Deck 5: Itemized Deductions and Other Incentives

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/143

Play

Full screen (f)

Deck 5: Itemized Deductions and Other Incentives

1

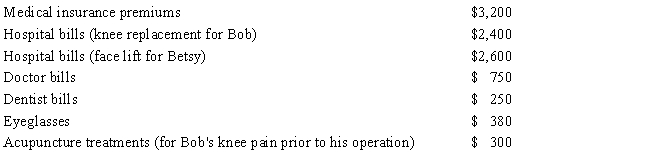

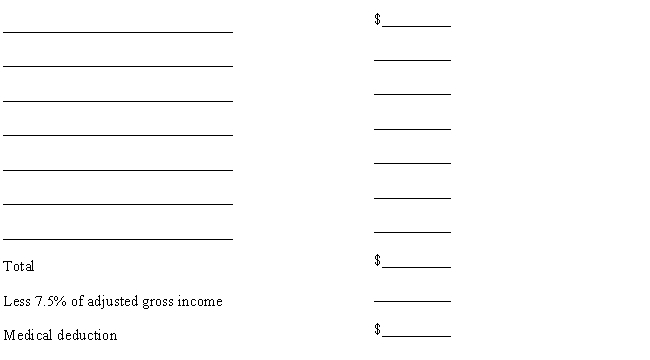

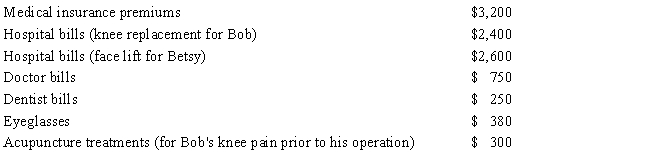

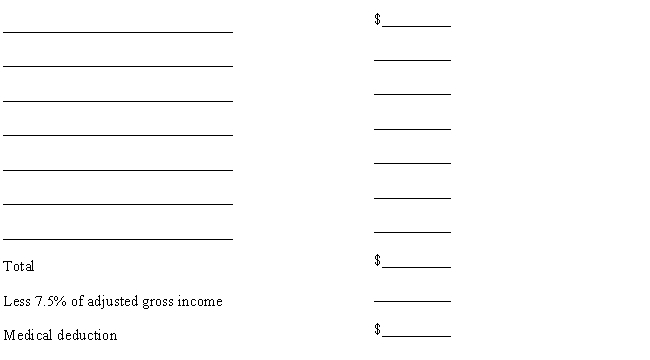

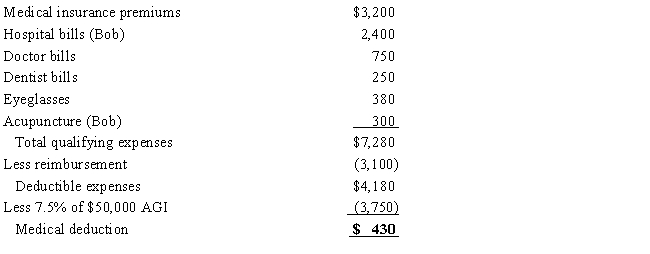

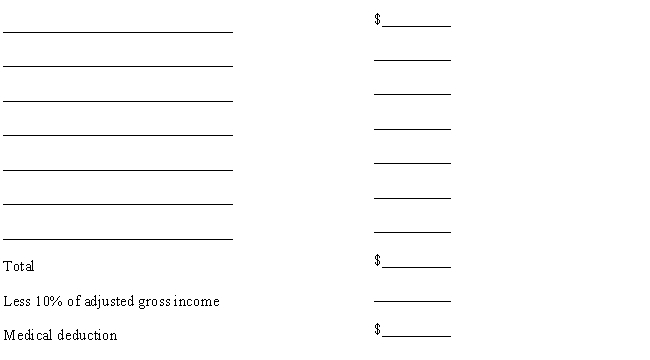

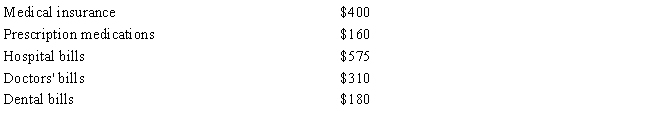

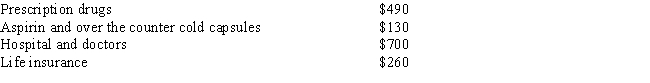

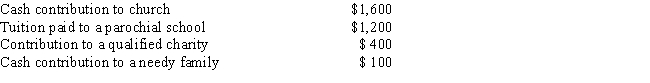

For 2016, Betsy and Bob, ages 62 and 68, respectively, are married taxpayers who file a joint tax return with AGI of $50,000. During the year they incurred the following expenses:

In addition, their insurance company reimbursed them $3,100 for the above expenses.

Using the format below, calculate Betsy and Bob's deduction for medical and dental expenses for 2016.

In addition, their insurance company reimbursed them $3,100 for the above expenses.

Using the format below, calculate Betsy and Bob's deduction for medical and dental expenses for 2016.

2

Lodging for a trip associated with medical care associated with a licensed hospital is not deductible.

False

3

If real property is sold during the year, the property taxes must be allocated between the buyer and seller based on the number of days the property was held by each party.

True

4

Glenda heard from a friend that prescriptions drugs were considerably cheaper overseas and purchases her regular prescription over the internet from a foreign company for $500. Though technically illegal, Glenda saves quite a bit and is pretty sure "everyone is doing it." Glenda can include the $500 cost of the prescription as a deductible medical expense.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

5

The 2016 standard mileage rate for taxpayer use of a personal auto for transportation for medical care is $.23 per mile.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

6

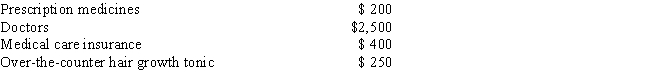

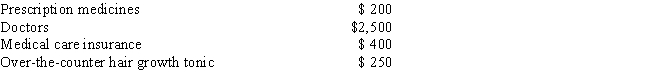

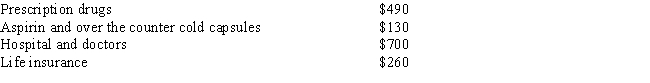

In 2016, David, age 65, had adjusted gross income of $32,000. During the year he paid the following medical expenses:

What amount can David deduct as medical expenses (after the adjusted gross income limitation) in calculating his itemized deductions for 2016?

What amount can David deduct as medical expenses (after the adjusted gross income limitation) in calculating his itemized deductions for 2016?

A)$0

B)$700

C)$800

D)$3,100

E)None of the above

What amount can David deduct as medical expenses (after the adjusted gross income limitation) in calculating his itemized deductions for 2016?

What amount can David deduct as medical expenses (after the adjusted gross income limitation) in calculating his itemized deductions for 2016?A)$0

B)$700

C)$800

D)$3,100

E)None of the above

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is not an itemized deduction?

A)Medical expenses

B)IRA contribution deduction

C)Personal property taxes

D)Union dues

E)All of the above are itemized deductions

A)Medical expenses

B)IRA contribution deduction

C)Personal property taxes

D)Union dues

E)All of the above are itemized deductions

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is not considered a deductible medical expense?

A)A face lift

B)Eye exams

C)Prescription drugs

D)Medical insurance

A)A face lift

B)Eye exams

C)Prescription drugs

D)Medical insurance

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

9

The adjusted gross income (AGI) limitation on medical expenses is 15 percent.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

10

If a taxpayer installs special equipment in their home for medical reasons, some or all of the cost can be included as a deductible medical expense.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

11

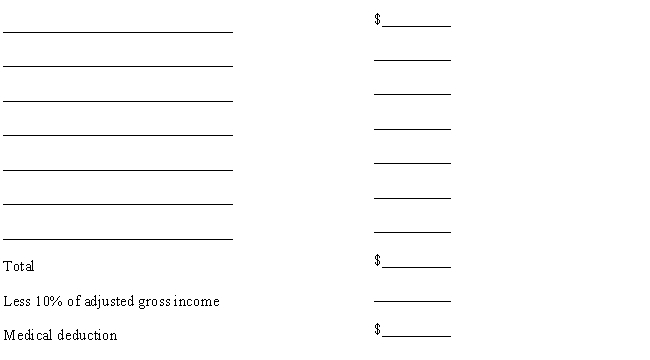

During 2016, Sarah, age 29, had adjusted gross income of $12,000 and paid the following amounts for medical expenses:

In 2016, Sarah drove 137 miles for medical transportation in her personal automobile, and she uses the standard mileage allowance. Her insurance company reimbursed Sarah $300 during the year for the above medical expenses. Using the schedule below, calculate the amount of Sarah's deduction for medical and dental expenses for the 2016 tax year.

In 2016, Sarah drove 137 miles for medical transportation in her personal automobile, and she uses the standard mileage allowance. Her insurance company reimbursed Sarah $300 during the year for the above medical expenses. Using the schedule below, calculate the amount of Sarah's deduction for medical and dental expenses for the 2016 tax year.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

12

The cost of a chiropractor's services qualifies as a medical deduction.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

13

Randy is advised by his physician to install an elevator in his residence, since he is afflicted with heart disease. The cost of installing the elevator is $10,000 and it has an estimated useful life of 10 years. He installs the elevator in January of the current year, and it increases the value of his residence by $8,000. Disregarding the limitation based on adjusted gross income, how much of the cost of the elevator may Randy take into account in determining his medical expense deduction for the current year?

A)$0

B)$750

C)$2,000

D)$10,000

E)None of the above

A)$0

B)$750

C)$2,000

D)$10,000

E)None of the above

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is not deductible as a medical expense on Schedule A?

A)Payments to a nurse

B)Payments for marriage counseling

C)Payments for dentures

D)Payments for psychiatric care

E)All of the above are deductible as medical expenses

A)Payments to a nurse

B)Payments for marriage counseling

C)Payments for dentures

D)Payments for psychiatric care

E)All of the above are deductible as medical expenses

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

15

Roberto, age 50, has AGI of $110,000 for 2016. He has medical expenses of $13,200. How much of the medical expenses can Roberto deduct on his Schedule A for 2016?

A)$0

B)$4,950

C)$11,000

D)$13,200

E)None of the above

A)$0

B)$4,950

C)$11,000

D)$13,200

E)None of the above

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

16

Premiums paid for life insurance policies are deductible as medical expenses.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

17

The cost of over-the-counter aspirin and decongestants is a deductible medical expense even though they are non-prescription drugs.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

18

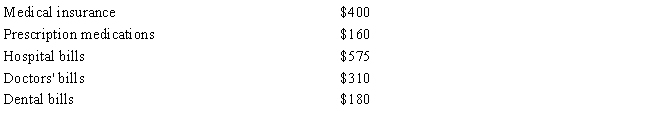

Jon, age 45, had adjusted gross income of $26,000 in 2016. During the year, he incurred and paid the following medical expenses: Jon received $900 in 2016 as a reimbursement for a portion of the doctors' fees. If Jon were to itemize his deductions, what would be his allowable medical expense deduction after the adjusted gross income limitation is taken into account?

A)$0

B)$425

C)$600

D)$1,000

E)None of the above

A)$0

B)$425

C)$600

D)$1,000

E)None of the above

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

19

Jake developed serious health problems and had his bathroom remodeled so it is wheelchair-accessible and had a handicapped shower installed, based on a written prescription by his doctor. The cost of the remodel is $15,000 and is deemed to add no value to his house by a real estate appraiser. How is the cost of the remodel treated on Jake's tax return?

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

20

During the current year, Mary paid the following expenses: What is the total amount of medical expenses (before considering the limitation based on adjusted gross income) that would enter into the calculation of itemized deductions on Mary's current year income tax return?

A)$700

B)$1,190

C)$1,450

D)$1,580

E)None of the above

A)$700

B)$1,190

C)$1,450

D)$1,580

E)None of the above

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

21

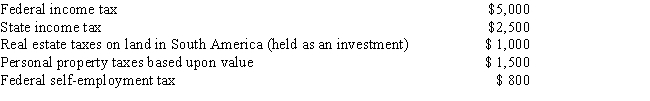

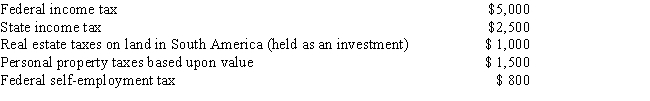

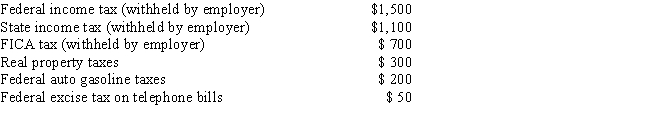

During the current year, Seth, a self-employed individual, paid the following taxes: What amount can Seth claim as an itemized deduction for taxes paid during the current year, assuming he elects to deduct state and local income taxes?

A)$2,400

B)$3,300

C)$4,200

D)$5,000

E)None of the above

A)$2,400

B)$3,300

C)$4,200

D)$5,000

E)None of the above

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

22

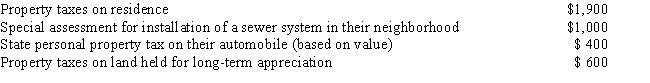

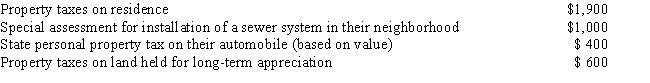

During the current year, Mr. and Mrs. West paid the following taxes: What amount can the Wests deduct as property taxes in calculating itemized deductions for the current year?

A)$0

B)$1,900

C)$2,300

D)$2,900

E)None of the above

A)$0

B)$1,900

C)$2,300

D)$2,900

E)None of the above

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

23

To calculate the amount of state and local income taxes which may be deducted as an itemized deduction, state income taxes paid during the year must be reduced by state income tax refunds received during the year.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

24

Meade paid $5,000 of state income taxes in 2016. The total actual sales taxes paid during 2016 was $4,500, which did not include $3,000 for the sales taxes paid in 2016 on Meade's new boat. How should Meade treat the taxes paid in his 2016 tax return?

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

25

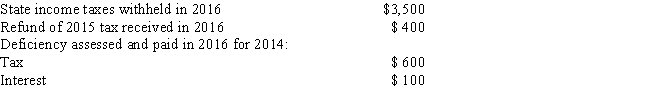

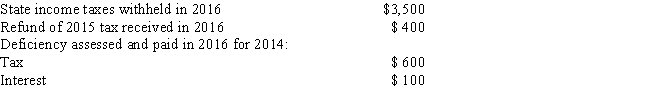

Weber resides in a state that imposes a tax on income. The following information relating to Weber's state income taxes is available: Assuming he elects to deduct state and local income taxes, what amount should Weber use as state and local income taxes in calculating itemized deductions for his 2016 Federal income tax return?

A)$2,700

B)$3,000

C)$3,500

D)$3,800

E)None of the above

A)$2,700

B)$3,000

C)$3,500

D)$3,800

E)None of the above

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

26

Daniel lives in a state that charges a vehicle registration fee of $50 plus $20 for every $1,000 of value. During the current year, Daniel paid $170 for registration of his automobile.

a.

How much of the vehicle registration fee is deductible as a personal property tax on Schedule A of Daniel's Form 1040?

b.Explain your answer.

a.

How much of the vehicle registration fee is deductible as a personal property tax on Schedule A of Daniel's Form 1040?

b.Explain your answer.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

27

Harvey itemized deductions on his 2015 income tax return. Harvey plans to itemize deductions again in 2016 and the following information is available regarding state and local income taxes: Assuming he elects to deduct state and local income taxes, the above information should be reported by Harvey in his 2016 tax return as:

A)Itemized deduction for state and local income taxes of $2,500, and income from state and local tax refund of $200

B)Itemized deduction for state and local income taxes of $2,300

C)Itemized deduction for state and local income taxes of $2,800

D)Itemized deduction for state and local income taxes of $2,800 and income from state and local tax refund of $500

E)None of the above

A)Itemized deduction for state and local income taxes of $2,500, and income from state and local tax refund of $200

B)Itemized deduction for state and local income taxes of $2,300

C)Itemized deduction for state and local income taxes of $2,800

D)Itemized deduction for state and local income taxes of $2,800 and income from state and local tax refund of $500

E)None of the above

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

28

Sherry had $5,600 withheld from her wages for state income taxes during 2016. In May of 2016, she received a $450 refund for her prior year state tax return. The amount of Sherry's tax on her 2016 tax return is $6,100 and she pays the additional tax of $500 ($6,100 - $5,600) when she files her state income tax return in April of 2017.

a.

Assuming she elects to deduct the state income tax, how much state income taxes should Sherry deduct on Schedule A of Form 1040 of her 2016 federal income tax return?

b.How should Sherry report the $450 refund?

a.

Assuming she elects to deduct the state income tax, how much state income taxes should Sherry deduct on Schedule A of Form 1040 of her 2016 federal income tax return?

b.How should Sherry report the $450 refund?

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

29

Taxpayers are permitted to take an itemized deduction for the lesser of state income taxes paid or state sales taxes paid.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

30

Stan, a single taxpayer, has $1,700 of state income taxes withheld from his wages in the current year. In the current year, he also received a $320 refund on his prior year state income tax. Stan did not itemize last year but he intends to do so this year. Stan used the sales tax estimate tables and determined his sales tax deduction amount is $1,600. What amount should Stan deduct for state taxes?

A)$0

B)$1,380

C)$1,600

D)$1,700

E)None of the above

A)$0

B)$1,380

C)$1,600

D)$1,700

E)None of the above

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

31

Frank is a resident of a state that imposes a tax on income. The following information pertaining to Frank's state income taxes is available: What amount should Frank use as state and local income taxes in calculating itemized deductions for his 2016 Federal tax return, assuming he elects to deduct state and local income taxes?

A)$3,500

B)$3,700

C)$4,100

D)$4,200

E)None of the above

A)$3,500

B)$3,700

C)$4,100

D)$4,200

E)None of the above

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

32

Margo has $2,200 withheld from her wages for state income taxes during 2016. In March of 2016, she paid $400 in additional taxes for her 2015 state tax return. Her state income tax liability for 2016 is $2,700 and she pays the additional $500 when she files her 2016 state tax return in April of 2017. What amount should Margo deduct as an itemized deduction for state income taxes on her 2016 federal income tax return, assuming she elects to deduct state and local income taxes?

A)$2,100

B)$2,500

C)$2,600

D)$3,100

E)None of the above

A)$2,100

B)$2,500

C)$2,600

D)$3,100

E)None of the above

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

33

The cost of a fishing license is considered a personal property tax and is deductible as an itemized deduction.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

34

Newt is a single taxpayer living in Hollywood, California, with adjusted gross income for the 2016 tax year of $43,050. Newt's employer withheld $3,700 in state income tax from his salary. In April of 2016, he paid $300 in additional state taxes for his prior year's return. The real estate taxes on his home are $1,800 for 2016 and his personal property tax based on the value of his automobile is $75. Also, he paid $210 for state gasoline taxes for the year. The IRS estimate of general sales tax for Newt is $1,200 for 2016.

How much should Newt deduct on Schedule A of Form 1040 of his 2016 tax return for taxes paid?

How much should Newt deduct on Schedule A of Form 1040 of his 2016 tax return for taxes paid?

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is not deductible as an itemized deduction?

A)State income taxes

B)Personal property taxes

C)Charitable contributions

D)Local income taxes

E)All of the above may be deductible as itemized deductions

A)State income taxes

B)Personal property taxes

C)Charitable contributions

D)Local income taxes

E)All of the above may be deductible as itemized deductions

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

36

In 2016, state income taxes may be deducted as an itemized deduction on Schedule A.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

37

Which one of the following is not tax deductible?

A)Real estate taxes

B)Property taxes

C)Local income taxes

D)State income taxes

E)All of the above are tax deductible

A)Real estate taxes

B)Property taxes

C)Local income taxes

D)State income taxes

E)All of the above are tax deductible

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

38

The amount of a special assessment charged to residents for the installation of sidewalks on their street is not deductible on Schedule A as property taxes.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following taxes is not deductible as an itemized deduction?

A)Property tax on second residence

B)Sales tax in a state with no income tax

C)Federal income tax

D)State income tax

A)Property tax on second residence

B)Sales tax in a state with no income tax

C)Federal income tax

D)State income tax

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

40

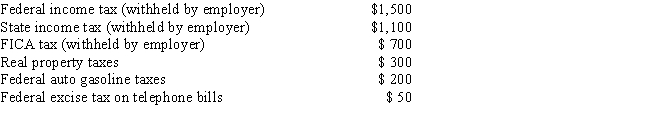

During the current year, George, a salaried taxpayer, paid the following taxes which were not incurred in connection with a trade or business: What amount can George claim for the current year as an itemized deduction for the taxes paid, assuming he elects to deduct state and local income taxes?

A)$1,100

B)$1,150

C)$1,400

D)$2,000

E)None of the above

A)$1,100

B)$1,150

C)$1,400

D)$2,000

E)None of the above

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

41

What is the maximum amount of home equity debt (not acquisition debt) on which interest is fully deductible?

A)$0

B)$50,000

C)$100,000

D)$200,000

E)None of the above

A)$0

B)$50,000

C)$100,000

D)$200,000

E)None of the above

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

42

Mortgage interest on a taxpayer's personal residence is not deductible on Schedule A.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

43

The interest paid on a loan used to acquire municipal bonds is not deductible.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

44

State sales taxes can be deducted in lieu of state income taxes.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

45

Bill has a mortgage loan on his personal residence. He decides to pay 18 months of interest in advance on October 1, 2016. The total advanced interest payment is $36,000. How much of the advance interest payment can he deduct in 2016?

A)$6,000

B)$24,000

C)$36,000

D)Mortgage interest is not deductible.

E)If a taxpayer makes an advance payment, he may not deduct any interest.

A)$6,000

B)$24,000

C)$36,000

D)Mortgage interest is not deductible.

E)If a taxpayer makes an advance payment, he may not deduct any interest.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

46

During the current year, Cary and Bill incurred acquisition debt on their residence of $1,300,000 and a home equity loan of $200,000. On a joint tax return, what is the amount of their qualified acquisition debt and qualified home equity debt, respectively?

A)$900,000 and $100,000

B)$1,000,000 and $0

C)$1,000,000 and $100,000

D)$1,300,000 and $200,000

E)None of the above

A)$900,000 and $100,000

B)$1,000,000 and $0

C)$1,000,000 and $100,000

D)$1,300,000 and $200,000

E)None of the above

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

47

Brittany determined that she paid $450 in gasoline excise taxes during the year when she bought gas for her commute to and from work. Brittany's gas excise taxes are deductible as an itemized deduction.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

48

The investment interest expense deduction is limited to the taxpayer's net investment income.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

49

Foreign income taxes paid are deductible.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

50

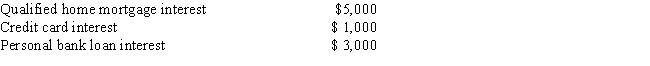

Amy paid the following interest expense during the current year: What is the amount of Amy's interest deduction for the current year?

A)$1,000

B)$3,000

C)$4,000

D)$5,000

E)$6,000

A)$1,000

B)$3,000

C)$4,000

D)$5,000

E)$6,000

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

51

Shellie, a single individual, received her Bachelor's degree in 2015, and took a job with a salary of $45,000 per year. In 2016, she began paying interest on qualified education loans. She was able to pay $1,500 in 2016. Which of the following statements is correct?

A)The full $1,500 is deductible in arriving at adjusted gross income (AGI).

B)If her payment had been $3,000, only $2,000 would have been deductible in arriving at AGI and the $1,000 excess would have been treated as nondeductible consumer interest.

C)If her income had been $60,000, the deductible amount would have been phased out.

D)Taxpayers are not allowed a deduction for education loan interest in 2016.

A)The full $1,500 is deductible in arriving at adjusted gross income (AGI).

B)If her payment had been $3,000, only $2,000 would have been deductible in arriving at AGI and the $1,000 excess would have been treated as nondeductible consumer interest.

C)If her income had been $60,000, the deductible amount would have been phased out.

D)Taxpayers are not allowed a deduction for education loan interest in 2016.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following types of interest is not deductible?

A)Qualified mortgage interest on residence

B)Qualified mortgage interest on second residence

C)Credit card interest

D)All of the above

E)None of the above

A)Qualified mortgage interest on residence

B)Qualified mortgage interest on second residence

C)Credit card interest

D)All of the above

E)None of the above

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

53

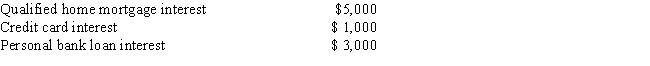

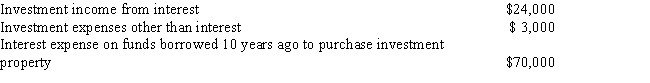

Fran paid the following amounts of interest during 2016:

Calculate the amount of Fran's interest deduction for 2016.

Calculate the amount of Fran's interest deduction for 2016.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following interest expense amounts is not deductible 2016?

A)Education loan interest of $2,000, assuming the taxpayer is single and has income of $150,000.

B)Home equity loan interest of $9,000 on a loan of $100,000, the proceeds of which were used to purchase a vacation home.

C)Investment interest expense of $10,000, assuming the taxpayer has $15,000 of investment income.

D)Points of $2,000 paid on a mortgage loan for the purchase of a new principal residence.

A)Education loan interest of $2,000, assuming the taxpayer is single and has income of $150,000.

B)Home equity loan interest of $9,000 on a loan of $100,000, the proceeds of which were used to purchase a vacation home.

C)Investment interest expense of $10,000, assuming the taxpayer has $15,000 of investment income.

D)Points of $2,000 paid on a mortgage loan for the purchase of a new principal residence.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

55

For the current tax year, David, a married taxpayer filing a joint return, reported the following: What is the maximum amount that David can deduct in the current year as investment interest expense?

A)$7,000

B)$20,000

C)$21,000

D)$24,000

E)None of the above

A)$7,000

B)$20,000

C)$21,000

D)$24,000

E)None of the above

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following is not deductible as interest expense on Schedule A?

A)Loan fee charged for appraisal service

B)Home mortgage interest

C)Mortgage interest on a second residence

D)Home mortgage prepayment penalties

E)All of the above are deductible as interest expense

A)Loan fee charged for appraisal service

B)Home mortgage interest

C)Mortgage interest on a second residence

D)Home mortgage prepayment penalties

E)All of the above are deductible as interest expense

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

57

Charu is charged $70 by the state she lives in related to vehicle registration based on the weight of her personal auto. Charu can deduct the $70 as an itemized deduction.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

58

Matthew purchases a new principal residence in the current year and pays points of $2,000 to obtain a mortgage loan. What is the proper tax treatment for the points paid?

A)The points are a nondeductible personal expense.

B)The points must be amortized over the life of the loan.

C)The points are fully deductible in the current year.

D)The points must be capitalized into the cost of the residence.

E)The points must be amortized over 5 years.

A)The points are a nondeductible personal expense.

B)The points must be amortized over the life of the loan.

C)The points are fully deductible in the current year.

D)The points must be capitalized into the cost of the residence.

E)The points must be amortized over 5 years.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

59

To deduct interest paid with respect to indebtedness, the taxpayer must be legally liable for the debt.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

60

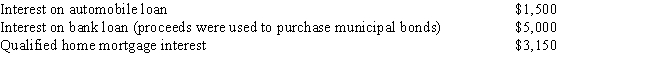

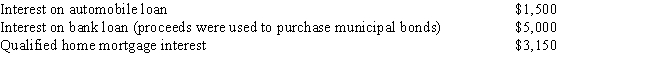

Jerry and Ann paid the following amounts during the current year: What is the maximum amount they can use as interest expense in calculating itemized deductions for the current year?

A)$3,000

B)$3,150

C)$4,500

D)$8,000

E)None of the above

A)$3,000

B)$3,150

C)$4,500

D)$8,000

E)None of the above

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following charitable contributions is not tax deductible?

A)Cash donated to a qualified church.

B)Clothing donated to a qualified veterans' organization.

C)Time donated to a qualified veterans' organization.

D)Donation of a car to a qualified non-profit organization.

E)All of the above are tax deductible.

A)Cash donated to a qualified church.

B)Clothing donated to a qualified veterans' organization.

C)Time donated to a qualified veterans' organization.

D)Donation of a car to a qualified non-profit organization.

E)All of the above are tax deductible.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

62

Stewart had adjusted gross income of $22,000 in 2016. During the year, he made the following contributions to qualified charities: - $7,000 cash

- 1,000 shares of Able Corporation common stock, acquired in 1980 (cost and fair market value of $5,000)

Considering the charitable contribution deduction limitation, what amount can Stewart claim as a deduction for charitable contributions in 2016?

A)$5,000

B)$7,000

C)$11,000

D)$12,000

E)None of the above

- 1,000 shares of Able Corporation common stock, acquired in 1980 (cost and fair market value of $5,000)

Considering the charitable contribution deduction limitation, what amount can Stewart claim as a deduction for charitable contributions in 2016?

A)$5,000

B)$7,000

C)$11,000

D)$12,000

E)None of the above

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

63

Taxpayers must itemize their deductions to be allowed a charitable contribution deduction.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

64

A taxpayer may donate the free use of property to a charitable organization and deduct the value as an itemized deduction.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following types of interest are not likely to be deductible in 2016?

A)Interest on personal credit cards

B)Interest on a $40,000 home equity line used to buy a car

C)Interest on a $150,000 mortgage on a principle residence

D)Private mortgage insurance premiums

E)All of the above are likely to be deductible

A)Interest on personal credit cards

B)Interest on a $40,000 home equity line used to buy a car

C)Interest on a $150,000 mortgage on a principle residence

D)Private mortgage insurance premiums

E)All of the above are likely to be deductible

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

66

Dongkuk uses his holiday bonus to pay his January 2017 mortgage payment in December 2016. The payment would normally be due January 31st. Dongkuk may deduct the interest paid as part of the early mortgage payment.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

67

Richie Rominey purchases a new $4.3 million qualified principal residence in Palo Alto, CA using a mortgage loan of $3 million. Richie's mortgage interest deduction may be limited.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

68

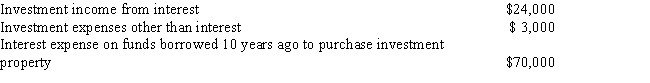

Douglas and Dena paid the following amounts of interest during the current year:

a.Calculate the amount of their allowable deduction for investment interest for the current year.

b.Calculate the amount of Douglas and Dena's total allowable deduction for interest for the current year.

a.Calculate the amount of their allowable deduction for investment interest for the current year.

b.Calculate the amount of Douglas and Dena's total allowable deduction for interest for the current year.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

69

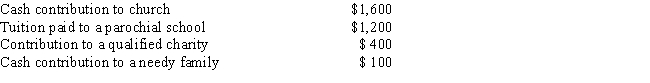

For 2016, Eugene and Linda had adjusted gross income of $30,000. Additional information for 2016 is as follows: What is the maximum amount that they can use as a deduction for charitable contributions for 2016?

A)$500

B)$1,600

C)$1,700

D)$2,000

E)None of the above

A)$500

B)$1,600

C)$1,700

D)$2,000

E)None of the above

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

70

Sally and Jim purchased their personal residence in Santa Barbara 20 years ago for $150,000. The home has a fair market value today of $1,000,000. For the current year, they have a $10,000 first mortgage on their home, on which they paid $1,000 in interest. They also have a home equity loan secured by their home with a balance throughout the year of $110,000. The proceeds of the home equity loan were used to send their two children to college. They paid interest on the home equity loan of $5,500 for the year.

Calculate the amount of their deduction for interest paid on qualified residence acquisition debt and qualified home equity debt for the current year.

Qualified residence acquisition debt interest:

Qualified home equity debt interest:

Calculate the amount of their deduction for interest paid on qualified residence acquisition debt and qualified home equity debt for the current year.

Qualified residence acquisition debt interest:

Qualified home equity debt interest:

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

71

Individual taxpayers may carry forward indefinitely charitable contributions that are not allowed as a deduction in the current year due to the adjusted gross income limitation.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

72

Perry Mayson, a single taxpayer, graduated law school last year with quite a bit of qualified student loan debt and ends up paying $4,300 in interest on the loan in the current tax year. Fortunately, Perry is well compensated and earns adjusted gross income of $85,000 during the current year. Perry may deduct his student loan interest in the current year.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

73

Christine saw a television advertisement asking for donations of used vehicles to a charitable foundation and decided to donate her old car. Which of the following statements is correct?

A)She can take a tax deduction large enough on an after-tax basis to equal the amount she would have received if she sold the car directly.

B)She can take a deduction greater than the amount for which the charity actually sells the vehicle.

C)She can claim an estimated value for the auto if the charity uses it rather than selling it.

D)The charity is not required to provide her with any information about what they do with the auto.

A)She can take a tax deduction large enough on an after-tax basis to equal the amount she would have received if she sold the car directly.

B)She can take a deduction greater than the amount for which the charity actually sells the vehicle.

C)She can claim an estimated value for the auto if the charity uses it rather than selling it.

D)The charity is not required to provide her with any information about what they do with the auto.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

74

Alice purchases a new personal auto and finances the purchase through the dealer. The interest of $760 she pays on the car loan during the current tax year is deductible.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

75

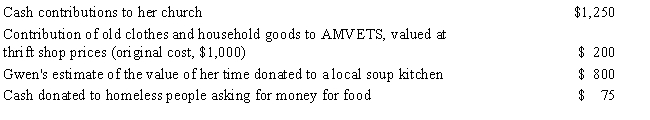

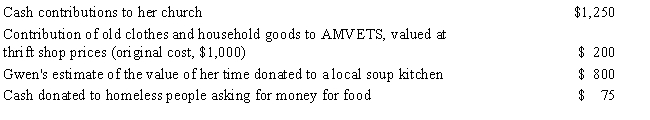

Gwen has written acknowledgments for each of the following charitable contributions during the current year:

What is Gwen's charitable contribution deduction for the current year?

What is Gwen's charitable contribution deduction for the current year?

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

76

Andy borrows $20,000 to invest in bonds. During the current year, his interest on the loan is $2,000. Andy's interest income from the bonds is $400 and his investment expenses are $300.

a.Calculate Andy's itemized deduction for investment interest for this year.

b.Is Andy entitled to a deduction in future years?

a.Calculate Andy's itemized deduction for investment interest for this year.

b.Is Andy entitled to a deduction in future years?

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

77

If a taxpayer contributes a painting to a museum but reserves the right to use the painting for parties, he may not be allowed a deduction for the charitable contribution.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

78

For a taxpayer with adjusted gross income of $56,000, private mortgage insurance (PMI) is deductible in 2016.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

79

During the current year, Hom donates a sculpture that cost $1,000 to a museum for exhibition. The sculpture's fair market value was $1,700 on the date of the donation, and Hom's adjusted gross income is $40,000.

a.

If Hom had held the sculpture for 4 months and the $700 ($1,700 - $1,000) of appreciation would have been a short-term capital gain, calculate the amount of his itemized deduction for the contribution.

b.

If Hom had held the sculpture for 2 years and the $700 gain would have been a long-term capital gain, calculate the amount of his itemized deduction for the contribution.

a.

If Hom had held the sculpture for 4 months and the $700 ($1,700 - $1,000) of appreciation would have been a short-term capital gain, calculate the amount of his itemized deduction for the contribution.

b.

If Hom had held the sculpture for 2 years and the $700 gain would have been a long-term capital gain, calculate the amount of his itemized deduction for the contribution.

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck

80

Melvin owns his home and has a $200,000 mortgage related to his purchase of the residence. In the fall of the current year, he borrows $40,000 on credit cards for college costs for his two sons. The interest expense on the mortgage is $15,000 and the interest expense on the credit cards is $6,000. How much of the interest is deductible as an itemized deduction and why? If you were Melvin's accountant, what tax planning suggestion might you have made to him?

Unlock Deck

Unlock for access to all 143 flashcards in this deck.

Unlock Deck

k this deck