Deck 5: Intercompany Profit Transactions Inventories

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/40

Play

Full screen (f)

Deck 5: Intercompany Profit Transactions Inventories

1

The material sale of inventory items by a parent company to an affiliated company

A) enters the consolidated revenue computation only if the transfer was the result of arm's length bargaining.

B) affects consolidated net income under a periodic inventory system but not under a perpetual inventory system.

C) does not result in consolidated income until the merchandise is sold to outside parties.

D) does not require a working paper adjustment if the merchandise was transferred at cost.

A) enters the consolidated revenue computation only if the transfer was the result of arm's length bargaining.

B) affects consolidated net income under a periodic inventory system but not under a perpetual inventory system.

C) does not result in consolidated income until the merchandise is sold to outside parties.

D) does not require a working paper adjustment if the merchandise was transferred at cost.

C

2

Use the following information to answer the question(s) below..

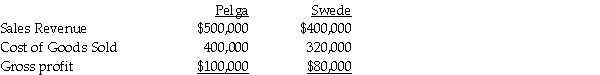

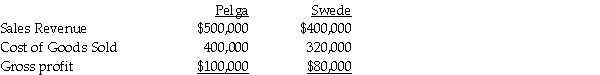

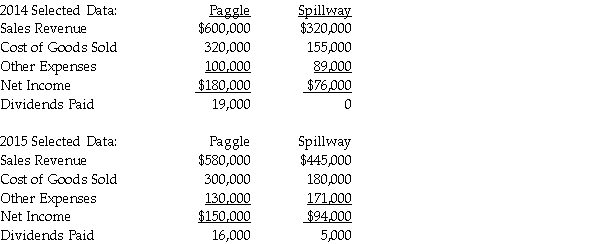

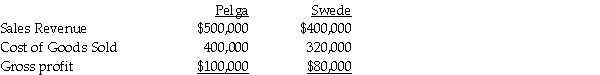

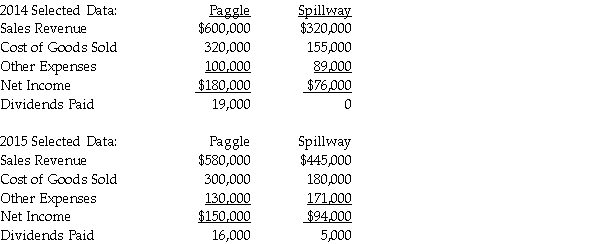

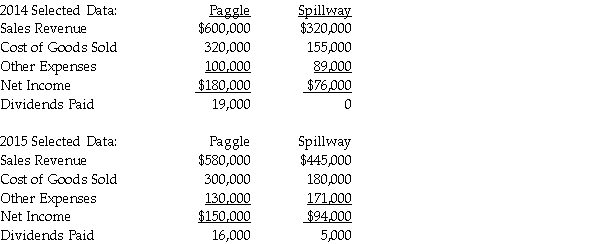

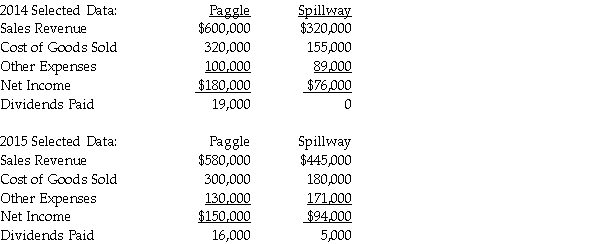

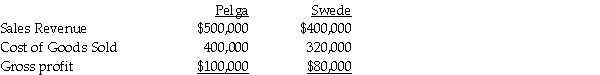

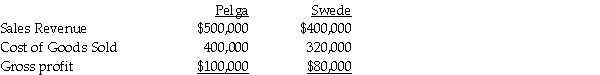

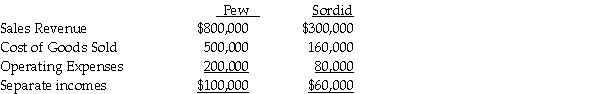

Pelga Company routinely receives goods from its 80%-owned subsidiary, Swede Corporation. In 2014, Swede sold merchandise that cost $80,000 to Pelga for $100,000. Half of this merchandise remained in Pelga's December 31, 2014 inventory. This inventory was sold in 2015. During 2015, Swede sold merchandise that cost $160,000 to Pelga for $200,000. $62,500 of the 2015 merchandise inventory remained in Pelga's December 31, 2015 inventory. Selected income statement information for the two affiliates for the year 2015 was as follows:

Consolidated cost of goods sold for Pelga and Subsidiary for 2015 were

A) $512,000.

B) $526,000.

C) $522,500.

D) $528,000.

Pelga Company routinely receives goods from its 80%-owned subsidiary, Swede Corporation. In 2014, Swede sold merchandise that cost $80,000 to Pelga for $100,000. Half of this merchandise remained in Pelga's December 31, 2014 inventory. This inventory was sold in 2015. During 2015, Swede sold merchandise that cost $160,000 to Pelga for $200,000. $62,500 of the 2015 merchandise inventory remained in Pelga's December 31, 2015 inventory. Selected income statement information for the two affiliates for the year 2015 was as follows:

Consolidated cost of goods sold for Pelga and Subsidiary for 2015 were

A) $512,000.

B) $526,000.

C) $522,500.

D) $528,000.

C

3

Use the following information to answer the question(s) below.

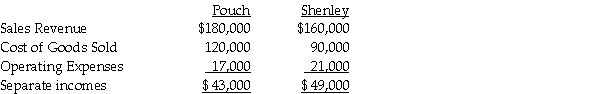

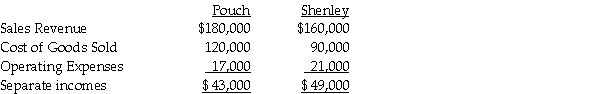

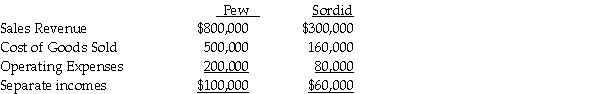

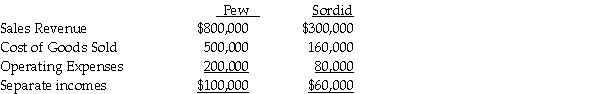

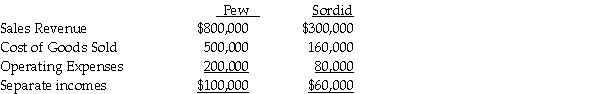

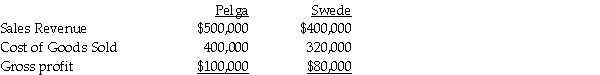

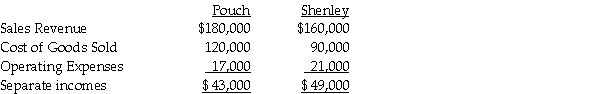

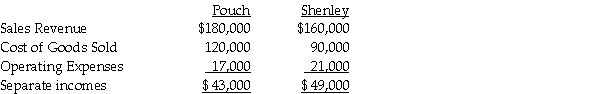

Pouch Corporation acquired an 80% interest in Shenley Corporation on January 1, 2014, when the book values of Shenley's assets and liabilities were equal to their fair values. The cost of the 80% interest was equal to 80% of the book value of Shenley's net assets. During 2014, Pouch sold merchandise that cost $70,000 to Shenley for $86,000. On December 31, 2014, three-fourths of the merchandise acquired from Pouch remained in Shenley's inventory. Separate incomes (investment income not included) of the two companies are as follows:

The consolidated income statement for Pouch Corporation and subsidiary for the year ended December 31, 2014 will show consolidated cost of sales of

A) $120,000.

B) $136,000.

C) $148,000.

D) $210,000.

Pouch Corporation acquired an 80% interest in Shenley Corporation on January 1, 2014, when the book values of Shenley's assets and liabilities were equal to their fair values. The cost of the 80% interest was equal to 80% of the book value of Shenley's net assets. During 2014, Pouch sold merchandise that cost $70,000 to Shenley for $86,000. On December 31, 2014, three-fourths of the merchandise acquired from Pouch remained in Shenley's inventory. Separate incomes (investment income not included) of the two companies are as follows:

The consolidated income statement for Pouch Corporation and subsidiary for the year ended December 31, 2014 will show consolidated cost of sales of

A) $120,000.

B) $136,000.

C) $148,000.

D) $210,000.

B

4

Use the following information to answer the question(s) below.

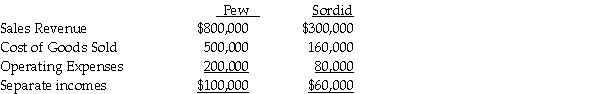

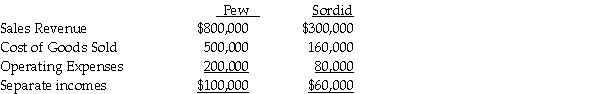

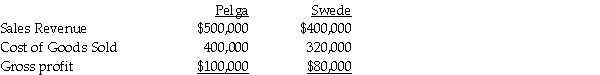

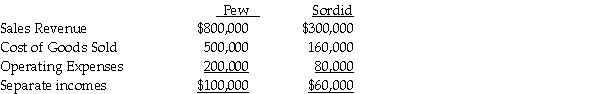

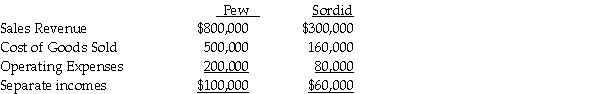

Pew Corporation acquired 80% ownership of Sordid Incorporated, at a time when Pew's investment cost was equal to 80% of Sordid's book value. At the time of acquisition, the book values and fair values of Sordid's assets and liabilities were equal. Pew uses the equity method. During 2014, Pew sold goods to Sordid for $160,000 making a gross profit percentage of 20%. Half of these goods remained unsold in Sordid's inventory at the end of the year. Income statement information for Pew and Sordid for 2014 were as follows:

On January 1, 2014, Plastam Industries acquired an 80% interest in Sparta Company to assure a steady supply of Sparta's inventory that Plastam uses in its own manufacturing businesses. Sparta sold 100% of its output to Plastam during 2014 and 2015 at a markup of 125% of Sparta's cost. Plastam had $12,000 of these items remaining in its inventory at December 31, 2015. If Plastam neglected to eliminate unrealized profits from all intercompany sales from Sparta, the inventory on the consolidated balance sheet at December 31, 2015 was

A) overstated by $1,920.

B) understated by $1,920.

C) overstated by $2,400.

D) understated by $2,400.

Pew Corporation acquired 80% ownership of Sordid Incorporated, at a time when Pew's investment cost was equal to 80% of Sordid's book value. At the time of acquisition, the book values and fair values of Sordid's assets and liabilities were equal. Pew uses the equity method. During 2014, Pew sold goods to Sordid for $160,000 making a gross profit percentage of 20%. Half of these goods remained unsold in Sordid's inventory at the end of the year. Income statement information for Pew and Sordid for 2014 were as follows:

On January 1, 2014, Plastam Industries acquired an 80% interest in Sparta Company to assure a steady supply of Sparta's inventory that Plastam uses in its own manufacturing businesses. Sparta sold 100% of its output to Plastam during 2014 and 2015 at a markup of 125% of Sparta's cost. Plastam had $12,000 of these items remaining in its inventory at December 31, 2015. If Plastam neglected to eliminate unrealized profits from all intercompany sales from Sparta, the inventory on the consolidated balance sheet at December 31, 2015 was

A) overstated by $1,920.

B) understated by $1,920.

C) overstated by $2,400.

D) understated by $2,400.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

5

Use the following information to answer the question(s) below.

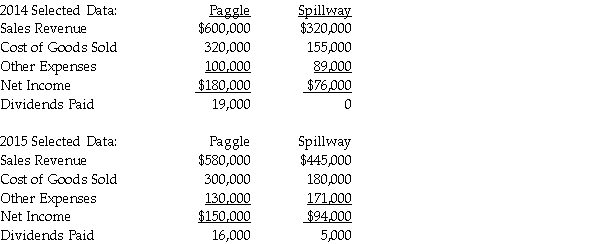

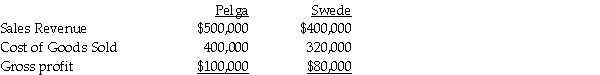

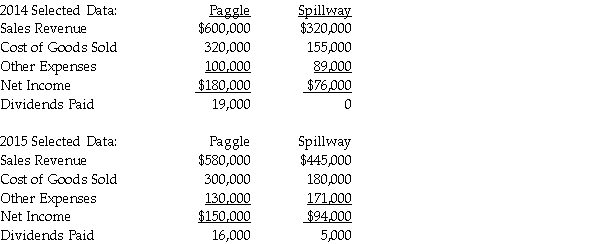

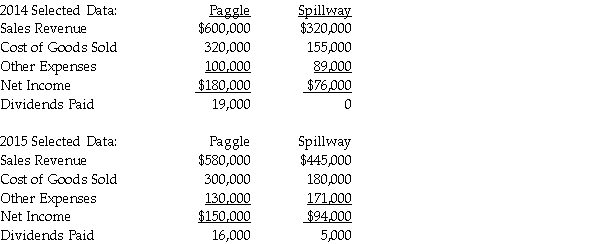

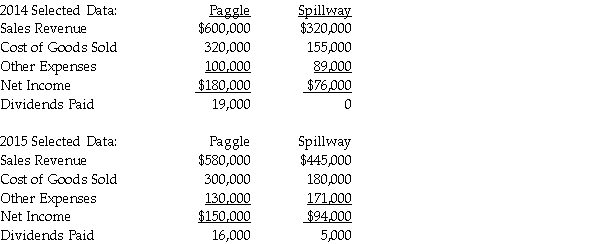

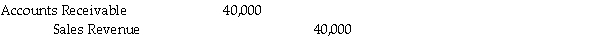

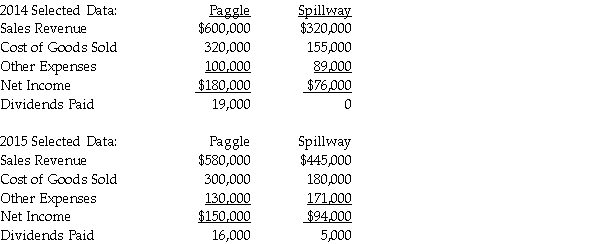

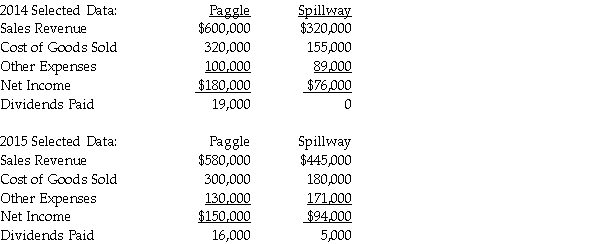

Paggle Corporation owns 80% of Spillway Inc.'s common stock that was purchased at its underlying book value. At the time of purchase, the book value and fair value of Spillway's net assets were equal. The two companies report the following information for 2014 and 2015.

During 2014, one company sold inventory to the other company for $50,000 which cost the transferor $40,000. As of the end of 2014, 30% of the inventory was unsold. In 2015, the remaining inventory was resold outside the consolidated entity.

If the sale referred to above was a downstream sale, by what amount must Inventory on the consolidated balance sheet be reduced to reflect the correct balance as of the end of 2014?

A) $3,000

B) $10,000

C) $14,000

D) $20,000

Paggle Corporation owns 80% of Spillway Inc.'s common stock that was purchased at its underlying book value. At the time of purchase, the book value and fair value of Spillway's net assets were equal. The two companies report the following information for 2014 and 2015.

During 2014, one company sold inventory to the other company for $50,000 which cost the transferor $40,000. As of the end of 2014, 30% of the inventory was unsold. In 2015, the remaining inventory was resold outside the consolidated entity.

If the sale referred to above was a downstream sale, by what amount must Inventory on the consolidated balance sheet be reduced to reflect the correct balance as of the end of 2014?

A) $3,000

B) $10,000

C) $14,000

D) $20,000

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

6

Use the following information to answer the question(s) below..

Pelga Company routinely receives goods from its 80%-owned subsidiary, Swede Corporation. In 2014, Swede sold merchandise that cost $80,000 to Pelga for $100,000. Half of this merchandise remained in Pelga's December 31, 2014 inventory. This inventory was sold in 2015. During 2015, Swede sold merchandise that cost $160,000 to Pelga for $200,000. $62,500 of the 2015 merchandise inventory remained in Pelga's December 31, 2015 inventory. Selected income statement information for the two affiliates for the year 2015 was as follows:

What amount of unrealized profit did Pelga Company have at the end of 2015?

A) $10,000

B) $12,500

C) $50,000

D) $62,500

Pelga Company routinely receives goods from its 80%-owned subsidiary, Swede Corporation. In 2014, Swede sold merchandise that cost $80,000 to Pelga for $100,000. Half of this merchandise remained in Pelga's December 31, 2014 inventory. This inventory was sold in 2015. During 2015, Swede sold merchandise that cost $160,000 to Pelga for $200,000. $62,500 of the 2015 merchandise inventory remained in Pelga's December 31, 2015 inventory. Selected income statement information for the two affiliates for the year 2015 was as follows:

What amount of unrealized profit did Pelga Company have at the end of 2015?

A) $10,000

B) $12,500

C) $50,000

D) $62,500

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

7

A(n) ________ sale is a sale by a parent company to a subsidiary. A(n) ________ sale is a sale by a subsidiary to a parent company.

A) deferred; realized.

B) realized; deferred.

C) upstream; downstream

D) downstream; upstream

A) deferred; realized.

B) realized; deferred.

C) upstream; downstream

D) downstream; upstream

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

8

Use the following information to answer the question(s) below.

Paggle Corporation owns 80% of Spillway Inc.'s common stock that was purchased at its underlying book value. At the time of purchase, the book value and fair value of Spillway's net assets were equal. The two companies report the following information for 2014 and 2015.

During 2014, one company sold inventory to the other company for $50,000 which cost the transferor $40,000. As of the end of 2014, 30% of the inventory was unsold. In 2015, the remaining inventory was resold outside the consolidated entity.

If the intercompany sale was an upstream sale, the total amount of consolidated cost of goods sold for 2015 will be

A) $300,000.

B) $430,000.

C) $470,000.

D) $477,000.

Paggle Corporation owns 80% of Spillway Inc.'s common stock that was purchased at its underlying book value. At the time of purchase, the book value and fair value of Spillway's net assets were equal. The two companies report the following information for 2014 and 2015.

During 2014, one company sold inventory to the other company for $50,000 which cost the transferor $40,000. As of the end of 2014, 30% of the inventory was unsold. In 2015, the remaining inventory was resold outside the consolidated entity.

If the intercompany sale was an upstream sale, the total amount of consolidated cost of goods sold for 2015 will be

A) $300,000.

B) $430,000.

C) $470,000.

D) $477,000.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

9

Assume there are routine inventory sales between parent companies and subsidiaries. When preparing the consolidated financial statements, which of the following line items is indifferent to the sales being either upstream or downstream?

A) Consolidated retained earnings

B) Consolidated gross profit

C) Noncontrolling interest share

D) Controlling interest share of consolidated net income

A) Consolidated retained earnings

B) Consolidated gross profit

C) Noncontrolling interest share

D) Controlling interest share of consolidated net income

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

10

Use the following information to answer the question(s) below.

Paggle Corporation owns 80% of Spillway Inc.'s common stock that was purchased at its underlying book value. At the time of purchase, the book value and fair value of Spillway's net assets were equal. The two companies report the following information for 2014 and 2015.

During 2014, one company sold inventory to the other company for $50,000 which cost the transferor $40,000. As of the end of 2014, 30% of the inventory was unsold. In 2015, the remaining inventory was resold outside the consolidated entity.

If the intercompany sale mentioned above was an upstream sale, what will be the reported amount of total consolidated sales revenue for 2015?

A) $1,025,000

B) $1,900,000

C) $1,950,000

D) $2,000,000

Paggle Corporation owns 80% of Spillway Inc.'s common stock that was purchased at its underlying book value. At the time of purchase, the book value and fair value of Spillway's net assets were equal. The two companies report the following information for 2014 and 2015.

During 2014, one company sold inventory to the other company for $50,000 which cost the transferor $40,000. As of the end of 2014, 30% of the inventory was unsold. In 2015, the remaining inventory was resold outside the consolidated entity.

If the intercompany sale mentioned above was an upstream sale, what will be the reported amount of total consolidated sales revenue for 2015?

A) $1,025,000

B) $1,900,000

C) $1,950,000

D) $2,000,000

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

11

Phast Corporation owns a 80% interest in Stechno Company, acquired several years ago at a cost equal to book value and fair value. Stechno sells merchandise to Phast for the first time in 2014, and some is unsold at December 31, 2014. In computing income from the investee for 2014 under the equity method, Phast uses which equation?

A) 80% of Stechno's income less 100% of the unrealized profit in Phast's ending inventory

B) 80% of Stechno's income plus 100% of the unrealized profit in Phast's ending inventory

C) 80% of Stechno's income less 80% of the unrealized profit in Phast's ending inventory

D) 80% of Stechno's income plus 80% of the unrealized profit in Phast's ending inventory

A) 80% of Stechno's income less 100% of the unrealized profit in Phast's ending inventory

B) 80% of Stechno's income plus 100% of the unrealized profit in Phast's ending inventory

C) 80% of Stechno's income less 80% of the unrealized profit in Phast's ending inventory

D) 80% of Stechno's income plus 80% of the unrealized profit in Phast's ending inventory

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

12

Use the following information to answer the question(s) below.

Pew Corporation acquired 80% ownership of Sordid Incorporated, at a time when Pew's investment cost was equal to 80% of Sordid's book value. At the time of acquisition, the book values and fair values of Sordid's assets and liabilities were equal. Pew uses the equity method. During 2014, Pew sold goods to Sordid for $160,000 making a gross profit percentage of 20%. Half of these goods remained unsold in Sordid's inventory at the end of the year. Income statement information for Pew and Sordid for 2014 were as follows:

The 2014 consolidated income statement showed noncontrolling interest share of

A) $3,200.

B) $6,400.

C) $8,800.

D) $12,000.

Pew Corporation acquired 80% ownership of Sordid Incorporated, at a time when Pew's investment cost was equal to 80% of Sordid's book value. At the time of acquisition, the book values and fair values of Sordid's assets and liabilities were equal. Pew uses the equity method. During 2014, Pew sold goods to Sordid for $160,000 making a gross profit percentage of 20%. Half of these goods remained unsold in Sordid's inventory at the end of the year. Income statement information for Pew and Sordid for 2014 were as follows:

The 2014 consolidated income statement showed noncontrolling interest share of

A) $3,200.

B) $6,400.

C) $8,800.

D) $12,000.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

13

Use the following information to answer the question(s) below.

Paggle Corporation owns 80% of Spillway Inc.'s common stock that was purchased at its underlying book value. At the time of purchase, the book value and fair value of Spillway's net assets were equal. The two companies report the following information for 2014 and 2015.

During 2014, one company sold inventory to the other company for $50,000 which cost the transferor $40,000. As of the end of 2014, 30% of the inventory was unsold. In 2015, the remaining inventory was resold outside the consolidated entity.

If the sale referred to above was a downstream sale, the total sales revenue reported in the consolidated income statement for 2014 would be

A) $870,000.

B) $880,000.

C) $920,000.

D) $970,000.

Paggle Corporation owns 80% of Spillway Inc.'s common stock that was purchased at its underlying book value. At the time of purchase, the book value and fair value of Spillway's net assets were equal. The two companies report the following information for 2014 and 2015.

During 2014, one company sold inventory to the other company for $50,000 which cost the transferor $40,000. As of the end of 2014, 30% of the inventory was unsold. In 2015, the remaining inventory was resold outside the consolidated entity.

If the sale referred to above was a downstream sale, the total sales revenue reported in the consolidated income statement for 2014 would be

A) $870,000.

B) $880,000.

C) $920,000.

D) $970,000.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

14

Use the following information to answer the question(s) below..

Pelga Company routinely receives goods from its 80%-owned subsidiary, Swede Corporation. In 2014, Swede sold merchandise that cost $80,000 to Pelga for $100,000. Half of this merchandise remained in Pelga's December 31, 2014 inventory. This inventory was sold in 2015. During 2015, Swede sold merchandise that cost $160,000 to Pelga for $200,000. $62,500 of the 2015 merchandise inventory remained in Pelga's December 31, 2015 inventory. Selected income statement information for the two affiliates for the year 2015 was as follows:

Shalles Corporation, a 80%-owned subsidiary of Pani Corporation, sold inventory items to its parent at a $48,000 profit in 2014. Pani resold one-third of this inventory to outside entities. Shalles reported net income of $200,000 for 2014. Noncontrolling interest share of consolidated net income that will appear in the income statement for 2014 is

A) $30,400.

B) $32,000.

C) $33,600.

D) $40,000.

Pelga Company routinely receives goods from its 80%-owned subsidiary, Swede Corporation. In 2014, Swede sold merchandise that cost $80,000 to Pelga for $100,000. Half of this merchandise remained in Pelga's December 31, 2014 inventory. This inventory was sold in 2015. During 2015, Swede sold merchandise that cost $160,000 to Pelga for $200,000. $62,500 of the 2015 merchandise inventory remained in Pelga's December 31, 2015 inventory. Selected income statement information for the two affiliates for the year 2015 was as follows:

Shalles Corporation, a 80%-owned subsidiary of Pani Corporation, sold inventory items to its parent at a $48,000 profit in 2014. Pani resold one-third of this inventory to outside entities. Shalles reported net income of $200,000 for 2014. Noncontrolling interest share of consolidated net income that will appear in the income statement for 2014 is

A) $30,400.

B) $32,000.

C) $33,600.

D) $40,000.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

15

Use the following information to answer the question(s) below.

Pew Corporation acquired 80% ownership of Sordid Incorporated, at a time when Pew's investment cost was equal to 80% of Sordid's book value. At the time of acquisition, the book values and fair values of Sordid's assets and liabilities were equal. Pew uses the equity method. During 2014, Pew sold goods to Sordid for $160,000 making a gross profit percentage of 20%. Half of these goods remained unsold in Sordid's inventory at the end of the year. Income statement information for Pew and Sordid for 2014 were as follows:

What is Pew's income from Sordid for 2014?

A) $32,000

B) $48,000

C) $60,000

D) $75,000

Pew Corporation acquired 80% ownership of Sordid Incorporated, at a time when Pew's investment cost was equal to 80% of Sordid's book value. At the time of acquisition, the book values and fair values of Sordid's assets and liabilities were equal. Pew uses the equity method. During 2014, Pew sold goods to Sordid for $160,000 making a gross profit percentage of 20%. Half of these goods remained unsold in Sordid's inventory at the end of the year. Income statement information for Pew and Sordid for 2014 were as follows:

What is Pew's income from Sordid for 2014?

A) $32,000

B) $48,000

C) $60,000

D) $75,000

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

16

Use the following information to answer the question(s) below..

Pelga Company routinely receives goods from its 80%-owned subsidiary, Swede Corporation. In 2014, Swede sold merchandise that cost $80,000 to Pelga for $100,000. Half of this merchandise remained in Pelga's December 31, 2014 inventory. This inventory was sold in 2015. During 2015, Swede sold merchandise that cost $160,000 to Pelga for $200,000. $62,500 of the 2015 merchandise inventory remained in Pelga's December 31, 2015 inventory. Selected income statement information for the two affiliates for the year 2015 was as follows:

A parent company regularly sells merchandise to its 70%-owned subsidiary. Which of the following statements describes the computation of noncontrolling interest share?

A) The subsidiary's net income times 30%

B) (The subsidiary's net income × 30%) + unrealized profits in the beginning inventory - unrealized profits in the ending inventory

C) (The subsidiary's net income + unrealized profits in the beginning inventory - unrealized profits in the ending inventory) × 30%

D) (The subsidiary's net income + unrealized profits in the ending inventory - unrealized profits in the beginning inventory) × 30%

Pelga Company routinely receives goods from its 80%-owned subsidiary, Swede Corporation. In 2014, Swede sold merchandise that cost $80,000 to Pelga for $100,000. Half of this merchandise remained in Pelga's December 31, 2014 inventory. This inventory was sold in 2015. During 2015, Swede sold merchandise that cost $160,000 to Pelga for $200,000. $62,500 of the 2015 merchandise inventory remained in Pelga's December 31, 2015 inventory. Selected income statement information for the two affiliates for the year 2015 was as follows:

A parent company regularly sells merchandise to its 70%-owned subsidiary. Which of the following statements describes the computation of noncontrolling interest share?

A) The subsidiary's net income times 30%

B) (The subsidiary's net income × 30%) + unrealized profits in the beginning inventory - unrealized profits in the ending inventory

C) (The subsidiary's net income + unrealized profits in the beginning inventory - unrealized profits in the ending inventory) × 30%

D) (The subsidiary's net income + unrealized profits in the ending inventory - unrealized profits in the beginning inventory) × 30%

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

17

Use the following information to answer the question(s) below.

Pew Corporation acquired 80% ownership of Sordid Incorporated, at a time when Pew's investment cost was equal to 80% of Sordid's book value. At the time of acquisition, the book values and fair values of Sordid's assets and liabilities were equal. Pew uses the equity method. During 2014, Pew sold goods to Sordid for $160,000 making a gross profit percentage of 20%. Half of these goods remained unsold in Sordid's inventory at the end of the year. Income statement information for Pew and Sordid for 2014 were as follows:

The 2014 consolidated income statement showed cost of goods sold of

A) $500,000.

B) $516,000.

C) $532,000.

D) $660,000.

Pew Corporation acquired 80% ownership of Sordid Incorporated, at a time when Pew's investment cost was equal to 80% of Sordid's book value. At the time of acquisition, the book values and fair values of Sordid's assets and liabilities were equal. Pew uses the equity method. During 2014, Pew sold goods to Sordid for $160,000 making a gross profit percentage of 20%. Half of these goods remained unsold in Sordid's inventory at the end of the year. Income statement information for Pew and Sordid for 2014 were as follows:

The 2014 consolidated income statement showed cost of goods sold of

A) $500,000.

B) $516,000.

C) $532,000.

D) $660,000.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

18

Use the following information to answer the question(s) below.

Pouch Corporation acquired an 80% interest in Shenley Corporation on January 1, 2014, when the book values of Shenley's assets and liabilities were equal to their fair values. The cost of the 80% interest was equal to 80% of the book value of Shenley's net assets. During 2014, Pouch sold merchandise that cost $70,000 to Shenley for $86,000. On December 31, 2014, three-fourths of the merchandise acquired from Pouch remained in Shenley's inventory. Separate incomes (investment income not included) of the two companies are as follows:

What is Pouch's income from Shenley for 2014?

A) $27,200

B) $29,600

C) $39,200

D) $49,000

Pouch Corporation acquired an 80% interest in Shenley Corporation on January 1, 2014, when the book values of Shenley's assets and liabilities were equal to their fair values. The cost of the 80% interest was equal to 80% of the book value of Shenley's net assets. During 2014, Pouch sold merchandise that cost $70,000 to Shenley for $86,000. On December 31, 2014, three-fourths of the merchandise acquired from Pouch remained in Shenley's inventory. Separate incomes (investment income not included) of the two companies are as follows:

What is Pouch's income from Shenley for 2014?

A) $27,200

B) $29,600

C) $39,200

D) $49,000

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

19

Swamp Co., a 55%-owned subsidiary of Pond Inc., made the following entry to record a sale of merchandise to Pond:  All Swamp sales are at 125% of cost. One-fourth of this merchandise remained in the Pond's inventory at year-end. A working paper entry to eliminate unrealized profits from consolidated inventory would include a credit to Inventory in the amount of

All Swamp sales are at 125% of cost. One-fourth of this merchandise remained in the Pond's inventory at year-end. A working paper entry to eliminate unrealized profits from consolidated inventory would include a credit to Inventory in the amount of

A) $2,000.

B) $2,500.

C) $8,000.

D) $10,000.

All Swamp sales are at 125% of cost. One-fourth of this merchandise remained in the Pond's inventory at year-end. A working paper entry to eliminate unrealized profits from consolidated inventory would include a credit to Inventory in the amount of

All Swamp sales are at 125% of cost. One-fourth of this merchandise remained in the Pond's inventory at year-end. A working paper entry to eliminate unrealized profits from consolidated inventory would include a credit to Inventory in the amount ofA) $2,000.

B) $2,500.

C) $8,000.

D) $10,000.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

20

Use the following information to answer the question(s) below.

Paggle Corporation owns 80% of Spillway Inc.'s common stock that was purchased at its underlying book value. At the time of purchase, the book value and fair value of Spillway's net assets were equal. The two companies report the following information for 2014 and 2015.

During 2014, one company sold inventory to the other company for $50,000 which cost the transferor $40,000. As of the end of 2014, 30% of the inventory was unsold. In 2015, the remaining inventory was resold outside the consolidated entity.

For 2014, consolidated net income will be what amount if the intercompany sale was downstream?

A) $180,000

B) $253,000

C) $256,000

D) $259,000

Paggle Corporation owns 80% of Spillway Inc.'s common stock that was purchased at its underlying book value. At the time of purchase, the book value and fair value of Spillway's net assets were equal. The two companies report the following information for 2014 and 2015.

During 2014, one company sold inventory to the other company for $50,000 which cost the transferor $40,000. As of the end of 2014, 30% of the inventory was unsold. In 2015, the remaining inventory was resold outside the consolidated entity.

For 2014, consolidated net income will be what amount if the intercompany sale was downstream?

A) $180,000

B) $253,000

C) $256,000

D) $259,000

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

21

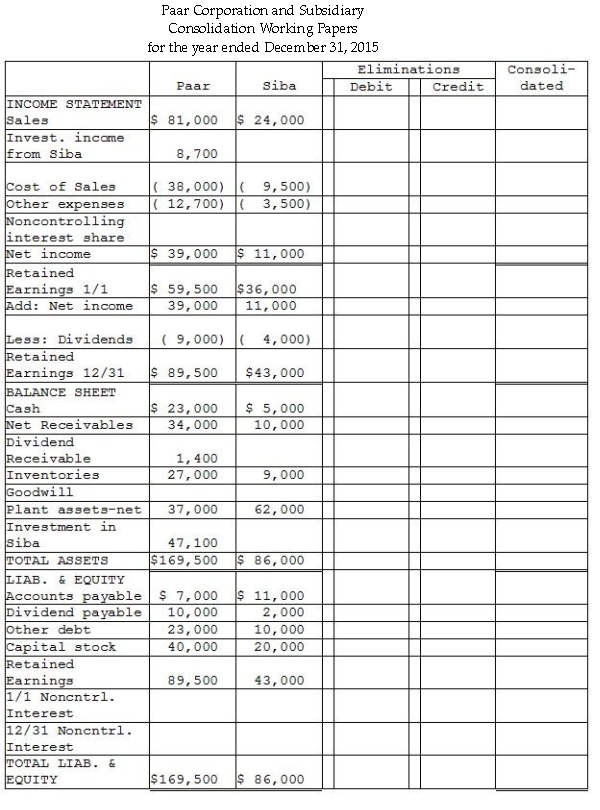

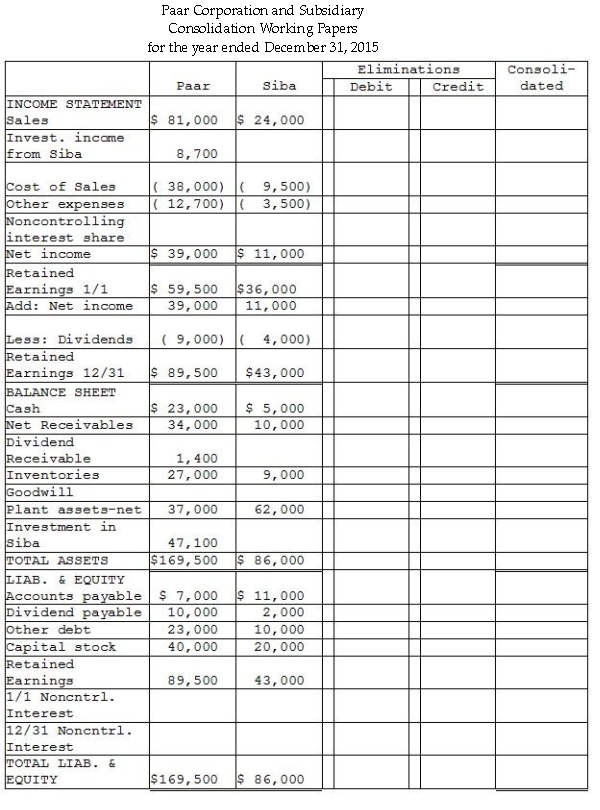

On January 1, 2014, Paar Incorporated paid $38,500 for a 70% interest in Siba Enterprises, at a time when Siba's stockholder's equity consisted of $20,000 in Capital stock and $30,000 in Retained Earnings. The fair values of Siba's assets and liabilities equaled their recorded book values at that time, so any additional amount paid was attributed to goodwill.

In 2014, Siba purchased merchandise from Paar at a price of $6,000. The products originally cost Paar $4,000, and 75% of this merchandise remained in inventory at December 31, 2014. This inventory was sold in 2015. Siba reported net income of $9,000 and paid dividends of $3,000 during 2014.

In 2015, Siba purchased merchandise from Paar at a price of $8,000. The products had a cost to Paar of $7,000, and 50% of this merchandise remained in inventory at December 31, 2015. Siba still owed Paar $1,800 for these purchases at December 31, 2015.

Required:

Financial statements of Paar and Siba appear in the first two columns of the partially completed working papers. Complete the consolidation working papers for Paar Corporation and Subsidiary for the year ended December 31, 2015.

In 2014, Siba purchased merchandise from Paar at a price of $6,000. The products originally cost Paar $4,000, and 75% of this merchandise remained in inventory at December 31, 2014. This inventory was sold in 2015. Siba reported net income of $9,000 and paid dividends of $3,000 during 2014.

In 2015, Siba purchased merchandise from Paar at a price of $8,000. The products had a cost to Paar of $7,000, and 50% of this merchandise remained in inventory at December 31, 2015. Siba still owed Paar $1,800 for these purchases at December 31, 2015.

Required:

Financial statements of Paar and Siba appear in the first two columns of the partially completed working papers. Complete the consolidation working papers for Paar Corporation and Subsidiary for the year ended December 31, 2015.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

22

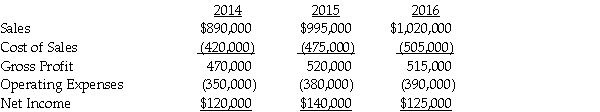

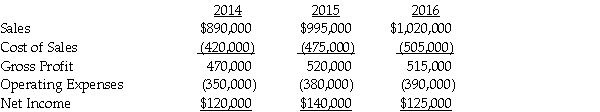

PreBuild Manufacturing acquired 100% of Shoding Industries common stock on January 1, 2014, for $670,000 when the book values of Shoding's assets and liabilities were equal to their fair values and Shoding's stockholders' equity consisted of $380,000 of Capital Stock and $290,000 of Retained Earnings.

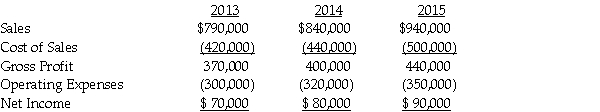

PreBuild's separate income (excluding investment income from Shoding) was $870,000, $830,000 and $960,000 in 2014, 2015 and 2016, respectively. PreBuild sold inventory to Shoding during 2014 at a gross profit of $50,000 and 50% remained at Shoding at the end of the year. The remaining 50% was sold in 2015. At the end of 2015, PreBuild has $54,000 of inventory received from Shoding from a sale of $180,000 which cost Shoding $150,000. There are no unrealized profits in the inventory of PreBuild or Shoding at the end of 2016. PreBuild uses the equity method in its separate books. Select financial information for Shoding follows:

Required:

Required:

Prepare a schedule to determine PreBuild Manufacturing's Consolidated net income for 2014, 2015, and 2016.

PreBuild's separate income (excluding investment income from Shoding) was $870,000, $830,000 and $960,000 in 2014, 2015 and 2016, respectively. PreBuild sold inventory to Shoding during 2014 at a gross profit of $50,000 and 50% remained at Shoding at the end of the year. The remaining 50% was sold in 2015. At the end of 2015, PreBuild has $54,000 of inventory received from Shoding from a sale of $180,000 which cost Shoding $150,000. There are no unrealized profits in the inventory of PreBuild or Shoding at the end of 2016. PreBuild uses the equity method in its separate books. Select financial information for Shoding follows:

Required:

Required:Prepare a schedule to determine PreBuild Manufacturing's Consolidated net income for 2014, 2015, and 2016.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

23

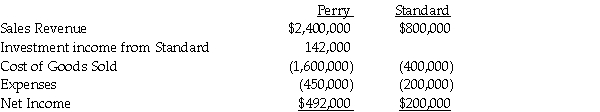

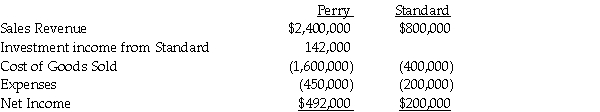

Perry Instruments International purchased 75% of the outstanding common stock of Standard Systems in 1997 when the book values and fair values of Standard's assets and liabilities were equal. The cost of Perry's investment was equal to 75% of the book value of Standard's net assets. Separate company income statements for Perry and Standard for the year ended December 31, 2014 are summarized as follows:

During 2014, the companies began to manage their inventory differently, and worked together to keep their inventories low at each location. In doing so, they agreed to sell inventory to each other as needed at a markup of 10% of cost. Perry sold merchandise that cost $100,000 to Standard for $110,000, and Standard sold inventory that cost $80,000 to Perry for $88,000. Half of this merchandise remained in each company's inventory at December 31, 2014.

During 2014, the companies began to manage their inventory differently, and worked together to keep their inventories low at each location. In doing so, they agreed to sell inventory to each other as needed at a markup of 10% of cost. Perry sold merchandise that cost $100,000 to Standard for $110,000, and Standard sold inventory that cost $80,000 to Perry for $88,000. Half of this merchandise remained in each company's inventory at December 31, 2014.

Required:

Prepare a consolidated income statement for Perry Corporation and Subsidiary for 2014.

During 2014, the companies began to manage their inventory differently, and worked together to keep their inventories low at each location. In doing so, they agreed to sell inventory to each other as needed at a markup of 10% of cost. Perry sold merchandise that cost $100,000 to Standard for $110,000, and Standard sold inventory that cost $80,000 to Perry for $88,000. Half of this merchandise remained in each company's inventory at December 31, 2014.

During 2014, the companies began to manage their inventory differently, and worked together to keep their inventories low at each location. In doing so, they agreed to sell inventory to each other as needed at a markup of 10% of cost. Perry sold merchandise that cost $100,000 to Standard for $110,000, and Standard sold inventory that cost $80,000 to Perry for $88,000. Half of this merchandise remained in each company's inventory at December 31, 2014.Required:

Prepare a consolidated income statement for Perry Corporation and Subsidiary for 2014.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

24

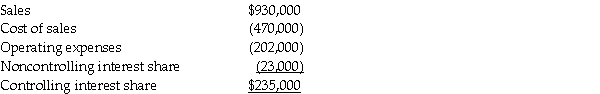

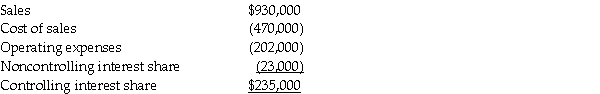

Pastern Industries has an 80% ownership stake in Sascon Incorporated. At the time of purchase, the book value of Sascon's assets and liabilities were equal to the fair value. The cost of the 80% investment was equal to 80% of the book value of Sascon's net assets. At the end of 2014, they issued the following consolidated income statement:

Shortly after the statements were issued, Pastern discovered that the 2014 intercompany sales transactions had not been properly eliminated in consolidation. In fact, Pastern had sold inventory that cost $80,000 to Sascon for $90,000, and Sascon had sold inventory that cost $50,000 to Pastern for $65,000. Half of the products from both transactions still remained in inventory at December 31, 2014.

Shortly after the statements were issued, Pastern discovered that the 2014 intercompany sales transactions had not been properly eliminated in consolidation. In fact, Pastern had sold inventory that cost $80,000 to Sascon for $90,000, and Sascon had sold inventory that cost $50,000 to Pastern for $65,000. Half of the products from both transactions still remained in inventory at December 31, 2014.

Required: Prepare a corrected income statement for Pastern and Subsidiary for 2014.

Shortly after the statements were issued, Pastern discovered that the 2014 intercompany sales transactions had not been properly eliminated in consolidation. In fact, Pastern had sold inventory that cost $80,000 to Sascon for $90,000, and Sascon had sold inventory that cost $50,000 to Pastern for $65,000. Half of the products from both transactions still remained in inventory at December 31, 2014.

Shortly after the statements were issued, Pastern discovered that the 2014 intercompany sales transactions had not been properly eliminated in consolidation. In fact, Pastern had sold inventory that cost $80,000 to Sascon for $90,000, and Sascon had sold inventory that cost $50,000 to Pastern for $65,000. Half of the products from both transactions still remained in inventory at December 31, 2014.Required: Prepare a corrected income statement for Pastern and Subsidiary for 2014.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

25

Pirate Transport bought 80% of the outstanding voting stock of Seaways Shipping at book value several years ago. (At the time of purchase, the fair value and book value of Seaways' net assets were equal.) Pirate sells merchandise to Seaways at 120% above Pirate's cost. Intercompany sales from Pirate to Seaways for 2014 were $450,000. Unrealized profits in Seaways' December 31, 2013 inventory and December 31, 2014 inventory were $17,000 and $15,000, respectively. Seaways reported net income of $750,000 for 2014.

Required:

1. Determine Pirate's income from Seaways for 2014.

2. In General Journal format, prepare consolidation working paper entries at December 31, 2014 to eliminate the effects of the intercompany inventory sales assuming the perpetual inventory method is used.

Required:

1. Determine Pirate's income from Seaways for 2014.

2. In General Journal format, prepare consolidation working paper entries at December 31, 2014 to eliminate the effects of the intercompany inventory sales assuming the perpetual inventory method is used.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

26

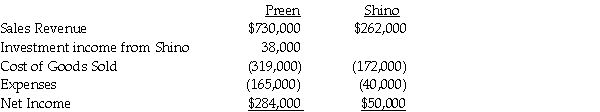

Preen Corporation acquired a 60% interest in Shino Corporation at a cost equal to 60% of the book value of Shino's net assets in 2014. At the time of acquisition, the book value and fair value of Shino's assets and liabilities were equal. During 2015, Preen sold $120,000 of merchandise to Shino. All intercompany sales are made at 150% of Preen's cost. Shino's beginning and ending inventories resulting from intercompany sales for 2015 were $60,000 and $36,000, respectively. Income statement information for both companies for 2015 is as follows:

Required:

Required:

Prepare a consolidated income statement for Preen Corporation and Subsidiary for 2015.

Required:

Required:Prepare a consolidated income statement for Preen Corporation and Subsidiary for 2015.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

27

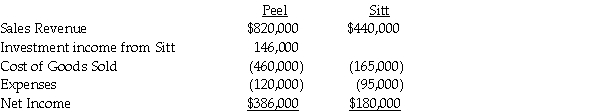

Peel Corporation acquired a 80% interest in Sitt Corporation at a cost equal to 80% of the book value of Sitt several years ago. At the time of purchase, the fair value and book value of Sitt's assets and liabilities were equal. Sitt purchases its entire inventory from Peel at 150% of Peel's cost. During 2014, Peel sold $190,000 of merchandise to Sitt. Sitt's beginning and ending inventories for 2014 were $72,000 and $66,000, respectively. Income statement information for both companies for 2014 is as follows:

Required:

Required:

Prepare a consolidated income statement for Peel Corporation and Subsidiary for 2014.

Required:

Required:Prepare a consolidated income statement for Peel Corporation and Subsidiary for 2014.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

28

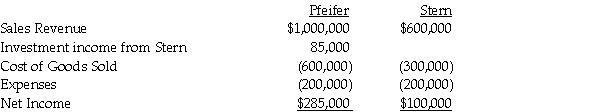

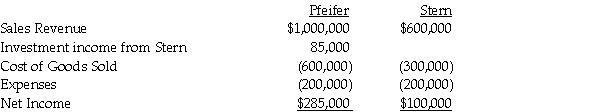

Pfeifer Corporation acquired an 80% interest in Stern Corporation several years ago when the book values and fair values of Stern's assets and liabilities were equal. At the time of acquisition, the cost of the 80% interest was equal to 80% of the book value of Stern's net assets. Separate company income statements for Pfeifer and Stern for the year ended December 31, 2014 are summarized as follows:

During 2013, Pfeifer sold merchandise that cost $120,000 to Stern for $180,000. Half of this merchandise remained in Stern's inventory at December 31, 2013. During 2014, Pfeifer sold merchandise that cost $150,000 to Stern for $225,000. One-third of this merchandise remained in Stern's December 31, 2014 inventory.

During 2013, Pfeifer sold merchandise that cost $120,000 to Stern for $180,000. Half of this merchandise remained in Stern's inventory at December 31, 2013. During 2014, Pfeifer sold merchandise that cost $150,000 to Stern for $225,000. One-third of this merchandise remained in Stern's December 31, 2014 inventory.

Required:

Prepare a consolidated income statement for Pfeifer Corporation and Subsidiary for 2014.

During 2013, Pfeifer sold merchandise that cost $120,000 to Stern for $180,000. Half of this merchandise remained in Stern's inventory at December 31, 2013. During 2014, Pfeifer sold merchandise that cost $150,000 to Stern for $225,000. One-third of this merchandise remained in Stern's December 31, 2014 inventory.

During 2013, Pfeifer sold merchandise that cost $120,000 to Stern for $180,000. Half of this merchandise remained in Stern's inventory at December 31, 2013. During 2014, Pfeifer sold merchandise that cost $150,000 to Stern for $225,000. One-third of this merchandise remained in Stern's December 31, 2014 inventory.Required:

Prepare a consolidated income statement for Pfeifer Corporation and Subsidiary for 2014.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

29

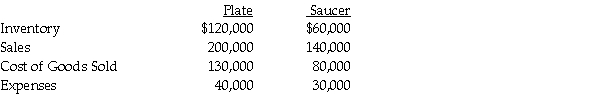

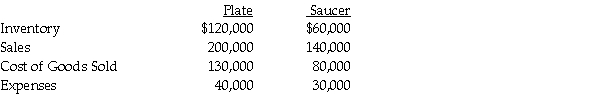

Presented below are several figures reported for Plate Corporation and Saucer Industries as of December 31, 2014. Plate has owned 70% of Saucer for the past five years, and at the time of purchase, the book value of Saucer's assets and liabilities equaled the fair value. The cost of the 70% investment was equal to 70% of the book value of Saucer's net assets. At the time of purchase, the fair values and book values of Saucer's assets and liabilities were equal.

In 2013, Saucer sold inventory to Plate which had cost $40,000 for $60,000. 25% of this inventory remained on hand at December 31, 2013, but was sold in 2014. In 2014, Saucer sold inventory to Plate which had cost $30,000 for $45,000. 40% of this inventory remained unsold at December 31, 2014.

In 2013, Saucer sold inventory to Plate which had cost $40,000 for $60,000. 25% of this inventory remained on hand at December 31, 2013, but was sold in 2014. In 2014, Saucer sold inventory to Plate which had cost $30,000 for $45,000. 40% of this inventory remained unsold at December 31, 2014.

Required: Calculate following balances at December 31, 2014.

a. Consolidated Sales

b. Consolidated Cost of goods sold

c. Consolidated Expenses

d. Noncontrolling interest share of Saucer's net income

e. Consolidated Inventory

In 2013, Saucer sold inventory to Plate which had cost $40,000 for $60,000. 25% of this inventory remained on hand at December 31, 2013, but was sold in 2014. In 2014, Saucer sold inventory to Plate which had cost $30,000 for $45,000. 40% of this inventory remained unsold at December 31, 2014.

In 2013, Saucer sold inventory to Plate which had cost $40,000 for $60,000. 25% of this inventory remained on hand at December 31, 2013, but was sold in 2014. In 2014, Saucer sold inventory to Plate which had cost $30,000 for $45,000. 40% of this inventory remained unsold at December 31, 2014.Required: Calculate following balances at December 31, 2014.

a. Consolidated Sales

b. Consolidated Cost of goods sold

c. Consolidated Expenses

d. Noncontrolling interest share of Saucer's net income

e. Consolidated Inventory

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

30

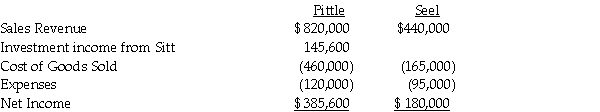

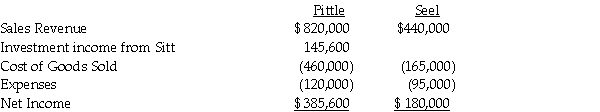

Pittle Corporation acquired a 80% interest in Seel Corporation at a cost equal to 80% of the book value of Seel's net assets several years ago. At the time of purchase, the fair value and book value of Seel's assets and liabilities were equal. Pittle purchases its entire inventory from Seel at 150% of Seel's cost. During 2014, Seel sold $490,000 of merchandise to Pittle. Pittle's beginning and ending inventories for 2014 were $72,000 and $66,000, respectively. Income statement information for both companies for 2014 is as follows:

Required:

Required:

Prepare a consolidated income statement for Pittle Corporation and Subsidiary for 2014.

Required:

Required:Prepare a consolidated income statement for Pittle Corporation and Subsidiary for 2014.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

31

Penguin Corporation acquired a 60% interest in Squid Corporation on January 1, 2014, at a cost equal to 60% of the book value of Squid's net assets. At the time of the acquisition, the book values of Squid's assets and liabilities were equal to the fair values. Squid reports net income of $880,000 for 2014. Penguin regularly sells merchandise to Squid at 120% of Penguin's cost. The intercompany sales information for 2014 is as follows:

Required:

Required:

1. Determine the unrealized profit in Squid's inventory at December 31, 2014.

2 Compute Penquin's income from Squid for 2014.

Required:

Required:1. Determine the unrealized profit in Squid's inventory at December 31, 2014.

2 Compute Penquin's income from Squid for 2014.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

32

On January 1, 2014, Palling Corporation purchased 70% of the common stock of Sam's Storage Systems for $320,000 when Sam's had Common Stock outstanding of $100,000 and Retained Earnings of $200,000. Any excess differential was attributed to goodwill.

At the end of 2014, Palling and Sam's had unrealized inventory profits from intercompany sales of $6,000 and $8,000, respectively. These year-end profit amounts were realized in 2015. At the end of 2015, Palling held inventory acquired from Sam's with a $10,000 unrealized profit. Palling reported separate income of $100,000 for 2015 and paid dividends of $30,000. Sam's reported separate income of $70,000 for 2015 and paid dividends of $20,000.

Required:

Compute the controlling interest share of consolidated net income for 2015.

At the end of 2014, Palling and Sam's had unrealized inventory profits from intercompany sales of $6,000 and $8,000, respectively. These year-end profit amounts were realized in 2015. At the end of 2015, Palling held inventory acquired from Sam's with a $10,000 unrealized profit. Palling reported separate income of $100,000 for 2015 and paid dividends of $30,000. Sam's reported separate income of $70,000 for 2015 and paid dividends of $20,000.

Required:

Compute the controlling interest share of consolidated net income for 2015.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

33

Salli Corporation regularly purchases merchandise from their 90% owner, Playtime Corporation. Playtime purchased the 90% interest at a cost equal to 90% of the book value of Salli's net assets. At the time of acquisition, the book values and fair values of Salli's assets and liabilities were equal. Playtime makes their sales to Salli at 120% of cost. In 2014, Salli reported net income of $460,000, and made purchases totaling $172,000 from Playtime. Although Salli had no inventory on hand at the beginning of 2014 that they had purchased from Playtime, at year end, they had $51,600 of this merchandise in inventory.

Required:

1. Determine the unrealized profit in Salli's inventory at December 31, 2014.

2. Compute Playtime's income from Salli for 2014.

Required:

1. Determine the unrealized profit in Salli's inventory at December 31, 2014.

2. Compute Playtime's income from Salli for 2014.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

34

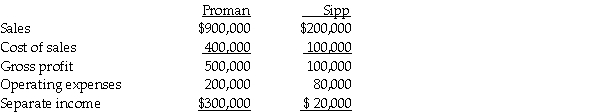

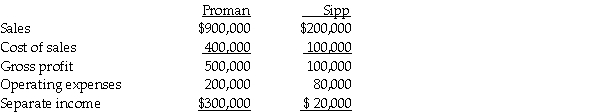

Proman Manufacturing owns a 90% interest in Sipp Company, purchased at a time when the book values of Sipp's recorded assets and liabilities were equal to fair values. During 2014, Sipp sold merchandise to Proman for $80,000 at a 20% gross profit. At December 31, 2014, 25% of this merchandise is still in Proman's inventory. Separate incomes for Proman and Sipp are summarized as follows:

Required: Prepare a consolidated income statement for 2014 for Proman and subsidiary.

Required: Prepare a consolidated income statement for 2014 for Proman and subsidiary.

Required: Prepare a consolidated income statement for 2014 for Proman and subsidiary.

Required: Prepare a consolidated income statement for 2014 for Proman and subsidiary.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

35

Psalm Enterprises owns 90% of the outstanding voting stock of Solomon Siding, which was purchased at a cost equal to 90% of the book value of Solomon's net assets many years ago. (At the time of purchase, the fair value and book value of Solomon's net assets were equal.) Psalm purchases merchandise from Solomon at 110% above Solomon's cost. In 2014, intercompany sales from Solomon to Psalm amounted to $362,000. Unrealized profits in Psalm's December 31, 2013 inventory and December 31, 2014 inventory were $82,000 and $26,000, respectively. Solomon reported net income of $980,000 for 2014.

Required:

1. Determine Psalm's income from Solomon for 2014.

2. In General Journal format, prepare consolidation working paper entries at December 31, 2014 to eliminate the effects of the intercompany inventory sales assuming the perpetual inventory method is used.

Required:

1. Determine Psalm's income from Solomon for 2014.

2. In General Journal format, prepare consolidation working paper entries at December 31, 2014 to eliminate the effects of the intercompany inventory sales assuming the perpetual inventory method is used.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

36

Plover Corporation acquired 80% of Sink Inc. equity on January 1, 2013, when the book values of Sink's assets and liabilities were equal to their fair values. The cost of the investment was equal to 80% of the book value of Sink's net assets.

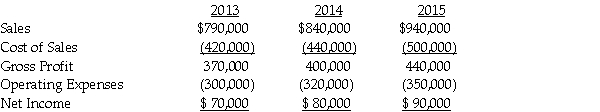

Plover separate income (excluding Sink) was $1,800,000, $1,700,000 and $1,900,000 in 2013, 2014 and 2015 respectively. Plover sold inventory to Sink during 2013 at a gross profit of $48,000 and one quarter remained at Sink at the end of the year. The remaining 25 percent was sold in 2014. At the end of 2014, Plover has $25,000 of inventory received from Sink from a sale of $100,000 which cost Sink $80,000. There are no unrealized profits in the inventory of Plover or Sink at the end of 2015. Plover uses the equity method in its separate books. Select financial information for Sink follows:

Required:

Required:

Prepare a schedule to determine the controlling interest share of the consolidated net income for 2013, 2014, and 2015.

Plover separate income (excluding Sink) was $1,800,000, $1,700,000 and $1,900,000 in 2013, 2014 and 2015 respectively. Plover sold inventory to Sink during 2013 at a gross profit of $48,000 and one quarter remained at Sink at the end of the year. The remaining 25 percent was sold in 2014. At the end of 2014, Plover has $25,000 of inventory received from Sink from a sale of $100,000 which cost Sink $80,000. There are no unrealized profits in the inventory of Plover or Sink at the end of 2015. Plover uses the equity method in its separate books. Select financial information for Sink follows:

Required:

Required:Prepare a schedule to determine the controlling interest share of the consolidated net income for 2013, 2014, and 2015.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

37

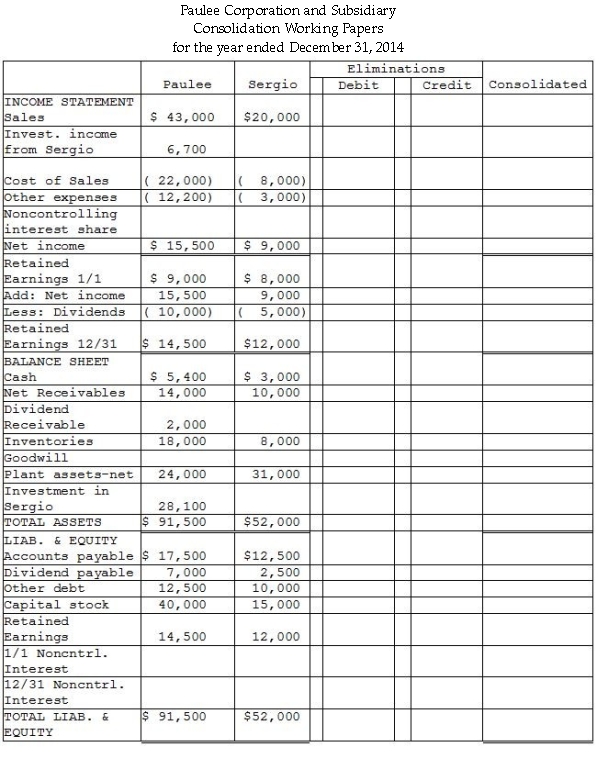

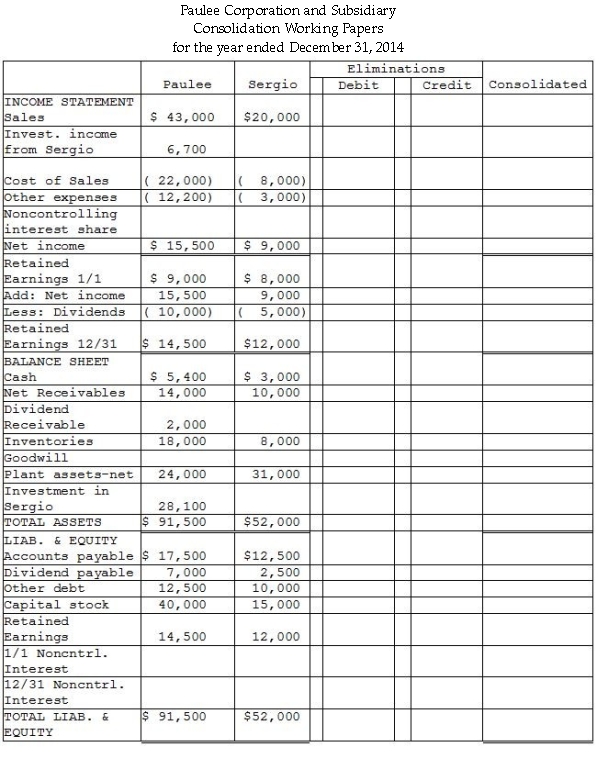

Paulee Corporation paid $24,800 for an 80% interest in Sergio Corporation on January 1, 2013, at which time Sergio's stockholders' equity consisted of $15,000 of Common Stock and $6,000 of Retained Earnings. The fair values of Sergio Corporation's assets and liabilities were identical to recorded book values when Paulee acquired its 80% interest.

Sergio Corporation reported net income of $4,000 and paid dividends of $2,000 during 2013.

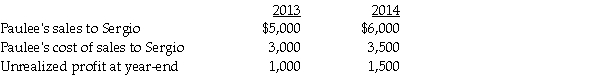

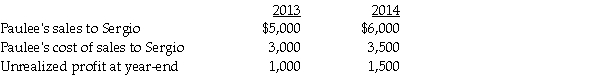

Paulee Corporation sold inventory items to Sergio during 2013 and 2014 as follows:

At December 31, 2014, the accounts payable of Sergio include $1,500 owed to Paulee for inventory purchases.

At December 31, 2014, the accounts payable of Sergio include $1,500 owed to Paulee for inventory purchases.

Required:

Financial statements of Paulee and Sergio appear in the first two columns of the partially completed working papers. Complete the consolidation working papers for Paulee Corporation and Subsidiary for the year ended December 31, 2014.

Sergio Corporation reported net income of $4,000 and paid dividends of $2,000 during 2013.

Paulee Corporation sold inventory items to Sergio during 2013 and 2014 as follows:

At December 31, 2014, the accounts payable of Sergio include $1,500 owed to Paulee for inventory purchases.

At December 31, 2014, the accounts payable of Sergio include $1,500 owed to Paulee for inventory purchases.Required:

Financial statements of Paulee and Sergio appear in the first two columns of the partially completed working papers. Complete the consolidation working papers for Paulee Corporation and Subsidiary for the year ended December 31, 2014.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

38

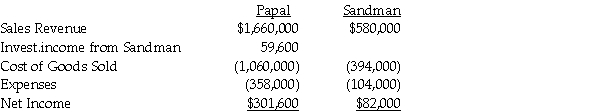

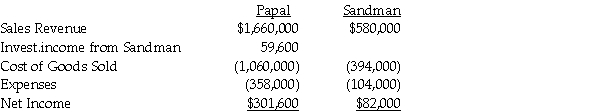

Papal Corporation acquired an 80% interest in Sandman Corporation at a cost equal to 80% of the book value of Sandman's net assets in 2013. At the time of the acquisition, the book values and fair values of Sandman's assets and liabilities were equal. During 2014, Papal recorded sales of $440,000 of merchandise to Sandman at a gross profit rate of 30%. Sandman's beginning and ending inventories for 2014 were $60,000 and $80,000, respectively. Income statement information for both companies for 2014 is as follows:

Required:

Required:

Prepare a consolidated income statement for Papal Corporation and Subsidiary for 2014.

Required:

Required:Prepare a consolidated income statement for Papal Corporation and Subsidiary for 2014.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

39

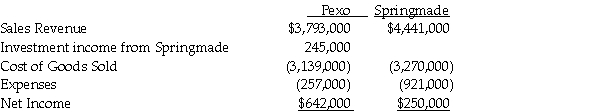

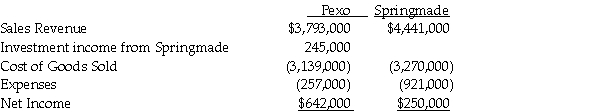

Pexo Industries purchases the majority of their raw materials from a wholly-owned subsidiary, Springmade Chemicals. Pexo purchased Springmade to assure supply availability at a time when the materials were being rationed in the industry due to supply issues overseas. Pexo was able to purchase Springmade at the book value of Springmade's net assets. At the time of purchase, the book value and fair value of Springmade's net assets were equal. Pexo purchased $2,890,000 of materials from Springmade in 2014 alone. All intercompany sales are made at 120% of cost, although Springmade is able to mark up their products 80% to other outside buyers. Pexo carried inventory on their books at the beginning and end of the year in the amount of $450,000 and $480,000, respectively, all of which had been purchased from Springmade. Income statement information for both companies for 2014 is as follows:

Required:

Required:

Prepare a consolidated income statement for Pexo Corporation and Subsidiary for 2014.

Required:

Required:Prepare a consolidated income statement for Pexo Corporation and Subsidiary for 2014.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

40

Plateau Incorporated bought 60% of the common stock of Sachet Company several years ago. At the time of purchase, the fair value and book value of Sachet's net assets were equal. The cost of the 60% investment was equal to 60% of the book value of Sachet's net assets. Plateau sells merchandise to Sachet at 125% above Plateau's cost. Intercompany sales from Plateau to Sachet for 2014 were $60,000. Unrealized profits in Sachet's December 31, 2013 inventory and December 31, 2014 inventory were $6,000 and $4,500, respectively. Sachet reported net income of $120,000 for 2014.

Required: In General Journal format, prepare consolidation working paper entries at December 31, 2014 to eliminate the effects of the intercompany inventory sales.

Required: In General Journal format, prepare consolidation working paper entries at December 31, 2014 to eliminate the effects of the intercompany inventory sales.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck