Deck 9: Deductions: Employee and Self-Employed-Related Expenses

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/178

Play

Full screen (f)

Deck 9: Deductions: Employee and Self-Employed-Related Expenses

1

A taxpayer who maintains an office in the home to conduct his only business will not have nondeductible commuting expense.

True

2

Jake performs services for Maude. If Maude provides a helper and tools, this is indicative of independent contractor (rather than employee) status.

False

3

A taxpayer who uses the automatic mileage method to compute auto expenses can also deduct the business portion of tolls and parking.

True

4

A statutory employee is not a common law employee but is subject to Social Security tax.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

5

A taxpayer who uses the automatic mileage method for the business use of an automobile can change to the actual cost method in a later year.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

6

Amy lives and works in St. Louis. In the morning she flies to Boston, has a three-hour business meeting, and returns to St. Louis that evening. For tax purposes, Amy was away from home.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

7

The IRS will issue advanced rulings as to whether a worker's status is that of an employee or an independent contractor.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

8

For tax purposes, "travel" is a broader classification than "transportation."

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

9

For tax purposes, a statutory employee is treated the same as a common law employee.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

10

If an individual is subject to the direction or control of another only to the extent of the end result but not as to the means of accomplishment, an employer-employee relationship does not exist.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

11

James has a job that compels him to go to many different states during the year. It is possible that James was never away from his tax home during the year.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

12

Marvin lives with his family in Alabama. He has two jobs: one in Alabama and one in North Carolina. Marvin's tax home is where he lives (Alabama).

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

13

Once the actual cost method is used, a taxpayer cannot change to the automatic mileage method in a later year.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

14

After she finishes working at her main job, Ann returns home, has dinner, then drives to her second job. Ann may deduct the mileage between her first and second job.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

15

After the automatic mileage rate has been set by the IRS for a year, it cannot later be changed by the IRS.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

16

In some cases it may be appropriate for a taxpayer to report work-related expenses by using both Form 2106 and Schedule C.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

17

In choosing between the actual expense method and the automatic mileage method, a taxpayer should consider the cost of insurance on the automobile.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

18

The work-related expenses of an independent contractor will be subject to the 2%-of-AGI floor.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

19

One indicia of independent contractor (rather than employee) status is when the individual performing the services is paid based on time spent (rather than on tasks performed).

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

20

A deduction for parking and other traffic violations incurred during business use of the automobile is allowed under the actual cost method but not the automatic mileage method.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

21

Alexis (a CPA) sold her public accounting practice in Des Moines and accepted a job with the Seattle office of a national accounting firm. Her moving expenses are not deductible because she has changed employment status (i.e., went from self-employed to employee).

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

22

In November 2017, Katie incurs unreimbursed moving expenses to accept a new job. Katie cannot deduct any of these expenses when she timely files her 2017 income tax return since she has not yet satisfied the 39-week time test.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

23

An education expense deduction may be allowed even if the education results in a promotion or pay raise for the employee.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

24

A taxpayer who lives and works in Tulsa travels to Buffalo for five days. If three days are spent on business and two days are spent on visiting relatives, only 60% of the airfare is deductible.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

25

In May 2017, after 11 months on a new job, Ken is fired after he assaults a customer. Ken must include in his gross income for 2017 any deduction for moving expenses he may have claimed on his 2016 tax return.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

26

A taxpayer who lives and works in Kansas City is sent to Chicago on an eight-day business trip. While in Chicago, taxpayer uses the hotel valet service to have some laundry done. The valet charge is a nondeductible personal travel expense.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

27

A moving expense deduction is allowed even if at the time of the move the taxpayer did not have a job at the new location.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

28

There is no cutback adjustment for meals and entertainment as to employees who are subject to regulation by the U.S. Department of Transportation.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

29

At age 65, Camilla retires from her job in Boston and moves to Florida. As a retiree, she is not subject to the time test in deducting her moving expenses.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

30

Sick of her 65 mile daily commute, Edna purchases a condo that is only four miles from her job. Edna's moving expenses to her new condo are not allowed and cannot be claimed by her as a deduction.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

31

Lloyd, a practicing CPA, pays tuition to attend law school. Since a law degree involves education leading to a new trade or business, the tuition is not deductible.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

32

Liam just graduated from college. Because it is his first job, the cost of moving his personal belongings from his parents' home to the job site does not qualify for the moving expense deduction.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

33

After completing an overseas assignment in Oslo (Norway), Daniel retires from Pelican Corporation and moves to a retirement community in Key West (Florida). Daniel's moving expenses from Oslo to Key West are deductible as they are exempt from the time test.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

34

The tax law specifically provides that a taxpayer cannot be temporarily away from home for any period of employment that exceeds one year.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

35

Bob lives and works in Newark, NJ. He travels to London for a three-day business meeting, after which he spends three days touring Scotland. All of his air fare is deductible.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

36

Qualified moving expenses include the cost of lodging but not meals during the move.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

37

Under the right circumstances, a taxpayer's meals and lodging expense can qualify as a deductible education expense.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

38

Kelly, an unemployed architect, moves from Boston to Phoenix to accept a job as a chef at a restaurant. Kelly's moving expenses are not deductible because her new job is in a different trade or business.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

39

Qualified moving expenses of an employee that are not reimbursed are a deduction for AGI.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

40

Eileen lives and works in Mobile. She travels to Rome for an eight-day business meeting, after which she spends two days touring Italy. All of Eileen's airfare is deductible.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

41

Both traditional and Roth IRAs possess the advantage of tax-free accumulation of income within the plan.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

42

Under the simplified method, the maximum office in the home deduction allowed is the greater of $1,500 or the office square feet × $5.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

43

A taxpayer who claims the standard deduction will not be able to claim an office in the home deduction.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

44

Mallard Corporation pays for a trip to Aruba for its two top salespersons. This expense is subject to the cutback adjustment.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

45

If a taxpayer does not own a home but rents an apartment, the office in the home deduction is not available.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

46

On their birthdays, Lily sends gift certificates (each valued at $25) to Caden (a key client) and to each of Caden's two minor children. Lily can deduct only $25 as to these gifts.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

47

After graduating from college with a degree in chemistry, Alberto obtains a job as a chemist with DuPont. Alberto's job search expenses qualify as deductions.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

48

Flamingo Corporation furnishes meals at cost to its employees by means of a cafeteria it maintains. The cost of operating the cafeteria is not subject to the cutback adjustment.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

49

A taxpayer takes six clients to an NBA playoff game. If all of the tickets (list price of $120 each) are purchased on the Internet for $1,800 ($300 each), only $60 ($120 × 50% cutback adjustment) per ticket is deductible.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

50

Ethan, a bachelor with no immediate family, uses the Pine Shadows Country Club exclusively for his business entertaining. All of Ethan's annual dues for his club membership are deductible.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

51

If the cost of uniforms is deductible, their maintenance cost (e.g., laundry, dry cleaning, alterations) also is deductible.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

52

Jackson gives his supervisor and her husband each a $30 box of chocolates at Christmas. Jackson may claim only $25 as a deduction.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

53

Frank, a recently retired FBI agent, pays job search expenses to obtain a position with a city police department. Frank's job search expenses do qualify as deductions.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

54

Madison is an instructor of fine arts at a local community college. If she spends $600 (not reimbursed) on art supplies for her classes, $250 of this amount can be claimed as a deduction for AGI.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

55

Tired of renting, Dr. Smith buys the academic robes she will wear at her college's graduation procession. The cost of this attire does not qualify as a uniform expense.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

56

Qualifying job search expenses are deductible even if the taxpayer does not change jobs.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

57

Travis holds rights to a skybox (containing 10 seats) at Memorial Stadium which he uses to entertain key clients. At one sporting event, he took only six clients since three were ill. Even so, Travis may still deduct the appropriate cost of all ten seats.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

58

For tax year 2016, Taylor used the simplified method of determining her office in the home deduction. For 2017, Taylor must continue to use the simplified method and cannot switch to the regular (actual expense) method.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

59

Under the regular (actual expense) method, the portion of the office in the home deduction that exceeds the income from the business can be carried over to future years.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

60

In the case of an office in the home deduction, the exclusive business use test does not apply when the home is used as a daycare center.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

61

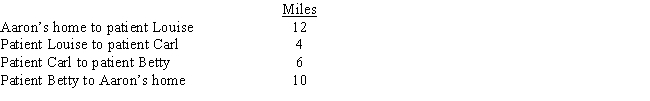

Amy works as an auditor for a large major CPA firm. During the months of September through November of each year, she is permanently assigned to the team auditing Garnet Corporation. As a result, every day she drives from her home to Garnet and returns home after work. Mileage is as follows:

For these three months, Amy's deductible mileage for each workday is:

For these three months, Amy's deductible mileage for each workday is:

A)0.

B)30.

C)35.

D)60.

E)None of these.

For these three months, Amy's deductible mileage for each workday is:

For these three months, Amy's deductible mileage for each workday is:A)0.

B)30.

C)35.

D)60.

E)None of these.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

62

Allowing for the cutback adjustment (50% reduction for meals and entertainment), which of the following trips, if any, will qualify for the travel expense deduction?

A)Dr. Jones, a general dentist, attends a two-day seminar on developing a dental practice.

B)Dr. Brown, a surgeon, attends a two-day seminar on financial planning.

C)Paul, a romance language high school teacher, spends summer break in France, Portugal, and Spain improving his language skills.

D)Myrna went on a two-week vacation in Boston. While there, she visited her employer's home office to have lunch with former co-workers.

E)All of these.

A)Dr. Jones, a general dentist, attends a two-day seminar on developing a dental practice.

B)Dr. Brown, a surgeon, attends a two-day seminar on financial planning.

C)Paul, a romance language high school teacher, spends summer break in France, Portugal, and Spain improving his language skills.

D)Myrna went on a two-week vacation in Boston. While there, she visited her employer's home office to have lunch with former co-workers.

E)All of these.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

63

The Federal per diem rates that can be used for "deemed substantiated" purposes are the same for all locations in the country.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

64

A taxpayer who claims the standard deduction will not avoid the 2%-of-AGI floor on unreimbursed employee expenses.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

65

Dave is the regional manager for a national chain of auto-parts stores and is based in Salt Lake City. When the company opens new stores in Boise, Dave is given the task of supervising their initial operation. For three months, he works weekdays in Boise and returns home on weekends. He spends $350 returning to Salt Lake City but would have spent $410 had he stayed in Boise for the weekend. As to the weekend trips, how much, if any, qualifies as a deduction?

A)$0, since the trips are personal and not work related.

B)$0, since Dave's tax home has changed from Salt Lake City to Boise.

C)$60

D)$350

E)$410

A)$0, since the trips are personal and not work related.

B)$0, since Dave's tax home has changed from Salt Lake City to Boise.

C)$60

D)$350

E)$410

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

66

When using the automatic mileage method, which, if any, of the following expenses also can be claimed?

A)Engine tune-up.

B)Parking.

C)Interest on automobile loan.

D)MACRS depreciation.

E)None of these.

A)Engine tune-up.

B)Parking.

C)Interest on automobile loan.

D)MACRS depreciation.

E)None of these.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

67

Employees who render an adequate accounting to the employer and are fully reimbursed will shift the 50% cutback adjustment to their employer.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

68

Aiden performs services for Lucas. Which, if any, of the following factors indicate that Aiden is an employee, rather than an independent contractor?

A)Aiden provides his own support services (e.g., work assistants).

B)Aiden obtained his training (i.e., job skills) from his father.

C)Aiden is paid based on hours worked.

D)Aiden makes his services available to others.

E)None of these.

A)Aiden provides his own support services (e.g., work assistants).

B)Aiden obtained his training (i.e., job skills) from his father.

C)Aiden is paid based on hours worked.

D)Aiden makes his services available to others.

E)None of these.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

69

For self-employed taxpayers, travel expenses are not subject to the 2%-of-AGI floor.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

70

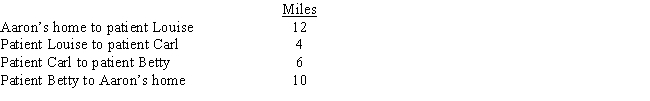

Aaron is a self-employed practical nurse who works out of his home. He provides nursing care for disabled persons living in their residences. During the day he drives his car as follows.

Aaron's deductible mileage for each workday is:

Aaron's deductible mileage for each workday is:

A)10 miles.

B)12 miles.

C)20 miles.

D)22 miles.

E)32 miles.

Aaron's deductible mileage for each workday is:

Aaron's deductible mileage for each workday is:A)10 miles.

B)12 miles.

C)20 miles.

D)22 miles.

E)32 miles.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

71

Statutory employees:

A)Report their expenses on Form 2106.

B)Include common law employees.

C)Are subject to income tax withholdings.

D)Claim their expenses as deductions for AGI.

E)None of these.

A)Report their expenses on Form 2106.

B)Include common law employees.

C)Are subject to income tax withholdings.

D)Claim their expenses as deductions for AGI.

E)None of these.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

72

In which, if any, of the following situations is the automatic mileage available?

A)A limousine to be rented by the owner for special occasions (e.g., weddings, high school proms).

B)The auto belongs to taxpayer's mother.

C)One of seven cars used to deliver pizzas.

D)MACRS statutory percentage method has been claimed on the automobile.

E)None of these.

A)A limousine to be rented by the owner for special occasions (e.g., weddings, high school proms).

B)The auto belongs to taxpayer's mother.

C)One of seven cars used to deliver pizzas.

D)MACRS statutory percentage method has been claimed on the automobile.

E)None of these.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

73

When contributions are made to a traditional IRA, they are deductible by the participant. Later distributions from the IRA upon retirement are fully taxed.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

74

A worker may prefer to be treated as an independent contractor (rather than an employee) for which of the following reasons:

A)Avoids the cutback adjustment as to business meals.

B)All of the self-employment tax is deductible for income tax purposes.

C)Work-related expenses are not subject to the 2%-of-AGI floor.

D)A Schedule C does not have to be filed.

E)None of these.

A)Avoids the cutback adjustment as to business meals.

B)All of the self-employment tax is deductible for income tax purposes.

C)Work-related expenses are not subject to the 2%-of-AGI floor.

D)A Schedule C does not have to be filed.

E)None of these.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

75

By itself, credit card receipts will not constitute adequate substantiation for travel expenses.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

76

Which, if any, of the following factors is not a characteristic of independent contractor status?

A)Work-related expenses are reported on Form 2106.

B)Receipt of a Form 1099 reporting payments received.

C)Workplace fringe benefits are not available.

D)Services are performed for more than one party.

E)None of these.

A)Work-related expenses are reported on Form 2106.

B)Receipt of a Form 1099 reporting payments received.

C)Workplace fringe benefits are not available.

D)Services are performed for more than one party.

E)None of these.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

77

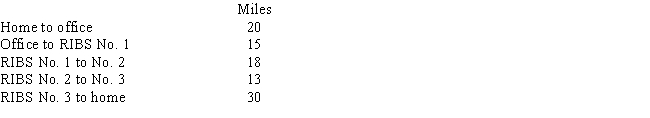

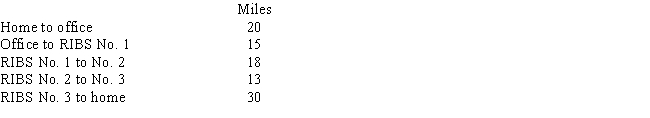

Corey is the city sales manager for "RIBS," a national fast food franchise. Every working day, Corey drives his car as follows:

Corey's deductible mileage is:

Corey's deductible mileage is:

A)0 miles.

B)50 miles.

C)66 miles.

D)76 miles.

E)None of these.

Corey's deductible mileage is:

Corey's deductible mileage is:A)0 miles.

B)50 miles.

C)66 miles.

D)76 miles.

E)None of these.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

78

Jordan performs services for Ryan. Which, if any, of the following factors indicate that Jordan is an independent contractor, rather than an employee?

A)Ryan sets the work schedule.

B)Ryan provides the tools used.

C)Jordan files a Form 2106 with his Form 1040.

D)Jordan is paid based on tasks performed.

E)None of these.

A)Ryan sets the work schedule.

B)Ryan provides the tools used.

C)Jordan files a Form 2106 with his Form 1040.

D)Jordan is paid based on tasks performed.

E)None of these.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

79

A worker may prefer to be classified as an employee (rather than an independent contractor) for which of the following reasons:

A)To claim unreimbursed work-related expenses as a deduction for AGI.

B)To avoid the self-employment tax.

C)To avoid the cutback adjustment on unreimbursed business entertainment expenses.

D)To avoid the 2%-of-AGI floor on unreimbursed work-related expenses.

E)None of these.

A)To claim unreimbursed work-related expenses as a deduction for AGI.

B)To avoid the self-employment tax.

C)To avoid the cutback adjustment on unreimbursed business entertainment expenses.

D)To avoid the 2%-of-AGI floor on unreimbursed work-related expenses.

E)None of these.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck

80

Under the actual cost method, which, if any, of the following expenses will not be allowed?

A)Car registration fees.

B)Auto insurance.

C)Interest expense on a car loan (taxpayer is an employee).

D)Dues to auto clubs.

E)All of these will be allowed.

A)Car registration fees.

B)Auto insurance.

C)Interest expense on a car loan (taxpayer is an employee).

D)Dues to auto clubs.

E)All of these will be allowed.

Unlock Deck

Unlock for access to all 178 flashcards in this deck.

Unlock Deck

k this deck