Deck 20: Cost-Volume-Profit Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/173

Play

Full screen (f)

Deck 20: Cost-Volume-Profit Analysis

1

Fixed cost per unit is assumed to be constant within a particular relevant range of activity.

False

2

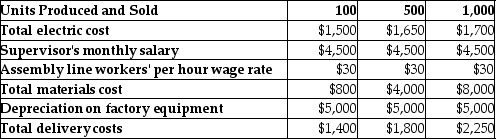

First Buy Television Antenna Company provided the following manufacturing costs for the month of June. From the above information,calculate First Buy's total fixed costs.

A)$298,800

B)$40,200

C)$60,200

D)$64,200

A)$298,800

B)$40,200

C)$60,200

D)$64,200

$64,200

3

Total variable costs change in direct proportion to changes in the volume of production.

True

4

Which of the following statements is true of the behavior of total variable costs,within the relevant range?

A)They will decrease as production increases.

B)They will remain the same as production levels change.

C)They will decrease as production decreases.

D)They will increase as production decreases.

A)They will decrease as production increases.

B)They will remain the same as production levels change.

C)They will decrease as production decreases.

D)They will increase as production decreases.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

5

If the volume of activity doubles in the relevant range,total variable costs will also double.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

6

The fixed costs per unit will ________.

A)increase as production decreases

B)decrease as production decreases

C)remain the same as production levels change

D)increase as production increases

A)increase as production decreases

B)decrease as production decreases

C)remain the same as production levels change

D)increase as production increases

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

7

Total fixed costs can change from one relevant range to another.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

8

Fixed costs per unit decrease as production levels decrease.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

9

Fixed costs per unit is inversely proportional to the volume of units produced.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

10

Within the relevant range,the total fixed costs and the variable cost per unit remain the same.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

11

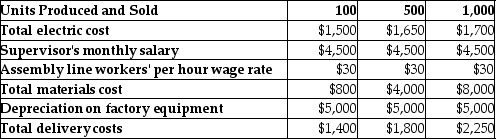

North Shore Clothing Company provided the following manufacturing costs for the month of June. From the above information,calculate North Shore's total variable costs.

A)$313,200

B)$71,000

C)$242,200

D)$223,000

A)$313,200

B)$71,000

C)$242,200

D)$223,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following statements is true of the behavior of total fixed costs,within the relevant range?

A)They will remain the same as production levels change.

B)They will increase as production decreases.

C)They will decrease as production decreases.

D)They will decrease as production increases.

A)They will remain the same as production levels change.

B)They will increase as production decreases.

C)They will decrease as production decreases.

D)They will decrease as production increases.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is a variable cost?

A)property taxes

B)salary of plant manager

C)direct materials cost

D)straight-line depreciation expense

A)property taxes

B)salary of plant manager

C)direct materials cost

D)straight-line depreciation expense

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following costs does not change in total despite changes in volume within the relevant range?

A)fixed costs

B)variable costs

C)mixed costs

D)total production costs

A)fixed costs

B)variable costs

C)mixed costs

D)total production costs

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

15

The high-low method requires the identification of the lowest and highest levels of total costs,not activity,over a period of time.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

16

Variable cost per unit is constant throughout various relevant ranges.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

17

Variable cost per unit,within the relevant range,will ________.

A)increase as production decreases

B)decrease as production decreases

C)remain the same as production levels change

D)decrease as production increases

A)increase as production decreases

B)decrease as production decreases

C)remain the same as production levels change

D)decrease as production increases

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

18

During the current year,Simpson,Inc.incurred $9,000 in fixed costs and $13,000 in variable costs.If the number of units produced is halved next year,the company will incur $4,500 as fixed costs and $6,500 as variable costs.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following costs change in total in direct proportion to a change in volume?

A)fixed costs

B)variable costs

C)mixed costs

D)period costs

A)fixed costs

B)variable costs

C)mixed costs

D)period costs

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

20

A 15% increase in production volume will result in a ________.

A)15% increase in the variable cost per unit

B)15% increase in total mixed costs

C)15% increase in total administration costs

D)15% increase in total variable costs

A)15% increase in the variable cost per unit

B)15% increase in total mixed costs

C)15% increase in total administration costs

D)15% increase in total variable costs

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

21

Jupiter,Inc.incurred fixed costs of $300,000.Total costs,both fixed and variable,are $500,000 when 59,000 units are produced.It sold 35,000 units during the year.Calculate the variable cost per unit.(Round your answer to the nearest cent. )

A)$8.47

B)$14.29

C)$5.08

D)$3.39

A)$8.47

B)$14.29

C)$5.08

D)$3.39

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

22

Ron Moss,a manager of Waterworks,Inc. ,was reviewing the water bills of a dog daycare and spa.He determined that its highest and lowest bills of $3,600 and $2,800 were incurred in the months of May and November,respectively.If 500 dogs were washed in May and 200 dogs were washed in November,what was the variable cost per dog associated with the company's water bill? (Round your answer to the nearest cent. )

A)$4.00

B)$14.00

C)$7.20

D)$2.67

A)$4.00

B)$14.00

C)$7.20

D)$2.67

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

23

The phone bill for a company consists of both fixed and variable costs.Refer to the four-month data below and apply the high-low method to answer the question.(Round any intermediate calculations to the nearest cent,and your final answer to the nearest dollar. ) What is the fixed portion of the total cost?

A)$607

B)$370

C)$2,393

D)$2,630

A)$607

B)$370

C)$2,393

D)$2,630

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

24

The highest value of total cost was $800,000 in June for Mantilla Beverages,Inc.Its lowest value of total cost was $510,000 in December.The company makes a single product.The production volume in June and December were 13,000 and 8,000 units,respectively.What is the fixed cost per month? (Round any intermediate calculations to the nearest cent,and your final answer to the nearest dollar. )

A)$510,000

B)$290,000

C)$46,000

D)$8,000

A)$510,000

B)$290,000

C)$46,000

D)$8,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

25

Kamal Company incurs both fixed and variable production costs.Assuming that production is within the relevant range,if volume goes up by 20%,then the total costs would ________.

A)increase by 20%

B)remain the same

C)increase by an amount less than 20%

D)decrease by 20%

A)increase by 20%

B)remain the same

C)increase by an amount less than 20%

D)decrease by 20%

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

26

The phone bill for a corporation consists of both fixed and variable costs.Refer to the four-month data below and apply the high-low method to answer the question. If the company uses 390 minutes in May,how much will the total bill be? (Round any intermediate calculations to the nearest cent and your final answer to the nearest dollar. )

A)$1,842.60

B)$1,829.10

C)$3,672

D)$6,157

A)$1,842.60

B)$1,829.10

C)$3,672

D)$6,157

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

27

Winslow,Inc. ,a tennis equipment manufacturer,has variable costs of $0.60 per unit of product.In August,the volume of production was 27,000 units,and units sold were 21,800.The total production costs incurred were $30,600.What are the fixed costs per month?

A)$14,400

B)$17,520

C)$3,600

D)$16,200

A)$14,400

B)$17,520

C)$3,600

D)$16,200

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

28

Prudence Company incurs both fixed and variable production costs.Assuming that production is within the relevant range,if volume goes up by 28%,then the total fixed costs would ________.

A)increase by 28%

B)remain the same

C)increase by an amount less than 28%

D)decrease by 28%

A)increase by 28%

B)remain the same

C)increase by an amount less than 28%

D)decrease by 28%

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

29

Left Hand,Inc.has fixed costs of $400,000.Total costs,both fixed and variable,are $550,000 when 40,000 units are produced.Calculate the total costs if the volume increases to 64,000 units.(Round any intermediate calculations to the nearest cent,and your final answer to the nearest dollar. )

A)$950,000

B)$150,000

C)$640,000

D)$550,000

A)$950,000

B)$150,000

C)$640,000

D)$550,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

30

A cellphone service provider charges $5.00 per month and $0.20 per minute per call.If a customer's current bill is $55,how many minutes did the customer use? (Round any intermediate calculations and your final answer to the nearest whole minute. )

A)275 minutes

B)300 minutes

C)250 minutes

D)225 minutes

A)275 minutes

B)300 minutes

C)250 minutes

D)225 minutes

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

31

The relevant production range for Orleans Trailers,Inc.is between 130,000 units and 180,000 units per month.If the company produces beyond 180,000 units per month,________.

A)the fixed costs will remain the same,but the variable cost per unit may change

B)the fixed costs may change,but the variable cost per unit will remain the same

C)the fixed costs and the variable cost per unit will not change

D)both the fixed costs and the variable cost per unit may change

A)the fixed costs will remain the same,but the variable cost per unit may change

B)the fixed costs may change,but the variable cost per unit will remain the same

C)the fixed costs and the variable cost per unit will not change

D)both the fixed costs and the variable cost per unit may change

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

32

The highest value of total cost was $70,000 in June for Fargo Beverages,Inc.Its lowest value of total cost was $52,000 in December.The company makes a single product.The production volume in June and December were 13,000 and 7,000 units,respectively.What is the variable cost per month? (Round your answer to the nearest cent. )

A)$1.38 per unit

B)$2.57 per unit

C)$3.00 per unit

D)$11.67 per unit

A)$1.38 per unit

B)$2.57 per unit

C)$3.00 per unit

D)$11.67 per unit

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

33

Costs that have both variable and fixed components are called ________.

A)fixed costs

B)variable costs

C)mixed costs

D)contribution costs

A)fixed costs

B)variable costs

C)mixed costs

D)contribution costs

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

34

The phone bill for a company consists of both fixed and variable costs.Refer to the four-month data below and apply the high-low method to answer the question. What is the variable cost per minute? (Round your answer to the nearest cent. )

A)$1.17

B)$6.52

C)$0.85

D)$0.11

A)$1.17

B)$6.52

C)$0.85

D)$0.11

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

35

The high-low method is used to ________.

A)determine the highest price that can be charged for a product

B)separate mixed costs into their variable and fixed components

C)identify the relevant and irrelevant costs of a business

D)determine the sales level at highest capacity

A)determine the highest price that can be charged for a product

B)separate mixed costs into their variable and fixed components

C)identify the relevant and irrelevant costs of a business

D)determine the sales level at highest capacity

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

36

When the total variable costs are deducted from total mixed costs,we obtain ________.

A)mixed cost per unit

B)variable cost per unit

C)total high-low costs

D)total fixed costs

A)mixed cost per unit

B)variable cost per unit

C)total high-low costs

D)total fixed costs

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

37

Jose Foster,a manager of Prettiest Pooch,Inc. ,was reviewing the water bills of a dog daycare and spa.He determined that its highest and lowest bills of $3,800 and $2,000 were incurred in the months of May and November,respectively.If 600 dogs were washed in May and 200 dogs were washed in November,what was the fixed cost associated with the company's water bill? (Round any intermediate calculations to the nearest cent and your final answer to the nearest dollar. )

A)$2,000

B)$3,800

C)$1,100

D)$1,800

A)$2,000

B)$3,800

C)$1,100

D)$1,800

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

38

Anthony Chemicals,Inc.has fixed costs of $34,000 per month.The highest production volume during the year was in January when 120,000 units were produced,72,000 units were sold,and total costs of $610,000 were incurred.In June,the company produced only 54,000 units.What was the total cost incurred in June? (Round any intermediate calculations to the nearest cent and your final answer to the nearest dollar. )

A)$259,200

B)$293,200

C)$610,000

D)$644,000

A)$259,200

B)$293,200

C)$610,000

D)$644,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

39

Porterhouse Company incurs both fixed and variable production costs.Assuming that production is within the relevant range,if volume goes up by 28%,then the total variable costs would ________.

A)increase by 28%

B)remain the same

C)increase by an amount less than 28%

D)decrease by 28%

A)increase by 28%

B)remain the same

C)increase by an amount less than 28%

D)decrease by 28%

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

40

Within the relevant range,which of the following costs remains the same irrespective of the changes in production?

A)total mixed costs

B)total operating costs

C)total variable costs

D)total fixed costs

A)total mixed costs

B)total operating costs

C)total variable costs

D)total fixed costs

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

41

How is the unit contribution margin calculated?

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

42

Garcia's,a company that sells fishing nets,provides the following information about its product: What is the contribution margin ratio? (Round any intermediate calculations and your final answer to two decimal places. )

A)85.00%

B)100%

C)75.00%

D)15.00%

A)85.00%

B)100%

C)75.00%

D)15.00%

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

43

Emara Company sells two generators-Model A and Model B-for $456 and $394,respectively.The variable cost of Model A is $406 and of Model B is $304.The company will generate lower revenues but a higher net income if it sells more of Model B than Model A.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

44

Arturo Company sells two generators-Model A and Model B-for $454 and $396,respectively.The variable cost of Model A is $408 and of Model B is $314.If Arturo Company's sales incentives reward sales of the goods with the highest contribution margin,the sales force will be motivated to push sales of Model A more aggressively than Model B.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following is the correct formula for calculating total mixed cost?

A)Total mixed cost = (Variable cost per unit / Number of units)+ Total fixed cost

B)Total mixed cost = (Variable cost per unit × Number of units)- Total fixed cost

C)Total mixed cost = (Variable cost per unit × Number of units)+ Total fixed cost

D)Total mixed cost = (Variable cost per unit / Number of units)- Total fixed cost

A)Total mixed cost = (Variable cost per unit / Number of units)+ Total fixed cost

B)Total mixed cost = (Variable cost per unit × Number of units)- Total fixed cost

C)Total mixed cost = (Variable cost per unit × Number of units)+ Total fixed cost

D)Total mixed cost = (Variable cost per unit / Number of units)- Total fixed cost

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

46

Because contribution margin is based on sales price and variable costs,the ratio can be calculated using either the total amounts or the unit amounts.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

47

Identify each cost below as variable (V),fixed (F),or mixed (M),relative to units sold.Explain the reason for your answer.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

48

How is the contribution margin ratio calculated?

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

49

Gainesville Company has provided the following information: Calculate the contribution margin ratio.(Round your answer to two decimal places. )

A)21.43%

B)82.35%

C)64.71%

D)78.57%

A)21.43%

B)82.35%

C)64.71%

D)78.57%

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

50

How is the contribution margin calculated?

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

51

Young Company has provided the following information: Calculate the contribution margin per unit.

A)$36.00

B)$52.00

C)$68.00

D)$16.00

A)$36.00

B)$52.00

C)$68.00

D)$16.00

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

52

Contribution margin ratio is the ratio of contribution margin to ________.

A)net sales revenue

B)cost of goods sold

C)total variable costs

D)total fixed costs

A)net sales revenue

B)cost of goods sold

C)total variable costs

D)total fixed costs

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

53

The Perfect Fit Company sells hand sewn shirts at $58.00 per shirt.It incurs monthly fixed costs of $8,000.The contribution margin ratio is calculated to be 30%.What is the variable cost per shirt? (Round any intermediate calculations and your final answer to two decimal places. )

A)$40.60 per shirt

B)$75.40 per shirt

C)$58.00 per shirt

D)$17.40 per shirt

A)$40.60 per shirt

B)$75.40 per shirt

C)$58.00 per shirt

D)$17.40 per shirt

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

54

If the sales price of Product X is $24.00 per unit and unit fixed cost is $7.50,its contribution margin per unit is $16.50.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

55

Contribution margin is the amount that contributes to covering variable costs.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

56

Contribution margin ratio is the ratio of contribution margin to net income.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

57

Pluto Hand Blenders Company sold 3,000 units in October at a sales price of $45 per unit.The variable cost is $25 per unit.Calculate the total contribution margin.

A)$135,000

B)$60,000

C)$75,000

D)$37,500

A)$135,000

B)$60,000

C)$75,000

D)$37,500

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following formulas is the right formula for calculating contribution margin ratio?

A)Contribution margin ratio = Contribution margin + Net sales revenue

B)Contribution margin ratio = Contribution margin / Net sales revenue

C)Contribution margin ratio = Contribution margin × Net sales revenue

D)Contribution margin ratio = Contribution margin - Net sales revenue

A)Contribution margin ratio = Contribution margin + Net sales revenue

B)Contribution margin ratio = Contribution margin / Net sales revenue

C)Contribution margin ratio = Contribution margin × Net sales revenue

D)Contribution margin ratio = Contribution margin - Net sales revenue

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

59

Contribution margin is the difference between net sales revenue and variable costs.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

60

Contribution margin ratio is equal to ________.

A)fixed costs divided by contribution margin per unit

B)net sales revenue per unit minus variable costs per unit

C)net sales revenue minus variable costs

D)contribution margin divided by net sales revenue

A)fixed costs divided by contribution margin per unit

B)net sales revenue per unit minus variable costs per unit

C)net sales revenue minus variable costs

D)contribution margin divided by net sales revenue

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

61

A ________ groups cost by behavior; costs are classified as either variable costs or fixed costs.

A)balance sheet

B)contribution margin income statement

C)traditional income statement

D)absorption costing income statement

A)balance sheet

B)contribution margin income statement

C)traditional income statement

D)absorption costing income statement

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

62

A CVP graph shows how changes in the level of sales will affect profits.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

63

CVP analysis assumes that the sales price per unit does not change as volume changes.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following is a period cost?

A)manufacturing overhead

B)direct labor cost

C)direct materials cost

D)administrative cost

A)manufacturing overhead

B)direct labor cost

C)direct materials cost

D)administrative cost

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

65

Darwin Company sells glass vases at a wholesale price of $4.50 per unit.The variable cost to manufacture is $1.75 per unit.The monthly fixed costs are $8,500.Its current sales are 29,000 units per month.If the company wants to increase its operating income by 20%,how many additional units must it sell? (Round any intermediate calculations to two decimal places and your final answer to the nearest whole number. )

A)130,500 glass vases

B)8,500 glass vases

C)34,182 glass vases

D)5,182 glass vases

A)130,500 glass vases

B)8,500 glass vases

C)34,182 glass vases

D)5,182 glass vases

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

66

The breakeven point is the point where the sales revenues are equal to the fixed costs.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following is not an assumption of cost-volume-profit (CVP)analysis?

A)The only factor that affects total costs is a change in volume,which increases or decreases variable and mixed costs.

B)The price per unit does not change as volume changes.

C)Fixed costs do not change.

D)The price per unit changes as volume changes.

A)The only factor that affects total costs is a change in volume,which increases or decreases variable and mixed costs.

B)The price per unit does not change as volume changes.

C)Fixed costs do not change.

D)The price per unit changes as volume changes.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following appears as a line item in a contribution margin income statement?

A)Gross profit

B)Total cost of goods sold

C)Operating income

D)Total selling and administrative expenses

A)Gross profit

B)Total cost of goods sold

C)Operating income

D)Total selling and administrative expenses

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

69

The fundamental assumption of cost-volume-profit (CVP)analysis is that,in the long run,fixed costs become variable costs.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

70

Galose Coffee Company sold 7,000 units in October at a sales price of $45 per unit.The variable cost is $20 per unit.The monthly fixed costs are $8,000.What is the operating income earned in October?

A)$175,000

B)$315,000

C)$167,000

D)$140,000

A)$175,000

B)$315,000

C)$167,000

D)$140,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

71

Companies can use the contribution margin ratio approach to compute required sales in terms of units rather than in sales dollars.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

72

Target profit can be determined by using the contribution margin,contribution margin ratio,or break even approach.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

73

Savannah Company sells glass vases at a wholesale price of $5 per unit.The variable cost of manufacture is $2.50 per unit.The fixed costs are $6,200 per month.It sold 5,700 units during this month.Calculate Savannah's operating income (loss)for this month.

A)$22,300

B)$8,050

C)($8,050)

D)($6,200)

A)$22,300

B)$8,050

C)($8,050)

D)($6,200)

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

74

The dollar amount that provides for covering fixed costs and then provides for operating income is called ________.

A)variable cost

B)total cost

C)contribution margin

D)margin of safety

A)variable cost

B)total cost

C)contribution margin

D)margin of safety

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

75

Andres Napkin Company sells a product for $80 per unit.Variable costs are $25 per unit,and fixed costs are $4,000 per month.Andres sold 2,000 units in October.Prepare an income statement for October using the contribution margin format.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

76

A contribution margin income statement classifies costs by function; that is,costs are classified as either product costs or period costs.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

77

List the cost-volume-profit (CVP)assumptions.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

78

Target profit is the operating income that results when sales revenue minus variable and fixed costs equals management's profit goal.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

79

Complete the following statements:

-

A traditional income statement classifies costs by ________; that is,costs are classified as either ________ costs or ________ costs.

A contribution margin income statement classifies costs by ________; that is,costs are classified as either ________ costs or ________ costs.

-

A traditional income statement classifies costs by ________; that is,costs are classified as either ________ costs or ________ costs.

A contribution margin income statement classifies costs by ________; that is,costs are classified as either ________ costs or ________ costs.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

80

Contribution margin is the amount that contributes to covering the fixed costs and then to providing operating income.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck