Deck 12: Analyzing Project Cash Flows

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/112

Play

Full screen (f)

Deck 12: Analyzing Project Cash Flows

1

How is interest expense that is associated with a project treated in the capital budgeting process?

A)It is treated as a cash outflow when estimating the incremental cash flows associated with a project.

B)It is built into the discount rate.

C)It is considered a synergistic incremental cash flow.

D)Interest expense is not relevant to any capital budgeting decisions.

A)It is treated as a cash outflow when estimating the incremental cash flows associated with a project.

B)It is built into the discount rate.

C)It is considered a synergistic incremental cash flow.

D)Interest expense is not relevant to any capital budgeting decisions.

B

2

Which of the following cash flows should be included as incremental costs when evaluating capital projects?

A)Overhead expenses that are directly related to a project

B)Interest expense that is directly related to the financing of a project

C)Sunk costs that are related to a project

D)Principal payments that are directly related to the financing of a project

A)Overhead expenses that are directly related to a project

B)Interest expense that is directly related to the financing of a project

C)Sunk costs that are related to a project

D)Principal payments that are directly related to the financing of a project

A

3

Which of the following is NOT one of the categories for a project's relevant after-tax cash flows?

A)Financing flows

B)Initial cash outflow

C)Differential flows over the project's life

D)Terminal cash flow

A)Financing flows

B)Initial cash outflow

C)Differential flows over the project's life

D)Terminal cash flow

A

4

Incremental cash flows from a project =

A)Firm cash flows without the project plus or minus changes in net income.

B)Firm cash flows with the project plus firm cash flows without the project.

C)Firm cash flows with the project minus firm cash flows without the project.

D)Firm cash flows without the project plus or minus changes in revenue with the project.

A)Firm cash flows without the project plus or minus changes in net income.

B)Firm cash flows with the project plus firm cash flows without the project.

C)Firm cash flows with the project minus firm cash flows without the project.

D)Firm cash flows without the project plus or minus changes in revenue with the project.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

5

Holding all other variables constant,which of the following would INCREASE net working capital for given year on a project?

A)Allowing customers less time to pay for purchases

B)Taking longer to pay suppliers

C)Increasing inventory levels

D)Both A and C

A)Allowing customers less time to pay for purchases

B)Taking longer to pay suppliers

C)Increasing inventory levels

D)Both A and C

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is NOT considered in the calculation of incremental cash flows?

A)Depreciation tax shield

B)Sunk costs

C)Opportunity costs

D)Both A and B

A)Depreciation tax shield

B)Sunk costs

C)Opportunity costs

D)Both A and B

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is NOT part of a project's initial cash outflow?

A)The asset's purchase price

B)Funds committed to support increased inventory levels due to expected increased sales if the firm adopts the project

C)A marketing survey completed last year to determine the project's feasibility

D)Expenses incurred to install the asset

A)The asset's purchase price

B)Funds committed to support increased inventory levels due to expected increased sales if the firm adopts the project

C)A marketing survey completed last year to determine the project's feasibility

D)Expenses incurred to install the asset

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

8

The owner of a convenience store is considering adding a take-out sandwich section to her offerings.The new activity will occupy 25% of the space and account for 30% of total revenues.Property insurance on the building is $9,000 per year and will not change because of the new activity.How much of the insurance premium should be allocated to the new product line?

A)$2,700

B)$2,475

C)$2,250

D)$0.00

A)$2,700

B)$2,475

C)$2,250

D)$0.00

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

9

When evaluating Capital Budgeting decisions,which of the following items should NOT be included in the construction of cash flow projections for purposes of analysis?

A)Net salvage value

B)Land and building expenses

C)Changes in net working capital requirements

D)Shipping and installation costs

E)All of the above should be included.

A)Net salvage value

B)Land and building expenses

C)Changes in net working capital requirements

D)Shipping and installation costs

E)All of the above should be included.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

10

The calculation of differential cash flows over a project's life should include which of the following?

A)Labor and material savings

B)Additional revenues attributable to the project

C)Investment in net working capital

D)All of the above

E)None of the above

A)Labor and material savings

B)Additional revenues attributable to the project

C)Investment in net working capital

D)All of the above

E)None of the above

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is the best example of an incremental cash inflow/outflow?

A)Cash flows that are achieved by diverting sales from other projects of the firm

B)Cash flows that are associated with the financing of a project

C)Cash flows that occur a little at a time

D)What the total cash flows will be to the company if the project is undertaken as opposed to what they would have been if the project had not been undertaken

A)Cash flows that are achieved by diverting sales from other projects of the firm

B)Cash flows that are associated with the financing of a project

C)Cash flows that occur a little at a time

D)What the total cash flows will be to the company if the project is undertaken as opposed to what they would have been if the project had not been undertaken

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is an example of a sunk cost?

A)Overhead costs that are associated with a project

B)Interest expense associated with a project

C)Market study expenses incurred in order to decide if a firm should accept a project

D)Income taxes associated with a project

E)Depreciation expenses associated with a project

A)Overhead costs that are associated with a project

B)Interest expense associated with a project

C)Market study expenses incurred in order to decide if a firm should accept a project

D)Income taxes associated with a project

E)Depreciation expenses associated with a project

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following best describes why cash flows are utilized rather than accounting profits when evaluating capital projects?

A)Cash flows have a greater present value than accounting profits.

B)Cash flows reflect the timing of benefits and costs more accurately than accounting profits.

C)Cash flows are more stable than accounting profits.

D)Cash flows improve the tax position of a firm more than accounting profits.

E)None of the above.

A)Cash flows have a greater present value than accounting profits.

B)Cash flows reflect the timing of benefits and costs more accurately than accounting profits.

C)Cash flows are more stable than accounting profits.

D)Cash flows improve the tax position of a firm more than accounting profits.

E)None of the above.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

14

Depreciation expenses affect tax-related cash flows by:

A)increasing taxable income,thus increasing taxes.

B)decreasing taxable income,thus reducing taxes.

C)decreasing taxable income,but not altering cash flows since depreciation is not a cash expense.

D)all of the above.

A)increasing taxable income,thus increasing taxes.

B)decreasing taxable income,thus reducing taxes.

C)decreasing taxable income,but not altering cash flows since depreciation is not a cash expense.

D)all of the above.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

15

If an investment project would make use of land which the firm currently owns,the project should be charged with:

A)a sunk cost.

B)an opportunity cost.

C)amortization.

D)interest.

E)abuse of power.

A)a sunk cost.

B)an opportunity cost.

C)amortization.

D)interest.

E)abuse of power.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following cash flows are NOT considered in the calculation of the initial outlay for a capital investment proposal?

A)Increase in accounts receivable

B)The cost of shipping new equipment

C)The cost of issuing new bonds if the project is financed by a new bond issue

D)The cost of installing new equipment

E)All of the above should be considered.

A)Increase in accounts receivable

B)The cost of shipping new equipment

C)The cost of issuing new bonds if the project is financed by a new bond issue

D)The cost of installing new equipment

E)All of the above should be considered.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following expenses should be included when estimating cash flows for investment projects?

A)Interest expense related to financing a project

B)Sunk costs

C)Required principal payments related to financing a project

D)Opportunity costs

A)Interest expense related to financing a project

B)Sunk costs

C)Required principal payments related to financing a project

D)Opportunity costs

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

18

Relevant incremental cash flows include:

A)sales captured from the firm's competitors.

B)retained sales that would have been lost to new competing products.

C)incremental sales brought to the firm as a whole.

D)all of the above.

A)sales captured from the firm's competitors.

B)retained sales that would have been lost to new competing products.

C)incremental sales brought to the firm as a whole.

D)all of the above.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following cash flows should be included as incremental costs when evaluating capital projects?

A)Investment in working capital that is directly related to a project

B)Expenses that are incurred in order to modify a firm's production facility in order to invest in a project

C)Overhead expenses that are directly related to a project

D)Opportunity costs that are directly related to a project

E)All of the above

A)Investment in working capital that is directly related to a project

B)Expenses that are incurred in order to modify a firm's production facility in order to invest in a project

C)Overhead expenses that are directly related to a project

D)Opportunity costs that are directly related to a project

E)All of the above

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following would be considered a termination cash flow?

A)The expected salvage value of the asset

B)Any tax payments or refunds associated with the salvage value of the asset

C)Recapture of any investment in working capital that was included as an incremental cash outlay

D)All of the above

A)The expected salvage value of the asset

B)Any tax payments or refunds associated with the salvage value of the asset

C)Recapture of any investment in working capital that was included as an incremental cash outlay

D)All of the above

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

21

Anderson-EOG Inc.is evaluating the the construction of a gas pipeline to bring natural gas from Western New York state to New York City.The controller argues that depreciation has to be included among the expenses.The Treasurer argues that depreciation is irrelevant because it does not affect cash flow.Who is correct?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

22

The pertinent issue for determining whether overhead costs should be part of a project's relevant after-tax cash flow is whether the project benefits from the overhead items.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

23

When replacing an existing asset,the cash inflow associated with the sale of the old asset and any related tax effects must be considered and accounted for in the analysis.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

24

Diamond Inc.has estimated that a new building will cost $2,500,000 to construct.Land was purchased a year ago for $500,000 and could be sold today for $550,000.An environmental impact study required by the state was performed at a cost of $48,000.For capital budgeting purposes,what is the relevant cost of the new building?

A)$2,500,000

B)$3,048,000

C)$3,050,000

D)$3,098,000

A)$2,500,000

B)$3,048,000

C)$3,050,000

D)$3,098,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

25

The initial outlay involves the immediate cash outflow necessary to purchase the asset and put it in operating order.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

26

The initial outlay of an asset does not include installation costs.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

27

Mr.Smith included the cost of test marketing before production in the calculation of the initial outlay.Apparently,Mr.Smith does not understand the concept of:

A)side-effect costs.

B)opportunity costs.

C)sunk costs.

D)variable costs.

A)side-effect costs.

B)opportunity costs.

C)sunk costs.

D)variable costs.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

28

Thaler & Co.anticipates an increase of $1,000,0000 in Net Operating Income from first year sales of a new product.Taxes will be $350,000 and the company took $150,000 in depreciation expense.Operating cash flow equals

A)$1,000,000

B)$500,000

C)$800,000

D)$650,000

A)$1,000,000

B)$500,000

C)$800,000

D)$650,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

29

Anderson-EOG Inc.is evaluating the the construction of a gas pipeline to bring natural gas from Western New York state to New York City.The controller argues that every project of the company has to absorb a portion of administrative overhead including corporate headquarters and executive salaries.The Treasurer argues that these costs are irrelevant because they are merely being shifted from part of the company to another.Who is correct?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

30

In measuring cash flows we are interested only in the incremental or differential after-tax cash flows that are attributed to the investment proposal being evaluated.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

31

Cape Cod Cranberries is evaluating the introduction of a new line of organic cranberry products.Market research suggests that approximates 1/3 of sales of the new products will come at the expense of existing product lines.How should this "cannibalization effect" be incorporated into the analysis.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

32

Incremental cash flows include all of the following EXCEPT:

A)research and development costs .

B)increased labor costs from the project.

C)advertising costs .

D)both B and C.

A)research and development costs .

B)increased labor costs from the project.

C)advertising costs .

D)both B and C.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

33

In making a capital budgeting decision we only include the incremental cash flows resulting from the investment decision.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

34

The opportunity cost of using a resource in some way is the amount the resource could earn if used in an alternative way.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

35

To be conservative,capital budgeting analysis assumes that projects cannot add sales to existing lines of business.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

36

Briefly explain why each of the following should or should not be considered in forecasting incremental cash flows from a project:

a.the cost of building a prototype of a new product to see if it was feasible.

b.market research suggests that after buying a company's "smart phone" customers will begin to buy more of the same company's notebook computers.

c.a company decides to use existing space for storage.The company could have rented the space to another business for $2,500 a month.

a.the cost of building a prototype of a new product to see if it was feasible.

b.market research suggests that after buying a company's "smart phone" customers will begin to buy more of the same company's notebook computers.

c.a company decides to use existing space for storage.The company could have rented the space to another business for $2,500 a month.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

37

Cape Cod Cranberries will finance a new organic juice production facility with a $10,000,000 bond issue.Interest on the bonds will be $637,500 per year for the life of the project.Should the interest payments be subtracted from the project's incremental cash flows?

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

38

Schiller Construction Inc.has estimated the following revenues and expenses related phase I of a proposed new housing development? Incremental sales= $5,000,000,total cash expenses $3,500,000,depreciation $500,000,taxes 35%,interest expense,$200,000.Operating cash flow equals

A)$650,000

B)$1,000,000

C)$1,150,000

D)$975,000

A)$650,000

B)$1,000,000

C)$1,150,000

D)$975,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

39

Sunk costs are a type of incremental cash flow that should be included in all capital-budgeting decisions.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

40

When determining how much overhead cost to include in incremental cash flows for a capital budgeting decision,the allocation of overhead by the accounting department based on percentage of space used by a project should always be used.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

41

XYZ,Inc.is considering adding a product line that would utilize unused floor place of their manufacturing plant.The floor space would be considered a(n):

A)variable cost.

B)opportunity cost.

C)sunk cost.

D)irrelevant cash flow.

A)variable cost.

B)opportunity cost.

C)sunk cost.

D)irrelevant cash flow.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

42

The machine's after-tax incremental cash flow in year five is:

A)$6,980.

B)$5,980.

C)$7,120.

D)$8,620.

A)$6,980.

B)$5,980.

C)$7,120.

D)$8,620.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following is included in the calculation of the initial outlay for a capital investment?

A)Investment in working capital

B)Shipping expenses

C)Installation

D)All of the above

A)Investment in working capital

B)Shipping expenses

C)Installation

D)All of the above

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

44

Depreciation expenses affect capital budgeting analysis by increasing:

A)taxes paid.

B)incremental cash flows.

C)the initial outlay.

D)working capital.

A)taxes paid.

B)incremental cash flows.

C)the initial outlay.

D)working capital.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

45

ABC already spent $85,000 on a feasibility study for a machine that will produce a new product.The machine will cost $2,575,000.Required modifications will cost $375,000.ABC will need to invest $75,000 for additional inventory.The machine has an IRS approved useful life of 7 years;it is presumed to have no salvage value.It will only be operated for 3 years,after which it will be sold for $600,000.What is the depreciable cost basis of the machine?

A)$3,025,000

B)$2,950,000

C)$2,575,000

D)$2,350,000

A)$3,025,000

B)$2,950,000

C)$2,575,000

D)$2,350,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

46

ABC already spent $85,000 on a feasibility study for a machine that will produce a new product.The machine will cost $2,575,000.Required modifications will cost $375,000.ABC will need to invest $75,000 for additional inventory.The machine has an IRS approved useful life of 7 years;it is presumed to have no salvage value.It will only be operated for 3 years,after which it will be sold for $600,000.What is the total investment amount required for the machine?

A)$3,025,000

B)$2,950,000

C)$2,575,000

D)$2,350,000

A)$3,025,000

B)$2,950,000

C)$2,575,000

D)$2,350,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

47

ABC will purchase a machine that will cost $2,575,000.Required modifications will cost $375,000.ABC will need to invest $75,000 for additional inventory.The machine has an IRS approved useful life of 7 years;it is presumed to have no salvage value.ABC plans to depreciate the machine by using the straight-line method.The machine is expected to increase ABC's sales revenues by $1,890,000 per year;operating costs excluding depreciation are estimated at $454,600 per year.Assume that the firm's tax rate is 40%.What is the annual operating cash flow?

A)$922,464

B)$1,126,287

C)$813,563

D)$1,029,811

A)$922,464

B)$1,126,287

C)$813,563

D)$1,029,811

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

48

If depreciation expense is taken over 5 years rather than 3 years,all things equal,

A)net present value will go down.

B)depreciation has no effect on net present value.

C)net present value will go up.

D)the answer depends on the company's marginal tax rate.

A)net present value will go down.

B)depreciation has no effect on net present value.

C)net present value will go up.

D)the answer depends on the company's marginal tax rate.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

49

If the federal income tax rate were increased,the impact of the tax increase on acceptable investment proposals would be to (ignore the impact of the tax change on the cost of capital):

A)decrease the tax shelter from depreciation.

B)decrease net present value but the internal rate of return would stay the same.

C)increase net present value because the tax shelter from interest and depreciation becomes more valuable.

D)decrease both net present value.and internal rate of return.

A)decrease the tax shelter from depreciation.

B)decrease net present value but the internal rate of return would stay the same.

C)increase net present value because the tax shelter from interest and depreciation becomes more valuable.

D)decrease both net present value.and internal rate of return.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following would increase the net working capital for a project? An increase in:

A)accounts receivable.

B)fixed assets.

C)accounts payable.

D)common stock.

A)accounts receivable.

B)fixed assets.

C)accounts payable.

D)common stock.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following would decrease free cash flows? A decrease in:

A)depreciation expense.

B)interest expense.

C)incremental sales.

D)both A and C.

E)all of the above.

A)depreciation expense.

B)interest expense.

C)incremental sales.

D)both A and C.

E)all of the above.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

52

The machine's IRR is:

A)less than 0.

B)greater than 12 percent.

C)less than 12 percent.

D)equal to 12 percent.

A)less than 0.

B)greater than 12 percent.

C)less than 12 percent.

D)equal to 12 percent.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

53

If SuperMart decides to offer a line of groceries at its discount retail outlet,inventories are expected to increase by $1,200,000,accounts receivable by $300,000 and accounts payable by $500,000.What is the cash outflow for working capital requirements?

A)$2,000,000

B)$1,700,000

C)$1,500,000

D)$1,000,000

A)$2,000,000

B)$1,700,000

C)$1,500,000

D)$1,000,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

54

A firm purchased an asset with a 5-year life for $90,000,and it cost $10,000 for shipping and installation.According to the current tax laws the cost basis of the asset at time of purchase is:

A)$100,000.

B)$95,000.

C)$80,000.

D)$70,000.

A)$100,000.

B)$95,000.

C)$80,000.

D)$70,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

55

ABC purchased a machine for $2,575,000.Required modifications will cost $375,000.ABC will need to invest $75,000 for additional inventory.The machine has an IRS approved useful life of 7 years;it is presumed to have no salvage value.It will only be operated for 3 years,after-which it will be sold for $600,000.ABC plans to depreciate the machine by using the straight-line method.Assume that the firm's tax rate is 40%.What is the termination (non-operating)cash flow from the machine in year three?

A)$900,623

B)$1,109,286

C)$1,298,114

D)$879,247

A)$900,623

B)$1,109,286

C)$1,298,114

D)$879,247

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

56

The machine's incremental after-tax cash inflow for year 1 is:

A)$6,420.

B)$7,980.

C)$8,620.

D)$5,980.

A)$6,420.

B)$7,980.

C)$8,620.

D)$5,980.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following is included in the terminal cash flow?

A)The expected salvage value of the asset

B)Tax impacts from selling asset

C)Recapture of any working capital

D)All of the above

A)The expected salvage value of the asset

B)Tax impacts from selling asset

C)Recapture of any working capital

D)All of the above

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

58

The machine's NPV is:

A)$1,556.56.

B)$2,556.56.

C)$1,123.99.

D)$2,123.99.

A)$1,556.56.

B)$2,556.56.

C)$1,123.99.

D)$2,123.99.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

59

The machine's initial cash outflow is:

A)$20,000.

B)$21,000.

C)$27,000.

D)$23,000.

A)$20,000.

B)$21,000.

C)$27,000.

D)$23,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following should be included in the initial outlay?

A)Shipping and installation costs

B)Increased working capital requirements

C)Cost of employee training associated specifically with the asset being evaluated

D)All of the above

A)Shipping and installation costs

B)Increased working capital requirements

C)Cost of employee training associated specifically with the asset being evaluated

D)All of the above

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following should be considered in the estimation of free cash flows?

A)Cash generated from the sale of a project

B)Recovery of net working capital

C)Operating cash flow

D)All of the above

A)Cash generated from the sale of a project

B)Recovery of net working capital

C)Operating cash flow

D)All of the above

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

62

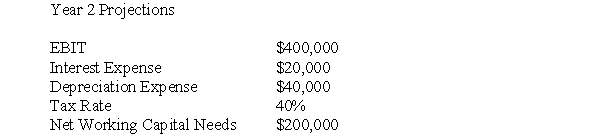

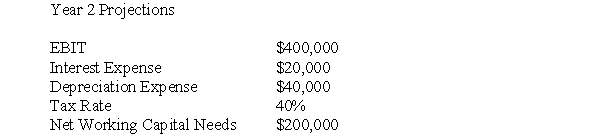

SpaceTech is considering a new project with the following projections for Year 2.

If the projected net working capital needs for Year 1 was $150,000,calculate the free cash flow for Year 2.

A)$130,000

B)$180,000

C)$230,000

D)$280,000

If the projected net working capital needs for Year 1 was $150,000,calculate the free cash flow for Year 2.

A)$130,000

B)$180,000

C)$230,000

D)$280,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

63

Your company is considering replacing an old steel cutting machine with a new one.Two months ago,you sent the company engineer to a training seminar demonstrating the new machine's operation and efficiency.The $2,500 cost for this training session has already been paid.If the new machine is purchased,it would require $5,000 in installation and modification costs to make it suitable for operation in your factory.The old machine originally cost $50,000 five years ago and has been depreciated by $7,000 per year for five years up to now.The new machine will cost $75,000 before installation and modification.It will be depreciated by $5,000 per year.The old machine can be sold today for $10,000.The marginal tax rate for the firm is 40%.Compute the relevant initial outlay in this capital budgeting decision.

A)$72,500

B)$68,000

C)$70,500

D)$78,000

A)$72,500

B)$68,000

C)$70,500

D)$78,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

64

Burr Habit Corporation is considering a new product line.The company currently manufactures several lines of snow skiing apparel.The new products,insulated ski shorts,are expected to generate sales less cost of goods sold of $1 million per year for the next five years.They expect that during this five year period,they will lose about $250,000 per year in sales less cost of goods sold on their existing lines of longer ski pants as a result of the introduction of the new product line.The new line will require no additional equipment or space in the plant and can be produced in the same manner as the existing apparel products.The new project will,however,require that the company spend an additional $80,000 per year on insurance in case customers sue for frostbite.Also,a new marketing director would be hired to oversee the line at $45,000 per year in salary and benefits.Because of the different construction of the shorts,an increase in inventory of 3,800 would be required initially.If the marginal tax rate is 30%,compute the incremental after tax cash flows per year for years 1-5.

A)$434,500 per year

B)$625,000 per year

C)$187,500 per year

D)$437,500 per year

A)$434,500 per year

B)$625,000 per year

C)$187,500 per year

D)$437,500 per year

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

65

If Morgan Tool & Die Co.acquires a new turret lathe,the lathe will cost $80,000,transportation $6,000,installation $7,500.Installing the new lathe will allow Morgan to reduce its finished goods inventory by $10,000.For capital budgeting purposes,the initial investment required for the new lathe is:

A)$83,500.

B)$87,500.

C)$93,500.

D)$103,500.

A)$83,500.

B)$87,500.

C)$93,500.

D)$103,500.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

66

Jefferson Corporation is considering an expansion project.The necessary equipment could be purchased for $15 million and shipping and installation costs are another $500,000.The project will also require an initial $2 million investment in net working capital.The company's tax rate is 40%.What is the project's initial investment outlay (in millions)?

A)$15.0

B)$15.5

C)$16.5

D)$17.0

E)$17.5

A)$15.0

B)$15.5

C)$16.5

D)$17.0

E)$17.5

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following would cause free cash flow to differ from operating cash flow when an investment project is terminated?

A)Sale of assets

B)Recovery of net working capital

C)Income taxes

D)All of the above

A)Sale of assets

B)Recovery of net working capital

C)Income taxes

D)All of the above

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

68

In year 3 of project Gamma.sales were $3,000,0000,cost of goods sold $1,500,000,other cash costs were $400,000,depreciation was $600,000 and interest expense was $250,000.The company's marginal tax rate is 35%.Compute operating cash flow for year 3 of project Gamma.

A)$925,000

B)$675,000

C)$500,000

D)$325,000

A)$925,000

B)$675,000

C)$500,000

D)$325,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

69

When an old asset is sold for exactly its depreciated value,the only taxable income is the difference between the initial cost of the machine and the selling price.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

70

Woodstock Inc.expects to own a building for five years,then sell it for $1,500,000 net of taxes,sales commissions and other selling costs.Woodstock's cost of capital is 11%.How much will the sale of the building contribute to the NPV of the project?

A)$890,177

B)$1,351,351

C)$1,500,000

D)$2,527,587

A)$890,177

B)$1,351,351

C)$1,500,000

D)$2,527,587

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

71

A project under consideration by Bizet Co.will require the purchase of machinery for $50,000 and additional inventory for $15,000? Accounts receivable will increase by $12,000 and accounts payable by $14,000.Liability insurance will increase by $2,500 per year and utilities expense by $1,500 per year.What is the investment in working capital required by this project?

A)$77,000

B)$41,000

C)$13,000

D)$4,000

A)$77,000

B)$41,000

C)$13,000

D)$4,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

72

The Director of Capital Budgeting of Capital Assets Corp.is considering the acquisition of a new high speed photocopy machine.The photocopy machine is priced at $85,000 and would require $2,000 in transportation costs and $4,000 for installation.The equipment will have a useful life of 5 years.The proposal will require that Capital Assets Corp.send technician for training at a cost of $5,000.The firm's marginal tax rate is 40 percent.How much is the initial cash outlay of the photocopy machine?

A)$58,600

B)$64,000

C)$77,000

D)$81,000

E)$96,000

A)$58,600

B)$64,000

C)$77,000

D)$81,000

E)$96,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

73

The Board of Directors of Waste Free Chemicals is considering the acquisition of a new chemical processor.The processor is priced at $600,000 but would require $60,000 in transportation costs and $40,000 for installation.The processor will have a useful life of 10 years.The project will require Waste Free to increase its investment in accounts receivable by $80,000 and will also require an additional investment in inventory of $150,000.The firm's marginal tax rate is 40 percent.How much is the initial cash outlay of the processor?

A)$700,000

B)$850,000

C)$930,000

D)$1,040,000

A)$700,000

B)$850,000

C)$930,000

D)$1,040,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

74

Famous Danish Corp.is replacing an old cookie cutter with a new one.The cookie cutter is being sold for $25,000 and it has a net book value of $75,000.Assume that Famous Danish is in the 34% income tax bracket.How much will Famous Danish net from the sale?

A)$61,000

B)$55,000

C)$75,000

D)$42,000

A)$61,000

B)$55,000

C)$75,000

D)$42,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

75

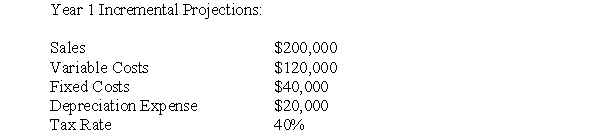

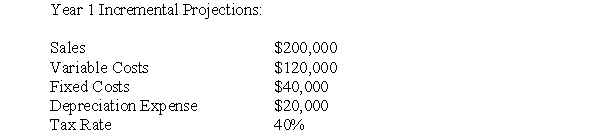

Wright's Warehouse has the following projections for Year 1 of a capital budgeting project.

Calculate the operating cash flow for Year 1.

A)$12,000

B)$32,000

C)$52,000

D)$72,000

Calculate the operating cash flow for Year 1.

A)$12,000

B)$32,000

C)$52,000

D)$72,000

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

76

Regal Enterprises is considering the purchase of a new embroidering machine.It is expected to generate additional sales of $400,000 per year.The machine will cost $295,000,plus $3,000 to install it.The embroiderer will save $12,000 in labor expense each year.Regal is in the 34% income tax bracket.The machine will be depreciated on a straight-line basis over five years (it has no salvage value).The embroiderer will require annual operating expenses of $136,000.What is the annual operating cash flow that the machine will generate?

A)$316,954

B)$124,000

C)$202,424

D)$165,816

A)$316,954

B)$124,000

C)$202,424

D)$165,816

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

77

The capital budgeting decision-making process involves measuring the expected incremental cash flows of an investment proposal and evaluating the value of these cash flows relative to the project's cost.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

78

In the fourth and final year of a project,SVC expects operating cash flow of $440,000.The project required an $80,000 investment in working capital at the beginning.Of that amount,$60,000 will be recovered in year 4.Machinery associated with the project will be sold for exactly its under appreciated value of $15,000.Total free cash flow for the fourth year is:

A)$75,000.

B)$1$500,000.

C)$515,000.

D)$535,000.

A)$75,000.

B)$1$500,000.

C)$515,000.

D)$535,000.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following cash flows are NOT considered in the calculation of the initial outlay for a capital investment proposal?

A)Training expense

B)Working capital investments

C)Installation costs of an asset

D)Before-tax selling price of old machine

A)Training expense

B)Working capital investments

C)Installation costs of an asset

D)Before-tax selling price of old machine

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck

80

Because installment costs of a new asset are a current cash expense,they are excluded from the initial outlay.

Unlock Deck

Unlock for access to all 112 flashcards in this deck.

Unlock Deck

k this deck