Deck 3: Mortgage Loan Foundations: The Time Value of Money

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/30

Play

Full screen (f)

Deck 3: Mortgage Loan Foundations: The Time Value of Money

1

If you deposit $1,000 in an account that earns 5% per year (compounded monthly),what will the balance in the account be at the end of 5 years?

A)$1,272

B)$1,276

C)$1,280

D)$1,283

A)$1,272

B)$1,276

C)$1,280

D)$1,283

$1,283

2

Assuming an interest rate of 6%,the present value of $1 that will be received a year from now is $0.75.

$0.94

3

The future value compound factor given for period (n)at 15%:

A)Would be less than the factor for period (n + 1)at 15%

B)Would be greater than the factor given for period (n + 1)at 15%

C)Would be the same as the factor given for period (n + 1)at 15%

D)Bears no relationship to the factor for period (n + 1)at 15%

A)Would be less than the factor for period (n + 1)at 15%

B)Would be greater than the factor given for period (n + 1)at 15%

C)Would be the same as the factor given for period (n + 1)at 15%

D)Bears no relationship to the factor for period (n + 1)at 15%

Would be less than the factor for period (n + 1)at 15%

4

The future value of a single deposit of $1,000 will be greatest when this amount is compounded:

A)Annually

B)Semi-annually

C)Quarterly

D)Monthly

A)Annually

B)Semi-annually

C)Quarterly

D)Monthly

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

5

Ten years ago,you put $150,000 into an interest-earning account.Today it is worth $275,000.What is the effective annual interest earned on the account?

A)47.99%

B)6.00%

C)6.25%

D)8.33%

A)47.99%

B)6.00%

C)6.25%

D)8.33%

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

6

Assume that an investment,with a single initial cost of $1,000 and a yield of $50 monthly for 10 years,had a 7% IRR in the 60th month and a 7.2% IRR five months later.The IRR can be 6.8% in the 62nd month.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

7

The future value of $800 deposited today would be greater if that deposit earned 8% rather than 7.75%.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

8

Your friend just won the lottery.He has a choice of receiving $50,000 a year for the next 20 years or a lump sum today.The lottery uses a 15% discount rate.What would be the lump sum amount your friend would receive?

A)$312,967

B)$316,426

C)$500,000

D)$1,000,000

A)$312,967

B)$316,426

C)$500,000

D)$1,000,000

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

9

The future value of a $1 annuity compounded at 5% annually is greater than the future value of a $1 annuity compounded at 5% semi-annually.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

10

Your friend has a trust fund that will pay him $100,000 at the end of 10 years.Your friend,however,wants his money today.He promises to sign his trust fund over to you if you give him some money today.You require a 20% interest rate on money you lend to friends.How much would you be willing to lend under these terms?

A)$16,151

B)$50,000

C)$80,000

D)$0-it would be impossible to earn 20% interest on the loan.

A)$16,151

B)$50,000

C)$80,000

D)$0-it would be impossible to earn 20% interest on the loan.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

11

An investment may have more than one internal rate of return.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

12

Begin with a single sum of money at period 0.First,calculate a future value of that sum at 12.01%.Then discount that future value back to period 0 at 11.99%.In relation to the initial single sum,the discounted future value:

A)Is greater than the original amount

B)Is less than the original amount

C)Is the same as the original amount

D)Cannot be determined with the information given

A)Is greater than the original amount

B)Is less than the original amount

C)Is the same as the original amount

D)Cannot be determined with the information given

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

13

The internal rate of return is the good feeling you get inside when you earn a return on your investment.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

14

One way to calculate the present value of a single payment is with the following formula: PV = FV × (1 + i)n.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

15

At the end of 8 years,your friend wants to have $50,000 saved for a down payment on a house.He expects to earn 8%-compounded monthly-on his investments over the next 8 years.How much would your friend have to put in his investment account each month to reach his goal?

A)$188

B)$374

C)$392

D)$521

A)$188

B)$374

C)$392

D)$521

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

16

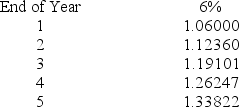

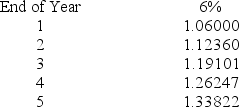

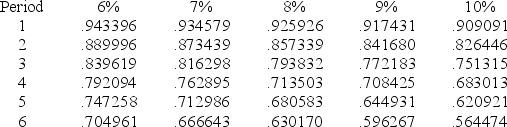

If you saw a table containing the following factors,what kind of interest factor would you be looking at?

A)Present value of a single amount

B)Future value of a single amount

C)Present value of an annuity

D)Future value of an annuity

A)Present value of a single amount

B)Future value of a single amount

C)Present value of an annuity

D)Future value of an annuity

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

17

A deposit placed in an interest-earning account earning 8% a year will double in value in ________ years.

A)6

B)8

C)9

D)72

A)6

B)8

C)9

D)72

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

18

In order to solve a compounding problem,you must know all four of the variables in order to solve for the fifth variable.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

19

You always see an ordinary annuity used in business and never see an annuity due used in business.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

20

The future value of $1,000 compounded annually for 8 years at 12% may be calculated with the following formula: FV = $1,000 * (1 + 12%)8

If the same $1,000 was compounded quarterly,what formula would you use to calculate the FV?

A)FV = $1,000 * (1 + 3%)8

B)FV = $1,000 * (1 + 12%)32

C)FV = $1,000 * (1 + 3%)32

D)FV = $1,000 * (1 + 12%)2

If the same $1,000 was compounded quarterly,what formula would you use to calculate the FV?

A)FV = $1,000 * (1 + 3%)8

B)FV = $1,000 * (1 + 12%)32

C)FV = $1,000 * (1 + 3%)32

D)FV = $1,000 * (1 + 12%)2

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

21

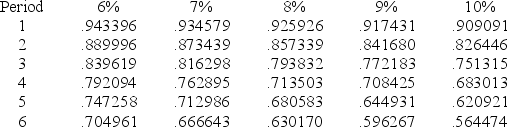

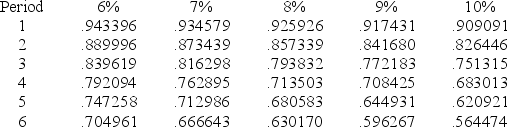

Using only the information in the table below,approximately how much would you pay today for an investment that pays $0 annual interest,but earns 8% interest over the next four years and has a face value at maturity of $13,500? Present Value Factor for Reversion of $1

A)$8,000

B)$9,000

C)$10,000

D)$11,000

A)$8,000

B)$9,000

C)$10,000

D)$11,000

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

22

If Beth make an initial investment of $1,000,how much will it be worth after three years if her average return is 8.25% (use monthly compounding)?

A)$1,268.48

B)$17,354.20

C)$1,279.74

D)$1,020.77

A)$1,268.48

B)$17,354.20

C)$1,279.74

D)$1,020.77

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

23

If an investment earns 12% annually:

A)An equivalent monthly investment would have to earn a higher equivalent nominal rate to yield the same return

B)An equivalent monthly investment would have to earn a lower equivalent nominal rate to yield the same return

C)An equivalent monthly investment would have to earn the same equivalent nominal rate to yield the same return

D)A relation cannot be determined between a monthly and annual investment

A)An equivalent monthly investment would have to earn a higher equivalent nominal rate to yield the same return

B)An equivalent monthly investment would have to earn a lower equivalent nominal rate to yield the same return

C)An equivalent monthly investment would have to earn the same equivalent nominal rate to yield the same return

D)A relation cannot be determined between a monthly and annual investment

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

24

The name for a series of equal,annual cash flows that are received at the end of each period is?

A)Ordinary annuity

B)Annuity due

C)Regular annuity

D)Ordinary annuity due

A)Ordinary annuity

B)Annuity due

C)Regular annuity

D)Ordinary annuity due

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

25

An investment that costs $105,000 today is expected to produce the following cash inflows over each of the next five years: $20,000; $25,000; $23,000; $22,000; $21,000.What is the IRR (compounded annually)for this investment?

A)188.6%

B)18.9%

C)1.89%

D)−18.9%

A)188.6%

B)18.9%

C)1.89%

D)−18.9%

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

26

How much money does Ted need to invest each month in order to accumulate $10,000 over a five-year period,if he expects to get a return of 5.625% per year?

A)$144.71

B)$1,787.30

C)$148.94

D)$146.36

A)$144.71

B)$1,787.30

C)$148.94

D)$146.36

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

27

For situations calling for other than annual compounding,each of these factors (when present)must be adjusted for the number of compounding periods in a year:

A)PV & FV

B)N & i,

C)N,i,& PMT

D)N,i,PV,& PMT

A)PV & FV

B)N & i,

C)N,i,& PMT

D)N,i,PV,& PMT

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following is not a basic component of any compounding problem?

A)An initial deposit

B)An interest rate

C)A period of time

D)A net present value

A)An initial deposit

B)An interest rate

C)A period of time

D)A net present value

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

29

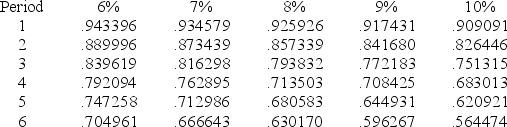

Using only the information in the table below,what would the IRR be for an investment that cost $500 in period 0 and was sold for $750 in period 5? Present Value Factor for Reversion of $1

A)Between 6% and 7%

B)Between 7% and 8%

C)Between 8% and 9%

D)Between 9% and 10%

A)Between 6% and 7%

B)Between 7% and 8%

C)Between 8% and 9%

D)Between 9% and 10%

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

30

The internal rate of return:

A)Is also known as the investment of investor's yield

B)Represents a return on investment expressed as a compound rate of interest

C)Is calculated by setting the price of an investment equal to the stream of cash flows it generates and solving for the interest rate

D)Can be defined by all of the above

A)Is also known as the investment of investor's yield

B)Represents a return on investment expressed as a compound rate of interest

C)Is calculated by setting the price of an investment equal to the stream of cash flows it generates and solving for the interest rate

D)Can be defined by all of the above

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck