Queen Mattresses,Inc.were using the periodic inventory system,what is the journal entry for May 9?

If Queen Mattresses,Inc.were using the periodic inventory system,what is the journal entry for May 9?

If Queen Mattresses,Inc.were using the periodic inventory system,what is the journal entry for May 9?

If Queen Mattresses,Inc.were using the periodic inventory system,what is the journal entry for May 9?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

24

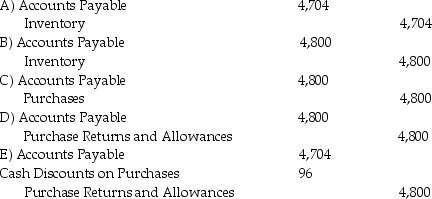

On March 1,20X3,Environmental Impacts acquired inventory on account.The cost of the inventory was $85,000.The terms of the purchase were 2/10,n/30.Upon inspection of the inventory on March 2,$4,800 worth of inventory was returned.Environmental Impacts paid for the inventory on March 8.The company uses a periodic inventory system.What journal entry will Environmental Impacts make on March 2,20X3?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

25

Queen Mattresses,Inc.had the following transactions occur during May 20X3.Assume there is no beginning inventory.  If Queen Mattresses,Inc.were using the perpetual inventory system,what is the journal entry for

If Queen Mattresses,Inc.were using the perpetual inventory system,what is the journal entry for

May 2?

If Queen Mattresses,Inc.were using the perpetual inventory system,what is the journal entry for

If Queen Mattresses,Inc.were using the perpetual inventory system,what is the journal entry forMay 2?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following statements is incorrect?

A)Both freight-in and freight-out affect gross profit.

B)Freight-in appears as part of cost of goods sold under the periodic inventory system.

C)Freight-out is a shipping expense.

D)Freight-in for the purchaser occurs when the terms of the invoice are FOB shipping point.

E)When the seller bears the shipping cost,the invoice is stated as FOB destination.

A)Both freight-in and freight-out affect gross profit.

B)Freight-in appears as part of cost of goods sold under the periodic inventory system.

C)Freight-out is a shipping expense.

D)Freight-in for the purchaser occurs when the terms of the invoice are FOB shipping point.

E)When the seller bears the shipping cost,the invoice is stated as FOB destination.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

27

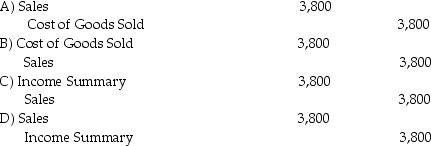

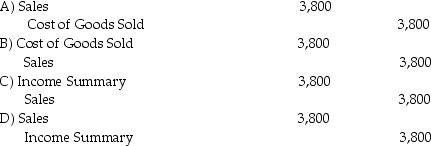

Queen Mattresses,Inc.had the following transactions occur during May 20X3.Assume there is no beginning inventory.  If Queen Mattresses,Inc.were using a periodic inventory system,what is the journal entry to close sales on May 31?

If Queen Mattresses,Inc.were using a periodic inventory system,what is the journal entry to close sales on May 31?

E)No entry is necessary on a monthly basis.

If Queen Mattresses,Inc.were using a periodic inventory system,what is the journal entry to close sales on May 31?

If Queen Mattresses,Inc.were using a periodic inventory system,what is the journal entry to close sales on May 31?

E)No entry is necessary on a monthly basis.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

28

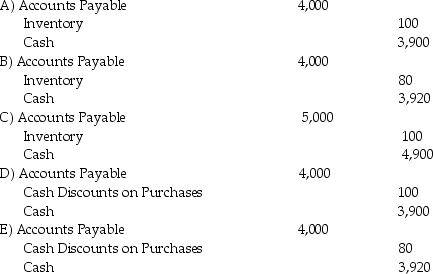

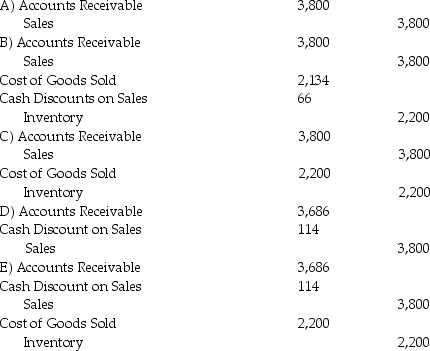

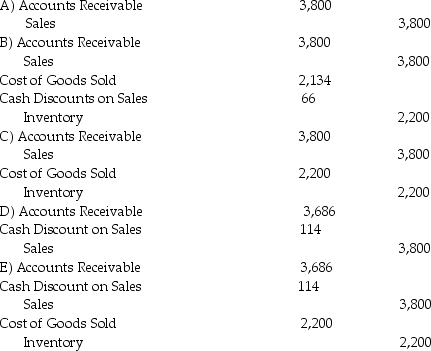

Queen Mattresses,Inc.had the following transactions occur during May 20X3.Assume there is no beginning inventory.  If Queen Mattresses,Inc.were using a periodic inventory system,what is the journal entry on May 15?

If Queen Mattresses,Inc.were using a periodic inventory system,what is the journal entry on May 15?

If Queen Mattresses,Inc.were using a periodic inventory system,what is the journal entry on May 15?

If Queen Mattresses,Inc.were using a periodic inventory system,what is the journal entry on May 15?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

29

Historically,periodic inventory systems have been used for low value,high volume items,whereas the perpetual inventory system has been used for high value,low volume items.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

30

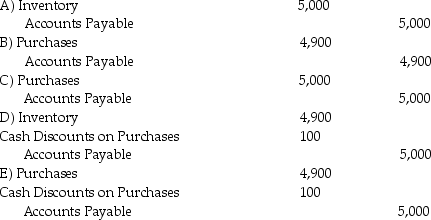

Queen Mattresses,Inc.had the following transactions occur during May 20X3.Assume there is no beginning inventory.  If Queen Mattresses Inc.were using the periodic inventory system,what is the journal entry for May 2?

If Queen Mattresses Inc.were using the periodic inventory system,what is the journal entry for May 2?

If Queen Mattresses Inc.were using the periodic inventory system,what is the journal entry for May 2?

If Queen Mattresses Inc.were using the periodic inventory system,what is the journal entry for May 2?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

31

When the seller bears the cost of shipping,the sales invoice is stated as FOB destination.When the buyer bears the cost of shipping,the sales invoice is stated as FOB shipping point.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

32

The purchaser bears the transportation cost when the terms are FOB destination.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

33

On March 1,20X3,Environmental Impacts acquired inventory on account.The cost of the inventory was $85,000.The terms of the purchase were 2/10,n/30.Upon inspection of the inventory on March 2,$4,800 worth of inventory was returned.Environmental Impacts paid for the inventory on March 8.The company uses a periodic inventory system.What journal entry will Environmental Impacts make on March 1,20X3?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

34

A physical inventory count is required under both the perpetual and periodic inventory systems.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

35

On March 1,20X3,Environmental Impacts acquired inventory on account.The cost of the inventory was $85,000.The terms of the purchase were 2/10,n/30.Upon inspection of the inventory on March 2,$4,800 worth of inventory was returned.Environmental Impacts paid for the inventory on March 8.The company uses a periodic inventory system.What journal entry will Environmental Impacts make on March 8,20X3?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

36

In a transaction where the merchandise invoice indicates F.O.B.shipping point,who pays the cost of shipping?

A)The buyer

B)The seller

C)The common carrier

D)The freight forwarder

E)None of the above

A)The buyer

B)The seller

C)The common carrier

D)The freight forwarder

E)None of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following statements is correct?

A)The perpetual inventory system uses a separate account for Purchase Returns and Allowances.

B)The periodic inventory system continually updates the Inventory and Cost of Goods Sold accounts.

C)The perpetual inventory system requires a closing entry in order to determine Cost of Goods Sold.

D)The Purchases account is used under both the periodic and perpetual inventory systems.

E)Under the periodic inventory system,neither the Cost of Goods Sold account nor the Inventory account is updated on a daily basis.

A)The perpetual inventory system uses a separate account for Purchase Returns and Allowances.

B)The periodic inventory system continually updates the Inventory and Cost of Goods Sold accounts.

C)The perpetual inventory system requires a closing entry in order to determine Cost of Goods Sold.

D)The Purchases account is used under both the periodic and perpetual inventory systems.

E)Under the periodic inventory system,neither the Cost of Goods Sold account nor the Inventory account is updated on a daily basis.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

38

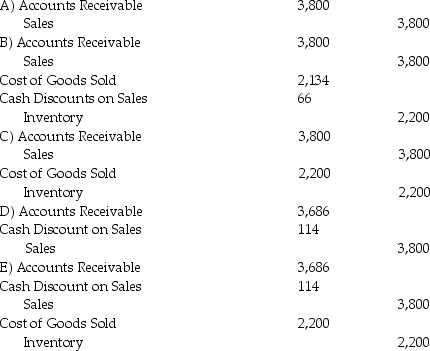

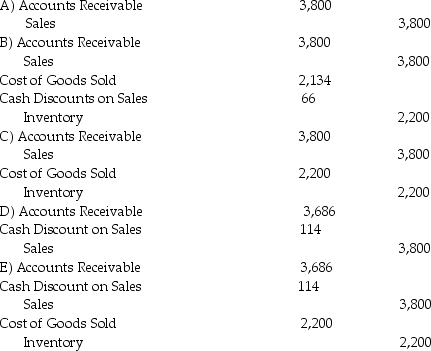

Queen Mattresses,Inc.had the following transactions occur during May 20X3.Assume there is no beginning inventory.  If Queen Mattresses,Inc.were using a perpetual inventory system,what is the journal entry for May 15?

If Queen Mattresses,Inc.were using a perpetual inventory system,what is the journal entry for May 15?

If Queen Mattresses,Inc.were using a perpetual inventory system,what is the journal entry for May 15?

If Queen Mattresses,Inc.were using a perpetual inventory system,what is the journal entry for May 15?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

39

Queen Mattresses,Inc.had the following transactions occur during May 20X3.Assume there is no beginning inventory.  If Queen Mattresses,Inc.were using the perpetual inventory system,what is the journal entry for May 3?

If Queen Mattresses,Inc.were using the perpetual inventory system,what is the journal entry for May 3?

If Queen Mattresses,Inc.were using the perpetual inventory system,what is the journal entry for May 3?

If Queen Mattresses,Inc.were using the perpetual inventory system,what is the journal entry for May 3?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

40

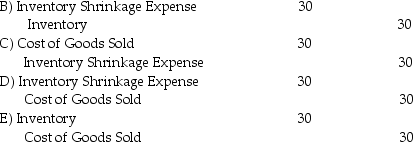

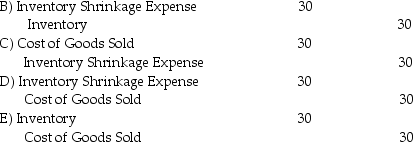

At the year-end,the perpetual inventory system of Horran Company indicated an ending inventory level of 190 units at a cost of $5 each.A physical count performed at year-end resulted in 184 units being on hand at a cost of $5 each.What journal entry,if any,is necessary at year-end?

A)No journal entry is necessary.

A)No journal entry is necessary.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

41

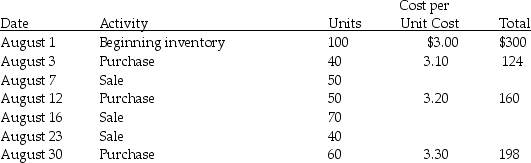

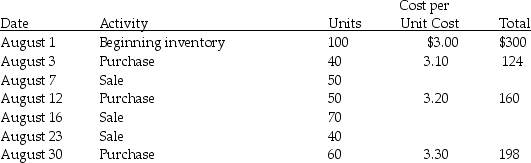

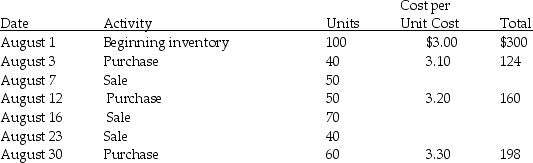

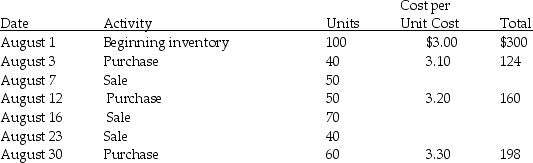

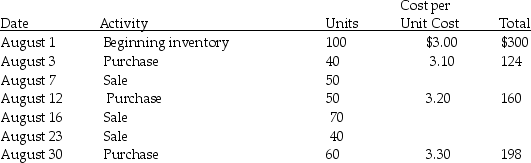

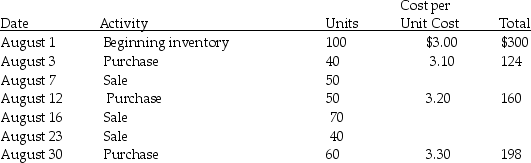

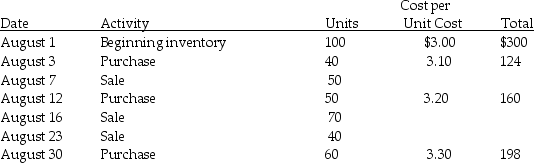

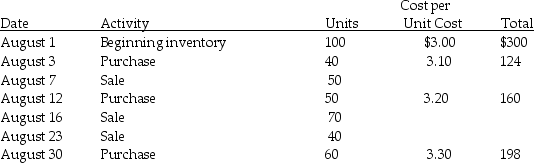

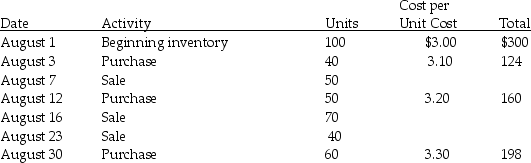

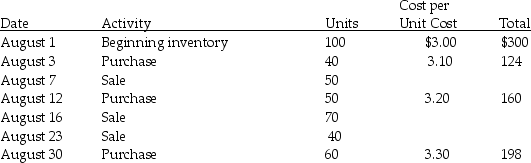

Biscuit Bakery had the following activity in its inventory account during August 20X3.  What is the ending inventory balance at August 31,20X3,for Biscuit Bakery if the company uses perpetual FIFO as its inventory valuation method?

What is the ending inventory balance at August 31,20X3,for Biscuit Bakery if the company uses perpetual FIFO as its inventory valuation method?

A)$198.00

B)$270.00

C)$294.00

D)$297.50

E)$358.00

What is the ending inventory balance at August 31,20X3,for Biscuit Bakery if the company uses perpetual FIFO as its inventory valuation method?

What is the ending inventory balance at August 31,20X3,for Biscuit Bakery if the company uses perpetual FIFO as its inventory valuation method?A)$198.00

B)$270.00

C)$294.00

D)$297.50

E)$358.00

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

42

Silver Line Transportation purchased inventory on account for $20,000 on April 2,20X3.They use a periodic inventory system.The terms of the purchase were 3/10,n/45.Shipping was $800,FOB destination.On April 4,the inventory was inspected,and it was discovered that some was damaged.The seller granted Silver Line Transportation a $600 allowance.On April 11,Silver Line Transportation paid the appropriate amount.Prepare the journal entries for each of the events noted above.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

43

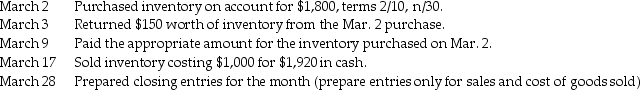

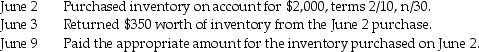

Morrill Manufacturing had inventory of $350 on March 1.The company had the following transactions during March.

Prepare the appropriate journal entry for each of the above transactions assuming Morrill Manufacturing uses the perpetual inventory method.

Prepare the appropriate journal entry for each of the above transactions assuming Morrill Manufacturing uses the perpetual inventory method.

Prepare the appropriate journal entry for each of the above transactions assuming Morrill Manufacturing uses the perpetual inventory method.

Prepare the appropriate journal entry for each of the above transactions assuming Morrill Manufacturing uses the perpetual inventory method.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

44

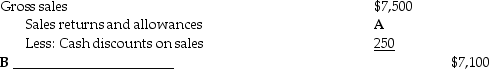

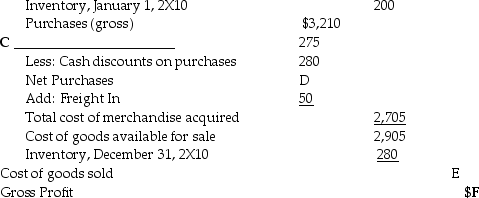

Fill in the appropriate blank figures in the income statement below.

Cost of goods sold

Cost of goods sold

Cost of goods sold

Cost of goods sold

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

45

The cost of merchandise acquired is the invoice price of the goods plus directly identifiable inbound transportation costs less any cash or quantity discounts and less any returns or allowances.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

46

Assuming inflation,if a company wanted to maximize net income,it would select which of the following inventory valuation methods?

A)FIFO

B)LIFO

C)Weighted-average

D)The selection of an inventory valuation method does not affect the net income.

E)Specific identification

A)FIFO

B)LIFO

C)Weighted-average

D)The selection of an inventory valuation method does not affect the net income.

E)Specific identification

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

47

Using the LIFO method,the earliest purchases of inventory are assumed to be contained

A)on the balance sheet as part of ending inventory.

B)on the income statement as part of cost of goods sold.

C)equally split between the income statement and the balance sheet.

D)Impossible to determine from the given data

E)The earliest purchases of inventory under LIFO are not shown on any financial statement.

A)on the balance sheet as part of ending inventory.

B)on the income statement as part of cost of goods sold.

C)equally split between the income statement and the balance sheet.

D)Impossible to determine from the given data

E)The earliest purchases of inventory under LIFO are not shown on any financial statement.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

48

When inventory prices are rising,the ending inventory balance reported on a LIFO basis is generally

A)lower than on a FIFO basis.

B)equal to a FIFO basis.

C)greater than on a FIFO basis.

D)equal to a weighted-average basis.

E)greater than a weighted-average basis.

A)lower than on a FIFO basis.

B)equal to a FIFO basis.

C)greater than on a FIFO basis.

D)equal to a weighted-average basis.

E)greater than a weighted-average basis.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

49

Assuming inflation,which of the following statements incorrectly describes an attribute of,or the relationship among,inventory valuation methods?

A)Specific identification is used primarily when ending inventory consists of a relatively few but very expensive and distinctive items.

B)Given inflation and in order to minimize taxes,most firms have tended to switch to LIFO if they had been using FIFO.

C)LIFO tends to provide ending inventory valuations that closely approximate the actual market value of the inventory at the balance sheet date.

D)LIFO tends to report current acquisition costs of inventory through cost of goods sold.

E)Weighted average provides less extreme balance sheet and income statement results than either FIFO or LIFO.

A)Specific identification is used primarily when ending inventory consists of a relatively few but very expensive and distinctive items.

B)Given inflation and in order to minimize taxes,most firms have tended to switch to LIFO if they had been using FIFO.

C)LIFO tends to provide ending inventory valuations that closely approximate the actual market value of the inventory at the balance sheet date.

D)LIFO tends to report current acquisition costs of inventory through cost of goods sold.

E)Weighted average provides less extreme balance sheet and income statement results than either FIFO or LIFO.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

50

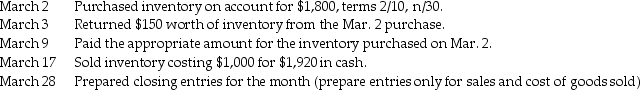

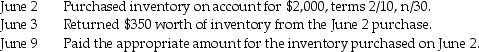

Dexter Warehouse had inventory of $200 on June 1.The company had the following transactions during June.

Prepare the appropriate journal entry for each of the above transactions assuming Dexter Warehouse uses a perpetual inventory system.

Prepare the appropriate journal entry for each of the above transactions assuming Dexter Warehouse uses a perpetual inventory system.

Prepare the appropriate journal entry for each of the above transactions assuming Dexter Warehouse uses a perpetual inventory system.

Prepare the appropriate journal entry for each of the above transactions assuming Dexter Warehouse uses a perpetual inventory system.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following inventory methods physically links the particular items sold with the actual cost of goods sold for the items sold?

A)FIFO

B)LIFO

C)Weighted-average

D)Specific identification

E)FIFO and LIFO

A)FIFO

B)LIFO

C)Weighted-average

D)Specific identification

E)FIFO and LIFO

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

52

When inventory prices are rising,all of the following are reasons for choosing the LIFO method versus the FIFO method except:

A)LIFO generally results in lower income taxes paid.

B)LIFO uses more current costs in calculating cost of goods sold.

C)LIFO permits management to influence income by the timing of inventory purchases.

D)LIFO reports the most up-to-date inventory values on the balance sheet.

E)None of the above is correct.

A)LIFO generally results in lower income taxes paid.

B)LIFO uses more current costs in calculating cost of goods sold.

C)LIFO permits management to influence income by the timing of inventory purchases.

D)LIFO reports the most up-to-date inventory values on the balance sheet.

E)None of the above is correct.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

53

Inventory Shrinkage Expense decreases cost of goods sold.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

54

When inventory prices are rising,the FIFO method will generally yield a gross profit that is

A)less than the LIFO method.

B)equal to the gross profit of the LIFO method.

C)FIFO does not generally cause a gross profit that is different from that of any other costing method.

D)higher than the LIFO method.

E)All of the above are correct.

A)less than the LIFO method.

B)equal to the gross profit of the LIFO method.

C)FIFO does not generally cause a gross profit that is different from that of any other costing method.

D)higher than the LIFO method.

E)All of the above are correct.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

55

Polltok Pools & Spas had cost of goods sold for July,20X3 totaling $670,000.Purchase Discounts used by Polltok Pools & Spas totaled $4,500 and discounts used by customers totaled $3,000.Sales returns were $2,000 while purchase returns were $ 3,800.Total purchases amounted to $700,000.The inventory balance on July 1,20X3 was $ 70,000.The company uses the periodic inventory system.Determine Polltok Pools & Spas' ending inventory.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

56

Color Images,Inc.started March 1,20X3 with an inventory balance of 20 pieces of lumber originally purchased for $2.00 per piece.During the month,the company purchased 100 pieces of lumber for $2.00 per piece for cash and sold 50 pieces of lumber on account to one contractor for $5.00 per piece.At the end of March,20X3,Color Images,Inc.conducted a physical inventory of its lumber and accounted for 66 pieces of lumber.The company uses a perpetual inventory system.Make the necessary journal entries for the month of March,20X3.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following statements best describes how management selects an inventory valuation method?

A)If a company generally sells its oldest inventory first,it must use the FIFO inventory valuation method.

B)If a company generally sells its oldest inventory first,it must use the LIFO inventory valuation method.

C)If a company generally sells its newest inventory first,it must use the FIFO inventory valuation method.

D)If a company sometimes sells its newest inventory and sometimes sells its oldest inventory,then it must use the weighted average inventory valuation method.

E)A company may choose any inventory valuation method even if it is contradictory to the physical flow of inventory.

A)If a company generally sells its oldest inventory first,it must use the FIFO inventory valuation method.

B)If a company generally sells its oldest inventory first,it must use the LIFO inventory valuation method.

C)If a company generally sells its newest inventory first,it must use the FIFO inventory valuation method.

D)If a company sometimes sells its newest inventory and sometimes sells its oldest inventory,then it must use the weighted average inventory valuation method.

E)A company may choose any inventory valuation method even if it is contradictory to the physical flow of inventory.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

58

Assuming inflation,which of the following relationships among inventory valuation methods is incorrectly stated?

A)FIFO has a higher ending inventory balance and a higher net income than LIFO.

B)FIFO has a higher ending inventory balance and a higher net income than weighted-average.

C)LIFO has a higher ending inventory balance and a higher net income than weighted-average.

D)Weighted-average has a higher ending inventory balance and a lower cost of goods sold than LIFO.

E)LIFO has a lower ending inventory balance and a higher cost of goods sold than FIFO.

A)FIFO has a higher ending inventory balance and a higher net income than LIFO.

B)FIFO has a higher ending inventory balance and a higher net income than weighted-average.

C)LIFO has a higher ending inventory balance and a higher net income than weighted-average.

D)Weighted-average has a higher ending inventory balance and a lower cost of goods sold than LIFO.

E)LIFO has a lower ending inventory balance and a higher cost of goods sold than FIFO.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

59

Using the FIFO method,the earliest purchases of inventory are assumed to be contained

A)on the balance sheet as part of ending inventory.

B)on the income statement as part of cost of goods sold.

C)equally split between the income statement and the balance sheet.

D)Impossible to determine from the given data

E)The earliest purchases of inventory under FIFO are not shown on any financial statement.

A)on the balance sheet as part of ending inventory.

B)on the income statement as part of cost of goods sold.

C)equally split between the income statement and the balance sheet.

D)Impossible to determine from the given data

E)The earliest purchases of inventory under FIFO are not shown on any financial statement.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

60

Under the periodic inventory system,freight-in is an additional part of cost of goods sold.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

61

The specific identification method is frequently used for items with common characteristics,such as tons of coal.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

62

Biscuit Bakery had the following activity in its inventory account during August 20X3.  What is the cost of goods sold for the month ended August 31,20X3,for Biscuit Bakery if the company uses periodic FIFO as its inventory valuation method?

What is the cost of goods sold for the month ended August 31,20X3,for Biscuit Bakery if the company uses periodic FIFO as its inventory valuation method?

A)$424.00

B)$485.00

C)$488.00

D)$500.00

E)$584.00

What is the cost of goods sold for the month ended August 31,20X3,for Biscuit Bakery if the company uses periodic FIFO as its inventory valuation method?

What is the cost of goods sold for the month ended August 31,20X3,for Biscuit Bakery if the company uses periodic FIFO as its inventory valuation method?A)$424.00

B)$485.00

C)$488.00

D)$500.00

E)$584.00

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

63

Under the FIFO method,ending inventory is valued based on the oldest unit costs.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

64

If unit costs and prices did not fluctuate,specific identification,LIFO,FIFO,and weighted-average would show the same ending inventory and cost of goods sold balances.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

65

Biscuit Bakery had the following activity in its inventory account during August 20X3.  What is the cost of goods sold for the month ended August 31,20X3,for Biscuit Bakery if the company uses perpetual LIFO as its inventory valuation method?

What is the cost of goods sold for the month ended August 31,20X3,for Biscuit Bakery if the company uses perpetual LIFO as its inventory valuation method?

A)$344

B)$482

C)$494

D)$502

E)$542

What is the cost of goods sold for the month ended August 31,20X3,for Biscuit Bakery if the company uses perpetual LIFO as its inventory valuation method?

What is the cost of goods sold for the month ended August 31,20X3,for Biscuit Bakery if the company uses perpetual LIFO as its inventory valuation method?A)$344

B)$482

C)$494

D)$502

E)$542

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

66

Biscuit Bakery had the following activity in its inventory account during August 20X3.  What is the ending inventory balance at August 31,20X3,for Biscuit Bakery if the company uses perpetual LIFO as its inventory valuation method?

What is the ending inventory balance at August 31,20X3,for Biscuit Bakery if the company uses perpetual LIFO as its inventory valuation method?

A)$240

B)$270

C)$288

D)$300

E)$438

What is the ending inventory balance at August 31,20X3,for Biscuit Bakery if the company uses perpetual LIFO as its inventory valuation method?

What is the ending inventory balance at August 31,20X3,for Biscuit Bakery if the company uses perpetual LIFO as its inventory valuation method?A)$240

B)$270

C)$288

D)$300

E)$438

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

67

There is no difference in the value of ending inventory if a company uses perpetual FIFO as opposed to periodic FIFO.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

68

Biscuit Bakery had the following activity in its inventory account during August 20X3.  What is the ending inventory at August 31,20X3,for Biscuit Bakery if the company uses periodic weighted average as its inventory valuation method (round all calculations to the nearest penny)?

What is the ending inventory at August 31,20X3,for Biscuit Bakery if the company uses periodic weighted average as its inventory valuation method (round all calculations to the nearest penny)?

A)$281.70

B)$285.60

C)$290.22

D)$290.70

E)$294.00

What is the ending inventory at August 31,20X3,for Biscuit Bakery if the company uses periodic weighted average as its inventory valuation method (round all calculations to the nearest penny)?

What is the ending inventory at August 31,20X3,for Biscuit Bakery if the company uses periodic weighted average as its inventory valuation method (round all calculations to the nearest penny)?A)$281.70

B)$285.60

C)$290.22

D)$290.70

E)$294.00

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

69

IFRS prohibits the use of the ________ method of inventory valuation.

A)FIFO

B)weighted-average

C)moving average

D)specific identification

E)LIFO

A)FIFO

B)weighted-average

C)moving average

D)specific identification

E)LIFO

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

70

LIFO tends to decrease taxes when

A)costs are declining.

B)costs are constant.

C)costs are increasing.

D)LIFO will always yield the lowest possible taxes.

E)Impossible to determine without specific cost data

A)costs are declining.

B)costs are constant.

C)costs are increasing.

D)LIFO will always yield the lowest possible taxes.

E)Impossible to determine without specific cost data

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

71

Assuming inflation,the weighted-average method will result in a net income that is higher than LIFO.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

72

An attribute associated with inventory valuation methods is that the lower the cost of goods sold the higher the ending inventory.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

73

LIFO matches cost of goods sold to sales on the income statement more accurately than does FIFO.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

74

The consistency convention requires a company to use LIFO from year to year.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

75

FIFO will report the highest cost of goods sold on the income statement when prices are falling.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

76

LIFO results in a more accurate valuation of ending inventory on the balance sheet than does FIFO.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

77

Assuming inflation,FIFO will result in a higher net income than LIFO.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

78

When prices are rising,LIFO generally results in the lowest taxable income,and therefore helps reduce taxes paid.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

79

FIFO tends to decrease taxes when

A)costs are increasing.

B)costs are decreasing.

C)costs are constant.

D)FIFO will always yield the lowest possible taxes.

E)Impossible to determine without specific cost data

A)costs are increasing.

B)costs are decreasing.

C)costs are constant.

D)FIFO will always yield the lowest possible taxes.

E)Impossible to determine without specific cost data

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

80

Biscuit Bakery had the following activity in its inventory account during August 20X3.  What is the ending inventory balance at August 31,20X3,for Biscuit Bakery if the company uses periodic LIFO as its inventory valuation method?

What is the ending inventory balance at August 31,20X3,for Biscuit Bakery if the company uses periodic LIFO as its inventory valuation method?

A)$240

B)$270

C)$288

D)$300

E)$438

What is the ending inventory balance at August 31,20X3,for Biscuit Bakery if the company uses periodic LIFO as its inventory valuation method?

What is the ending inventory balance at August 31,20X3,for Biscuit Bakery if the company uses periodic LIFO as its inventory valuation method?A)$240

B)$270

C)$288

D)$300

E)$438

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck