Deck 11: Consolidation Theories, push-Down Accounting, and Corporate Joint Ventures

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/55

Play

Full screen (f)

Deck 11: Consolidation Theories, push-Down Accounting, and Corporate Joint Ventures

1

Use the following information to answer the question(s) below.

Paris Corporation purchased 80% of the outstanding voting common stock of Sanders Corporation on January 1, 2014, at a cost of $400,000. The stockholders' equity of Sanders Corporation on this date consisted of $200,000 of Capital Stock and $100,000 of Retained Earnings. Book values were equal to fair values except for land and inventory. The book value of Sanders' land was $10,000, and fair value was $22,000. The book value of Sanders' inventory was $30,000, and fair value was $25,000.

-Assume Paris's land account had a book value of $50,000 and a fair value of $70,000 on January 1,2014.Using the parent company and entity theories,what amounts would be reported on the consolidated balance sheet at January 1,2014 for the land account?

A)

B)

C)

D)

Paris Corporation purchased 80% of the outstanding voting common stock of Sanders Corporation on January 1, 2014, at a cost of $400,000. The stockholders' equity of Sanders Corporation on this date consisted of $200,000 of Capital Stock and $100,000 of Retained Earnings. Book values were equal to fair values except for land and inventory. The book value of Sanders' land was $10,000, and fair value was $22,000. The book value of Sanders' inventory was $30,000, and fair value was $25,000.

-Assume Paris's land account had a book value of $50,000 and a fair value of $70,000 on January 1,2014.Using the parent company and entity theories,what amounts would be reported on the consolidated balance sheet at January 1,2014 for the land account?

A)

B)

C)

D)

2

Use the following information to answer the question(s) below.

Pascoe Corporation paid $450,000 for a 90% interest in Sarabet Corporation on January 1, 2014, when Sarabet's stockholders' equity consisted of $250,000 Common Stock and $50,000 Retained Earnings. The book values and fair values of Sarabet's assets and liabilities were equal when Pascoe acquired its interest.

The separate net incomes (excluding investment income) of Pascoe and Sarabet for 2014 were $600,000 and $100,000, respectively. Dividends declared and paid during 2014 were $250,000 for Pascoe and $50,000 for Sarabet. Pascoe uses the entity theory in consolidating its financial statements with those of Sarabet.

-Goodwill was reported in the December 31,2014 consolidated balance sheet at

A)$170,000.

B)$180,000.

C)$200,000.

D)$210,000.

Pascoe Corporation paid $450,000 for a 90% interest in Sarabet Corporation on January 1, 2014, when Sarabet's stockholders' equity consisted of $250,000 Common Stock and $50,000 Retained Earnings. The book values and fair values of Sarabet's assets and liabilities were equal when Pascoe acquired its interest.

The separate net incomes (excluding investment income) of Pascoe and Sarabet for 2014 were $600,000 and $100,000, respectively. Dividends declared and paid during 2014 were $250,000 for Pascoe and $50,000 for Sarabet. Pascoe uses the entity theory in consolidating its financial statements with those of Sarabet.

-Goodwill was reported in the December 31,2014 consolidated balance sheet at

A)$170,000.

B)$180,000.

C)$200,000.

D)$210,000.

$200,000.

3

Anthony and Cleopatra create a joint venture to distribute artifacts.Anthony contributes 70% and Cleopatra 30% of the cash for assets purchased from Tomb Company.How would Anthony report information about Cleopatra on Anthony's financial statements?

A)Not at all

B)In a footnote

C)As a liability

D)As a noncontrolling interest

A)Not at all

B)In a footnote

C)As a liability

D)As a noncontrolling interest

D

4

Use the following information to answer the question(s) below.

Paris Corporation purchased 80% of the outstanding voting common stock of Sanders Corporation on January 1, 2014, at a cost of $400,000. The stockholders' equity of Sanders Corporation on this date consisted of $200,000 of Capital Stock and $100,000 of Retained Earnings. Book values were equal to fair values except for land and inventory. The book value of Sanders' land was $10,000, and fair value was $22,000. The book value of Sanders' inventory was $30,000, and fair value was $25,000.

-Assume Paris's inventory account had a book value of $40,000 and a fair value of $44,000 on January 1,2014.Using the parent company theory,what was the amount reported on the consolidated balance sheet for inventories on January 1,2014?

A)$65,000

B)$66,000

C)$69,000

D)$70,000

Paris Corporation purchased 80% of the outstanding voting common stock of Sanders Corporation on January 1, 2014, at a cost of $400,000. The stockholders' equity of Sanders Corporation on this date consisted of $200,000 of Capital Stock and $100,000 of Retained Earnings. Book values were equal to fair values except for land and inventory. The book value of Sanders' land was $10,000, and fair value was $22,000. The book value of Sanders' inventory was $30,000, and fair value was $25,000.

-Assume Paris's inventory account had a book value of $40,000 and a fair value of $44,000 on January 1,2014.Using the parent company theory,what was the amount reported on the consolidated balance sheet for inventories on January 1,2014?

A)$65,000

B)$66,000

C)$69,000

D)$70,000

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

5

Under GAAP,the ________ will include the variable interest entity in consolidated financial statements.

A)special purpose entity

B)limited liability company

C)trust

D)primary beneficiary

A)special purpose entity

B)limited liability company

C)trust

D)primary beneficiary

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

6

A parent company acquired 100% of the outstanding common stock of another corporation.The parent is going to use push-down accounting.The fair market value of each of the acquired corporation's assets is lower than its respective book value.The fair market value of each of the acquired corporation's liabilities is higher than its respective book value.The acquired corporation has a deficit in the Retained Earnings account.Which one of the following statements is correct?

A)The push-down capital account will have a credit balance after this transaction is posted.

B)The push-down capital account will have a debit balance after this transaction is posted.

C)The push-down capital account will have either a debit or a credit balance depending upon whether the asset adjustments exceed the liability adjustments,or vice versa.

D)Subsidiary Retained Earnings will have a deficit balance after this transaction is posted.

A)The push-down capital account will have a credit balance after this transaction is posted.

B)The push-down capital account will have a debit balance after this transaction is posted.

C)The push-down capital account will have either a debit or a credit balance depending upon whether the asset adjustments exceed the liability adjustments,or vice versa.

D)Subsidiary Retained Earnings will have a deficit balance after this transaction is posted.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

7

Under parent company theory,noncontrolling interest is valued at ________ on the consolidated balance sheet.Under entity theory,noncontrolling interest is valued at ________ on the consolidated balance sheet.

A)fair value; present value

B)present value; fair value

C)book value; fair value

D)fair value; book value

A)fair value; present value

B)present value; fair value

C)book value; fair value

D)fair value; book value

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

8

Under parent company theory,noncontrolling interest is classified on the consolidated balance sheet as ________.Under entity theory,noncontrolling interest is classified on the consolidated balance sheet as ________.

A)stockholders' equity; stockholders' equity

B)stockholders' equity; liability

C)liability; a liability

D)liability; stockholders' equity

A)stockholders' equity; stockholders' equity

B)stockholders' equity; liability

C)liability; a liability

D)liability; stockholders' equity

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

9

Under parent company theory,the amount of consolidated net income is equal to the amount of ________ under entity theory.

A)noncontrolling interest share

B)noncontrolling interest income

C)income attributable to controlling stockholders

D)income attributable to noncontrolling stockholders

A)noncontrolling interest share

B)noncontrolling interest income

C)income attributable to controlling stockholders

D)income attributable to noncontrolling stockholders

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

10

Use the following information to answer the question(s) below.

Pascoe Corporation paid $450,000 for a 90% interest in Sarabet Corporation on January 1, 2014, when Sarabet's stockholders' equity consisted of $250,000 Common Stock and $50,000 Retained Earnings. The book values and fair values of Sarabet's assets and liabilities were equal when Pascoe acquired its interest.

The separate net incomes (excluding investment income) of Pascoe and Sarabet for 2014 were $600,000 and $100,000, respectively. Dividends declared and paid during 2014 were $250,000 for Pascoe and $50,000 for Sarabet. Pascoe uses the entity theory in consolidating its financial statements with those of Sarabet.

-Noncontrolling interest share was reported in the 2014 consolidated income statement at

A)$5,000.

B)$6,000.

C)$8,000.

D)$10,000.

Pascoe Corporation paid $450,000 for a 90% interest in Sarabet Corporation on January 1, 2014, when Sarabet's stockholders' equity consisted of $250,000 Common Stock and $50,000 Retained Earnings. The book values and fair values of Sarabet's assets and liabilities were equal when Pascoe acquired its interest.

The separate net incomes (excluding investment income) of Pascoe and Sarabet for 2014 were $600,000 and $100,000, respectively. Dividends declared and paid during 2014 were $250,000 for Pascoe and $50,000 for Sarabet. Pascoe uses the entity theory in consolidating its financial statements with those of Sarabet.

-Noncontrolling interest share was reported in the 2014 consolidated income statement at

A)$5,000.

B)$6,000.

C)$8,000.

D)$10,000.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

11

Use the following information to answer the question(s) below.

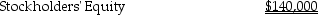

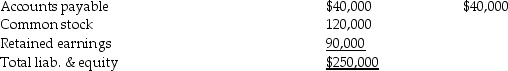

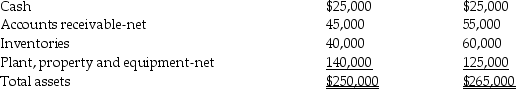

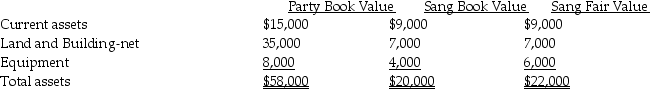

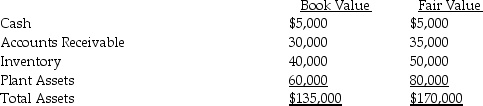

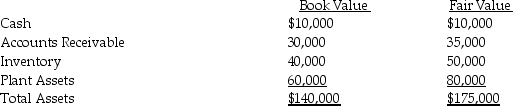

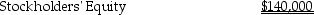

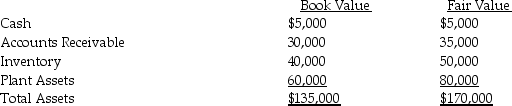

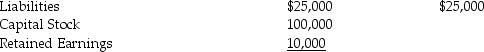

Pasfield Corporation acquired a 90% interest in Santini Corporation for $90,000 cash on January 1, 2014. The following information is available for Santini at that time

-Under the entity theory,a consolidated balance sheet prepared immediately after the business combination will show goodwill of

A)$15,000.

B)$22,500.

C)$25,000.

D)$32,500.

Pasfield Corporation acquired a 90% interest in Santini Corporation for $90,000 cash on January 1, 2014. The following information is available for Santini at that time

-Under the entity theory,a consolidated balance sheet prepared immediately after the business combination will show goodwill of

A)$15,000.

B)$22,500.

C)$25,000.

D)$32,500.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

12

Use the following information to answer the question(s) below.

Pasfield Corporation acquired a 90% interest in Santini Corporation for $90,000 cash on January 1, 2014. The following information is available for Santini at that time

-Under the entity theory,a consolidated balance sheet prepared immediately after the business combination will show noncontrolling interest of

A)$5,000.

B)$7,500.

C)$9,000.

D)$10,000.

Pasfield Corporation acquired a 90% interest in Santini Corporation for $90,000 cash on January 1, 2014. The following information is available for Santini at that time

-Under the entity theory,a consolidated balance sheet prepared immediately after the business combination will show noncontrolling interest of

A)$5,000.

B)$7,500.

C)$9,000.

D)$10,000.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

13

Entities other than the primary beneficiary account for their investment in a variable interest entity using the

A)cost method.

B)equity method.

C)cost or equity methods.

D)consolidated method.

A)cost method.

B)equity method.

C)cost or equity methods.

D)consolidated method.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

14

Use the following information to answer the question(s) below.

Paris Corporation purchased 80% of the outstanding voting common stock of Sanders Corporation on January 1, 2014, at a cost of $400,000. The stockholders' equity of Sanders Corporation on this date consisted of $200,000 of Capital Stock and $100,000 of Retained Earnings. Book values were equal to fair values except for land and inventory. The book value of Sanders' land was $10,000, and fair value was $22,000. The book value of Sanders' inventory was $30,000, and fair value was $25,000.

-Under the entity theory,what amount of goodwill was reported on the consolidated balance sheet at December 31,2014?

A)$185,000

B)$191,250

C)$193,000

D)$200,000

Paris Corporation purchased 80% of the outstanding voting common stock of Sanders Corporation on January 1, 2014, at a cost of $400,000. The stockholders' equity of Sanders Corporation on this date consisted of $200,000 of Capital Stock and $100,000 of Retained Earnings. Book values were equal to fair values except for land and inventory. The book value of Sanders' land was $10,000, and fair value was $22,000. The book value of Sanders' inventory was $30,000, and fair value was $25,000.

-Under the entity theory,what amount of goodwill was reported on the consolidated balance sheet at December 31,2014?

A)$185,000

B)$191,250

C)$193,000

D)$200,000

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

15

The SEC requires push-down accounting for SEC filings of subsidiaries when the subsidiary has no substantial publicly-held debt or preferred stock outstanding and

A)the parent has substantial ownership (5% or greater).

B)the parent has substantial ownership (20% or greater).

C)the parent has substantial ownership (50% or greater).

D)the parent has substantial ownership (90% or greater).

A)the parent has substantial ownership (5% or greater).

B)the parent has substantial ownership (20% or greater).

C)the parent has substantial ownership (50% or greater).

D)the parent has substantial ownership (90% or greater).

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

16

Use the following information to answer the question(s) below.

Paris Corporation purchased 80% of the outstanding voting common stock of Sanders Corporation on January 1, 2014, at a cost of $400,000. The stockholders' equity of Sanders Corporation on this date consisted of $200,000 of Capital Stock and $100,000 of Retained Earnings. Book values were equal to fair values except for land and inventory. The book value of Sanders' land was $10,000, and fair value was $22,000. The book value of Sanders' inventory was $30,000, and fair value was $25,000.

-Under the parent company theory,what amount of goodwill was reported on the consolidated balance sheet at December 31,2014?

A)$148,000

B)$153,000

C)$154,400

D)$160,000

Paris Corporation purchased 80% of the outstanding voting common stock of Sanders Corporation on January 1, 2014, at a cost of $400,000. The stockholders' equity of Sanders Corporation on this date consisted of $200,000 of Capital Stock and $100,000 of Retained Earnings. Book values were equal to fair values except for land and inventory. The book value of Sanders' land was $10,000, and fair value was $22,000. The book value of Sanders' inventory was $30,000, and fair value was $25,000.

-Under the parent company theory,what amount of goodwill was reported on the consolidated balance sheet at December 31,2014?

A)$148,000

B)$153,000

C)$154,400

D)$160,000

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

17

Noncontrolling interest share is viewed as an expense under ________ theory.

A)parent company

B)entity

C)contemporary

D)joint venture

A)parent company

B)entity

C)contemporary

D)joint venture

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

18

Earth Company,Fire Incorporated,and Wind Incorporated created a joint venture to market their products on the internet.Earth owns 40% of the stock,Fire owns 45% of the stock and Wind owns the remaining 15%.Which firms should report their joint venture investments using the equity method?

A)Earth

B)Fire

C)Earth and Fire

D)Earth,Fire and Wind

A)Earth

B)Fire

C)Earth and Fire

D)Earth,Fire and Wind

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

19

Use the following information to answer the question(s) below.

Pascoe Corporation paid $450,000 for a 90% interest in Sarabet Corporation on January 1, 2014, when Sarabet's stockholders' equity consisted of $250,000 Common Stock and $50,000 Retained Earnings. The book values and fair values of Sarabet's assets and liabilities were equal when Pascoe acquired its interest.

The separate net incomes (excluding investment income) of Pascoe and Sarabet for 2014 were $600,000 and $100,000, respectively. Dividends declared and paid during 2014 were $250,000 for Pascoe and $50,000 for Sarabet. Pascoe uses the entity theory in consolidating its financial statements with those of Sarabet.

-Pascoe's income from Sarabet under the equity method for 2014 was

A)$72,000.

B)$87,500.

C)$90,000.

D)$100,000.

Pascoe Corporation paid $450,000 for a 90% interest in Sarabet Corporation on January 1, 2014, when Sarabet's stockholders' equity consisted of $250,000 Common Stock and $50,000 Retained Earnings. The book values and fair values of Sarabet's assets and liabilities were equal when Pascoe acquired its interest.

The separate net incomes (excluding investment income) of Pascoe and Sarabet for 2014 were $600,000 and $100,000, respectively. Dividends declared and paid during 2014 were $250,000 for Pascoe and $50,000 for Sarabet. Pascoe uses the entity theory in consolidating its financial statements with those of Sarabet.

-Pascoe's income from Sarabet under the equity method for 2014 was

A)$72,000.

B)$87,500.

C)$90,000.

D)$100,000.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

20

Paroz Corporation acquired a 70% interest in Sandberg Corporation for $900,000 when Sandberg's stockholders' equity consisted of $600,000 of Capital Stock and $600,000 of Retained Earnings.The fair values of Sandberg's net assets were equal to their recorded book values.At the time of acquisition,on Paroz's books,Paroz will record

A)goodwill for $60,000 under the parent company theory.

B)goodwill for $85,714 under the entity theory.

C)investment in Sandberg for $1,285,714 under the entity theory.

D)investment in Sandberg for $900,000 under the entity and parent company theories.

A)goodwill for $60,000 under the parent company theory.

B)goodwill for $85,714 under the entity theory.

C)investment in Sandberg for $1,285,714 under the entity theory.

D)investment in Sandberg for $900,000 under the entity and parent company theories.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

21

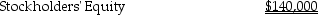

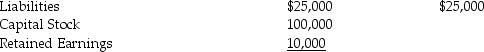

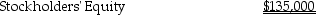

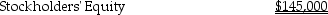

On January 1,2014,Jennifer Company acquired a 90% interest in Jayda Company for $270,000 cash.On January 1,2014,Jayda Company had the following assets and liabilities:

Total Liabilities &

Push-down accounting is used for the acquisition.Both companies use the entity theory.

Required:

1.What is the goodwill associated with Jayda Company on January 1,2014?

2.Prepare the journal entry(ies)on Jayda's books on January 1,2014.

3.Prepare the journal entry(ies)on Jennifer's books on January 1,2014.

4.Prepare the elimination entry(ies)on the consolidating working papers on January 1,2014.

Total Liabilities &

Push-down accounting is used for the acquisition.Both companies use the entity theory.

Required:

1.What is the goodwill associated with Jayda Company on January 1,2014?

2.Prepare the journal entry(ies)on Jayda's books on January 1,2014.

3.Prepare the journal entry(ies)on Jennifer's books on January 1,2014.

4.Prepare the elimination entry(ies)on the consolidating working papers on January 1,2014.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

22

With regard to a variable interest entity (VIE),Ann Company may meet the following two conditions: Condition I

Ann Company has the power to direct VIE activities that significantly impact VIE's economic performance.

Condition II

Ann Company has an obligation to absorb losses and/or a right to receive significant benefits from the VIE.

Ann Company must consolidate a VIE if

A)Condition I is met only.

B)Condition II is met only.

C)either Condition I or Condition II is met.

D)both Condition I and Condition II are met.

Ann Company has the power to direct VIE activities that significantly impact VIE's economic performance.

Condition II

Ann Company has an obligation to absorb losses and/or a right to receive significant benefits from the VIE.

Ann Company must consolidate a VIE if

A)Condition I is met only.

B)Condition II is met only.

C)either Condition I or Condition II is met.

D)both Condition I and Condition II are met.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

23

Use the following information to answer the question(s) below.

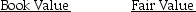

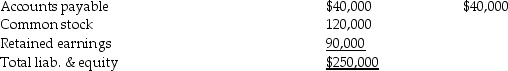

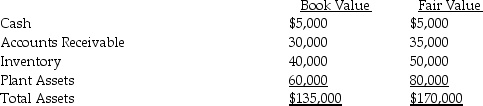

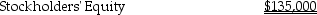

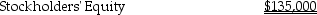

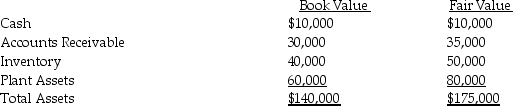

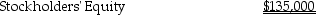

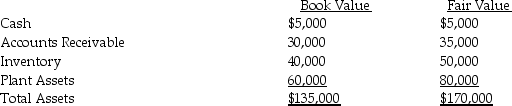

On January 1, 2014, Penelope Company acquired a 90% interest in Leah Company for $180,000 cash. On January 1, 2014, Leah Company had the following assets and liabilities:

Push-down accounting is used for the acquisition.

Push-down accounting is used for the acquisition.

-Assume the parent company theory is used.On January 2,2014,Leah Company will report Goodwill of ________ and Accounts Receivable of ________ on Leah's balance sheet.

A)$27,000; $30,000

B)$27,000; $35,000

C)$30,000; $30,000

D)$30,500; $34,500

On January 1, 2014, Penelope Company acquired a 90% interest in Leah Company for $180,000 cash. On January 1, 2014, Leah Company had the following assets and liabilities:

Push-down accounting is used for the acquisition.

Push-down accounting is used for the acquisition.-Assume the parent company theory is used.On January 2,2014,Leah Company will report Goodwill of ________ and Accounts Receivable of ________ on Leah's balance sheet.

A)$27,000; $30,000

B)$27,000; $35,000

C)$30,000; $30,000

D)$30,500; $34,500

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

24

On January 1,2014,Brody Company acquired an 80% interest in Kristin Company for $240,000 cash.On January 1,2014,Kristin Company had the following assets and liabilities:

Total Liabilities &

Push-down accounting is used for the acquisition.Both companies use the entity theory.

Required:

1.What is the goodwill associated with Kristin Company on January 1,2014?

2.Prepare the journal entry(ies)on Kristin's books on January 1,2014.

3.Prepare the journal entry(ies)on Brody's books on January 1,2014.

4.Prepare the elimination entry(ies)on the consolidating working papers on January 1,2014.

Total Liabilities &

Push-down accounting is used for the acquisition.Both companies use the entity theory.

Required:

1.What is the goodwill associated with Kristin Company on January 1,2014?

2.Prepare the journal entry(ies)on Kristin's books on January 1,2014.

3.Prepare the journal entry(ies)on Brody's books on January 1,2014.

4.Prepare the elimination entry(ies)on the consolidating working papers on January 1,2014.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

25

On July 1,2013,Parslow Corporation acquired a 75% interest in Sanderson Corporation for $150,000.Sanderson's net assets on this date had a book value of $140,000 and a fair value of $160,000.The excess of fair value over book value at acquisition was due to understated plant assets with a remaining useful life of five years from July 1,2013.Separate net incomes (excluding investment income)of Parslow and Sanderson for 2014 were $400,000 and $20,000,respectively.

Required:

1.Compute goodwill at July 1,2013 under the parent company theory and the entity theory.

2.Determine consolidated net income and noncontrolling interest share for 2014 under the parent company theory and the entity theory.

Required:

1.Compute goodwill at July 1,2013 under the parent company theory and the entity theory.

2.Determine consolidated net income and noncontrolling interest share for 2014 under the parent company theory and the entity theory.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

26

Johnsen Corporation paid $225,000 for a 70% interest in Jonas Corporation on January 1,2014.On that date,Jonas's balance sheet accounts,at book value and fair value,were as follows:

Assets

Assets

Equities

Equities

Required:

Required:

1.Prepare the journal entry necessary on January 1,2014 on Jonas Corporation's books.Both companies use push-down accounting and the entity theory.

2.Prepare the balance sheet for Jonas Corporation immediately after the acquisition on January 1,2014.

Assets

Assets Equities

Equities Required:

Required:1.Prepare the journal entry necessary on January 1,2014 on Jonas Corporation's books.Both companies use push-down accounting and the entity theory.

2.Prepare the balance sheet for Jonas Corporation immediately after the acquisition on January 1,2014.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following statements about variable interest entities (VIE)is false?

A)Under GAAP,a VIE may be a corporation,partnership,limited liability company or trust.

B)Under GAAP,pension plans are excluded from VIE accounting.

C)A potential VIE must be a separate entity,not a subset,branch or division of another entity.

D)VIEs do not require the identification of a primary beneficiary.

A)Under GAAP,a VIE may be a corporation,partnership,limited liability company or trust.

B)Under GAAP,pension plans are excluded from VIE accounting.

C)A potential VIE must be a separate entity,not a subset,branch or division of another entity.

D)VIEs do not require the identification of a primary beneficiary.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

28

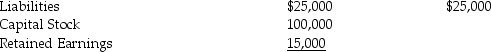

Pascal Corporation paid $225,000 for a 70% interest in Sank Corporation on January 1,2014.On that date,Sank's balance sheet accounts,at book value and fair value,were as follows:

Assets

Assets

Equities

Both companies use the parent company theory.Push-down accounting is used for the acquisition.

Required:

1.Prepare the journal entry on January 1,2014 on Sank Corporation's books.

2.Prepare a balance sheet for Sank Corporation immediately after the acquisition on January 1,2014.

Assets

AssetsEquities

Both companies use the parent company theory.Push-down accounting is used for the acquisition.

Required:

1.Prepare the journal entry on January 1,2014 on Sank Corporation's books.

2.Prepare a balance sheet for Sank Corporation immediately after the acquisition on January 1,2014.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

29

Patane Corporation acquired 80% of the outstanding voting common stock of Sanlon Corporation on January 1,2014,for $500,000.Sanlon Corporation's stockholders' equity at this date consisted of $250,000 in Capital Stock and $100,000 in Retained Earnings.The fair value of Sanlon's assets was equal to the book value of the assets except for land with a fair value $40,000 greater than its book value,and marketable securities with a fair value $50,000 greater than its book value.Sanlon also had a valuable patent with a fair value of $25,000 and a book value of zero because its development costs were expensed as incurred.The fair value of Sanlon's liabilities is $10,000 higher than the $40,000 book value.

Required:

Calculate the amount of goodwill under the parent company and entity theories of consolidation.

Required:

Calculate the amount of goodwill under the parent company and entity theories of consolidation.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

30

On January 1,2014,Parton Corporation acquired an 80% interest in Sandra Corporation for $184,000.Sandra's net assets on this date had a book value of $160,000 and a fair value of $210,000.The excess of fair value over book value at acquisition was attributable to $20,000 of understated plant assets with a remaining useful life of five years from January 1,2014,and $30,000 to an understated patent with a remaining economic life of six years from January 1,2014.Separate net incomes (excluding investment income)of Parton and Sandra for 2014 were $300,000 and $50,000,respectively.

Required:

1.Compute goodwill at January 1,2014 under the parent company theory and the entity theory.

2.Determine consolidated net income and noncontrolling interest share for 2014 under the parent company theory and the entity theory.

Required:

1.Compute goodwill at January 1,2014 under the parent company theory and the entity theory.

2.Determine consolidated net income and noncontrolling interest share for 2014 under the parent company theory and the entity theory.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

31

Under push-down accounting,the ________ of the acquired subsidiary's assets and liabilities are reported on the financial statements of the ________.

A)book value; subsidiary

B)book value; parent

C)fair value; subsidiary

D)present value; parent

A)book value; subsidiary

B)book value; parent

C)fair value; subsidiary

D)present value; parent

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

32

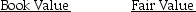

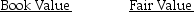

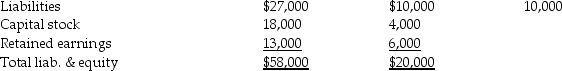

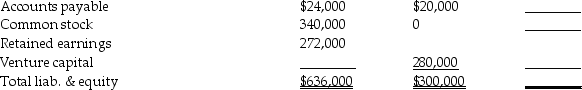

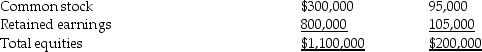

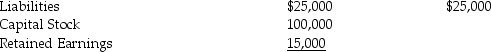

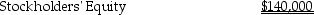

Party Corporation acquired an 80% interest in Sang Corporation on January 1,2014 for $20,000.Balance sheet and fair value information on this date is summarized as follows:

Required:

Required:

1.Prepare an entry on the books of Sang Corporation to record the push-down adjustment under parent company theory.

2.Prepare an entry on the books of Sang Corporation to record a push-down adjustment under entity theory.

Required:

Required:1.Prepare an entry on the books of Sang Corporation to record the push-down adjustment under parent company theory.

2.Prepare an entry on the books of Sang Corporation to record a push-down adjustment under entity theory.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

33

On January 1,2014,Jeff Company acquired a 90% interest in Marian Company for $198,000 cash.On January 1,2014,Marian Company had the following assets and liabilities:

Total Liabilities &

Total Liabilities &

Push-down accounting is used for the acquisition.

Push-down accounting is used for the acquisition.

Required:

1.Assume both companies use the entity theory.Prepare the elimination entry(ies)on consolidating work papers on January 1,2014.

2.Assume both companies use the parent company theory.Prepare the elimination entry(ies)on consolidating work papers on January 1,2014.

Total Liabilities &

Total Liabilities & Push-down accounting is used for the acquisition.

Push-down accounting is used for the acquisition.Required:

1.Assume both companies use the entity theory.Prepare the elimination entry(ies)on consolidating work papers on January 1,2014.

2.Assume both companies use the parent company theory.Prepare the elimination entry(ies)on consolidating work papers on January 1,2014.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

34

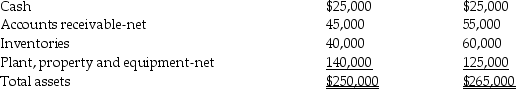

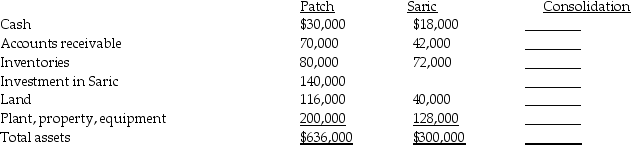

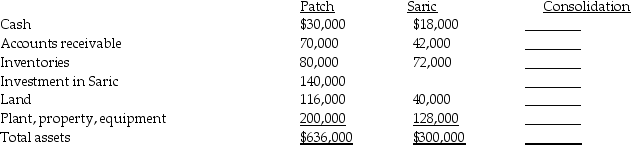

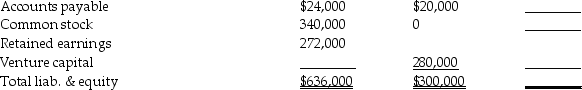

Patch Corporation has a 50% undivided interest in Saric Corporation,a joint venture.Patch accounts for its interest in Saric by the equity method and also prepares consolidated financial statements for external reporting purposes.Patch follows specialized industry practices and uses proportionate consolidation for its interest in Saric.Separate financial statements for Patch and Saric are as follows:

Required:

Required:

Prepare the consolidated balance sheet for Patch Corporation and its undivided interest in Saric Corporation.

Required:

Required:Prepare the consolidated balance sheet for Patch Corporation and its undivided interest in Saric Corporation.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

35

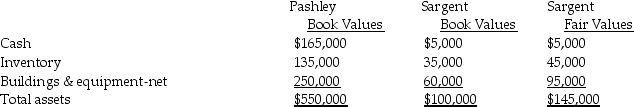

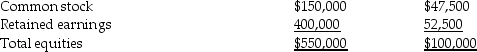

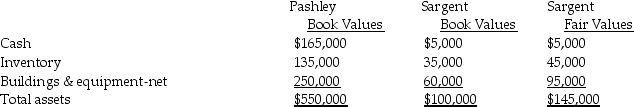

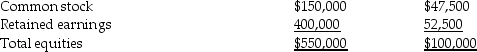

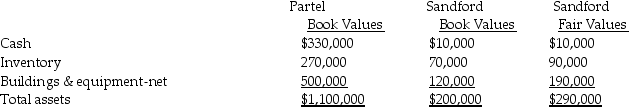

Pashley Corporation purchased 75% of Sargent Corporation on January 1,2014,for $115,000.Balance sheets for the two companies on this date,prepared just prior to the purchase,are provided below.

Required:

Required:

Prepare a consolidated balance sheet using the entity theory of consolidation.

Required:

Required:Prepare a consolidated balance sheet using the entity theory of consolidation.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

36

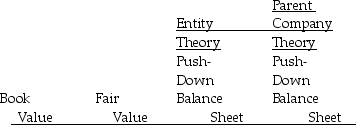

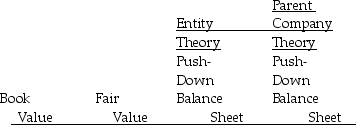

Partridge Corporation purchased an 80% interest in Sandy Corporation for $840,000 on January 1,2014.Sandy's balance sheet book values and accompanying fair values on this date are shown below.

Required:

Required:

Complete the push-down columns of Sandy Corporation's restructured balance sheet using entity theory and parent company theory.

Required:

Required:Complete the push-down columns of Sandy Corporation's restructured balance sheet using entity theory and parent company theory.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

37

Use the following information to answer the question(s) below.

On January 1, 2014, Penelope Company acquired a 90% interest in Leah Company for $180,000 cash. On January 1, 2014, Leah Company had the following assets and liabilities:

Push-down accounting is used for the acquisition.

Push-down accounting is used for the acquisition.

-Assume the entity theory is used.On January 2,2014,Leah Company will report Goodwill of ________ and Accounts Receivable of ________ on Leah's balance sheet.

A)$27,000; $30,000

B)$27,000; $34,500

C)$30,000; $30,000

D)$30,000; $35,000

On January 1, 2014, Penelope Company acquired a 90% interest in Leah Company for $180,000 cash. On January 1, 2014, Leah Company had the following assets and liabilities:

Push-down accounting is used for the acquisition.

Push-down accounting is used for the acquisition.-Assume the entity theory is used.On January 2,2014,Leah Company will report Goodwill of ________ and Accounts Receivable of ________ on Leah's balance sheet.

A)$27,000; $30,000

B)$27,000; $34,500

C)$30,000; $30,000

D)$30,000; $35,000

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

38

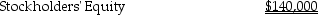

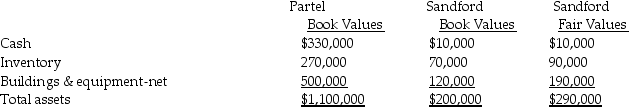

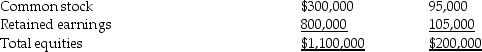

Partel Corporation purchased 75% of Sandford Corporation on January 1,2014,for $230,000.Balance sheets for the two companies on this date,prepared just prior to the purchase,are provided below.

Required:

Required:

1.Prepare a consolidated balance sheet using the entity theory of consolidation.

2.Prepare a consolidated balance sheet using the parent company theory of consolidation.

Required:

Required:1.Prepare a consolidated balance sheet using the entity theory of consolidation.

2.Prepare a consolidated balance sheet using the parent company theory of consolidation.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

39

On January 1,2014,Penny Company acquired a 90% interest in Lampire Company for $180,000 cash.On January 1,2014,Lampire Company had the following assets and liabilities:

Total Liabilities &

Total Liabilities &

Push-down accounting is used for the acquisition.

Push-down accounting is used for the acquisition.

Required:

1.Assume both companies use the entity theory.Record the push-down adjustment on Lampire's separate books on January 1,2014.

2.Assume both companies use the parent company theory.Record the push-down adjustment on Lampire's separate books on January 1,2014.

Total Liabilities &

Total Liabilities & Push-down accounting is used for the acquisition.

Push-down accounting is used for the acquisition.Required:

1.Assume both companies use the entity theory.Record the push-down adjustment on Lampire's separate books on January 1,2014.

2.Assume both companies use the parent company theory.Record the push-down adjustment on Lampire's separate books on January 1,2014.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

40

On January 1,2014,Jeff Company acquired a 90% interest in Margaret Company for $198,000 cash.On January 1,2014,Margaret Company had the following assets and liabilities:

Total Liabilities &

Total Liabilities &

Push-down accounting is used for the acquisition.

Push-down accounting is used for the acquisition.

Required:

1.Assume both companies use the entity theory.

a.Record the journal entry on Margaret's separate books on January 1,2014.

b.Record the journal entry on Jeff's separate books on January 1,2014.

2.Assume both companies use the parent company theory.

a.Record the journal entry on Margaret's separate books on January 1,2014.

b.Record the journal entry on Jeff's separate books on January 1,2014.

Total Liabilities &

Total Liabilities & Push-down accounting is used for the acquisition.

Push-down accounting is used for the acquisition.Required:

1.Assume both companies use the entity theory.

a.Record the journal entry on Margaret's separate books on January 1,2014.

b.Record the journal entry on Jeff's separate books on January 1,2014.

2.Assume both companies use the parent company theory.

a.Record the journal entry on Margaret's separate books on January 1,2014.

b.Record the journal entry on Jeff's separate books on January 1,2014.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

41

Companies in which equity investors cannot provide financing for the entity's business risks and activities without additional financial support are considered variable interest entitites according to the GAAP.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

42

Per the GAAP,the noncontrolling interest is shown as a single,combined amount under the consolidated stockholder's equity.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

43

Income attributable to the noncontrolling interest is treated as an expense.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

44

Push-down accounting is the establishment of a new accounting and reporting basis for an entity in its separate financial statements,based on a purchase transaction in the voting stock of the entity that results in a substantial change of ownership of the outstanding voting stock of the entity.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

45

All companies holding a significant interest in a variable interest entity (VIE)must disclose the nature,purpose,size and activities of the VIE in the consolidated statements.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

46

On January 1,2014,Gregory Company acquired a 90% interest in Subway Company for $200,000 cash.On January 1,2014,Subway Company had the following assets and liabilities:

Total Liabilities &

The plant assets have 20 years of useful life remaining.Straight-line depreciation is used.The excess fair value over book value associated with Accounts Receivable and Inventory is realized in 2014.

The plant assets have 20 years of useful life remaining.Straight-line depreciation is used.The excess fair value over book value associated with Accounts Receivable and Inventory is realized in 2014.

In 2014,Subway reported net income of $35,000 and declared and paid common dividends of $10,000.Gregory reported Income from Subway in 2014 of $17,100.

Required:

Assume both companies use the entity theory.Prepare the elimination entry(ies)on consolidating work papers for the year ending December 31,2014.

Total Liabilities &

The plant assets have 20 years of useful life remaining.Straight-line depreciation is used.The excess fair value over book value associated with Accounts Receivable and Inventory is realized in 2014.

The plant assets have 20 years of useful life remaining.Straight-line depreciation is used.The excess fair value over book value associated with Accounts Receivable and Inventory is realized in 2014.In 2014,Subway reported net income of $35,000 and declared and paid common dividends of $10,000.Gregory reported Income from Subway in 2014 of $17,100.

Required:

Assume both companies use the entity theory.Prepare the elimination entry(ies)on consolidating work papers for the year ending December 31,2014.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

47

The entity theory approach to consolidated statements states the income of the noncontrolling interests is a distribution of the total income of the consolidated entity.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

48

The Securities and Exchange Commission requires the use of push-down accounting for SEC filings when a subsidiary is substantially wholly-owned with no substantial publicly held debt or preferred stock outstanding.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

49

A leveraged buyout occurs when an investor group acquires a company from the public shareholders in a transaction financed with large equity and very little debt.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

50

Unrealized gains and losses are to be considered when totalling consolidated net income under the entity theory.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

51

Push-down capital is an additional paid-in capital account.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

52

The GAAP states a noncontrolling interest in a subsidiary should be labeled and displayed as a separate financial note to the consolidated balance sheet.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

53

Joint ventures may be organized as partnerships or undivided interests,but not corporations.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

54

The entity theory requires that the income and equity of a subsidiary be determined for all stockholders; therefore the total amounts will be allocated between controlling and noncontrolling shareholders.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

55

Under the entity theory,subsidiary assets and liabilities are consolidated at fair values and controlling and noncontrolling interests in the net assets are accounted for consistently.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck