Deck 14: Capital Investment Decisions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/68

Play

Full screen (f)

Deck 14: Capital Investment Decisions

1

To calculate the Accounting Rate of Return, it is necessary to determine annual profit. Annual profit is calculated on a/an:

A)market value basis.

B)cash basis.

C)accrual basis.

D)current cost basis.

A)market value basis.

B)cash basis.

C)accrual basis.

D)current cost basis.

C

2

Which of these is an advantage of the payback method?

A)It is easily understood.

B)It is simple.

C)It emphasises the short-term.

D)All of the above

A)It is easily understood.

B)It is simple.

C)It emphasises the short-term.

D)All of the above

D

3

What is the decision rule for the payback method of investment appraisal?

A)Choose the project with the longest payback period.

B)Choose the project with the shortest payback period.

C)Choose the project where the payback period is longer than a hurdle period.

D)Below a maximum period, accept the project with the shortest payback period.

A)Choose the project with the longest payback period.

B)Choose the project with the shortest payback period.

C)Choose the project where the payback period is longer than a hurdle period.

D)Below a maximum period, accept the project with the shortest payback period.

D

4

The decision rule for the accounting rate of return method of assessing investment projects is to accept all projects with:

A)a positive return.

B)the highest return.

C)the highest return subject to a minimum required return.

D)none of the above.

A)a positive return.

B)the highest return.

C)the highest return subject to a minimum required return.

D)none of the above.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

5

Bev is considering purchasing a new buttonholer for her business. She estimates the machine will cost $90 000 and will be paid for in cash. Her cash savings from the first 4 years of operation of the machine will be $20 000 in year 1, $30 000 in year 2, $35 000 in year 3 and $35 000 in year 4. The payback period for the machine is:

A)4 years.

B)3.86 years.

C)3.14 years.

D)2.66 years.

A)4 years.

B)3.86 years.

C)3.14 years.

D)2.66 years.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

6

George is considering setting up a business selling free-range chickens. He estimates his establishment costs will be $600 000 and his net cash flows for the first five years will be $100 000 in year 1, $200 000 in year 2, stabilising at $300 000 in year 3. The payback period for the investment is:

A)3 years.

B)3.2 years.

C)5 years.

D)3.8 years.

A)3 years.

B)3.2 years.

C)5 years.

D)3.8 years.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

7

Which method for appraising investments is regarded as the 'superior' method?

A)NPV

B)ARR

C)PP

D)IRR

A)NPV

B)ARR

C)PP

D)IRR

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

8

It is important to get investment decisions right for which of the following reasons?

A)Large amounts of resources are often involved

B)They may affect the business for many years

C)They can be difficult and/or expensive to 'bail-out' of once started

D)All of the above

A)Large amounts of resources are often involved

B)They may affect the business for many years

C)They can be difficult and/or expensive to 'bail-out' of once started

D)All of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

9

Timothy Moore, Managing Director of Tiles Ltd, has received a report from his Finance Manager recommending four investment projects for his approval. However, the firm has only sufficient funds to invest in one project. The firm's rate of return is 6%. The accounting rate of return for each project is: A - 12%, B - 9%, C - 13%, D - 15%. Short will select:

A)Project A.

B)Project B.

C)Project C.

D)Project D.

A)Project A.

B)Project B.

C)Project C.

D)Project D.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

10

Use the information below to answer the following questions.

Y3 Ltd is expanding its production of binoculars. The plant is expected to cost $750 000, have a life of 5 years, and a nil residual value. It will be ready for operation on 31 December 2017. The following statement of comprehensive income figures for the new binoculars are forecast:

Depreciation has been calculated on a straight-line basis. You should assume that all cash flows occur at the end of the year in which they arise. The company's cost of capital is 10%. Ignore taxation.

-Refer to the table above. The payback period is:

A)between years 2 and 3.

B)between years 4 and 5.

C)between years 3 and 4.

D)between years 1 and 2.

Y3 Ltd is expanding its production of binoculars. The plant is expected to cost $750 000, have a life of 5 years, and a nil residual value. It will be ready for operation on 31 December 2017. The following statement of comprehensive income figures for the new binoculars are forecast:

Depreciation has been calculated on a straight-line basis. You should assume that all cash flows occur at the end of the year in which they arise. The company's cost of capital is 10%. Ignore taxation.

-Refer to the table above. The payback period is:

A)between years 2 and 3.

B)between years 4 and 5.

C)between years 3 and 4.

D)between years 1 and 2.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

11

What is a disadvantage associated with the use of the accounting rate of return method for assessing investment opportunities?

A)It is a method that is not widely understood by business.

B)It is based on an accrual approach rather than cash flows.

C)It ignores the time value of money.

D)Both B and C

A)It is a method that is not widely understood by business.

B)It is based on an accrual approach rather than cash flows.

C)It ignores the time value of money.

D)Both B and C

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

12

What is the assessment method widely used in practice which enables managers to screen investment projects to determine which projects can recoup their investment outlay the fastest?

A)Internal rate of return method

B)Accounting rate of return method

C)Payback method

D)Net present value method

A)Internal rate of return method

B)Accounting rate of return method

C)Payback method

D)Net present value method

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

13

Which of these is not generally regarded as an advantage of the payback method?

A)It emphasises early cash flows which have greater certainty.

B)It emphasises liquidity.

C)It minimises having to forecast too far into the future.

D)It avoids having to take into account the time value of money.

A)It emphasises early cash flows which have greater certainty.

B)It emphasises liquidity.

C)It minimises having to forecast too far into the future.

D)It avoids having to take into account the time value of money.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

14

What investment decision method takes the average profit and expresses it as a percentage of the average investment?

A)Accounting rate of return

B)Net present value

C)Payback period

D)Internal rate of return

A)Accounting rate of return

B)Net present value

C)Payback period

D)Internal rate of return

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

15

The statement that is a disadvantage of the payback method of investment evaluation is:

A)it disregards the time value of money.

B)it disregards the post payback period cash flows.

C)it is based on cash flows.

D)Both A and B

A)it disregards the time value of money.

B)it disregards the post payback period cash flows.

C)it is based on cash flows.

D)Both A and B

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

16

All of the investment appraisal methods below use cash flows exclusively except:

A)accounting rate of return.

B)payback.

C)internal rate of return.

D)net present value.

A)accounting rate of return.

B)payback.

C)internal rate of return.

D)net present value.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is not a method for appraising potential investments?

A)Payback method

B)Return on assets

C)Accounting rate of return

D)Net present value

A)Payback method

B)Return on assets

C)Accounting rate of return

D)Net present value

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

18

Gardall Ltd, a printing business, intends purchasing a new computerised printing machine for $900 000. The annual cash flows from the new machine are expected to be $150 000 per year. The machine has an eight-year useful life. The payback period is:

A)8 years.

B)5.33 years.

C)5 years.

D)6 years.

A)8 years.

B)5.33 years.

C)5 years.

D)6 years.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

19

Container Ltd, a manufacturing firm, is considering investing $110 000 in a new mainframe computer. It is estimated that net cash flow per year will be $30 000 and the computer will have a 10-year useful life and zero residual value. The machine will be depreciated on a straight-line basis. What is the accounting rate of return?

A)10.55%

B)30.0%

C)22.72%

D)15.86%

A)10.55%

B)30.0%

C)22.72%

D)15.86%

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

20

Use the information below to answer the following questions.

Y3 Ltd is expanding its production of binoculars. The plant is expected to cost $750 000, have a life of 5 years, and a nil residual value. It will be ready for operation on 31 December 2017. The following statement of comprehensive income figures for the new binoculars are forecast:

Depreciation has been calculated on a straight-line basis. You should assume that all cash flows occur at the end of the year in which they arise. The company's cost of capital is 10%. Ignore taxation.

-Refer to the table above. The accounting rate of return is:

A)40%

B)80%

C)50%

D)30%

Y3 Ltd is expanding its production of binoculars. The plant is expected to cost $750 000, have a life of 5 years, and a nil residual value. It will be ready for operation on 31 December 2017. The following statement of comprehensive income figures for the new binoculars are forecast:

Depreciation has been calculated on a straight-line basis. You should assume that all cash flows occur at the end of the year in which they arise. The company's cost of capital is 10%. Ignore taxation.

-Refer to the table above. The accounting rate of return is:

A)40%

B)80%

C)50%

D)30%

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

21

Use the information below to answer the following questions.

Y3 Ltd is expanding its production of binoculars. The plant is expected to cost $750 000, have a life of 5 years, and a nil residual value. It will be ready for operation on 31 December 2017. The following statement of comprehensive income figures for the new binoculars are forecast:

Depreciation has been calculated on a straight-line basis. You should assume that all cash flows occur at the end of the year in which they arise. The company's cost of capital is 10%. Ignore taxation.

-Refer to the table above. The annual cash outflow for the project is:

A)$700 000

B)$850 000

C)$750 000

D)$650 000

Y3 Ltd is expanding its production of binoculars. The plant is expected to cost $750 000, have a life of 5 years, and a nil residual value. It will be ready for operation on 31 December 2017. The following statement of comprehensive income figures for the new binoculars are forecast:

Depreciation has been calculated on a straight-line basis. You should assume that all cash flows occur at the end of the year in which they arise. The company's cost of capital is 10%. Ignore taxation.

-Refer to the table above. The annual cash outflow for the project is:

A)$700 000

B)$850 000

C)$750 000

D)$650 000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

22

When a new investment requires an increase in working capital (e.g., accounts receivable, inventory)the analysis should incorporate this by:

A)recording a cash outflow in Year 0 and a cash inflow at the end of the project.

B)recording a cash inflow at the end of the project.

C)evenly dividing the amount of working capital as a cash outflow for each year of the investment.

D)doing nothing as there is a nil impact on cash flows.

A)recording a cash outflow in Year 0 and a cash inflow at the end of the project.

B)recording a cash inflow at the end of the project.

C)evenly dividing the amount of working capital as a cash outflow for each year of the investment.

D)doing nothing as there is a nil impact on cash flows.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

23

What is the factor in Net Present Value analysis that normally involves the least degree of uncertainty?

A)The future cash flows

B)The cost of the initial investment

C)The life of the project

D)The discount rate

A)The future cash flows

B)The cost of the initial investment

C)The life of the project

D)The discount rate

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

24

You have won a special type of lottery where you are to receive $250 000 in 4 years' time. The current interest rate is 6%. How much is the lottery win worth in today's dollars?

A)$200 000

B)$158 400

C)$255 010

D)$198 000

A)$200 000

B)$158 400

C)$255 010

D)$198 000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

25

The required rate of return is the ________ acceptable percentage return on an investment after taking into account the ________ of the investment.

A)minimum; opportunity cost

B)maximum; opportunity cost

C)maximum; risk

D)minimum; risk

A)minimum; opportunity cost

B)maximum; opportunity cost

C)maximum; risk

D)minimum; risk

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

26

If the net present value analysis of a project resulted in a positive value and the company did not accept the project, it could be assumed that:

A)qualitative factors outweigh the benefit of the investment.

B)the net initial investment cannot be recovered.

C)the return is greater than that required by the company.

D)All of the above

A)qualitative factors outweigh the benefit of the investment.

B)the net initial investment cannot be recovered.

C)the return is greater than that required by the company.

D)All of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following would be a reason for preferring $100 now rather than $100 in one year's time?

A)Risk

B)Interest lost

C)The effects of inflation

D)All of the above

A)Risk

B)Interest lost

C)The effects of inflation

D)All of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

28

Depreciation is not included in 'net present value' analysis because it is:

A)a non-cash item.

B)an historic cost.

C)a fixed cost.

D)a variable cost.

A)a non-cash item.

B)an historic cost.

C)a fixed cost.

D)a variable cost.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

29

Use the information below to answer the following questions.

Han Ltd supplies chilli paste to large supermarket chains. The company is currently considering scrapping the old processor and investing in a new processor. Information about the investment is as follows:

Initial investment in processor Operating cash flows over next 5 years:

-Refer to the table above. What is the annual net cash flow for years 1-4?

A)$10 000

B)$30 000

C)$40 000

D)$20 000

Han Ltd supplies chilli paste to large supermarket chains. The company is currently considering scrapping the old processor and investing in a new processor. Information about the investment is as follows:

Initial investment in processor Operating cash flows over next 5 years:

-Refer to the table above. What is the annual net cash flow for years 1-4?

A)$10 000

B)$30 000

C)$40 000

D)$20 000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

30

The potential benefits forgone by rejecting one alternative while accepting another is known as a/an:

A)past cost.

B)cost/benefit cost.

C)opportunity cost.

D)deprivation cost.

A)past cost.

B)cost/benefit cost.

C)opportunity cost.

D)deprivation cost.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

31

An investor has the opportunity to invest at 15 per cent per year. Would they prefer to have $20 000 in a year's time or have any of the following sums now?

A)$15 000

B)$16 000

C)$15 667

D)$17 500

A)$15 000

B)$16 000

C)$15 667

D)$17 500

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

32

Use the information below to answer the following questions.

Han Ltd supplies chilli paste to large supermarket chains. The company is currently considering scrapping the old processor and investing in a new processor. Information about the investment is as follows:

Initial investment in processor Operating cash flows over next 5 years:

-Refer to the table above. Using the Net Present Value approach the management of Han Ltd will make which of the following decisions?

A)Accept the investment proposal and purchase the new processor.

B)Retain the current processor and buy the new processor.

C)Retain the current processor.

D)Increase the residual value of the processor.

Han Ltd supplies chilli paste to large supermarket chains. The company is currently considering scrapping the old processor and investing in a new processor. Information about the investment is as follows:

Initial investment in processor Operating cash flows over next 5 years:

-Refer to the table above. Using the Net Present Value approach the management of Han Ltd will make which of the following decisions?

A)Accept the investment proposal and purchase the new processor.

B)Retain the current processor and buy the new processor.

C)Retain the current processor.

D)Increase the residual value of the processor.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

33

Using the Net Present Value method, the decision rule for projects when finance is not a restriction is:

A)take on all projects with a positive NPV.

B)select the project with the largest cash inflows.

C)select the project where the cash inflows are greatest in the early years of the project.

D)select the project with cash flows equal to the initial investment.

A)take on all projects with a positive NPV.

B)select the project with the largest cash inflows.

C)select the project where the cash inflows are greatest in the early years of the project.

D)select the project with cash flows equal to the initial investment.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

34

Use the information below to answer the following questions.

Han Ltd supplies chilli paste to large supermarket chains. The company is currently considering scrapping the old processor and investing in a new processor. Information about the investment is as follows:

Initial investment in processor Operating cash flows over next 5 years:

-Refer to the table above. What is the annual net cash flow in year 5?

A)$45 000

B)$50 000

C)$35 000

D)$30 000

Han Ltd supplies chilli paste to large supermarket chains. The company is currently considering scrapping the old processor and investing in a new processor. Information about the investment is as follows:

Initial investment in processor Operating cash flows over next 5 years:

-Refer to the table above. What is the annual net cash flow in year 5?

A)$45 000

B)$50 000

C)$35 000

D)$30 000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

35

Use the information below to answer the following questions.

Y3 Ltd is expanding its production of binoculars. The plant is expected to cost $750 000, have a life of 5 years, and a nil residual value. It will be ready for operation on 31 December 2017. The following statement of comprehensive income figures for the new binoculars are forecast:

Depreciation has been calculated on a straight-line basis. You should assume that all cash flows occur at the end of the year in which they arise. The company's cost of capital is 10%. Ignore taxation.

-Refer to the table above. The annual depreciation charge for the project is:

A)$300 000

B)$250 000

C)$150 000

D)$200 000

Y3 Ltd is expanding its production of binoculars. The plant is expected to cost $750 000, have a life of 5 years, and a nil residual value. It will be ready for operation on 31 December 2017. The following statement of comprehensive income figures for the new binoculars are forecast:

Depreciation has been calculated on a straight-line basis. You should assume that all cash flows occur at the end of the year in which they arise. The company's cost of capital is 10%. Ignore taxation.

-Refer to the table above. The annual depreciation charge for the project is:

A)$300 000

B)$250 000

C)$150 000

D)$200 000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

36

If you banked $27 778 today at an interest rate of 20%, in two years' time you would have:

A)$40 000

B)$36 000

C)$33 334

D)$27 778

A)$40 000

B)$36 000

C)$33 334

D)$27 778

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

37

The time value of money is an important concept in investment decisions as it takes into account that:

A)a dollar received today is more valuable than a dollar received tomorrow.

B)a dollar received today is equal to a dollar received tomorrow.

C)a dollar received tomorrow is more valuable than a dollar received today.

D)it takes time to earn profits.

A)a dollar received today is more valuable than a dollar received tomorrow.

B)a dollar received today is equal to a dollar received tomorrow.

C)a dollar received tomorrow is more valuable than a dollar received today.

D)it takes time to earn profits.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

38

Use the information below to answer the following questions.

Y3 Ltd is expanding its production of binoculars. The plant is expected to cost $750 000, have a life of 5 years, and a nil residual value. It will be ready for operation on 31 December 2017. The following statement of comprehensive income figures for the new binoculars are forecast:

Depreciation has been calculated on a straight-line basis. You should assume that all cash flows occur at the end of the year in which they arise. The company's cost of capital is 10%. Ignore taxation.

-Refer to the table above. The net present value (rounded)is:

A)$984 000

B)$1 019 900

C)$883 000

D)$860 500

Y3 Ltd is expanding its production of binoculars. The plant is expected to cost $750 000, have a life of 5 years, and a nil residual value. It will be ready for operation on 31 December 2017. The following statement of comprehensive income figures for the new binoculars are forecast:

Depreciation has been calculated on a straight-line basis. You should assume that all cash flows occur at the end of the year in which they arise. The company's cost of capital is 10%. Ignore taxation.

-Refer to the table above. The net present value (rounded)is:

A)$984 000

B)$1 019 900

C)$883 000

D)$860 500

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

39

Use the information below to answer the following questions.

Han Ltd supplies chilli paste to large supermarket chains. The company is currently considering scrapping the old processor and investing in a new processor. Information about the investment is as follows:

Initial investment in processor Operating cash flows over next 5 years:

-Refer to the table above. The net present value (rounded)of the investment is:

A)$68 125

B)$66 500

C)$67 000

D)$71 000

Han Ltd supplies chilli paste to large supermarket chains. The company is currently considering scrapping the old processor and investing in a new processor. Information about the investment is as follows:

Initial investment in processor Operating cash flows over next 5 years:

-Refer to the table above. The net present value (rounded)of the investment is:

A)$68 125

B)$66 500

C)$67 000

D)$71 000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

40

After appraisal of an investment opportunity, the Net Present Value was calculated as $3 000. This indicated that the project's return is:

A)the opportunity rate.

B)equal to the market rate of return.

C)greater than the company's rate of return.

D)greater than the discount rate used in the analysis.

A)the opportunity rate.

B)equal to the market rate of return.

C)greater than the company's rate of return.

D)greater than the discount rate used in the analysis.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

41

What is the formula for net present value per $1 of investment?

A)Net Present Value/Investment

B)Net cash flows/ Investment

C)Present value of inflows/Initial investment

D)Present values of inflows/Present value of outflows

A)Net Present Value/Investment

B)Net cash flows/ Investment

C)Present value of inflows/Initial investment

D)Present values of inflows/Present value of outflows

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

42

What is the main disadvantage of the Internal Rate of Return method?

A)It ignores the scale of projects, which could lead to wrong decision-making.

B)It is difficult for management to incorporate it into decision-making.

C)It is too simplistic.

D)All of the above

A)It ignores the scale of projects, which could lead to wrong decision-making.

B)It is difficult for management to incorporate it into decision-making.

C)It is too simplistic.

D)All of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

43

The following data was given for three projects being considered by Manosteel Ltd. Only one project can be accepted due to funding limitations. Which project is the best given that Manosteel's required rate of return is 14%?

A)Project A

B)Project B

C)Project C

D)All projects should be accepted, as all have a positive Net Present Value and an Internal Rate of Return greater than the required rate of return.

A)Project A

B)Project B

C)Project C

D)All projects should be accepted, as all have a positive Net Present Value and an Internal Rate of Return greater than the required rate of return.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

44

What discount rate should be used in Net Present Value assessments?

A)The weighted average cost of capital of the business

B)The government bond rate

C)The specific cost of capital associated with funding a particular project

D)The expected rate of return required by ordinary shareholders

A)The weighted average cost of capital of the business

B)The government bond rate

C)The specific cost of capital associated with funding a particular project

D)The expected rate of return required by ordinary shareholders

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

45

Depreciation is a non-cash expense, but it affects cash flows from an investment because:

A)it affects the amount of tax paid.

B)it affects the cost of the investment.

C)it affects the scrap value of the investment.

D)All of the above

A)it affects the amount of tax paid.

B)it affects the cost of the investment.

C)it affects the scrap value of the investment.

D)All of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following does the Net Present Value method of investment appraisal not address?

A)The whole of the relevant cash flows

B)Qualitative factors

C)The timing of the cash flows

D)None of the above, i.e., all matters are addressed

A)The whole of the relevant cash flows

B)Qualitative factors

C)The timing of the cash flows

D)None of the above, i.e., all matters are addressed

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

47

Which of these factors influences the returns required by investors from an investment project?

A)Interest foregone

B)Inflation

C)Risk premium

D)All are influences

A)Interest foregone

B)Inflation

C)Risk premium

D)All are influences

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

48

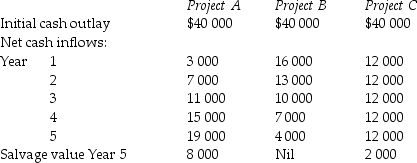

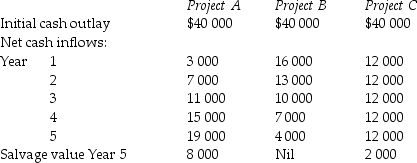

The following information relates to three mutually exclusive projects.

REQUIRED:

REQUIRED:

Compute the net present value of each project at a discount rate of 10%.

REQUIRED:

REQUIRED:Compute the net present value of each project at a discount rate of 10%.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

49

Courtmaster provides superturf for tennis courts. The company has recently investigated investing in a new machine, which will speed up the laying of the superturf. The old machine has a remaining life of 5 years, and the new equipment has a value of $150 000 with a five-year life. The expected additional cash inflows are $35 000 per year. In what range is the internal rate of return for the new machine?

A)4 - 6%

B)2 - 4%

C)6 - 8%

D)8 - 10%

A)4 - 6%

B)2 - 4%

C)6 - 8%

D)8 - 10%

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

50

The Square Package Group is thinking of buying, at a cost of $220 000, some new packaging equipment that is expected to save $50 000 in costs per year. Its estimated useful life is 10 years and it will have zero disposal value. The required rate of return is 16%. Ignore income tax issues.

REQUIRED:

Compute the following:

a)Net present value

b)Payback period

_____________________________________________________________________________________________

_____________________________________________________________________________________________

REQUIRED:

Compute the following:

a)Net present value

b)Payback period

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

51

In capital investment decision-making, what does PV stand for?

A)Payback value

B)Present value

C)Profit vesting

D)Purchasing value

A)Payback value

B)Present value

C)Profit vesting

D)Purchasing value

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

52

What is a problem with the internal rate of return method?

A)It ignores the time value of money.

B)It has difficulty handling projects with unconventional cash flows.

C)It ignores the timing of cash flows.

D)All of the above

A)It ignores the time value of money.

B)It has difficulty handling projects with unconventional cash flows.

C)It ignores the timing of cash flows.

D)All of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

53

Which of these costs would not be relevant to an investment decision to replace an existing asset with a newer model capable of increasing production?

A)Disposal value of existing asset

B)Future operating costs of existing asset

C)Trade-in value of existing asset

D)Carrying amount of asset to be replaced

A)Disposal value of existing asset

B)Future operating costs of existing asset

C)Trade-in value of existing asset

D)Carrying amount of asset to be replaced

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

54

Wishlist recently purchased a new packaging machine for $678 026. The machine has a remaining useful life of 10 years. Net cash flow per year will be $120 000. The internal rate of return is:

A)16%

B)20%

C)24%

D)12%

A)16%

B)20%

C)24%

D)12%

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

55

TG Industries is considering investing in a fleet of six delivery vehicles. The annual running costs are expected to total $90 000 per vehicle, including the driver's salary. The vehicles are expected to operate for a total of five years. At present TG industries uses a commercial carrier for its deliveries. The commercial carrier is expected to charge a total of $680 000 for each of the next five years to make the deliveries. What is the estimated net annual cash cost saving on delivery vehicle running cost if TG industries invests in the fleet of six vehicles?

A)$90 000

B)$400 000

C)$310 000

D)$140 000

A)$90 000

B)$400 000

C)$310 000

D)$140 000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

56

Manosteel Ltd is considering the purchase of a new machine for $100 000. It is to be depreciated on a straight-line basis and is estimated to have no residual value at the end of a useful life of 10 years. The tax rate is 30 per cent. What will be the annual cash tax saving in relation to depreciation expense?

A)$3 000

B)$100

C)$300

D)$10 000

A)$3 000

B)$100

C)$300

D)$10 000

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

57

On what should the decision to invest in a project be based?

A)Both financial and quantitative information

B)Both non-financial and qualitative information

C)Both financial and non-financial information

D)None of the above

A)Both financial and quantitative information

B)Both non-financial and qualitative information

C)Both financial and non-financial information

D)None of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

58

The 'internal rate of return' is the discount rate that makes the net present value:

A)zero.

B)negative.

C)high.

D)positive.

A)zero.

B)negative.

C)high.

D)positive.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

59

Projects can have multiple internal rates of return due to:

A)all positive cash flows.

B)all negative cash flows.

C)both positive and negative cash flows at different points during its life.

D)None of the above

A)all positive cash flows.

B)all negative cash flows.

C)both positive and negative cash flows at different points during its life.

D)None of the above

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

60

If the net present value of a project is $1 000 after using a discount rate of 8%, then one can conclude that the internal rate of return is:

A)greater than 8%

B)8%

C)between 8% and 10%

D)less than 8%

A)greater than 8%

B)8%

C)between 8% and 10%

D)less than 8%

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following are practical issues that need to be considered when using investment appraisal methods?

A)Irrelevant costs

B)Taxation

C)Interest payments

D)Both B and C

A)Irrelevant costs

B)Taxation

C)Interest payments

D)Both B and C

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

62

An advantage of the Internal Rate of Return method over the Net Present Value method of investment appraisal is that:

A)the IRR is easier to calculate than the NPV.

B)the IRR method is more well known that the NPV method.

C)the IRR is expressed in percentage terms whereas the NPV is expressed in absolute terms.

D)All are advantages

A)the IRR is easier to calculate than the NPV.

B)the IRR method is more well known that the NPV method.

C)the IRR is expressed in percentage terms whereas the NPV is expressed in absolute terms.

D)All are advantages

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

63

Which method of investment appraisal has been found in surveys to be the least popular with Australian businesses?

A)Net present value

B)Accounting rate of return

C)Internal rate of return

D)Payback period

A)Net present value

B)Accounting rate of return

C)Internal rate of return

D)Payback period

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

64

Which statement is true?

A)The 'internal rate of return' method assumes that cash reinvested in the course of the life of the project earns at the same rate as the project.

B)The 'net present value' method assumes that the reinvestment rate is at the cost of capital.

C)Both the 'internal rate of return' and the 'net present value' methods assume that the reinvestment rate is at the cost of capital.

D)Both A and B

A)The 'internal rate of return' method assumes that cash reinvested in the course of the life of the project earns at the same rate as the project.

B)The 'net present value' method assumes that the reinvestment rate is at the cost of capital.

C)Both the 'internal rate of return' and the 'net present value' methods assume that the reinvestment rate is at the cost of capital.

D)Both A and B

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

65

The finding from surveys of the methods of business investments that is true is:

A)businesses generally only use one method to assess each investment decision.

B)there is a tendency for larger businesses to use the discounting methods.

C)the payback method is hardly used in practice.

D)All of the statements are true

A)businesses generally only use one method to assess each investment decision.

B)there is a tendency for larger businesses to use the discounting methods.

C)the payback method is hardly used in practice.

D)All of the statements are true

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

66

Refer to Real World box on page 502 for survey referenced. The method of investment appraisal found in surveys to be used by 94% of Australian companies is:

A)internal rate of return.

B)accounting rate of return.

C)net present value.

D)payback period.

A)internal rate of return.

B)accounting rate of return.

C)net present value.

D)payback period.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following statements is incorrect?

A)It may be very difficult to quantify all factors that impact on an investment decision.

B)Investment decisions are made easier as cash forecasts are always correct.

C)The validity of assumptions made in relation to an investment proposal may influence the final decision.

D)The results from using an investment appraisal method is only one input into the final decision.

A)It may be very difficult to quantify all factors that impact on an investment decision.

B)Investment decisions are made easier as cash forecasts are always correct.

C)The validity of assumptions made in relation to an investment proposal may influence the final decision.

D)The results from using an investment appraisal method is only one input into the final decision.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

68

Relevant cash flows for investment decisions are:

A)expected cash flows that will not differ between alternatives.

B)actual cash flows that differ between alternatives.

C)expected cash flows that will differ between alternatives.

D)actual cash flows that do not differ between alternatives.

A)expected cash flows that will not differ between alternatives.

B)actual cash flows that differ between alternatives.

C)expected cash flows that will differ between alternatives.

D)actual cash flows that do not differ between alternatives.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck