Deck 8: Consolidated Tax Returns

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/145

Play

Full screen (f)

Deck 8: Consolidated Tax Returns

1

A consolidated Federal income tax group must meet the eligibility requirements of the Regulations only on the first day of the first year for which the election to consolidate is effective.

False

2

A consolidated Federal income tax return may be the product of a merger of the affiliates, or of some other tax-favored reorganization.

True

3

A Federal consolidated group can claim a dividends received deduction for payments that the parent receives from other affiliates.

False

4

The calendar-year Sterling Group files its Federal corporate income tax return on a consolidated basis. Its Form 1120 is due on March 15, or September 15 if an extended due date is approved by the IRS.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

5

The rules for computing Federal consolidated taxable income can differ a significant way from those governing financial reporting for conglomerates.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

6

The right to file on a consolidated basis is available to a group of corporations when they constitute a "parent-subsidiary affiliated group."

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

7

Campbell Corporation left the Crane consolidated tax return group after the calendar 2011 tax year. Crane can add Campbell back to the consolidated group, but no earlier than for the 2017 tax year.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

8

For consolidated tax return purposes, goodwill is amortized as a deduction to taxable income. Under financial accounting rules, no such amortization is allowed.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

9

When the parent acquires 51% of a subsidiary U.S. corporation, the subsidiary can join the consolidated financial statements, but not the consolidated tax return of the parent.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

10

A wholly owned LLC can join the parent's consolidated group for book, but not for tax, purposes.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

11

A joint venture, taxed like a partnership, can join in a consolidated Federal income tax return.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

12

A C corporation must leave the consolidated group if it is restructured as an LLC.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

13

Tax incentives constitute the primary motivation for most corporations to form a conglomerate and file tax and financial accounting reports on a consolidated basis.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

14

A group's election to file consolidated Federal corporate income tax returns must be made by the extended due date of the first return on which the consolidation is applied.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

15

Most of the Federal consolidated income tax return rules are found in detailed sections of the Internal Revenue Code.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

16

A tax-exempt hospital cannot join in a consolidated return.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

17

Over time, the consolidated return rules have shifted from penalizing joint filing to allowing a tax-neutral means by which to elect to file on a consolidated basis.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

18

A corporation organized outside of the U.S. can be included in a Federal consolidated return.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

19

After a takeover, the parent takes a fair market value cost basis in the subsidiary, for both book and tax purposes.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

20

In an affiliated group, the parent must own at least 50 percent of each of the subsidiaries.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

21

In computing consolidated E & P, dividends paid to the parent by group members are ignored.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

22

When the net accumulated taxable losses of a subsidiary exceed the parent's acquisition price, the parent's basis in the subsidiary's stock becomes negative.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

23

Keep Corporation joined an affiliated group by merger. The group generated a 2011 consolidated NOL, and Keep's share of the loss was $50,000. Keep's share of the loss is included in the group's NOL carryforward to 2012.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

24

In computing consolidated taxable income, § 1231 gains and losses are removed from the taxable incomes of the group members and determined on a group basis.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

25

Consolidated group members each must use the same tax year end.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

26

Keep Corporation joined an affiliated group by merger in 2011. The group generated a consolidated 2011 NOL, and Keep's share of the loss was $50,000. Lacking an election by the parent to the contrary, Keep can carry the loss back to its separate 2009 return, and the parent can claim a tax refund.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

27

A Federal consolidated tax return group commonly applies the "relative tax liability" method as a means to apportion the tax liabilities of the members among the affiliates.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

28

Lacking elections to the contrary, Federal consolidated NOLs are carried back two years and then forward twenty years.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

29

In computing consolidated E & P, a negative adjustment is allowed for the group's Federal income tax payments.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

30

When a subsidiary sells to the parent some business-use property that has appreciated from its $20,000 basis to a $50,000 fair market value, the subsidiary immediately recognizes $30,000 ordinary income on the consolidated return.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

31

With the filing of its first consolidated return, a Federal consolidated group makes an irrevocable election as to how it will allocate a tax year's income tax liability among the group members.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

32

The starting point in computing consolidated taxable income is the separate Federal taxable income amounts of the affiliated group members.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

33

If subsidiary stock is redeemed or sold outside the group when an excess loss account exists, the selling parent corporation recognizes capital gain income equal to the account balance.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

34

Each of the members of a Federal consolidated tax return group can claim its own $40,000 AMT exemption, subject to phase-out.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

35

In computing consolidated taxable income, cost of goods sold is removed from the taxable incomes of the group members and determined on a group basis.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

36

In computing consolidated taxable income, the domestic production activities deduction (DPAD) is removed from the taxable incomes of the group members and determined on a group basis.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

37

An example of an intercompany transaction is the use of the financial accounting software of the parent corporation by a subsidiary for an arm's length management fee.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

38

When a consolidated NOL is generated, each affiliate is allocated a share of the loss.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

39

Consolidated group members each are jointly and severally liable for the entire consolidated income tax liability.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

40

All affiliates joining in a newly formed consolidated return must consent to the election on Form 1122, as attached to the tax return for the group.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following potentially is a disadvantage of electing to file a Federal corporate income tax consolidated return?

A) Additional administrative costs in complying with the election.

B) Deferral of gains realized in transactions between group members.

C) Increased basis in the stock of a subsidiary that generates annual taxable income.

D) Dividends received deduction for payments from a subsidiary to the group's parent.

A) Additional administrative costs in complying with the election.

B) Deferral of gains realized in transactions between group members.

C) Increased basis in the stock of a subsidiary that generates annual taxable income.

D) Dividends received deduction for payments from a subsidiary to the group's parent.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following tax effects becomes more restrictive if an election is made to file a group's Federal corporate income tax returns on a consolidated basis?

A) Choice of members' tax year ends.

B) Use of the lower tax rate brackets.

C) Use of the $40,000 AMT exemption.

D) Choice of members' tax accounting methods

A) Choice of members' tax year ends.

B) Use of the lower tax rate brackets.

C) Use of the $40,000 AMT exemption.

D) Choice of members' tax accounting methods

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

43

Cooper Corporation joined the Duck consolidated Federal income tax return group, when Cooper held a $1 million NOL carryforward. In its first year as a part of the Duck group, Cooper generated a $150,000 NOL. For that year, Duck can deduct only $150,000 of Cooper's NOL in computing consolidated taxable income.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

44

Cooper Corporation joined the Duck consolidated Federal income tax return group, when Cooper held a $1 million NOL carryforward. In its first year as a part of the Duck group, Cooper generated a $150,000 taxable profit. For that year, Duck can deduct up to $150,000 of Cooper's NOL in computing consolidated taxable income.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

45

When a member departs a consolidated group, it forfeits the use of any NOLs it generated while in the group.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

46

The losses of a consolidated group member are subject to both the SRLY rules and a § 382 limitation. When both limitations apply, the SRLY rules override the § 382 restrictions for this affiliate.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following potentially is a disadvantage of electing to file a Federal consolidated corporate income tax return?

A) Recognition of losses from certain intercompany transactions is deferred.

B) The taxation of intercompany dividends is not eliminated.

C) The tax basis of investments in the stock of subsidiaries is unaffected by members contributing to consolidated taxable income.

D) The § 1231 loss of one member is not offset against the § 1231 gain of another member of the group.

A) Recognition of losses from certain intercompany transactions is deferred.

B) The taxation of intercompany dividends is not eliminated.

C) The tax basis of investments in the stock of subsidiaries is unaffected by members contributing to consolidated taxable income.

D) The § 1231 loss of one member is not offset against the § 1231 gain of another member of the group.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

48

An affiliated group aggregates its separate charitable contributions, deductions for which then are subject to an annual limitation of 10% of consolidated taxable income.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

49

The domestic production activities deduction of a consolidated group can be greater than the sum of the deductions of the group members when filing separately.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

50

Conformity among the members of a consolidated group must be implemented for which of the following tax items?

A) Use of foreign tax payments (i.e., as a credit or deduction).

B) Tax accounting method (i.e., cash or accrual).

C) Inventory accounting method (e.g., FIFO or LIFO).

D) Election to claim the § 179 depreciation expensing amount.

E) Tax year end.

A) Use of foreign tax payments (i.e., as a credit or deduction).

B) Tax accounting method (i.e., cash or accrual).

C) Inventory accounting method (e.g., FIFO or LIFO).

D) Election to claim the § 179 depreciation expensing amount.

E) Tax year end.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following is not a requirement that must be met before a group files a consolidated return?

A) None of the corporations can be ineligible under the Code to file on a consolidated basis with the others.

B) All of the corporations must be members of an affiliated group.

C) None of the group members can use the LIFO method of accounting for inventories.

D) The group members must share a common tax year end.

A) None of the corporations can be ineligible under the Code to file on a consolidated basis with the others.

B) All of the corporations must be members of an affiliated group.

C) None of the group members can use the LIFO method of accounting for inventories.

D) The group members must share a common tax year end.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

52

The Rub, Sal, and Ton Corporations file Federal income tax returns on a consolidated basis. The group's tax return currently is under audit. Under a valid tax-sharing agreement, each corporation is liable for one-third of the group's consolidated tax liability. The affiliates have agreed with the auditor that the group's unpaid liability for the year is $90,000. Because of an incorrect tax return position, another $3,000 in interest and a $1,800 penalty is attributable solely to Ton. At present, only Rub is solvent and has the cash with which to make such a tax payment. What is the maximum amount for which the government could be successful in forcing Rub to satisfy the outstanding liabilities of the consolidated group?

A) $4,800.

B) $90,000.

C) $91,800.

D) $93,000.

E) $94,800.

A) $4,800.

B) $90,000.

C) $91,800.

D) $93,000.

E) $94,800.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

53

Members of a controlled group share all but which of the following tax attributes?

A) The lower tax rates on the first $75,000 of taxable income.

B) The tax accounting inventory method used by the members.

C) The $40,000 AMT exemption.

D) The floor on the accumulated earnings credit.

A) The lower tax rates on the first $75,000 of taxable income.

B) The tax accounting inventory method used by the members.

C) The $40,000 AMT exemption.

D) The floor on the accumulated earnings credit.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

54

How must the IRS collect the liability for Federal taxes from among a consolidated group?

A) Against the parent of the group.

B) According to the members' relative net asset holdings.

C) According to the members' current internal tax-sharing agreement.

D) Against the member of the group that generated the tax.

E) No particular order of collection is prescribed by IRS rules.

A) Against the parent of the group.

B) According to the members' relative net asset holdings.

C) According to the members' current internal tax-sharing agreement.

D) Against the member of the group that generated the tax.

E) No particular order of collection is prescribed by IRS rules.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following is eligible to join in a Federal consolidated return?

A) A sole proprietor with annual sales of more than $50 million.

B) A U.S. corporation's § 401(k) plan.

C) A partnership organized in Germany.

D) A corporation that operates in seven different U.S. states.

A) A sole proprietor with annual sales of more than $50 million.

B) A U.S. corporation's § 401(k) plan.

C) A partnership organized in Germany.

D) A corporation that operates in seven different U.S. states.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

56

How do the members of a consolidated group split among themselves the benefits of the lower tax brackets on the first $75,000 of taxable income?

A) According to their relative net asset holdings.

B) According to an internal tax-sharing agreement.

C) According to an internal tax-sharing agreement, which may be modified by the IRS upon audit.

D) According to a tax-sharing agreement that must be approved by the IRS by the end of the first quarter of the tax year.

A) According to their relative net asset holdings.

B) According to an internal tax-sharing agreement.

C) According to an internal tax-sharing agreement, which may be modified by the IRS upon audit.

D) According to a tax-sharing agreement that must be approved by the IRS by the end of the first quarter of the tax year.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

57

A penalty can be assessed by the IRS if the parent corporation does not keep good records to support the computation of a subsidiary's stock basis.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

58

How are the members of a Federal consolidated group affected by computations related to E & P?

A) E & P is computed solely on a consolidated basis.

B) Each member keeps its own E & P account.

C) Members' E & P balances are frozen as long as the consolidation election is in place.

D) Consolidated E & P is computed as the sum of the E & P balances of each of the group members.

A) E & P is computed solely on a consolidated basis.

B) Each member keeps its own E & P account.

C) Members' E & P balances are frozen as long as the consolidation election is in place.

D) Consolidated E & P is computed as the sum of the E & P balances of each of the group members.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following is not generally a disadvantage of filing Federal corporate income tax returns on a consolidated basis?

A) Compliance costs usually are higher when a consolidation election is in effect.

B) Realized losses from transactions between affiliates are not recognized immediately.

C) Capital gains from one affiliate can be offset by the capital losses from another. This can reduce the tax liabilities of the group as a whole.

D) The election generally is binding for future tax years.

A) Compliance costs usually are higher when a consolidation election is in effect.

B) Realized losses from transactions between affiliates are not recognized immediately.

C) Capital gains from one affiliate can be offset by the capital losses from another. This can reduce the tax liabilities of the group as a whole.

D) The election generally is binding for future tax years.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following is eligible to file Federal income tax returns on a consolidated basis?

A) U.S. corporation engaged in the oil and gas industry.

B) Japanese corporation engaged in multinational operations, including two-thirds of its activities in the U.S.

C) Japanese corporation engaged in multinational operations, including one-third of its activities in the U.S.

D) Limited liability company operating exclusively in Texas.

A) U.S. corporation engaged in the oil and gas industry.

B) Japanese corporation engaged in multinational operations, including two-thirds of its activities in the U.S.

C) Japanese corporation engaged in multinational operations, including one-third of its activities in the U.S.

D) Limited liability company operating exclusively in Texas.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

61

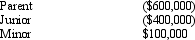

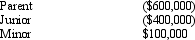

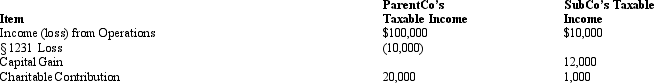

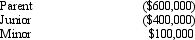

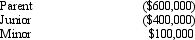

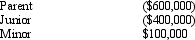

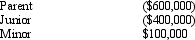

The Philstrom consolidated group reported the following taxable income amounts. Parent owns all of the stock of both Junior and Minor. Determine the net operating loss (NOL) that is apportioned to Minor.

A) $0. Minor did not report an NOL of its own.

B) $0. All NOLs of a consolidated group are apportioned to the parent.

C) $100,000.

D) $300,000.

A) $0. Minor did not report an NOL of its own.

B) $0. All NOLs of a consolidated group are apportioned to the parent.

C) $100,000.

D) $300,000.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following statements is true with regard to intercompany transactions?

A) An intercompany transaction is eliminated from consolidated taxable income.

B) All intercompany gains are recognized, but losses must be deferred.

C) A cash sale of a business asset by the purchasing member to an acquirer outside of the group triggers immediate recognition of the gain or loss.

D) The gain or loss on an intercompany transaction is deferred for up to ten years, after which it is recognized.

A) An intercompany transaction is eliminated from consolidated taxable income.

B) All intercompany gains are recognized, but losses must be deferred.

C) A cash sale of a business asset by the purchasing member to an acquirer outside of the group triggers immediate recognition of the gain or loss.

D) The gain or loss on an intercompany transaction is deferred for up to ten years, after which it is recognized.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

63

ParentCo owned 100% of SubCo for the entire year. ParentCo uses the accrual method of tax accounting, whereas SubCo uses the cash method. During the year, SubCo sold raw materials to ParentCo for $35,000 under a contract that requires no payment to SubCo until the following year. Exclusive of this transaction, ParentCo had income for the year of $30,000, and SubCo had income of $50,000. The group's consolidated taxable income for the year was:

A) $165,000.

B) $150,000.

C) $115,000.

D) $80,000.

A) $165,000.

B) $150,000.

C) $115,000.

D) $80,000.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

64

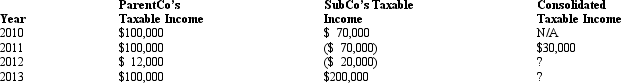

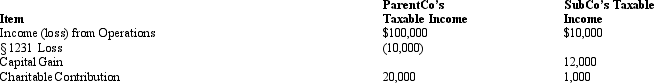

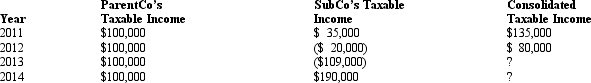

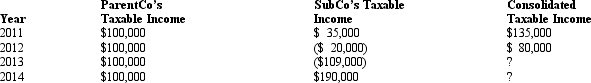

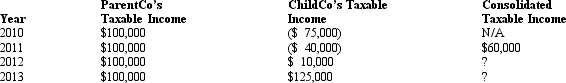

ParentCo purchased 100% of SubCo's stock on January 1, 2011, and the companies have filed consolidated returns since then. Taxable income computations for the members include the following. Neither group member incurred any capital gain or loss transactions during these years, nor did they make any charitable contributions.  The 2012 net operating loss:

The 2012 net operating loss:

A) may be carried back to offset SubCo's 2010 taxable income.

B) may be carried forward only and applied against group income if so elected by ParentCo.

C) cannot be carried back against 2010 SubCo income, as consolidated returns were not filed.

D) either a or b, but not both.

The 2012 net operating loss:

The 2012 net operating loss:A) may be carried back to offset SubCo's 2010 taxable income.

B) may be carried forward only and applied against group income if so elected by ParentCo.

C) cannot be carried back against 2010 SubCo income, as consolidated returns were not filed.

D) either a or b, but not both.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

65

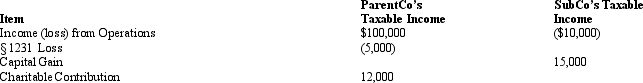

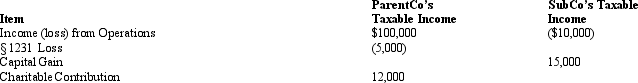

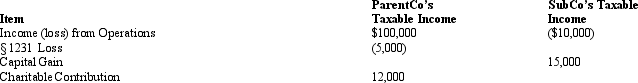

ParentCo and SubCo had the following items of income and deduction for the current year.  Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

ParentCo SubCo

A) $81,000 $21,000

B) $81,000 $22,000

C) $70,000 $22,000

D) $70,000 $21,000

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.ParentCo SubCo

A) $81,000 $21,000

B) $81,000 $22,000

C) $70,000 $22,000

D) $70,000 $21,000

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

66

ParentCo and SubCo had the following items of income and deduction for the current year.  Compute ParentCo and SubCo's consolidated taxable income or loss.

Compute ParentCo and SubCo's consolidated taxable income or loss.

A) $81,000.

B) $88,000.

C) $90,000.

D) $90,500.

Compute ParentCo and SubCo's consolidated taxable income or loss.

Compute ParentCo and SubCo's consolidated taxable income or loss.A) $81,000.

B) $88,000.

C) $90,000.

D) $90,500.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

67

The Philstrom consolidated group reported the following taxable income amounts. Parent owns all of the stock of both Junior and Minor. Determine the net operating loss (NOL) that is apportioned to Junior.

A) $0. All NOLs of a consolidated group are apportioned to the parent.

B) $300,000.

C) $360,000.

D) $400,000.

A) $0. All NOLs of a consolidated group are apportioned to the parent.

B) $300,000.

C) $360,000.

D) $400,000.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

68

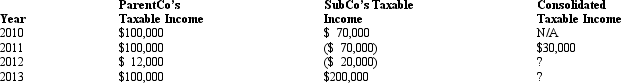

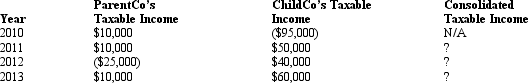

ParentCo and SubCo have filed consolidated returns since both entities were incorporated in 2011. Taxable income computations for the members include the following. Neither group member incurred any capital gain or loss transactions during these years, nor did they make any charitable contributions.  The 2013 consolidated loss:

The 2013 consolidated loss:

A) must be carried forward before it can be carried back.

B) must be carried forward, unless an election to forgo carryforward is made by the parent.

C) must be carried back, unless an election to forgo the carryback is made by the parent.

D) can be used only to offset SubCo's future income.

E) cannot be used to offset any of ParentCo's 2011 income.

The 2013 consolidated loss:

The 2013 consolidated loss:A) must be carried forward before it can be carried back.

B) must be carried forward, unless an election to forgo carryforward is made by the parent.

C) must be carried back, unless an election to forgo the carryback is made by the parent.

D) can be used only to offset SubCo's future income.

E) cannot be used to offset any of ParentCo's 2011 income.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

69

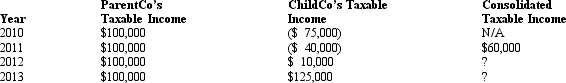

ParentCo purchased all of the stock of ChildCo on January 2, 2011, and the two companies filed consolidated returns for 2011 and thereafter. Both entities were incorporated in 2010. Taxable income computations for the members include the following. Neither group member incurred any capital gain or loss transactions during these years, nor did they make any charitable contributions. No § 382 limit applies.  To what extent can SubCo's 2010 losses be used by the group in 2013?

To what extent can SubCo's 2010 losses be used by the group in 2013?

A) $125,000.

B) $75,000.

C) $10,000.

D) $0.

To what extent can SubCo's 2010 losses be used by the group in 2013?

To what extent can SubCo's 2010 losses be used by the group in 2013?A) $125,000.

B) $75,000.

C) $10,000.

D) $0.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

70

ParentCo acquired all of the stock of SubCo on January 1, 2011, for $1,000,000. The parties immediately elected to file consolidated income tax returns. SubCo generated taxable income of $150,000 for 2011 and paid a dividend of $100,000 to ParentCo. In 2012, SubCo generated an operating loss of $350,000, and in 2013 it produced taxable income of $75,000. As of the last day of 2013, what was ParentCo's basis in the stock of SubCo?

A) $1,000,000.

B) $875,000.

C) $775,000.

D) $0.

A) $1,000,000.

B) $875,000.

C) $775,000.

D) $0.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

71

The consolidated net operating loss of the Parent Group includes all of the following except:

A) Parent's operating income/loss.

B) Parent's passive activity income/loss.

C) Parent's charitable contributions.

D) Subsidiary's operating income/loss.

A) Parent's operating income/loss.

B) Parent's passive activity income/loss.

C) Parent's charitable contributions.

D) Subsidiary's operating income/loss.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

72

ParentCo purchased all of the stock of ChildCo on January 2, 2011, and the two companies filed consolidated returns for 2011 and thereafter. Both entities were incorporated in 2010. Taxable income computations for the members include the following. Neither group member incurred any capital gain or loss transactions during these years, nor did they make any charitable contributions. No § 382 limit applies.  Assuming that no election is made to forgo the carryback, to what extent are ChildCo's 2010 losses used by the group in 2011-2013?

Assuming that no election is made to forgo the carryback, to what extent are ChildCo's 2010 losses used by the group in 2011-2013?

A) $95,000.

B) $70,000.

C) $60,000.

D) $50,000.

E) $0.

Assuming that no election is made to forgo the carryback, to what extent are ChildCo's 2010 losses used by the group in 2011-2013?

Assuming that no election is made to forgo the carryback, to what extent are ChildCo's 2010 losses used by the group in 2011-2013?A) $95,000.

B) $70,000.

C) $60,000.

D) $50,000.

E) $0.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

73

ParentCo owned 100% of SubCo for the entire year, and both companies use the accrual method of tax accounting. During the year, SubCo purchased $20,000 of supplies from ParentCo. In addition, SubCo provided internal audit services to ParentCo, which were worth $40,000. Including these transactions, ParentCo's separate taxable income was $75,000, and SubCo's separate taxable income was $100,000. What is the group's consolidated taxable income for the year?

A) $215,000.

B) $195,000.

C) $175,000.

D) $155,000.

A) $215,000.

B) $195,000.

C) $175,000.

D) $155,000.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following items is not computed on a consolidated basis?

A) Dividends received deduction.

B) § 1231 losses.

C) Charitable contributions.

D) Cost recovery deduction.

A) Dividends received deduction.

B) § 1231 losses.

C) Charitable contributions.

D) Cost recovery deduction.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

75

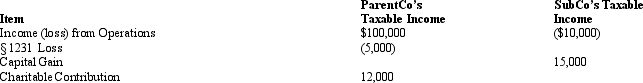

ParentCo and SubCo had the following items of income and deduction for the current year.  Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

ParentCo SubCo

A) $85,000 $5,000

B) $85,000 $3,000

C) $85,500 $5,000

D) $85,500 $3,000

E) None of the above.

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.ParentCo SubCo

A) $85,000 $5,000

B) $85,000 $3,000

C) $85,500 $5,000

D) $85,500 $3,000

E) None of the above.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

76

The Harris consolidated group reports a net operating loss (NOL) for the year. The tax law works to:

A) Keep the consolidated group from benefiting when the election to consolidate is motivated chiefly by tax reduction strategies.

B) Disallow any carrybacks of NOL deductions.

C) Allow unused charitable contributions a 20-year carryforward.

D) All of the above statements describe effects of the consolidated return rules.

A) Keep the consolidated group from benefiting when the election to consolidate is motivated chiefly by tax reduction strategies.

B) Disallow any carrybacks of NOL deductions.

C) Allow unused charitable contributions a 20-year carryforward.

D) All of the above statements describe effects of the consolidated return rules.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

77

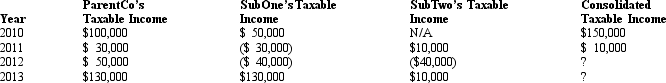

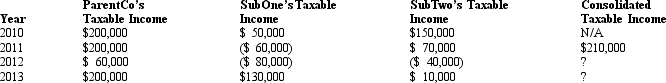

ParentCo and SubOne have filed consolidated returns since 2008. SubTwo was formed in 2012 through an asset spin-off from ParentCo. SubTwo has joined in the filing of consolidated returns since then. Taxable income computations for the members include the following. None of the group members incurred any capital gain or loss transactions during these years, nor did they make any charitable contributions.  If ParentCo does not elect to forgo the carryback of the 2012 net operating loss, how much of the 2012 consolidated net operating loss is carried back to offset prior years' income?

If ParentCo does not elect to forgo the carryback of the 2012 net operating loss, how much of the 2012 consolidated net operating loss is carried back to offset prior years' income?

A) $80,000.

B) $40,000.

C) $30,000.

D) $0.

If ParentCo does not elect to forgo the carryback of the 2012 net operating loss, how much of the 2012 consolidated net operating loss is carried back to offset prior years' income?

If ParentCo does not elect to forgo the carryback of the 2012 net operating loss, how much of the 2012 consolidated net operating loss is carried back to offset prior years' income?A) $80,000.

B) $40,000.

C) $30,000.

D) $0.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

78

ParentCo purchased all of the stock of SubCo on January 1, 2011, for $500,000. SubCo produced a loss for 2011 of $150,000 and distributed cash of $25,000 to ParentCo. In 2012, SubCo generated a loss of $450,000; in 2013, it recognized net income of $45,000. What is ParentCo's capital gain or loss if it sells all of its SubCo stock to a nongroup member on January 1, 2014, for $50,000?

A) $10,000.

B) $50,000.

C) ($80,000).

D) ($50,000).

A) $10,000.

B) $50,000.

C) ($80,000).

D) ($50,000).

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

79

The Philstrom consolidated group reported the following taxable income amounts. Parent owns all of the stock of both Junior and Minor. Determine the net operating loss (NOL) that is apportioned to Parent.

A) $0. The SRLY rules apply.

B) $900,000. All NOLs of a consolidated group are apportioned to the parent.

C) $600,000.

D) $540,000.

A) $0. The SRLY rules apply.

B) $900,000. All NOLs of a consolidated group are apportioned to the parent.

C) $600,000.

D) $540,000.

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck

80

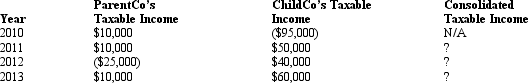

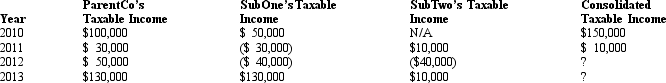

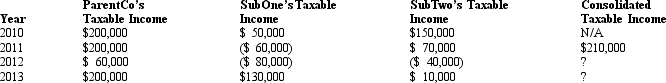

ParentCo, SubOne and SubTwo have filed consolidated returns since 2011. All of the entities were incorporated in 2010. Taxable income computations for the members include the following. None of the group members incurred any capital gain or loss transactions during these years, nor did they make any charitable contributions.  How should the 2012 consolidated net operating loss be apportioned among the group members?

How should the 2012 consolidated net operating loss be apportioned among the group members?

ParentCo SubOne SubTwo

A) $60,000 $ 0 $ 0

B) $20,000 $20,000 $20,000

C) $ 0 $20,000 $40,000

D) $ 0 $40,000 $20,000

How should the 2012 consolidated net operating loss be apportioned among the group members?

How should the 2012 consolidated net operating loss be apportioned among the group members?ParentCo SubOne SubTwo

A) $60,000 $ 0 $ 0

B) $20,000 $20,000 $20,000

C) $ 0 $20,000 $40,000

D) $ 0 $40,000 $20,000

Unlock Deck

Unlock for access to all 145 flashcards in this deck.

Unlock Deck

k this deck