Deck 1: Conceptual Foundations of Tax Law

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/150

Play

Full screen (f)

Deck 1: Conceptual Foundations of Tax Law

1

A regressive tax rate structure is defined as a tax in which the average tax rate decreases as the tax base increases.

True

2

Self-employed people are required to make quarterly payments of their estimated tax liability.

True

3

Gifts to qualified charitable organizations may be deducted as a contribution,but not to exceed 50% of an individual taxpayer's adjusted gross income.

True

4

An annual loss results from an excess of allowable deductions for a tax year over the reported income.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

5

Adam Smith identified efficient,certainty,convenience,and economy as the four basic requirements for a good tax system.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following payments would not be considered a tax?

A)An assessment based on the selling price of the vehicle.

B)A local assessment for new sewers based on the amount of water used.

C)A local assessment for schools based on the value of the taxpayer's property.

D)A surcharge based upon the amount of income tax already calculated.

A)An assessment based on the selling price of the vehicle.

B)A local assessment for new sewers based on the amount of water used.

C)A local assessment for schools based on the value of the taxpayer's property.

D)A surcharge based upon the amount of income tax already calculated.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

7

According to the IRS definition,which of the following is not a characteristic of a tax?

A)The payment to the governmental authority is required by law.

B)The payment relates to the receipt of a specific benefit.

C)The payment is required pursuant to the legislative power to tax.

D)The purpose of requiring the payment is to provide revenue to be used for the public or governmental purposes.

A)The payment to the governmental authority is required by law.

B)The payment relates to the receipt of a specific benefit.

C)The payment is required pursuant to the legislative power to tax.

D)The purpose of requiring the payment is to provide revenue to be used for the public or governmental purposes.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

8

Horizontal equity exists when two similarly situated taxpayers are taxed the same.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

9

Based on the definition given in Chapter 1 of the text,which of the following is a tax?

I)A registration fee paid to the state to get a car license plate.

II)2% special sales tax for funding public education.

III)A special property tax assessment for installing sidewalks in the taxpayer's neighborhood.

IV)An income tax imposed by Chicago on persons living or working within the city limits.

A)Only statement I is correct.

B)Only statement III is correct.

C)Only statement IV is correct.

D)Statements I and IV are correct.

E)Statements II and IV are correct.

I)A registration fee paid to the state to get a car license plate.

II)2% special sales tax for funding public education.

III)A special property tax assessment for installing sidewalks in the taxpayer's neighborhood.

IV)An income tax imposed by Chicago on persons living or working within the city limits.

A)Only statement I is correct.

B)Only statement III is correct.

C)Only statement IV is correct.

D)Statements I and IV are correct.

E)Statements II and IV are correct.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following payments meets the IRS definition of a tax?

A)A fee paid on the value of property transferred from one individual to another by gift.

B)A one-time additional property tax assessment to add a sidewalk to the neighborhood.

C)A fee paid on the purchase of aerosol producing products to fund ozone research.

D)A fee for a sticker purchased from a city that must be attached to garbage bags before the city garbage trucks will pick up the bags.

E)All of the above meet the definition of a tax.

A)A fee paid on the value of property transferred from one individual to another by gift.

B)A one-time additional property tax assessment to add a sidewalk to the neighborhood.

C)A fee paid on the purchase of aerosol producing products to fund ozone research.

D)A fee for a sticker purchased from a city that must be attached to garbage bags before the city garbage trucks will pick up the bags.

E)All of the above meet the definition of a tax.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following payments is a tax?

I)Artis paid the IRS a penalty of $475 (above his $11,184 income tax balance due)because he had significantly underpaid his estimated income tax.

II)Lindsey paid $135 to the State of Indiana to renew her CPA license.

III)Carrie paid a $3.50 toll to cross the Mississippi River.

IV)Darnell paid $950 to the County Treasurer's Office for an assessment on his business equipment.

A)Only statement IV is correct.

B)Only statement III is correct.

C)Statements II and IV are correct.

D)Statements I,II,and III are correct.

E)Statements I,II,III,and IV are correct.

I)Artis paid the IRS a penalty of $475 (above his $11,184 income tax balance due)because he had significantly underpaid his estimated income tax.

II)Lindsey paid $135 to the State of Indiana to renew her CPA license.

III)Carrie paid a $3.50 toll to cross the Mississippi River.

IV)Darnell paid $950 to the County Treasurer's Office for an assessment on his business equipment.

A)Only statement IV is correct.

B)Only statement III is correct.

C)Statements II and IV are correct.

D)Statements I,II,and III are correct.

E)Statements I,II,III,and IV are correct.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

12

All tax practitioners are governed by the AICPA's Code of Professional Conduct.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

13

Employers are required to pay a Federal Unemployment Tax of 6.2% of the first $10,000 in wages to each employee less a credit of up to 5.4% of state unemployment taxes paid.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

14

The marginal tax rate is the rate of tax that will be paid on the next dollar of income or the rate of tax that will be saved by the next dollar of deduction.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

15

A CPA may prepare tax returns using estimates provided by the taxpayer if it is impracticable to obtain exact data and the estimates are reasonable.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

16

Congress is required to insure that the tax law has the following characteristics: equality,certainty,convenience,and economy.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

17

A deferral is like an exclusion in that it does not have a current tax effect,but it differs in that an exclusion is never subject to taxation,whereas a deferral will be subject to tax at some point of time in the future.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

18

A tax is an enforced contribution used to finance the functions of government.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

19

Tax avoidance occurs when a taxpayer uses fraudulent methods or deceptive behavior to hide actual tax liability.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

20

The statute of limitations is three years,six years if the taxpayer omits gross income in excess of 25%,and there is no statute of limitations if the taxpayer willfully defrauds the government.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

21

Terry is a worker in the country Pretoria.His salary is $46,000 and his taxable income is $52,000.Pretoria imposes a Worker Tax as follows:

Employers withhold a tax of 20% of all wages and salaries.If taxable income as reported on the employee's income tax return is greater than $50,000,an additional 10% tax is withheld on all income.Terry's marginal tax rate is:

A)0%

B)10%

C)20%

D)30%

Employers withhold a tax of 20% of all wages and salaries.If taxable income as reported on the employee's income tax return is greater than $50,000,an additional 10% tax is withheld on all income.Terry's marginal tax rate is:

A)0%

B)10%

C)20%

D)30%

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

22

Katie pays $10,000 in tax-deductible property taxes.Katie's marginal tax rate is 25%,average tax rate is 24%,and effective tax rate is 20%.Katie's tax savings from paying the property tax is:

A)$1,600

B)$2,000

C)$2,400

D)$2,500

E)$10,000

A)$1,600

B)$2,000

C)$2,400

D)$2,500

E)$10,000

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

23

When planning for an investment that will extend over several years,the ability to predict how the results of the investment will be taxed is important.This statement is an example of

A)Certainty.

B)Transparency

C)Equality.

D)Neutrality.

E)Fairness.

A)Certainty.

B)Transparency

C)Equality.

D)Neutrality.

E)Fairness.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

24

Andrea is single and has a 2017 taxable income of $199,800.She also received $15,000 of tax-exempt income.Andrea's average tax rate is:

A)22.8%

B)23.5%

C)24.8%

D)28.5%

E)33.0%

A)22.8%

B)23.5%

C)24.8%

D)28.5%

E)33.0%

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

25

Jim and Anna are married and have a 2017 taxable income of $280,000.They also received $20,000 of tax-exempt income.Their effective tax rate is:

A)22.7%

B)22.5%

C)24.8%

D)33.0%

E)35.0%

A)22.7%

B)22.5%

C)24.8%

D)33.0%

E)35.0%

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

26

Pay-as-you-go withholding is consistent with Adam Smith's criteria of

A)Certainty.

B)Convenience.

C)Economy.

D)Fairness.

E)Transparency.

A)Certainty.

B)Convenience.

C)Economy.

D)Fairness.

E)Transparency.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

27

Frank and Fran are married and have a 2017 taxable income of $280,000.They also received $20,000 of tax-exempt income.Their average tax rate is:

A)23.1%

B)24.1%

C)25.3%

D)33.0%

E)35.0%

A)23.1%

B)24.1%

C)25.3%

D)33.0%

E)35.0%

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

28

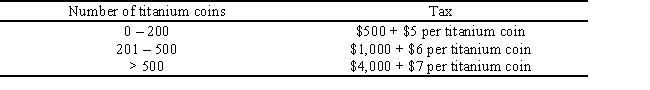

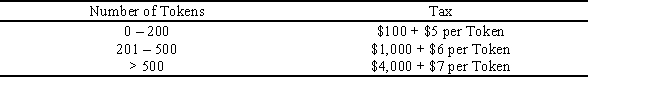

The mythical country of Januvia imposes a tax based on the number of titanium coins each taxpayer owns at the end of each year per the following schedule:

Marvin,a resident of Januvia,owns 300 titanium coins at the end of the current year.

I)Marvin's titanium coins tax is $2,800.

II)Marvin's marginal tax rate is $6.

III)Marvin's average tax rate is $9.33.

IV)Marvin's average tax rate is $6.

A)Statements II and III are correct.

B)Statements I,II,and IV are correct.

C)Statements II and IV are correct.

D)Statements I,II and III are correct.

E)Only statement II is correct.

Marvin,a resident of Januvia,owns 300 titanium coins at the end of the current year.

I)Marvin's titanium coins tax is $2,800.

II)Marvin's marginal tax rate is $6.

III)Marvin's average tax rate is $9.33.

IV)Marvin's average tax rate is $6.

A)Statements II and III are correct.

B)Statements I,II,and IV are correct.

C)Statements II and IV are correct.

D)Statements I,II and III are correct.

E)Only statement II is correct.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

29

Maria is single and has a 2017 taxable income of $199,800.She also received $15,000 of tax-exempt income.Maria's effective tax rate is:

A)22.8%

B)23.0%

C)25.3%

D)28.0%

E)33.0%

A)22.8%

B)23.0%

C)25.3%

D)28.0%

E)33.0%

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

30

Bob and Linda are married and have a 2017 taxable income of $280,000.They also received $20,000 of tax-exempt income.Their marginal tax rate is:

A)23.1%

B)24.8%

C)28.0%

D)33.0%

E)35.0%

A)23.1%

B)24.8%

C)28.0%

D)33.0%

E)35.0%

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

31

Which of Adam Smith's requirements for a good tax system best supports the argument that the federal income tax rate structure should be progressive?

A)Certainty.

B)Convenience.

C)Equality.

D)Neutrality.

E)Sufficiency.

A)Certainty.

B)Convenience.

C)Equality.

D)Neutrality.

E)Sufficiency.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

32

Horizontal equity

I)means that those taxpayers who have the greatest ability to pay the tax should pay the greatest proportion of the tax.

II)means that two similarly situated taxpayers are taxed the same.

III)is reflected in the progressive nature of the federal income tax system.

IV)exists when Avis,a single individual with 4 dependent children,and Art,a single individual with no dependents,both pay $2,400 income tax on equal $26,000 annual salaries.

A)Statements III and IV are correct.

B)Statements II and III are correct.

C)Statements I and III are correct.

D)Only statement IV is correct.

E)Statements I,II,III,and IV are correct.

I)means that those taxpayers who have the greatest ability to pay the tax should pay the greatest proportion of the tax.

II)means that two similarly situated taxpayers are taxed the same.

III)is reflected in the progressive nature of the federal income tax system.

IV)exists when Avis,a single individual with 4 dependent children,and Art,a single individual with no dependents,both pay $2,400 income tax on equal $26,000 annual salaries.

A)Statements III and IV are correct.

B)Statements II and III are correct.

C)Statements I and III are correct.

D)Only statement IV is correct.

E)Statements I,II,III,and IV are correct.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following payments meets the IRS definition of a tax?

A)Sewer fee charged added to a city trash collection bill.

B)A special assessment paid to the county to pave a street.

C)A levy on the value of a deceased taxpayer's estate.

D)Payment of $300 to register an automobile.The $300 consists of a $50 registration fee and $250 based on the weight of the auto.

A)Sewer fee charged added to a city trash collection bill.

B)A special assessment paid to the county to pave a street.

C)A levy on the value of a deceased taxpayer's estate.

D)Payment of $300 to register an automobile.The $300 consists of a $50 registration fee and $250 based on the weight of the auto.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

34

If a taxpayer has a choice of receiving income in the current year versus the following year,which of the following tax rates is important in determining the year in which he should include the income?

A)Average.

B)Effective.

C)Composite.

D)Marginal.

A)Average.

B)Effective.

C)Composite.

D)Marginal.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

35

Jessica is single and has a 2017 taxable income of $199,800.She also received $15,000 of tax-exempt income.Jessica's marginal tax rate is:

A)22.8%

B)23.5%

C)25.0%

D)28.0%

E)33.0%

A)22.8%

B)23.5%

C)25.0%

D)28.0%

E)33.0%

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

36

Vertical equity

I)means that those taxpayers who have the greatest ability to pay the tax should pay the greatest proportion of the tax.

II)means that two similarly situated taxpayers are taxed the same.

III)is reflected in the progressive nature of the federal income tax system.

IV)exists when Avis,a single individual with 4 dependent children,and Art,a single individual with no dependents,both pay $2,400 income tax on equal $26,000 annual salaries.

A)Statements III and IV are correct.

B)Statements II and III are correct.

C)Statements I and III are correct.

D)Only statement IV is correct.

E)Statements I,II,III,and IV are correct.

I)means that those taxpayers who have the greatest ability to pay the tax should pay the greatest proportion of the tax.

II)means that two similarly situated taxpayers are taxed the same.

III)is reflected in the progressive nature of the federal income tax system.

IV)exists when Avis,a single individual with 4 dependent children,and Art,a single individual with no dependents,both pay $2,400 income tax on equal $26,000 annual salaries.

A)Statements III and IV are correct.

B)Statements II and III are correct.

C)Statements I and III are correct.

D)Only statement IV is correct.

E)Statements I,II,III,and IV are correct.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

37

Jaun plans to give $5,000 to the American Diabetes Association.Jaun's marginal tax rate is 28%.His average tax rate is 25%.Jaun's after-tax cost of the contribution is

A)$1,250

B)$1,400

C)$3,600

D)$3,750

E)$5,000

A)$1,250

B)$1,400

C)$3,600

D)$3,750

E)$5,000

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following are included among Adam Smith's criteria for evaluating a tax?

I)Convenience.

II)Fairness.

III)Neutrality.

IV)Economy.

A)Statements I and II are correct.

B)Statements I,II,and III are correct.

C)Statements I and IV are correct.

D)Statements II and III are correct.

E)Statements I,II,III,and IV are correct.

I)Convenience.

II)Fairness.

III)Neutrality.

IV)Economy.

A)Statements I and II are correct.

B)Statements I,II,and III are correct.

C)Statements I and IV are correct.

D)Statements II and III are correct.

E)Statements I,II,III,and IV are correct.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following statement is/are included in Adam Smith's four requirements for a good tax system?

I)Changes in the tax law should be made as needed to raise revenue and for proper administration.

II)A tax should be imposed in proportion to a taxpayer's ability to pay.

III)A taxpayer should be required to pay a tax when it is most likely to be convenient for the taxpayer to make the payment.

IV)The government must collect taxes equal to it's expenses.

A)Statements I and II are correct.

B)Statements I and IV are correct.

C)Statements II and III are correct.

D)Statements II and IV are correct.

E)Statements III and IV are correct.

I)Changes in the tax law should be made as needed to raise revenue and for proper administration.

II)A tax should be imposed in proportion to a taxpayer's ability to pay.

III)A taxpayer should be required to pay a tax when it is most likely to be convenient for the taxpayer to make the payment.

IV)The government must collect taxes equal to it's expenses.

A)Statements I and II are correct.

B)Statements I and IV are correct.

C)Statements II and III are correct.

D)Statements II and IV are correct.

E)Statements III and IV are correct.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

40

Adam Smith's concept of vertical equity is found in a tax rate structure that is

A)Regressive.

B)Proportional.

C)Horizontal.

D)Progressive.

E)Economical.

A)Regressive.

B)Proportional.

C)Horizontal.

D)Progressive.

E)Economical.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

41

Greg pays sales tax of $7.20 on the purchase of a lamp for $120.Michelle paid sales tax of $9 on the purchase of a similar lamp for $150.Greg's taxable income for the current year is $40,000.Michelle's taxable income is $55,000.

I)The structure of the sales tax is progressive if based on taxable income.

II)The structure of the sales tax is proportional if based on sales price.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)The structure of the sales tax is progressive if based on taxable income.

II)The structure of the sales tax is proportional if based on sales price.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

42

The Federal income tax is a

A)revenue neutral tax.

B)regressive tax.

C)value-added tax.

D)progressive tax.

E)form of sales tax.

A)revenue neutral tax.

B)regressive tax.

C)value-added tax.

D)progressive tax.

E)form of sales tax.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

43

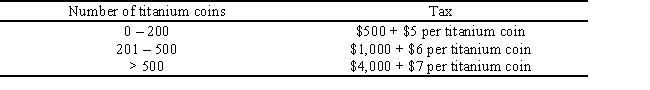

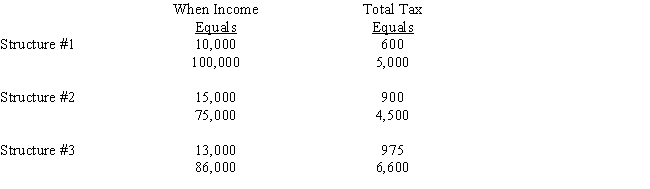

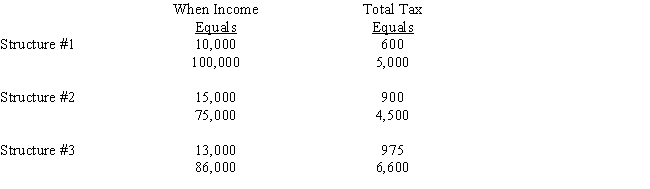

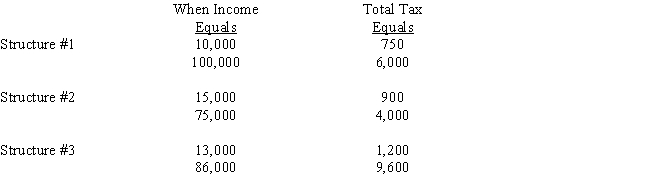

Indicate which of the following statements concerning the following tax rate structures is/are correct.

I)Tax Structure #1 is proportional.

II)Tax Structure #1 is regressive

III)Tax Structure #2 is progressive.

IV)Tax Structure #3 is progressive

A)Only statement I is correct.

B)Only statement III is correct.

C)Statements I and II are correct.

D)Statements II and IV are correct.

E)Statements I,II,and IV are correct.

I)Tax Structure #1 is proportional.

II)Tax Structure #1 is regressive

III)Tax Structure #2 is progressive.

IV)Tax Structure #3 is progressive

A)Only statement I is correct.

B)Only statement III is correct.

C)Statements I and II are correct.

D)Statements II and IV are correct.

E)Statements I,II,and IV are correct.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

44

Lee's 2017 taxable income is $88,000 before considering charitable contributions.Lee is a single individual.She makes a donation of $10,000 to the American Heart Association in December 2017.By how much did Lee's marginal tax rate decline simply because of the donation?

A)0%

B)10%

C)3%

D)5%

E)8%

A)0%

B)10%

C)3%

D)5%

E)8%

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

45

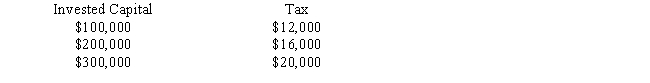

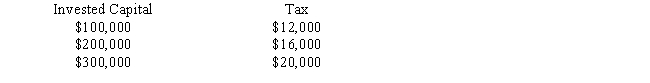

The mythical country of Woodland imposes two taxes:

Worker tax: Employers withhold ten percent of all wages and salaries.If taxable income as reported on the employee's income tax return is greater than $40,000,an additional 5% tax is levied on all income.

Business tax: All businesses pay a tax on invested capital based on a valuation formula.The tax computed for three different amounts of invested capital is provided below:

According to the definitions in the text:

I)The worker tax is a regressive tax rate structure.

II)The business tax is a progressive tax rate structure.

III)The worker tax is a progressive tax rate structure.

IV)The business tax is a regressive tax rate structure.

A)Statements I and III are correct.

B)Statements II and III are correct.

C)Only statements III is correct.

D)Statements I and IV are correct.

E)Statements III and IV are correct.

Worker tax: Employers withhold ten percent of all wages and salaries.If taxable income as reported on the employee's income tax return is greater than $40,000,an additional 5% tax is levied on all income.

Business tax: All businesses pay a tax on invested capital based on a valuation formula.The tax computed for three different amounts of invested capital is provided below:

According to the definitions in the text:

I)The worker tax is a regressive tax rate structure.

II)The business tax is a progressive tax rate structure.

III)The worker tax is a progressive tax rate structure.

IV)The business tax is a regressive tax rate structure.

A)Statements I and III are correct.

B)Statements II and III are correct.

C)Only statements III is correct.

D)Statements I and IV are correct.

E)Statements III and IV are correct.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

46

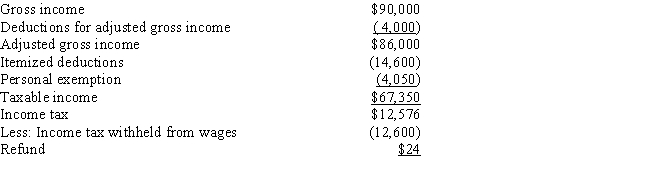

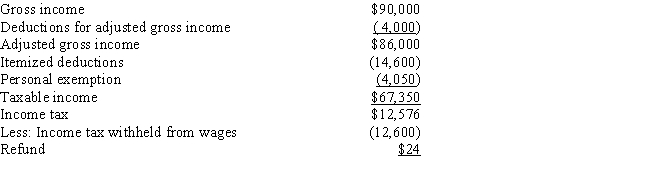

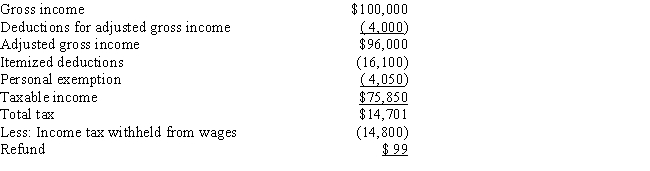

Betty is a single individual.In 2017,she receives $5,000 of tax-exempt income in addition to her salary and other investment income.Betty's 2017 tax return showed the following information:

Which of the following statements concerning Betty's tax rates is (are)correct?

I)Betty's average tax rate is 18.7%.

II)Betty's average tax rate is 17.4%.

III)Betty's effective tax rate is 18.7%.

IV)Betty's effective tax rate is 17.4%.

A)Statements I and III are correct.

B)Statements I and IV are correct.

C)Statements II and III are correct.

D)Statements II and IV are correct.

Which of the following statements concerning Betty's tax rates is (are)correct?

I)Betty's average tax rate is 18.7%.

II)Betty's average tax rate is 17.4%.

III)Betty's effective tax rate is 18.7%.

IV)Betty's effective tax rate is 17.4%.

A)Statements I and III are correct.

B)Statements I and IV are correct.

C)Statements II and III are correct.

D)Statements II and IV are correct.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

47

Alan is a single taxpayer with a gross income of $88,000,a taxable income of $66,000,and an income tax liability of $12,239 for 2017.Josh also has $8,000 of tax-exempt interest income.What are Alan's marginal,average,and effective tax rates?

A)25% marginal;16.5% average;18.5% effective.

B)28% marginal;15.9% average;21.5% effective.

C)28% marginal;16.5% average;21.5% effective.

D)25% marginal;13.9% average;16.5% effective.

A)25% marginal;16.5% average;18.5% effective.

B)28% marginal;15.9% average;21.5% effective.

C)28% marginal;16.5% average;21.5% effective.

D)25% marginal;13.9% average;16.5% effective.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

48

Elrod is an employee of Gomez Inc.During 2017,Elrod receives a salary of $120,000 from Gomez.What amount should Gomez withhold from Elrod's salary as payment of Elrod's social security and medicare taxes?

A)$7,440.00

B)$7,803.40

C)$8,422.65

D)$9,087.00

E)$9,180.00

A)$7,440.00

B)$7,803.40

C)$8,422.65

D)$9,087.00

E)$9,180.00

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

49

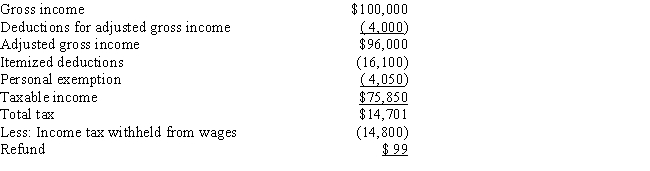

Sally is a single individual.In 2016,she receives $10,000 of tax-exempt income in addition to her salary and other investment income of $100,000.Sally's 2016 tax return showed the following information:

Which of the following statements concerning Sally's tax rates is (are)correct?

I)Sally's average tax rate is 19.4%.

II)Sally's average tax rate is 25.0%.

III)Sally's marginal tax rate is 25%.

IV)Sally's marginal tax rate is 28%.

A)Statements I and III are correct.

B)Statements I and IV are correct.

C)Statements II and III are correct.

D)Statements II and IV are correct.

E)Only statement IV is correct.

Which of the following statements concerning Sally's tax rates is (are)correct?

I)Sally's average tax rate is 19.4%.

II)Sally's average tax rate is 25.0%.

III)Sally's marginal tax rate is 25%.

IV)Sally's marginal tax rate is 28%.

A)Statements I and III are correct.

B)Statements I and IV are correct.

C)Statements II and III are correct.

D)Statements II and IV are correct.

E)Only statement IV is correct.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

50

Employment taxes are

A)revenue neutral.

B)regressive.

C)value-added.

D)progressive.

E)proportional.

A)revenue neutral.

B)regressive.

C)value-added.

D)progressive.

E)proportional.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

51

Jered and Samantha are married.Their 2017 taxable income is $90,000 before considering their mortgage interest deduction.If the mortgage interest totals $10,000 for 2017,what are the tax savings attributable to their interest deduction?

A)$1,500

B)$2,500

C)$2,800

D)$3,300

E)$10,000

A)$1,500

B)$2,500

C)$2,800

D)$3,300

E)$10,000

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

52

Taxpayer A pays tax of $3,300 on taxable income of $10,000 while taxpayer B pays tax of $6,600 on $20,000.The tax is a

A)proportional tax.

B)regressive tax.

C)progressive tax.

D)horizontal tax.

A)proportional tax.

B)regressive tax.

C)progressive tax.

D)horizontal tax.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

53

A tax provision has been discussed that would add an additional marginal tax rate of 42% to be applied to an individual's taxable income in excess of $800,000.If this provision were to become law,what overall distributional impact would it have on our current income tax system?

A)Proportional.

B)Regressive.

C)Progressive.

D)Disproportional.

E)None of the above.

A)Proportional.

B)Regressive.

C)Progressive.

D)Disproportional.

E)None of the above.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

54

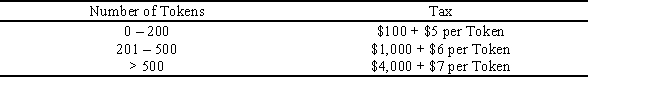

The mythical country of Traviola imposes a tax based on the number of gold Tokens each taxpayer owns at the end of each year per the following schedule:

Traviola's Token tax is a

A)proportional tax.

B)regressive tax.

C)progressive tax.

D)value-added tax.

Traviola's Token tax is a

A)proportional tax.

B)regressive tax.

C)progressive tax.

D)value-added tax.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

55

Oliver pays sales tax of $7.20 on the purchase of a lamp for $120.Michelle paid sales tax of $9 on the purchase of a similar lamp for $150.Oliver's taxable income for the current year is $40,000.Michelle's taxable income is $55,000.

I)The structure of the sales tax is regressive if based on taxable income.

II)The structure of the sales tax is proportional if based on sales price.

III)The structure of the sales tax is progressive based on taxable income.

IV)The average sales tax paid on a purchase equals the marginal tax rate for this tax.

A)Only statement I is correct.

B)Only statement II is correct.

C)Statements III and IV are correct.

D)Statements II and IV are correct.

E)Statements I,II,and IV are correct.

I)The structure of the sales tax is regressive if based on taxable income.

II)The structure of the sales tax is proportional if based on sales price.

III)The structure of the sales tax is progressive based on taxable income.

IV)The average sales tax paid on a purchase equals the marginal tax rate for this tax.

A)Only statement I is correct.

B)Only statement II is correct.

C)Statements III and IV are correct.

D)Statements II and IV are correct.

E)Statements I,II,and IV are correct.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

56

Heidi and Anastasia are residents of the mythical country of Wetland.Heidi pays $1,500 income tax on taxable income of $6,000.Anastasia pays income tax of $21,000 on taxable income of $72,000.The income tax structure is

I)Progressive.

II)Proportional.

III)Regressive.

IV)Value-added.

V)Marginal.

A)Only statement I is correct.

B)Only statement II is correct.

C)Only statement III is correct.

D)Only statement V is correct.

E)Statements II and IV are correct.

I)Progressive.

II)Proportional.

III)Regressive.

IV)Value-added.

V)Marginal.

A)Only statement I is correct.

B)Only statement II is correct.

C)Only statement III is correct.

D)Only statement V is correct.

E)Statements II and IV are correct.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

57

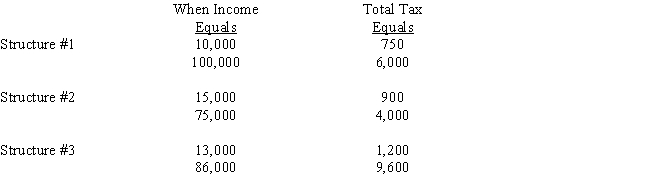

Indicate which of the following statements concerning the following tax rate structures is/are correct.

I)Tax Structure #1 is regressive.

II)Tax Structure #1 is proportional

III)Tax Structure #2 is progressive.

IV)Tax Structure #3 is progressive

A)Only statement I is correct.

B)Only statement III is correct.

C)Statements I and IV are correct.

D)Statements II and IV are correct.

E)Statements I,II,and IV are correct.

I)Tax Structure #1 is regressive.

II)Tax Structure #1 is proportional

III)Tax Structure #2 is progressive.

IV)Tax Structure #3 is progressive

A)Only statement I is correct.

B)Only statement III is correct.

C)Statements I and IV are correct.

D)Statements II and IV are correct.

E)Statements I,II,and IV are correct.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

58

A state sales tax levied on all goods and services sold is an example of a

A)progressive tax.

B)regressive tax.

C)proportional tax.

D)value added tax.

A)progressive tax.

B)regressive tax.

C)proportional tax.

D)value added tax.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

59

Katarina,a single taxpayer,has total income from all sources of $100,000 for 2017.Her taxable income after taking into consideration $25,000 in deductions and $10,000 in exclusions is $65,000.Katarina's tax liability is $11,989.What are Katarina's marginal,average,and effective tax rates?

A)28% marginal;18.4% average;18.4% effective.

B)25% marginal;16.0% average;16.0% effective.

C)25% marginal;16.0% average;18.5% effective.

D)25% marginal;18.4% average;16.0% effective.

E)28% marginal;16.0% average;18.4% effective.

A)28% marginal;18.4% average;18.4% effective.

B)25% marginal;16.0% average;16.0% effective.

C)25% marginal;16.0% average;18.5% effective.

D)25% marginal;18.4% average;16.0% effective.

E)28% marginal;16.0% average;18.4% effective.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

60

Shara's 2017 taxable income is $39,000 before considering charitable contributions.Shara is a single individual.She makes a donation of $5,000 to the American Heart Association in December 2017.By how much did Shara's marginal tax rate decline simply because of the donation?

A)0%

B)7%

C)3%

D)5%

E)10%

A)0%

B)7%

C)3%

D)5%

E)10%

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

61

How long does a taxpayer have to file a petition with the U.S.Tax Court after receiving a Statutory Notice of Deficiency?

A)10 days

B)30 days

C)90 days

D)120 days

E)180 days

A)10 days

B)30 days

C)90 days

D)120 days

E)180 days

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

62

Phyllis is an electrician employed by Bogie Company.Phil is a self-employed electrician.During the current year,Phyllis's salary is $75,000 and Phil's net self-employment income is $75,000.Which of the following statements about the Social Security and self-employment taxes paid is/are correct?

I)Phil's self-employment tax is greater than the Social Security tax paid on Phyllis's income.

II)Phil pays more self-employment tax than Phyllis pays in Social Security tax.

III)Phil and Phyllis pay the same amount of tax.

IV)Phil's self-employment tax is equal to the Social Security tax paid on Phyllis's income.

A)Only statement I is correct.

B)Only statement I is correct.

C)Only statement IV is correct.

D)Statements I and III are correct.

E)Statements II and IV are correct.

I)Phil's self-employment tax is greater than the Social Security tax paid on Phyllis's income.

II)Phil pays more self-employment tax than Phyllis pays in Social Security tax.

III)Phil and Phyllis pay the same amount of tax.

IV)Phil's self-employment tax is equal to the Social Security tax paid on Phyllis's income.

A)Only statement I is correct.

B)Only statement I is correct.

C)Only statement IV is correct.

D)Statements I and III are correct.

E)Statements II and IV are correct.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

63

Joy receives a used car worth $13,000 from her uncle as a graduation present.As a result of the gift

I)Joy will have $13,000 of taxable income.

II)Joy's uncle's gift will subject him to the gift tax.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Joy will have $13,000 of taxable income.

II)Joy's uncle's gift will subject him to the gift tax.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

64

When property is transferred,gift and estate taxes are based on the

A)fair market value of the assets on the date of transfer.

B)replacement cost of the transferred property.

C)transferor's original cost of the transferred property.

D)transferor's adjusted basis of the transferred property.

E)fair market value less adjusted basis on the date of the transfer.

A)fair market value of the assets on the date of transfer.

B)replacement cost of the transferred property.

C)transferor's original cost of the transferred property.

D)transferor's adjusted basis of the transferred property.

E)fair market value less adjusted basis on the date of the transfer.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

65

How much additional Social Security tax does Connie pay in 2017 on her $10,000 Christmas bonus? Her total earnings for the year (before the bonus)are $42,000.

A)$ 0

B)$145.00

C)$620.00

D)$765.00

A)$ 0

B)$145.00

C)$620.00

D)$765.00

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

66

How much additional Social Security tax does Elise pay in 2017 on her $10,000 Christmas bonus? Her total earnings for the year (before the bonus)are $140,000.

A)$ 0

B)$ 145

C)$ 620

D)$ 765

A)$ 0

B)$ 145

C)$ 620

D)$ 765

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

67

The return selection program designed to select returns with the highest probability of errors is

A)The TCMP.

B)The DIF program.

C)The special audit program.

D)The document perfection program.

E)The information-matching program.

A)The TCMP.

B)The DIF program.

C)The special audit program.

D)The document perfection program.

E)The information-matching program.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

68

Ordinary income is

I)the common type of income that individuals and businesses earn.

II)receives no special treatment under tax laws.

III)the character of the gain from the sales of shares of stock held more than one year

A)Only statement I is correct.

B)Only statement II is correct.

C)Statements I and II are correct.

D)Statements I and III are correct.

E)Statements I,II,and III are correct.

I)the common type of income that individuals and businesses earn.

II)receives no special treatment under tax laws.

III)the character of the gain from the sales of shares of stock held more than one year

A)Only statement I is correct.

B)Only statement II is correct.

C)Statements I and II are correct.

D)Statements I and III are correct.

E)Statements I,II,and III are correct.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

69

Sally is an electrician employed by Bogie Company.Sam is a self-employed electrician.During the current year,Sally's salary is $85,000 and Sam's net self-employment income is $85,000.Which of the following statements about the Social Security and self-employment taxes paid is/are correct?

I)Sam's self-employment tax is greater than the Social Security tax paid on Sally's income.

II)Sam and Sally pay the same amount of tax.

A)Only statement I is correct.

B)Only statement II is correct

C)Both statements are correct

D)Neither statement is correct

I)Sam's self-employment tax is greater than the Social Security tax paid on Sally's income.

II)Sam and Sally pay the same amount of tax.

A)Only statement I is correct.

B)Only statement II is correct

C)Both statements are correct

D)Neither statement is correct

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

70

Christy's 2016 tax return was audited during November 2017.The auditor proposed additional tax due of $1,500.Christy disagreed.What should Christy do next?

I)Within 30 days,she must file a protest.

II)She must respond with a written protest letter.

III)She may respond with an oral protest.

A)Only statement I is correct.

B)Only statement II is correct.

C)Only statement III is correct.

D)Statements I and III are correct.

E)Statements I and II are correct.

I)Within 30 days,she must file a protest.

II)She must respond with a written protest letter.

III)She may respond with an oral protest.

A)Only statement I is correct.

B)Only statement II is correct.

C)Only statement III is correct.

D)Statements I and III are correct.

E)Statements I and II are correct.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

71

Samantha is a self-employed electrician.During 2017,her net self-employment income is $120,000.What is Samantha's self-employment tax?

A)$15,570.00

B)$15,606.80

C)$16,845.30

D)$18,174.00

E)$18,360.00

A)$15,570.00

B)$15,606.80

C)$16,845.30

D)$18,174.00

E)$18,360.00

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

72

Marie earns $80,000 as a sales manager for Household Books.How much Social Security and medicare tax does Marie have to pay for 2017?

A)$4,960.00

B)$6,120.00

C)$6,400.00

D)$2,240.00

A)$4,960.00

B)$6,120.00

C)$6,400.00

D)$2,240.00

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following are types of IRS examinations?

I)Information matching program.

II)Office examination.

III)Field examination.

IV)Revenue agent report.

A)Statements II and III are correct.

B)Only statement III is correct.

C)Statements I and IV are correct.

D)Statements I,II and III are correct.

E)Only statement II is correct.

I)Information matching program.

II)Office examination.

III)Field examination.

IV)Revenue agent report.

A)Statements II and III are correct.

B)Only statement III is correct.

C)Statements I and IV are correct.

D)Statements I,II and III are correct.

E)Only statement II is correct.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

74

The term "tax law" as used in your textbook includes

I)Treasury regulations.

II)College textbooks (i.e."Concepts in Federal Income Taxes").

III)Internal Revenue Code of 1986.

IV)Tax related decisions of a U.S.Circuit Court of Appeals.

A)Only statement III is correct.

B)Statements I,III,and IV are correct.

C)Statements I and III are correct.

D)Only statement II is correct.

E)All four statements are correct

I)Treasury regulations.

II)College textbooks (i.e."Concepts in Federal Income Taxes").

III)Internal Revenue Code of 1986.

IV)Tax related decisions of a U.S.Circuit Court of Appeals.

A)Only statement III is correct.

B)Statements I,III,and IV are correct.

C)Statements I and III are correct.

D)Only statement II is correct.

E)All four statements are correct

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

75

Sally is an electrician employed by Bogie Company.Sam is a self-employed electrician.During the current year,Sally's salary is $85,000 and Sam's net self-employment income is $85,000.Which of the following statements about the Social Security and self-employment taxes paid is/are correct?

I)Sam pays more self-employment tax than Sally pays in Social Security tax.

II)Sam's self-employment tax is equal to the Social Security tax paid on Sally's income.

A)Only statement I is correct.

B)Only statement II correct.

C)Both statements are correct.

D)Neither statement is correct.

I)Sam pays more self-employment tax than Sally pays in Social Security tax.

II)Sam's self-employment tax is equal to the Social Security tax paid on Sally's income.

A)Only statement I is correct.

B)Only statement II correct.

C)Both statements are correct.

D)Neither statement is correct.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following types of taxes rely solely on "income" as the tax base for determining the amount of tax liability?

I)Sales Tax

II)Property Tax

III)Gift Tax

IV)Social Security Tax

V)Excise Tax

A)Statements I,II,III,IV,and V are correct.

B)Statements I,III,and IV are correct.

C)Statements II and IV are correct.

D)Only statement IV is correct.

E)None of the above types of taxes relies on income for its tax base.

I)Sales Tax

II)Property Tax

III)Gift Tax

IV)Social Security Tax

V)Excise Tax

A)Statements I,II,III,IV,and V are correct.

B)Statements I,III,and IV are correct.

C)Statements II and IV are correct.

D)Only statement IV is correct.

E)None of the above types of taxes relies on income for its tax base.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

77

A property tax

I)is levied on the value of property.

II)is referred to as ad valorem.

III)on personal property is more common than a tax on real property.

IV)is based upon assessed value rather than actual transactions.

A)Only statement I is correct.

B)Statements II and III are correct.

C)Statements I,II,and IV are correct.

D)Statements I,II,III,and IV are correct.

I)is levied on the value of property.

II)is referred to as ad valorem.

III)on personal property is more common than a tax on real property.

IV)is based upon assessed value rather than actual transactions.

A)Only statement I is correct.

B)Statements II and III are correct.

C)Statements I,II,and IV are correct.

D)Statements I,II,III,and IV are correct.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

78

An excise tax

I)is levied on the value of property.

II)is levied on the quantity of the product or service.

III)differs from an sale tax,because a sales tax is imposed on the value of property.

A)Only statement I is correct.

B)Only statement II is correct.

C)Statements I and II are correct.

D)Statements II and III are correct.

E)Statements I,II,and III are correct.

I)is levied on the value of property.

II)is levied on the quantity of the product or service.

III)differs from an sale tax,because a sales tax is imposed on the value of property.

A)Only statement I is correct.

B)Only statement II is correct.

C)Statements I and II are correct.

D)Statements II and III are correct.

E)Statements I,II,and III are correct.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

79

How much additional Social Security tax does Betty pay in 2017 on her $10,000 Christmas bonus? Her total earnings for the year (before the bonus)are $100,000.

A)$145.00

B)$269.20

C)$461.20

D)$641.00

E)$765.00

A)$145.00

B)$269.20

C)$461.20

D)$641.00

E)$765.00

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

80

Rayburn is the sole owner of a dance studio.During the current year,his net self-employment income from the dance studio is $50,000.What is Rayburn 's self-employment tax?

A)$3,825.00

B)$5,738.00

C)$6,200.00

D)$7,650.00

A)$3,825.00

B)$5,738.00

C)$6,200.00

D)$7,650.00

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck