Deck 20: Corporations and Bonds Payable

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/138

Play

Full screen (f)

Deck 20: Corporations and Bonds Payable

1

Bond certificates state the:

A)market value and contract rate.

B)face value and contract rate.

C)market value and current interest rate.

D)face value and current interest rate.

A)market value and contract rate.

B)face value and contract rate.

C)market value and current interest rate.

D)face value and current interest rate.

B

2

Bonds that may be redeemed at a certain price level are known as:

A)callable bonds.

B)debenture bonds.

C)serial bonds.

D)convertible bonds.

A)callable bonds.

B)debenture bonds.

C)serial bonds.

D)convertible bonds.

A

3

Which of the following statements is true?

A)Bondholders would be paid before stockholders in a liquidation.

B)Dividends are required to be paid to stockholders.

C)Bondholders are owners while stockholders are creditors.

D)Stockholders receive a fixed interest while bondholders are paid only if earnings are sufficient.

A)Bondholders would be paid before stockholders in a liquidation.

B)Dividends are required to be paid to stockholders.

C)Bondholders are owners while stockholders are creditors.

D)Stockholders receive a fixed interest while bondholders are paid only if earnings are sufficient.

A

4

A $1,000 bond quoted at 96.5 would sell for:

A)$1,000.

B)$965.

C)$96.50.

D)None of the above.

A)$1,000.

B)$965.

C)$96.50.

D)None of the above.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

5

A $1,000 bond quoted at 104 would sell for:

A)$1,104.

B)$1,000.

C)$104.

D)$1,040.

A)$1,104.

B)$1,000.

C)$104.

D)$1,040.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

6

The interest rate specified in the bond indenture is called the:

A)market rate.

B)discount rate.

C)contract rate.

D)effective rate.

A)market rate.

B)discount rate.

C)contract rate.

D)effective rate.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

7

The information on the bond certificate written by the corporation in a formal agreement is called:

A)a bond contract.

B)a bondholder's agreement.

C)a bond indenture.

D)a bond quote.

A)a bond contract.

B)a bondholder's agreement.

C)a bond indenture.

D)a bond quote.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

8

When the contract rate of interest on bonds is equal to the market rate of interest, bonds sell at:

A)a premium.

B)their face value.

C)their maturity value.

D)a discount.

A)a premium.

B)their face value.

C)their maturity value.

D)a discount.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

9

Bonds payable issued with collateral are called:

A)debenture bonds.

B)serial bonds.

C)callable bonds.

D)secured bonds.

A)debenture bonds.

B)serial bonds.

C)callable bonds.

D)secured bonds.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

10

Bailey Corporation has decided to issue bonds pledging specific assets. What type of bonds is it offering?

A)Secured bonds

B)Debenture bonds

C)Convertible bonds

D)Serial bonds

A)Secured bonds

B)Debenture bonds

C)Convertible bonds

D)Serial bonds

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

11

A bond payable is similar to which of the following?

A)Accounts Payable

B)Accounts Receivable

C)Notes Payable

D)Cash

A)Accounts Payable

B)Accounts Receivable

C)Notes Payable

D)Cash

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

12

The amount to be paid on the maturity date of a bond is called the:

A)face value of the bond.

B)current market value of the bond.

C)quoted value of the bond.

D)indenture amount of the bond.

A)face value of the bond.

B)current market value of the bond.

C)quoted value of the bond.

D)indenture amount of the bond.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

13

When the market rate of interest on bonds is higher than the contract rate, the bonds will sell at:

A)a premium.

B)their face value.

C)their maturity value.

D)a discount.

A)a premium.

B)their face value.

C)their maturity value.

D)a discount.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

14

A special type of long-term interest-bearing note payable issued by a corporation to raise capital is called a:

A)short-term note payable.

B)bond payable.

C)stock issue.

D)treasury stock issue.

A)short-term note payable.

B)bond payable.

C)stock issue.

D)treasury stock issue.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

15

One reason a corporation might issue bonds rather than selling stock is that:

A)bond interest is a tax-deductible expense.

B)interest rates are high.

C)dividends will lower the amount of tax due.

D)bondholders have claims at liquidation.

A)bond interest is a tax-deductible expense.

B)interest rates are high.

C)dividends will lower the amount of tax due.

D)bondholders have claims at liquidation.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

16

Dividends paid to stockholders are:

A)taxable to the recipient stockholder.

B)taxable to the corporation.

C)treated the same as bond interest.

D)None of these answers are correct.

A)taxable to the recipient stockholder.

B)taxable to the corporation.

C)treated the same as bond interest.

D)None of these answers are correct.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

17

When the maturities of a bond issue are spread over a several dates, the bonds are called:

A)term bonds.

B)bearer bonds.

C)debenture bonds.

D)serial bonds.

A)term bonds.

B)bearer bonds.

C)debenture bonds.

D)serial bonds.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

18

The contract rate for a bond is:

A)the annual interest rate based on selling price.

B)the annual interest rate based on market value.

C)the annual interest rate based on face value.

D)None of these answers are correct.

A)the annual interest rate based on selling price.

B)the annual interest rate based on market value.

C)the annual interest rate based on face value.

D)None of these answers are correct.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

19

The buyer pays the purchase price plus accrued interest since the last interest payment when:

A)the bond matures.

B)the bond is bought on an interest date.

C)the bond is bought between interest dates.

D)the bond is originally issued.

A)the bond matures.

B)the bond is bought on an interest date.

C)the bond is bought between interest dates.

D)the bond is originally issued.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

20

For a corporation, a premium on bonds results when:

A)the contract rate is greater than the market rate.

B)the contract rate is less than the market rate.

C)the face value is greater than the effective rate.

D)None of these answers are correct.

A)the contract rate is greater than the market rate.

B)the contract rate is less than the market rate.

C)the face value is greater than the effective rate.

D)None of these answers are correct.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

21

A bond is issued for more than its face value. Which of the following statements most likely would explain why?

A)The bond's contract rate is lower than the market rate at the time of the issue.

B)The bond's contract rate is the same as the market rate at the time of the issue.

C)The bond's contract rate is higher than the market rate at the time of the issue.

D)The bond is secured by specific assets of the corporation.

A)The bond's contract rate is lower than the market rate at the time of the issue.

B)The bond's contract rate is the same as the market rate at the time of the issue.

C)The bond's contract rate is higher than the market rate at the time of the issue.

D)The bond is secured by specific assets of the corporation.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

22

The sale and issuance of $400,000, 8% bonds with a market rate of 8% would involving debiting Cash for:

A)$432,000.

B)$400,000.

C)$368,000.

D)$ 32,000.

A)$432,000.

B)$400,000.

C)$368,000.

D)$ 32,000.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

23

A bond is issued for an amount equal to its face value. Which of the following statements most likely would explain why?

A)The bond's contract rate is lower than the market rate at the time of the issue.

B)The bond's contract rate is the same as the market rate at the time of the issue.

C)The bond's contract rate is higher than the market rate at the time of the issue.

D)The bond is secured by specific assets of the corporation.

A)The bond's contract rate is lower than the market rate at the time of the issue.

B)The bond's contract rate is the same as the market rate at the time of the issue.

C)The bond's contract rate is higher than the market rate at the time of the issue.

D)The bond is secured by specific assets of the corporation.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

24

If bonds are sold between interest payment dates, the amount of cash the issuer receives is:

A)more than the market value of the bonds.

B)less than the market value of the bonds.

C)equal to the market value of the bonds.

D)equal to the face value of the bonds.

A)more than the market value of the bonds.

B)less than the market value of the bonds.

C)equal to the market value of the bonds.

D)equal to the face value of the bonds.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

25

A bond is issued for less than its face value. Which of the following statements most likely would explain why?

A)The bond's contract rate is lower than the market rate at the time of the issue.

B)The bond's contract rate is the same as the market rate at the time of the issue.

C)The bond's contract rate is higher than the market rate at the time of the issue.

D)The bond is not secured by specific assets of the corporation.

A)The bond's contract rate is lower than the market rate at the time of the issue.

B)The bond's contract rate is the same as the market rate at the time of the issue.

C)The bond's contract rate is higher than the market rate at the time of the issue.

D)The bond is not secured by specific assets of the corporation.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

26

On April 1, Braintree Corporation issued 10%, 10-year, $300,000 bonds at face value. Interest dates are April 1 and October 1. The amount of cash paid out for interest during the current calendar year is:

A)$0.

B)$15,000.

C)$30,000.

D)$31,000.

A)$0.

B)$15,000.

C)$30,000.

D)$31,000.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

27

When a bond issued at face value is retired, the journal entry is:

A)debit Bond Interest Expense, credit Cash.

B)debit Bonds Payable, credit Cash.

C)debit Cash, credit Bonds Payable.

D)debit Cash, credit Bond Interest Expense.

A)debit Bond Interest Expense, credit Cash.

B)debit Bonds Payable, credit Cash.

C)debit Cash, credit Bonds Payable.

D)debit Cash, credit Bond Interest Expense.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

28

All other factors being equal, issuing bonds rather than issuing stock will:

A)increase earnings per share.

B)decrease earnings per share.

C)have no effect on earnings per share.

D)Cannot be determined from information given.

A)increase earnings per share.

B)decrease earnings per share.

C)have no effect on earnings per share.

D)Cannot be determined from information given.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

29

The interest rate on which cash payments to bondholders are based is the:

A)market rate.

B)discount rate.

C)contract rate.

D)amortization rate.

A)market rate.

B)discount rate.

C)contract rate.

D)amortization rate.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

30

The entry to record the issuance of a bond between interest payment dates will include a:

A)debit to Cash; credit to Bonds Payable; credit to Bonds Interest Payable.

B)debit to Bonds Payable; credit to Cash.

C)debit to Bond Interest Expense; credit to Bond Interest Payable.

D)debit to Bond Interest Payable; credit to Bond Interest Expense.

A)debit to Cash; credit to Bonds Payable; credit to Bonds Interest Payable.

B)debit to Bonds Payable; credit to Cash.

C)debit to Bond Interest Expense; credit to Bond Interest Payable.

D)debit to Bond Interest Payable; credit to Bond Interest Expense.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

31

When interest payments are made on a bond issued at face value, the journal entry is:

A)debit Bond Interest Expense, credit Cash.

B)debit Bonds Payable, credit Cash.

C)debit Cash, credit Bonds Payable.

D)debit Cash, credit Bond Interest Expense.

A)debit Bond Interest Expense, credit Cash.

B)debit Bonds Payable, credit Cash.

C)debit Cash, credit Bonds Payable.

D)debit Cash, credit Bond Interest Expense.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following best describes the term maturity date?

A)The date on which each interest payments is made

B)The date on which the bond is issued

C)The date on which the bond is called

D)The date on which the principal is repaid

A)The date on which each interest payments is made

B)The date on which the bond is issued

C)The date on which the bond is called

D)The date on which the principal is repaid

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

33

For a corporation, bond interest:

A)is treated the same as dividends for tax purposes.

B)has no effect on earnings and therefore has no effect on income taxes.

C)reduces income tax by reducing earnings.

D)None of the above.

A)is treated the same as dividends for tax purposes.

B)has no effect on earnings and therefore has no effect on income taxes.

C)reduces income tax by reducing earnings.

D)None of the above.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

34

The payment of quarterly interest on 12%, $60,000 bonds would be to:

A)debit Cash $3,600; credit Bond Interest Expense $3,600.

B)debit Bond Interest Expense $7,200; credit Cash $7,200.

C)debit Cash $1,800; credit Bond Interest Expense $1,800.

D)debit Bond Interest Expense $1,800; credit Cash $1,800.

A)debit Cash $3,600; credit Bond Interest Expense $3,600.

B)debit Bond Interest Expense $7,200; credit Cash $7,200.

C)debit Cash $1,800; credit Bond Interest Expense $1,800.

D)debit Bond Interest Expense $1,800; credit Cash $1,800.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

35

Bonds that are backed solely by the general credit of the corporation issuing the bonds are called:

A)callable bonds.

B)debenture bonds.

C)indenture bonds.

D)convertible bonds.

A)callable bonds.

B)debenture bonds.

C)indenture bonds.

D)convertible bonds.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

36

On October 1, Allan Company issued 8%, 10-year, $300,000 bonds at 100. Interest dates are April 1 and October 1. The amount of cash paid out for interest during the current calendar year is:

A)$0.

B)$24,000.

C)$12,000.

D)$6,000.

A)$0.

B)$24,000.

C)$12,000.

D)$6,000.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

37

The primary difference between secured bonds and debenture bonds is:

A)debenture bonds are paid on the same maturity date while secured bonds are paid on multiple dates.

B)secured bonds are backed with specific assets while debenture bonds are not.

C)secured bonds are registered with the issuing company while debenture bonds are not.

D)debenture bonds can be converted to stock while secured bonds cannot.

A)debenture bonds are paid on the same maturity date while secured bonds are paid on multiple dates.

B)secured bonds are backed with specific assets while debenture bonds are not.

C)secured bonds are registered with the issuing company while debenture bonds are not.

D)debenture bonds can be converted to stock while secured bonds cannot.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

38

Allan Corporation issued 300, 8%, 10-year, $1,000 bonds on July 1. The annual bond interest date is June 30, and the bonds were issued at face value. The amount of interest expense reported for the current year is:

A)$0.

B)$24,000.

C)$12,000.

D)None of the above are correct.

A)$0.

B)$24,000.

C)$12,000.

D)None of the above are correct.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

39

At the time a bond was sold at face value the entire amount of interest was recorded as an expense and a liability. This error would cause:

A)the period end assets to be overstated.

B)the period end liabilities to be understated.

C)the period's net income to be overstated.

D)None of the above are correct.

A)the period end assets to be overstated.

B)the period end liabilities to be understated.

C)the period's net income to be overstated.

D)None of the above are correct.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

40

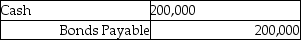

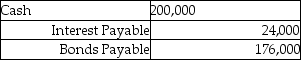

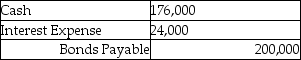

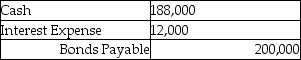

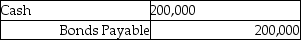

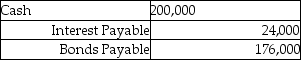

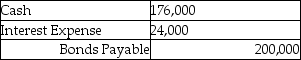

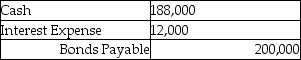

Martin Corporation sells $200,000, 12%, 10-year bonds at face value on January 1. Interest is paid on January 1 and July 1. The entry to record the issuance of the bonds on January 1 is:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

41

Bond interest expense is tax deductible only after the bond is paid off at maturity.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

42

On January 1, 20XX, Edward Company issued $200,000, 10-year, 8% bonds with semiannual interest payments on June 30 and December 31. Record the 20XX journal entries.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

43

On April 1, 20XX, Jones Company issued $200,000, 10-year, 6% bonds with semiannual interest payments on June 30 and December 31. Record the 20XX journal entries.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

44

To determine the interest payment on a bond, multiply the ________ value times the ________ interest rate.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

45

Using the straight-line method, the semiannual bond interest expense of a 12%, $300,000, 15-year bond issued at 95 is:

A)$36,500.

B)$35,500.

C)$18,500.

D)$17,500.

A)$36,500.

B)$35,500.

C)$18,500.

D)$17,500.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

46

The market rate of interest and the contract rate of interest will always be the same for a bond sold at face value.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

47

Bonds are long-term interest-bearing notes issued to multiple lenders, usually in increments of $1,000.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

48

The interest paid to bondholders is determined by:

A)multiplying the bond's annual rate of interest by the face value.

B)multiplying the market rate of interest by the face value.

C)dividing the bond's annual rate of interest by the face value.

D)dividing the face value by the bond's annual rate of interest.

A)multiplying the bond's annual rate of interest by the face value.

B)multiplying the market rate of interest by the face value.

C)dividing the bond's annual rate of interest by the face value.

D)dividing the face value by the bond's annual rate of interest.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

49

When the total amount of a bond issue matures at a certain date at which time the bondholder can convert into shares of stock, the bonds are called convertible bonds.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

50

A bond that has a face value of $250,000 with an annual interest rate of 9% paid semiannually and sold at par would have an interest payment of ________ semiannually.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

51

Bonds that can be exchanged for stock in the corporation are called ________ bonds.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

52

If a bond is issued at a premium, the effective interest rate is most likely ________ the contract interest rate.

A)higher than

B)lower than

C)the same as

D)Cannot be determined based on information given.

A)higher than

B)lower than

C)the same as

D)Cannot be determined based on information given.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

53

On October 1, German Company issued 12%, 10-year, $400,000 bonds at 105. Interest dates are April 1 and October 1. The amount of straight-line amortization for the current calendar year is:

A)$250.

B)$1000.

C)$2,000.

D)$500.

A)$250.

B)$1000.

C)$2,000.

D)$500.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

54

The entry to record the semiannual payment and amortization of the discount using the straight-line method on a 10%, $100,000, 5-year bond issued at 97 would be to:

A)debit Bond Interest Expense $5,000; credit Cash $5,000.

B)debit Bond Interest Expense $5,300; credit Cash $5,000; credit Discount on Bonds Payable $300.

C)debit Bond Interest Expense $10,000; credit Cash $10,000.

D)debit Bond Interest Expense $13,000; credit Cash $10,000; credit Discount on Bonds Payable $3,000.

A)debit Bond Interest Expense $5,000; credit Cash $5,000.

B)debit Bond Interest Expense $5,300; credit Cash $5,000; credit Discount on Bonds Payable $300.

C)debit Bond Interest Expense $10,000; credit Cash $10,000.

D)debit Bond Interest Expense $13,000; credit Cash $10,000; credit Discount on Bonds Payable $3,000.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

55

Bondholder claims for interest and repayment rank ahead of the claims of stockholders.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

56

The formal written agreement for issuing bonds is called a(n)________.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

57

What is the difference between a secured bond and a debenture bond?

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

58

If a corporation issues serial bonds, each bond will have the same maturity date.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

59

The corporation will repay the principal amount of the bond on the maturity date.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

60

Using the straight-line method, the semiannual interest expense of a 12%, $300,000 bond for 15 years at 102 would be:

A)$20,000.

B)$18,000.

C)$17,800.

D)$35,600.

A)$20,000.

B)$18,000.

C)$17,800.

D)$35,600.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

61

The real or actual rate of interest to the borrowing corporation is called the:

A)market rate of interest.

B)effective rate of interest.

C)discount rate of interest.

D)premium rate of interest.

A)market rate of interest.

B)effective rate of interest.

C)discount rate of interest.

D)premium rate of interest.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

62

Discount on Bonds Payable is a:

A)contra-asset account.

B)contra-liability account.

C)contra-equity account.

D)None of these answers are correct.

A)contra-asset account.

B)contra-liability account.

C)contra-equity account.

D)None of these answers are correct.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

63

The carrying value for bonds sold at a discount:

A)equals face value at all times.

B)increases as time passes until it matures at face value.

C)decreases as time passes until it matures at face value.

D)None of these answers are correct.

A)equals face value at all times.

B)increases as time passes until it matures at face value.

C)decreases as time passes until it matures at face value.

D)None of these answers are correct.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

64

Carrying value is the same thing as:

A)fair market value.

B)discount value.

C)premium value.

D)book value.

A)fair market value.

B)discount value.

C)premium value.

D)book value.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

65

Evans Corporation sells $200,000, 10%, 10-year bonds for 97 on January 1. Compute the semi-annual interest expense recorded on July 1 using the interest method. The market rate is 12%.

A)$5,820

B)$20,000

C)$10,000

D)$11,640

A)$5,820

B)$20,000

C)$10,000

D)$11,640

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

66

When selling bonds at a premium, the premium received effectively:

A)reduces the cost of borrowing.

B)increases the cost of borrowing.

C)does not affect the cost of borrowing.

D)reduces the amount of cash received when bonds are sold.

A)reduces the cost of borrowing.

B)increases the cost of borrowing.

C)does not affect the cost of borrowing.

D)reduces the amount of cash received when bonds are sold.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

67

Corbin Corporation issued 400, $1,000, 11% bonds at 96. The entry to record this transaction is:

A)debit Cash $400,000; credit Bonds Payable $384,000; credit Discount on Bonds Payable $16,000.

B)debit Cash $384,000; credit Bonds Payable $384,000.

C)debit Cash $44,000; credit Bonds Payable $44,000.

D)debit Cash $384,000; debit Discount on Bonds Payable $16,000; credit Bonds Payable $400,000.

A)debit Cash $400,000; credit Bonds Payable $384,000; credit Discount on Bonds Payable $16,000.

B)debit Cash $384,000; credit Bonds Payable $384,000.

C)debit Cash $44,000; credit Bonds Payable $44,000.

D)debit Cash $384,000; debit Discount on Bonds Payable $16,000; credit Bonds Payable $400,000.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

68

Interest expense will be greater than the interest payment when bonds are issued at:

A)a premium.

B)face value.

C)a discount.

D)the contract rate.

A)a premium.

B)face value.

C)a discount.

D)the contract rate.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

69

Hefley Corporation issued a 10%, $500,000, 8-year bond at 105. The entry to record the issuance transaction is to:

A)debit Cash $500,000; credit Bonds Payable $500,000.

B)debit Cash $525,000; credit Bonds Payable $525,000.

C)debit Cash $525,000; credit Bonds Payable $500,000; credit Premium on Bonds Payable $25,000.

D)debit Cash $500,000; debit Premium on Bonds Payable $25,000; credit Bonds Payable $525,000.

A)debit Cash $500,000; credit Bonds Payable $500,000.

B)debit Cash $525,000; credit Bonds Payable $525,000.

C)debit Cash $525,000; credit Bonds Payable $500,000; credit Premium on Bonds Payable $25,000.

D)debit Cash $500,000; debit Premium on Bonds Payable $25,000; credit Bonds Payable $525,000.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

70

On April 1, Braintree Corporation issued 10%, 10-year, $300,000 bonds at 106. Interest dates are April 1 and October 1. The amount of cash paid out for interest during the current calendar year is:

A)$0.

B)$15,000.

C)$30,000.

D)$31,000.

A)$0.

B)$15,000.

C)$30,000.

D)$31,000.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

71

When interest payments are made on a discounted bond, a portion of the discount is:

A)depreciated.

B)depleted.

C)amortized.

D)transferred to reduce the interest expense.

A)depreciated.

B)depleted.

C)amortized.

D)transferred to reduce the interest expense.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

72

Plaza Corporation issued $350,000 of 8%, 10-year bonds for 98. The entry to record the issuance of the bonds includes a:

A)debit to Discount on Bonds Payable for $7,000.

B)credit to Bonds Payable for $343,000.

C)debit to Bonds Payable for $350,000.

D)credit to Cash for $343,000.

A)debit to Discount on Bonds Payable for $7,000.

B)credit to Bonds Payable for $343,000.

C)debit to Bonds Payable for $350,000.

D)credit to Cash for $343,000.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

73

Bond Interest Payable is reported as a:

A)current liability on the balance sheet.

B)current liability on the income statement.

C)contra-liability on the balance sheet.

D)contra-liability on the income statement.

A)current liability on the balance sheet.

B)current liability on the income statement.

C)contra-liability on the balance sheet.

D)contra-liability on the income statement.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

74

Moab Corporation sells $500,000 of 7%, 20-year bonds for 98 on January 1. Interest is paid on January 1 and July 1. Straight-line amortization is used. What is the amount of the discount at issuance?

A)$10,000

B)$ 5,000

C)$35,000

D)$17,500

A)$10,000

B)$ 5,000

C)$35,000

D)$17,500

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

75

On October 1, Allan Company issued 8%, 10-year, $300,000 bonds at 105. Interest dates are April 1 and October 1. The amount of cash paid out for interest during the current calendar year is:

A)$0.

B)$24,000.

C)$12,000.

D)$6,000.

A)$0.

B)$24,000.

C)$12,000.

D)$6,000.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

76

Applegate Corporation sells $100,000, 8%, 10-year bonds for 95 on January 1. Interest is paid on January 1 and July 1. Straight-line amortization is used. The amount of interest expense recorded on July 1, six months after issuance is:

A)$4,000.

B)$4,250.

C)$3,750.

D)$8,500.

A)$4,000.

B)$4,250.

C)$3,750.

D)$8,500.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

77

Miranda Corporation issued $200,000 of 12%, 10-year bonds for $220,000. The entry to record the issuance of the bonds includes a:

A)debit to Bonds Payable for $200,000.

B)credit to Premium on Bonds Payable for $20,000.

C)credit to Bonds Payable for $220,000.

D)credit to Cash for $220,000.

A)debit to Bonds Payable for $200,000.

B)credit to Premium on Bonds Payable for $20,000.

C)credit to Bonds Payable for $220,000.

D)credit to Cash for $220,000.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

78

The carrying value of bonds is calculated by:

A)subtracting the Premium on Bonds Payable account balance from the Bonds Payable account balance.

B)adding the Premium on Bonds Payable account balance to the Bonds Payable account balance.

C)adding the Discount on Bonds Payable account balance to the Bonds Payable account balance.

D)adding the Bonds Payable account balance to the Bond Interest Payable account balance.

A)subtracting the Premium on Bonds Payable account balance from the Bonds Payable account balance.

B)adding the Premium on Bonds Payable account balance to the Bonds Payable account balance.

C)adding the Discount on Bonds Payable account balance to the Bonds Payable account balance.

D)adding the Bonds Payable account balance to the Bond Interest Payable account balance.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

79

Condi Corporation sells $100,000, 12%, 10-year bonds for 97 on January 1, 2009. Interest is paid on January 1 and July 1. Straight-line amortization is used. The amount of interest paid on July 1, 2009 is:

A)$6,000.

B)$5,850.

C)$6,150.

D)$12,000.

A)$6,000.

B)$5,850.

C)$6,150.

D)$12,000.

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck

80

Davis Corporation sells $100,000, 12%, 10-year bonds for 103 on January 1. Compute the semi-annual interest expense recorded on July 1 using the interest method. The market rate is 8%.

A)$12,000

B)$4,120

C)$8,240

D)$6,000

A)$12,000

B)$4,120

C)$8,240

D)$6,000

Unlock Deck

Unlock for access to all 138 flashcards in this deck.

Unlock Deck

k this deck