Deck 15: Current Liabilities Management

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/171

Play

Full screen (f)

Deck 15: Current Liabilities Management

1

1/15 net 30 date of invoice translates as ________.

A)a 1 percent cash discount may be taken if paid in 15 days; if no cash discount is taken,the balance is due in 30 days after the middle of the month

B)a 1 percent cash discount may be taken if paid in 15 days; if no cash discount is taken,the balance is due 30 days after the invoice date

C)a 1 percent cash discount may be taken if paid in 15 days; if no cash discount is taken,the balance is due 30 days after the end of the month

D)a 1 percent discount may be taken on 15 percent of the purchase if the account is paid within 30 days after the end of the month

A)a 1 percent cash discount may be taken if paid in 15 days; if no cash discount is taken,the balance is due in 30 days after the middle of the month

B)a 1 percent cash discount may be taken if paid in 15 days; if no cash discount is taken,the balance is due 30 days after the invoice date

C)a 1 percent cash discount may be taken if paid in 15 days; if no cash discount is taken,the balance is due 30 days after the end of the month

D)a 1 percent discount may be taken on 15 percent of the purchase if the account is paid within 30 days after the end of the month

a 1 percent cash discount may be taken if paid in 15 days; if no cash discount is taken,the balance is due 30 days after the invoice date

2

Accruals and accounts payable are ________.

A)negotiated and secured sources of long-term financing

B)negotiated and unsecured sources of short-term financing

C)secured sources of short-term financing

D)spontaneous and unsecured sources of short-term financing

A)negotiated and secured sources of long-term financing

B)negotiated and unsecured sources of short-term financing

C)secured sources of short-term financing

D)spontaneous and unsecured sources of short-term financing

spontaneous and unsecured sources of short-term financing

3

One of the most common designations for the beginning of the credit period is ________.

A)2/10

B)the date of invoice

C)the end of a quarter

D)the transaction date

A)2/10

B)the date of invoice

C)the end of a quarter

D)the transaction date

the date of invoice

4

For firms that are in a financial position to take a cash discount,it is advisable not to take the discount if the terms offered are 2/10 net 30.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

5

Spontaneous unsecured financing has a specific interest cost associated with it that can be at a fixed or floating rate.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

6

As sales increase,a company needs more inventory and more employees resulting in ________.

A)more accounts payable and accruals,and therefore increasing its spontaneous liabilities

B)less accounts payable and accruals,and therefore decreasing its spontaneous liabilities

C)more accounts payable and accruals,and therefore decreasing its spontaneous liabilities

D)less accounts payable and accruals,and therefore increasing its spontaneous liabilities

A)more accounts payable and accruals,and therefore increasing its spontaneous liabilities

B)less accounts payable and accruals,and therefore decreasing its spontaneous liabilities

C)more accounts payable and accruals,and therefore decreasing its spontaneous liabilities

D)less accounts payable and accruals,and therefore increasing its spontaneous liabilities

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

7

Spontaneous liabilities such as accounts payable and notes payable represent a source of financing that arise from the normal course of business.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

8

The two major spontaneous liabilities that provide sources of short-term financing are ________.

A)a line of credit and notes payable

B)accounts payable and accruals

C)a line of credit and term loans

D)accounts receivable and notes payable

A)a line of credit and notes payable

B)accounts payable and accruals

C)a line of credit and term loans

D)accounts receivable and notes payable

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

9

Spontaneous liabilities such as accounts payable and accruals represent a source of financing that arise from the normal course of business.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

10

Accounts payable are spontaneous secured sources of short-term financing that arise from the normal operations of a firm.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

11

3/10 net 45 EOM translates as ________.

A)a 10 percent cash discount may be taken if paid in three days; if no cash discount is taken,the balance is due in 45 days

B)a 3 percent cash discount may be taken if paid in 10 days; if no cash discount is taken,the balance is due 45 days after transaction is complete

C)a 3 percent cash discount may be taken if paid in 10 days; if no cash discount is taken,the balance is due 45 days after the end of the month

D)a 3 percent discount may be taken on 10 percent of the purchase if the account is paid within 45 days after the end of the month

A)a 10 percent cash discount may be taken if paid in three days; if no cash discount is taken,the balance is due in 45 days

B)a 3 percent cash discount may be taken if paid in 10 days; if no cash discount is taken,the balance is due 45 days after transaction is complete

C)a 3 percent cash discount may be taken if paid in 10 days; if no cash discount is taken,the balance is due 45 days after the end of the month

D)a 3 percent discount may be taken on 10 percent of the purchase if the account is paid within 45 days after the end of the month

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

12

Accounts payable results from transactions in which merchandise is purchased but no formal note is signed to show the purchaser's liability to the seller.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

13

In giving up a cash discount,the amount of the discount that is given up is the interest being paid by a firm to keep its money by delaying payment for a number of days.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

14

The cost of giving up a cash discount is the implied rate of interest paid in order to delay payment of an account payable for an additional number of days.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

15

For firms that are in a financial position to take a cash discount,it is advisable to take the discount if the terms offered are 2/10 net 30.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

16

In credit terms,EOM (End-of-Month)indicates that the accounts payable must be paid by the end of the month in which the merchandise has been purchased.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

17

If a firm anticipates stretching accounts payable,its cost of giving up a cash discount is reduced.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

18

Spontaneous liabilities such as accounts payable and accruals represent a use of financing that arise from the normal course of business.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

19

A firm should take the cash discount if the firm's cost of borrowing from the bank is greater than the cost of giving up a cash discount.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

20

Notes payable are either spontaneous secured or spontaneous unsecured financing and result from the normal operations of a firm.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

21

The cost of giving up a cash discount under the terms of sale 5/20 net 120 (assume a 360-day year)is ________.

A)15 percent

B)18.9 percent

C)15.8 percent

D)20 percent

A)15 percent

B)18.9 percent

C)15.8 percent

D)20 percent

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

22

It would be a financially sound decision to pay employees once every two weeks rather than once a month.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

23

Tangshan Mining was extended credit terms of 3/15 net 30 EOM.The cost of giving up the cash discount,assuming payment would be made on the last day of the credit period,would be ________.If the firm were able to stretch its accounts payable to 60 days without damaging its credit rating,the cost of giving up the cash discount would only be ________.

A)72.99%; 18.81%

B)72.99%; 18.25%

C)75.25%; 21.90%

D)75.26%; 25.09%

A)72.99%; 18.81%

B)72.99%; 18.25%

C)75.25%; 21.90%

D)75.26%; 25.09%

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

24

When a firm stretches accounts payable without hurting its credit rating,the cost of giving up a cash discount is ________.

A)reduced

B)increased

C)unaffected

D)increased or decreased depending on the opening accounts payable balance

A)reduced

B)increased

C)unaffected

D)increased or decreased depending on the opening accounts payable balance

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

25

As part of a union negotiation agreement,the United Clerical Workers Union conceded to be paid every two weeks instead of every week.A major firm employing hundreds of clerical workers had a weekly payroll of $1,000,000 and the cost of short-term funds was 12 percent.The effect of this concession was to delay clearing time by one week.Due to the concession,the firm ________.

A)realized an annual loss of $120,000

B)realized an annual savings of $120,000

C)increased its cash cycle

D)decreased its cash turnover

A)realized an annual loss of $120,000

B)realized an annual savings of $120,000

C)increased its cash cycle

D)decreased its cash turnover

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

26

If a firm decides to take the cash discount that is offered on goods purchased on credit,the firm should ________.

A)pay as soon as possible

B)pay on the last day of the credit period

C)not take the discount no matter when the firm actually pays

D)pay on or before the last day of the discount period

A)pay as soon as possible

B)pay on the last day of the credit period

C)not take the discount no matter when the firm actually pays

D)pay on or before the last day of the discount period

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

27

The cost of giving up a cash discount on a credit purchase is ________.

A)added on to the price of the goods in order to make payment quickly

B)deducted from the price of the goods in order to make payment quickly

C)the implied interest rate paid in order to delay payment for an additional number of days

D)the true purchase price of the goods

A)added on to the price of the goods in order to make payment quickly

B)deducted from the price of the goods in order to make payment quickly

C)the implied interest rate paid in order to delay payment for an additional number of days

D)the true purchase price of the goods

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

28

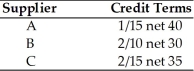

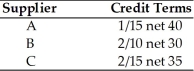

Ashley's Delivery Service is analyzing the credit terms of each of three suppliers,A,B,and C.  (a)Determine the approximate cost of giving up the cash discount (assume a 360-day year).

(a)Determine the approximate cost of giving up the cash discount (assume a 360-day year).

(b)Assuming the firm needs short-term financing,recommend whether or not the firm should give up the cash discount or borrow from the bank at 10 percent annual interest.Evaluate each supplier separately.

(a)Determine the approximate cost of giving up the cash discount (assume a 360-day year).

(a)Determine the approximate cost of giving up the cash discount (assume a 360-day year).(b)Assuming the firm needs short-term financing,recommend whether or not the firm should give up the cash discount or borrow from the bank at 10 percent annual interest.Evaluate each supplier separately.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

29

A firm is offered credit terms of 1/10 net 45 EOM by a major supplier.The firm has determined that it can stretch the credit period (net period only)by 25 days without damaging its credit standing with the supplier.Assuming the firm needs short-term financing and can borrow from the bank on a line of credit at an interest rate of 14 percent,the firm should ________.

A)give up the cash discount and finance the purchase with the line of credit

B)give up the cash discount and pay on the 70th day after the date of sale

C)take the cash discount and pay on the first day of the cash discount period

D)take the cash discount and finance the purchase with the line of credit,the cheaper source of funds

A)give up the cash discount and finance the purchase with the line of credit

B)give up the cash discount and pay on the 70th day after the date of sale

C)take the cash discount and pay on the first day of the cash discount period

D)take the cash discount and finance the purchase with the line of credit,the cheaper source of funds

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

30

A firm purchased goods on January 27 with a purchase price of $1,000 and credit terms of 2/10 net 30 EOM.The firm paid for these goods on February 9.The firm must pay ________ for the goods.

A)$1,000

B)$980

C)$800

D)$900

A)$1,000

B)$980

C)$800

D)$900

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

31

Credit terms 2/10,net 30 means ________.

A)a discount of 10% is granted if payments are done within 30 days

B)a discount of 10% is granted if payments are done within 2 days,net 30 days available

C)a discount of 2% is granted if payments are done within 10 days,net 30 days available

D)a discount of 2% is granted if payments are done within 30 days,beyond which a 10% interest is charged

A)a discount of 10% is granted if payments are done within 30 days

B)a discount of 10% is granted if payments are done within 2 days,net 30 days available

C)a discount of 2% is granted if payments are done within 10 days,net 30 days available

D)a discount of 2% is granted if payments are done within 30 days,beyond which a 10% interest is charged

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

32

Tangshan Mining has extended credit terms of 3/15 net 30 EOM.The cost of giving up the cash discount,assuming payment would be made on the last day of the credit period,is 75.26 percent.If the firm were able to stretch its accounts payable to 60 days without damaging its credit rating,the cost of giving up the cash discount would only be ________.

A)18.81%

B)18.25%

C)21.90%

D)25.09%

A)18.81%

B)18.25%

C)21.90%

D)25.09%

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

33

________ are the major source of unsecured short-term financing for business firms.

A)Accounts receivable

B)Term loans

C)Notes payable

D)Accounts payable

A)Accounts receivable

B)Term loans

C)Notes payable

D)Accounts payable

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

34

Accruals are liabilities for services received for which payment has yet to be made.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

35

If a firm stretches its accounts payable,its cost of giving up a cash discount is increased.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

36

A firm purchased goods with a purchase price of $1,000 and credit terms of 1/10 net 30.The firm paid for these goods on the 5th day after the date of sale.The firm must pay ________ for the goods.

A)$990

B)$900

C)$1,000

D)$1,100

A)$990

B)$900

C)$1,000

D)$1,100

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

37

The cost of giving up a cash discount under the terms of sale 1/10 net 60 (assume a 360-day year)is ________.

A)7.3 percent

B)6.1 percent

C)14.7 percent

D)12.2 percent

A)7.3 percent

B)6.1 percent

C)14.7 percent

D)12.2 percent

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

38

A firm is offered credit terms of 2/10 net 45 by most of its suppliers but frequently does not have the cash available to take the discount.The firm has a credit line available at a local bank at an interest rate of 12 percent.The firm should ________.

A)give up the cash discount,financing the purchase with the line of credit

B)take the cash discount and pay on the 45th day after the date of sale

C)take the cash discount and pay on the first day of the cash discount period

D)take the cash discount,financing the purchase with the line of credit,the cheaper source of funds

A)give up the cash discount,financing the purchase with the line of credit

B)take the cash discount and pay on the 45th day after the date of sale

C)take the cash discount and pay on the first day of the cash discount period

D)take the cash discount,financing the purchase with the line of credit,the cheaper source of funds

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

39

If a firm gives up the cash discount on goods purchased on credit,the firm should pay the bill ________.

A)as per its will

B)on the last day of the discount date

C)after the credit period

D)on the last day of the credit period

A)as per its will

B)on the last day of the discount date

C)after the credit period

D)on the last day of the credit period

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

40

Tangshan Mining has extended credit terms of 3/15 net 30 EOM.The cost of giving up the cash discount,assuming payment would be made on the last day of the credit period,would be ________.

A)75.26%

B)3.1%

C)72.99%

D)37.12%

A)75.26%

B)3.1%

C)72.99%

D)37.12%

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

41

The prime rate of interest fluctuates with changing supply-and-demand relationships for short-term funds.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

42

A line of credit is an agreement between a commercial bank and a business,specifying the amount of unsecured short-term borrowing the bank will make available to the firm over a given period of time.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

43

Jannet Company,currently pays its employees at the end of a week.The weekly payroll totals $400,000.If it were to extend the pay period so as to pay its employees 1 week later throughout an entire year,the employees would in effect be lending the firm ________ for a year.

A)$400,000

B)$20,800,000

C)$4,800,000

D)$675,000

A)$400,000

B)$20,800,000

C)$4,800,000

D)$675,000

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

44

A revolving credit agreement is a form of financing consisting of short-term,unsecured promissory notes issued by firms with a high credit standing.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

45

An increment above the prime rate on a floating-rate loan will be higher than on a fixed-rate loan of equivalent risk because the lender bears higher risk with a floating-rate loan.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

46

The interest rate on a line of credit is normally stated as a fixed rate-the prime rate.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

47

Under a line of credit agreement,a bank may retain the right to revoke the line if any major changes occur in the firm's financial condition or operations.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

48

________ are liabilities for services received for which payment has yet to be made.

A)Notes payable

B)Accruals

C)Accounts payable

D)Accounts receivable

A)Notes payable

B)Accruals

C)Accounts payable

D)Accounts receivable

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

49

Operating change restrictions are contractual restrictions that a bank may impose on a firm as part of a line of credit agreement.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

50

The risk-free rate is the lowest rate of interest charged by the nation's leading banks on business loans to their most important and reliable business borrowers.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

51

The major attraction of a line of credit from the bank's point of view is that it eliminates the need to examine the creditworthiness of a customer each time it borrows money within the year.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

52

Unlike the spontaneous sources of unsecured short-term financing,bank loans are negotiated and result from deliberate actions taken by the financial manager.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

53

Self-liquidating loans are mainly invested in productive assets (i.e.,fixed assets)which provide the mechanism through which the loan is repaid.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

54

Although more expensive than a line of credit,a revolving credit agreement can be less risky from the borrower's viewpoint.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

55

The effective interest rate on a bank loan depends on whether interest is paid when the loan matures or in advance.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

56

A single-payment note is a secured fund which can be obtained from a commercial bank when a borrower needs additional funds for a short period.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

57

A discount loan is a loan on which interest is paid in advance by deducting it from the loan so that the borrower actually receives less money than is requested.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

58

A compensating balance is a checking account balance equal to a certain percentage of the amount borrowed from a bank under a line-of-credit or revolving credit agreement.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

59

Self-liquidating loans are intended merely to carry a firm through seasonal peaks in financing needs that are due primarily to buildups of accounts receivable and inventory.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

60

Under a line of credit agreement,a bank may require an annual cleanup,which means that the borrower must pay off all its outstanding debts to all its operational creditors for a certain number of days during the year.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

61

Revolving credit agreements are guaranteed loans that specify the maximum amount that a firm can owe the bank at any point in time.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

62

Tangshan Mining borrowed $10,000 for one year under a line of credit with a stated interest rate of 8 percent and a 10 percent compensating balance.Thus,the firm keeps a balance of about $800 in its checking account.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

63

Lines of credit are non-guaranteed loans that specify the maximum amount that a firm can owe the bank at any point in time.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

64

Operating-change restrictions gives the bank a right to revoke the line of credit if any major changes occur in a firm's financial condition or operations.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

65

A compensating balance is a balance in checking account that is equal to a certain percentage of the borrower's short-term unsecured loan.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

66

Because the bank guarantees the availability of funds,a commitment fee is normally charged on a simple line of credit agreement.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

67

Cull Incorporated recently borrowed $250,000 from Century Bank when the prime rate was 4%.The loan was for 90 days with interest to be paid at the end of the period with a rate fixed at 1.5% above the prime rate.What is the total interest paid on this loan and what is the effective annual rate? (Assume a 365 day year.)

A)The total interest paid is $3,390.41 and the effective annual rate is 5.62%.

B)The total interest paid is $13,750 and the effective annual rate is 5.62%.

C)The total interest paid is $13,750 and the effective annual rate is 5.55%.

D)The total interest paid is $3,390.41 and the effective annual rate is 1.36%.

A)The total interest paid is $3,390.41 and the effective annual rate is 5.62%.

B)The total interest paid is $13,750 and the effective annual rate is 5.62%.

C)The total interest paid is $13,750 and the effective annual rate is 5.55%.

D)The total interest paid is $3,390.41 and the effective annual rate is 1.36%.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

68

The major type of loan made by banks to businesses is the ________.

A)fixed-asset-based loan

B)short-term secured loan

C)short-term,self-liquidating loan

D)capital improvement loan

A)fixed-asset-based loan

B)short-term secured loan

C)short-term,self-liquidating loan

D)capital improvement loan

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

69

Revolving credit agreements are non-guaranteed loans that specify the minimum amount that a firm can owe the bank at any point in time.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

70

If one borrows $1,000 at 8 percent interest on a discount basis,the effective rate of interest is 7.2 percent.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

71

Lines of credit are guaranteed loans that specify the maximum amount that a firm can owe the bank at any point in time.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

72

A compensating balance not only forces the borrower to be a good customer of the bank but may also raise the interest cost to the borrower.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

73

A fixed-rate loan is a loan whose rate of interest is established at a fixed increment above the prime rate and is allowed to vary above the prime rate only when the prime rate varies until maturity.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

74

The higher the riskiness of a borrower,the higher is the premium charged above the prime rate by a banker.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

75

Short-term,self-liquidating loans are intended to ________.

A)provide one-time loan to the borrower who needs funds for a specific purpose

B)cover seasonal peaks in financing caused by inventory and receivable buildups

C)provide maximum amount to the firm that it can owe to the bank

D)recapitalize the firm

A)provide one-time loan to the borrower who needs funds for a specific purpose

B)cover seasonal peaks in financing caused by inventory and receivable buildups

C)provide maximum amount to the firm that it can owe to the bank

D)recapitalize the firm

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

76

A loan that is usually a one-time loan made to a borrower who needs funds for a specific purpose for a short period is called a ________.

A)term loan

B)bill of exchange

C)mortgage loan

D)single-payment note

A)term loan

B)bill of exchange

C)mortgage loan

D)single-payment note

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

77

The effective interest rate for a discount loan is greater than the loan's stated interest rate.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

78

Short-term loans that businesses obtain from banks and through commercial paper are ________.

A)negotiated and secured

B)negotiated and unsecured

C)spontaneous and secured

D)spontaneous and unsecured

A)negotiated and secured

B)negotiated and unsecured

C)spontaneous and secured

D)spontaneous and unsecured

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

79

The ________ is a rate of interest charged on business loans by the nation's leading banks to creditworthy business borrowers.

A)prime rate

B)commercial paper rate

C)federal funds rate

D)treasury bill rate

A)prime rate

B)commercial paper rate

C)federal funds rate

D)treasury bill rate

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck

80

A commitment fee is the fee that is normally charged on a revolving credit agreement.

Unlock Deck

Unlock for access to all 171 flashcards in this deck.

Unlock Deck

k this deck