Deck 8: Risk and Return-Capital Market Theory

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/105

Play

Full screen (f)

Deck 8: Risk and Return-Capital Market Theory

1

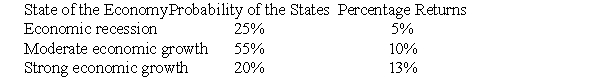

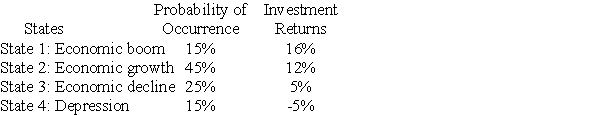

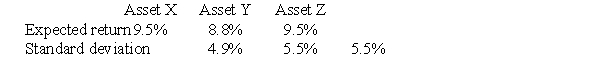

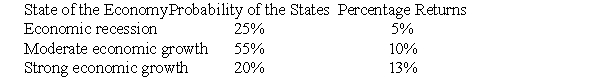

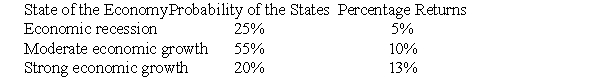

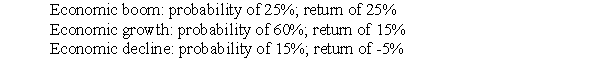

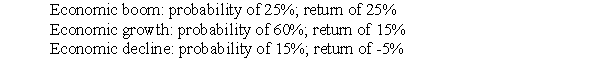

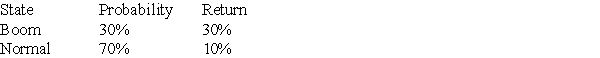

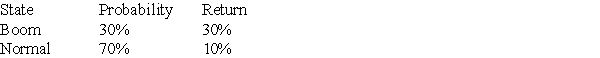

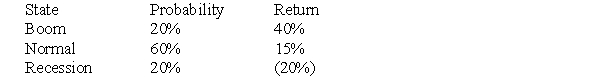

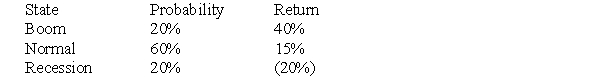

Use the following information,which describes the possible outcomes from investing in a particular asset,to answer the following question(s).

The standard deviation of returns is:

A)8.00%.

B)7.63%.

C)4.68%.

D)2.76%.

The standard deviation of returns is:

A)8.00%.

B)7.63%.

C)4.68%.

D)2.76%.

D

2

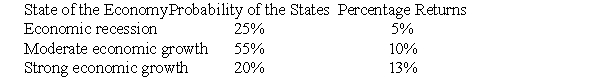

Use the following information,which describes the possible outcomes from investing in a particular asset,to answer the following question(s).

The expected return from investing in the asset is:

A)9.00%.

B)9.35%.

C)10.00%.

D)10.55%.

The expected return from investing in the asset is:

A)9.00%.

B)9.35%.

C)10.00%.

D)10.55%.

B

3

Which of the following best measures the risk of holding an asset in isolation (i.e. ,stand-alone risk)?

A)The mean co-variance

B)The standard deviation

C)The coefficient of optimization

D)The standard asset pricing model

E)The omegatron

A)The mean co-variance

B)The standard deviation

C)The coefficient of optimization

D)The standard asset pricing model

E)The omegatron

B

4

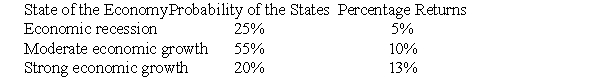

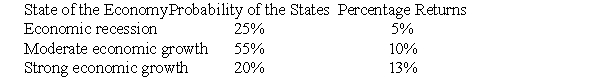

You are considering investing in a project with the following possible outcomes:

Calculate the expected rate of return and standard deviation of returns for this investment.

A)9.8%,7.0%

B)7.0%,43.6%

C)8.3%,6.6%

D)8.3%,16.1%

Calculate the expected rate of return and standard deviation of returns for this investment.

A)9.8%,7.0%

B)7.0%,43.6%

C)8.3%,6.6%

D)8.3%,16.1%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

5

You are considering investing in U.S.Steel.Which of the following is an example of nondiversifiable risk?

A)Risk resulting from foreign expropriation of U.S.Steel property

B)Risk resulting from oil exploration by Marathon Oil (a U.S.Steel subsidy)

C)Risk resulting from a strike against U.S.Steel

D)None of the above

A)Risk resulting from foreign expropriation of U.S.Steel property

B)Risk resulting from oil exploration by Marathon Oil (a U.S.Steel subsidy)

C)Risk resulting from a strike against U.S.Steel

D)None of the above

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

6

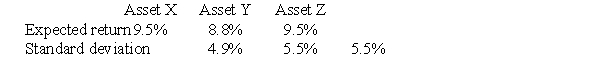

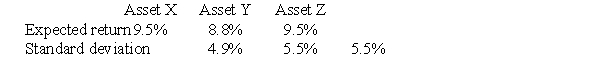

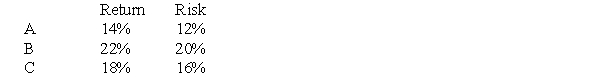

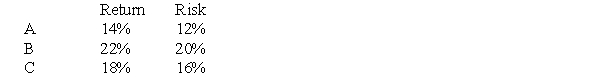

Use the following information,which describes the expected return and standard deviation for three different assets,to answer the following question(s).

If an investor must choose between investing in either Asset X or Asset Y,then:

A)she will always choose Asset X over Asset Y.

B)she will always choose Asset Y over Asset X.

C)she will be indifferent between investing in Asset X and Asset Y.

D)none of the above.

If an investor must choose between investing in either Asset X or Asset Y,then:

A)she will always choose Asset X over Asset Y.

B)she will always choose Asset Y over Asset X.

C)she will be indifferent between investing in Asset X and Asset Y.

D)none of the above.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

7

If there is a 20% chance we will get a 16% return,a 30% chance of getting a 14% return,a 40% chance of getting a 12% return,and a 10% chance of getting an 8% return,what is the expected rate of return?

A)12%

B)13%

C)14%

D)15%

A)12%

B)13%

C)14%

D)15%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

8

Use the following information,which describes the expected return and standard deviation for three different assets,to answer the following question(s).

If an investor must choose between investing in either Asset X or Asset Z,then:

A)he will always choose Asset X over Asset Z.

B)he will always choose Asset Z over Asset X.

C)he will be indifferent between investing in Asset X and Asset Z.

D)none of the above.

If an investor must choose between investing in either Asset X or Asset Z,then:

A)he will always choose Asset X over Asset Z.

B)he will always choose Asset Z over Asset X.

C)he will be indifferent between investing in Asset X and Asset Z.

D)none of the above.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

9

What is the standard deviation of an investment that has the following expected scenario? If there is an 18% probability of a recession,2.0% return;if there is a 65% probability of a moderate economy,9.5% return;if there is a 17% probability of a strong economy,14.2% return.

A)3.68%

B)1.23%

C)8.47%

D)6.66%

A)3.68%

B)1.23%

C)8.47%

D)6.66%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

10

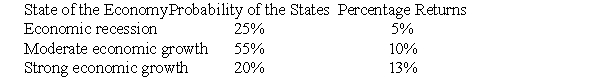

Use the following information,which describes the possible outcomes from investing in a particular asset,to answer the following question(s).

What is the expected return on an investment that has the following expected scenario? If there is a 10% probability of a booming economy,$250 return;if there is a 70% probability of a moderate economy,$154 return;if there is a 20% probability of a declining economy,$50 return.

A)$154.00

B)$142.80

C)$65.00

D)$15.12

What is the expected return on an investment that has the following expected scenario? If there is a 10% probability of a booming economy,$250 return;if there is a 70% probability of a moderate economy,$154 return;if there is a 20% probability of a declining economy,$50 return.

A)$154.00

B)$142.80

C)$65.00

D)$15.12

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

11

You are considering buying some stock in Continental Grain.Which of the following is an example of nondiversifiable risk?

A)Risk resulting from a general decline in the stock market

B)Risk resulting from a news release that several of Continental's grain silos were tainted

C)Risk resulting from an explosion in a grain elevator owned by Continental

D)Risk resulting from an impending lawsuit against Continental

A)Risk resulting from a general decline in the stock market

B)Risk resulting from a news release that several of Continental's grain silos were tainted

C)Risk resulting from an explosion in a grain elevator owned by Continental

D)Risk resulting from an impending lawsuit against Continental

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

12

If there is a 20% chance we will get a 16% return,a 30% chance of getting a 14% return,a 40% chance of getting a 12% return,and a 10% chance of getting an 8% return,what would be the standard deviation?

A)2.24

B)2.56

C)2.83

D)2.98

A)2.24

B)2.56

C)2.83

D)2.98

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

13

What is a practical measure that is used to quantify the risk of a single investment?

A)The systematic variation

B)The Fisher effect

C)The IRP

D)The standard deviation

A)The systematic variation

B)The Fisher effect

C)The IRP

D)The standard deviation

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is NOT an example of factors that affect systematic risk?

A)Changes in general interest rates

B)A firm wins a lawsuit dealing with patent infringement

C)Our country declares war in the Persian Gulf

D)Environmental awareness increases throughout the country

A)Changes in general interest rates

B)A firm wins a lawsuit dealing with patent infringement

C)Our country declares war in the Persian Gulf

D)Environmental awareness increases throughout the country

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is an adequate method of achieving portfolio diversification?

A)Invest in various bonds and stocks.

B)Invest in stocks of different industries.

C)Invest internationally.

D)All of the above.

E)None of the above.

A)Invest in various bonds and stocks.

B)Invest in stocks of different industries.

C)Invest internationally.

D)All of the above.

E)None of the above.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following investments is clearly preferred to the others?

A)Investment A

B)Investment B

C)Investment C

D)Cannot be determined

A)Investment A

B)Investment B

C)Investment C

D)Cannot be determined

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

17

You are considering investing in a firm that has the following possible outcomes:

What is the expected rate of return on the investment?

A)15.0%

B)11.7%

C)14.5%

D)25.0%

What is the expected rate of return on the investment?

A)15.0%

B)11.7%

C)14.5%

D)25.0%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

18

The prices for the Guns and Hoses Corporation for the first quarter of 1992 are given below.Find the holding period return for February.

A)18.56%

B)13.30%

C)-11.73%

D)8.83%

A)18.56%

B)13.30%

C)-11.73%

D)8.83%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

19

Wilson,Inc.is expecting the following returns on their stock and related probabilities.Calculate Wilson's expected return.

A)16%

B)14%

C)12%

D)10%

A)16%

B)14%

C)12%

D)10%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

20

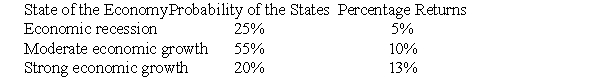

Use the following information,which describes the possible outcomes from investing in a particular asset,to answer the following question(s).

What is the expected rate of return for an investment that has the following expected scenario? If there is an 18% probability of a recession,2.0% return;if there is a 65% probability of a moderate economy,9.5% return;if there is a 17% probability of a strong economy,14.2% return.

A)11.25%

B)7.33%

C)8.95%

D)9.59%

What is the expected rate of return for an investment that has the following expected scenario? If there is an 18% probability of a recession,2.0% return;if there is a 65% probability of a moderate economy,9.5% return;if there is a 17% probability of a strong economy,14.2% return.

A)11.25%

B)7.33%

C)8.95%

D)9.59%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

21

Investing in foreign stocks is one way to improve diversification of a portfolio.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

22

By investing in different securities,an investor can lower his exposure to risk.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

23

Your broker mailed you your year-end statement.You have $25,000 invested in Dow Chemical,$18,000 tied up in GM,$36,000 in Microsoft stock,and $11,000 in Nike.The annualized returns for these stocks is 16.5% for Dow,12.0% for GM,18.5% for Microsoft,and 15.3% for Nike.What is the return of your entire portfolio?

A)15.60%

B)18.55%

C)16.25%

D)9.00%

A)15.60%

B)18.55%

C)16.25%

D)9.00%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

24

Using the following information for McDonovan,Inc.'s stock,calculate their expected return and standard deviation.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

25

You purchased the stock of Sargent Motors at a price of $75.75 one year ago today.If you sell the stock today for $89.00,what is your holding period return?

A)35.00%

B)12.50%

C)17.50%

D)25.00%

A)35.00%

B)12.50%

C)17.50%

D)25.00%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

26

The greater the dispersion of possible returns,the riskier is the investment.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

27

For the most part,there has been a positive relation between risk and return historically.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

28

You have been employed by Telemetry Medical Instruments (TMI)for seven years and participate in their 401 (k)plan by having 5% of your paycheck invested in the plan.You have been so impressed with the performance of the company's stock that you currently have all of your 401 (k)money invested in TMI's common stock.What does prudent investment management suggest that you do about risk?

A)Close out your 401 (k)and put the money in the bank.

B)Increase your payroll deduction from 5% to 10% but keep all funds invested in TMI.

C)Close out your 401 (k)and invest in T-bills.

D)Take some of your investment out of TMI's common stock and invest it in the stocks and bonds of other firms.

A)Close out your 401 (k)and put the money in the bank.

B)Increase your payroll deduction from 5% to 10% but keep all funds invested in TMI.

C)Close out your 401 (k)and invest in T-bills.

D)Take some of your investment out of TMI's common stock and invest it in the stocks and bonds of other firms.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

29

According to the experts,a model portfolio should consist of a mix of securities that over the long run should look something like this: cash or money market accounts,5%;bonds,25%;domestic stocks,35%;international stocks,35%.What is the determination of the proportions of various securities within a portfolio referred to as?

A)Risk assessment

B)Capital asset modeling

C)Beta selection

D)Portfolio regression

E)Asset allocation

A)Risk assessment

B)Capital asset modeling

C)Beta selection

D)Portfolio regression

E)Asset allocation

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

30

Beta is a statistical measure of:

A)hyperbolic.

B)total risk.

C)the standard deviation.

D)the relationship between an investment's returns and the market return.

A)hyperbolic.

B)total risk.

C)the standard deviation.

D)the relationship between an investment's returns and the market return.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

31

You are considering investing in Ford Motor Company.Which of the following is an example of diversifiable risk?

A)Risk resulting from the possibility of a stock market crash

B)Risk resulting from uncertainty regarding a possible strike against Ford

C)Risk resulting from an expected recession

D)Risk resulting from interest rates decreasing

A)Risk resulting from the possibility of a stock market crash

B)Risk resulting from uncertainty regarding a possible strike against Ford

C)Risk resulting from an expected recession

D)Risk resulting from interest rates decreasing

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following statements is correct?

A)Portfolio diversification reduces the variability of the returns on the individual stocks held in a portfolio.

B)Portfolio A has but one security,while Portfolio B has 100 securities.Because of diversification,we would expect Portfolio B to have lower risk.

C)If an investor buys enough stocks,he or she can,through diversification,eliminate all market risk.

D)Diversification can be achieved by purchasing stocks that are perfectly positively correlated.

A)Portfolio diversification reduces the variability of the returns on the individual stocks held in a portfolio.

B)Portfolio A has but one security,while Portfolio B has 100 securities.Because of diversification,we would expect Portfolio B to have lower risk.

C)If an investor buys enough stocks,he or she can,through diversification,eliminate all market risk.

D)Diversification can be achieved by purchasing stocks that are perfectly positively correlated.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

33

The capital asset pricing model:

A)provides a risk-return trade-off in which risk is measured in terms of the market returns.

B)provides a risk-return trade-off in which risk is measured in terms of beta.

C)measures risk as the coefficient of variation between security and market rates of return.

D)depicts the total risk of a security.

A)provides a risk-return trade-off in which risk is measured in terms of the market returns.

B)provides a risk-return trade-off in which risk is measured in terms of beta.

C)measures risk as the coefficient of variation between security and market rates of return.

D)depicts the total risk of a security.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

34

Sterling Incorporated has a beta of 1.0.If the expected return on the market is 12%,what is the expected return on Sterling Incorporated's stock?

A)9%

B)10%

C)12%

D)Insufficient information is provided

A)9%

B)10%

C)12%

D)Insufficient information is provided

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

35

You bought Chemtron stock for $45 a year ago.It is selling for $54 today.What is your holding period return?

A)9%

B)11%

C)6%

D)20%

A)9%

B)11%

C)6%

D)20%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

36

The appropriate measure for risk according to the capital asset pricing model is:

A)the standard deviation of a firm's cash flows.

B)alpha.

C)beta.

D)probability of correlation.

A)the standard deviation of a firm's cash flows.

B)alpha.

C)beta.

D)probability of correlation.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

37

A stock's beta is a measure of its:

A)systematic risk.

B)unsystematic risk.

C)company-specific risk.

D)diversifiable risk.

A)systematic risk.

B)unsystematic risk.

C)company-specific risk.

D)diversifiable risk.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following has a beta of zero?

A)A risk-free asset

B)The market

C)A high-risk asset

D)Both A and B

A)A risk-free asset

B)The market

C)A high-risk asset

D)Both A and B

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

39

You are considering a security with the following possible rates of return:

a.Calculate the expected rate of return.

b.Calculate the standard deviation of the returns.

a.Calculate the expected rate of return.

b.Calculate the standard deviation of the returns.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

40

The benefit from diversification is far greater when the diversification occurs across asset types.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

41

Total risk equals unique security risk times systematic risk.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following is NOT an example of systematic risk?

A)Inflation

B)Recession

C)Management risk

D)Interest rate risk

A)Inflation

B)Recession

C)Management risk

D)Interest rate risk

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

43

What type of risk can investors reduce through diversification?

A)All risk

B)Systematic risk only

C)Unsystematic risk only

D)Uncertainty

A)All risk

B)Systematic risk only

C)Unsystematic risk only

D)Uncertainty

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

44

Beta is a measurement of the relationship between a security's returns and the general market's returns.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

45

Changes in the general economy,such as changes in interest rates or tax laws,represent what type of risk?

A)Firm-specific risk

B)Market risk

C)Unsystematic risk

D)Diversifiable risk

A)Firm-specific risk

B)Market risk

C)Unsystematic risk

D)Diversifiable risk

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

46

The CAPM designates the risk-return tradeoff existing in the market,where risk is defined in terms of beta.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

47

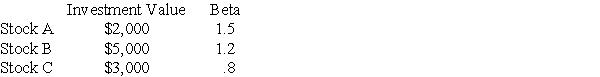

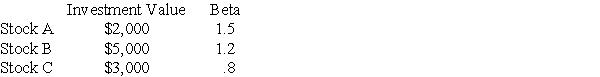

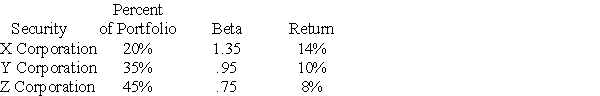

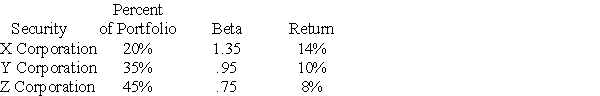

If you hold a portfolio made up of the following stocks:

What is the beta of the portfolio?

A)1.17

B)1.14

C)1.32

D)Can't be determined from information given

What is the beta of the portfolio?

A)1.17

B)1.14

C)1.32

D)Can't be determined from information given

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

48

A stock with a beta greater than 1.0 has returns that are ________ volatile than the market,and a stock with a beta of less than 1.0 exhibits returns which are ________ volatile than those of the market portfolio.

A)more,more

B)more,less

C)less,more

D)less,less

A)more,more

B)more,less

C)less,more

D)less,less

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following is a good measure of the relationship between an investment's returns and the market's returns?

A)The beta coefficient

B)The standard variation

C)The CPI

D)The S&P 500 Index

A)The beta coefficient

B)The standard variation

C)The CPI

D)The S&P 500 Index

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

50

The market (systematic)risk associated with an individual stock is most closely identified with the:

A)variance of the returns of the stock.

B)variance of the returns of the market.

C)beta of the stock.

D)standard deviation of the stock.

A)variance of the returns of the stock.

B)variance of the returns of the market.

C)beta of the stock.

D)standard deviation of the stock.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

51

The beta of ABC Co.stock is the slope of:

A)the security market line.

B)the characteristic line for a plot of returns on the S&P 500 versus returns on short-term Treasury bills.

C)the arbitrage pricing line.

D)the characteristic line for a plot of ABC Co.returns against the returns of the market portfolio for the same period.

A)the security market line.

B)the characteristic line for a plot of returns on the S&P 500 versus returns on short-term Treasury bills.

C)the arbitrage pricing line.

D)the characteristic line for a plot of ABC Co.returns against the returns of the market portfolio for the same period.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

52

Investment risk is:

A)the probability of achieving a return that is greater than what was expected.

B)the probability of achieving a beta coefficient that is less than what was expected.

C)the probability of achieving a return that is less than what was expected.

D)the probability of achieving a standard deviation that is less than what was expected.

A)the probability of achieving a return that is greater than what was expected.

B)the probability of achieving a beta coefficient that is less than what was expected.

C)the probability of achieving a return that is less than what was expected.

D)the probability of achieving a standard deviation that is less than what was expected.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

53

You hold a portfolio with the following securities:

Compute the expected return and beta for the portfolio.

A)10.67%,1.02

B)9.9%,1.02

C)34.4%,.94

D)9.9%,.94

Compute the expected return and beta for the portfolio.

A)10.67%,1.02

B)9.9%,1.02

C)34.4%,.94

D)9.9%,.94

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

54

Your broker mailed you your year-end statement.You have $25,000 invested in Dow Chemical,$18,000 tied up in GM,$36,000 in Microsoft stock,and $11,000 in Nike.The betas for each of your stocks are 1.55 for Dow,1.12 for GM,2.39 for Microsoft,and .76 for Nike.What is the beta of your portfolio?

A)1.46

B)1.70

C)2.60

D)0.41

A)1.46

B)1.70

C)2.60

D)0.41

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following statements is true?

A)A stock with a beta of zero has a very low level of systematic risk.

B)A stock with a beta greater than 1.0 has lower nondiversifiable risk than a stock with a beta of 1.0.

C)A stock with a beta less than 1.0 has lower nondiversifiable risk than a stock with a beta of 1.0.

D)A stock with a beta less than 1.0 has higher nondiversifiable risk than a stock with a beta of 1.0.

A)A stock with a beta of zero has a very low level of systematic risk.

B)A stock with a beta greater than 1.0 has lower nondiversifiable risk than a stock with a beta of 1.0.

C)A stock with a beta less than 1.0 has lower nondiversifiable risk than a stock with a beta of 1.0.

D)A stock with a beta less than 1.0 has higher nondiversifiable risk than a stock with a beta of 1.0.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following is generally used to measure the market when calculating betas?

A)The Dow Jones Transportations

B)The Standard & Poors 500

C)The Value Line Quantam Index

D)The Lehman Brothers Bond Index

A)The Dow Jones Transportations

B)The Standard & Poors 500

C)The Value Line Quantam Index

D)The Lehman Brothers Bond Index

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

57

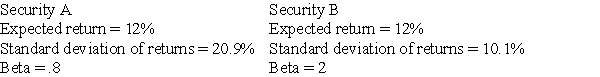

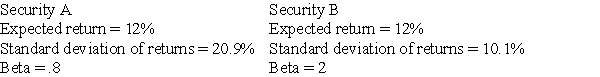

You are thinking of adding one of two investments to an already well diversified portfolio.

If you are a risk-averse investor:

A)security A is the better choice.

B)security B is the better choice.

C)either security would be acceptable.

D)cannot be determined with information given.

If you are a risk-averse investor:

A)security A is the better choice.

B)security B is the better choice.

C)either security would be acceptable.

D)cannot be determined with information given.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following statements is true?

A)Systematic,or market,risk can be reduced through diversification.

B)Both systematic and unsystematic risk can be reduced through diversification.

C)Unsystematic,or company,risk can be reduced through diversification.

D)Neither systematic nor unsystematic risk can be reduced through diversification.

A)Systematic,or market,risk can be reduced through diversification.

B)Both systematic and unsystematic risk can be reduced through diversification.

C)Unsystematic,or company,risk can be reduced through diversification.

D)Neither systematic nor unsystematic risk can be reduced through diversification.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

59

You are considering a portfolio of three stocks with 30% of your money invested in company X,45% of your money invested in company Y,and 25% of your money invested in company Z.If the betas for each stock are 1.22 for company X,1.46 for company Y,and 1.03 for company Z,what is the portfolio beta?

A)1.24

B)1.00

C)1.28

D)1.33

A)1.24

B)1.00

C)1.28

D)1.33

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

60

Currently,the expected return on the market is 12.5% and the required rate of return for Alpha,Inc.is 12.5%.Therefore,Alpha's beta must be:

A)less than 1.0.

B)greater than 1.0.

C)equal to 1.0.

D)unknown based on the information provided.

A)less than 1.0.

B)greater than 1.0.

C)equal to 1.0.

D)unknown based on the information provided.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

61

Provide an intuitive discussion of beta and its importance for measuring risk.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

62

Beta is a measure of systematic risk.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

63

The security market line (SML)relates risk to return,for a given set of market conditions.If expected inflation increases,which of the following would most likely occur?

A)The market risk premium would increase.

B)Beta would increase.

C)The slope of the SML would increase.

D)The SML line would shift up.

A)The market risk premium would increase.

B)Beta would increase.

C)The slope of the SML would increase.

D)The SML line would shift up.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

64

The market rewards assuming additional unsystematic risk with additional returns.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

65

The security market line (SML)relates risk to return,for a given set of market conditions.If risk aversion increases,which of the following would most likely occur?

A)The market risk premium would increase.

B)Beta would increase.

C)The slope of the SML would increase.

D)The SML line would shift up.

A)The market risk premium would increase.

B)Beta would increase.

C)The slope of the SML would increase.

D)The SML line would shift up.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

66

The stock of the Preston Corporation is expected to pay a dividend of $6 during the coming year.Dividends are expected to grow far into the future at 8%.Investors have recently evaluated future market return variance to be 0.0016 and the covariance of returns for Preston and the market as 0.00352.Assuming a required market return of 14% and a risk-free rate of 6%,at what price should the stock of Preston sell?

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

67

The risk-return relationship for each financial asset is shown on:

A)the capital market line.

B)the New York Stock Exchange market line.

C)the security market line.

D)none of the above.

A)the capital market line.

B)the New York Stock Exchange market line.

C)the security market line.

D)none of the above.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

68

The relevant risk to an investor is that portion of the variability of returns that cannot be diversified away.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

69

Briefly discuss why there is no reason to believe that the market will reward investors with additional returns for assuming unsystematic risk.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

70

A stock with a beta greater than 1.0 has lower nondiversifiable risk than a stock with a beta of 1.0.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

71

The Elvis Alive Corporation,makers of Elvis memorabilia,has a beta of 2.35.The return on the market portfolio is 13%,and the risk-free rate is 7%.According to CAPM,what is the risk premium on a stock with a beta of 1.0?

A)11.75%

B)18.75%

C)6%

D)13%

A)11.75%

B)18.75%

C)6%

D)13%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

72

Given the capital asset pricing model,a security with a beta of 1.5 should return ________,if the risk-free rate is 6% and the market return is 11%.

A)13.5%

B)14.0%

C)14.5%

D)15.0%

A)13.5%

B)14.0%

C)14.5%

D)15.0%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

73

Huit Industries' common stock has an expected return of 14.4% and a beta of 1.2.If the expected risk-free return is 8%,what is the expected return for the market (round your answer to the nearest .1%)?

A)7.7%

B)9.6%

C)12.0%

D)13.3%

A)7.7%

B)9.6%

C)12.0%

D)13.3%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

74

Siebling Manufacturing Company's common stock has a beta of .8.If the expected risk-free return is 7% and the market offers a premium of 8% over the risk-free rate,what is the expected return on Siebling's common stock?

A)7.8%

B)13.4%

C)14.4%

D)8.7%

A)7.8%

B)13.4%

C)14.4%

D)8.7%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

75

Unsystematic risk can be eliminated through diversification.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

76

Tanzlin Manufacturing's common stock has a beta of 1.5.If the expected risk-free return is 9% and the expected return on the market is 14%,what is the expected return on the stock?

A)13.5%

B)21.0%

C)16.5%

D)21.5%

A)13.5%

B)21.0%

C)16.5%

D)21.5%

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

77

A stock with a beta of 1.0 would earn the risk-free rate.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

78

Stocks with higher betas are usually more stable than stocks with lower betas.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

79

The market rewards assuming additional systematic risk with additional returns.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck

80

Betas for individual stocks tend to be stable.

Unlock Deck

Unlock for access to all 105 flashcards in this deck.

Unlock Deck

k this deck