Deck 13: Planning and Budgeting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

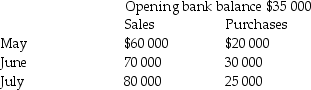

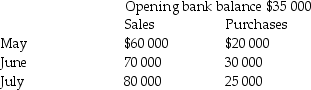

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

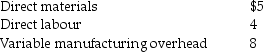

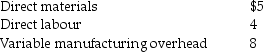

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/86

Play

Full screen (f)

Deck 13: Planning and Budgeting

1

In which step of the decision-making process are projected financial statements likely to have a valuable role?

A)Prepare a long-term plan based on the most appropriate options.

B)Identify objectives.

C)Consider options.

D)Evaluate options and make a decision.

A)Prepare a long-term plan based on the most appropriate options.

B)Identify objectives.

C)Consider options.

D)Evaluate options and make a decision.

A

2

What is the best description of the role of the budget committee?

A)Supervising and taking responsibility for the budget setting process

B)Predicting the budget

C)Setting goals for individual departments

D)Predicting the economic environment for the period

A)Supervising and taking responsibility for the budget setting process

B)Predicting the budget

C)Setting goals for individual departments

D)Predicting the economic environment for the period

A

3

What is the group which oversees the budgeting process within an organisation?

A)Estimates committee

B)Board of directors

C)Budget committee

D)Variance committee

A)Estimates committee

B)Board of directors

C)Budget committee

D)Variance committee

C

4

Which of the following assumptions or estimates would not be useful when preparing a projected income statement?

A)Levels of working capital

B)Income tax rates

C)Gross profit

D)Acquisitions of long-term assets

A)Levels of working capital

B)Income tax rates

C)Gross profit

D)Acquisitions of long-term assets

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

5

What is the main way in which budgets provide a means of control in an organisation?

A)By allowing senior management to control lower level managers

B)By allowing actual performance to be compared to budget targets

C)By allowing budget targets to be set at maximum performance

D)By allowing management to control the budget targets

A)By allowing senior management to control lower level managers

B)By allowing actual performance to be compared to budget targets

C)By allowing budget targets to be set at maximum performance

D)By allowing management to control the budget targets

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is not a step in providing details on how to work towards the objective of the business?

A)Mission statement

B)Position analysis

C)Strategic plan

D)Investors

A)Mission statement

B)Position analysis

C)Strategic plan

D)Investors

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following statements is true?

A)The relationship between objectives, long-term plans and budgets is unclear.

B)A long-term plan only consists of financial objectives.

C)Budgets detail actions that need to occur over the short term.

D)Once a budget is finalised, a business determines its primary objective.

A)The relationship between objectives, long-term plans and budgets is unclear.

B)A long-term plan only consists of financial objectives.

C)Budgets detail actions that need to occur over the short term.

D)Once a budget is finalised, a business determines its primary objective.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

8

If the principal objective of a firm is to enhance wealth, the most important budget target to meet is:

A)bank balance.

B)sales.

C)profit.

D)production.

A)bank balance.

B)sales.

C)profit.

D)production.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

9

The process of making planned events actually occur is:

A)the control process.

B)variance analysis.

C)short-term budgeting.

D)management accounting.

A)the control process.

B)variance analysis.

C)short-term budgeting.

D)management accounting.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

10

One of the approaches to setting budgets is known as the 'top down' approach. This is best described as:

A)production budget set first and working from this to other budgets.

B)budget targets set at the lowest level of management.

C)setting the sales forecast and working from this to other budgets.

D)budget targets set by senior management.

A)production budget set first and working from this to other budgets.

B)budget targets set at the lowest level of management.

C)setting the sales forecast and working from this to other budgets.

D)budget targets set by senior management.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

11

How is a master budget best described?

A)As a budget of the cash flows predicted for a future period of time

B)As the one and only budget that is of interest to management

C)As a summary of a number of interrelated budgets

D)As a budget for a manufacturing business

A)As a budget of the cash flows predicted for a future period of time

B)As the one and only budget that is of interest to management

C)As a summary of a number of interrelated budgets

D)As a budget for a manufacturing business

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

12

Budgets are said to be useful in promoting forward thinking and identification of short-term problems, because:

A)management can foresee future promotion opportunities.

B)management can react to problem areas as they occur.

C)potential problem areas can be identified early enough to allow management to explore ways of overcoming the problem.

D)All of the above

A)management can foresee future promotion opportunities.

B)management can react to problem areas as they occur.

C)potential problem areas can be identified early enough to allow management to explore ways of overcoming the problem.

D)All of the above

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

13

There is often a limiting factor that stops a business from achieving its objectives to the maximum extent. In most instances the limiting factor is:

A)the ability of the business to advertise its products.

B)the unrealistic goals of production managers.

C)the unrealistic objectives set by management.

D)the ability of the business to sell its products.

A)the ability of the business to advertise its products.

B)the unrealistic goals of production managers.

C)the unrealistic objectives set by management.

D)the ability of the business to sell its products.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

14

Coordination between budgets refers to a situation when:

A)activities of one department match and are complementary to those of other departments.

B)different parts of the organisation operate at cross-purposes.

C)more than one entity in an industry adopts similar goals.

D)a plan comes together with industry and government targets.

A)activities of one department match and are complementary to those of other departments.

B)different parts of the organisation operate at cross-purposes.

C)more than one entity in an industry adopts similar goals.

D)a plan comes together with industry and government targets.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

15

How is a budget best defined?

A)As a forecast for a future period of time

B)As a prediction for a future period

C)As a non-financial plan for a future period of time

D)As a financial plan for a future period of time

A)As a forecast for a future period of time

B)As a prediction for a future period

C)As a non-financial plan for a future period of time

D)As a financial plan for a future period of time

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

16

In which order do the following steps in the budget setting process actually occur? i)Co-ordinate the budget.

ii) Identify the limiting factor.

iii) Monitor performance relative to budget.

A)ii, iii, i.

B)ii, i, iii.

C)i, ii, iii.

D)iii, i, ii.

ii) Identify the limiting factor.

iii) Monitor performance relative to budget.

A)ii, iii, i.

B)ii, i, iii.

C)i, ii, iii.

D)iii, i, ii.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

17

A budget system that always provides plans for a full 12 months into the future is known as:

A)advance budget.

B)yearly budget.

C)future budget.

D)rolling budget.

A)advance budget.

B)yearly budget.

C)future budget.

D)rolling budget.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

18

Assumptions and estimates relating to the statement of financial position would generally NOT include which of the following?

A)Profit

B)Loans raised and repaid

C)New capital raised and the amount of profit retained

D)Working capital

A)Profit

B)Loans raised and repaid

C)New capital raised and the amount of profit retained

D)Working capital

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

19

The master budget would typically consist of a budgeted:

A)statement of financial position and statement of cash flows.

B)statement of comprehensive income, statement of financial position and statement of cash flows.

C)statement of comprehensive income and statement of financial position.

D)statement of comprehensive income and statement of cash flows.

A)statement of financial position and statement of cash flows.

B)statement of comprehensive income, statement of financial position and statement of cash flows.

C)statement of comprehensive income and statement of financial position.

D)statement of comprehensive income and statement of cash flows.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

20

When preparing its sales forecast, an organisation can use the 'bottom-up' approach. What is one of the features of this approach?

A)Operating personnel are motivated to prepare realistic budgets and accept them as benchmarks in performance evaluation.

B)Multiple levels of managers and salespersons are involved in the forecasting process.

C)It often involves negotiations between departments.

D)All of the above

A)Operating personnel are motivated to prepare realistic budgets and accept them as benchmarks in performance evaluation.

B)Multiple levels of managers and salespersons are involved in the forecasting process.

C)It often involves negotiations between departments.

D)All of the above

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

21

What is the typical overall time period for which a budget is set?

A)Two years

B)Three months

C)Twelve months

D)Five years

A)Two years

B)Three months

C)Twelve months

D)Five years

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

22

How can a budget help in decision making?

A)By identifying excesses or shortages of cash

B)By predicting purchase requirements for raw materials

C)By identifying future resource constraints

D)All of the above

A)By identifying excesses or shortages of cash

B)By predicting purchase requirements for raw materials

C)By identifying future resource constraints

D)All of the above

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

23

If a firm had credit sales of $1 550 000 for March and collected its sales 30% in the month of sale and 70% in the month following the sale, how much of March sales would be collected in cash in March?

A)$1 250 000

B)$375 000

C)$875 000

D)$465 000

A)$1 250 000

B)$375 000

C)$875 000

D)$465 000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

24

The Talent Agency had the following estimates for the six months ending 31 December 2018. The estimated cash balance at 31 December 2018 is:

A)$3 450

B)$5 050

C)$3 950 (overdraft)

D)$2 100 (overdraft)

A)$3 450

B)$5 050

C)$3 950 (overdraft)

D)$2 100 (overdraft)

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

25

Use the information below to answer the following questions.

Sales in December were $960 000. Projected sales for the first quarter of 2018 are:

Sales are 20% cash and 80% on credit. Debtors pay in the month following the sale.

-Refer to the table above. Calculate the total cash sales for the three months, January, February and March.

A)$256 000

B)$960 000

C)$2 848 000

D)$732 000

Sales in December were $960 000. Projected sales for the first quarter of 2018 are:

Sales are 20% cash and 80% on credit. Debtors pay in the month following the sale.

-Refer to the table above. Calculate the total cash sales for the three months, January, February and March.

A)$256 000

B)$960 000

C)$2 848 000

D)$732 000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

26

Use the information below to answer the following questions.

Sales in December were $960 000. Projected sales for the first quarter of 2018 are:

Sales are 20% cash and 80% on credit. Debtors pay in the month following the sale.

-Refer to the table above. What will be the balance of accounts receivable on 1 March?

A)$1 200 000

B)$1 040 000

C)$1 280 000

D)$864 000

Sales in December were $960 000. Projected sales for the first quarter of 2018 are:

Sales are 20% cash and 80% on credit. Debtors pay in the month following the sale.

-Refer to the table above. What will be the balance of accounts receivable on 1 March?

A)$1 200 000

B)$1 040 000

C)$1 280 000

D)$864 000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

27

Use the information below to answer the following questions.

Sales in December were $960 000. Projected sales for the first quarter of 2018 are:

Sales are 20% cash and 80% on credit. Debtors pay in the month following the sale.

-Refer to the table above. Calculate total cash collected from sales for the month of March.

A)$1 296 000

B)$1 456 000

C)$1 216 000

D)$256 000

Sales in December were $960 000. Projected sales for the first quarter of 2018 are:

Sales are 20% cash and 80% on credit. Debtors pay in the month following the sale.

-Refer to the table above. Calculate total cash collected from sales for the month of March.

A)$1 296 000

B)$1 456 000

C)$1 216 000

D)$256 000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

28

Use the information below to answer the following questions.

Crystal Computers owns a chain of seven shops selling computer goods. In the past the company maintained a healthy cash balance. However, this has fallen in recent months, and at the end of September 2018 it had an overdraft of $100 000. In view of this, its managing director has asked you to prepare a cash forecast for the next six months. You have collected the following information:

-Refer to the table above. The projected cash balance at the end of October is:

A)($245 000)

B)$6 000

C)($5 000)

D)($95 000)

Crystal Computers owns a chain of seven shops selling computer goods. In the past the company maintained a healthy cash balance. However, this has fallen in recent months, and at the end of September 2018 it had an overdraft of $100 000. In view of this, its managing director has asked you to prepare a cash forecast for the next six months. You have collected the following information:

-Refer to the table above. The projected cash balance at the end of October is:

A)($245 000)

B)$6 000

C)($5 000)

D)($95 000)

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

29

Budgets are generally regarded as having several areas of usefulness. Which of these is not one of them?

A)They can facilitate control within the business.

B)They tend to promote forward thinking.

C)They help coordinate the various sectors of the business.

D)They can be used to allocate direct expenses.

A)They can facilitate control within the business.

B)They tend to promote forward thinking.

C)They help coordinate the various sectors of the business.

D)They can be used to allocate direct expenses.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

30

Which outlay does not appear in the cash budget?

A)Monetary drawings

B)Repayment of loan

C)Interest on bank loan

D)Depreciation

A)Monetary drawings

B)Repayment of loan

C)Interest on bank loan

D)Depreciation

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

31

What does management by exception refer to in the budgeting process?

A)Rewarding exceptional effort

B)Delegating responsibility, leaving management free for other things

C)Concentrating most of management's efforts on those who do not achieve the budget

D)Motivating staff to boost the reputation of the business

A)Rewarding exceptional effort

B)Delegating responsibility, leaving management free for other things

C)Concentrating most of management's efforts on those who do not achieve the budget

D)Motivating staff to boost the reputation of the business

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

32

How many of the following items would be included in a cash budget? - Dividends paid to shareholders.

- Doubtful debts.

- Purchase of fixed asset for cash.

- Bonus share issue

A)1

B)2

C)3

D)4

- Doubtful debts.

- Purchase of fixed asset for cash.

- Bonus share issue

A)1

B)2

C)3

D)4

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

33

Which statement about the uses of budgets is not true?

A)They can assist in identifying short-term problems.

B)They can provide a system of authorisation for managers to spend up to a particular limit.

C)They are mainly used to set prices.

D)None of the above, i.e., all are true statements

A)They can assist in identifying short-term problems.

B)They can provide a system of authorisation for managers to spend up to a particular limit.

C)They are mainly used to set prices.

D)None of the above, i.e., all are true statements

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

34

Budget formats can best be described as:

A)the same from one business to the next.

B)conforming to accounting standards.

C)subject to management choice in style and layout.

D)None of the above

A)the same from one business to the next.

B)conforming to accounting standards.

C)subject to management choice in style and layout.

D)None of the above

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

35

Which statement is not correct?

A)The existence of budgets tends to provide motivation to improve performance.

B)The 'top down' approach to budgeting tends to improve motivation.

C)Setting demanding, but achievable, targets is a better motivator than setting undemanding targets.

D)Unrealistic targets have adverse effects on managers' performance.

A)The existence of budgets tends to provide motivation to improve performance.

B)The 'top down' approach to budgeting tends to improve motivation.

C)Setting demanding, but achievable, targets is a better motivator than setting undemanding targets.

D)Unrealistic targets have adverse effects on managers' performance.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

36

What is a common feature of most budgets?

A)The budget period is broken into months.

B)A columnar format

C)A section for non-cash expenses such as doubtful debts and depreciation

D)Both A and B

A)The budget period is broken into months.

B)A columnar format

C)A section for non-cash expenses such as doubtful debts and depreciation

D)Both A and B

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

37

Xon Company is planning to purchase fixed assets at a cost of $200 000. The planned delivery date is 1st February 2018. A deposit of $20 000 is to be paid on 1/11/17. The amount that will appear in the cash budget for November 2017 is:

A)$190 000 outflow.

B)$200 000 outflow.

C)$20 000 outflow.

D)$20 000 inflow.

A)$190 000 outflow.

B)$200 000 outflow.

C)$20 000 outflow.

D)$20 000 inflow.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

38

If the opening balance of cash for one month is $20 000, cash receipts are estimated to be $398 000 and cash payments are estimated as $300 000, the opening cash balance at the beginning of the next month is:

A)$118 000

B)$109 000

C)$69 000

D)Cannot be calculated

A)$118 000

B)$109 000

C)$69 000

D)Cannot be calculated

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

39

Use the information below to answer the following questions.

Sales in December were $960 000. Projected sales for the first quarter of 2018 are:

Sales are 20% cash and 80% on credit. Debtors pay in the month following the sale.

-Refer to the table above. Calculate the cash collected from accounts receivable in the month of February.

A)$1 080 000

B)$1 200 000

C)$960 000

D)$864 000

Sales in December were $960 000. Projected sales for the first quarter of 2018 are:

Sales are 20% cash and 80% on credit. Debtors pay in the month following the sale.

-Refer to the table above. Calculate the cash collected from accounts receivable in the month of February.

A)$1 080 000

B)$1 200 000

C)$960 000

D)$864 000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

40

The expense that does not appear in a cash budget is:

A)rent.

B)wages.

C)supplies.

D)taxation provided.

A)rent.

B)wages.

C)supplies.

D)taxation provided.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

41

Which of these involve a projection of future cash receipts and cash disbursements?

A)Cash budget

B)Statement of comprehensive income

C)Statement of financial position

D)None of the above

A)Cash budget

B)Statement of comprehensive income

C)Statement of financial position

D)None of the above

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

42

Use the information below to answer the following questions.

Patiomaster Products manufactures patio furniture. The estimated numbers of sets to be sold for the last three months of 2018 is:

Finished goods inventory at the end of September is 2 000 units. Finished goods inventory is set at 30 percent of next month's sales.

-Refer to the table above. What will be the amount of total production for October 2018?

A)9 400 units

B)7 800 units

C)10 100 units

D)8 400 units

Patiomaster Products manufactures patio furniture. The estimated numbers of sets to be sold for the last three months of 2018 is:

Finished goods inventory at the end of September is 2 000 units. Finished goods inventory is set at 30 percent of next month's sales.

-Refer to the table above. What will be the amount of total production for October 2018?

A)9 400 units

B)7 800 units

C)10 100 units

D)8 400 units

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

43

An adverse variance is best described as a:

A)variance where the actual performance falls short of the budget target.

B)variance where labour efficiencies have occurred.

C)combination of variances.

D)variance where actual performance exceeds the budget target.

A)variance where the actual performance falls short of the budget target.

B)variance where labour efficiencies have occurred.

C)combination of variances.

D)variance where actual performance exceeds the budget target.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

44

Leonard Company is preparing its second quarter production budget. Projected sales in units are 600 for April, 680 for May, and 750 for June. Leonard's policy is to have finished goods inventory equal to 20 per cent of the next month's projected unit sales. What should be the production quota for May?

A)830 units

B)694 units

C)680 units

D)666 units

A)830 units

B)694 units

C)680 units

D)666 units

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

45

If the opening cash balance at the beginning of the month is $27 500, total cash inflows for the month are $38 000 and total cash outflows are $98 000 the opening cash balance at the beginning of the next month is:

A)$67 500 (surplus)

B)$12 500 (surplus)

C)$32 500 (deficit)

D)Cannot be calculated

A)$67 500 (surplus)

B)$12 500 (surplus)

C)$32 500 (deficit)

D)Cannot be calculated

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

46

Use the information below to answer the following questions.

Crystal Computers owns a chain of seven shops selling computer goods. In the past the company maintained a healthy cash balance. However, this has fallen in recent months, and at the end of September 2018 it had an overdraft of $100 000. In view of this, its managing director has asked you to prepare a cash forecast for the next six months. You have collected the following information:

-Refer to the table above. The projected cash balance at the end of November is:

A)($25 000)

B)($120 000)

C)$25 000

D)($100 000)

Crystal Computers owns a chain of seven shops selling computer goods. In the past the company maintained a healthy cash balance. However, this has fallen in recent months, and at the end of September 2018 it had an overdraft of $100 000. In view of this, its managing director has asked you to prepare a cash forecast for the next six months. You have collected the following information:

-Refer to the table above. The projected cash balance at the end of November is:

A)($25 000)

B)($120 000)

C)$25 000

D)($100 000)

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

47

Use the information below to answer the following questions.

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2017 and planned sales for the first quarter of 2018.

Past records indicate that expected receipts collected from debtors will be:

60 per cent in the month of sale

40 per cent in the month following the sale

-Refer to the table above. What is the projected cash inflow from accounts receivable in January?

A)$43 000

B)$15 000

C)$20 000

D)$28 000

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2017 and planned sales for the first quarter of 2018.

Past records indicate that expected receipts collected from debtors will be:

60 per cent in the month of sale

40 per cent in the month following the sale

-Refer to the table above. What is the projected cash inflow from accounts receivable in January?

A)$43 000

B)$15 000

C)$20 000

D)$28 000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

48

Use the information below to answer the following questions.

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2017 and planned sales for the first quarter of 2018.

Past records indicate that expected receipts collected from debtors will be:

60 per cent in the month of sale

40 per cent in the month following the sale

-Refer to the table above. What is the total cash expected to be collected from all sales in March?

A)$50 000

B)$58 000

C)$62 000

D)$36 000

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2017 and planned sales for the first quarter of 2018.

Past records indicate that expected receipts collected from debtors will be:

60 per cent in the month of sale

40 per cent in the month following the sale

-Refer to the table above. What is the total cash expected to be collected from all sales in March?

A)$50 000

B)$58 000

C)$62 000

D)$36 000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

49

The Gel Company, hair products wholesaler, budgeted $180 000 of credit sales and $30 000 of cash sales for June. All merchandise is marked up to sell at 125% of its invoice cost. What is the budgeted cost of sales for June?

A)$168 000

B)$132 500

C)$136 000

D)$127 500

A)$168 000

B)$132 500

C)$136 000

D)$127 500

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

50

Use the information below to answer the following questions.

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2017 and planned sales for the first quarter of 2018.

Past records indicate that expected receipts collected from debtors will be:

60 per cent in the month of sale

40 per cent in the month following the sale

-Refer to the table above. What is the projected cash inflow from accounts receivable in February?

A)$32 000

B)$48 000

C)$26 000

D)$18 000

Jackson Bottle Yard, a recycling glass company, has supplied the following information in relation to their actual sales in 2017 and planned sales for the first quarter of 2018.

Past records indicate that expected receipts collected from debtors will be:

60 per cent in the month of sale

40 per cent in the month following the sale

-Refer to the table above. What is the projected cash inflow from accounts receivable in February?

A)$32 000

B)$48 000

C)$26 000

D)$18 000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

51

Use the information below to answer the following questions.

-Refer to the table above. Which of these variance calculations is correct for Raw materials, Labour and Overheads respectively? Note: F - Favourable, U - Unfavourable (adverse).

A)12 000U; $70 000F; $50 000U

B)$12 000F; $70 000F; $50 000U

C)12 000U; $70 000U; $50 000F

D)None of the above

-Refer to the table above. Which of these variance calculations is correct for Raw materials, Labour and Overheads respectively? Note: F - Favourable, U - Unfavourable (adverse).

A)12 000U; $70 000F; $50 000U

B)$12 000F; $70 000F; $50 000U

C)12 000U; $70 000U; $50 000F

D)None of the above

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

52

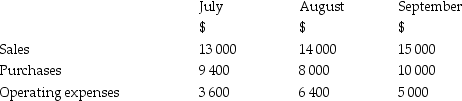

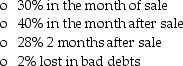

Bluebird Ltd has provided the estimates below for the July-September quarter in 2017.  You are also given the following additional information:

You are also given the following additional information:

• 35% of sales are cash sales, the remaining 65% credit sales are collected as follows:

• Sales in the months of May and June were $11 000 and $10 000 respectively.

• Sales in the months of May and June were $11 000 and $10 000 respectively.

• Operating expenses include depreciation each month of $900. All expenses and purchases are paid for in the same month they are incurred.

• The firm expects to sell some old machinery for $7 000 in August. New machinery worth $9 500 will be purchased in September.

• The cash balance on 1st July 2017 is $5 700.

REQUIRED:

A)Prepare a schedule of receipts from accounts receivable showing the collections in the three months July to September.

B)Prepare a cash budget for Bluebird Ltd for the three months July to September.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

You are also given the following additional information:

You are also given the following additional information:• 35% of sales are cash sales, the remaining 65% credit sales are collected as follows:

• Sales in the months of May and June were $11 000 and $10 000 respectively.

• Sales in the months of May and June were $11 000 and $10 000 respectively.• Operating expenses include depreciation each month of $900. All expenses and purchases are paid for in the same month they are incurred.

• The firm expects to sell some old machinery for $7 000 in August. New machinery worth $9 500 will be purchased in September.

• The cash balance on 1st July 2017 is $5 700.

REQUIRED:

A)Prepare a schedule of receipts from accounts receivable showing the collections in the three months July to September.

B)Prepare a cash budget for Bluebird Ltd for the three months July to September.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

53

What does flexing the budget mean?

A)Revising the budget sales figure to match actual sales

B)Ignoring previously set targets

C)Revising the budget to reflect changes in management behaviour

D)Revising the original budget estimates to produce a budget based on the actual volume of activity

A)Revising the budget sales figure to match actual sales

B)Ignoring previously set targets

C)Revising the budget to reflect changes in management behaviour

D)Revising the original budget estimates to produce a budget based on the actual volume of activity

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

54

Use the information below to answer the following questions.

-Refer to the table above. The adverse (unfavourable)sales variance of $100 000 is best explained by:

A)a decrease in price of the units sold.

B)the sales manager failing to sell the budgeted units.

C)an increase in expenses.

D)None of the above

-Refer to the table above. The adverse (unfavourable)sales variance of $100 000 is best explained by:

A)a decrease in price of the units sold.

B)the sales manager failing to sell the budgeted units.

C)an increase in expenses.

D)None of the above

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

55

Use the information below to answer the following questions.

Patiomaster Products manufactures patio furniture. The estimated numbers of sets to be sold for the last three months of 2018 is:

Finished goods inventory at the end of September is 2 000 units. Finished goods inventory is set at 30 percent of next month's sales.

-Refer to the table above. How many sets of patio furniture will be produced in December 2018?

A)7 200 units

B)6 200 units

C)5 200 units

D)6 400 units

Patiomaster Products manufactures patio furniture. The estimated numbers of sets to be sold for the last three months of 2018 is:

Finished goods inventory at the end of September is 2 000 units. Finished goods inventory is set at 30 percent of next month's sales.

-Refer to the table above. How many sets of patio furniture will be produced in December 2018?

A)7 200 units

B)6 200 units

C)5 200 units

D)6 400 units

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

56

What is the calculation of closing inventory for a finished goods inventory budget?

A)(Opening balance plus inventories manufactured)less sales of finished goods

B)(Opening balance plus sales of finished goods)less inventories manufactured

C)(Opening balance plus inventories manufactured)plus cash sales of finished goods

D)None of the above

A)(Opening balance plus inventories manufactured)less sales of finished goods

B)(Opening balance plus sales of finished goods)less inventories manufactured

C)(Opening balance plus inventories manufactured)plus cash sales of finished goods

D)None of the above

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

57

Managements interest in variances is due to:

A)the need to gain the information that may assist them to put things back in control.

B)the desire to gain the maximum information.

C)the need to compensate employees.

D)the desire to check all details.

A)the need to gain the information that may assist them to put things back in control.

B)the desire to gain the maximum information.

C)the need to compensate employees.

D)the desire to check all details.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

58

Use the information below to answer the following questions.

Patiomaster Products manufactures patio furniture. The estimated numbers of sets to be sold for the last three months of 2018 is:

Finished goods inventory at the end of September is 2 000 units. Finished goods inventory is set at 30 percent of next month's sales.

-Refer to the table above. If a patio set costs $100 to produce, what will be the cost of sales in the budgeted statement of comprehensive income for the period October to December 2018?

A)$1 800 000

B)$1 900 000

C)$2 200 000

D)$1 500 000

Patiomaster Products manufactures patio furniture. The estimated numbers of sets to be sold for the last three months of 2018 is:

Finished goods inventory at the end of September is 2 000 units. Finished goods inventory is set at 30 percent of next month's sales.

-Refer to the table above. If a patio set costs $100 to produce, what will be the cost of sales in the budgeted statement of comprehensive income for the period October to December 2018?

A)$1 800 000

B)$1 900 000

C)$2 200 000

D)$1 500 000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

59

The debtor's budget shows the planned amount owing from credit sales. The closing balance of the accounts receivable account is calculated as follows:

A)(opening balance plus sales)less cash receipts.

B)(opening balance less sales)less cash receipts.

C)(opening balance less sales)plus cash receipts.

D)(opening balance plus sales)plus cash receipts.

A)(opening balance plus sales)less cash receipts.

B)(opening balance less sales)less cash receipts.

C)(opening balance less sales)plus cash receipts.

D)(opening balance plus sales)plus cash receipts.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

60

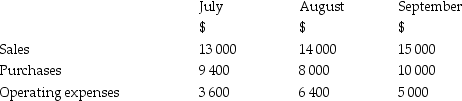

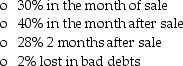

Records of Recycling Ltd contain the following data:

All sales are on credit. Records show that 80% of the customers pay during the month of the sale, 15% pay in the month after the sale, and the remaining 5% pay in the second month after the sale. Purchases are all paid the following month at a 1% discount. Cash disbursements for operating expenses in July were $8 000.

All sales are on credit. Records show that 80% of the customers pay during the month of the sale, 15% pay in the month after the sale, and the remaining 5% pay in the second month after the sale. Purchases are all paid the following month at a 1% discount. Cash disbursements for operating expenses in July were $8 000.

REQUIRED:

Prepare a cash budget for July.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

All sales are on credit. Records show that 80% of the customers pay during the month of the sale, 15% pay in the month after the sale, and the remaining 5% pay in the second month after the sale. Purchases are all paid the following month at a 1% discount. Cash disbursements for operating expenses in July were $8 000.

All sales are on credit. Records show that 80% of the customers pay during the month of the sale, 15% pay in the month after the sale, and the remaining 5% pay in the second month after the sale. Purchases are all paid the following month at a 1% discount. Cash disbursements for operating expenses in July were $8 000.REQUIRED:

Prepare a cash budget for July.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

61

Use the information below to answer the following questions.

-Refer to the table above. The raw materials variance can best be described as:

A)an adverse variance resulting from a rise in the price of raw materials.

B)an adverse variance resulting from excessive use of raw materials and/or an increase in their price.

C)an adverse variance resulting from excessive use of raw materials.

D)a favourable variance resulting from efficient use of raw materials.

-Refer to the table above. The raw materials variance can best be described as:

A)an adverse variance resulting from a rise in the price of raw materials.

B)an adverse variance resulting from excessive use of raw materials and/or an increase in their price.

C)an adverse variance resulting from excessive use of raw materials.

D)a favourable variance resulting from efficient use of raw materials.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

62

If budgeted profit is $11 000, favourable variances are $3 100 and unfavourable variances are $7 450, actual profit (loss)is:

A)$21 550 profit.

B)$15 350 profit.

C)($450)loss.

D)$6 650 profit.

A)$21 550 profit.

B)$15 350 profit.

C)($450)loss.

D)$6 650 profit.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

63

Where there is an insignificant adverse variance, management is best advised to:

A)ignore it, as the cost of investigation may outweigh the benefit.

B)investigate immediately and in full detail.

C)keep the variance under review.

D)ignore it, as it may be compensated by an insignificant favourable variance.

A)ignore it, as the cost of investigation may outweigh the benefit.

B)investigate immediately and in full detail.

C)keep the variance under review.

D)ignore it, as it may be compensated by an insignificant favourable variance.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

64

The adverse (unfavourable)variance is:

A)budgeted payment for rent $12 000, actual rent $11 500.

B)budgeted payment for interest $1 000, actual interest $1 000.

C)budgeted payment for wages $42 000, actual wages $45 000.

D)budgeted receipts from accounts receivable $60 000, actual receipts $65 000.

A)budgeted payment for rent $12 000, actual rent $11 500.

B)budgeted payment for interest $1 000, actual interest $1 000.

C)budgeted payment for wages $42 000, actual wages $45 000.

D)budgeted receipts from accounts receivable $60 000, actual receipts $65 000.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

65

An adverse (unfavourable)labour efficiency variance could be caused by:

A)a drop in production.

B)an increase in the hourly wage rate.

C)machine breakdowns.

D)All of the above

A)a drop in production.

B)an increase in the hourly wage rate.

C)machine breakdowns.

D)All of the above

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following could not be a possible cause of an adverse (unfavourable)materials usage variance?

A)Faulty machinery

B)Poor quality materials

C)An increase in the price of the raw materials

D)Inexperienced workers

A)Faulty machinery

B)Poor quality materials

C)An increase in the price of the raw materials

D)Inexperienced workers

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

67

The reconciliation between budgeted profit and actual profit can be summarised as:

A)budgeted profit minus all favourable variances plus all adverse variances equals actual profit.

B)actual profit plus all favourable variances plus all adverse variances equals budgeted profit.

C)actual profit plus all favourable variances minus all adverse variance equals budgeted profit.

D)budgeted profit plus all favourable variances minus all adverse variance equals actual profit.

A)budgeted profit minus all favourable variances plus all adverse variances equals actual profit.

B)actual profit plus all favourable variances plus all adverse variances equals budgeted profit.

C)actual profit plus all favourable variances minus all adverse variance equals budgeted profit.

D)budgeted profit plus all favourable variances minus all adverse variance equals actual profit.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

68

The variances which management should investigate each month are:

A)only favourable variances.

B)only adverse (unfavourable)variances.

C)all variances.

D)all variances management deems significant.

A)only favourable variances.

B)only adverse (unfavourable)variances.

C)all variances.

D)all variances management deems significant.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following could be the cause of a favourable materials price variance?

A)The price of materials in the original budget was set too high

B)A discount on the purchase of materials

C)Well-trained production workers

D)Both A and B

A)The price of materials in the original budget was set too high

B)A discount on the purchase of materials

C)Well-trained production workers

D)Both A and B

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

70

What variance does the difference between the actual cost of the direct labour hours worked and the planned cost of the direct labour hours measure?

A)The direct labour efficiency variance

B)The direct labour rate variance

C)The total direct labour variance

D)None of the above

A)The direct labour efficiency variance

B)The direct labour rate variance

C)The total direct labour variance

D)None of the above

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

71

The change in the price of raw materials multiplied by the actual materials bought calculates which variance?

A)Materials price variance

B)Sales price variance

C)Materials usage variance

D)Labour price variance

A)Materials price variance

B)Sales price variance

C)Materials usage variance

D)Labour price variance

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

72

If actual sales are $96 000 and budgeted sales are $87 000 and actual advertising paid is $6 100 and budgeted advertising is $7 300, the variances are respectively are: Note: F - Favourable, U - Unfavourable (adverse).

A)$9 000F; $1 200U

B)$9 000U; $1 200U

C)$9 000F; $1 200F

D)$9 000U; $1 200F

A)$9 000F; $1 200U

B)$9 000U; $1 200U

C)$9 000F; $1 200F

D)$9 000U; $1 200F

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

73

If actual income is $48 500 and budgeted income is $56 000 and actual utilities is $5 000 and budgeted utilities is $5 500, the variances are respectively: Note: F - Favourable, U - Unfavourable (adverse).

A)$7 500F; $500F

B)$7 500F; $500U

C)$7 500U; $500F

D)$7 500U; $500U

A)$7 500F; $500F

B)$7 500F; $500U

C)$7 500U; $500F

D)$7 500U; $500U

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

74

The total direct materials variance is best explained by:

A)the variance cannot be explained unless the budget is flexed to actual production.

B)better use of materials by the production manager.

C)a change in price of the raw materials.

D)the production manager failing to control the material usage.

A)the variance cannot be explained unless the budget is flexed to actual production.

B)better use of materials by the production manager.

C)a change in price of the raw materials.

D)the production manager failing to control the material usage.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

75

Where there is a significant favourable variance management is best advised to:

A)ignore it, because it does not cause immediate concern.

B)investigate, because it may mean that targets are unrealistically low.

C)investigate it to find out why things are not going according to plan.

D)Both B and C

A)ignore it, because it does not cause immediate concern.

B)investigate, because it may mean that targets are unrealistically low.

C)investigate it to find out why things are not going according to plan.

D)Both B and C

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

76

Which of these is not a limitation of the traditional approach to control through budgets?

A)The difficulty of separating the causes of variances into controllable or uncontrollable factors

B)The difficulty of creating clear lines of demarcation between areas of responsibility of various managers

C)The expense of preparing a budget is too great for the average business

D)None of the above, i.e., all are limitations

A)The difficulty of separating the causes of variances into controllable or uncontrollable factors

B)The difficulty of creating clear lines of demarcation between areas of responsibility of various managers

C)The expense of preparing a budget is too great for the average business

D)None of the above, i.e., all are limitations

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

77

Prepare a flexible cost budget for 8 000, 9 000 and 10 000 units of output, given the following data:

Variable costs:

Budgeted fixed manufacturing overhead $90 000.

Budgeted fixed manufacturing overhead $90 000.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

Variable costs:

Budgeted fixed manufacturing overhead $90 000.

Budgeted fixed manufacturing overhead $90 000._____________________________________________________________________________________________

_____________________________________________________________________________________________

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

78

Use the information below to answer the following questions.

-Refer to the table above. The labour variance can best be described as:

A)an adverse variance resulting from excessive use of labour and/or a rise in the hourly rate of pay.

B)a favourable variance resulting from the efficient use of labour and/or a reduction in the hourly pay rate.

C)being caused by an increase in the pay rate for labour.

D)being caused by more efficient labour.

-Refer to the table above. The labour variance can best be described as:

A)an adverse variance resulting from excessive use of labour and/or a rise in the hourly rate of pay.

B)a favourable variance resulting from the efficient use of labour and/or a reduction in the hourly pay rate.

C)being caused by an increase in the pay rate for labour.

D)being caused by more efficient labour.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

79

The original budget was set at 15 000 units and estimated variable overheads at $345 000 ($23 per unit). If actual output is 16 000 units, calculate the variable overhead total and unit cost that would be shown in a budget flexed to actual output.

A)$345 000; $23

B)$361 000; $23.50

C)$345 000; $22.50

D)$368 000; $23

A)$345 000; $23

B)$361 000; $23.50

C)$345 000; $22.50

D)$368 000; $23

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

80

Budget targets should be:

A)achievable.

B)easy.

C)challenging and achievable.

D)loose and achievable.

A)achievable.

B)easy.

C)challenging and achievable.

D)loose and achievable.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck