Deck 2: Recording Business Transactions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

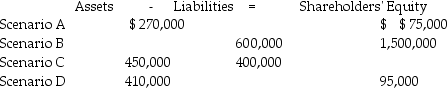

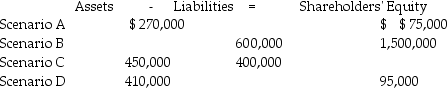

Question

Question

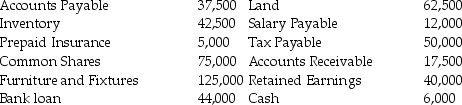

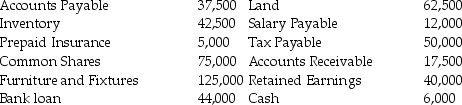

Question

Question

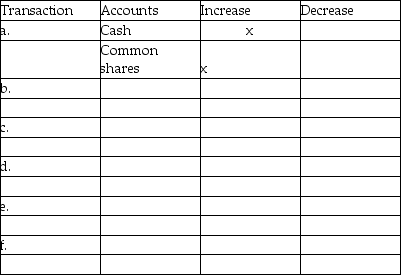

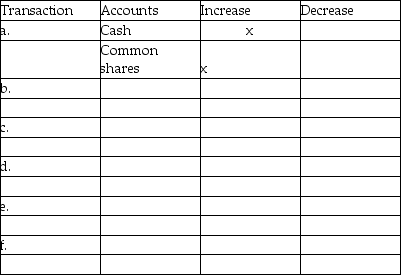

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

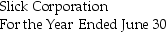

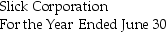

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/164

Play

Full screen (f)

Deck 2: Recording Business Transactions

1

Borrowing money from the bank by signing a note payable would:

A) increase shareholders' equity

B) increase net income

C) decrease liabilities

D) have no effect on shareholders' equity

A) increase shareholders' equity

B) increase net income

C) decrease liabilities

D) have no effect on shareholders' equity

D

2

The payment of an amount owed to a creditor would:

A) increase assets

B) increase liabilities

C) decrease net income

D) decrease liabilities

A) increase assets

B) increase liabilities

C) decrease net income

D) decrease liabilities

D

3

Which of the following business events may not be recorded in a company's general ledger?

A) The company paid each of its employees a Christmas bonus.

B) The company issued 100 shares of common stock.

C) The company purchased two acres of land for future plant expansion.

D) A lawsuit has been filed by one of the company's customers (against the company).

A) The company paid each of its employees a Christmas bonus.

B) The company issued 100 shares of common stock.

C) The company purchased two acres of land for future plant expansion.

D) A lawsuit has been filed by one of the company's customers (against the company).

D

4

Note payable, accounts payable, and salary payable are all examples of:

A) assets

B) revenue

C) expenses

D) liabilities

A) assets

B) revenue

C) expenses

D) liabilities

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

5

Purchasing supplies and paying cash for them would:

A) increase total assets

B) decrease total assets

C) have no effect on total assets

D) increase total liabilities and shareholders' equity

A) increase total assets

B) decrease total assets

C) have no effect on total assets

D) increase total liabilities and shareholders' equity

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

6

A balance sheet is organized in order of the accounting equation, with liabilities first, followed by assets and shareholders' equity.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

7

The purchase of land for cash would:

A) increase total assets

B) decrease shareholders' equity

C) increase the total debits on the trial balance

D) not affect the total of debits or credits on the trial balance

A) increase total assets

B) decrease shareholders' equity

C) increase the total debits on the trial balance

D) not affect the total of debits or credits on the trial balance

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

8

Dividends paid to the shareholders when declared will:

A) increase assets and decrease liabilities

B) decrease assets and increase liabilities

C) have no effect on shareholders' equity

D) decrease assets and decrease shareholders' equity

A) increase assets and decrease liabilities

B) decrease assets and increase liabilities

C) have no effect on shareholders' equity

D) decrease assets and decrease shareholders' equity

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

9

The collection of cash from a customer on account would:

A) increase net income and shareholders' equity

B) increase assets and decrease liabilities

C) increase assets and increase net income

D) have no effect on net income or shareholders' equity

A) increase net income and shareholders' equity

B) increase assets and decrease liabilities

C) increase assets and increase net income

D) have no effect on net income or shareholders' equity

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

10

A transaction involving the cash purchase of equipment will decrease one asset account and increase another asset account.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

11

Performing services on account would:

A) increase assets and liabilities

B) increase assets and decrease shareholders' equity

C) increase revenue and decrease shareholders' equity

D) increase net income and shareholders' equity

A) increase assets and liabilities

B) increase assets and decrease shareholders' equity

C) increase revenue and decrease shareholders' equity

D) increase net income and shareholders' equity

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

12

An owner investment of a building, valued at $100,000 with an $80,000 outstanding mortgage, transferring this asset into the business would:

A) increase assets by $20,000

B) increase assets by $80,000

C) increase shareholders' equity by $20,000

D) increase shareholders' equity by $100,000

A) increase assets by $20,000

B) increase assets by $80,000

C) increase shareholders' equity by $20,000

D) increase shareholders' equity by $100,000

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

13

When a company performs a service and immediately collects the cash from the customer, which of the following would occur?

A) Net income would increase.

B) Expenses would decrease.

C) Assets would decrease.

D) Shareholders' equity would decrease.

A) Net income would increase.

B) Expenses would decrease.

C) Assets would decrease.

D) Shareholders' equity would decrease.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

14

All of the following accounts would be considered assets except for:

A) Cash

B) Common Shares

C) Prepaid Expenses

D) Notes Receivable

A) Cash

B) Common Shares

C) Prepaid Expenses

D) Notes Receivable

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

15

A balance sheet is a required financial statement that reports the financial position of the company as of a given day in time.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

16

Receiving a payment from a customer on account would:

A) have no effect on shareholders' equity

B) increase net income

C) increase shareholders' equity

D) increase liabilities

A) have no effect on shareholders' equity

B) increase net income

C) increase shareholders' equity

D) increase liabilities

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

17

The costs of operating a business are usually called:

A) expenses

B) liabilities

C) assets

D) revenues

A) expenses

B) liabilities

C) assets

D) revenues

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

18

The payment of salaries to employees when earned would:

A) increase assets

B) increase net income

C) increase liabilities

D) decrease shareholders' equity

A) increase assets

B) increase net income

C) increase liabilities

D) decrease shareholders' equity

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

19

What type of account is Prepaid Rent?

A) a liability

B) an expense

C) shareholders' equity

D) an asset

A) a liability

B) an expense

C) shareholders' equity

D) an asset

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

20

Paying a utility bill when received would:

A) increase expenses

B) increase liabilities

C) increase owners' equity

D) decrease revenues

A) increase expenses

B) increase liabilities

C) increase owners' equity

D) decrease revenues

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

21

For each of the following independent scenarios, fill in the blanks with the appropriate dollar amount.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

22

The accounting transaction to record payment of the heating bill would include a:

A) debit to Cash

B) credit to Accounts Payable

C) debit to Utilities Expense

D) debit to Accounts Receivable

A) debit to Cash

B) credit to Accounts Payable

C) debit to Utilities Expense

D) debit to Accounts Receivable

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

23

The following is a summary of the balance sheet accounts for Betty's Bacon Inc. Organize the accounts into Betty's Bacon's Balance Sheet.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

24

An owner makes an investment of cash into the business. Such a transaction would include a:

A) debit to Common shares

B) credit to Cash

C) debit to Cash

D) debit to Accounts Receivable

A) debit to Common shares

B) credit to Cash

C) debit to Cash

D) debit to Accounts Receivable

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

25

Analyze the following transactions. Indicate which accounts are affected and whether they will increase or decrease. Transaction (a) is completed as an example.

a. Owner investment of cash into the business.

b. Payment of a utility bill.

c. Purchase of inventory for cash.

d. Payment of an accounts payable.

e. Performing a service on account.

f. Collecting cash from a customer as payment on his account.

a. Owner investment of cash into the business.

b. Payment of a utility bill.

c. Purchase of inventory for cash.

d. Payment of an accounts payable.

e. Performing a service on account.

f. Collecting cash from a customer as payment on his account.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

26

The account called Accrued Liabilities is really an expense account and not a liability account.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

27

The entry to record the purchase of supplies on account would include a:

A) credit to the Accounts Payable account

B) debit to the Retained Earnings account

C) credit to the Cash account

D) credit to the Supplies account

A) credit to the Accounts Payable account

B) debit to the Retained Earnings account

C) credit to the Cash account

D) credit to the Supplies account

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

28

List the types of accounts that appear on the income statement. List the types of accounts that appear on the balance sheet.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

29

The purchase of office equipment for cash would include a:

A) debit to Cash

B) debit to Office Equipment

C) credit to Accounts Payable

D) credit to Office Equipment

A) debit to Cash

B) debit to Office Equipment

C) credit to Accounts Payable

D) credit to Office Equipment

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

30

A business purchases a truck by signing a note payable to the seller. Such a transaction would include a:

A) credit to Truck

B) debit to Note Payable

C) credit to Note Payable

D) debit to an expense account

A) credit to Truck

B) debit to Note Payable

C) credit to Note Payable

D) debit to an expense account

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

31

The retained earnings account represents the money invested by shareholders into the business since its inception.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

32

Notes Payable is a typical example of a liability account.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

33

Prepare a Statement of Retained Earnings for the year ended June 30, 2014.

Chedacorn was incorporated on July 1, 2012 by 10 shareholders who each invested $100,000 in cash in exchange for common shares. Chedacorn's year end is June 30th. In its first year of business Chedacorn had a net income of $243,750. For its years ended June 30, 2013 and 2014, its second and third years of operation, Chedacorn reported net income of $472,500 and $560,000 respectively. In its first year Chedacorn did not pay any dividends, but in fiscal 2013 it paid $62,500 in dividends and in 2014 it paid $100,000 in dividends.

Chedacorn was incorporated on July 1, 2012 by 10 shareholders who each invested $100,000 in cash in exchange for common shares. Chedacorn's year end is June 30th. In its first year of business Chedacorn had a net income of $243,750. For its years ended June 30, 2013 and 2014, its second and third years of operation, Chedacorn reported net income of $472,500 and $560,000 respectively. In its first year Chedacorn did not pay any dividends, but in fiscal 2013 it paid $62,500 in dividends and in 2014 it paid $100,000 in dividends.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

34

Credits to revenue accounts ultimately result in:

A) a decrease in owners' equity

B) an increase in owners' equity

C) a decrease in assets

D) an increase in liabilities

A) a decrease in owners' equity

B) an increase in owners' equity

C) a decrease in assets

D) an increase in liabilities

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

35

Slick Corporation has summarized financial statements as shown below. Fill in the blank areas to complete the financial statements. Begin in 2012 and move forward from there.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

36

The right side of a T-account is always the:

A) increase side

B) credit side

C) debit side

D) decrease side

A) increase side

B) credit side

C) debit side

D) decrease side

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

37

What criteria are used to determine if a transaction has occurred?

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

38

The purchase of office equipment on account would increase an asset and decrease a liability account.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

39

The accounting transaction to record payment of the advertising bill would include a:

A) debit to Cash

B) credit to Accounts Payable

C) debit to Advertising Expense

D) debit to Accounts Receivable

A) debit to Cash

B) credit to Accounts Payable

C) debit to Advertising Expense

D) debit to Accounts Receivable

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

40

Explain the following terms in your own words and give an example of each for Humpty's Equipment Inc.

a. asset

b. liability

c. shareholders' equity

d. dividend

e. revenue

f. expense

a. asset

b. liability

c. shareholders' equity

d. dividend

e. revenue

f. expense

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

41

Receiving cash from a customer on account would include a:

A) debit to Accounts Receivable and a credit to Cash

B) debit to Cash and a credit to Accounts Payable

C) debit to Accounts Payable and a credit to Cash

D) debit to Cash and a credit to Accounts Receivable

A) debit to Accounts Receivable and a credit to Cash

B) debit to Cash and a credit to Accounts Payable

C) debit to Accounts Payable and a credit to Cash

D) debit to Cash and a credit to Accounts Receivable

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

42

The purchase of office furniture on account (that is, on credit) would include a:

A) credit to Accounts Payable

B) credit to Office Furniture

C) debit to Accounts Receivable

D) credit to Cash

A) credit to Accounts Payable

B) credit to Office Furniture

C) debit to Accounts Receivable

D) credit to Cash

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

43

The purchase of an automobile with a cash down payment and a written promise to pay the balance in the future would include a:

A) credit to Cash and a credit to Note Payable

B) debit to Cash and a credit to Automobile

C) debit to Note Payable and a credit to Cash

D) debit to Cash and a debit to Note Payable

A) credit to Cash and a credit to Note Payable

B) debit to Cash and a credit to Automobile

C) debit to Note Payable and a credit to Cash

D) debit to Cash and a debit to Note Payable

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

44

Making a cash payment to settle a debt would include a:

A) debit to Cash and a credit to Accounts Receivable

B) debit to Accounts Receivable and a credit to Cash

C) debit to Accounts Payable and a credit to Cash

D) debit to Accounts Payable and a credit to Accounts Receivable

A) debit to Cash and a credit to Accounts Receivable

B) debit to Accounts Receivable and a credit to Cash

C) debit to Accounts Payable and a credit to Cash

D) debit to Accounts Payable and a credit to Accounts Receivable

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

45

The accounting transaction to record payment of the telephone bill would include a:

A) credit to Cash

B) credit to Accounts Payable

C) credit to Utilities Expense

D) debit to Accounts Receivable

A) credit to Cash

B) credit to Accounts Payable

C) credit to Utilities Expense

D) debit to Accounts Receivable

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following statements regarding accounts is false?

A) An asset is increased by a debit and decreased by a credit.

B) Revenue is increased by a debit and an expense is increased by a credit.

C) A liability is decreased by a debit and increased by a credit.

D) Revenue is increased by a credit and an expense is increased by a debit.

A) An asset is increased by a debit and decreased by a credit.

B) Revenue is increased by a debit and an expense is increased by a credit.

C) A liability is decreased by a debit and increased by a credit.

D) Revenue is increased by a credit and an expense is increased by a debit.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

47

Receiving a cheque from a customer on account would include a:

A) debit to Accounts Receivable and a credit to Cash

B) debit to Cash and a credit to Accounts Payable

C) debit to Accounts Payable and a credit to Cash

D) debit to Cash and a credit to Accounts Receivable

A) debit to Accounts Receivable and a credit to Cash

B) debit to Cash and a credit to Accounts Payable

C) debit to Accounts Payable and a credit to Cash

D) debit to Cash and a credit to Accounts Receivable

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

48

The account credited when supplies are purchased on account is:

A) Cash

B) Supplies

C) Supplies Expense

D) Accounts Payable

A) Cash

B) Supplies

C) Supplies Expense

D) Accounts Payable

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following statements regarding accounts is true?

A) Assets are decreased by debits.

B) Expenses are decreased by debits.

C) Revenues are increased by debits.

D) Liabilities are decreased by debits.

A) Assets are decreased by debits.

B) Expenses are decreased by debits.

C) Revenues are increased by debits.

D) Liabilities are decreased by debits.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

50

Sending out a cheque to settle a debt would include a:

A) debit to Cash and a credit to Accounts Receivable

B) debit to Accounts Receivable and a credit to Cash

C) debit to Accounts Payable and a credit to Cash

D) debit to Accounts Payable and a credit to Accounts Receivable

A) debit to Cash and a credit to Accounts Receivable

B) debit to Accounts Receivable and a credit to Cash

C) debit to Accounts Payable and a credit to Cash

D) debit to Accounts Payable and a credit to Accounts Receivable

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

51

An owners' investment of land and a building into the business would include a:

A) debit to Land and a credit to Common shares

B) debit to Land and a credit to Building

C) debit to Common shares and a credit to Building

D) debit to Building and a debit to Common shares

A) debit to Land and a credit to Common shares

B) debit to Land and a credit to Building

C) debit to Common shares and a credit to Building

D) debit to Building and a debit to Common shares

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

52

The payment for rent of the office building for one month would include a:

A) debit to Cash

B) credit to Accounts Payable

C) debit to Rent Expense

D) credit to Revenue

A) debit to Cash

B) credit to Accounts Payable

C) debit to Rent Expense

D) credit to Revenue

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

53

The purchase of a building with a cash down payment and a written promise to pay the balance in the future would include a:

A) credit to Cash and a credit to Note Payable

B) debit to Cash and a credit to Buildings

C) debit to Note Payable and a credit to Cash

D) debit to Cash and a debit to Note Payable

A) credit to Cash and a credit to Note Payable

B) debit to Cash and a credit to Buildings

C) debit to Note Payable and a credit to Cash

D) debit to Cash and a debit to Note Payable

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

54

When the owner of a business invests cash into the business, which of the following accounts is debited?

A) Dividends

B) Cash

C) Common Shares

D) Accounts Receivable

A) Dividends

B) Cash

C) Common Shares

D) Accounts Receivable

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

55

Paying a dividend to the company's shareholders would include a:

A) debit to Cash and a credit to Dividends

B) debit to Dividends and a credit to Cash

C) debit to Retained Earnings and a credit to Dividends

D) debit to Accounts Payable and a credit to Retained Earnings

A) debit to Cash and a credit to Dividends

B) debit to Dividends and a credit to Cash

C) debit to Retained Earnings and a credit to Dividends

D) debit to Accounts Payable and a credit to Retained Earnings

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

56

When a business sells inventory in exchange for cash, which of the following accounts is credited?

A) Revenue

B) Cash

C) Owners' Equity

D) Accounts Payable

A) Revenue

B) Cash

C) Owners' Equity

D) Accounts Payable

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

57

Purchasing a three-year insurance policy for cash would include a:

A) debit to Cash and a credit to Accounts Receivable

B) debit to Insurance Expense and a credit to Dividends

C) debit to Prepaid Insurance and a credit to Accounts Payable

D) debit to Prepaid Insurance and a credit to Cash

A) debit to Cash and a credit to Accounts Receivable

B) debit to Insurance Expense and a credit to Dividends

C) debit to Prepaid Insurance and a credit to Accounts Payable

D) debit to Prepaid Insurance and a credit to Cash

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

58

Performing a service on account would include a:

A) debit to Cash

B) debit to Revenue

C) credit to Accounts Receivable

D) debit to Accounts Receivable

A) debit to Cash

B) debit to Revenue

C) credit to Accounts Receivable

D) debit to Accounts Receivable

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

59

The accounting transaction to record the payment of salaries to employees would include a:

A) credit to Salary Expense

B) debit to Accounts Payable

C) debit to Salary Expense

D) debit to Cash

A) credit to Salary Expense

B) debit to Accounts Payable

C) debit to Salary Expense

D) debit to Cash

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following accounts normally has a debit balance?

A) Dividends

B) Retained Earnings

C) Share capital

D) Revenue

A) Dividends

B) Retained Earnings

C) Share capital

D) Revenue

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

61

A credit decreases the balance of which types of accounts?

A) expenses and assets

B) liabilities and expenses

C) assets and liabilities

D) assets and shareholders' equity

A) expenses and assets

B) liabilities and expenses

C) assets and liabilities

D) assets and shareholders' equity

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

62

The purchase of a building with a down payment of cash and the signing of a note payable for the remainder would include a debit to both the asset Building, and a credit to the asset Cash and the liability Note Payable.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

63

A debit increases the balance of which types of accounts?

A) assets and liabilities

B) assets and expenses

C) liabilities and expenses

D) assets and shareholders' equity

A) assets and liabilities

B) assets and expenses

C) liabilities and expenses

D) assets and shareholders' equity

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

64

When a company purchases inventory on account (that is, on credit), which type of account is credited to record the transaction?

A) asset

B) expense

C) liability

D) owners' equity

A) asset

B) expense

C) liability

D) owners' equity

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

65

Expenses increase shareholders equity. That is why they are credits.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

66

An expense account is known as a contra equity account.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

67

A credit increases the balance of which types of accounts?

A) revenue and assets

B) liabilities and assets

C) liabilities and expenses

D) shareholders' equity and liabilities

A) revenue and assets

B) liabilities and assets

C) liabilities and expenses

D) shareholders' equity and liabilities

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

68

The right side of a T-account is always the debit side.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

69

The left side of a T-account is always the side that increases the balance of the account.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

70

Every accounting transaction involves an increase in at least one account and a decrease in at least one other account.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

71

A credit always decreases an asset account.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

72

Which type of account is credited when a company pays its employees?

A) an expense account

B) an asset account

C) a liability account

D) the owners' equity account

A) an expense account

B) an asset account

C) a liability account

D) the owners' equity account

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

73

A dividend account is known as a contra equity account.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

74

Assets, owners' equity, and expenses are all increased by debits.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

75

The account credited when cash is received from a customer on account is:

A) Cash

B) Accounts Payable

C) Revenue

D) Accounts Receivable

A) Cash

B) Accounts Payable

C) Revenue

D) Accounts Receivable

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

76

The payment of the owner's personal expenses from the business's chequebook should be recorded with a debit to:

A) Cash

B) Dividends

C) Common shares

D) Accounts Receivable

A) Cash

B) Dividends

C) Common shares

D) Accounts Receivable

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

77

The purchase of office supplies for cash would include a debit to the asset Office Supplies and a credit to the asset Cash.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

78

Which type of account is credited when a company records a debt?

A) expense

B) retained earnings

C) liability

D) asset

A) expense

B) retained earnings

C) liability

D) asset

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

79

Every transaction affects at least two accounts.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck

80

The Dividends account normally has a debit balance.

Unlock Deck

Unlock for access to all 164 flashcards in this deck.

Unlock Deck

k this deck