Deck 3: Accrual Accounting and the Financial Statements

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/144

Play

Full screen (f)

Deck 3: Accrual Accounting and the Financial Statements

1

There are two methods used to account for transactions.These methods are:

A) cash and deferral

B) cash and accrual

C) accrual and deferral

D) deferral and prepaid

A) cash and deferral

B) cash and accrual

C) accrual and deferral

D) deferral and prepaid

B

2

Under the revenue recognition principle,a business should record revenue when the business:

A) receives an order from a customer for goods or services

B) prepares the invoice (bill) for goods or services

C) delivers goods or services to a customer

D) receives payment from a customer for goods or services

A) receives an order from a customer for goods or services

B) prepares the invoice (bill) for goods or services

C) delivers goods or services to a customer

D) receives payment from a customer for goods or services

C

3

The cash basis of accounting records the impact of all business transactions as they occur.

False

4

People using the cash basis of accounting for their business generally make better decisions.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following transactions would be recorded at the time the transaction occurs under the accrual basis,but would not be recorded until sometime in the future under the cash basis?

A) sale of merchandise on account

B) payment of interest expenses

C) payment of employee salaries

D) issuance of stock

A) sale of merchandise on account

B) payment of interest expenses

C) payment of employee salaries

D) issuance of stock

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

6

Using accrual accounting,expenses are not recorded until the cash for the expense is disbursed.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

7

Cash for services to be performed in 2017 is received in 2016.Using the accrual basis of accounting,the revenue should appear on:

A) the 2017 income statement

B) both the 2016 and 2017 income statements

C) neither the 2016 nor 2017 income statement

D) the 2016 income statement

A) the 2017 income statement

B) both the 2016 and 2017 income statements

C) neither the 2016 nor 2017 income statement

D) the 2016 income statement

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

8

An expense incurred in 2016 is not paid until 2017.Using the accrual basis of accounting,the expense should appear on:

A) the 2017 income statement

B) the 2016 income statement

C) neither the 2016 nor 2017 income statement

D) both the 2016 and 2017 income statements

A) the 2017 income statement

B) the 2016 income statement

C) neither the 2016 nor 2017 income statement

D) both the 2016 and 2017 income statements

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

9

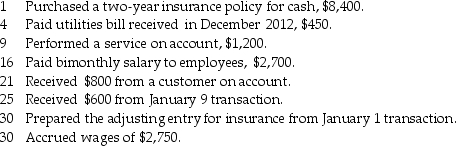

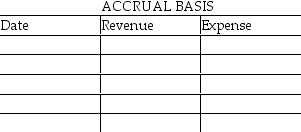

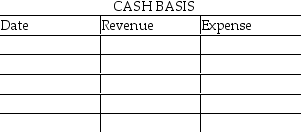

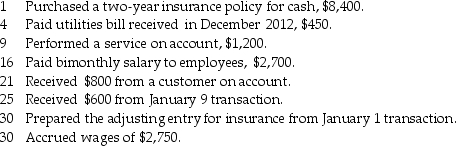

The following transactions for Carleton Company occurred during January 2017:

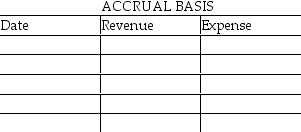

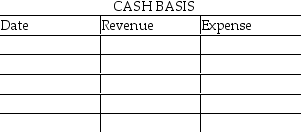

Required: Show the amount of revenue and expense recognized for each transaction under both the accrual basis and the cash basis of accounting by completing the charts below.

Required: Show the amount of revenue and expense recognized for each transaction under both the accrual basis and the cash basis of accounting by completing the charts below.

Required: Show the amount of revenue and expense recognized for each transaction under both the accrual basis and the cash basis of accounting by completing the charts below.

Required: Show the amount of revenue and expense recognized for each transaction under both the accrual basis and the cash basis of accounting by completing the charts below.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

10

Corporations typically use the cash basis for their transactions.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

11

On October 25,2017 Quick Corp.prints a cheque for November's rent payment.Quick Corp.mails the cheque on October 27 to the landlord.The landlord receives the cheque October 31 and cashes the cheque on November 2.When should Quick Corp.record the rent expense associated with this transaction?

A) October 25, 2017

B) October 27, 2017

C) November 30, 2017

D) November 2, 2017

A) October 25, 2017

B) October 27, 2017

C) November 30, 2017

D) November 2, 2017

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

12

An accrual refers to an event:

A) where the cash has not been exchanged between the two parties

B) that will never involve an income statement account

C) that will never involve cash

D) where the cash has already exchanged hands between the two parties

A) where the cash has not been exchanged between the two parties

B) that will never involve an income statement account

C) that will never involve cash

D) where the cash has already exchanged hands between the two parties

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

13

One of the most widely used financial ratios is the current ratio.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

14

An accrual refers to an event:

A) where the expense or revenue is recorded after the cash settlement

B) where the liability is recorded after the cash settlement

C) where the expense or revenue is recorded before the cash settlement

D) where the asset is recorded after the cash settlement

A) where the expense or revenue is recorded after the cash settlement

B) where the liability is recorded after the cash settlement

C) where the expense or revenue is recorded before the cash settlement

D) where the asset is recorded after the cash settlement

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

15

Accrual accounting is more complex than the cash basis.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

16

In accrual accounting,revenue may be earned prior to or after cash is received.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

17

A company using the cash basis of accounting receives cash for services yet to be performed.The entry to record the cash received will involve a credit to:

A) Prepaid Revenue

B) Service Revenue

C) Accrued Revenue

D) Deferred Revenue

A) Prepaid Revenue

B) Service Revenue

C) Accrued Revenue

D) Deferred Revenue

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

18

On December 15,2016,a company receives an order from a customer for services to be performed on December 28,2016.Due to a backlog of orders,the company does not perform the services until January 3,2017.The customer pays for the services on January 6,2017.When should revenue be recorded by the company?

A) December 15, 2016

B) January 3, 2017

C) December 28, 2016

D) January 6, 2017

A) December 15, 2016

B) January 3, 2017

C) December 28, 2016

D) January 6, 2017

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

19

The accounting principle which tells accountants when to record revenue and in what amount is called the:

A) matching principle

B) revenue recognition principle

C) full disclosure principle

D) going concern principle

A) matching principle

B) revenue recognition principle

C) full disclosure principle

D) going concern principle

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

20

An accountant who records a transaction only when cash is received or disbursed is using which basis of accounting?

A) prepaid

B) accrual

C) cash

D) deferral

A) prepaid

B) accrual

C) cash

D) deferral

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is not one of the three basic categories of adjusting entries?

A) accruals

B) depreciation

C) deferrals

D) expiration

A) accruals

B) depreciation

C) deferrals

D) expiration

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

22

On October 31 of the current year,a contract was signed and a cheque received for services to be performed by October 31 of the following year.The Unearned Service Revenue account was credited for $4,800.Assuming services were performed evenly during the remainder of the year,the adjusting entry on December 31 will involve a:

A) credit to Unearned Service Revenue $800

B) credit to Service Revenue for $4,000

C) credit to Service Revenue $800

D) debit to Unearned Service Revenue $4,000

A) credit to Unearned Service Revenue $800

B) credit to Service Revenue for $4,000

C) credit to Service Revenue $800

D) debit to Unearned Service Revenue $4,000

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

23

A company using the accrual basis of accounting receives its utility bill which will be paid in two weeks.The entry will involve a debit to:

A) Utilities Expense

B) Utilities Payable

C) Prepaid Utilities

D) Prepaid Revenue

A) Utilities Expense

B) Utilities Payable

C) Prepaid Utilities

D) Prepaid Revenue

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

24

An accountant recognizes the impact of a business event as it occurs and accounts for it appropriately in which basis of accounting?

A) deferred

B) accrual

C) cash

D) prepaid

A) deferred

B) accrual

C) cash

D) prepaid

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

25

An adjustment of an asset for which the business paid cash in advance is:

A) a deferral

B) an accrual

C) unearned revenue

D) revenue recognition

A) a deferral

B) an accrual

C) unearned revenue

D) revenue recognition

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

26

On December 31,2017,salaries owed to employees total $5,650 and will be paid on January 4,2014.The adjusting entry prepared on December 31,2017,includes a:

A) debit to Salary Expense for $5,650

B) debit to Salary Payable for $5,650

C) credit to Cash for $5,650

D) credit to Salary Expense for $5,650

A) debit to Salary Expense for $5,650

B) debit to Salary Payable for $5,650

C) credit to Cash for $5,650

D) credit to Salary Expense for $5,650

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

27

Adjusting entries:

A) are prepared at the option of the accountant

B) are not needed under the accrual basis of accounting

C) are prepared at the beginning of the accounting period to update all accounts

D) are prepared at the end of the accounting period to update certain accounts

A) are prepared at the option of the accountant

B) are not needed under the accrual basis of accounting

C) are prepared at the beginning of the accounting period to update all accounts

D) are prepared at the end of the accounting period to update certain accounts

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

28

To obtain a new customer,a business sells merchandise to the customer for $100.Normally,the merchandise sells for $120.For this sale,the business should record revenue of $100,not $120.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

29

The adjusting entry for supplies used during the current period will involve a credit to:

A) Supplies

B) Supplies Expense

C) Accrued Supplies

D) Supplies Revenue

A) Supplies

B) Supplies Expense

C) Accrued Supplies

D) Supplies Revenue

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

30

On December 1,2017,Cream Ale Ltd.receives $1,800 in advance for an agreement to brew beer during the months of December,January,and February.As of December 31,2017,Cream Ale Ltd:

A) would have a $1,200 liability to its client under accrual accounting, and would have a $1,800 liability to its client under cash-basis accounting

B) would have recognized $600 revenue under accrual accounting, and would have recognized $1,800 revenue under cash-basis accounting

C) would have a $0 liability to its client under accrual accounting, and would have a $1,200 liability to its client under cash-basis accounting

D) would have recognized $600 cash under accrual accounting, and would have recognized 1,800 cash under cash-basis accounting

A) would have a $1,200 liability to its client under accrual accounting, and would have a $1,800 liability to its client under cash-basis accounting

B) would have recognized $600 revenue under accrual accounting, and would have recognized $1,800 revenue under cash-basis accounting

C) would have a $0 liability to its client under accrual accounting, and would have a $1,200 liability to its client under cash-basis accounting

D) would have recognized $600 cash under accrual accounting, and would have recognized 1,800 cash under cash-basis accounting

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

31

The adjusting entry to record salaries owed to employees but not paid until the next accounting period involves a credit to:

A) Salary Expense

B) Unearned Salaries

C) Salary Payable

D) Deferred Salary

A) Salary Expense

B) Unearned Salaries

C) Salary Payable

D) Deferred Salary

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

32

An accountant who keeps his books using accrual accounting performs a service but does not receive payment at the time the service is performed.The entry made by the accountant will require a credit to:

A) Unearned Expense

B) Deferred Expense

C) Service Revenue

D) Unearned Service Revenue

A) Unearned Expense

B) Deferred Expense

C) Service Revenue

D) Unearned Service Revenue

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

33

Accrual accounting provides some ethical challenges that cash accounting avoids.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

34

An accountant who uses the accrual basis of accounting receives cash in advance for services yet to be performed.The entry to record this transaction will include a credit to which of the following accounts?

A) Unearned Service Revenue

B) Prepaid Expense

C) Unearned Expense

D) Service Revenue

A) Unearned Service Revenue

B) Prepaid Expense

C) Unearned Expense

D) Service Revenue

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

35

On September 1 of the current year,Prepaid Rent was debited for $3,000.This amount represents payment for one year of rent,paid in advance.The adjusting entry on December 31 will involve a:

A) debit to Rent Expense for $2,000

B) debit to Rent Expense for $1,000

C) debit to Rent Payable for $2,000

D) debit to Rent Payable for $1,000

A) debit to Rent Expense for $2,000

B) debit to Rent Expense for $1,000

C) debit to Rent Payable for $2,000

D) debit to Rent Payable for $1,000

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

36

The adjusting entry to allocate the cost of a plant asset such as equipment involves a credit to:

A) Equipment Expense

B) Depreciation Expense

C) Accumulated Equipment

D) Accumulated Depreciation

A) Equipment Expense

B) Depreciation Expense

C) Accumulated Equipment

D) Accumulated Depreciation

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

37

A deferral refers to an event:

A) where the recognition of an expense or revenue is recorded before the cash is paid or received

B) where the liability for an expense is recorded after the expense is actually incurred

C) where the liability for an expense is recorded before the expense is actually incurred

D) where the recognition of an expense or revenue is recorded after the cash is paid or received

A) where the recognition of an expense or revenue is recorded before the cash is paid or received

B) where the liability for an expense is recorded after the expense is actually incurred

C) where the liability for an expense is recorded before the expense is actually incurred

D) where the recognition of an expense or revenue is recorded after the cash is paid or received

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

38

A company using the cash basis of accounting pays for one year of rent in advance.The entry to record this transaction will involve a debit to:

A) Deferred Rent Revenue

B) Rent Revenue

C) Rent Expense

D) Prepaid Rent

A) Deferred Rent Revenue

B) Rent Revenue

C) Rent Expense

D) Prepaid Rent

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

39

Under the revenue recognition principle,businesses should record revenue when it is earned regardless of when payment is received from the customer.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

40

A company using the accrual basis of accounting pays for one year of rent in advance.The entry to record this payment will involve a debit to:

A) Rent Revenue

B) Rent Expense

C) Prepaid Rent

D) Deferred Rent Revenue

A) Rent Revenue

B) Rent Expense

C) Prepaid Rent

D) Deferred Rent Revenue

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

41

Allocating the cost of long-lived tangible assets used in the operations of a business is referred to as:

A) depreciation

B) a deferral

C) an accrual

D) using up the asset

A) depreciation

B) a deferral

C) an accrual

D) using up the asset

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

42

Chance stables purchased a new baler as their annual equipment purchase.The baler was purchased for $10,000 down and a $50,000 note with an estimated life of 8 years.The baler will be worthless at the end of its life.The annual amount of depreciation on this equipment is:

A) $7,500

B) $6,250

C) $10,000

D) $50,000

A) $7,500

B) $6,250

C) $10,000

D) $50,000

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

43

A journal entry contains a debit to the Cash account and a credit to the Unearned Service Revenue account.This is an example of a(n):

A) deferred expense

B) accrued expense

C) accrued revenue

D) deferred revenue

A) deferred expense

B) accrued expense

C) accrued revenue

D) deferred revenue

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

44

A journal entry contains a debit to an asset account and a credit to a revenue account.This is an example of a(n):

A) accrued revenue

B) deferred expense

C) unearned revenue

D) accrued expense

A) accrued revenue

B) deferred expense

C) unearned revenue

D) accrued expense

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

45

An adjustment is made for an expense incurred prior to its payment.The adjustment is called a(n):

A) accrued expense

B) prepaid expense

C) unearned expense

D) accrued asset

A) accrued expense

B) prepaid expense

C) unearned expense

D) accrued asset

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

46

On June 1,2017,Destiny Ltd.received $3,600 for services to be performed evenly over the next twelve months.The adjusting entry on December 31,2017,would include a:

A) debit to Cash for $3,600

B) debit to Service Revenue for $1,500

C) debit to Unearned Service Revenue for $1,500

D) debit to Unearned Service Revenue for $2,100

A) debit to Cash for $3,600

B) debit to Service Revenue for $1,500

C) debit to Unearned Service Revenue for $1,500

D) debit to Unearned Service Revenue for $2,100

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

47

Honey Brown Inc.paid six months' rent in advance totalling $9,000.At the end of the first month,the adjusting entry would include a:

A) debit to Prepaid Rent for $7,500

B) debit to Prepaid Rent for $1,500

C) debit to Rent Expense for $7,500

D) debit to Rent Expense for $1,500

A) debit to Prepaid Rent for $7,500

B) debit to Prepaid Rent for $1,500

C) debit to Rent Expense for $7,500

D) debit to Rent Expense for $1,500

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

48

What is the liability called that arises from an expense that the business has incurred but has not yet paid?

A) It is known as an unearned expense.

B) It is called a deferred expense.

C) It is called a prepaid expense.

D) It is referred to as an accrued expense.

A) It is known as an unearned expense.

B) It is called a deferred expense.

C) It is called a prepaid expense.

D) It is referred to as an accrued expense.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

49

What will be the result if no adjusting entry is made to record revenue earned during the current period when the cash was received in the last accounting period?

A) The assets will be understated.

B) The liabilities will be understated.

C) The liabilities will be overstated.

D) The assets will be overstated.

A) The assets will be understated.

B) The liabilities will be understated.

C) The liabilities will be overstated.

D) The assets will be overstated.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

50

Rover Ltd.had $8,200 of supplies on hand at the beginning of the month.A count at the end of the month indicated $1,350 of supplies were still on hand.The adjusting entry at year end would include a:

A) debit to Supplies Expense for $6,850

B) credit to Supplies Expense for $6,850

C) credit to Supplies Expense for $1,350

D) debit to Supplies for $1,350

A) debit to Supplies Expense for $6,850

B) credit to Supplies Expense for $6,850

C) credit to Supplies Expense for $1,350

D) debit to Supplies for $1,350

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

51

What effect does an accrued revenue adjustment have on a company's net income?

A) The adjustment increases net income for the period.

B) The adjustment decreases net income for the period.

C) The adjustment has no effect on net income.

D) The effect of the adjustment cannot be determined with the information given.

A) The adjustment increases net income for the period.

B) The adjustment decreases net income for the period.

C) The adjustment has no effect on net income.

D) The effect of the adjustment cannot be determined with the information given.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

52

Shaftebury Ltd.began operations and purchased $15,900 of supplies.By year end,$8,800 of supplies were still on hand.The adjusting entry at year end would include a:

A) debit to Supplies for $8,800

B) credit to Supplies Expense for $7,100

C) credit to Supplies Expense for $8,800

D) debit to Supplies Expense for $7,100

A) debit to Supplies for $8,800

B) credit to Supplies Expense for $7,100

C) credit to Supplies Expense for $8,800

D) debit to Supplies Expense for $7,100

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

53

What will be the result if the adjusting entry to record the current period's depreciation on equipment is not recorded?

A) The net income for the period will be understated.

B) The net income for the period will be overstated.

C) The net income for the period will not be affected.

D) The assets for the period will be understated.

A) The net income for the period will be understated.

B) The net income for the period will be overstated.

C) The net income for the period will not be affected.

D) The assets for the period will be understated.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

54

The adjusted trial balance serves as the basis for preparing:

A) the balance sheet only

B) the income statement only

C) both the balance sheet and the income statement

D) the statement of retained earnings

A) the balance sheet only

B) the income statement only

C) both the balance sheet and the income statement

D) the statement of retained earnings

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

55

A journal entry contains a debit to an expense account and a credit to a payable account.This is an example of a(n):

A) accrued revenue

B) accrued expense

C) deferred revenue

D) deferred expense

A) accrued revenue

B) accrued expense

C) deferred revenue

D) deferred expense

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

56

Unearned Revenue is a(n):

A) revenue account

B) expense account

C) asset account

D) liability account

A) revenue account

B) expense account

C) asset account

D) liability account

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

57

Upper Canada Corp.bought $72,000 of equipment with an estimated service life of 4 years.The equipment will be worthless at the end of its life.The annual amount of depreciation on this equipment is:

A) $18,000

B) $36,000

C) $72,000

D) $0

A) $18,000

B) $36,000

C) $72,000

D) $0

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

58

Accumulated depreciation is classified as a(n):

A) expense account

B) contra-asset account

C) asset account

D) liability account

A) expense account

B) contra-asset account

C) asset account

D) liability account

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

59

The adjusting entry made to record prepaid insurance that has expired during the period would include a debit to:

A) Unearned Insurance

B) Prepaid Insurance

C) Accrued Insurance

D) Insurance Expense

A) Unearned Insurance

B) Prepaid Insurance

C) Accrued Insurance

D) Insurance Expense

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

60

What effect does an accrued expense adjustment have on the financial statements?

A) The adjustment increases expenses and decreases assets.

B) The adjustment decreases expenses and increases liabilities.

C) The adjustment increases expenses and increases liabilities.

D) The adjustment increases expenses and increases net income.

A) The adjustment increases expenses and decreases assets.

B) The adjustment decreases expenses and increases liabilities.

C) The adjustment increases expenses and increases liabilities.

D) The adjustment increases expenses and increases net income.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

61

Prepaid expenses are often referred to as deferrals because the recording of the expense is deferred until after cash is paid.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

62

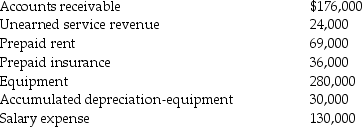

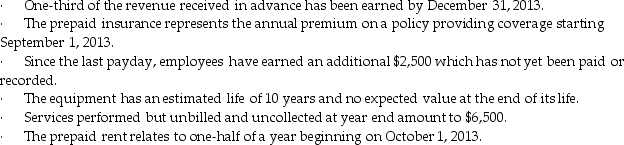

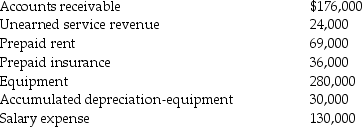

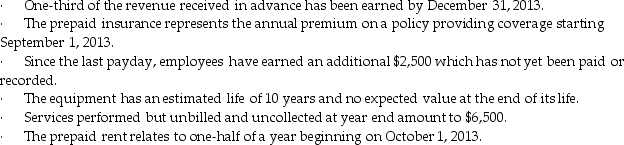

The December 31,2013,trial balance of Pilsner Inc.included the following selected accounts:

Additional data:

Additional data:

Prepare the necessary year-end adjusting entries as of December 31,2013.

Prepare the necessary year-end adjusting entries as of December 31,2013.

Additional data:

Additional data: Prepare the necessary year-end adjusting entries as of December 31,2013.

Prepare the necessary year-end adjusting entries as of December 31,2013.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

63

The adjusting entry for unearned revenue always involves a:

A) debit to a revenue account and a credit to a liability account

B) debit to a liability account and a credit to a revenue account

C) debit to an asset account and a credit to a liability account

D) debit to an asset account and a credit to a revenue account

A) debit to a revenue account and a credit to a liability account

B) debit to a liability account and a credit to a revenue account

C) debit to an asset account and a credit to a liability account

D) debit to an asset account and a credit to a revenue account

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

64

A liability that the business has incurred but has not yet paid is known as accrued revenue.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

65

The adjusting entry for a prepaid expense always involves a(n):

A) liability account and a revenue account

B) expense account and a liability account

C) asset account and a liability account

D) expense account and an asset account

A) liability account and a revenue account

B) expense account and a liability account

C) asset account and a liability account

D) expense account and an asset account

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

66

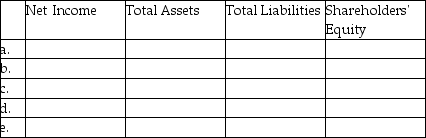

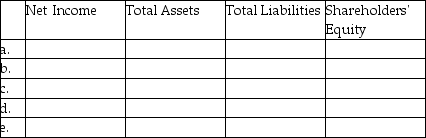

State the effect on net income,total assets,total liabilities,and shareholders' equity if the following adjustments are omitted by completing the chart below.

a.Utilities expense incurred but not yet paid,$350.

b.Supplies used during the current period,$650.

c.Service revenue earned,but not yet collected,$4,500.

d.Unearned revenue earned during the period,$900.

e.Depreciation on equipment,$2,600.

a.Utilities expense incurred but not yet paid,$350.

b.Supplies used during the current period,$650.

c.Service revenue earned,but not yet collected,$4,500.

d.Unearned revenue earned during the period,$900.

e.Depreciation on equipment,$2,600.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

67

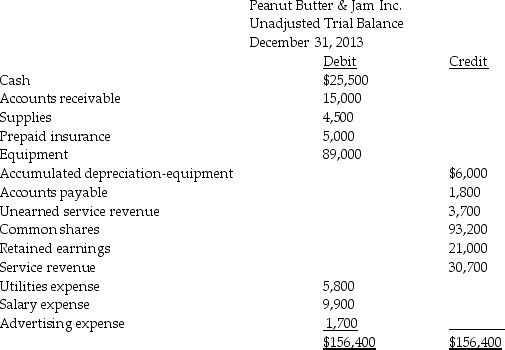

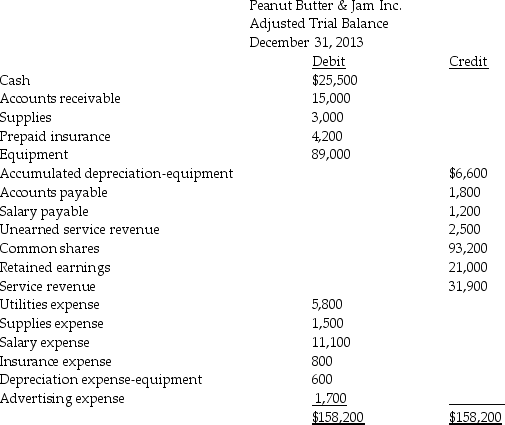

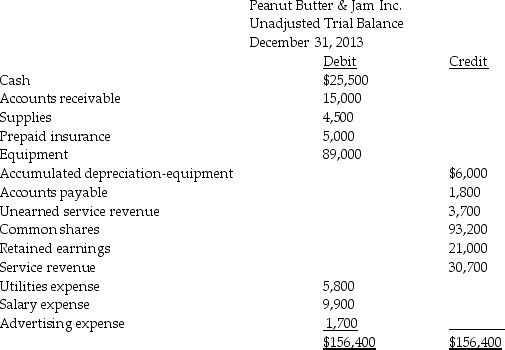

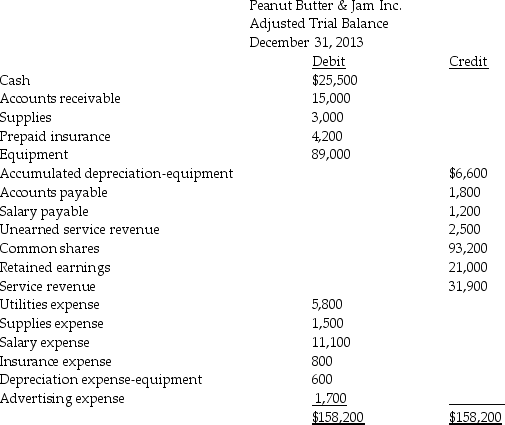

Prepare the necessary adjusting entries on December 31,2013,based on the following unadjusted and adjusted trial balances.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

68

If prepaid rent has expired during the current period and no adjustment has been made,net income for the current period will be overstated.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

69

Depreciation is every bit as much an expense as the salary that a business pays its employees.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

70

The adjusting entry for accrued revenue always involves a:

A) debit to a revenue account and a credit to an asset account

B) debit to a liability account and a credit to an asset account

C) debit to an asset account and a credit to a liability account

D) debit to an asset account and a credit to a revenue account

A) debit to a revenue account and a credit to an asset account

B) debit to a liability account and a credit to an asset account

C) debit to an asset account and a credit to a liability account

D) debit to an asset account and a credit to a revenue account

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

71

If deferred revenue has been earned by the end of the current period and no adjustment is recorded,net income for the current period will be understated.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

72

Explain the concept of accrued expenses using a Le Chateau store as an example.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

73

The adjusting entry for unearned revenue always involves an asset account and a revenue account.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

74

Explain the concept of unearned revenue using your student tuition fees.How does your academic institution account for the payment of tuition in its financial statements?

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

75

Deferred revenue occurs when cash is received from a customer before work or the sale is completed.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

76

Given the following adjustment data,state whether the resulting adjustment will be a deferral or an accrual.

a.Supplies were used during the month.

b.Estimated the monthly utilities bill and recorded the expense.

c.Unearned service revenue had been earned by the end of the month.

d.Recorded the monthly depreciation on the office equipment.

e.Recorded salaries owed to employees at the end of the month but not paid until early next month.

f.Recorded interest earned on a note receivable but not yet collected.

a.Supplies were used during the month.

b.Estimated the monthly utilities bill and recorded the expense.

c.Unearned service revenue had been earned by the end of the month.

d.Recorded the monthly depreciation on the office equipment.

e.Recorded salaries owed to employees at the end of the month but not paid until early next month.

f.Recorded interest earned on a note receivable but not yet collected.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

77

Adjusting journal entries recorded at the end of an accounting period update only revenue and expense accounts,and have no effect on either asset or liability accounts.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

78

Prepare adjusting entries dated December 31,2013,based on the following data.

a.A two-year insurance policy costing $3,000 was purchased on October 31,2013.

b.Salaries owed to employees on December 31,2013,amount to $2,300.

c.The balance in Supplies before adjustment is $1,400.A physical count reveals $450 of supplies on hand on December 31,2013.

d.Depreciation on office equipment for the year is $1,869.

e.Unearned Service Revenue has a balance of $4,200 before adjustment.Records show that $2,725 of that amount has been earned by December 31,2013.

a.A two-year insurance policy costing $3,000 was purchased on October 31,2013.

b.Salaries owed to employees on December 31,2013,amount to $2,300.

c.The balance in Supplies before adjustment is $1,400.A physical count reveals $450 of supplies on hand on December 31,2013.

d.Depreciation on office equipment for the year is $1,869.

e.Unearned Service Revenue has a balance of $4,200 before adjustment.Records show that $2,725 of that amount has been earned by December 31,2013.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

79

An adjusted trial balance is prepared without incorporating any end-of-period adjustments.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

80

An expense that a business has paid for but not yet incurred is an accrued expense.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck