Deck 18: Financial Modelling and Pro-Forma Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/102

Play

Full screen (f)

Deck 18: Financial Modelling and Pro-Forma Analysis

1

'Net new financing' is the amount of additional external financing required to pay for planned increase in assets.

True

2

Bunbury Doughnuts had sales of $200 million in 2016. Its cost of sales was $160 million. If sales are expected to grow at 10% in 2017, compute the forecasted costs using the per cent of sales method.

A)$173 million

B)$176 million

C)$170 million

D)$160 million

A)$173 million

B)$176 million

C)$170 million

D)$160 million

$176 million

3

Long-term financial planning helps a financial manager in budgeting but has little to do with understanding how the business operates.

False

4

A common starting point for forecasting is the 'per cent of sales method'.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

5

'Net new financing' is computed as the difference between projected assets and projected equity.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

6

If a firm is planning an expansion or changes in how it manages its inventory, long-term financial planning can help determine the impact on the firm's

A)debt financing.

B)free cash flows.

C)capital investment.

D)all of the above

A)debt financing.

B)free cash flows.

C)capital investment.

D)all of the above

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

7

Forecasting a balance sheet with the per cent of sales method requires two passes-a first pass to determine financing needs and a second pass that shows the sources and amounts of financing.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

8

One of the shortcomings of the 'per cent of sales method' is that it does not account for the fact that capacity changes are lumpy and not incremental.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

9

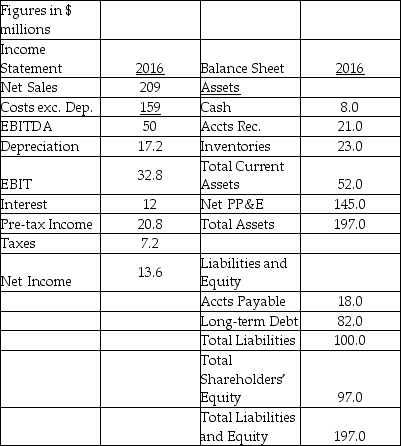

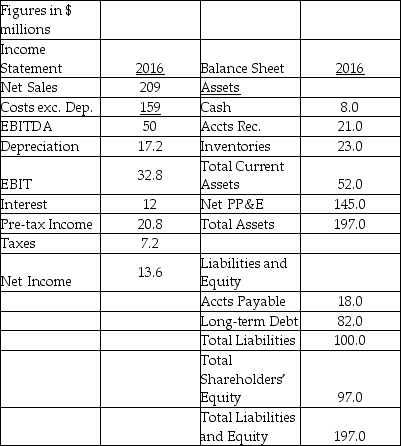

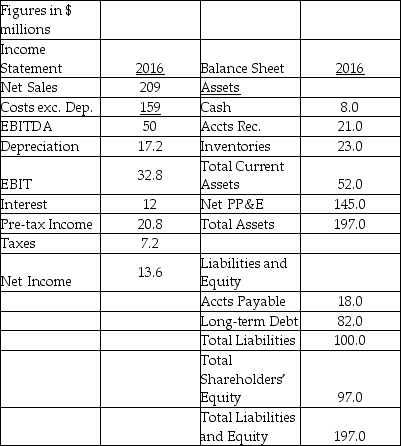

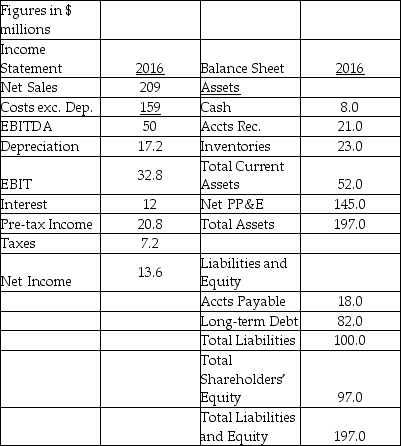

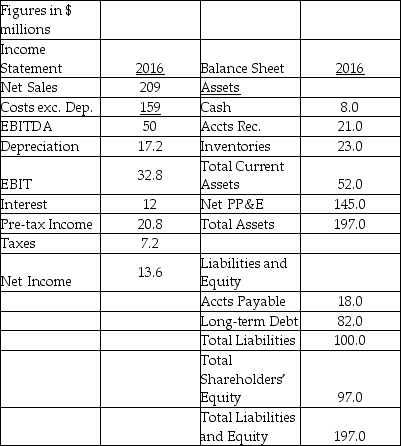

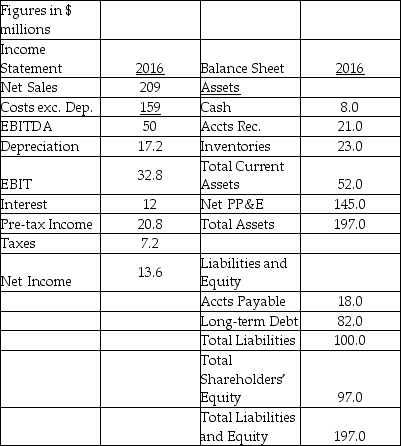

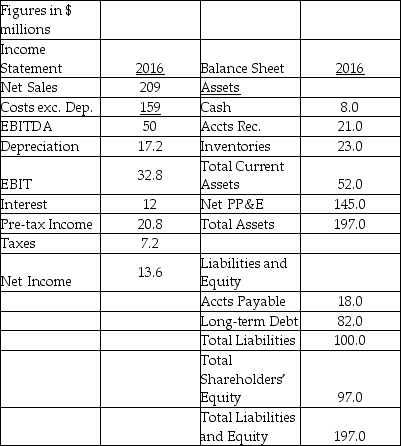

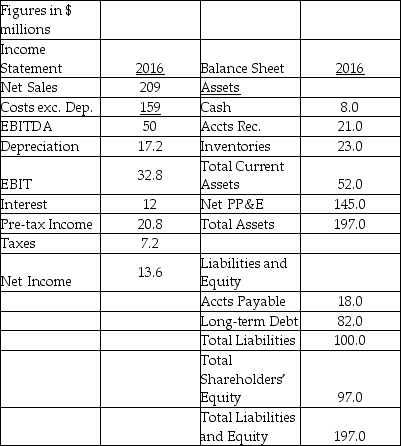

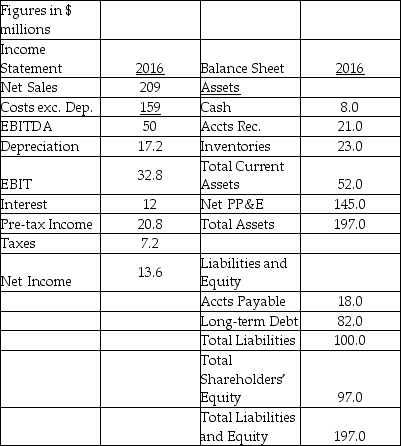

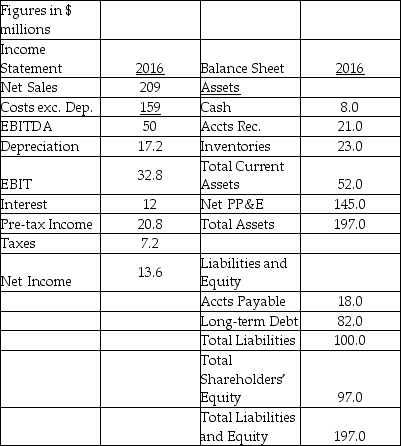

Use the information about Billy's Burgers to answer the following question(s):

Billy's Burgers

Using the per cent of sales method, and assuming 15% growth in sales, estimate Billy's Burgers' depreciation for 2017.

A)$20.8 million

B)$19.8 million

C)$17.2 million

D)$22.0 million

Billy's Burgers

Using the per cent of sales method, and assuming 15% growth in sales, estimate Billy's Burgers' depreciation for 2017.

A)$20.8 million

B)$19.8 million

C)$17.2 million

D)$22.0 million

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

10

The goal of the financial manager is to maximise the value of the shareholder's stake in the firm.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

11

Building a model for long-term forecasting reveals points in the future where the firm will have

A)excess cash that can be used for dividends, debt repayment, or share repurchases.

B)a need for expanding property, plant and equipment to meet increases in capacity.

C)cash needs that must be funded with external financing.

D)all of the above.

A)excess cash that can be used for dividends, debt repayment, or share repurchases.

B)a need for expanding property, plant and equipment to meet increases in capacity.

C)cash needs that must be funded with external financing.

D)all of the above.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

12

Use the information about Billy's Burgers to answer the following question(s):

Billy's Burgers

Using the per cent of sales method, and assuming 15% growth in sales and no change in interest expense, estimate Billy's Burgers' Pre-tax Income for 2017.

A)$25.28 million

B)$35.76 million

C)$25.72 million

D)$24.84 million

Billy's Burgers

Using the per cent of sales method, and assuming 15% growth in sales and no change in interest expense, estimate Billy's Burgers' Pre-tax Income for 2017.

A)$25.28 million

B)$35.76 million

C)$25.72 million

D)$24.84 million

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

13

The 'per cent of sales method' assumes that as sales grow, many income statement and balance sheet items grow at the same rate.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

14

Bunbury Doughnuts had sales of $300 million in 2016. Its cost of sales was $200 million. If sales are expected to grow at 15% in 2017, compute the forecasted costs using the per cent of sales method.

A)$215 million

B)$230 million

C)$210 million

D)$225 million

A)$215 million

B)$230 million

C)$210 million

D)$225 million

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

15

While the assets and accounts payable of a firm may reasonably be expected to grow with sales, ________ will not naturally grow with sales.

A)long-term debt

B)cash

C)supplier credit

D)cost of sales

A)long-term debt

B)cash

C)supplier credit

D)cost of sales

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following accounts may reasonably be expected to grow with sales? I. Accounts Receivable

II. Accounts Payable

III. Property, Plant and Equipment

IV. Inventory

V. Long-Term Debt

A)I, II and IV

B)I, II and V

C)III and V

D)I, II and III

II. Accounts Payable

III. Property, Plant and Equipment

IV. Inventory

V. Long-Term Debt

A)I, II and IV

B)I, II and V

C)III and V

D)I, II and III

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

17

The ________ method assumes that as sales grow, many income statement and balance sheet items will grow, while remaining the same percent of sales.

A)percent of assets

B)percent of income

C)percent of sales

D)percent of liabilities

A)percent of assets

B)percent of income

C)percent of sales

D)percent of liabilities

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

18

Long-term financial planning allows a financial manager to understand the business by ________ between sales, costs, capital investments and financing.

A)increasing the spread between

B)decreasing the spread between

C)identifying wastage

D)identifying linkages

A)increasing the spread between

B)decreasing the spread between

C)identifying wastage

D)identifying linkages

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

19

Bunbury Doughnuts had sales of $100 million in 2016. Its cost of sales was $70 million. If sales are expected to grow at 20% in 2017, compute the forecasted costs using the per cent of sales method.

A)$84 million

B)$96 million

C)$80 million

D)$88 million

A)$84 million

B)$96 million

C)$80 million

D)$88 million

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

20

Building a model for long-term forecasting reveals points in the future where the firm will need ________ when retained earnings are not enough to fund planned future investments.

A)mergers

B)external financing

C)stock dividends

D)dividend payments

A)mergers

B)external financing

C)stock dividends

D)dividend payments

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

21

A services firm does all its business in cash only. The firm projects a cash balance of $4 000 in its account after all taxes and costs are paid. The owners plan to invest $7 000 and pay a dividend of $1 000. How much net new financing is needed?

A)$7 000

B)$4 000

C)$5 000

D)$6 000

A)$7 000

B)$4 000

C)$5 000

D)$6 000

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

22

________ is the amount of additional external financing needed to fund planned increases in assets.

A)Equity issuance

B)Debt issuance

C)Net new financing

D)Preference shares issuance

A)Equity issuance

B)Debt issuance

C)Net new financing

D)Preference shares issuance

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

23

The 'per cent of sales method' relies on the idea that capacity increases are ________, even though in practice such increases are ________.

A)incremental, incremental

B)lumpy, lumpy

C)lumpy, incremental

D)incremental, lumpy

A)incremental, incremental

B)lumpy, lumpy

C)lumpy, incremental

D)incremental, lumpy

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

24

When the projected liabilities and equity are greater than the assets, the firm can plan to

A)pay dividends.

B)retire debt.

C)retain extra cash.

D)all of the above

A)pay dividends.

B)retire debt.

C)retain extra cash.

D)all of the above

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

25

The market size for Flippers is 100 million units. If XYZ Ltd has a market share of 15% and the average sales price is $3 per Flippers, what is the dollar amount of sales of XYZ?

A)$48 million

B)$45 million

C)$42 million

D)$40 million

A)$48 million

B)$45 million

C)$42 million

D)$40 million

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

26

The amount of dividends a company pays will affect the ________ it has to finance future growth.

A)debt

B)current liabilities

C)current ratio

D)retained earnings

A)debt

B)current liabilities

C)current ratio

D)retained earnings

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

27

AHG Ltd has done a long-term forecast of its balance sheet. The projected total assets for the next year are $150 million. The current liabilities are projected to be $100 million and other long-term liabilities are $30 million. How much net new financing is needed in the following year?

A)$25 million

B)$20 million

C)$10 million

D)$32 million

A)$25 million

B)$20 million

C)$10 million

D)$32 million

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

28

The market size for Widgets is 75 million units. If SPI Ltd has a market share of 38% and the average sales price is $4.50 per Widget, what is the dollar amount of sales of SPI?

A)$128.5 million

B)$128.3 million

C)$122.4 million

D)$122.5 million

A)$128.5 million

B)$128.3 million

C)$122.4 million

D)$122.5 million

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

29

AHG Ltd has done a long-term forecast of its balance sheet. The projected total assets for the next year are $250 million. The current liabilities are projected to be $100 million and other long-term liabilities are $100 million. How much net new financing is needed in the following year?

A)$100 million

B)$150 million

C)$20 million

D)$50 million

A)$100 million

B)$150 million

C)$20 million

D)$50 million

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

30

A services firm does all its business in cash only. The firm projects a cash balance of $3 000 in its account after all taxes and costs are paid. The owners plan to invest $8 000 and pay a dividend of $1 000. How much net new financing is needed?

A)$4 000

B)$7 000

C)$6 000

D)$5 000

A)$4 000

B)$7 000

C)$6 000

D)$5 000

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

31

Total working capital, rather than changes in working capital, has implications for cash flows.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

32

A services firm does all its business in cash only. The firm projects a cash balance of $2 000 in its account after all taxes and costs are paid. The owners plan to invest $5 000 and pay a dividend of $1 000. How much net new financing is needed?

A)$6 000

B)$7 000

C)$4 000

D)$5 000

A)$6 000

B)$7 000

C)$4 000

D)$5 000

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

33

When making long-term plans, any increases in ________ and ________ reflect capital structure decisions that require managers to actively raise capital.

A)current ratio, equity

B)debt, assets

C)assets, equity

D)debt, equity

A)current ratio, equity

B)debt, assets

C)assets, equity

D)debt, equity

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

34

The asset and liability side of a pro forma balance sheet projection will not balance, in general, unless we make assumptions about how ________ and ________ will grow with sales.

A)debt, equity

B)dividends, equity

C)coupons, debt

D)dividends, preference shares

A)debt, equity

B)dividends, equity

C)coupons, debt

D)dividends, preference shares

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

35

For valuing a planned expansion, in addition to forecasting cash flows, we need to estimate the firm's continuation value.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

36

AHG Ltd has done a long-term forecast of its balance sheet. The projected total assets for the next year are $300 million. The current liabilities are projected to be $200 million and other long-term liabilities are $85 million. How much net new financing is needed in the following year?

A)$25 million

B)$55 million

C)$15 million

D)$10 million

A)$25 million

B)$55 million

C)$15 million

D)$10 million

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

37

Use the information about Billy's Burgers to answer the following question(s):

Billy's Burgers

Using the per cent of sales method, and assuming 15% growth in sales, estimate Billy's Burgers' Accounts Payable for 2017.

A)$28.0 million

B)$21.0 million

C)$25.2 million

D)$20.7 million

Billy's Burgers

Using the per cent of sales method, and assuming 15% growth in sales, estimate Billy's Burgers' Accounts Payable for 2017.

A)$28.0 million

B)$21.0 million

C)$25.2 million

D)$20.7 million

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

38

Use the information about Billy's Burgers to answer the following question(s):

Billy's Burgers

Using the per cent of sales method, and assuming 15% growth in sales, estimate Billy's Burgers' Accounts Receivable for 2017.

A)$28.0 million

B)$21.0 million

C)$21.6 million

D)$24.15 million

Billy's Burgers

Using the per cent of sales method, and assuming 15% growth in sales, estimate Billy's Burgers' Accounts Receivable for 2017.

A)$28.0 million

B)$21.0 million

C)$21.6 million

D)$24.15 million

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

39

Use the information about Billy's Burgers to answer the following question(s):

Billy's Burgers

Using the per cent of sales method, and assuming 15% growth in sales and no change in interest expense, estimate Billy's Burgers' Net Income for 2017.

A)$18.16 million

B)$13.28 million

C)$15.76 million

D)$16.82 million

Billy's Burgers

Using the per cent of sales method, and assuming 15% growth in sales and no change in interest expense, estimate Billy's Burgers' Net Income for 2017.

A)$18.16 million

B)$13.28 million

C)$15.76 million

D)$16.82 million

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

40

The market size for Loppins is 50 million units. If SPI Ltd has a market share of 30% and the average sales price is $4 per Loppin, what is the dollar amount of sales of SPI?

A)$62 million

B)$58 million

C)$52 million

D)$60 million

A)$62 million

B)$58 million

C)$52 million

D)$60 million

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

41

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

What is the free cash flow to equity holders for a firm with free cash flow of $9 000, after-tax interest expense of $3 000, and an increase in debt of $1 000?

A)$7 000

B)$8 000

C)$9 000

D)$6 000

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

What is the free cash flow to equity holders for a firm with free cash flow of $9 000, after-tax interest expense of $3 000, and an increase in debt of $1 000?

A)$7 000

B)$8 000

C)$9 000

D)$6 000

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

42

The minimum required cash represents the minimum level of cash needed to keep the business running smoothly, allowing for the daily variations in the timing of income and expenses.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

43

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Given the following data for a given period, compute the free cash flow to the firm. Net Income = $5 000

After-tax Interest Expense = $500

Depreciation = $500

Increase in NWC = $1 000

Capital Expenditures = $2 000

A)$3 500

B)$3 900

C)$3 700

D)$3 000

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Given the following data for a given period, compute the free cash flow to the firm. Net Income = $5 000

After-tax Interest Expense = $500

Depreciation = $500

Increase in NWC = $1 000

Capital Expenditures = $2 000

A)$3 500

B)$3 900

C)$3 700

D)$3 000

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

44

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Compute the after-tax interest expense for a firm with Interest earned from Excess Cash = $1 000, Interest on Debt = $5 000, and a tax rate of 30%.

A)$3 100

B)$2 800

C)$3 300

D)$2 500

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Compute the after-tax interest expense for a firm with Interest earned from Excess Cash = $1 000, Interest on Debt = $5 000, and a tax rate of 30%.

A)$3 100

B)$2 800

C)$3 300

D)$2 500

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

45

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Given the following data for a given period, compute the free cash flow to the firm. Net Income = $12 000

After-tax Interest Expense = $2 000

Depreciation = $1 000

Increase in NWC = $2 000

Capital Expenditures = $1 000

A)$12 000

B)$11 000

C)$10 000

D)$13 000

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Given the following data for a given period, compute the free cash flow to the firm. Net Income = $12 000

After-tax Interest Expense = $2 000

Depreciation = $1 000

Increase in NWC = $2 000

Capital Expenditures = $1 000

A)$12 000

B)$11 000

C)$10 000

D)$13 000

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

46

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

With the proper changes it is believed that Ideko's credit policies will allow for an accounts receivable days of 60. The forecasted accounts receivable for Ideko in 2015 is closest to:

A)$16 970

B)$19 690

C)$14 525

D)$22 710

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

With the proper changes it is believed that Ideko's credit policies will allow for an accounts receivable days of 60. The forecasted accounts receivable for Ideko in 2015 is closest to:

A)$16 970

B)$19 690

C)$14 525

D)$22 710

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

47

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

The amount of net working capital for Ideko in 2014 was closest to:

A)$30 510

B)$22 750

C)$35 195

D)$28 170

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

The amount of net working capital for Ideko in 2014 was closest to:

A)$30 510

B)$22 750

C)$35 195

D)$28 170

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

48

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Compute the after-tax interest expense for a firm with Interest earned from Excess Cash = $5 000, Interest on Debt = $8 000, and a tax rate of 30%.

A)$2 500

B)$2 700

C)$2 100

D)$2 200

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Compute the after-tax interest expense for a firm with Interest earned from Excess Cash = $5 000, Interest on Debt = $8 000, and a tax rate of 30%.

A)$2 500

B)$2 700

C)$2 100

D)$2 200

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

49

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

The amount of net working capital for Ideko in 2013 was closest to:

A)$35 195

B)$30 510

C)$26 200

D)$29 420

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

The amount of net working capital for Ideko in 2013 was closest to:

A)$35 195

B)$30 510

C)$26 200

D)$29 420

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

50

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Given the following data for a given period, compute the free cash flow to the firm. Net Income = $10 000

After-tax Interest Expense = $1 000

Depreciation = $1 000

Increase in NWC = $1 000

Capital Expenditures = $2 000

A)$9 000

B)$9 900

C)$9 700

D)$9 500

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Given the following data for a given period, compute the free cash flow to the firm. Net Income = $10 000

After-tax Interest Expense = $1 000

Depreciation = $1 000

Increase in NWC = $1 000

Capital Expenditures = $2 000

A)$9 000

B)$9 900

C)$9 700

D)$9 500

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

51

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

What is the free cash flow to equity holders for a firm with free cash flow of $7 000, after-tax interest expense of $1 000, and an increase in debt of $3 000?

A)$7 000

B)$8 000

C)$6 000

D)$9 000

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

What is the free cash flow to equity holders for a firm with free cash flow of $7 000, after-tax interest expense of $1 000, and an increase in debt of $3 000?

A)$7 000

B)$8 000

C)$6 000

D)$9 000

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

52

Based upon Ideko's Sales and Operating Cost Assumptions, what production capacity will Ideko require in 2017?

A)1 323 units

B)1 702 units

C)1 914 units

D)1 505 units

E)1 115 units

A)1 323 units

B)1 702 units

C)1 914 units

D)1 505 units

E)1 115 units

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

53

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

The amount of the increase in net working capital for Ideko in 2015 is closest to:

A)$3 665

B)$5 230

C)$4 685

D)$4 920

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

The amount of the increase in net working capital for Ideko in 2015 is closest to:

A)$3 665

B)$5 230

C)$4 685

D)$4 920

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

54

Based upon Ideko's Sales and Operating Cost Assumptions, what production capacity will Ideko require in 2016?

A)1 323 units

B)1 702 units

C)1 505 units

D)1 914 units

E)1 115 units

A)1 323 units

B)1 702 units

C)1 505 units

D)1 914 units

E)1 115 units

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

55

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

What is the free cash flow to equity holders for a firm with free cash flow of $11 000, after-tax interest expense of $2 000, and an increase in debt of $2 000?

A)$9 000

B)$11 000

C)$8 000

D)$7 000

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

What is the free cash flow to equity holders for a firm with free cash flow of $11 000, after-tax interest expense of $2 000, and an increase in debt of $2 000?

A)$9 000

B)$11 000

C)$8 000

D)$7 000

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

56

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

The amount of the decrease in net working capital for Ideko in 2014 was closest to:

A)$4 090

B)$5 230

C)$3 410

D)$4 685

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

The amount of the decrease in net working capital for Ideko in 2014 was closest to:

A)$4 090

B)$5 230

C)$3 410

D)$4 685

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

57

Based upon Ideko's Sales and Operating Cost Assumptions, what production capacity will Ideko require in 2015?

A)1 323 units

B)1 914 units

C)1 505 units

D)1 115 units

E)1 702 units

A)1 323 units

B)1 914 units

C)1 505 units

D)1 115 units

E)1 702 units

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

58

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

With the proper changes it is believed that Ideko's credit policies will allow for an accounts receivable days of 60. The forecasted accounts receivable for Ideko in 2016 is closest to:

A)$16 970

B)$22 710

C)$19 690

D)$14 525

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

With the proper changes it is believed that Ideko's credit policies will allow for an accounts receivable days of 60. The forecasted accounts receivable for Ideko in 2016 is closest to:

A)$16 970

B)$22 710

C)$19 690

D)$14 525

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

59

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

The amount of net working capital for Ideko in 2015 was closest to:

A)$42 420

B)$26 420

C)$35 195

D)$22 170

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

The amount of net working capital for Ideko in 2015 was closest to:

A)$42 420

B)$26 420

C)$35 195

D)$22 170

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

60

Use the tables for the question(s)below.

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Compute the after-tax interest expense for a firm with Interest earned from Excess Cash = $2 000, Interest on Debt = $7 000, and a tax rate of 30%.

A)$3 100

B)$2 800

C)$3 500

D)$2 500

Pro Forma Income Statement for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Pro Forma Assets & Liabilities for Ideko, 2013-2018

Compute the after-tax interest expense for a firm with Interest earned from Excess Cash = $2 000, Interest on Debt = $7 000, and a tax rate of 30%.

A)$3 100

B)$2 800

C)$3 500

D)$2 500

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

61

Pledrea Ltd has EBITDA at the forecast horizon of $130 000. Its EBITDA multiple is 10. What is the terminal value of the firm at the forecast horizon?

A)$1 200 000

B)$1 000 000

C)$1 100 000

D)$1 300 000

A)$1 200 000

B)$1 000 000

C)$1 100 000

D)$1 300 000

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

62

A firm has $50 million in equity and $20 million of debt, it pays dividends of 30% of net income, and has a net income of $10 million. What is the firm's 'sustainable growth rate'?

A)15%

B)13%

C)12%

D)14%

A)15%

B)13%

C)12%

D)14%

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

63

'Internal growth rate' indicates whether a planned investment will increase or decrease firm value.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

64

A firm has $40 million in equity and $20 million of debt, it pays dividends of 20% of net income, and has a net income of $10 million. What is the firm's 'internal growth rate'?

A)13.3%

B)12.2%

C)15.2%

D)14.1%

A)13.3%

B)12.2%

C)15.2%

D)14.1%

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

65

A firm has $20 million in equity and $20 million of debt, it pays dividends of 20% of net income, and has a net income of $5 million. What is the firm's 'sustainable growth rate'?

A)21%

B)19%

C)20%

D)18%

A)21%

B)19%

C)20%

D)18%

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

66

Compute the value of a firm with free cash flows of $1 000, $2 500 and $3 000 over the next three years, a terminal firm value of $40 000 after three years, and the unlevered cost of capital is 15%. Assume that the interest rate tax shield is zero.

A)$31 033

B)$27 234

C)$39 343

D)$26 191

A)$31 033

B)$27 234

C)$39 343

D)$26 191

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

67

The maximum growth rate that a firm can achieve without issuing new equity or by increasing its debt-to-equity ratio is the firm's 'sustainable growth rate'.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

68

Compute the value of a firm with free cash flows of $4 000, $4 500 and $5 000 over the next three years, a terminal firm value of $60 000 after three years, and the unlevered cost of capital is 10%. Assume that the interest rate tax shield is zero.

A)$58 098

B)$56 191

C)$59 123

D)$57 234

A)$58 098

B)$56 191

C)$59 123

D)$57 234

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

69

The 'sustainable growth rate' assumes that the firm will raise no new debt financing.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

70

A firm has $80 million in equity and $40 million of debt, it pays dividends of 20% of net income, and has a net income of $10 million. What is the firm's 'sustainable growth rate'?

A)7%

B)9%

C)10%

D)8%

A)7%

B)9%

C)10%

D)8%

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

71

A firm has $70 million in equity and $30 million of debt, it pays dividends of 30% of net income, and has a net income of $10 million. What is the firm's 'internal growth rate'?

A)6%

B)8%

C)9%

D)7%

A)6%

B)8%

C)9%

D)7%

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

72

A firm has $50 million in equity and $20 million of debt, it pays dividends of 30% of net income, and has a net income of $10 million. What is the firm's 'internal growth rate'?

A)10%

B)12%

C)11%

D)9%

A)10%

B)12%

C)11%

D)9%

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

73

Pledrea Ltd has EBITDA at the forecast horizon of $10 000. Its EBITDA multiple is 12. What is the terminal value of the firm at the forecast horizon?

A)$130 000

B)$110 000

C)$100 000

D)$120 000

A)$130 000

B)$110 000

C)$100 000

D)$120 000

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

74

Pledrea Ltd has EBITDA at the forecast horizon of $15 000. Its EBITDA multiple is 10. What is the terminal value of the firm at the forecast horizon?

A)$150 000

B)$120 000

C)$130 000

D)$1 500 000

A)$150 000

B)$120 000

C)$130 000

D)$1 500 000

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

75

A firm expects growth next year to be 10%. Its sustainable growth rate is 12%. Which of the following is true?

A)The firm will have excess cash to increase dividends, pay back debt, or repurchase equity.

B)The firm may be able to keep its debt-to-equity ratio the same by reducing dividends (assuming they are projected to be high enough).

C)The firm will need to raise additional debt such that its debt-to-equity ratio will increase.

D)The firm will need to raise additional capital through a stock issue.

A)The firm will have excess cash to increase dividends, pay back debt, or repurchase equity.

B)The firm may be able to keep its debt-to-equity ratio the same by reducing dividends (assuming they are projected to be high enough).

C)The firm will need to raise additional debt such that its debt-to-equity ratio will increase.

D)The firm will need to raise additional capital through a stock issue.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

76

The 'internal growth rate' is the maximum growth rate a firm can achieve without resorting to external financing.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

77

A firm that generates more cash than planned must distribute the excess cash as dividends.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

78

A firm expects growth next year to be 12%. Its sustainable growth rate is 10%. Which of the following is true?

A)The firm will have excess cash to increase dividends, pay back debt, or repurchase equity.

B)The firm will need to raise additional capital through a stock issue.

C)The firm will need to raise additional debt such that its debt-to-equity ratio will increase.

D)The firm may be able to keep its debt-to-equity ratio the same by reducing dividends (assuming they are projected to be high enough).

A)The firm will have excess cash to increase dividends, pay back debt, or repurchase equity.

B)The firm will need to raise additional capital through a stock issue.

C)The firm will need to raise additional debt such that its debt-to-equity ratio will increase.

D)The firm may be able to keep its debt-to-equity ratio the same by reducing dividends (assuming they are projected to be high enough).

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

79

The estimate of a firm's value at the end of the forecast horizon using a valuation multiple is also called its

A)payback value.

B)terminal value.

C)fixed value.

D)none of the above

A)payback value.

B)terminal value.

C)fixed value.

D)none of the above

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck

80

The 'internal growth rate' assumes that the firm can finance investments via the sale of debt.

Unlock Deck

Unlock for access to all 102 flashcards in this deck.

Unlock Deck

k this deck