Deck 23: Flexible Budgets and Standard Cost Systems

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/173

Play

Full screen (f)

Deck 23: Flexible Budgets and Standard Cost Systems

1

A static budget is prepared for only one level of sales volume.

True

2

Onyx Company has prepared a static budget at the beginning of the month. At the end of the month, the following information has been retrieved from the records. Static budget:

Sales volume: 2,000 units: Price: $50 per unit

Variable expense: $12 per unit: Fixed expenses: $25,000 per month

Operating income: $51,000

Actual results:

Sales volume: 1,800 units: Price: $58 per unit

Variable expense: $16 per unit: Fixed expenses: $35,000 per month

Operating income: $40,600

Calculate the flexible budget variance for variable expenses.

A) $5,490 U

B) $2,970 U

C) $7,200 U

D) $3,960 F

Sales volume: 2,000 units: Price: $50 per unit

Variable expense: $12 per unit: Fixed expenses: $25,000 per month

Operating income: $51,000

Actual results:

Sales volume: 1,800 units: Price: $58 per unit

Variable expense: $16 per unit: Fixed expenses: $35,000 per month

Operating income: $40,600

Calculate the flexible budget variance for variable expenses.

A) $5,490 U

B) $2,970 U

C) $7,200 U

D) $3,960 F

C

3

Allen Manufacturing makes staplers. The budgeted selling price is $12 per stapler, the variable costs are $4 per stapler, and budgeted fixed costs are $12,000. What is the budgeted operating income for 5,000 staplers?

A) $40,000

B) $28,000

C) $60,000

D) $68,000

A) $40,000

B) $28,000

C) $60,000

D) $68,000

B

4

Onyx Company has prepared a static budget at the beginning of the month. At the end of the month, the following information has been retrieved from the records. Static budget:

Sales volume: 1,000 units: Price: $70 per unit

Variable expense: $32 per unit: Fixed expenses: $37,500 per month

Operating income: $500

Actual results:

Sales volume: 990 units: Price: $74 per unit

Variable expense: $35 per unit: Fixed expenses: $33,000 per month

Operating income: $5,610

Calculate the flexible budget variance for fixed expenses.

A) $4,500 U

B) $4,500 F

C) $0

D) $5,490 F

Sales volume: 1,000 units: Price: $70 per unit

Variable expense: $32 per unit: Fixed expenses: $37,500 per month

Operating income: $500

Actual results:

Sales volume: 990 units: Price: $74 per unit

Variable expense: $35 per unit: Fixed expenses: $33,000 per month

Operating income: $5,610

Calculate the flexible budget variance for fixed expenses.

A) $4,500 U

B) $4,500 F

C) $0

D) $5,490 F

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

5

Kevin Company prepared the following static budget for the year 2015: If a flexible budget was prepared at a volume of 6,000, calculate the amount of operating income.

A) $5,000

B) $3,500

C) $9,000

D) $4,000

A) $5,000

B) $3,500

C) $9,000

D) $4,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

6

Sales volume variance is the difference between the:

A) actual amounts and the flexible budget due to differences in price and costs.

B) expected results in the flexible budget for the actual units sold and the static budget.

C) static budget and actual amounts due to differences in selling price.

D) flexible budget and static budget due to differences in fixed costs.

A) actual amounts and the flexible budget due to differences in price and costs.

B) expected results in the flexible budget for the actual units sold and the static budget.

C) static budget and actual amounts due to differences in selling price.

D) flexible budget and static budget due to differences in fixed costs.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

7

Flexible budget variance is the difference between the:

A) actual results and the expected results in the flexible budget for the actual units sold.

B) expected results in the flexible budget for the units expected to be sold and the static budget.

C) flexible budget and actual amounts due to differences in volumes.

D) flexible budget and static budget due to differences in fixed costs.

A) actual results and the expected results in the flexible budget for the actual units sold.

B) expected results in the flexible budget for the units expected to be sold and the static budget.

C) flexible budget and actual amounts due to differences in volumes.

D) flexible budget and static budget due to differences in fixed costs.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

8

A flexible budget summarizes revenues and expenses for various levels of sales volume within a relevant range.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following amounts of a flexible budget remain constant when the sales volume changes?

A) total contribution margin

B) total fixed costs

C) total variable expenses

D) total sales revenue

A) total contribution margin

B) total fixed costs

C) total variable expenses

D) total sales revenue

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following amounts of a flexible budget change with changes in sales volume?

A) selling price per unit

B) total fixed costs

C) variable expense per unit

D) total contribution margin

A) selling price per unit

B) total fixed costs

C) variable expense per unit

D) total contribution margin

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

11

A static budget presents financial data at multiple levels of sales volume.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

12

Onyx Company has prepared a static budget at the beginning of the month. At the end of the month, the following information has been retrieved from the records. Static budget:

Sales volume: 1,000 units: Price: $70 per unit

Variable expense: $32 per unit: Fixed expenses: $37,500 per month

Operating income: $500

Actual results:

Sales volume: 990 units: Price: $74 per unit

Variable expense: $35 per unit: Fixed expenses: $33,000 per month

Operating income: $5,610

Calculate the flexible budget variance for Sales Revenue.

A) $5,490 U

B) $5,490 F

C) $3,960 U

D) $3,960 F

Sales volume: 1,000 units: Price: $70 per unit

Variable expense: $32 per unit: Fixed expenses: $37,500 per month

Operating income: $500

Actual results:

Sales volume: 990 units: Price: $74 per unit

Variable expense: $35 per unit: Fixed expenses: $33,000 per month

Operating income: $5,610

Calculate the flexible budget variance for Sales Revenue.

A) $5,490 U

B) $5,490 F

C) $3,960 U

D) $3,960 F

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

13

Flexible budget variance is the difference between expected results in the flexible budget for the actual units sold and the static budget.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

14

The flexible budget variance is the difference between the actual results and the expected results in the flexible budget for the actual units sold.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

15

Ibis Company prepared the following static budget for the month of November, 2015: If a flexible budget was prepared at a volume of 13,000 units, calculate the operating income at 13,000 units of production.

A) $22,000

B) $17,500

C) $14,000

D) $26,000

A) $22,000

B) $17,500

C) $14,000

D) $26,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

16

Kevin Company prepared the following static budget for the year 2015: If a flexible budget was prepared at a volume of 7,000, calculate the amount of operating income.

A) $3,500

B) $10,500

C) $6,500

D) $4,000

A) $3,500

B) $10,500

C) $6,500

D) $4,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

17

A variance is the difference between an actual amount and a budgeted amount.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

18

The difference between the expected results in the flexible budget for the actual units sold and the static budget is called the sales volume variance.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

19

The sales volume variance is a result of the difference between the actual selling price and the budgeted selling price.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

20

A favorable variance reflects a decrease in operating income.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

21

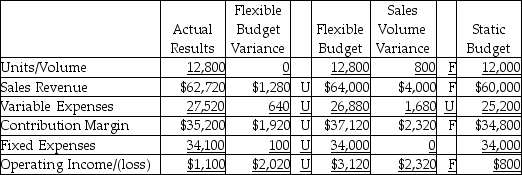

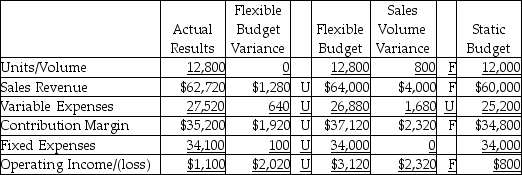

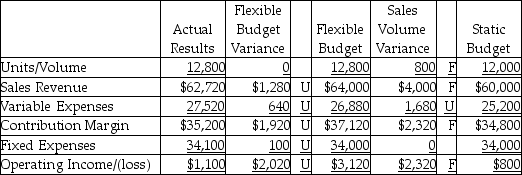

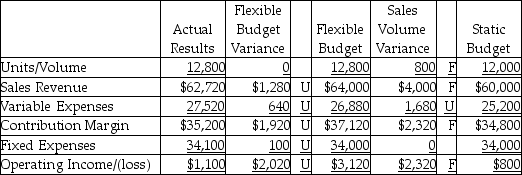

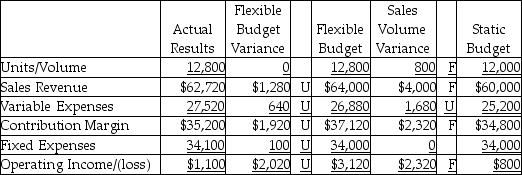

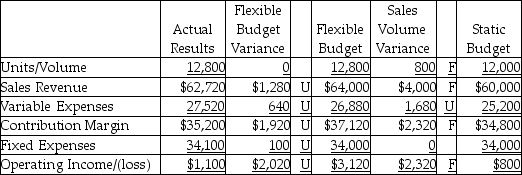

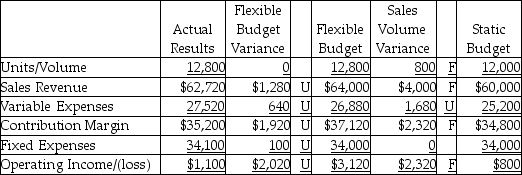

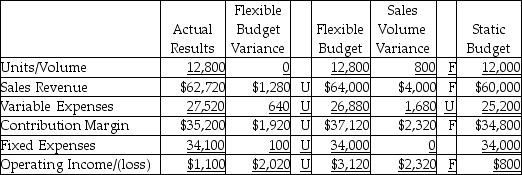

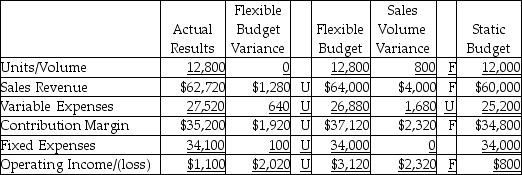

The Carolina Products Company has completed the flexible budget analysis for the 2nd quarter, which is as given below.  Which of the following statements would be a correct interpretation of the flexible budget variance for sales revenue?

Which of the following statements would be a correct interpretation of the flexible budget variance for sales revenue?

A) decrease in price per unit

B) increase in variable cost per unit

C) increase in sales volume

D) increase in fixed costs

Which of the following statements would be a correct interpretation of the flexible budget variance for sales revenue?

Which of the following statements would be a correct interpretation of the flexible budget variance for sales revenue?A) decrease in price per unit

B) increase in variable cost per unit

C) increase in sales volume

D) increase in fixed costs

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

22

Onyx Company has prepared a static budget at the beginning of the month. At the end of the month, the following information has been retrieved from the records. Static budget:

Sales volume: 2,000 units: Price: $50 per unit

Variable expense: $12 per unit: Fixed expenses: $25,000 per month

Operating income: $51,000

Actual results:

Sales volume: 1,800 units: Price: $58 per unit

Variable expense: $16 per unit: Fixed expenses: $35,000 per month

Operating income: $40,600

Calculate the sales volume variance for variable expenses.

A) $2,970 U

B) $2,400 F

C) $3,800 U

D) $3,960 F

Sales volume: 2,000 units: Price: $50 per unit

Variable expense: $12 per unit: Fixed expenses: $25,000 per month

Operating income: $51,000

Actual results:

Sales volume: 1,800 units: Price: $58 per unit

Variable expense: $16 per unit: Fixed expenses: $35,000 per month

Operating income: $40,600

Calculate the sales volume variance for variable expenses.

A) $2,970 U

B) $2,400 F

C) $3,800 U

D) $3,960 F

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

23

A company is analyzing its month-end results by comparing it to both static and flexible budgets. During the previous month, the actual sales volume was lower than the expected sales volume as per the static budget. This difference results in an unfavorable:

A) flexible budget variance for variable expenses.

B) sales volume variance for variable expenses.

C) flexible budget variance for sales revenues.

D) sales volume variance for sales revenues.

A) flexible budget variance for variable expenses.

B) sales volume variance for variable expenses.

C) flexible budget variance for sales revenues.

D) sales volume variance for sales revenues.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

24

An unfavorable flexible budget variance in operating income might be due to a(n):

A) increase in price.

B) decrease in volume.

C) increase in variable expenses per unit.

D) decrease in fixed costs.

A) increase in price.

B) decrease in volume.

C) increase in variable expenses per unit.

D) decrease in fixed costs.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

25

A company is analyzing its month-end results by comparing it to both static and flexible budgets. During the previous month, the actual selling price was higher than the expected price as per the static budget. This difference results in a(n):

A) favorable flexible budget variance for sales revenues.

B) favorable sales volume variance for sales revenues.

C) unfavorable flexible budget variance for sales revenues.

D) unfavorable sales volume variance for sales revenues.

A) favorable flexible budget variance for sales revenues.

B) favorable sales volume variance for sales revenues.

C) unfavorable flexible budget variance for sales revenues.

D) unfavorable sales volume variance for sales revenues.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

26

A company is analyzing its month-end results by comparing it to both static and flexible budgets. During the previous month, the actual fixed costs were lower than the expected fixed costs as per the static budget. This difference results in a(n):

A) unfavorable flexible budget variance for fixed costs.

B) favorable sales volume variance for fixed costs.

C) favorable flexible budget variance for fixed costs.

D) unfavorable sales volume variance for fixed costs.

A) unfavorable flexible budget variance for fixed costs.

B) favorable sales volume variance for fixed costs.

C) favorable flexible budget variance for fixed costs.

D) unfavorable sales volume variance for fixed costs.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

27

A company is analyzing its month-end results by comparing it to both static and flexible budgets. During the previous month, the actual variable expenses per unit were lower than the expected variable costs per unit as per the static budget. This difference results in a(n):

A) favorable flexible budget variance for variable expenses.

B) favorable sales volume variance for variable expenses.

C) unfavorable flexible budget variance for variable expenses.

D) unfavorable sales volume variance for variable expenses.

A) favorable flexible budget variance for variable expenses.

B) favorable sales volume variance for variable expenses.

C) unfavorable flexible budget variance for variable expenses.

D) unfavorable sales volume variance for variable expenses.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

28

Onyx Company has prepared a static budget at the beginning of the month. At the end of the month, the following information has been retrieved from the records. Static budget:

Sales volume: 1,000 units: Price: $70 per unit

Variable expense: $32 per unit: Fixed expenses: $37,500 per month

Operating income: $500

Actual results:

Sales volume: 990 units: Price: $74 per unit

Variable expense: $35 per unit: Fixed expenses: $33,000 per month

Operating income: $5,610

Calculate the sales volume variance for revenues.

A) $4,500 U

B) $700 U

C) $380 U

D) $3,960 F

Sales volume: 1,000 units: Price: $70 per unit

Variable expense: $32 per unit: Fixed expenses: $37,500 per month

Operating income: $500

Actual results:

Sales volume: 990 units: Price: $74 per unit

Variable expense: $35 per unit: Fixed expenses: $33,000 per month

Operating income: $5,610

Calculate the sales volume variance for revenues.

A) $4,500 U

B) $700 U

C) $380 U

D) $3,960 F

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

29

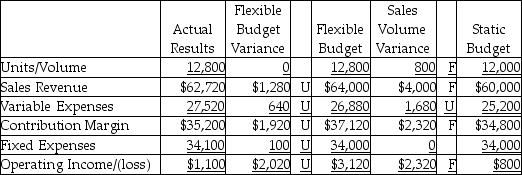

The Carolina Products Company has completed the flexible budget analysis for the 2nd quarter, which is as given below.  Which of the following statements would be a correct interpretation of the sales volume variance for operating income?

Which of the following statements would be a correct interpretation of the sales volume variance for operating income?

A) decrease in price per unit

B) increase in variable cost per unit

C) increase in sales volume

D) increase in fixed costs

Which of the following statements would be a correct interpretation of the sales volume variance for operating income?

Which of the following statements would be a correct interpretation of the sales volume variance for operating income?A) decrease in price per unit

B) increase in variable cost per unit

C) increase in sales volume

D) increase in fixed costs

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

30

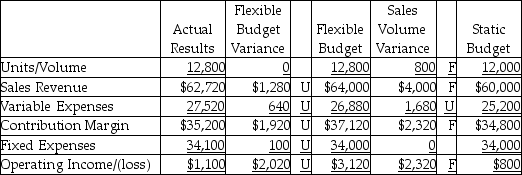

The Carolina Products Company has completed the flexible budget analysis for the 2nd quarter, which is as given below.  Which of the following would be a correct interpretation of the sales volume variance for variable expenses?

Which of the following would be a correct interpretation of the sales volume variance for variable expenses?

A) decrease in price per unit

B) increase in variable cost per unit

C) increase in sales volume

D) increase in fixed costs

Which of the following would be a correct interpretation of the sales volume variance for variable expenses?

Which of the following would be a correct interpretation of the sales volume variance for variable expenses?A) decrease in price per unit

B) increase in variable cost per unit

C) increase in sales volume

D) increase in fixed costs

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

31

A favorable sales volume variance in variable expenses suggests a(n):

A) increase in number of actual units sold.

B) decrease in number of actual units sold when compared to the expected number of units sold.

C) increase in variable expenses per unit.

D) decrease in fixed costs.

A) increase in number of actual units sold.

B) decrease in number of actual units sold when compared to the expected number of units sold.

C) increase in variable expenses per unit.

D) decrease in fixed costs.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

32

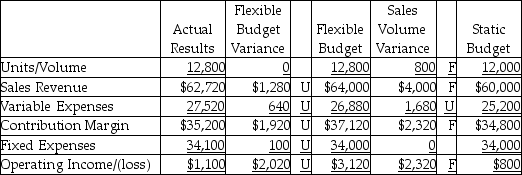

The Carolina Products Company has completed the flexible budget analysis for the 2nd quarter, which is as given below.  Which of the following statements would be a correct interpretation of the flexible budget variance for fixed expenses?

Which of the following statements would be a correct interpretation of the flexible budget variance for fixed expenses?

A) decrease in price per unit

B) increase in variable cost per unit

C) increase in sales volume

D) increase in fixed costs

Which of the following statements would be a correct interpretation of the flexible budget variance for fixed expenses?

Which of the following statements would be a correct interpretation of the flexible budget variance for fixed expenses?A) decrease in price per unit

B) increase in variable cost per unit

C) increase in sales volume

D) increase in fixed costs

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

33

A favorable flexible budget variance in sales revenues suggests a(n):

A) increase in selling price.

B) increase in volume.

C) decrease in variable costs per unit.

D) decrease in fixed costs.

A) increase in selling price.

B) increase in volume.

C) decrease in variable costs per unit.

D) decrease in fixed costs.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

34

A favorable sales volume variance in sales revenue suggests a(n):

A) increase in price.

B) increase in number of actual units sold when compared to the expected number of units sold.

C) increase in variable expenses per unit.

D) decrease in fixed costs.

A) increase in price.

B) increase in number of actual units sold when compared to the expected number of units sold.

C) increase in variable expenses per unit.

D) decrease in fixed costs.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

35

The Carolina Products Company has completed the flexible budget analysis for the 2nd quarter, which is as given below.  Which of the following would be a correct interpretation of the sales volume variance for sales revenues?

Which of the following would be a correct interpretation of the sales volume variance for sales revenues?

A) increase in price per unit

B) increase in sales volume

C) increase in variable expense per unit

D) increase in fixed costs

Which of the following would be a correct interpretation of the sales volume variance for sales revenues?

Which of the following would be a correct interpretation of the sales volume variance for sales revenues?A) increase in price per unit

B) increase in sales volume

C) increase in variable expense per unit

D) increase in fixed costs

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

36

The Carolina Products Company has completed the flexible budget analysis for the 2nd quarter, which is as given below.  Which of the following statements would be a correct interpretation of the flexible budget variance for variable expenses?

Which of the following statements would be a correct interpretation of the flexible budget variance for variable expenses?

A) decrease in price per unit

B) increase in variable cost per unit

C) increase in sales volume

D) increase in fixed costs

Which of the following statements would be a correct interpretation of the flexible budget variance for variable expenses?

Which of the following statements would be a correct interpretation of the flexible budget variance for variable expenses?A) decrease in price per unit

B) increase in variable cost per unit

C) increase in sales volume

D) increase in fixed costs

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

37

An unfavorable flexible budget variance in variable expenses suggests a(n):

A) increase in price.

B) decrease in volume.

C) increase in variable expenses per unit.

D) decrease in fixed costs.

A) increase in price.

B) decrease in volume.

C) increase in variable expenses per unit.

D) decrease in fixed costs.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

38

Onyx Company has prepared a static budget at the beginning of the month. At the end of the month, the following information has been retrieved from the records. Static budget:

Sales volume: 1,000 units: Price: $70 per unit

Variable expense: $32 per unit: Fixed expenses: $37,500 per month

Operating income: $500

Actual results:

Sales volume: 990 units: Price: $74 per unit

Variable expense: $35 per unit: Fixed expenses: $33,000 per month

Operating income: $5,610

Calculate the sales volume variance for fixed expenses.

A) $2,970 U

B) $4,500 F

C) $380 U

D) $0

Sales volume: 1,000 units: Price: $70 per unit

Variable expense: $32 per unit: Fixed expenses: $37,500 per month

Operating income: $500

Actual results:

Sales volume: 990 units: Price: $74 per unit

Variable expense: $35 per unit: Fixed expenses: $33,000 per month

Operating income: $5,610

Calculate the sales volume variance for fixed expenses.

A) $2,970 U

B) $4,500 F

C) $380 U

D) $0

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

39

Onyx Company has prepared a static budget at the beginning of the month. At the end of the month, following information has been retrieved from the records. Static budget:

Sales volume: 2,000 units: Price: $50 per unit

Variable expense: $12 per unit: Fixed expenses: $25,000 per month

Operating income: $51,000

Actual results:

Sales volume: 1,800 units: Price: $58 per unit

Variable expense: $16 per unit: Fixed expenses: $35,000 per month

Operating income: $40,600

Calculate the flexible budget variance for operating income.

A) $4,500 U

B) $7,600 U

C) $2,800 U

D) $5,490 F

Sales volume: 2,000 units: Price: $50 per unit

Variable expense: $12 per unit: Fixed expenses: $25,000 per month

Operating income: $51,000

Actual results:

Sales volume: 1,800 units: Price: $58 per unit

Variable expense: $16 per unit: Fixed expenses: $35,000 per month

Operating income: $40,600

Calculate the flexible budget variance for operating income.

A) $4,500 U

B) $7,600 U

C) $2,800 U

D) $5,490 F

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

40

Onyx Company has prepared a static budget at the beginning of the month. At the end of the month, the following information has been retrieved from the records. Static budget:

Sales volume: 2,000 units: Price: $50 per unit

Variable expense: $12 per unit: Fixed expenses: $25,000 per month

Operating income: $51,000

Actual results:

Sales volume: 1,800 units: Price: $58 per unit

Variable expense: $16 per unit: Fixed expenses: $35,000 per month

Operating income: $40,600

Calculate the sales volume variance for operating income.

A) $2,970 U

B) $5,490 F

C) $7,600 U

D) $5,110 F

Sales volume: 2,000 units: Price: $50 per unit

Variable expense: $12 per unit: Fixed expenses: $25,000 per month

Operating income: $51,000

Actual results:

Sales volume: 1,800 units: Price: $58 per unit

Variable expense: $16 per unit: Fixed expenses: $35,000 per month

Operating income: $40,600

Calculate the sales volume variance for operating income.

A) $2,970 U

B) $5,490 F

C) $7,600 U

D) $5,110 F

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

41

Western Outfitters projected sales of 75,000 units for the year 2015 at a unit sale price of $12.00. Actual sales in 2015: 72,000 units, at $14.00 per unit. Variable costs were budgeted at $4.00 per unit; actual variable cost was $4.75 per unit. Budgeted fixed costs totaled $375,000 while actual fixed costs amounted to $400,000. What is the sales volume variance for operating income?

A) $41,000 unfavorable

B) $24,000 unfavorable

C) $24,000 favorable

D) $65,000 unfavorable

A) $41,000 unfavorable

B) $24,000 unfavorable

C) $24,000 favorable

D) $65,000 unfavorable

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

42

City Golf Center reported actual operating income for the current year of $65,000. The flexible budget operating income for actual volume is $55,000, while the static budget operating income is $58,000. What is the flexible budget variance for operating income?

A) $10,000 favorable

B) $10,000 unfavorable

C) $3,000 unfavorable

D) $3,000 favorable

A) $10,000 favorable

B) $10,000 unfavorable

C) $3,000 unfavorable

D) $3,000 favorable

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

43

Setting standard costs is a function done within a company's production department and does not require any input from other departments.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

44

Global Engineering's actual operating income for the current year is $55,000. The flexible budget operating income for actual sales volume is $48,000, while the static budget operating income is $53,000. What is the sales volume variance for operating income?

A) $5,000 favorable

B) $2,000 unfavorable

C) $5,000 unfavorable

D) $2,000 favorable

A) $5,000 favorable

B) $2,000 unfavorable

C) $5,000 unfavorable

D) $2,000 favorable

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

45

A material cost variance measures the difference in quantities of actual input used and the standard quantity of input allowed for the actual number of units produced.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

46

Standard costs are developed by the cooperative effort of procurement, production, human resources, and accounting personnel.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

47

A standard is a price, cost, or quantity that is expected under normal conditions.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

48

Mountain Sports Equipment Company projected sales of 78,000 units at a unit sale price of $12 for the year 2015. Actual sales of 2015 were 75,000 units at $14 per unit. Variable costs were budgeted at $3 per unit; actual amount was $4 per unit. Budgeted fixed costs totaled $375,000, while actual fixed costs amounted to $400,000. What is the flexible budget variance for variable expenses?

A) $78,000 unfavorable

B) $75,000 unfavorable

C) $75,000 favorable

D) $78,000 favorable

A) $78,000 unfavorable

B) $75,000 unfavorable

C) $75,000 favorable

D) $78,000 favorable

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

49

Standard costs help motivate employees by serving as benchmarks against which their performance is measured.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

50

Western Outfitters projected sales of 75,000 units for the year 2015 at a unit sale price of $12.00. Actual sales in 2015 was 72,000 units, at $14.00 per unit. Variable costs were budgeted at $4.00 per unit; actual variable cost was $4.75 per unit. Budgeted fixed costs totaled $375,000 while actual fixed costs amounted to $400,000. What is the flexible budget variance for operating income?

A) $48,000 unfavorable

B) $65,000 favorable

C) $65,000 unfavorable

D) $41,000 favorable

A) $48,000 unfavorable

B) $65,000 favorable

C) $65,000 unfavorable

D) $41,000 favorable

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

51

In a standard costing system, each item has a cost standard and a quantity standard.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following is the correct formula to measure cost variance?

A) Cost Variance = (Actual Cost + Standard Cost) ÷ Actual Quantity

B) Cost Variance = (Actual Cost - Standard Cost) × Actual Quantity

C) Cost Variance = (Actual Cost + Standard Cost) + Actual Quantity

D) Cost Variance = (Actual Cost - Standard Cost) - Actual Quantity

A) Cost Variance = (Actual Cost + Standard Cost) ÷ Actual Quantity

B) Cost Variance = (Actual Cost - Standard Cost) × Actual Quantity

C) Cost Variance = (Actual Cost + Standard Cost) + Actual Quantity

D) Cost Variance = (Actual Cost - Standard Cost) - Actual Quantity

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

53

A standard cost system helps management set performance standards.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

54

An unfavorable sales volume variance in operating income suggests a(n):

A) increase in number of actual units sold.

B) decrease in number of actual units sold when compared to the expected number of units sold.

C) increase in variable expenses per unit.

D) decrease in fixed costs.

A) increase in number of actual units sold.

B) decrease in number of actual units sold when compared to the expected number of units sold.

C) increase in variable expenses per unit.

D) decrease in fixed costs.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

55

The static budget is used to compute flexible budget variance or price and efficiency variances.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

56

A standard cost system is an accounting system that uses standards for product costs.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

57

An efficiency variance measures how well a company keeps unit prices of material and labor inputs within standards.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

58

Companies use techniques like time-and-motion studies, and consult industry "best practices" when developing standards. This is referred to as benchmarking.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

59

An efficiency variance measures how well the business uses its materials or human resources.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

60

Mountain Sports Equipment Company projected sales of 78,000 units at a unit sale price of $12 for the year 2015. Actual sales of 2015 were 75,000 units at $14.00 per unit. Variable costs were budgeted at $3 per unit; actual amount was $4 per unit. Budgeted fixed costs totaled $375,000, while actual fixed costs amounted to $400,000. What is the sales volume variance for total revenue?

A) $23,000 favorable

B) $23,000 unfavorable

C) $36,000 unfavorable

D) $36,000 favorable

A) $23,000 favorable

B) $23,000 unfavorable

C) $36,000 unfavorable

D) $36,000 favorable

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

61

Wood Designs Company, a custom cabinet manufacturing company, is setting standard costs for one of its products. The main material is cedar wood, sold by the square foot. The current cost of cedar wood is $4.00 per square foot from the supplier. Delivery costs are $0.25 per board foot. Carpenters' wages are $25.00 per hour. Payroll costs are $3.60 per hour and benefits are $5.00 per hour. How much is the direct labor cost standard (per hour)?

A) $25.00 per hour

B) $25.60 per hour

C) $28.00 per hour

D) $33.60 per hour

A) $25.00 per hour

B) $25.60 per hour

C) $28.00 per hour

D) $33.60 per hour

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following is an example of a labor efficiency standard?

A) $20 per direct labor hour

B) 50 square feet per unit

C) $0.95 per square foot

D) 6 direct labor hours per unit

A) $20 per direct labor hour

B) 50 square feet per unit

C) $0.95 per square foot

D) 6 direct labor hours per unit

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following formulae is the correct formula to measure the efficiency variance?

A) Efficiency Variance = (Actual Quantity + Standard Quantity) - Standard Cost

B) Efficiency Variance = (Actual Quantity × Standard Quantity) ÷ Standard Cost

C) Efficiency Variance = (Actual Quantity ÷ Standard Quantity) × Standard Cost

D) Efficiency Variance = (Actual Quantity - Standard Quantity) × Standard Cost

A) Efficiency Variance = (Actual Quantity + Standard Quantity) - Standard Cost

B) Efficiency Variance = (Actual Quantity × Standard Quantity) ÷ Standard Cost

C) Efficiency Variance = (Actual Quantity ÷ Standard Quantity) × Standard Cost

D) Efficiency Variance = (Actual Quantity - Standard Quantity) × Standard Cost

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

64

Wood Designs Company, a custom cabinet manufacturing company, is setting standard costs for one of its products. The main material is cedar wood, sold by the square foot. The current cost of cedar wood is $4.00 per square foot from the supplier. Delivery costs are $0.25 per board foot. Carpenters' wages are $25.00 per hour. Payroll costs are $3.60 per hour and benefits are $5.00 per hour. How much is the direct materials cost standard (per square foot)?

A) $9.25 per square foot

B) $7.85 per square foot

C) $4.25 per square foot

D) $4.00 per square foot

A) $9.25 per square foot

B) $7.85 per square foot

C) $4.25 per square foot

D) $4.00 per square foot

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

65

A company is setting its direct materials and direct labor standards for its leading product. Materials cost from the supplier are $5 per square foot, net of purchase discount. Freight-in amounts to $0.10 per square foot. Basic wages of the assembly line personnel are $10 per hour. Payroll taxes are approximately 20% of wages. Benefits amount to $2 per hour. How much is the direct material cost standard (per square foot)?

A) $5.10 per square foot

B) $5.00 per square foot

C) $12.00 per square foot

D) $17.10 per square foot

A) $5.10 per square foot

B) $5.00 per square foot

C) $12.00 per square foot

D) $17.10 per square foot

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

66

What do cost variances measure?

A) the difference between the price the company pays and the price its competitors pay

B) the change in costs over time

C) the difference between actual and standard cost

D) the volume discounts companies receive when ordering materials in large quantities

A) the difference between the price the company pays and the price its competitors pay

B) the change in costs over time

C) the difference between actual and standard cost

D) the volume discounts companies receive when ordering materials in large quantities

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following does the efficiency variance measure?

A) the difference between the quantity used by the company and the quantity used by its competitors

B) the change in quantities used over time

C) the difference between actual and standard quantity used

D) how quickly materials are processed into finished goods

A) the difference between the quantity used by the company and the quantity used by its competitors

B) the change in quantities used over time

C) the difference between actual and standard quantity used

D) how quickly materials are processed into finished goods

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following will result in an unfavorable direct labor cost variance?

A) when actual direct labor hours exceed standard direct labor hours

B) when actual direct labor hours are less than standard direct labor hours

C) when the actual direct labor rate exceeds the standard direct labor rate

D) when the actual direct labor rate is less than the standard direct labor rate

A) when actual direct labor hours exceed standard direct labor hours

B) when actual direct labor hours are less than standard direct labor hours

C) when the actual direct labor rate exceeds the standard direct labor rate

D) when the actual direct labor rate is less than the standard direct labor rate

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following best describes standard costs?

A) costs used as a budget for a single unit of product

B) costs incurred to produce a product

C) costs based on the average of current market values

D) costs used to compare with competitors' prices

A) costs used as a budget for a single unit of product

B) costs incurred to produce a product

C) costs based on the average of current market values

D) costs used to compare with competitors' prices

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following is one of the reasons why companies use standard costs?

A) to enhance customer loyalty

B) to ensure the accuracy of the financial records

C) to share best practices with other companies

D) to make budgeting easier and more efficient

A) to enhance customer loyalty

B) to ensure the accuracy of the financial records

C) to share best practices with other companies

D) to make budgeting easier and more efficient

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following is an example of a materials efficiency standard?

A) $40 per direct labor hour

B) 50 square feet per unit

C) $0.95 per square foot

D) 6 direct labor hours per unit

A) $40 per direct labor hour

B) 50 square feet per unit

C) $0.95 per square foot

D) 6 direct labor hours per unit

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

72

A favorable direct materials cost variance occurs when the actual direct materials costs incurred is less than the standard direct materials cost.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following will result in an unfavorable direct materials efficiency variance?

A) The actual cost per unit of direct materials exceeded the standard cost of direct materials.

B) The actual cost per unit of direct materials was less than the standard cost of direct materials.

C) The actual quantity of direct materials used per unit exceeded the standard quantity of direct materials allowed per unit.

D) The actual quantity of direct materials used per unit was less than the standard quantity of direct materials allowed per unit.

A) The actual cost per unit of direct materials exceeded the standard cost of direct materials.

B) The actual cost per unit of direct materials was less than the standard cost of direct materials.

C) The actual quantity of direct materials used per unit exceeded the standard quantity of direct materials allowed per unit.

D) The actual quantity of direct materials used per unit was less than the standard quantity of direct materials allowed per unit.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

74

Only unfavorable variances should be investigated, if substantial, to determine their causes.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

75

A company is setting its direct materials and direct labor standards for its leading product. Materials cost from the supplier are $5 per square foot, net of purchase discount. Freight-in amounts to $0.10 per square foot. Basic wages of the assembly line personnel are $10 per hour. Payroll taxes are approximately 20% of wages. How much is the direct labor cost standard (per hour)?

A) $2 per hour

B) $10 per hour

C) $12 per hour

D) $17 per hour

A) $2 per hour

B) $10 per hour

C) $12 per hour

D) $17 per hour

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following is an example of a labor cost standard?

A) $40 per direct labor hour

B) 50 square feet per unit

C) $0.95 per square foot

D) 0.5 direct labor hours per unit

A) $40 per direct labor hour

B) 50 square feet per unit

C) $0.95 per square foot

D) 0.5 direct labor hours per unit

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following statements is true of cost variances and efficiency variances?

A) They pertain to the difference between the static budget and actual results.

B) They pertain to the difference between the flexible budget and actual results.

C) They pertain to the difference between the flexible budget and the static budget.

D) They pertain to the difference between the static budget and the previous year's actual results.

A) They pertain to the difference between the static budget and actual results.

B) They pertain to the difference between the flexible budget and actual results.

C) They pertain to the difference between the flexible budget and the static budget.

D) They pertain to the difference between the static budget and the previous year's actual results.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

78

A favorable variance of direct materials cost occurs when the actual direct materials cost incurred is more than the standard direct materials cost determined.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following is an example of a materials cost standard?

A) $40 per direct labor hour

B) 50 square feet per unit

C) $0.95 per square foot

D) 6 direct labor hours per unit

A) $40 per direct labor hour

B) 50 square feet per unit

C) $0.95 per square foot

D) 6 direct labor hours per unit

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following is one of the reasons why companies use standard costs?

A) to enhance customer loyalty

B) to set performance targets

C) to share best practices with other companies

D) to ensure the accuracy of the financial records

A) to enhance customer loyalty

B) to set performance targets

C) to share best practices with other companies

D) to ensure the accuracy of the financial records

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck