Deck 21: Transfer Pricing and Multinational Management Control Systems

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

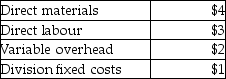

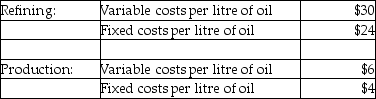

Question

Question

Question

Question

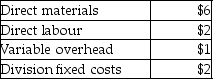

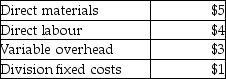

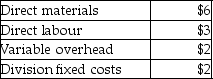

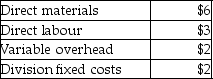

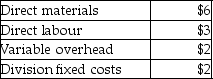

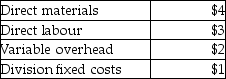

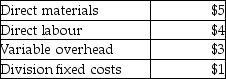

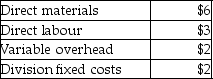

Question

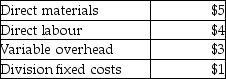

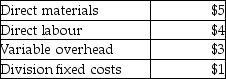

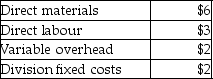

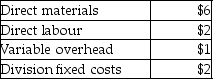

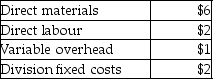

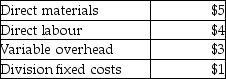

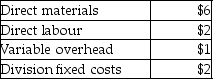

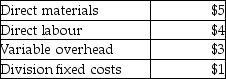

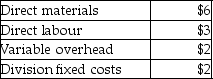

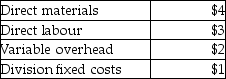

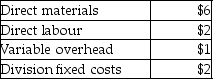

Question

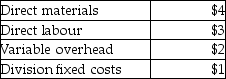

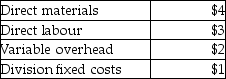

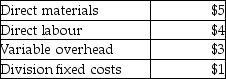

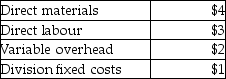

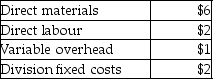

Question

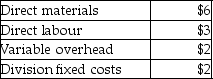

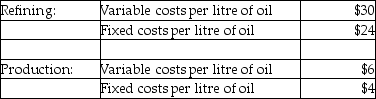

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/183

Play

Full screen (f)

Deck 21: Transfer Pricing and Multinational Management Control Systems

1

Motivation is the desire to attain a selected goal combined with the resulting drive or pursuit toward that goal.

True

2

A management control system is a means of gathering and using information to aid and coordinate the process of making planning and control decisions throughout the organization, and to guide employee behaviour.

True

3

A management control system would include both formal as well as informal control mechanisms.

True

4

The goal of a management control system is to improve the collective decisions in an organization in an economically feasible way.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

5

A management control system should have all of the following characteristics, EXCEPT

A)it should motivate employees.

B)it should be closely aligned to organizational goals and objectives.

C)it should provide information for individual managers for decision making.

D)it should motivate managers.

E)it should always focus on customer satisfaction.

A)it should motivate employees.

B)it should be closely aligned to organizational goals and objectives.

C)it should provide information for individual managers for decision making.

D)it should motivate managers.

E)it should always focus on customer satisfaction.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

6

Management control systems reflect only financial data.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

7

Goal congruence occurs when managers act in their own best interest at the expense of the organization.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

8

Subunit managers are better informed about their suppliers than top management is.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

9

A decentralized organizational structure may result in duplication of activities.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

10

Suboptimal decision making is also called congruent decision making.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

11

An important advantage of decentralized operations is that it improves corporate control.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

12

Management control systems motivate managers and other employees to exert effort through a variety of rewards tied to the achievement of goals.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

13

Effort in terms of management control systems is defined in terms of physical exertion such as a worker producing at a faster rate.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

14

The essence of decentralization is the freedom for managers at lower levels of the organization to make decisions.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

15

A benefit of decentralization should be increased motivation of subunit managers.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

16

The degree of freedom to make decisions is known as decentralization.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

17

One benefit of centralization is an increase in development of an experienced pool of management talent to fill higher-level management positions.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

18

Management control systems collect which type of data?

A)financial

B)non-financial

C)data from outside of the company

D)financial and non-financial

E)financial and non-financial, including data from both within the company and outside of the company

A)financial

B)non-financial

C)data from outside of the company

D)financial and non-financial

E)financial and non-financial, including data from both within the company and outside of the company

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

19

A well-designed management control system obtains all of its information from within the company.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

20

An informal management control systems includes specific rules, procedures, and performance measures.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

21

The degree of freedom to make decisions is

A)decentralization.

B)autonomy.

C)centralization.

D)motivation.

E)goal congruence.

A)decentralization.

B)autonomy.

C)centralization.

D)motivation.

E)goal congruence.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

22

An advantage of decentralization is that it

A)creates greater responsiveness to local needs.

B)focuses manager's attention on the organization as a whole.

C)does not result in a duplication of activities.

D)reduces the cost of gathering information.

E)leads to decision making consistent with company goals.

A)creates greater responsiveness to local needs.

B)focuses manager's attention on the organization as a whole.

C)does not result in a duplication of activities.

D)reduces the cost of gathering information.

E)leads to decision making consistent with company goals.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following statements is FALSE?

A)A centralized structure does not empower employees to handle customer complaints directly.

B)A decentralized structure forces top management to lose some control over the organization.

C)Decentralization slows responsiveness to local needs for decision making.

D)The extent to which decisions are pushed downward, and the types of decisions that are pushed down, provide a measure of the level of centralization/decentralization in an organization.

E)Decentralization can increase motivation by allowing managers to exercise greater individual initiative.

A)A centralized structure does not empower employees to handle customer complaints directly.

B)A decentralized structure forces top management to lose some control over the organization.

C)Decentralization slows responsiveness to local needs for decision making.

D)The extent to which decisions are pushed downward, and the types of decisions that are pushed down, provide a measure of the level of centralization/decentralization in an organization.

E)Decentralization can increase motivation by allowing managers to exercise greater individual initiative.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

24

Discuss some of the recent legislation and frameworks relating to assurance and internal controls.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

25

For each of the following activities, characteristics, and applications, tell whether they are primarily labelled as being found in a centralized organization, a decentralized organization, or both types of organizations.

A)both

B)centralization

C)decentralization

Greater responsiveness to user needs.

A)both

B)centralization

C)decentralization

Greater responsiveness to user needs.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

26

What is the purpose of the internal control system within an organization?

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

27

Provide a complete definition of a management control system.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

28

For each of the following activities, characteristics, and applications, tell whether they are primarily labelled as being found in a centralized organization, a decentralized organization, or both types of organizations.

A)both

B)centralization

C)decentralization

Maximum constraints and minimum freedom for managers at lowest levels.

A)both

B)centralization

C)decentralization

Maximum constraints and minimum freedom for managers at lowest levels.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

29

For each of the following activities, characteristics, and applications, tell whether they are primarily labelled as being found in a centralized organization, a decentralized organization, or both types of organizations.

A)both

B)centralization

C)decentralization

Maximization of benefits over costs.

A)both

B)centralization

C)decentralization

Maximization of benefits over costs.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

30

The costs, as opposed to benefits, of decentralization include all of the following, except

A)management development and learning.

B)duplication of output.

C)increased costs of information-gathering.

D)focus of manager's attention on the subunit rather than the company as a whole.

E)suboptimal decision making.

A)management development and learning.

B)duplication of output.

C)increased costs of information-gathering.

D)focus of manager's attention on the subunit rather than the company as a whole.

E)suboptimal decision making.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

31

All of the following are benefits of decentralization EXCEPT

A)it creates greater responsiveness to local needs.

B)it decreases management and worker morale.

C)it leads to quicker decision making.

D)it sharpens the focus of managers.

E)it leads to better supplier relationships.

A)it creates greater responsiveness to local needs.

B)it decreases management and worker morale.

C)it leads to quicker decision making.

D)it sharpens the focus of managers.

E)it leads to better supplier relationships.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

32

For each of the following activities, characteristics, and applications, tell whether they are primarily labelled as being found in a centralized organization, a decentralized organization, or both types of organizations.

A)both

B)centralization

C)decentralization

Minimization of duplicate functions.

A)both

B)centralization

C)decentralization

Minimization of duplicate functions.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

33

For each of the following activities, characteristics, and applications, tell whether they are primarily labelled as being found in a centralized organization, a decentralized organization, or both types of organizations.

A)both

B)centralization

C)decentralization

Have few interdependencies among divisions.

A)both

B)centralization

C)decentralization

Have few interdependencies among divisions.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

34

The president of Silicon Company has just returned from a week of professional development courses and is very excited that she will not have to change the organization from a centralized structure to a decentralized structure just to have responsibility centres.However, she is somewhat confused about how responsibility centres relate to centralized organizations where a few managers have most of the authority.Required:

Explain how a centralized organization might allow for responsibility centres.

Explain how a centralized organization might allow for responsibility centres.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is FALSE concerning profit centres and cost centres?

A)A profit centre can exist within a centralized organization.

B)A profit centre can exist within a decentralized organization.

C)A cost centre can exist within a centralized organization.

D)A cost centre can exist within a decentralized organization.

E)If a profit centre exists within a centralized organization, there cannot be any cost centres in the organization.

A)A profit centre can exist within a centralized organization.

B)A profit centre can exist within a decentralized organization.

C)A cost centre can exist within a centralized organization.

D)A cost centre can exist within a decentralized organization.

E)If a profit centre exists within a centralized organization, there cannot be any cost centres in the organization.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

36

Physical exertion and mental action towards a goal can best be described as

A)motivation.

B)effort.

C)goal congruence.

D)incentive.

E)loyalty.

A)motivation.

B)effort.

C)goal congruence.

D)incentive.

E)loyalty.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

37

For each of the following activities, characteristics, and applications, tell whether they are primarily labelled as being found in a centralized organization, a decentralized organization, or both types of organizations.

A)both

B)centralization

C)decentralization

Gathering information may be very expensive.

A)both

B)centralization

C)decentralization

Gathering information may be very expensive.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following is NOT a responsibility centre within an organization, whether centralized or decentralized?

A)cost centre

B)profit centre

C)revenue centre

D)savings centre

E)investment centre

A)cost centre

B)profit centre

C)revenue centre

D)savings centre

E)investment centre

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

39

Discuss the possible problems a corporation might have if its operations are totally decentralized.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

40

Informal management control systems include

A)incentive plans.

B)codes of conduct.

C)qualitative measures of performance.

D)policies.

E)company culture.

A)incentive plans.

B)codes of conduct.

C)qualitative measures of performance.

D)policies.

E)company culture.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

41

A product is know as ________ when it is transferred from one subunit to another subunit in the same organization.

A)an interdepartmental product

B)an intermediate product

C)a subunit product

D)a transfer product

E)a secondary product

A)an interdepartmental product

B)an intermediate product

C)a subunit product

D)a transfer product

E)a secondary product

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

42

Products transferred between subunits within an organization are considered intermediate products.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

43

Subunits X and Y determined the price for interdepartmental services during the last monthly meeting, using the selling prices charged to outside parties.This is an example of

A)subunit transfer prices.

B)negotiated transfer prices.

C)market-based transfer prices.

D)cost-based transfer prices.

E)multinational transfer pricing.

A)subunit transfer prices.

B)negotiated transfer prices.

C)market-based transfer prices.

D)cost-based transfer prices.

E)multinational transfer pricing.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

44

Negotiated transfer prices are always transacted at the top management levels.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

45

The Canada Revenue Agency has adopted International Financial Reporting Standards as the framework for transfer pricing regulations.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

46

The choice of a transfer-pricing method has minimal effect on the allocation of company-wide operating income among divisions.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

47

Companies may approach tax authorities to obtain an Advanced Transfer Price Arrangement to ascertain if a proposed transfer pricing arrangement is acceptable.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

48

Market price is the only price that a firm should use when transferring goods from one subunit to another subunit.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

49

All of the following are general methods for determining transfer prices EXCEPT

A)cost-based transfer prices.

B)market-based transfer prices.

C)negotiated transfer prices.

D)taxation policies.

E)multi-national transfer prices.

A)cost-based transfer prices.

B)market-based transfer prices.

C)negotiated transfer prices.

D)taxation policies.

E)multi-national transfer prices.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

50

For each of the following activities, characteristics, and applications, tell whether they are primarily labelled as being found in a centralized organization, a decentralized organization, or both types of organizations.

A)both

B)centralization

C)decentralization

Multiple responsibility centres with various reporting units.

A)both

B)centralization

C)decentralization

Multiple responsibility centres with various reporting units.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

51

Department A charges Department B $1,350 for copying services provided.The $1,350 is considered a transfer price.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

52

Market-based transfer prices are generally accepted by tax authorities because they represent arm's length prices.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

53

Examples of market-based transfer prices include variable manufacturing costs, full manufacturing costs, and full product costs.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

54

For each of the following activities, characteristics, and applications, tell whether they are primarily labelled as being found in a centralized organization, a decentralized organization, or both types of organizations.

A)both

B)centralization

C)decentralization

Profit centres

A)both

B)centralization

C)decentralization

Profit centres

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

55

The price one subunit of an organization charges for a product or service supplied to another subunit of the same organization is called

A)an interdepartmental product price.

B)an intermediate product price.

C)a subunit price.

D)a transfer price.

E)a fixed price.

A)an interdepartmental product price.

B)an intermediate product price.

C)a subunit price.

D)a transfer price.

E)a fixed price.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

56

A transfer pricing method should lead to which of the following results?

A)managers always acting in their own best interest

B)managers acting in their own best interest and their decisions being in the long-term best interest of the manager's subunit

C)managers acting in their own best interest and their decisions being in the long-term best interest of the company

D)managers not acting in their own best interest and their decisions being in the best interest of the company

E)managers competing with each other so that they become more efficient

A)managers always acting in their own best interest

B)managers acting in their own best interest and their decisions being in the long-term best interest of the manager's subunit

C)managers acting in their own best interest and their decisions being in the long-term best interest of the company

D)managers not acting in their own best interest and their decisions being in the best interest of the company

E)managers competing with each other so that they become more efficient

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

57

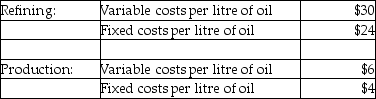

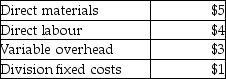

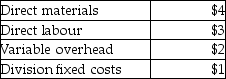

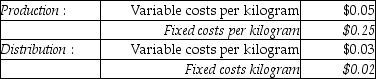

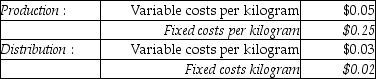

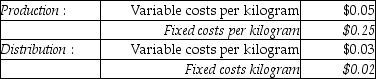

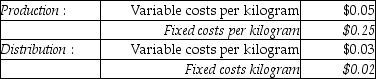

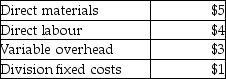

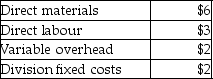

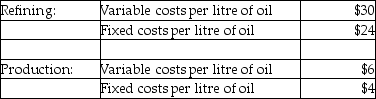

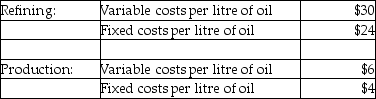

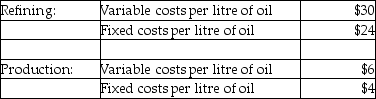

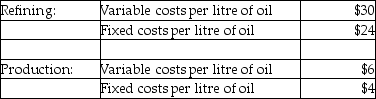

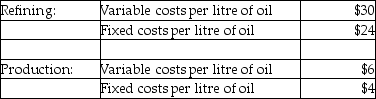

Use the information below to answer the following question(s).Blackoil Corp.has two divisions, Refining and Production.The company's primary product is Clean Oil.Each division's costs are provided below:

The Production Division is able to sell the oil to other areas for $24 per litre.The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers.The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.

The Production Division is able to sell the oil to other areas for $24 per litre.The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers.The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.

What is the transfer price per litre assuming the method used is 175% of variable costs?

A)$10.50

B)$12.00

C)$17.50

D)$24.50

E)$12.50

The Production Division is able to sell the oil to other areas for $24 per litre.The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers.The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.

The Production Division is able to sell the oil to other areas for $24 per litre.The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers.The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.What is the transfer price per litre assuming the method used is 175% of variable costs?

A)$10.50

B)$12.00

C)$17.50

D)$24.50

E)$12.50

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

58

For each of the following activities, characteristics, and applications, tell whether they are primarily labelled as being found in a centralized organization, a decentralized organization, or both types of organizations.

A)both

B)centralization

C)decentralization

Minimum of sub optimal decision making.

A)both

B)centralization

C)decentralization

Minimum of sub optimal decision making.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

59

No matter how low the transfer price, the manager of the selling division should sell the division's product to other company divisions in the interests of overall company profitability.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

60

All of the following criteria may be used to choose a transfer-pricing method EXCEPT

A)promotion of quality products.

B)promotion of a sustained high level of management effort.

C)promotion of a high level of subunit autonomy.

D)promotion of goal congruence.

E)help top management evaluate subunit performance.

A)promotion of quality products.

B)promotion of a sustained high level of management effort.

C)promotion of a high level of subunit autonomy.

D)promotion of goal congruence.

E)help top management evaluate subunit performance.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

61

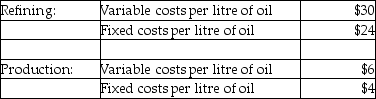

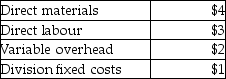

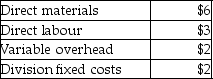

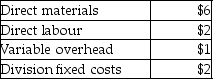

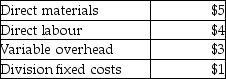

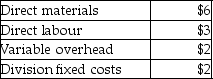

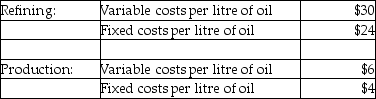

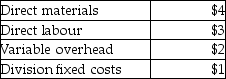

Answer the following question(s)using the information below.Beta Shoe Ltd.manufactures only one type of shoe and has two divisions, the Sole Division, and the Assembly Division.The Sole Division manufactures soles for the Assembly Division, which completes the shoe and sells it to retailers.The Sole Division "sells" soles to the Assembly Division.The market price for the Assembly Division to purchase a pair of soles is $20.(Ignore changes in inventory.)The per unit fixed costs are based on a production of 60,000 pairs of shoes.Sole's costs per pair of soles are:

Assembly's costs per completed pair of shoes are:

Assembly's costs per completed pair of shoes are:

If the Assembly Division sells 100,000 pairs of shoes at a price of $60 a pair to customers, what is the company's operating income?

A)$4,400,000

B)$4,020,000

C)$3,900,000

D)$2,600,000

E)$2,400,000

Assembly's costs per completed pair of shoes are:

Assembly's costs per completed pair of shoes are:

If the Assembly Division sells 100,000 pairs of shoes at a price of $60 a pair to customers, what is the company's operating income?

A)$4,400,000

B)$4,020,000

C)$3,900,000

D)$2,600,000

E)$2,400,000

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

62

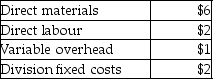

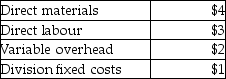

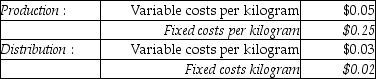

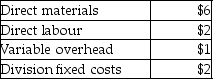

Answer the following question(s)using the information below.Delta Footwear Ltd.manufactures only one type of sandal and has two divisions, the Sole Division, and the Assembly Division.The Sole Division manufactures soles for the Assembly Division, which completes the sandal and sells it to retailers.The Sole Division "sells" soles to the Assembly Division.The market price for the Assembly Division to purchase a pair of soles is $18.(Ignore changes in inventory.)The per unit fixed costs are based on a production of 50,000 pairs of sandals.Sole's costs per pair of soles are:

Assembly's costs per completed pair of sandals are:

Assembly's costs per completed pair of sandals are:

What is the transfer price per pair of sandals from the Sole Division to the Assembly Division if the method used to place a value on each pair of soles is 150% of variable costs?

A)$18.00

B)$19.50

C)$13.50

D)$16.50

E)$7.50

Assembly's costs per completed pair of sandals are:

Assembly's costs per completed pair of sandals are:

What is the transfer price per pair of sandals from the Sole Division to the Assembly Division if the method used to place a value on each pair of soles is 150% of variable costs?

A)$18.00

B)$19.50

C)$13.50

D)$16.50

E)$7.50

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

63

Answer the following question(s)using the information below.Beta Shoe Ltd.manufactures only one type of shoe and has two divisions, the Sole Division, and the Assembly Division.The Sole Division manufactures soles for the Assembly Division, which completes the shoe and sells it to retailers.The Sole Division "sells" soles to the Assembly Division.The market price for the Assembly Division to purchase a pair of soles is $20.(Ignore changes in inventory.)The per unit fixed costs are based on a production of 60,000 pairs of shoes.Sole's costs per pair of soles are:

Assembly's costs per completed pair of shoes are:

Assembly's costs per completed pair of shoes are:

Assume the transfer price for a pair of soles is 180% of total costs of the Sole Division and 40,000 of soles are produced and transferred to the Assembly Division.The Sole Division's operating income is

A)$300,000.

B)$320,000.

C)$248,000.

D)$440,000.

E)$400,000.

Assembly's costs per completed pair of shoes are:

Assembly's costs per completed pair of shoes are:

Assume the transfer price for a pair of soles is 180% of total costs of the Sole Division and 40,000 of soles are produced and transferred to the Assembly Division.The Sole Division's operating income is

A)$300,000.

B)$320,000.

C)$248,000.

D)$440,000.

E)$400,000.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

64

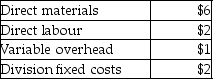

Answer the following question(s)using the information below:

Greenlawn Ltd.has two divisions, Distribution and Production.The company's primary product is fertilizer.Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,000,000 kilograms a week and usually purchases 2,000,000 kilograms from the Production Division and 2,000,000 kilograms from other suppliers at $0.45 per kilogram.

The Distribution Division has been operating at a capacity of 4,000,000 kilograms a week and usually purchases 2,000,000 kilograms from the Production Division and 2,000,000 kilograms from other suppliers at $0.45 per kilogram.

Assume 100,000 kilograms are transferred from the Production Division to the Distribution Division for a transfer price of $0.40 per kilogram.The Distribution Division sells the 100,000 kilograms at a price of $0.55 each to customers.What is the company's operating income?

A)$10,000

B)$15,000

C)$20,000

D)$25,000

E)$0

Greenlawn Ltd.has two divisions, Distribution and Production.The company's primary product is fertilizer.Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,000,000 kilograms a week and usually purchases 2,000,000 kilograms from the Production Division and 2,000,000 kilograms from other suppliers at $0.45 per kilogram.

The Distribution Division has been operating at a capacity of 4,000,000 kilograms a week and usually purchases 2,000,000 kilograms from the Production Division and 2,000,000 kilograms from other suppliers at $0.45 per kilogram.Assume 100,000 kilograms are transferred from the Production Division to the Distribution Division for a transfer price of $0.40 per kilogram.The Distribution Division sells the 100,000 kilograms at a price of $0.55 each to customers.What is the company's operating income?

A)$10,000

B)$15,000

C)$20,000

D)$25,000

E)$0

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

65

Answer the following question(s)using the information below.Delta Footwear Ltd.manufactures only one type of sandal and has two divisions, the Sole Division, and the Assembly Division.The Sole Division manufactures soles for the Assembly Division, which completes the sandal and sells it to retailers.The Sole Division "sells" soles to the Assembly Division.The market price for the Assembly Division to purchase a pair of soles is $18.(Ignore changes in inventory.)The per unit fixed costs are based on a production of 50,000 pairs of sandals.Sole's costs per pair of soles are:

Assembly's costs per completed pair of sandals are:

Assembly's costs per completed pair of sandals are:

What is the market-based transfer price per pair of soles from the Sole Division to the Assembly Division?

A)$9

B)$10

C)$18

D)$16

E)$27

Assembly's costs per completed pair of sandals are:

Assembly's costs per completed pair of sandals are:

What is the market-based transfer price per pair of soles from the Sole Division to the Assembly Division?

A)$9

B)$10

C)$18

D)$16

E)$27

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

66

Answer the following question(s)using the information below:

Greenlawn Ltd.has two divisions, Distribution and Production.The company's primary product is fertilizer.Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,000,000 kilograms a week and usually purchases 2,000,000 kilograms from the Production Division and 2,000,000 kilograms from other suppliers at $0.45 per kilogram.

The Distribution Division has been operating at a capacity of 4,000,000 kilograms a week and usually purchases 2,000,000 kilograms from the Production Division and 2,000,000 kilograms from other suppliers at $0.45 per kilogram.

What is the transfer price per kilogram from the Production Division to the Distribution Division, assuming the method used to place a value on each kilogram of fertilizer is 160% of variable costs?

A)$0.05

B)$0.11

C)$0.08

D)$0.40

E)$0.48

Greenlawn Ltd.has two divisions, Distribution and Production.The company's primary product is fertilizer.Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,000,000 kilograms a week and usually purchases 2,000,000 kilograms from the Production Division and 2,000,000 kilograms from other suppliers at $0.45 per kilogram.

The Distribution Division has been operating at a capacity of 4,000,000 kilograms a week and usually purchases 2,000,000 kilograms from the Production Division and 2,000,000 kilograms from other suppliers at $0.45 per kilogram.What is the transfer price per kilogram from the Production Division to the Distribution Division, assuming the method used to place a value on each kilogram of fertilizer is 160% of variable costs?

A)$0.05

B)$0.11

C)$0.08

D)$0.40

E)$0.48

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

67

Answer the following question(s)using the information below:

Greenlawn Ltd.has two divisions, Distribution and Production.The company's primary product is fertilizer.Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,000,000 kilograms a week and usually purchases 2,000,000 kilograms from the Production Division and 2,000,000 kilograms from other suppliers at $0.45 per kilogram.

The Distribution Division has been operating at a capacity of 4,000,000 kilograms a week and usually purchases 2,000,000 kilograms from the Production Division and 2,000,000 kilograms from other suppliers at $0.45 per kilogram.

What is the transfer price per kilogram from the Production Division to the Distribution Division, assuming the method used to place a value on each kilogram of fertilizer is 120% of full costs?

A)$0.30

B)$0.36

C)$0.45

D)$0.55

E)$0.42

Greenlawn Ltd.has two divisions, Distribution and Production.The company's primary product is fertilizer.Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,000,000 kilograms a week and usually purchases 2,000,000 kilograms from the Production Division and 2,000,000 kilograms from other suppliers at $0.45 per kilogram.

The Distribution Division has been operating at a capacity of 4,000,000 kilograms a week and usually purchases 2,000,000 kilograms from the Production Division and 2,000,000 kilograms from other suppliers at $0.45 per kilogram.What is the transfer price per kilogram from the Production Division to the Distribution Division, assuming the method used to place a value on each kilogram of fertilizer is 120% of full costs?

A)$0.30

B)$0.36

C)$0.45

D)$0.55

E)$0.42

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

68

Answer the following question(s)using the information below.Beta Shoe Ltd.manufactures only one type of shoe and has two divisions, the Sole Division, and the Assembly Division.The Sole Division manufactures soles for the Assembly Division, which completes the shoe and sells it to retailers.The Sole Division "sells" soles to the Assembly Division.The market price for the Assembly Division to purchase a pair of soles is $20.(Ignore changes in inventory.)The per unit fixed costs are based on a production of 60,000 pairs of shoes.Sole's costs per pair of soles are:

Assembly's costs per completed pair of shoes are:

Assembly's costs per completed pair of shoes are:

What is the transfer price per pair of shoes from the Sole Division to the Assembly Division if the transfer price per pair of soles is 125% of full costs?

A)$10.00

B)$12.50

C)$11.25

D)$20.00

E)$8.75

Assembly's costs per completed pair of shoes are:

Assembly's costs per completed pair of shoes are:

What is the transfer price per pair of shoes from the Sole Division to the Assembly Division if the transfer price per pair of soles is 125% of full costs?

A)$10.00

B)$12.50

C)$11.25

D)$20.00

E)$8.75

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

69

Answer the following question(s)using the information below.Delta Footwear Ltd.manufactures only one type of sandal and has two divisions, the Sole Division, and the Assembly Division.The Sole Division manufactures soles for the Assembly Division, which completes the sandal and sells it to retailers.The Sole Division "sells" soles to the Assembly Division.The market price for the Assembly Division to purchase a pair of soles is $18.(Ignore changes in inventory.)The per unit fixed costs are based on a production of 50,000 pairs of sandals.Sole's costs per pair of soles are:

Assembly's costs per completed pair of sandals are:

Assembly's costs per completed pair of sandals are:

If the Assembly Division sells 100,000 pairs of sandals at a price of $35 a pair to customers, what is the company's operating income?

A)$1,400,000

B)$1,950,000

C)$900,000

D)$2,200,000

E)$1,050,000

Assembly's costs per completed pair of sandals are:

Assembly's costs per completed pair of sandals are:

If the Assembly Division sells 100,000 pairs of sandals at a price of $35 a pair to customers, what is the company's operating income?

A)$1,400,000

B)$1,950,000

C)$900,000

D)$2,200,000

E)$1,050,000

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

70

Answer the following question(s)using the information below.Delta Footwear Ltd.manufactures only one type of sandal and has two divisions, the Sole Division, and the Assembly Division.The Sole Division manufactures soles for the Assembly Division, which completes the sandal and sells it to retailers.The Sole Division "sells" soles to the Assembly Division.The market price for the Assembly Division to purchase a pair of soles is $18.(Ignore changes in inventory.)The per unit fixed costs are based on a production of 50,000 pairs of sandals.Sole's costs per pair of soles are:

Assembly's costs per completed pair of sandals are:

Assembly's costs per completed pair of sandals are:

What is the transfer price per pair of sandals from the Sole Division to the Assembly Division if the transfer price per pair of soles is 125% of full costs?

A)$15.00

B)$13.00

C)$26.25

D)$16.25

E)$8.75

Assembly's costs per completed pair of sandals are:

Assembly's costs per completed pair of sandals are:

What is the transfer price per pair of sandals from the Sole Division to the Assembly Division if the transfer price per pair of soles is 125% of full costs?

A)$15.00

B)$13.00

C)$26.25

D)$16.25

E)$8.75

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

71

Use the information below to answer the following question(s).Blackoil Corp.has two divisions, Refining and Production.The company's primary product is Clean Oil.Each division's costs are provided below:

The Production Division is able to sell the oil to other areas for $24 per litre.The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers.The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.

The Production Division is able to sell the oil to other areas for $24 per litre.The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers.The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.

What is the Refining Division's operating income if 150 litres of oil are sold at $110 /litre and 200 litres are transferred in? Assume the transfer price is based on 175% of variable costs.

A)$16,500

B)$15,600

C)$525

D)$6,825

E)$8,500

The Production Division is able to sell the oil to other areas for $24 per litre.The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers.The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.

The Production Division is able to sell the oil to other areas for $24 per litre.The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers.The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.What is the Refining Division's operating income if 150 litres of oil are sold at $110 /litre and 200 litres are transferred in? Assume the transfer price is based on 175% of variable costs.

A)$16,500

B)$15,600

C)$525

D)$6,825

E)$8,500

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

72

Answer the following question(s)using the information below.Beta Shoe Ltd.manufactures only one type of shoe and has two divisions, the Sole Division, and the Assembly Division.The Sole Division manufactures soles for the Assembly Division, which completes the shoe and sells it to retailers.The Sole Division "sells" soles to the Assembly Division.The market price for the Assembly Division to purchase a pair of soles is $20.(Ignore changes in inventory.)The per unit fixed costs are based on a production of 60,000 pairs of shoes.Sole's costs per pair of soles are:

Assembly's costs per completed pair of shoes are:

Assembly's costs per completed pair of shoes are:

What is the market-based transfer price per pair of soles from the Sole Division to the Assembly Division?

A)$9

B)$10

C)$20

D)$16

E)$27

Assembly's costs per completed pair of shoes are:

Assembly's costs per completed pair of shoes are:

What is the market-based transfer price per pair of soles from the Sole Division to the Assembly Division?

A)$9

B)$10

C)$20

D)$16

E)$27

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

73

Use the information below to answer the following question(s).Bon Accord uses two divisions in the production of soybean burgers.Division A sells soybean paste internally to Division B, which, in turn, produces soybean burgers that sell for $5 per kilogram.Division A incurs costs of $0.75 per kilogram, while Division B incurs additional costs of $2.50 per kilogram.

What is Division B's operating income per kilogram assuming the transfer price of the soybean paste is set at $1.25 per kilogram?

A)$0.500

B)$0.875

C)$1.250

D)$1.625

E)$1.525

What is Division B's operating income per kilogram assuming the transfer price of the soybean paste is set at $1.25 per kilogram?

A)$0.500

B)$0.875

C)$1.250

D)$1.625

E)$1.525

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

74

Use the information below to answer the following question(s).Blackoil Corp.has two divisions, Refining and Production.The company's primary product is Clean Oil.Each division's costs are provided below:

The Production Division is able to sell the oil to other areas for $24 per litre.The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers.The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.

The Production Division is able to sell the oil to other areas for $24 per litre.The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers.The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.

What is the transfer price per litre from the Production Division to the Refining Division assuming the method is 120% of full costs?

A)$16.80

B)$12.00

C)$9.50

D)$7.20

E)$12.50

The Production Division is able to sell the oil to other areas for $24 per litre.The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers.The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.

The Production Division is able to sell the oil to other areas for $24 per litre.The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers.The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.What is the transfer price per litre from the Production Division to the Refining Division assuming the method is 120% of full costs?

A)$16.80

B)$12.00

C)$9.50

D)$7.20

E)$12.50

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

75

Use the information below to answer the following question(s).Bon Accord uses two divisions in the production of soybean burgers.Division A sells soybean paste internally to Division B, which, in turn, produces soybean burgers that sell for $5 per kilogram.Division A incurs costs of $0.75 per kilogram, while Division B incurs additional costs of $2.50 per kilogram.

What is Division A's operating income per kilogram assuming the transfer price of the soybean paste is set at $1.25 per kilogram?

A)$0.500

B)$0.875

C)$1.250

D)$1.625

E)$1.525

What is Division A's operating income per kilogram assuming the transfer price of the soybean paste is set at $1.25 per kilogram?

A)$0.500

B)$0.875

C)$1.250

D)$1.625

E)$1.525

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

76

Use the information below to answer the following question(s).Blackoil Corp.has two divisions, Refining and Production.The company's primary product is Clean Oil.Each division's costs are provided below:

The Production Division is able to sell the oil to other areas for $24 per litre.The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers.The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.

The Production Division is able to sell the oil to other areas for $24 per litre.The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers.The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.

What is the transfer price per litre from production to refining if the market price method of pricing is used?

A)$24

B)$32

C)$36

D)$40

E)$38

The Production Division is able to sell the oil to other areas for $24 per litre.The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers.The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.

The Production Division is able to sell the oil to other areas for $24 per litre.The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers.The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.What is the transfer price per litre from production to refining if the market price method of pricing is used?

A)$24

B)$32

C)$36

D)$40

E)$38

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

77

Use the information below to answer the following question(s).Bon Accord uses two divisions in the production of soybean burgers.Division A sells soybean paste internally to Division B, which, in turn, produces soybean burgers that sell for $5 per kilogram.Division A incurs costs of $0.75 per kilogram, while Division B incurs additional costs of $2.50 per kilogram.

What is Bon Accord's operating income per kilogram?

A)$1.75

B)$1.25

C)$0.50

D)$0

E)$2.00

What is Bon Accord's operating income per kilogram?

A)$1.75

B)$1.25

C)$0.50

D)$0

E)$2.00

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

78

Use the information below to answer the following question(s).Blackoil Corp.has two divisions, Refining and Production.The company's primary product is Clean Oil.Each division's costs are provided below:

The Production Division is able to sell the oil to other areas for $24 per litre.The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers.The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.

The Production Division is able to sell the oil to other areas for $24 per litre.The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers.The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.

What is the Production Division's operating income per 200 litres of oil reported under the 175% of variable costs method?

A)$1,500

B)$880

C)$100

D)$(100)

E)$1,200

The Production Division is able to sell the oil to other areas for $24 per litre.The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers.The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.

The Production Division is able to sell the oil to other areas for $24 per litre.The Refining Division has been operating at a capacity of 80,000 litres a day, using oil from the Production Division and oil purchased from other suppliers.The Refining Division usually purchases 50,000 litres of oil, on average, from the Production Division and 30,000 litres, on average, from other suppliers at $40/litre.What is the Production Division's operating income per 200 litres of oil reported under the 175% of variable costs method?

A)$1,500

B)$880

C)$100

D)$(100)

E)$1,200

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

79

Answer the following question(s)using the information below.Delta Footwear Ltd.manufactures only one type of sandal and has two divisions, the Sole Division, and the Assembly Division.The Sole Division manufactures soles for the Assembly Division, which completes the sandal and sells it to retailers.The Sole Division "sells" soles to the Assembly Division.The market price for the Assembly Division to purchase a pair of soles is $18.(Ignore changes in inventory.)The per unit fixed costs are based on a production of 50,000 pairs of sandals.Sole's costs per pair of soles are:

Assembly's costs per completed pair of sandals are:

Assembly's costs per completed pair of sandals are:

Assume the transfer price for a pair of soles is 150% of total costs of the Sole Division and 40,000 of soles are produced and transferred to the Assembly Division.The Sole Division's operating income is

A)$250,000.

B)$260,000.

C)$248,000.

D)$300,000.

E)$400,000.

Assembly's costs per completed pair of sandals are:

Assembly's costs per completed pair of sandals are:

Assume the transfer price for a pair of soles is 150% of total costs of the Sole Division and 40,000 of soles are produced and transferred to the Assembly Division.The Sole Division's operating income is

A)$250,000.

B)$260,000.

C)$248,000.

D)$300,000.

E)$400,000.

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck

80

Answer the following question(s)using the information below.Beta Shoe Ltd.manufactures only one type of shoe and has two divisions, the Sole Division, and the Assembly Division.The Sole Division manufactures soles for the Assembly Division, which completes the shoe and sells it to retailers.The Sole Division "sells" soles to the Assembly Division.The market price for the Assembly Division to purchase a pair of soles is $20.(Ignore changes in inventory.)The per unit fixed costs are based on a production of 60,000 pairs of shoes.Sole's costs per pair of soles are:

Assembly's costs per completed pair of shoes are:

Assembly's costs per completed pair of shoes are:

What is the transfer price per pair of soles from the Sole Division to the Assembly Division if the method used to place a value on each pair of soles is 180% of variable costs?

A)$14.40

B)$12.60

C)$16.20

D)$28.80

E)$32.40

Assembly's costs per completed pair of shoes are:

Assembly's costs per completed pair of shoes are:

What is the transfer price per pair of soles from the Sole Division to the Assembly Division if the method used to place a value on each pair of soles is 180% of variable costs?

A)$14.40

B)$12.60

C)$16.20

D)$28.80

E)$32.40

Unlock Deck

Unlock for access to all 183 flashcards in this deck.

Unlock Deck

k this deck