Deck 16: Impairment of Assets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/23

Play

Full screen (f)

Deck 16: Impairment of Assets

1

During 2013 Sacco Limited, estimated that the carrying amount of goodwill was impaired and wrote it down by $50 000. In 2014, the company reassessed goodwill was decided that the old acquired goodwill still existed. The appropriate accounting treatment in 2014 is:

A) reverse the previous goodwill impairment loss

B) recognise the revalued amount of goodwill by an adjustment against the asset revaluation surplus account

C) ignore the reversal as it is prohibited by AASB 136 Impairment of Assets

D) increase goodwill by an adjustment to retained earnings.

A) reverse the previous goodwill impairment loss

B) recognise the revalued amount of goodwill by an adjustment against the asset revaluation surplus account

C) ignore the reversal as it is prohibited by AASB 136 Impairment of Assets

D) increase goodwill by an adjustment to retained earnings.

C

2

If an entity does not expect to recover the carrying amount of an asset, the entity has incurred:

A) an impairment loss

B) a depreciation expense

C) an amortisation cost

D) a loss on disposal

A) an impairment loss

B) a depreciation expense

C) an amortisation cost

D) a loss on disposal

A

3

An appropriate journal entry to recognise an impairment loss under the cost model is:

A)

DR Accumulated impairment losses

CR Impairment loss

B)

DR Accumulated impairment losses

CR Asset revaluation (Equity)

C)

DR Impairment loss

CR Accumulated depreciation \& impairment losses

D)

DR Revenue

CR Impairment loss

A)

DR Accumulated impairment losses

CR Impairment loss

B)

DR Accumulated impairment losses

CR Asset revaluation (Equity)

C)

DR Impairment loss

CR Accumulated depreciation \& impairment losses

D)

DR Revenue

CR Impairment loss

DR Impairment loss

CR Accumulated depreciation \& impairment losses

CR Accumulated depreciation \& impairment losses

4

When goodwill is acquired under a business combination it is subject to an impairment test every:

A) year

B) two years

C) three years

D) five years.

A) year

B) two years

C) three years

D) five years.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

5

The impairment test must be applied to tangible assets:

A) at each balance date

B) every three years

C) at each reporting date including interim reporting dates such as half-year

D) only if there is an indication that the asset may be impaired

A) at each balance date

B) every three years

C) at each reporting date including interim reporting dates such as half-year

D) only if there is an indication that the asset may be impaired

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

6

In relation to the impairment of assets, AASB 136 Impairment of Assets, requires the following disclosures for each class of assets:

I The line of the statement of profit or loss and other comprehensive income in which impairment losses are included.

II The amount of reversals of impairment losses during the period.

III The amount of impairment losses recognised directly in other comprehensive income.

IV The beginning and ending balances of any 'provision for impairment' account.

A) I, II, III and IV

B) I, II and III only

C) II and IV only

D) IV only.

I The line of the statement of profit or loss and other comprehensive income in which impairment losses are included.

II The amount of reversals of impairment losses during the period.

III The amount of impairment losses recognised directly in other comprehensive income.

IV The beginning and ending balances of any 'provision for impairment' account.

A) I, II, III and IV

B) I, II and III only

C) II and IV only

D) IV only.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

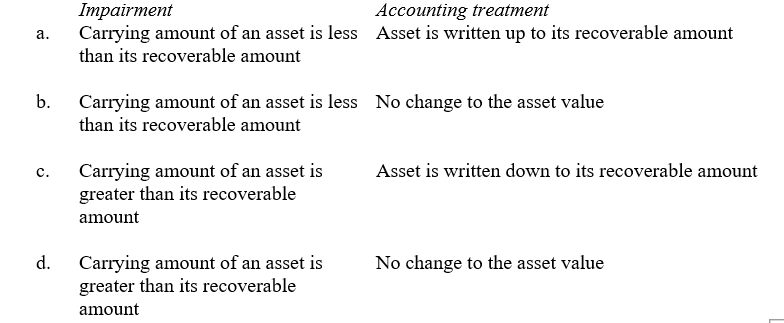

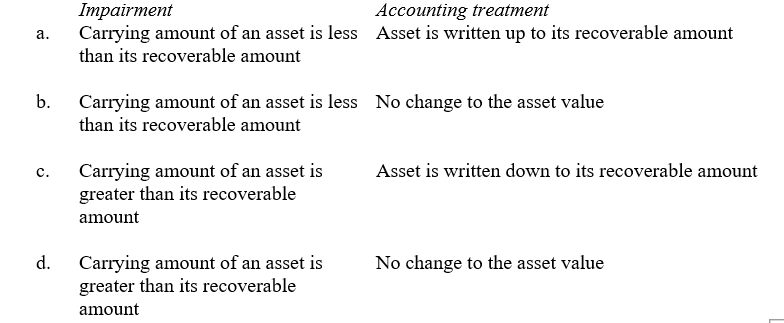

7

Under AASB 136 Impairment of Assets, impairment of an asset, and the accounting treatment using the cost model, are as follows:

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

8

Jam Pty Ltd has two cash generating units. CGU A had a carrying amount of $700 and value in use of $750. CGU B has a carrying amount of $900 and a value in use of $800. The carrying amount of the head office assets is $400. CGU A & B utilise the head office services equally. The impairment loss for CGU A is:

A) $0

B) $50

C) $150

D) $350

A) $0

B) $50

C) $150

D) $350

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

9

Candy Limited expected future cash flows from the use of Equipment as follows: End of Year 1 $4000; End of Year 2 $5000; End of Year 3 $2000. The discount rate was determined as 5%. The value in use of the equipment is:

A) $10 073

B) $10 576

C) $11 000

D) $11 550.

A) $10 073

B) $10 576

C) $11 000

D) $11 550.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

10

Value in use is:

A) amount obtainable from disposal of an asset excluding any selling costs

B) initial cost of an asset less any expected disposal costs

C) incremental costs directly attributable to disposal of an asset

D) the present value of future cash flows expected to be derived from an asset

A) amount obtainable from disposal of an asset excluding any selling costs

B) initial cost of an asset less any expected disposal costs

C) incremental costs directly attributable to disposal of an asset

D) the present value of future cash flows expected to be derived from an asset

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

11

An impairment loss occurs when:

A) the recoverable amount of an asset exceeds the carrying amount

B) the carrying amount of an asset exceeds the recoverable amount

C) the asset has a zero residual value

D) the recoverable amount of an asset exceeds its initial cost.

A) the recoverable amount of an asset exceeds the carrying amount

B) the carrying amount of an asset exceeds the recoverable amount

C) the asset has a zero residual value

D) the recoverable amount of an asset exceeds its initial cost.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

12

Nguyen Limited estimated that it would receive future cash flows from the use of equipment:

End of Year 1 $10 000

End of Year 2 $50 000

End of Year 3 $20 000

The discount rate was determined as 8%. The 'value in use' of the equipment is:

A) $80 000

B) $73 600

C) $68 000

D) $63 500.

End of Year 1 $10 000

End of Year 2 $50 000

End of Year 3 $20 000

The discount rate was determined as 8%. The 'value in use' of the equipment is:

A) $80 000

B) $73 600

C) $68 000

D) $63 500.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

13

At reporting date Guilder Limited estimated an impairment loss of $50 000 against its single cash-generating unit. The company had the following assets: Headquarters Building $100 000; Plant $60 000; Equipment $40 000. The net carrying amount of the Plant after allocation of the impairment loss is:

A) $60 000

B) $45 000

C) $35 000

D) $10 000.

A) $60 000

B) $45 000

C) $35 000

D) $10 000.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

14

According to AASB 136 Impairment of Assets, the recoverable amount test requires an entity to compare the fair value an asset less costs to sell, with:

A) the amount obtainable from the sale of the asset

B) the costs directly attributable to the liquidation of the asset

C) its disposal value

D) its value in use.

A) the amount obtainable from the sale of the asset

B) the costs directly attributable to the liquidation of the asset

C) its disposal value

D) its value in use.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

15

Where an asset is measured using the cost model, any impairment loss is:

A) accumulated in a separate 'accumulated impairment losses' account

B) set off against the balance of revenue

C) taken directly to equity

D) added to the balance of the accumulated depreciation account.

A) accumulated in a separate 'accumulated impairment losses' account

B) set off against the balance of revenue

C) taken directly to equity

D) added to the balance of the accumulated depreciation account.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following assets need to be tested for impairment every year?

I intangible assets with indefinite useful lives

II intangible assets not yet available for use

III intangible assets accounted for under the revaluation method

IV goodwill acquired in a business combination

A) I, II and III only

B) II, III and IV only

C) I, II and IV only

D) I, III and IV only

I intangible assets with indefinite useful lives

II intangible assets not yet available for use

III intangible assets accounted for under the revaluation method

IV goodwill acquired in a business combination

A) I, II and III only

B) II, III and IV only

C) I, II and IV only

D) I, III and IV only

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

17

When assessing the recoverable of assets that have previously been subject to an impairment loss, which of the following indicators assist in providing external evidence that an impairment loss has reversed:

A) the asset's market value has decreased significantly during the period

B) significant changes with an adverse effect on the entity have taken place

C) market interest rates have decreased during the period

D) internal reporting sources indicate that the economic performance of the asset will not be as good as expected.

A) the asset's market value has decreased significantly during the period

B) significant changes with an adverse effect on the entity have taken place

C) market interest rates have decreased during the period

D) internal reporting sources indicate that the economic performance of the asset will not be as good as expected.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

18

When an asset is measured using the revaluation model, any impairment loss is treated as:

A) a revaluation decrement

B) a revaluation increment

C) a set-off against depreciation expense

D) an addition to depreciation expense.

A) a revaluation decrement

B) a revaluation increment

C) a set-off against depreciation expense

D) an addition to depreciation expense.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

19

When evaluating whether an asset has been impaired, the carrying amount of the asset must be compared to recoverable amount. Recoverable amount is the higher of:

A) initial cost: and, fair value;

B) fair value less costs to sell: and, value in use;

C) original cost: and, net present value;

D) value in use: and, original cost.

A) initial cost: and, fair value;

B) fair value less costs to sell: and, value in use;

C) original cost: and, net present value;

D) value in use: and, original cost.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

20

Hayfield Limited recognised an impairment loss of $200 against a cash-generating unit containing the following assets: Buildings $500; Roads $300; Equipment $600. The net carrying amount of the Roads after allocation of the impairment loss is:

A) $100

B) $235

C) $257.

D) $300

A) $100

B) $235

C) $257.

D) $300

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is NOT correct in relation to the reversal of an impairment loss of an individual asset?

A) When reversing an impairment loss the carrying amount cannot be increased to an amount in excess of the carrying amount that would have been determined had no impairment loss been recognised.

B) For a depreciable asset there needs to be a calculation of carrying amount using the depreciation variables applied before the impairment loss to determine what the carrying amount would have been if there had been no impairment loss.

C) If the individual asset is recorded under the cost model, then the increase in the carrying amount is recognised immediately in profit or loss:

D) Where the recoverable amount is less than the carrying amount of an individual asset, the reversal of a previous impairment loss requires adjusting the carrying amount of the asset to recoverable amount.

A) When reversing an impairment loss the carrying amount cannot be increased to an amount in excess of the carrying amount that would have been determined had no impairment loss been recognised.

B) For a depreciable asset there needs to be a calculation of carrying amount using the depreciation variables applied before the impairment loss to determine what the carrying amount would have been if there had been no impairment loss.

C) If the individual asset is recorded under the cost model, then the increase in the carrying amount is recognised immediately in profit or loss:

D) Where the recoverable amount is less than the carrying amount of an individual asset, the reversal of a previous impairment loss requires adjusting the carrying amount of the asset to recoverable amount.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

22

Constructor Limited estimated an impairment loss of $500 against its single cash- generating unit. The company had the following assets: Headquarters Building $1000; Construction Plant $600; Equipment $400. The net carrying amount of the Equipment after allocation of the impairment loss is:

A) $200

B) $400

C) $300

D) $0

A) $200

B) $400

C) $300

D) $0

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following is required to be disclosed for each class of assets?

I the amount of impairment losses recognised in profit or loss during the period

II the amount of reversals of impairment losses recognised in profit or loss during the period

III the amount of impairment losses on revalued assets recognised directly in equity during the period; and

IV the amount of reversals of impairment losses on revalued assets recognised directly in other comprehensive income during the period.

A) III and IV only

B) I, II, III and IV

C) I, II and III only

D) I and II only

I the amount of impairment losses recognised in profit or loss during the period

II the amount of reversals of impairment losses recognised in profit or loss during the period

III the amount of impairment losses on revalued assets recognised directly in equity during the period; and

IV the amount of reversals of impairment losses on revalued assets recognised directly in other comprehensive income during the period.

A) III and IV only

B) I, II, III and IV

C) I, II and III only

D) I and II only

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck