Deck 7: Cash and Receivables

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

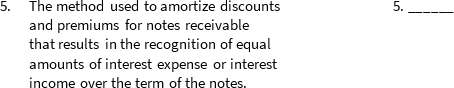

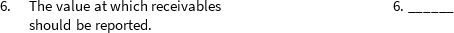

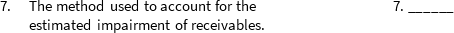

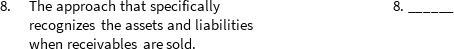

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/114

Play

Full screen (f)

Deck 7: Cash and Receivables

1

Grieves Company has the following items at year end: Cash in bank...................................................................................$42,,000

Petty cash........................................................................................1,500

Short-term paper with maturity of 2 months.................................6,500

Postdated chequer..........................................................................3,400

Grieves should report cash and cash equivalents of

A) $42,000.

B) $43,500.

C) $50,000.

D) $46,600.

Petty cash........................................................................................1,500

Short-term paper with maturity of 2 months.................................6,500

Postdated chequer..........................................................................3,400

Grieves should report cash and cash equivalents of

A) $42,000.

B) $43,500.

C) $50,000.

D) $46,600.

$50,000.

2

Receivables are initially valued based on their ______.

A) fair value

B) estimated amount collectible

C) lower-of-cost-and-market value

D) historical cost

A) fair value

B) estimated amount collectible

C) lower-of-cost-and-market value

D) historical cost

fair value

3

Which of the following is considered as "cash" for reporting purposes?

A) money-market chequing accounts

B) certificates of deposit (CDs)

C) travel advances to employees

D) postdated cheques

A) money-market chequing accounts

B) certificates of deposit (CDs)

C) travel advances to employees

D) postdated cheques

money-market chequing accounts

4

The interest element for trade receivables

A) is usually not recognized because of materiality considerations.

B) must always be recognized and be accounted for.

C) is included in the net realizable value of the receivables.

D) becomes more significant as the time between the sale and payment shortens.

A) is usually not recognized because of materiality considerations.

B) must always be recognized and be accounted for.

C) is included in the net realizable value of the receivables.

D) becomes more significant as the time between the sale and payment shortens.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

5

Playtime sold toys listed at $280 per unit to Jack Inc. for $252, a trade discount of 10 percent. Jack Inc. in turn sells the toys in the market at $265. Jenny should record the receivable and related sales revenue (per unit) at

A) $280.

B) $265.

C) $252.

D) $227.

A) $280.

B) $265.

C) $252.

D) $227.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

6

Brighton Inc. reported the following amounts: Cash in bank-chequing account of $37,000, Cash on hand of $1,000, Postdated cheques received totalling $3,500, and certificates of deposit totalling $248,000. How much should be reported as cash in the statement of financial position?

A) $ 37,000.

B) $ 38,000.

C) $ 45,000.

D) $286,000.

A) $ 37,000.

B) $ 38,000.

C) $ 45,000.

D) $286,000.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

7

"Sales Returns and Allowances" are reported as

A) an expense.

B) a deduction from Sales Revenue.

C) a deduction from Accounts Receivable.

D) an addition to Accounts Receivable.

A) an expense.

B) a deduction from Sales Revenue.

C) a deduction from Accounts Receivable.

D) an addition to Accounts Receivable.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

8

Dividends and interest receivable would be classified as

A) loans receivable.

B) trade receivables.

C) notes receivable.

D) nontrade receivables.

A) loans receivable.

B) trade receivables.

C) notes receivable.

D) nontrade receivables.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

9

Because of their special nature, nontrade receivables are generally

A) reported as cash and cash equivalents.

B) classified and reported as separate items on the statement of financial position.

C) classified in a note that is cross referenced to the statement of financial position.

D) both b) and c) are correct.

A) reported as cash and cash equivalents.

B) classified and reported as separate items on the statement of financial position.

C) classified in a note that is cross referenced to the statement of financial position.

D) both b) and c) are correct.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is not an example of a nontrade receivable?

A) amounts arising from sale of goods or services

B) dividends and interest receivable

C) claims against insurance companies for losses suffered

D) amounts owing from a purchaser on sale of capital

A) amounts arising from sale of goods or services

B) dividends and interest receivable

C) claims against insurance companies for losses suffered

D) amounts owing from a purchaser on sale of capital

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

11

Assuming that the ideal measure of short-term receivables in the statement of financial position is the discounted value of the cash to be received in the future, failure to follow this practice usually does NOT make the financial statements misleading because

A) most short-term receivables are not interest-bearing.

B) the allowance for uncollectible accounts includes a discount element.

C) the amount of the discount is not material.

D) most receivables can be sold to a bank or factor.

A) most short-term receivables are not interest-bearing.

B) the allowance for uncollectible accounts includes a discount element.

C) the amount of the discount is not material.

D) most receivables can be sold to a bank or factor.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following are reasons why companies should monitor accounts receivable levels carefully?

A) to maximize costs of collection

B) to encourage prompt payment from their customers

C) to minimize the stress on working capital and related bank debt

D) b) and c) only

A) to maximize costs of collection

B) to encourage prompt payment from their customers

C) to minimize the stress on working capital and related bank debt

D) b) and c) only

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is NOT a financial asset?

A) a contractual right to receive cash or other financial asset from another party

B) an equity instrument of another entity

C) a contractual right to exchange financial instruments with another party under potentially favourable conditions

D) a contractual right to pay cash or another financial asset to another party

A) a contractual right to receive cash or other financial asset from another party

B) an equity instrument of another entity

C) a contractual right to exchange financial instruments with another party under potentially favourable conditions

D) a contractual right to pay cash or another financial asset to another party

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

14

On Cairo Corp.'s December 31, 2020 statement of financial position, the current receivables consisted of the following:

At December 31, 2020, the correct total of Cairo's current net receivables was

A) $78,000.

B) $74,500.

C) $70,500.

D) $66,500.

At December 31, 2020, the correct total of Cairo's current net receivables was

A) $78,000.

B) $74,500.

C) $70,500.

D) $66,500.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

15

Trade discounts are generally NOT used to

A) avoid frequent changes in catalogues.

B) quote different prices for different quantities purchased.

C) encourage faster payment.

D) hide the true invoice price from competitors.

A) avoid frequent changes in catalogues.

B) quote different prices for different quantities purchased.

C) encourage faster payment.

D) hide the true invoice price from competitors.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

16

The portion of any demand deposit that a customer keeps as support for its existing or maturing obligations is called

A) an account receivable.

B) a bank overdraft.

C) a compensating balance.

D) restricted cash.

A) an account receivable.

B) a bank overdraft.

C) a compensating balance.

D) restricted cash.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

17

Bank overdrafts are generally reported as

A) a current asset.

B) a contra account.

C) a non-current asset.

D) a current liability.

A) a current asset.

B) a contra account.

C) a non-current asset.

D) a current liability.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following actions would NOT be considered good management of accounts receivable?

A) assessing creditworthiness of new or potential customers

B) very loose or flexible credit terms to encourage sales

C) offering discounts to encourage faster payment

D) regular aged receivables analysis

A) assessing creditworthiness of new or potential customers

B) very loose or flexible credit terms to encourage sales

C) offering discounts to encourage faster payment

D) regular aged receivables analysis

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

19

The general accounting standards for recognition and measurement of accounts receivable include

A) measuring the receivable initially at amortized cost.

B) measuring the receivable initially at fair value.

C) after initial recognition, measuring the receivable at fair value.

D) not recognizing the receivable until it is paid.

A) measuring the receivable initially at amortized cost.

B) measuring the receivable initially at fair value.

C) after initial recognition, measuring the receivable at fair value.

D) not recognizing the receivable until it is paid.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following statements is correct regarding receivables?

A) Receivables are written promises of the purchaser to pay for goods or services.

B) Receivables are claims held against customers and others for money, goods, or services.

C) Receivables are non-financial assets.

D) Receivables that are expected to be collected within a year are classified as non-current.

A) Receivables are written promises of the purchaser to pay for goods or services.

B) Receivables are claims held against customers and others for money, goods, or services.

C) Receivables are non-financial assets.

D) Receivables that are expected to be collected within a year are classified as non-current.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

21

Lebanon Ltd. prepared an aging of its accounts receivable at December 31, 2020 and determined that the net realizable value of the receivables was $290,000. Additional information for calendar 2020 follows: Allowance for doubtful accounts, beginning. .........................................

Uncollectible account written off during year.......................................... 23,000

Accounts receivable, ending.................................................................... 320,000

Uncollectible accounts recovered during year. ........................................5,000For the year ended December 31, 2020, Lebanon's bad debt expense should be

A) $20,000.

B) $23,000.

C) $16,000.

D) $14,000.

Uncollectible account written off during year.......................................... 23,000

Accounts receivable, ending.................................................................... 320,000

Uncollectible accounts recovered during year. ........................................5,000For the year ended December 31, 2020, Lebanon's bad debt expense should be

A) $20,000.

B) $23,000.

C) $16,000.

D) $14,000.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

22

The direct write off method of accounting for the impairment of receivables

A) is never acceptable.

B) is an acceptable method when the effect of not applying the allowance method would be highly immaterial.

C) is specifically disallowed under IFRS.

D) usually results in the same net income as the allowance method.

A) is never acceptable.

B) is an acceptable method when the effect of not applying the allowance method would be highly immaterial.

C) is specifically disallowed under IFRS.

D) usually results in the same net income as the allowance method.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

23

Under the allowance method of recognizing uncollectible accounts, the entry to recognize the collection of a previously written off uncollectible account

A) increases net income.

B) has no effect on the allowance for doubtful accounts.

C) decreases the allowance for doubtful accounts.

D) increases the allowance for doubtful accounts.

A) increases net income.

B) has no effect on the allowance for doubtful accounts.

C) decreases the allowance for doubtful accounts.

D) increases the allowance for doubtful accounts.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following statements is correct?

A) There is no interest included in a zero-interest-bearing note.

B) A long-term note's fair value and present value are always the same.

C) All notes contain an interest element because of the time value of money.

D) A note is signed by the payee in favour of the maker.

A) There is no interest included in a zero-interest-bearing note.

B) A long-term note's fair value and present value are always the same.

C) All notes contain an interest element because of the time value of money.

D) A note is signed by the payee in favour of the maker.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

25

The likelihood of loss because of the failure of the other party to fully pay the amount owed is called

A) accounting risk.

B) bad debts.

C) credit risk.

D) currency risk.

A) accounting risk.

B) bad debts.

C) credit risk.

D) currency risk.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

26

"Allowance for Doubtful Accounts" is a(n)

A) expense account.

B) contra account.

C) liability account.

D) current asset.

A) expense account.

B) contra account.

C) liability account.

D) current asset.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

27

The following accounts were included on Mali Co.'s unadjusted trial balance at December 31, 2020:

Mali estimates that 1.5 % of the gross accounts receivable will become uncollectible. After the proper adjustment at December 31, 2020, the allowance for doubtful accounts should have a credit balance of

A) $23,750.

B) $12,750.

C) $11,000.

D) $ 1,750.

Mali estimates that 1.5 % of the gross accounts receivable will become uncollectible. After the proper adjustment at December 31, 2020, the allowance for doubtful accounts should have a credit balance of

A) $23,750.

B) $12,750.

C) $11,000.

D) $ 1,750.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

28

During the year, Popsicle Inc., which uses the allowance method, made an entry to write off a $4,000 uncollectible account. Before this entry was posted, the balance in accounts receivable was $80,000 and the balance in the allowance account was $7,000. The net realizable value of accounts receivable after the write off entry was

A) $80,000.

B) $77,000.

C) $76,000.

D) $73,000.

A) $80,000.

B) $77,000.

C) $76,000.

D) $73,000.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

29

For the year ended December 31, 2020, Ferguson Corp. estimated its allowance for doubtful accounts using the year-end aging of accounts receivable. Additional information for calendar 2020 follows:

For the year ended December 31, 2020, Ferguson's bad debt expense should be

A) $74,000.

B) $104,000.

C) $178,000.

D) $252,000.

For the year ended December 31, 2020, Ferguson's bad debt expense should be

A) $74,000.

B) $104,000.

C) $178,000.

D) $252,000.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following approaches to determine bad debts expense best achieves the matching concept?

A) percentage of sales

B) percentage of ending accounts receivable

C) percentage of average accounts receivable

D) direct write off

A) percentage of sales

B) percentage of ending accounts receivable

C) percentage of average accounts receivable

D) direct write off

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

31

Sudan Ltd.'s allowance for doubtful accounts was $85,000 at the end of 2020 and $105,000 at the end of 2019. For the year ended December 31, 2020, Sudan reported bad debt expense of $18,000 in its income statement. What amount did Sudan debit to allowance for doubtful accounts during 2020 to write off actual bad debts?

A) $38,000

B) $34,650

C) $20,000

D) $12,000

A) $38,000

B) $34,650

C) $20,000

D) $12,000

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

32

The following information is available for Pirate Company: Allowance for Doubtful Accounts at December 31, 2020....................................

Credit Sales during 2021 .......................................................................................270,000

Accounts Receivable deemed worthless and written off during 2021...................2,800

As a result of a review and aging of Accounts Receivable in early January 2022, however, it has been determined that an Allowance For Doubtful Accounts of $7,500 is required at December 31, 2021. What amount should Pirate record as bad debt expense for calendar 2021?

A) $4,200

B) $3,300

C) $7,500

D) $74,000

Credit Sales during 2021 .......................................................................................270,000

Accounts Receivable deemed worthless and written off during 2021...................2,800

As a result of a review and aging of Accounts Receivable in early January 2022, however, it has been determined that an Allowance For Doubtful Accounts of $7,500 is required at December 31, 2021. What amount should Pirate record as bad debt expense for calendar 2021?

A) $4,200

B) $3,300

C) $7,500

D) $74,000

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

33

The advantage of relating a company's bad debt expense to its outstanding accounts receivable is that this approach

A) gives a reasonably correct valuation of the receivables in the statement of financial position.

B) best relates bad debts expense to the period of sale.

C) is the only generally accepted method for valuing accounts receivable.

D) makes estimates of uncollectible accounts unnecessary.

A) gives a reasonably correct valuation of the receivables in the statement of financial position.

B) best relates bad debts expense to the period of sale.

C) is the only generally accepted method for valuing accounts receivable.

D) makes estimates of uncollectible accounts unnecessary.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

34

At the beginning of 2020, Graham Company received a three-year zero-interest-bearing $5,000 trade note. The market rate for equivalent notes was 10% at that time. Gannon reported this note as a $5,000 trade note receivable on its 2020 year-end statement of financial position and $5,000 as sales revenue for 2020. What effect did this accounting for the note have on Gannon's net earnings for 2020, 2021, 2022, and its retained earnings at the end of 2022, respectively?

A) overstate, overstate, understate, zero

B) overstate, understate, understate, understate

C) overstate, overstate, overstate, overstate

D) None of these answer choices are correct.

A) overstate, overstate, understate, zero

B) overstate, understate, understate, understate

C) overstate, overstate, overstate, overstate

D) None of these answer choices are correct.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

35

Using the allowance method, when an account receivable is written off, the account to be debited is

A) accounts receivable.

B) bad debts expense.

C) allowance for doubtful accounts.

D) cash.

A) accounts receivable.

B) bad debts expense.

C) allowance for doubtful accounts.

D) cash.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

36

Cupcake Corp. has sold goods at terms 2/10, n/30. If the discount is not taken, the amount receivable is $8,725. The entry to record the sale is

A) a debit and credit of $7,852.50 to Accounts Receivable and Sales respectively.

B) a debit and credit of $8,550.50 to Accounts Receivable and Sales respectively.

C) a debit and credit of $8,725 to Accounts Receivable and Sales respectively.

D) debits of $8,550.50 and $174.50 to Accounts Receivable and "Forfeited Sales Discounts" respectively, and a credit to Sales for the total.

A) a debit and credit of $7,852.50 to Accounts Receivable and Sales respectively.

B) a debit and credit of $8,550.50 to Accounts Receivable and Sales respectively.

C) a debit and credit of $8,725 to Accounts Receivable and Sales respectively.

D) debits of $8,550.50 and $174.50 to Accounts Receivable and "Forfeited Sales Discounts" respectively, and a credit to Sales for the total.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

37

What is the single most important indicator used to identify impaired accounts receivable?

A) the customer's payment history

B) the age of the accounts

C) credit reports and references

D) industry in which the company operates

A) the customer's payment history

B) the age of the accounts

C) credit reports and references

D) industry in which the company operates

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

38

What is the normal journal entry for recording bad debt expense under the allowance method?

A) debit Allowance for Doubtful Accounts, credit Accounts Receivable

B) debit Allowance for Doubtful Accounts, credit Bad Debt Expense

C) debit Bad Debt Expense, credit Allowance for Doubtful Accounts

D) debit Accounts Receivable, credit Allowance for Doubtful Accounts

A) debit Allowance for Doubtful Accounts, credit Accounts Receivable

B) debit Allowance for Doubtful Accounts, credit Bad Debt Expense

C) debit Bad Debt Expense, credit Allowance for Doubtful Accounts

D) debit Accounts Receivable, credit Allowance for Doubtful Accounts

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

39

Under the allowance method of recognizing uncollectible accounts, the entry to write off an uncollectible account

A) increases the allowance for doubtful accounts.

B) has no effect on the allowance for doubtful accounts.

C) has no effect on net income.

D) decreases net income.

A) increases the allowance for doubtful accounts.

B) has no effect on the allowance for doubtful accounts.

C) has no effect on net income.

D) decreases net income.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

40

Assume Sentinel Corp., an equipment distributor, sells a piece of machinery with a list price of $700,000 to Arch Inc. Arch Inc. will pay $725,000 in one year. Sentinel Corp. normally sells this type of equipment for 80% of list price. How much should be recorded as revenue?

A) $560,000

B) $580,000

C) $700,000

D) $725,000

A) $560,000

B) $580,000

C) $700,000

D) $725,000

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

41

Starlight Ltd. assigned $600,000 of Accounts Receivable to Moonbeam Management as security for a loan of $580,000. Moonbeam charged a 3% commission on the amount of the loan; the interest rate on the loan was 10%. During the first month, Starlight collected $320,000 of the assigned accounts, after deducting $500 of discounts. As well, Starlight accepted returns worth $2,600 and wrote off assigned accounts totalling $4,500. The amount of cash Starlight received from Moonbeam at the time of the transfer was

A) $378,000.

B) $582,000.

C) $562,600.

D) $280,000.

A) $378,000.

B) $582,000.

C) $562,600.

D) $280,000.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

42

If a note receivable was issued at an amount that is more than its face value, then

A) the note was issued at a premium and the note's stated rate was different from the prevailing market rate of interest.

B) the note was issued at a premium and the note's stated rate was the same as the prevailing market rate of interest.

C) the note was issued at a discount and the note's stated rate was the same as the prevailing market rate of interest.

D) the note was issued at a discount and the note's stated rate was different from the prevailing market rate of interest.

A) the note was issued at a premium and the note's stated rate was different from the prevailing market rate of interest.

B) the note was issued at a premium and the note's stated rate was the same as the prevailing market rate of interest.

C) the note was issued at a discount and the note's stated rate was the same as the prevailing market rate of interest.

D) the note was issued at a discount and the note's stated rate was different from the prevailing market rate of interest.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

43

The ratio that is used to assess the liquidity of accounts receivable is the

A) current ratio.

B) receivables turnover ratio.

C) quick ratio.

D) inventory turnover ratio.

A) current ratio.

B) receivables turnover ratio.

C) quick ratio.

D) inventory turnover ratio.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

44

On December 31, 2020, Flint Corporation sold for $100,000 an old machine having an original cost of $180,000 and a book value of $80,000. The terms of the sale were as follows:

$20,000 down payment,

$40,000 payable on December 31 each of the next two years.

The agreement of sale made no mention of interest; however, 9% would be a fair rate for this type of transaction. What should be the amount of the notes receivable net of the unamortized discount on December 31, 2020, rounded to the nearest dollar?

A) $70,364

B) $90,364

C) $80,000

D) $140,728

$20,000 down payment,

$40,000 payable on December 31 each of the next two years.

The agreement of sale made no mention of interest; however, 9% would be a fair rate for this type of transaction. What should be the amount of the notes receivable net of the unamortized discount on December 31, 2020, rounded to the nearest dollar?

A) $70,364

B) $90,364

C) $80,000

D) $140,728

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

45

On February 1, 2020, Strawberry Corp. factored receivables with a carrying amount of $250,000 to Shortcake Inc. Shortcake assessed a finance charge of 3% of the receivables and retained 5% of the receivables. Relative to this transaction, you are to determine the amount of loss on disposal to be reported in the income statement of Strawberry Corp. for February. Assume that Strawberry factors the receivables on a without recourse basis. The loss to be reported is

A) $ 0.

B) $7,500.

C) $15,000.

D) $14,550.

A) $ 0.

B) $7,500.

C) $15,000.

D) $14,550.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

46

When a zero-interest-bearing note is issued, its present value is

A) zero.

B) the face value plus interest.

C) the face value.

D) the cash paid to the issuer.

A) zero.

B) the face value plus interest.

C) the face value.

D) the cash paid to the issuer.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

47

Use the following information for questions.

Braun Company factors $300,000 of accounts receivable with Schick Factors Inc. on a without recourse basis. The receivables records are transferred to Schick Factors, which takes over full responsibility for collections. Schick assesses a finance charge of 4% and withholds an initial amount equal to 7% of the accounts receivable for returns and allowances.

The cash paid by Schick Factors to Braun Company is

A) $300,000.

B) $288,000.

C) $267,000.

D) $279,000.

Braun Company factors $300,000 of accounts receivable with Schick Factors Inc. on a without recourse basis. The receivables records are transferred to Schick Factors, which takes over full responsibility for collections. Schick assesses a finance charge of 4% and withholds an initial amount equal to 7% of the accounts receivable for returns and allowances.

The cash paid by Schick Factors to Braun Company is

A) $300,000.

B) $288,000.

C) $267,000.

D) $279,000.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

48

The accounts receivable turnover ratio is calculated by dividing

A) gross sales by ending net trade receivables.

B) gross sales by average net trade receivables.

C) net sales by ending net trade receivables.

D) net sales by average net trade receivables.

A) gross sales by ending net trade receivables.

B) gross sales by average net trade receivables.

C) net sales by ending net trade receivables.

D) net sales by average net trade receivables.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

49

Cookie Ltd. receives a four-year, $100,000 zero-interest-bearing note. The present value of this note is $82,270. Interest income to be recognized for calendar 2021 will be

A) $10,000.

B) $4,319.18.

C) $8,227.00.

D) $7,910.75.

A) $10,000.

B) $4,319.18.

C) $8,227.00.

D) $7,910.75.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

50

Cookie Ltd. receives a four-year, $100,000, zero-interest-bearing note. The present value of this note is $82,270. Assuming the note was issued on January 1, 2020, and the effective interest method is used, the interest income to be recognized for calendar 2020 will be

A) $5,000.

B) $9,000.46.

C) $4,113.50.

D) $6,587.31.

A) $5,000.

B) $9,000.46.

C) $4,113.50.

D) $6,587.31.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

51

On February 1, 2020, Strawberry Corp. factored receivables with a carrying amount of $250,000 to Shortcake Inc. Shortcake assessed a finance charge of 3% of the receivables and retained 5% of the receivables. Relative to this transaction, you are to determine the amount of loss on disposal to be reported in the income statement of Strawberry Corp. for February. Assume that Strawberry factors the receivables on a with recourse basis. The recourse obligation has a fair value of $1,000. The loss to be reported is

A) $17,000.

B) $7,000.

C) $8,500.

D) $1,000.

A) $17,000.

B) $7,000.

C) $8,500.

D) $1,000.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following is NOT a difference between factoring and securitization of receivables?

A) In securitization, many investors are involved, whereas factoring usually involves only one company.

B) Receivables are derecognized when securitized, but not when factored.

C) The quality of receivables factored tends to be lower than those securitized.

D) The seller retains responsibility to collect amounts due when securitized, but not when factored.

A) In securitization, many investors are involved, whereas factoring usually involves only one company.

B) Receivables are derecognized when securitized, but not when factored.

C) The quality of receivables factored tends to be lower than those securitized.

D) The seller retains responsibility to collect amounts due when securitized, but not when factored.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

53

Starlight Ltd. assigned $600,000 of Accounts Receivable to Moonbeam Management as security for a loan of $580,000. Moonbeam charged a 3% commission on the amount of the loan; the interest rate on the loan was 10%. During the first month, Starlight collected $320,000 of the assigned accounts, after deducting $500 of discounts. As well, Starlight accepted returns worth $2,600 and wrote off assigned accounts totalling $4,500. Entries made by Starlight during the first month would include a

A) debit to Cash of $322,600.

B) debit to Bad Debts Expense of $4,500.

C) debit to Allowance for Doubtful Accounts of $4,500.

D) debit to Accounts Receivable of $324,500.

A) debit to Cash of $322,600.

B) debit to Bad Debts Expense of $4,500.

C) debit to Allowance for Doubtful Accounts of $4,500.

D) debit to Accounts Receivable of $324,500.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

54

Use the following information for questions.

Braun Company factors $300,000 of accounts receivable with Schick Factors Inc. on a without recourse basis. The receivables records are transferred to Schick Factors, which takes over full responsibility for collections. Schick assesses a finance charge of 4% and withholds an initial amount equal to 7% of the accounts receivable for returns and allowances.

The loss on disposal of receivables recorded by Braun is

A) $12,000.

B) $21,000.

C) $33,000.

D) $0.

Braun Company factors $300,000 of accounts receivable with Schick Factors Inc. on a without recourse basis. The receivables records are transferred to Schick Factors, which takes over full responsibility for collections. Schick assesses a finance charge of 4% and withholds an initial amount equal to 7% of the accounts receivable for returns and allowances.

The loss on disposal of receivables recorded by Braun is

A) $12,000.

B) $21,000.

C) $33,000.

D) $0.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

55

The straight-line method of amortization of discounts and premiums for long-term notes

A) is allowed by both IFRS and ASPE.

B) reflects the economic reality of the loan.

C) is only allowed by ASPE.

D) requires more complicated calculations than the effective interest method.

A) is allowed by both IFRS and ASPE.

B) reflects the economic reality of the loan.

C) is only allowed by ASPE.

D) requires more complicated calculations than the effective interest method.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

56

When the stated rate and market rate of a note receivable are the same,

A) the note's face value would be different.

B) the note's face value would be indeterminable.

C) the note's face value and fair value would be the same.

D) it must be a zero-interest-bearing note.

A) the note's face value would be different.

B) the note's face value would be indeterminable.

C) the note's face value and fair value would be the same.

D) it must be a zero-interest-bearing note.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

57

Cookie Ltd. receives a four-year, $100,000, zero-interest-bearing note. The present value of this note is $82,270. What is the implicit rate of interest?

A) 3%

B) 5%

C) 7%

D) 9%

A) 3%

B) 5%

C) 7%

D) 9%

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

58

If a note receivable was issued at an amount that is less than its face value, then

A) the note was issued at a premium.

B) the note was issued at a discount.

C) the note's stated rate was the same as the prevailing market rate of interest.

D) it must be a zero-interest-bearing note.

A) the note was issued at a premium.

B) the note was issued at a discount.

C) the note's stated rate was the same as the prevailing market rate of interest.

D) it must be a zero-interest-bearing note.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following is INCORRECT regarding factoring of receivables?

A) Factoring usually involves a sale to only one company.

B) The fees are relatively high.

C) The quality of the receivables may be lower.

D) The seller usually continues to service the receivables.

A) Factoring usually involves a sale to only one company.

B) The fees are relatively high.

C) The quality of the receivables may be lower.

D) The seller usually continues to service the receivables.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

60

If receivables are used as collateral in borrowing transactions,

A) the receivables generally come under the control of the lender.

B) a liability is reported on the borrower's statement of financial position.

C) the receivables will be reported as a liability.

D) the transaction would be reported as a sale.

A) the receivables generally come under the control of the lender.

B) a liability is reported on the borrower's statement of financial position.

C) the receivables will be reported as a liability.

D) the transaction would be reported as a sale.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

61

Definitions

Provide clear, concise answers for the following:

1. What are cash and cash equivalents and how are they reported?

2. What are receivables and how are they reported?

3. How are receivables measured?

4. How are impairments relating to uncollectible receivables accounted for?

5. How can receivables be "converted" to cash prior to their collection from customers?

6. How are receivables analyzed?

7. Identify the main differences between private entity GAAP and IFRS with respect to the accounting for receivables?

Provide clear, concise answers for the following:

1. What are cash and cash equivalents and how are they reported?

2. What are receivables and how are they reported?

3. How are receivables measured?

4. How are impairments relating to uncollectible receivables accounted for?

5. How can receivables be "converted" to cash prior to their collection from customers?

6. How are receivables analyzed?

7. Identify the main differences between private entity GAAP and IFRS with respect to the accounting for receivables?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

62

In preparing its bank reconciliation for the month of April 2020, Henke Inc. has the following information available:

What should be the correct balance of cash at April 30, 2020?

A) $34,370

B) $33,940

C) $33,490

D) $33,470

What should be the correct balance of cash at April 30, 2020?

A) $34,370

B) $33,940

C) $33,490

D) $33,470

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

63

The journal entries related to a bank reconciliation

A) are taken from the "balance per bank" section only.

B) may include a credit to Bank Charges Expense for bank service charges.

C) may include a debit to Accounts Receivable for an NSF cheque.

D) may include a debit to Accounts Payable for an NSF cheque.

A) are taken from the "balance per bank" section only.

B) may include a credit to Bank Charges Expense for bank service charges.

C) may include a debit to Accounts Receivable for an NSF cheque.

D) may include a debit to Accounts Payable for an NSF cheque.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following is NOT a common reconciling item recorded in preparation of a company's bank reconciliation(s)?

A) deposits in transit

B) bank charges

C) cash in other accounts

D) bank credits

A) deposits in transit

B) bank charges

C) cash in other accounts

D) bank credits

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

65

Congo Ltd. prepared the following bank reconciliation at March 31: Balance per bank statement....................................$37,200

Add: Deposit in transit..............................................10,300

....................................................................................47,500

Less: Outtanding cheques............................................12,600

Correct cash balance per books, March 31..................$34,900 Data per bank statement for the month of April follows:

Deposits..............................................$47,700

Disburiements....................................49,700

All reconciling items at March 31 cleared the bank in April. Outstanding cheques at April 30 totalled $5,000. There were no deposits in transit at April 30. What is the correct cash balance per books at April 30?

A) $30,200

B) $32,900

C) $35,200

D) $40,500

Add: Deposit in transit..............................................10,300

....................................................................................47,500

Less: Outtanding cheques............................................12,600

Correct cash balance per books, March 31..................$34,900 Data per bank statement for the month of April follows:

Deposits..............................................$47,700

Disburiements....................................49,700

All reconciling items at March 31 cleared the bank in April. Outstanding cheques at April 30 totalled $5,000. There were no deposits in transit at April 30. What is the correct cash balance per books at April 30?

A) $30,200

B) $32,900

C) $35,200

D) $40,500

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

66

Cash management from a business perspective

Cite and explain three (3) practices and/or procedures companies engage in to manage their cash balances.

Cite and explain three (3) practices and/or procedures companies engage in to manage their cash balances.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

67

The requirements for presentation and disclosure of receivables under IFRS are different than those required by ASPE. Which of the following statements is true about these disclosures?

A) More information is required under ASPE than IFRS.

B) IFRS requires extensive quantitative and qualitative information about all accounts.

C) Under ASPE, a reconciliation of changes in the allowance account during the period must be reported.

D) Far less information about risk exposures and fair values is required under ASPE.

A) More information is required under ASPE than IFRS.

B) IFRS requires extensive quantitative and qualitative information about all accounts.

C) Under ASPE, a reconciliation of changes in the allowance account during the period must be reported.

D) Far less information about risk exposures and fair values is required under ASPE.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

68

In preparing its bank reconciliation at May 31, 2020, Kennedy Co. has the following information available: Balance per bank statement.......................................$78,000

Deposit in transit........................................................15,600

Outstanding cheques.................................................4,200

Note collected by bank in May...................................7,200

The correct balance of cash at May 31, 2020 is

A) $95,600.

B) $94,800.

C) $89,400.

D) $84,000.

Deposit in transit........................................................15,600

Outstanding cheques.................................................4,200

Note collected by bank in May...................................7,200

The correct balance of cash at May 31, 2020 is

A) $95,600.

B) $94,800.

C) $89,400.

D) $84,000.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

69

If a petty cash fund is established in the amount of $550, and contains $500 in cash and $45 in receipts for disbursements when it is replenished, the journal entry to record replenishment should include credits to the following accounts:

A) Petty Cash, $45.

B) Petty Cash, $50.

C) Cash, $45; Cash Over and Short, $5.

D) Cash, $50.

A) Petty Cash, $45.

B) Petty Cash, $50.

C) Cash, $45; Cash Over and Short, $5.

D) Cash, $50.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

70

Credit policies

What are the implications if credit policies are too "tight" or restrictive versus too "loose" or flexible?

What are the implications if credit policies are too "tight" or restrictive versus too "loose" or flexible?

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following statements is/are true regarding the receivables turnover ratio?

A) It is used to assess receivables' liquidity.

B) It measures the number of times, on average, that receivables are collected during the period.

C) It is calculated by dividing average sales by gross receivables outstanding during the year.

D) Both a) and b) are correct.

A) It is used to assess receivables' liquidity.

B) It measures the number of times, on average, that receivables are collected during the period.

C) It is calculated by dividing average sales by gross receivables outstanding during the year.

D) Both a) and b) are correct.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

72

Regarding receivables recognition and measurement, which of the following is true regarding the related IFRS standard?

A) It requires the effective interest method is used to recognize interest and related premiums or discounts.

B) It requires the straight-line method is used to recognize interest and related premiums or discounts.

C) It allows a choice between the effective interest and straight-line methods.

D) None of these statements is correct.

A) It requires the effective interest method is used to recognize interest and related premiums or discounts.

B) It requires the straight-line method is used to recognize interest and related premiums or discounts.

C) It allows a choice between the effective interest and straight-line methods.

D) None of these statements is correct.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

73

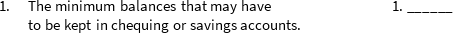

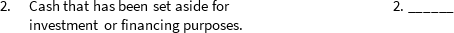

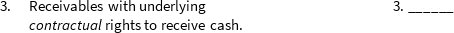

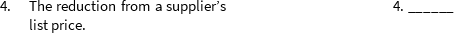

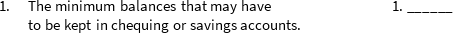

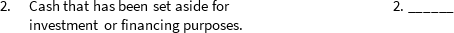

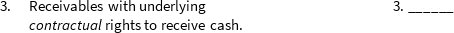

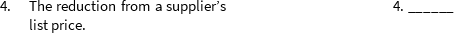

Terminology

In the space provided at right, write the word or phrase that is defined or indicated.

In the space provided at right, write the word or phrase that is defined or indicated.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

74

In preparing its bank reconciliation at April 30, 2020, Delta Inc. has the following information available:

Balance per bank statement............................................................$45,700

NSF cheque returned with April bank statement .............................420

Deposits in transit..............................................................................2,500

Outstanding cheques..........................................................................16,000

Bank service charges for April.........................................................25

The correct balance of cash at April 30, 2020 is

A) $45,280.

B) $32,200.

C) $48,200.

D) $61,700.

Balance per bank statement............................................................$45,700

NSF cheque returned with April bank statement .............................420

Deposits in transit..............................................................................2,500

Outstanding cheques..........................................................................16,000

Bank service charges for April.........................................................25

The correct balance of cash at April 30, 2020 is

A) $45,280.

B) $32,200.

C) $48,200.

D) $61,700.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

75

When preparing a bank reconciliation, a deposit credited to our account by the bank in error is

A) added to the bank statement balance.

B) deducted from the bank statement balance.

C) added to the balance per books.

D) deducted from the balance per books.

A) added to the bank statement balance.

B) deducted from the bank statement balance.

C) added to the balance per books.

D) deducted from the balance per books.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

76

A Cash Over and Short account is

A) not generally acceptable under Canadian GAAP.

B) debited when the sum of the receipts and the cash in the fund is more than the imprest amount.

C) debited when the sum of the receipts and the cash in the fund is less than the imprest amount.

D) a contra account to Cash.

A) not generally acceptable under Canadian GAAP.

B) debited when the sum of the receipts and the cash in the fund is more than the imprest amount.

C) debited when the sum of the receipts and the cash in the fund is less than the imprest amount.

D) a contra account to Cash.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

77

In preparing its September 30 bank reconciliation, Frieda Corp. has the following information available: Balance per bank statement...............................

Deposit in transit......................................................4,650

Customer's cheque returned NSF..............................325

Outstanding cheques.....................................................1,925

Bank service charges for September..............................40

Frieda's correct cash balance at September 30 is Frieda's correct cash balance at September 30 is

A) $36,910.

B) $36,870.

C) $37,235.

D) $34,510.

Deposit in transit......................................................4,650

Customer's cheque returned NSF..............................325

Outstanding cheques.....................................................1,925

Bank service charges for September..............................40

Frieda's correct cash balance at September 30 is Frieda's correct cash balance at September 30 is

A) $36,910.

B) $36,870.

C) $37,235.

D) $34,510.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

78

If the month-end bank statement shows a balance of $51,000, outstanding cheques are $14,000, a deposit of $3,000 was in transit at month end, and a cheque for $800 was erroneously charged by the bank against the account, the correct balance in the bank account at month end is

A) $40,800.

B) $51,000.

C) $28,800.

D) $14,800.

A) $40,800.

B) $51,000.

C) $28,800.

D) $14,800.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

79

Reporting of cash

At December 31, 2020, Burkina Ltd.'s general ledger Cash balance was $24,600. In addition, Burkina held the following items in its safe on December 31:

1. A cheque for $780 from Zambia Ltd. received December 30, 2020, which was not deposited until January 2, 2021.

2. A cheque from Zanzibar Inc. for $1,800 that had been deposited on December 20, but was returned NSF on December 29. The cheque was to be re-deposited on January 3, 2021. The original deposit has been included in the December 31 chequebook balance.

3. Coin and currency on hand: $2,630.

Instructions

Calculate the proper amount to be reported as cash on Burkina's statement of financial position at December 31, 2020.

At December 31, 2020, Burkina Ltd.'s general ledger Cash balance was $24,600. In addition, Burkina held the following items in its safe on December 31:

1. A cheque for $780 from Zambia Ltd. received December 30, 2020, which was not deposited until January 2, 2021.

2. A cheque from Zanzibar Inc. for $1,800 that had been deposited on December 20, but was returned NSF on December 29. The cheque was to be re-deposited on January 3, 2021. The original deposit has been included in the December 31 chequebook balance.

3. Coin and currency on hand: $2,630.

Instructions

Calculate the proper amount to be reported as cash on Burkina's statement of financial position at December 31, 2020.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck

80

Regarding treatment of cash and cash equivalents under ASPE vs. IFRS, which of the following is NOT correct?

A) IFRS allows preferred shares acquired close to their maturity date to qualify as a cash equivalent.

B) Cash equivalents under ASPE may be highly liquid investments readily convertible to cash.

C) Cash equivalents under ASPE may be investments convertible to unknown amounts of cash with material risk of change and value.

D) All of these statements are correct.

A) IFRS allows preferred shares acquired close to their maturity date to qualify as a cash equivalent.

B) Cash equivalents under ASPE may be highly liquid investments readily convertible to cash.

C) Cash equivalents under ASPE may be investments convertible to unknown amounts of cash with material risk of change and value.

D) All of these statements are correct.

Unlock Deck

Unlock for access to all 114 flashcards in this deck.

Unlock Deck

k this deck