Deck 11: The Income Statement the Statement of Stockholders Equity

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/145

Play

Full screen (f)

Deck 11: The Income Statement the Statement of Stockholders Equity

1

Ongoing expenses incurred by the entity, other than direct expenses for merchandise and other costs directly related to sales, are called:

A)cost of goods sold.

B)extraordinary items.

C)operating expenses.

D)other expenses.

A)cost of goods sold.

B)extraordinary items.

C)operating expenses.

D)other expenses.

C

2

Steadily decreasing cost of goods sold as a percentage of net sales is a sign of:

A)decreasing earnings quality.

B)increasing earnings quality.

C)earnings quality remaining the same.

D)none of the above.

A)decreasing earnings quality.

B)increasing earnings quality.

C)earnings quality remaining the same.

D)none of the above.

B

3

Each identifiable part of a company is called a business segment.

True

4

In order to recognize revenue:

A)the seller must deliver the product or service to the customer.

B)the customer must take possession and ownership of the product or service.

C)the seller must either collect the cash or be reasonably assured of collecting the cash in the near future.

D)all of the above must occur.

A)the seller must deliver the product or service to the customer.

B)the customer must take possession and ownership of the product or service.

C)the seller must either collect the cash or be reasonably assured of collecting the cash in the near future.

D)all of the above must occur.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

5

"Top line" decline means that cost of goods sold is declining.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

6

Components of earnings quality include:

A)proper revenue and expense recognition.

B)low operating expenses compared to sales.

C)high and improving gross margin.

D)all of the above.

A)proper revenue and expense recognition.

B)low operating expenses compared to sales.

C)high and improving gross margin.

D)all of the above.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

7

Most financial statement frauds recognize revenues later than they should be recognized and expenses before they should be recognized.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

8

The value of a company's stock can be estimated by dividing the company's current year estimated annual income by the investment capitalization rate.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

9

Financial statement fraud can include the improper recognition of expenses.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

10

Roughly half of all financial statement frauds over the past two decades have involved:

A)improper depreciation methods.

B)improper expense recognition.

C)improper revenue recognition.

D)discontinued operations.

A)improper depreciation methods.

B)improper expense recognition.

C)improper revenue recognition.

D)discontinued operations.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

11

The characteristic of an earnings number that makes it most useful for decision making is called:

A)comprehensive income.

B)clean opinion.

C)earnings quality.

D)extraordinary item.

A)comprehensive income.

B)clean opinion.

C)earnings quality.

D)extraordinary item.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

12

Revenue frauds include:

A)channel stuffing.

B)sales to nonexistent customers.

C)reporting revenue when goods have not yet been delivered.

D)all of the above.

A)channel stuffing.

B)sales to nonexistent customers.

C)reporting revenue when goods have not yet been delivered.

D)all of the above.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

13

To estimate the value of a company's common stock, financial analysts determine the present value of the company's stream of future income.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

14

A type of financial statement fraud that is accomplished by shipping more to customers than they ordered, with the expectation that they may return some or all of it is called:

A)fictitious sales.

B)earnings quality.

C)channel stuffing.

D)improper expense recognition.

A)fictitious sales.

B)earnings quality.

C)channel stuffing.

D)improper expense recognition.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

15

Under the accrual method of accounting, a retail store recognizes revenue at the time the customers receive and pay for the merchandise.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

16

U.S. GAAP and IFRS always have the same revenue recognition criteria.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

17

The higher the risk of the investment, the higher the investment capitalization rate.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

18

The purpose of channel stuffing is to decrease operating expenses.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

19

The degree to which earnings are an accurate reflection of underlying economic events for both revenues and expenses, and the extent to which earnings from a company's core operations are improving over time, is:

A)comprehensive income.

B)discontinued operations.

C)earnings quality.

D)revenue recognition.

A)comprehensive income.

B)discontinued operations.

C)earnings quality.

D)revenue recognition.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

20

Companies will recognize revenues earlier than required by GAAP to meet company sales targets which are often tied to executive bonuses.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

21

A company sold an unused building at a loss. The loss from this event would be shown as:

A)a prior-period adjustment.

B)an extraordinary item.

C)a normal business occurrence requiring an adjustment to the beginning balance in Retained Earnings.

D)other gains and losses.

A)a prior-period adjustment.

B)an extraordinary item.

C)a normal business occurrence requiring an adjustment to the beginning balance in Retained Earnings.

D)other gains and losses.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following must be reported on the income statement as a cumulative effect of change in accounting principle?

A)Change from straight-line to double-declining-balance method of computing depreciation

B)Change from double-declining-balance to straight-line method of computing depreciation

C)Both A and B

D)Neither A nor B

A)Change from straight-line to double-declining-balance method of computing depreciation

B)Change from double-declining-balance to straight-line method of computing depreciation

C)Both A and B

D)Neither A nor B

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following would probably be reported as an extraordinary gain or loss?

A)Retiring bonds payable

B)Corporate restructuring

C)A natural disaster

D)All of the above

A)Retiring bonds payable

B)Corporate restructuring

C)A natural disaster

D)All of the above

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

24

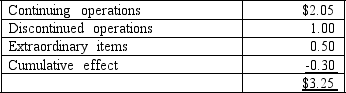

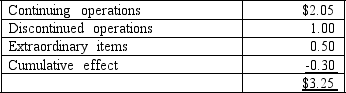

Current earnings per share information is as follows:  The interest capitalization rate is 8%. How much should an investor pay for a share of stock?

The interest capitalization rate is 8%. How much should an investor pay for a share of stock?

A)$25.63

B)$28.13

C)$40.63

D)$31.88

The interest capitalization rate is 8%. How much should an investor pay for a share of stock?

The interest capitalization rate is 8%. How much should an investor pay for a share of stock?A)$25.63

B)$28.13

C)$40.63

D)$31.88

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

25

A business incurs a loss from a hurricane. It is the first time the business has had a loss from such an event. This loss would probably be classified on an income statement as an:

A)extraordinary item.

B)other expense item.

C)operating expense.

D)adjustment to the beginning balance of retained earnings.

A)extraordinary item.

B)other expense item.

C)operating expense.

D)adjustment to the beginning balance of retained earnings.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

26

A company that switches from straight-line depreciation to double-declining-balance depreciation during an accounting period must report this change on the financial statements as:

A)income from continuing operations in current and prospective periods.

B)a prior-period adjustment.

C)an extraordinary item.

D)a cumulative effect of a change in accounting principle.

A)income from continuing operations in current and prospective periods.

B)a prior-period adjustment.

C)an extraordinary item.

D)a cumulative effect of a change in accounting principle.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

27

The actual market value of a corporation can be calculated by:

A)multiplying the shares outstanding times the current market price per share.

B)subtracting the current market price per share from the shares outstanding.

C)dividing the current market price per share by the shares outstanding.

D)dividing the shares outstanding by the current market price per share.

A)multiplying the shares outstanding times the current market price per share.

B)subtracting the current market price per share from the shares outstanding.

C)dividing the current market price per share by the shares outstanding.

D)dividing the shares outstanding by the current market price per share.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

28

The gain or loss on the disposal of a business segment is shown on the income statement as:

A)a component of comprehensive income.

B)an extraordinary item.

C)part of discontinued operations.

D)other gains or losses.

A)a component of comprehensive income.

B)an extraordinary item.

C)part of discontinued operations.

D)other gains or losses.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

29

The value of a company's stock can be estimated by dividing the:

A)company's retained earnings by the estimated annual income in the future.

B)company's estimated annual income in the future by the investment capitalization rate.

C)company's current annual income by the future estimated investment capitalization rate.

D)company's investment capitalization rate by retained earnings.

A)company's retained earnings by the estimated annual income in the future.

B)company's estimated annual income in the future by the investment capitalization rate.

C)company's current annual income by the future estimated investment capitalization rate.

D)company's investment capitalization rate by retained earnings.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

30

The estimated value of a company's stock exceeds the current market value of the company. The appropriate investment decision should be:

A)to hold the company's stock.

B)to buy the company's stock.

C)to sell the company's stock.

D)none of the above. The analyst does not have sufficient information to make a prudent investment decision in this situation.

A)to hold the company's stock.

B)to buy the company's stock.

C)to sell the company's stock.

D)none of the above. The analyst does not have sufficient information to make a prudent investment decision in this situation.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

31

Changes in accounting estimates:

A)are reported for the current and future periods on the new basis.

B)require prior financial statements to be restated.

C)are not allowed under GAAP.

D)are a prior period adjustment.

A)are reported for the current and future periods on the new basis.

B)require prior financial statements to be restated.

C)are not allowed under GAAP.

D)are a prior period adjustment.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

32

A company incurs a loss due to restructuring. This is the first time the company has experienced a restructuring. The loss from this event would be shown as:

A)a normal business occurrence requiring an adjustment to the beginning balance in Retained Earnings. B a prior-period adjustment.

C)an extraordinary item.

D)other gains and losses.

A)a normal business occurrence requiring an adjustment to the beginning balance in Retained Earnings. B a prior-period adjustment.

C)an extraordinary item.

D)other gains and losses.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

33

Changes in accounting principles:

A)are reported for the current and future periods on the new basis.

B)require the company to retrospectively restate all prior-period amounts presented for comparative purposes.

C)are not allowed under GAAP.

D)are shown on the balance sheet.

A)are reported for the current and future periods on the new basis.

B)require the company to retrospectively restate all prior-period amounts presented for comparative purposes.

C)are not allowed under GAAP.

D)are shown on the balance sheet.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

34

The gain or loss on the disposal of a business segment is shown:

A)on the balance sheet net of the income tax consequences.

B)on the income statement net of the income tax consequences.

C)as part of other comprehensive income.

D)as part of extraordinary items.

A)on the balance sheet net of the income tax consequences.

B)on the income statement net of the income tax consequences.

C)as part of other comprehensive income.

D)as part of extraordinary items.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

35

Extraordinary items:

A)are treated the same under IFRS and GAAP.

B)include a loss from a lawsuit.

C)include the expropriation of a company's assets by a foreign government.

D)include a loss from the sale of plant assets.

A)are treated the same under IFRS and GAAP.

B)include a loss from a lawsuit.

C)include the expropriation of a company's assets by a foreign government.

D)include a loss from the sale of plant assets.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following should probably be included when estimating future earnings?

A)Income from continuing operations

B)Gain on sale of business segment

C)Loss due to natural disaster

D)Both A and B

A)Income from continuing operations

B)Gain on sale of business segment

C)Loss due to natural disaster

D)Both A and B

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

37

Putman Corporation reported income from continuing operations of $58,000 and net income of $65,000. Putman had 200,000 shares of $2.00 par value common stock outstanding for the year. The capitalization rate is 12%. The appropriate investment decision should be to:

A)sell the stock.

B)buy the stock.

C)hold the stock.

D)obtain additional information before making a decision.

A)sell the stock.

B)buy the stock.

C)hold the stock.

D)obtain additional information before making a decision.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following criteria must be met before an item is considered extraordinary?

A)The item must be unusual in its nature.

B)The item must either be unusual in nature or infrequent in its occurrence.

C)The item must be both unusual in nature and infrequent in occurrence.

D)The item must be infrequent in its occurrence.

A)The item must be unusual in its nature.

B)The item must either be unusual in nature or infrequent in its occurrence.

C)The item must be both unusual in nature and infrequent in occurrence.

D)The item must be infrequent in its occurrence.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

39

Accounting changes:

A)can be a way for a company to create profits when the company can't earn enough from continuing operations.

B)must be disclosed, including their effects on earnings.

C)are allowed under GAAP if there is a valid reason for the change.

D)include all of the above.

A)can be a way for a company to create profits when the company can't earn enough from continuing operations.

B)must be disclosed, including their effects on earnings.

C)are allowed under GAAP if there is a valid reason for the change.

D)include all of the above.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

40

The earnings rate used to estimate the value of an investment in stock is the:

A)investment rate.

B)market rate.

C)stated rate.

D)investment capitalization rate.

A)investment rate.

B)market rate.

C)stated rate.

D)investment capitalization rate.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

41

The existence of the Deferred Tax Liability account indicates that the company lacked sufficient cash to pay its tax bill.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

42

Earnings per share is computed for which of the following?

A)Comprehensive income

B)Discontinued operations

C)Prior-period adjustments

D)All of the above

A)Comprehensive income

B)Discontinued operations

C)Prior-period adjustments

D)All of the above

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

43

Companies generally use an accelerated method to compute depreciation for tax purposes and the straight-line method to compute depreciation for the financial statements.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

44

Which items are excluded from the determination of net income, but are included in the determination of other comprehensive income?

A)Realized gains and losses on the sale of available-for-sale securities

B)Foreign currency exchange gains and losses

C)Foreign currency translation adjustments

D)All of the above

A)Realized gains and losses on the sale of available-for-sale securities

B)Foreign currency exchange gains and losses

C)Foreign currency translation adjustments

D)All of the above

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

45

The amount of a company's net income per share of its outstanding common stock is:

A)earnings per share.

B)comprehensive income per share.

C)income per share

D)taxable income per share.

A)earnings per share.

B)comprehensive income per share.

C)income per share

D)taxable income per share.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

46

Deferred tax liability is computed by multiplying taxable income by the income tax rate.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

47

If a company records a revenue or expense incorrectly, and the error is not corrected until a later period, the balance of Retained earnings is wrong until the error is corrected.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

48

Earnings per share (EPS)is calculated as:

A)the average number of shares of common stock outstanding throughout the year divided by net income.

B)the number of shares of common stock outstanding at the end of the year divided by net income.

C)net income divided by the number of shares of common stock outstanding at the end of the year.

D)net income divided by the average number of shares of common stock outstanding throughout the year.

A)the average number of shares of common stock outstanding throughout the year divided by net income.

B)the number of shares of common stock outstanding at the end of the year divided by net income.

C)net income divided by the number of shares of common stock outstanding at the end of the year.

D)net income divided by the average number of shares of common stock outstanding throughout the year.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

49

Which statement below is TRUE regarding EPS and a company's financial statements?

A)An EPS figure should be calculated and presented for each significant element of net income on the income statement.

B)EPS is based on the weighted-average shares of preferred stock outstanding for an accounting period.

C)EPS based on the actual outstanding number of common shares of stock is called diluted EPS.

D)The EPS calculation never takes into consideration preferred stock or preferred stock dividends.

A)An EPS figure should be calculated and presented for each significant element of net income on the income statement.

B)EPS is based on the weighted-average shares of preferred stock outstanding for an accounting period.

C)EPS based on the actual outstanding number of common shares of stock is called diluted EPS.

D)The EPS calculation never takes into consideration preferred stock or preferred stock dividends.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

50

When computing earnings per share, preferred dividends are:

A)subtracted from common shares in the denominator of the EPS calculation.

B)subtracted from net income in the numerator of the EPS calculation.

C)added to net income in the numerator of the EPS calculation.

D)added to common shares in the denominator of the EPS calculation.

A)subtracted from common shares in the denominator of the EPS calculation.

B)subtracted from net income in the numerator of the EPS calculation.

C)added to net income in the numerator of the EPS calculation.

D)added to common shares in the denominator of the EPS calculation.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

51

Unrealized gains or losses on available-for-sale investments are reported as:

A)part of a company's pro forma earnings only.

B)part of a company's net income or loss from its continuing operations.

C)other comprehensive income, since these items do not enter into the determination of net income.

D)none of the above.

A)part of a company's pro forma earnings only.

B)part of a company's net income or loss from its continuing operations.

C)other comprehensive income, since these items do not enter into the determination of net income.

D)none of the above.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

52

Companies with a complex capital structure report:

A)basic EPS.

B)diluted EPS.

C)both A and B.

D)none of the above.

A)basic EPS.

B)diluted EPS.

C)both A and B.

D)none of the above.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

53

Ethelred Corp. reported net income for the current year of $480,000. Ethelred Corp. had 8,500 shares of $100 par value, 15% preferred stock outstanding and 50,000 shares of $10 par value common stock outstanding for the entire year. Earnings per share was:

A)$6.67.

B)$7.05.

C)$7.20.

D)$9.60.

A)$6.67.

B)$7.05.

C)$7.20.

D)$9.60.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

54

Jennings Corporation's net income for the current year was $270,000. The corporation had outstanding 5,000 shares of 10%, $100 par value nonconvertible preferred stock and 10,000 shares of $20 par value common stock. No shares were issued or retired during the year. The amount of income to be used in the basic calculation of earnings per share is:

A)$350,000.

B)$285,000.

C)$220,000.

D)$245,000.

A)$350,000.

B)$285,000.

C)$220,000.

D)$245,000.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

55

A company is required to report both basic and diluted earnings per share when the:

A)company has extraordinary gains and losses.

B)company reports both net income and comprehensive income.

C)company's capital structure includes convertible preferred stock.

D)company's outstanding stock is less than its issued stock.

A)company has extraordinary gains and losses.

B)company reports both net income and comprehensive income.

C)company's capital structure includes convertible preferred stock.

D)company's outstanding stock is less than its issued stock.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

56

Items appear on the income statement in which order?

A)Discontinued operations, extraordinary gains and losses, and income from continuing operations

B)Income from continuing operations, discontinued operations, and extraordinary gains and losses

C)Extraordinary gains and losses, change in accounting principle, and discontinued operations

D)Discontinued operations, extraordinary gains and losses, and income from continuing operations

A)Discontinued operations, extraordinary gains and losses, and income from continuing operations

B)Income from continuing operations, discontinued operations, and extraordinary gains and losses

C)Extraordinary gains and losses, change in accounting principle, and discontinued operations

D)Discontinued operations, extraordinary gains and losses, and income from continuing operations

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

57

Corporations generally credit Income Tax Payable based on the amount of pretax accounting income multiplied by the income tax rate.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

58

When computing earnings per share, preferred dividends are:

A)subtracted from net income and discontinued operations.

B)subtracted from net income.

C)added to net income.

D)added to net income and discontinued operations.

A)subtracted from net income and discontinued operations.

B)subtracted from net income.

C)added to net income.

D)added to net income and discontinued operations.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

59

Prior-period adjustments are reported on the income statement for the period in which it is discovered an adjustment is necessary.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

60

The cumulative effect of a previously recorded accounting error is known as a prior-period adjustment.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

61

For most companies, tax expense equals tax payable.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

62

Gains and losses on the sale of available-for-sale securities are used to compute comprehensive income.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

63

The amount of tax to pay the government in the next period is known as:

A)income tax expense.

B)income tax payable.

C)deferred tax asset.

D)deferred tax liability.

A)income tax expense.

B)income tax payable.

C)deferred tax asset.

D)deferred tax liability.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

64

The most common difference between accounting income and taxable income is that a corporation uses straight-line depreciation in its financial statements and accelerated depreciation in its tax return.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

65

Pretax accounting income is found on the:

A)tax return and income statement.

B)balance sheet and income statement.

C)income statement.

D)tax return.

A)tax return and income statement.

B)balance sheet and income statement.

C)income statement.

D)tax return.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

66

Corrections to the beginning balance of Retained Earnings for errors found within the current period are called prior-period adjustments.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

67

Taxable income is found on the:

A)income statement.

B)tax return.

C)balance sheet and income statement.

D)tax return and income statement.

A)income statement.

B)tax return.

C)balance sheet and income statement.

D)tax return and income statement.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

68

The income tax return is prepared in accordance with GAAP.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following statements is TRUE?

A)The income tax return and the financial statements are the same documents.

B)The income tax return is prepared using GAAP.

C)The income tax return is prepared using rules set by the IRS.

D)Taxable income is found on the income statement.

A)The income tax return and the financial statements are the same documents.

B)The income tax return is prepared using GAAP.

C)The income tax return is prepared using rules set by the IRS.

D)Taxable income is found on the income statement.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

70

Income tax payable appears on the:

A)income statement.

B)tax return.

C)balance sheet.

D)statement of stockholders' equity.

A)income statement.

B)tax return.

C)balance sheet.

D)statement of stockholders' equity.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

71

If income tax expense and income tax payable are the same amount, the journal entry to record the expense is:

A)debit income tax payable and credit income tax expense.

B)debit income tax expense and credit deferred tax liability.

C)debit income tax expense and credit income tax payable.

D)debit deferred tax liability and credit income tax expense.

A)debit income tax payable and credit income tax expense.

B)debit income tax expense and credit deferred tax liability.

C)debit income tax expense and credit income tax payable.

D)debit deferred tax liability and credit income tax expense.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

72

The formula to determine income tax payable is:

A)income before income tax expense (from the income tax return)multiplied by the income tax rate.

B)income before income tax expense (from the income statement)multiplied by the income tax rate.

C)taxable income (from the income tax return)multiplied by the income tax rate.

D)taxable income (from the income statement)multiplied by the income tax rate.

A)income before income tax expense (from the income tax return)multiplied by the income tax rate.

B)income before income tax expense (from the income statement)multiplied by the income tax rate.

C)taxable income (from the income tax return)multiplied by the income tax rate.

D)taxable income (from the income statement)multiplied by the income tax rate.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

73

For any given year, Income Tax Payable can never exceed Income Tax Expense.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

74

Income tax expense helps measure net income.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

75

When pretax accounting income exceeds taxable income:

A)Prepaid Income Tax is credited.

B)Deferred Tax Asset is debited.

C)Deferred Tax Liability is credited.

D)Prepaid Income Tax is debited.

A)Prepaid Income Tax is credited.

B)Deferred Tax Asset is debited.

C)Deferred Tax Liability is credited.

D)Prepaid Income Tax is debited.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

76

The basis for computing the amount of tax to pay the government is:

A)pretax accounting income.

B)taxable income.

C)comprehensive income.

D)net income.

A)pretax accounting income.

B)taxable income.

C)comprehensive income.

D)net income.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

77

Comprehensive income includes net income less unrealized gains or losses on available-for-sale investments.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

78

The formula to determine income tax expense is:

A)income before income tax expense (from the tax return)multiplied by the income tax rate.

B)income before income tax expense (from the income statement)multiplied by the income tax rate.

C)taxable income (from the income tax return)multiplied by the income tax rate.

D)taxable income (from the income statement)multiplied by the income tax rate.

A)income before income tax expense (from the tax return)multiplied by the income tax rate.

B)income before income tax expense (from the income statement)multiplied by the income tax rate.

C)taxable income (from the income tax return)multiplied by the income tax rate.

D)taxable income (from the income statement)multiplied by the income tax rate.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

79

Income before tax on the income statement is:

A)income tax payable.

B)net income.

C)pretax accounting income.

D)taxable income.

A)income tax payable.

B)net income.

C)pretax accounting income.

D)taxable income.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

80

Income tax expense appears on the:

A)income statement.

B)tax return.

C)balance sheet.

D)statement of stockholders' equity.

A)income statement.

B)tax return.

C)balance sheet.

D)statement of stockholders' equity.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck