Deck 9: Performance Measurement and Responsibility Accounting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/149

Play

Full screen (f)

Deck 9: Performance Measurement and Responsibility Accounting

1

Controllable costs are the same as direct expenses.

False

2

Responsibility performance reports usually compare actual costs to the budgeted costs amounts.

True

3

Evaluation of the performance of a department involves only financial measures.

False

4

Evaluation of the performance of managers of profit centers assumes that the managers can control or influence both costs and revenue generation.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

5

A transfer price has no direct impact on a company's overall profits.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

6

Departmental information is important and always disclosed to the public as part of the company's annual report and footnotes.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

7

A service department is usually evaluated as a profit center.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

8

Generally, it does not matter how cost allocations are designed and explained, because most employees do not care whether the allocations appear to be fair or not.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

9

A department's direct expenses can be entirely avoided if the department manager carefully controls and monitors operations.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

10

Uncontrollable costs would continue even if a department were eliminated.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

11

Direct expenses must be allocated across departments.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

12

A cost center does not directly generate revenues.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

13

Advertising expense can be reasonably allocated to departments on the basis of sales.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

14

The price that should be used to record transfers between divisions in the same company is called the divisional price.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

15

Departmental accounting and responsibility accounting are related.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

16

The concepts of direct expenses and controllable costs are essentially the same.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

17

Indirect expenses should be allocated to departments based on the benefits received by each department.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

18

Expense allocations cannot always avoid some arbitrariness.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

19

Departmental wage expenses are direct expenses of that department.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

20

A department can never be considered to be a profit center.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

21

Cycle time is a financial measure commonly used to evaluate a company's production processes.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

22

A useful measure used to evaluate the manager of an investment center is return on total costs for the investment center.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following is most likely to be considered a profit center?

A)An individual retail store in a large chain.

B)The grocery department of a Walmart Supercenter or Target Superstore.

C)The maintenance department of a large retail operation.

D)The personnel office of a business.

E)A stand-alone eye clinic.

A)An individual retail store in a large chain.

B)The grocery department of a Walmart Supercenter or Target Superstore.

C)The maintenance department of a large retail operation.

D)The personnel office of a business.

E)A stand-alone eye clinic.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

24

In producing oat bran, the joint cost of milling the oats into bran, oatmeal, and animal feed is considered a direct cost to the oat bran, because the oat bran cannot be produced without incurring the joint cost.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

25

The process of preparing departmental income statements starts with allocating service departments.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

26

Cycle efficiency is the ratio of value-added time to total cycle time.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

27

A unit of a business that not only incurs costs but also generates revenues is called a:

A)Performance center.

B)Profit center.

C)Cost center.

D)Responsibility center.

E)Expense center.

A)Performance center.

B)Profit center.

C)Cost center.

D)Responsibility center.

E)Expense center.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

28

Joint costs can be allocated either using a physical basis or a value basis.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

29

Return on total assets for a cost center is a useful measure to evaluate the cost center manager.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

30

Joint costs are a group of several costs incurred in producing or purchasing a single product.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

31

An accounting system that provides information that management can use to evaluate the profitability and/or cost effectiveness of a department's activities is a:

A)Departmental accounting system.

B)Cost accounting system.

C)Service accounting system.

D)Revenue accounting system.

E)Standard accounting system.

A)Departmental accounting system.

B)Cost accounting system.

C)Service accounting system.

D)Revenue accounting system.

E)Standard accounting system.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

32

When a company has no excess capacity, the use of cost-based transfer pricing is preferred.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

33

Investment center managers are responsible only for revenues and the costs of investment.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following would not be considered a cost center?

A)Accounting department.

B)Purchasing department.

C)Research department.

D)Advertising department.

E)Pharmacy in a grocery store.

A)Accounting department.

B)Purchasing department.

C)Research department.

D)Advertising department.

E)Pharmacy in a grocery store.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

35

A joint cost of producing two products can be allocated between those products on the basis of the relative physical quantities of each product produced.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

36

Return on investment for a given investment center can be split into two components: profit margin and investment turnover.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

37

Contribution to overhead generated by a department is the same as gross profit generated by that department.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

38

Departmental contribution to overhead is the amount of revenues for that department less its direct expenses.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

39

A profit center:

A)Incurs costs but does not directly generate revenues.

B)Incurs costs and directly generates revenues.

C)Has a manager who is evaluated solely on efficiency in controlling costs.

D)Incurs only indirect costs and directly generates revenues.

E)Incurs only indirect costs and generates revenues.

A)Incurs costs but does not directly generate revenues.

B)Incurs costs and directly generates revenues.

C)Has a manager who is evaluated solely on efficiency in controlling costs.

D)Incurs only indirect costs and directly generates revenues.

E)Incurs only indirect costs and generates revenues.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

40

Profit margin measures how efficiently an investment center generates sales from its invested assets.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following would not appear on a responsibility accounting performance report?

A)Actual costs for a period.

B)Variance from the budget.

C)Budgeted costs for a period.

D)Controllable costs.

E)Uncontrollable costs.

A)Actual costs for a period.

B)Variance from the budget.

C)Budgeted costs for a period.

D)Controllable costs.

E)Uncontrollable costs.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

42

Regardless of the system used in departmental cost analysis:

A)Direct costs are allocated, indirect costs are not.

B)Indirect costs are allocated, direct costs are not.

C)Both direct and indirect costs are allocated.

D)Neither direct nor indirect costs are allocated.

E)Total departmental costs will always be the same.

A)Direct costs are allocated, indirect costs are not.

B)Indirect costs are allocated, direct costs are not.

C)Both direct and indirect costs are allocated.

D)Neither direct nor indirect costs are allocated.

E)Total departmental costs will always be the same.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

43

A difficult problem in calculating the total costs and expenses of a department is:

A)Determining the gross profit ratio.

B)Assigning direct costs to the department.

C)Assigning indirect expenses to the department.

D)Determining the amount of sales of the department.

E)Determining the direct expenses of the department.

A)Determining the gross profit ratio.

B)Assigning direct costs to the department.

C)Assigning indirect expenses to the department.

D)Determining the amount of sales of the department.

E)Determining the direct expenses of the department.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

44

A report that specifies the expected and actual costs under the control of a manager is a:

A)Segmental accounting report.

B)Managerial cost report.

C)Controllable expense report.

D)Departmental accounting report.

E)Responsibility accounting report.

A)Segmental accounting report.

B)Managerial cost report.

C)Controllable expense report.

D)Departmental accounting report.

E)Responsibility accounting report.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

45

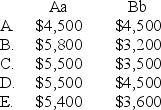

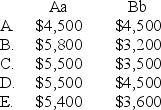

A company has two departments, Aa and Bb, that incur delivery expenses.An analysis of the total delivery expense of $9,000 indicates that Dept.Aa had a direct expense of $1,000 for deliveries.None of the $9,000 is a direct expense to Dept.Bb.The analysis also indicates that 60% of regular delivery requests originate in Dept.Aa and 40% in Dept.Bb.The delivery expenses that should be charged to Dept.Aa and Dept.Bb, respectively, are:

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

46

An expense that does not require allocation between departments is a(n):

A)Common expense.

B)Indirect expense.

C)Direct expense.

D)Administrative expense.

E)Overhead expense.

A)Common expense.

B)Indirect expense.

C)Direct expense.

D)Administrative expense.

E)Overhead expense.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

47

The most useful evaluation of a manager's cost performance is based on:

A)Controllable costs.

B)Contribution percentages.

C)Departmental contributions to overhead.

D)Fixed expenses.

E)Direct costs.

A)Controllable costs.

B)Contribution percentages.

C)Departmental contributions to overhead.

D)Fixed expenses.

E)Direct costs.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

48

The most useful allocation basis for the departmental costs of an advertising campaign for a storewide sale is likely to be:

A)Floor space of each department.

B)Relative number of items each department had on sale.

C)Number of customers to enter each department.

D)An equal amount of cost for each department.

E)Total sales of each department.

A)Floor space of each department.

B)Relative number of items each department had on sale.

C)Number of customers to enter each department.

D)An equal amount of cost for each department.

E)Total sales of each department.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

49

Responsibility accounting performance reports:

A)Become more detailed at higher levels of management.

B)Become less detailed at higher levels of management.

C)Are equally detailed at all levels of management.

D)Are useful in any format.

E)Are irrelevant.

A)Become more detailed at higher levels of management.

B)Become less detailed at higher levels of management.

C)Are equally detailed at all levels of management.

D)Are useful in any format.

E)Are irrelevant.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

50

Costs that the manager has the power to determine or at least strongly influence are called:

A)Uncontrollable costs

B)Controllable costs

C)Joint costs

D)Direct costs

E)Indirect costs

A)Uncontrollable costs

B)Controllable costs

C)Joint costs

D)Direct costs

E)Indirect costs

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

51

Within an organizational structure, the person most likely to be evaluated in terms of controllable costs would be:

A)A payroll clerk.

B)A cost center manager.

C)A production line worker.

D)A maintenance worker.

E)A graphic designer.

A)A payroll clerk.

B)A cost center manager.

C)A production line worker.

D)A maintenance worker.

E)A graphic designer.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

52

Expenses that are easily traced and assigned to a specific department because they are incurred for the sole benefit of that department are called:

A)Direct expenses

B)Indirect expenses

C)Controllable expenses

D)Uncontrollable expenses

E)Fixed expenses

A)Direct expenses

B)Indirect expenses

C)Controllable expenses

D)Uncontrollable expenses

E)Fixed expenses

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

53

The salaries of employees who spend all their time working in one department are:

A)Variable expenses

B)Indirect expenses

C)Direct expenses

D)Responsibility expenses

E)Unavoidable expenses

A)Variable expenses

B)Indirect expenses

C)Direct expenses

D)Responsibility expenses

E)Unavoidable expenses

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

54

Costs that the manager does not have the power to determine or strongly influence are:

A)Variable costs

B)Uncontrollable costs

C)Indirect costs

D)Direct costs

E)Joint costs

A)Variable costs

B)Uncontrollable costs

C)Indirect costs

D)Direct costs

E)Joint costs

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

55

Expenses that are not easily associated with a specific department, and which are incurred for the benefit of more than one department, are:

A)Fixed expenses

B)Indirect expenses

C)Direct expenses

D)Uncontrollable expenses

E)Variable expenses

A)Fixed expenses

B)Indirect expenses

C)Direct expenses

D)Uncontrollable expenses

E)Variable expenses

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

56

An accounting system that provides information that management can use to evaluate the performance of a department's manager is called a:

A)Cost accounting system.

B)Managerial accounting system.

C)Responsibility accounting system.

D)Financial accounting system.

E)Activity-based accounting system.

A)Cost accounting system.

B)Managerial accounting system.

C)Responsibility accounting system.

D)Financial accounting system.

E)Activity-based accounting system.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

57

In a responsibility accounting system:

A)Controllable costs are assigned to managers who are responsible for them.

B)Each accounting report contains all items allocated to a responsibility center.

C)Organized and clear lines of authority and responsibility are only incidental.

D)All managers at a given level have equal authority and responsibility.

E)Control over costs belongs only to the top level of management.

A)Controllable costs are assigned to managers who are responsible for them.

B)Each accounting report contains all items allocated to a responsibility center.

C)Organized and clear lines of authority and responsibility are only incidental.

D)All managers at a given level have equal authority and responsibility.

E)Control over costs belongs only to the top level of management.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

58

A responsibility accounting performance report documents:

A)Only actual costs.

B)Only budgeted costs.

C)Both actual costs and budgeted costs.

D)Only direct costs.

E)Only indirect costs.

A)Only actual costs.

B)Only budgeted costs.

C)Both actual costs and budgeted costs.

D)Only direct costs.

E)Only indirect costs.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

59

A department that incurs costs without directly generating revenues is a:

A)Service center

B)Production center

C)Profit center

D)Cost center

E)Performance center

A)Service center

B)Production center

C)Profit center

D)Cost center

E)Performance center

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

60

The allocation bases for assigning indirect costs include:

A)Only physical bases.

B)Only cost bases.

C)Only value bases.

D)Only unit bases.

E)Any appropriate and reasonable bases.

A)Only physical bases.

B)Only cost bases.

C)Only value bases.

D)Only unit bases.

E)Any appropriate and reasonable bases.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

61

The portion of the $450 cost that should be allocated to Product A using the value basis of allocation is:

A.$0

B.$180

C.$225

D.$300

E.$425

A.$0

B.$180

C.$225

D.$300

E.$425

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

62

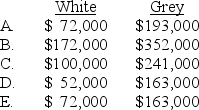

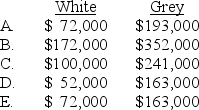

Gross profit for the White and Grey Divisions is:

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

63

A responsibility accounting report that compares actual costs and expenses for a department with the budgeted amounts is called a(n):

A)Performance report

B)Service report

C)Income statement

D)Balance sheet

E)Cost report

A)Performance report

B)Service report

C)Income statement

D)Balance sheet

E)Cost report

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

64

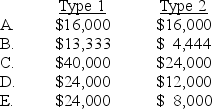

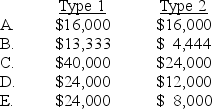

A sawmill bought a shipment of logs for $40,000.When cut, the logs produced 1 million board feet of lumber in the following grades: Type 1 - 400,000 bd.ft.priced to sell at $0.12 per bd.ft.

Type 2 - 400,000 bd.ft.priced to sell at $0.06 per bd.ft.

Type 3 - 200,000 bd.ft.priced to sell at $0.04 per bd.ft.

How much cost should be allocated to Type 1 and Type 2, respectively?

Type 2 - 400,000 bd.ft.priced to sell at $0.06 per bd.ft.

Type 3 - 200,000 bd.ft.priced to sell at $0.04 per bd.ft.

How much cost should be allocated to Type 1 and Type 2, respectively?

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

65

A sawmill paid $70,000 for logs that produced 200,000 board feet of lumber in three different grades and amounts as follows: How much of the $70,000 joint cost should be allocated to No.2 Common?

A)$0

B)$17,500

C)$23,333

D)$35,000

E)$70,000

A)$0

B)$17,500

C)$23,333

D)$35,000

E)$70,000

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following is an example of a financial performance measure that would be found in a balanced scorecard?

A)Percentage of sales from new customers.

B)Money spent on employee training programs.

C)Product costs.

D)Return on investment.

E)Money spent on research and development.

A)Percentage of sales from new customers.

B)Money spent on employee training programs.

C)Product costs.

D)Return on investment.

E)Money spent on research and development.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

67

Allocations of joint product costs can be based on the relative market values of the products:

A)And never on the relative physical quantities of the products.

B)Plus an adjustment for future excess margins.

C)And not on any other basis.

D)At the time the products are separated.

E)Only if the products contain both direct and indirect costs.

A)And never on the relative physical quantities of the products.

B)Plus an adjustment for future excess margins.

C)And not on any other basis.

D)At the time the products are separated.

E)Only if the products contain both direct and indirect costs.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

68

Data pertaining to a company's joint manufacturing process for the current period follows: What cost amount should be allocated to Product A for this period's $660 of joint costs on the basis of market value at the point of separation?

A)$330.00

B)$440.00

C)$220.00

D)$194.12

E)$484.00

A)$330.00

B)$440.00

C)$220.00

D)$194.12

E)$484.00

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

69

Under which of the following conditions is a market-based transfer price likely to be used?

A)There is no excess capacity.

B)No market price exists.

C)Excess capacity exists.

D)Excess capacity exists and the market price covers fixed costs.

E)There is only an internal market for the item in question.

A)There is no excess capacity.

B)No market price exists.

C)Excess capacity exists.

D)Excess capacity exists and the market price covers fixed costs.

E)There is only an internal market for the item in question.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

70

In the preparation of departmental income statements, the preparer completes the following steps in the following order:

A)Identify direct expenses; allocate indirect expenses; allocate service department expenses.

B)Identify indirect expenses; allocate direct expenses; allocate service department expenses.

C)Identify service department expenses; allocate direct expenses; allocate indirect expenses.

D)Identify direct expenses, allocate service department expenses, allocate indirect expenses.

E)Allocate all expenses.

A)Identify direct expenses; allocate indirect expenses; allocate service department expenses.

B)Identify indirect expenses; allocate direct expenses; allocate service department expenses.

C)Identify service department expenses; allocate direct expenses; allocate indirect expenses.

D)Identify direct expenses, allocate service department expenses, allocate indirect expenses.

E)Allocate all expenses.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

71

A single cost incurred in producing or purchasing two or more essentially different products is a(n):

A)Product cost

B)Incremental cost

C)Differential cost

D)Joint cost

E)Fixed cost

A)Product cost

B)Incremental cost

C)Differential cost

D)Joint cost

E)Fixed cost

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following is an example of a financial performance measure that would be found in a balanced scorecard?

A)Percentage of on-time delivery.

B)Residual income.

C)Customer satisfaction.

D)Cycle time.

E)Employee turnover.

A)Percentage of on-time delivery.

B)Residual income.

C)Customer satisfaction.

D)Cycle time.

E)Employee turnover.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

73

General Chemical produced 10,000 gallons of Greon and 20,000 gallons of Baron.Joint costs incurred in producing the two products totaled $7,500.At the split-off point, Greon has a market value of $6 per gallon and Baron $2 per gallon.What portion of the joint costs should be allocated to Greon if the basis is market value at point of separation?

A)$2,500

B)$3,000

C)$4,500

D)$5,625

E)$1,500

A)$2,500

B)$3,000

C)$4,500

D)$5,625

E)$1,500

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

74

If the $450 cost of the 300 gallons of Material M were to be allocated to the joint products in proportion to the number of gallons of each product produced, Product A's share would be:

A.$0

B.$180

C.$225

D.$300

E.$450

A.$0

B.$180

C.$225

D.$300

E.$450

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

75

A dairy allocates the cost of unprocessed milk to the production of milk, cream, butter and cheese.For the current period, unprocessed milk was purchased for $240,000, and the following quantities of product and sales revenues were produced. How much of the $240,000 cost should be allocated to milk?

A)$0

B)$86,400

C)$90,000

D)$133,333

E)$240,000

A)$0

B)$86,400

C)$90,000

D)$133,333

E)$240,000

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

76

Bevo Beef Company uses the relative market value method of allocating joint costs in their production of beef products.Relevant information for the current period follows: The total joint cost for the current period was $43,000.How much of this cost should Bevo Beef allocate to sirloin?

A)$0

B)$5,909

C)$8,600

D)$10,750

E)$43,000

A)$0

B)$5,909

C)$8,600

D)$10,750

E)$43,000

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

77

Allocating joint costs to products can be based on their relative:

A)Market values

B)Direct costs

C)Gross margins

D)Total costs

E)Variable costs

A)Market values

B)Direct costs

C)Gross margins

D)Total costs

E)Variable costs

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following is an example of a performance measure of the customer perspective that would be found in a balanced scorecard?

A)Product defect rates.

B)Number of new customers.

C)Employee satisfaction.

D)Return on investment.

E)Sales growth.

A)Product defect rates.

B)Number of new customers.

C)Employee satisfaction.

D)Return on investment.

E)Sales growth.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following is an example of a performance measure of internal business processes that would be found in a balanced scorecard:

A)Product defect rates.

B)Number of new customers.

C)Employee satisfaction.

D)Return on investment.

E)Sales growth.

A)Product defect rates.

B)Number of new customers.

C)Employee satisfaction.

D)Return on investment.

E)Sales growth.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck

80

A responsibility accounting system:

A)Is designed to measure the performance of managers in terms of uncontrollable costs.

B)Assigns responsibility for costs to the top managerial level.

C)Is designed to hold a manager responsible for costs over which the manager has no influence.

D)Can be applied at any level of an organization.

E)Is well suited to work in an environment without clear lines of responsibility and authority.

A)Is designed to measure the performance of managers in terms of uncontrollable costs.

B)Assigns responsibility for costs to the top managerial level.

C)Is designed to hold a manager responsible for costs over which the manager has no influence.

D)Can be applied at any level of an organization.

E)Is well suited to work in an environment without clear lines of responsibility and authority.

Unlock Deck

Unlock for access to all 149 flashcards in this deck.

Unlock Deck

k this deck