Deck 5: Fraud, internal Control, and Cash

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

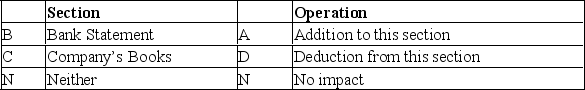

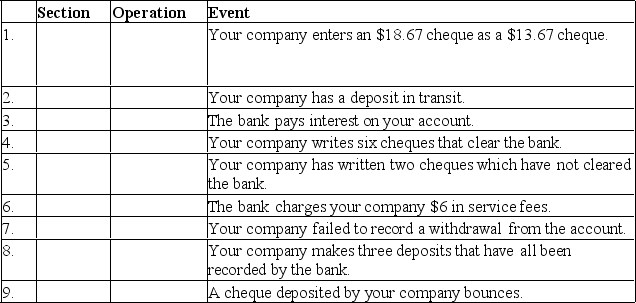

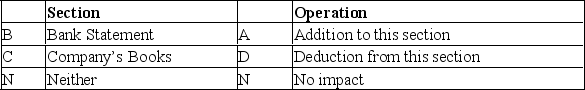

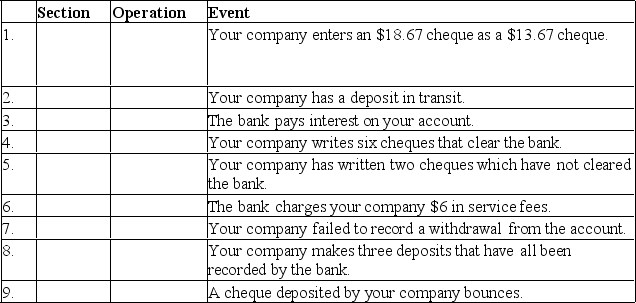

Match between columns

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/60

Play

Full screen (f)

Deck 5: Fraud, internal Control, and Cash

1

Cash reported on the balance sheet includes cash deposited in the bank but not cash equivalents.

False

2

The purchasing,receiving,and bill payment duties are amalgamated to ensure that the company obtains and pays only for the goods or services that have been properly authorized.

False

3

Five common principles of internal control are: establish responsibility,segregate duties,restricted access,document procedures,and independently verify.

True

4

Restricted cash is not reported separately on the balance sheet.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

5

The three elements of the fraud triangle are: means,opportunity,and incentives

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

6

EFT (electronic funds transfer)discovered on the bank statement do not require adjustments.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

7

The internal control principle of establishing responsibility occurs when one employee is made responsible for all parts of a process.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

8

The primary internal control goal for cash receipts is to ensure that the business receives the appropriate amount of cash and safely deposits it in the bank.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

9

Internal controls,if properly implemented,can eliminate the opportunity for fraud.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

10

Cash equivalents are short-term highly liquid investments purchased within 6 months of maturity.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

11

An imprest system is a process that controls the amount paid to others by limiting the total amount of money available for making payments to others.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

12

Internal control will always detect fraud.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

13

Employee fraud is grouped into three categories: corruption,asset misappropriation,and financial statement fraud.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

14

NSF (Not Sufficient funds)cheques are deducting from the balance per book when conducting bank reconciliation.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

15

A voucher system is a process for approving and documenting all purchases and payments on account.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

16

Those who willfully misrepresent financial results now face fines of up to $10 million and maximum jail sentences of 25 years.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

17

An imprest payroll system is one example of how banking procedures can fail to help a company control its cash

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

18

Incentives for engaging in fraud can be divided into two categories: creating business opportunities and satisfying personal greed.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

19

Internal controls include the policies and procedures a company implements to protect against theft of assets,to promote efficiency,and to ensure compliance with laws and regulations.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

20

The primary goal of internal controls for cash receipts is to ensure that the business pays only for properly authorized transactions.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

21

The internal control principle related to separating employees' duties so that the work of one person can be used to check the work of another person is called:

A)duplication of responsibility.

B)independent internal verification.

C)segregation of duties.

D)rotation of duties.

A)duplication of responsibility.

B)independent internal verification.

C)segregation of duties.

D)rotation of duties.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

22

Time lags are uncommon and the way to properly account for them will depend on whether a company is following IFRS or ASPE.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

23

Notification by the bank that a customer's deposited cheque was returned NSF requires that the company make the following adjusting journal entry:

A)Debit accounts receivable,credit cash

B)Debit cash,credit accounts receivable

C)Debit bank charges expense,credit accounts receivable

D)No adjusting entry required.

A)Debit accounts receivable,credit cash

B)Debit cash,credit accounts receivable

C)Debit bank charges expense,credit accounts receivable

D)No adjusting entry required.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

24

Segregation of duties means that a company assigns responsibilities so that:

A)sufficient workers are available to cover all necessary jobs.

B)responsibilities for related activities are assigned to two or more people.

C)employees are restricted to jobs for which they have adequate training.

D)workers are divided into those who make decisions and those who carry them out.

A)sufficient workers are available to cover all necessary jobs.

B)responsibilities for related activities are assigned to two or more people.

C)employees are restricted to jobs for which they have adequate training.

D)workers are divided into those who make decisions and those who carry them out.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

25

An employee authorized to sign cheques may record cash disbursement transactions.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

26

All of the following bank reconciliation items would result in an adjusting journal entry on the company's books except:

A)interest earned.

B)deposits in transit.

C)service charge.

D)a customer's cheque returned NSF.

A)interest earned.

B)deposits in transit.

C)service charge.

D)a customer's cheque returned NSF.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

27

Deposits are listed on the bank statement in the order in which the company receives them.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

28

Before reconciling to its bank statement,Lauren Cosmetics Corporation's general ledger had a month-end balance in the cash account of $5,250.The bank reconciliation for the month contained the following items: Given the above information,what adjusted cash balance should Lauren report at month-end?

A)$4,500

B)$4,820

C)$5,160

D)$5,590

A)$4,500

B)$4,820

C)$5,160

D)$5,590

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

29

After preparing a bank reconciliation,no adjusting journal entries need to be made for outstanding cheques or deposits in transit.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

30

The following information was available to the accountant of Horton Company when preparing the monthly bank reconciliation: The amount of cash that should appear on the balance sheet following completion of the reconciliation and adjustment of the accounting records is:

A)$660

B)$640

C)$620

D)$305

A)$660

B)$640

C)$620

D)$305

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

31

Your company writes a cheque for $967.Which of the following describes how this transaction should be accounted for?

A)You add $967 to your recorded cash balance and the bank deducts $967 from your chequing account balance.

B)You deduct $967 from your recorded cash balance and the bank deducts $967 from your chequing account balance.

C)You add $967 to your recorded cash balance and the bank adds $967 to your chequing account balance.

D)You deduct $967 from your recorded cash balance and the bank adds $967 to your chequing account balance.

A)You add $967 to your recorded cash balance and the bank deducts $967 from your chequing account balance.

B)You deduct $967 from your recorded cash balance and the bank deducts $967 from your chequing account balance.

C)You add $967 to your recorded cash balance and the bank adds $967 to your chequing account balance.

D)You deduct $967 from your recorded cash balance and the bank adds $967 to your chequing account balance.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

32

Internal controls are concerned with:

A)only manual systems of accounting.

B)the extent of government regulations.

C)protecting against theft of assets and enhancing the reliability of accounting information.

D)preparing income tax returns.

A)only manual systems of accounting.

B)the extent of government regulations.

C)protecting against theft of assets and enhancing the reliability of accounting information.

D)preparing income tax returns.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

33

If a company's records show a different cash balance from that shown on the company's bank statement,either the company or the bank has made an error.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

34

A bank reconciliation is an internal report prepared to verify the accuracy of both the cash account of a business or individual and the bank statement.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

35

NSF cheques are recorded as accounts payable.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

36

The main purposes of internal controls include:

A)prevention of error,theft,and fraud.

B)promotion of efficiency.

C)ensuring compliance with laws and regulations.

D)all of the answers are acceptable.

A)prevention of error,theft,and fraud.

B)promotion of efficiency.

C)ensuring compliance with laws and regulations.

D)all of the answers are acceptable.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

37

What has been the main thrust of recent changes in the financial reporting rules following the financial scandals of Enron,Worldcom,etc.?

A)To improve internal control over companies' financial reporting.

B)To add to the work of the companies' external accountants.

C)To force the companies' to disclose more of their internal information.

D)To provide incentives to increase their net income.

A)To improve internal control over companies' financial reporting.

B)To add to the work of the companies' external accountants.

C)To force the companies' to disclose more of their internal information.

D)To provide incentives to increase their net income.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

38

Your company makes a bank deposit of $857 in its chequing account.Which of the following describes how this transaction should be accounted for?

A)You add $857 to your recorded cash balance and the bank deducts $857 from your chequing account balance.

B)You deduct $857 from your recorded cash balance and the bank deducts $857 from your chequing account balance.

C)You add $857 to your recorded cash balance and the bank adds $857 to your chequing account balance.

D)You deduct $857 from your recorded cash balance and the bank adds $857 to your chequing account balance.

A)You add $857 to your recorded cash balance and the bank deducts $857 from your chequing account balance.

B)You deduct $857 from your recorded cash balance and the bank deducts $857 from your chequing account balance.

C)You add $857 to your recorded cash balance and the bank adds $857 to your chequing account balance.

D)You deduct $857 from your recorded cash balance and the bank adds $857 to your chequing account balance.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following is not stated as a primary objective of a company's internal control policies and procedures?

A)The proper recording and authorization of transactions.

B)The maintenance of adequate records.

C)The prevention or detection of unauthorized activities involving a company's records.

D)The provision of current information for outside investors and analysts.

A)The proper recording and authorization of transactions.

B)The maintenance of adequate records.

C)The prevention or detection of unauthorized activities involving a company's records.

D)The provision of current information for outside investors and analysts.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

40

DigDug Corporation had outstanding cheques totalling $5,400 on its June bank reconciliation.In July,DigDug issued cheques totalling $38,900.The July bank statement shows that $26,300 in cheques cleared the bank in July.The amount of outstanding cheques on DigDug's July bank reconciliation should be:

A)$12,600.

B)$18,000.

C)$5,400.

D)$7,200. Remaining outstanding cheques = Outstanding cheques + additional cheques issued - cheques cleared

$5,400+38,900-26,300 = $18,000.

A)$12,600.

B)$18,000.

C)$5,400.

D)$7,200. Remaining outstanding cheques = Outstanding cheques + additional cheques issued - cheques cleared

$5,400+38,900-26,300 = $18,000.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following is/are true?

A)The primary goal of internal controls for cash payments is to ensure that the business pays all transactions.

B)The primary internal control goal for cash receipts is to ensure that the business receives the appropriate amount of cash and safely deposits it in the bank.

C)The operating cycle is a series of activities that a company undertakes to generate returns and,ultimately,revenues.

D)All of the choices are correct.

A)The primary goal of internal controls for cash payments is to ensure that the business pays all transactions.

B)The primary internal control goal for cash receipts is to ensure that the business receives the appropriate amount of cash and safely deposits it in the bank.

C)The operating cycle is a series of activities that a company undertakes to generate returns and,ultimately,revenues.

D)All of the choices are correct.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

42

For each of the following events,match the event with the section of the bank reconciliation in which it is listed,if at all,and indicate the operation performed.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

43

Cash on the balance sheet does not include:

A)Cash in the bank

B)Petty Cash

C)Short-term investments

D)Cash equivalent

A)Cash in the bank

B)Petty Cash

C)Short-term investments

D)Cash equivalent

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following situations would cause the balance per bank to be less than the balance per books?

A)Interest payments made by the bank.

B)Cheques from customers returned as NSF.

C)Outstanding cheques.

D)All of the answers are acceptable.

A)Interest payments made by the bank.

B)Cheques from customers returned as NSF.

C)Outstanding cheques.

D)All of the answers are acceptable.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

45

On October 31,2018,your company's records say that the company has $16,451.03 in its chequing account.A review of the bank statement shows you have three outstanding cheques total-ling $5,643.01,and the bank has paid you interest of $12.19 and charged you $9.00 in fees.The bank statement dated October 31,2018 would report a balance of:

A)$22,090.85.

B)$10,811.21.

C)$22,097.23.

D)$16,454.22 $16,451.03 + $12.19 - $9 = $16,454.22 would be the adjusted balance per company books.

The bank statement would show an unadjusted balance of $16,454.22 + $5,643.01 = $22,097.23.

A)$22,090.85.

B)$10,811.21.

C)$22,097.23.

D)$16,454.22 $16,451.03 + $12.19 - $9 = $16,454.22 would be the adjusted balance per company books.

The bank statement would show an unadjusted balance of $16,454.22 + $5,643.01 = $22,097.23.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

46

When you identify outstanding cheques in performing a bank reconciliation,you must:

A)deduct the amount of the outstanding cheques from the balance per books.

B)deduct the amount of the outstanding cheques from the balance per bank.

C)add the amount of the outstanding cheques to the balance per books.

D)add the amount of the outstanding cheques to the balance per bank.

A)deduct the amount of the outstanding cheques from the balance per books.

B)deduct the amount of the outstanding cheques from the balance per bank.

C)add the amount of the outstanding cheques to the balance per books.

D)add the amount of the outstanding cheques to the balance per bank.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

47

When a company makes a sale and accepts a credit card payment from a customer,the company:

A)debits Cash.

B)credits Accounts Receivable.

C)credits Cash.

D)debits Accounts Receivable.

A)debits Cash.

B)credits Accounts Receivable.

C)credits Cash.

D)debits Accounts Receivable.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

48

According to the changes in financial reporting which of the following is required to communicate with the external auditors and ensure that they are able to effectively perform their work?

A)Board of directors

B)Audit committee of the board of directors

C)Audit committee of the management

D)CEO and corporate officers

A)Board of directors

B)Audit committee of the board of directors

C)Audit committee of the management

D)CEO and corporate officers

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following items on a bank reconciliation would require an adjusting journal entry on the company's books?

A)An error by the bank.

B)Outstanding cheques.

C)A bank service charge.

D)A deposit in transit.

A)An error by the bank.

B)Outstanding cheques.

C)A bank service charge.

D)A deposit in transit.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following bank reconciliation items would not result in an adjusting journal entry in the company's books?

A)Service charge.

B)Outstanding cheques.

C)A customer's cheque returned NSF.

D)Interest earned on deposits.

A)Service charge.

B)Outstanding cheques.

C)A customer's cheque returned NSF.

D)Interest earned on deposits.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

51

In addition to examining the company's financial statements and report whether they were presented fairly without any misstatement what else is required of the external auditors by the recent changes in financial reporting?

A)To report any financial misstatements or irregularities to the press

B)To review and test the effectiveness of the company's internal controls

C)To review and test the effectiveness of the company's board of directors

D)To review and test the effectiveness of the company's marketing department

A)To report any financial misstatements or irregularities to the press

B)To review and test the effectiveness of the company's internal controls

C)To review and test the effectiveness of the company's board of directors

D)To review and test the effectiveness of the company's marketing department

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

52

Deposits in transit:

A)have been recorded by the company but not yet by the bank.

B)have been recorded by the bank but not yet by the company.

C)have not been recorded by the bank or the company.

D)are customers' cheques that have not yet been received by the company.

A)have been recorded by the company but not yet by the bank.

B)have been recorded by the bank but not yet by the company.

C)have not been recorded by the bank or the company.

D)are customers' cheques that have not yet been received by the company.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

53

Fraud investigators refer to what elements as being part of the fraud triangle?

A)Motive,incentive,opportunity.

B)Incentive,opportunity,rationalize behavior.

C)Motive,means,rationalize behavior.

D)Means,motive,opportunity.

A)Motive,incentive,opportunity.

B)Incentive,opportunity,rationalize behavior.

C)Motive,means,rationalize behavior.

D)Means,motive,opportunity.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

54

When you identify interest received from the bank in performing a bank reconciliation,you must:

A)add the amount of interest to the balance per bank.

B)deduct the amount of interest from the balance per books.

C)add the amount of interest to the balance per books.

D)deduct the amount of interest from the balance per bank.

A)add the amount of interest to the balance per bank.

B)deduct the amount of interest from the balance per books.

C)add the amount of interest to the balance per books.

D)deduct the amount of interest from the balance per bank.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

55

You have received the bank statement for your company's account and need to reconcile it with your cash account.Your records show an ending balance for the month of $12,722.40 while the bank's records show an ending balance of $12,367.16.

The bank charged $8 in service fees and paid $26.05 in interest.All but three cheques written during the month were processed by the bank without incident during the month.The three exceptions were:

1)Check #841 was correctly processed by the bank as $981.27 but was mistakenly recorded by you as $781.27.

2)Check #853 for $64.57 had not yet been processed by the bank.

3)Check #855 for $683.46 had not yet been processed by the bank.

The bank charged $8 in service fees and paid $26.05 in interest.All but three cheques written during the month were processed by the bank without incident during the month.The three exceptions were:

1)Check #841 was correctly processed by the bank as $981.27 but was mistakenly recorded by you as $781.27.

2)Check #853 for $64.57 had not yet been processed by the bank.

3)Check #855 for $683.46 had not yet been processed by the bank.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

56

On October 31,2018,the bank's records say that your company has $12,956.73 in its chequing account.You are aware of three outstanding cheques for a total of $2,112.19.During October 2018,the bank rejected two deposited cheques from customers totalling $654.19 because of insufficient funds and charged you $12.00 in service fees.You had not yet received notice about the bad cheques,but you were aware of and have recorded the $12.00 of service fees.Prior to adjustment on October 31,2018,your Cash account would have a balance of:

A)$14,402.73.

B)$15,711.11.

C)$11,498.73.

D)$10,202.35. Unadjusted balance per books = $12,956.73 - $2,112.10 + $654.19 = $11,498.73.

A)$14,402.73.

B)$15,711.11.

C)$11,498.73.

D)$10,202.35. Unadjusted balance per books = $12,956.73 - $2,112.10 + $654.19 = $11,498.73.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

57

Identify whether a company debits (Dr)or credits (Cr)its Cash account to record each of the following transactions:

_____ The company writes a $197.06 cheque.

_____ The company deposits a $5,000 cheque into its account.

_____ In a bank reconciliation,the company discovers that it recorded a $127.35 payment to a supplier as $27.35.

_____ The bank pays $16.00 interest on the company's account.

_____ The company electronically transfers $867 to a supplier.

_____ A customer's cheque in the amount of $31 is returned by the bank as NSF.

_____ The bank charges $12 in fees to the company's bank account.

_____ When preparing the bank reconciliation,the company's accountant discovers a cheque in the amount of $1,000 that had been written but had not been recorded.

_____ A customer electronically transfers $189.43 to the company's bank account.

_____ The company writes a $197.06 cheque.

_____ The company deposits a $5,000 cheque into its account.

_____ In a bank reconciliation,the company discovers that it recorded a $127.35 payment to a supplier as $27.35.

_____ The bank pays $16.00 interest on the company's account.

_____ The company electronically transfers $867 to a supplier.

_____ A customer's cheque in the amount of $31 is returned by the bank as NSF.

_____ The bank charges $12 in fees to the company's bank account.

_____ When preparing the bank reconciliation,the company's accountant discovers a cheque in the amount of $1,000 that had been written but had not been recorded.

_____ A customer electronically transfers $189.43 to the company's bank account.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

58

When preparing this month's bank reconciliation,you find that you failed to record a $95 deposit for a payment you received from a customer.You immediately prepare a journal entry to record the deposit.Which of the following describes the actions to be taken when preparing next month's bank reconciliation?

A)You must decrease the balance per bank by $95.

B)You must increase the balance per bank by $95.

C)You must increase the balance per books by $95.

D)No further action is necessary.

A)You must decrease the balance per bank by $95.

B)You must increase the balance per bank by $95.

C)You must increase the balance per books by $95.

D)No further action is necessary.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following situations would cause the balance per bank to be more than the balance per books?

A)Deposits in transit.

B)Service charges.

C)Outstanding cheques.

D)Cheques from customers returned as NSF.

A)Deposits in transit.

B)Service charges.

C)Outstanding cheques.

D)Cheques from customers returned as NSF.

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck

60

Match between columns

Unlock Deck

Unlock for access to all 60 flashcards in this deck.

Unlock Deck

k this deck