Deck 17: Job Order Costing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/170

Play

Full screen (f)

Deck 17: Job Order Costing

1

Define a process costing system and list two types of businesses that would use a process costing system.

A process costing system is an accounting system that accumulates costs by process.Businesses that would use a process costing system include a soft drink company,medical equipment manufacturer,and surf board manufacturer.

2

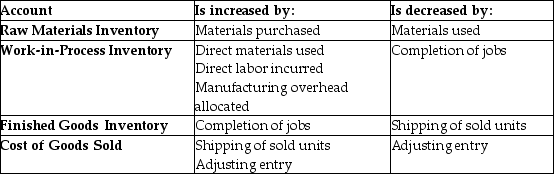

For each of the following accounts,indicate what event causes the account to increase and to decrease.The answer is not debit or credit.

3

When direct materials are received on the production floor,they are recorded on the job cost record.

True

4

Which one of the following companies is most likely to use job order costing?

A)a gold refinery

B)a law firm

C)a surfboard manufacturer

D)a soft drink company

A)a gold refinery

B)a law firm

C)a surfboard manufacturer

D)a soft drink company

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

5

For each of the following types of business,indicate why the manager needs to know the unit cost information.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

6

Cost accounting systems are used ________.

A)to accumulate product cost information

B)to accumulate and assign period costs to products

C)by manufacturing companies,not service companies

D)by stockholders for decision-making purposes

A)to accumulate product cost information

B)to accumulate and assign period costs to products

C)by manufacturing companies,not service companies

D)by stockholders for decision-making purposes

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

7

Both job order and process costing systems use a four-step method to track product costs.List each of the four steps.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

8

What is cost of goods sold? Describe the flow of this cost through the job order costing system.Your answer should include the accounts involved and whether the flow involves a debit or credit.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

9

A process costing system is used when a company produces identical units through a series of production steps.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following would use a process costing system rather than a job order costing system?

A)a health-care service provider

B)a music production studio

C)a paint manufacturer

D)a home remodeling contracting company

A)a health-care service provider

B)a music production studio

C)a paint manufacturer

D)a home remodeling contracting company

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

11

When raw materials are requisitioned for a job,the Raw Materials Inventory account is debited.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is true about ERP systems?

A)Because ERP systems are software based,they have given way to a more service-based economy.

B)Because ERP systems track costs more efficiently,the benefit from the cost information outweighs the cost of obtaining the information.

C)Because ERP systems track costs more efficiently,process costing systems are becoming more prevalent.

D)Because ERP systems have the ability to trace all production costs to individual units,all product costs can now be classified as either direct materials or direct labor.

A)Because ERP systems are software based,they have given way to a more service-based economy.

B)Because ERP systems track costs more efficiently,the benefit from the cost information outweighs the cost of obtaining the information.

C)Because ERP systems track costs more efficiently,process costing systems are becoming more prevalent.

D)Because ERP systems have the ability to trace all production costs to individual units,all product costs can now be classified as either direct materials or direct labor.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is a reason why a job order costing system is appropriate for a custom furniture manufacturer?

A)The cost incurred for each job will differ as per the order specifications.

B)The direct costs incurred for each job are the same,only indirect costs vary.

C)The raw materials used have already been accounted for using process costing.

D)Custom furniture manufacturers produce large quantities of similar products.

A)The cost incurred for each job will differ as per the order specifications.

B)The direct costs incurred for each job are the same,only indirect costs vary.

C)The raw materials used have already been accounted for using process costing.

D)Custom furniture manufacturers produce large quantities of similar products.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following statements is true of costing systems?

A)A process costing system would be used by manufacturers of custom-made perfumes.

B)A job order costing system would be used by manufacturers of baking utensils.

C)A construction company would likely use a process costing system.

D)An accounting firm would likely use a job order costing system.

A)A process costing system would be used by manufacturers of custom-made perfumes.

B)A job order costing system would be used by manufacturers of baking utensils.

C)A construction company would likely use a process costing system.

D)An accounting firm would likely use a job order costing system.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following businesses is most likely to use a process costing system?

A)a baker producing cakes to order

B)a legal service provider

C)an audit service provider

D)a candy manufacturer

A)a baker producing cakes to order

B)a legal service provider

C)an audit service provider

D)a candy manufacturer

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

16

A job order costing system is used by companies that manufacture batches of unique products or provide specialized services.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

17

Accounting firms,building contractors,and healthcare providers use process costing.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is the correct order of the four steps of tracking product costs?

A)assign → accumulate → allocate → adjust

B)accumulate → assign → allocate → adjust

C)adjust → allocate → accumulate → assign

D)allocate → adjust → accumulate → assign

A)assign → accumulate → allocate → adjust

B)accumulate → assign → allocate → adjust

C)adjust → allocate → accumulate → assign

D)allocate → adjust → accumulate → assign

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

19

What is cost of goods manufactured? Describe the flow of this cost through the job order costing system.Your answer should include the accounts involved and whether the flow involves a debit or credit.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

20

Define a job order costing system and list two types of businesses that would us a job order costing system.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

21

The journal entry to record direct labor costs actually incurred involves a debit to the ________.

A)Work-in-Process Inventory account

B)Wages Payable account

C)Manufacturing Overhead account

D)Raw Materials Inventory account

A)Work-in-Process Inventory account

B)Wages Payable account

C)Manufacturing Overhead account

D)Raw Materials Inventory account

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

22

The journal entry to issue indirect materials to production should include a debit to the ________.

A)Finished Goods Inventory account

B)Raw Materials Inventory account

C)Manufacturing Overhead account

D)Work-in-Process Inventory account

A)Finished Goods Inventory account

B)Raw Materials Inventory account

C)Manufacturing Overhead account

D)Work-in-Process Inventory account

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

23

Manufacturing Overhead is a temporary account used to accumulate indirect production costs during the accounting period.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

24

The journal entry to record indirect labor costs incurred involves a debit to the ________.

A)Manufacturing Overhead account

B)Wages Payable account

C)Finished Goods Inventory account

D)Work-in-Process Inventory account

A)Manufacturing Overhead account

B)Wages Payable account

C)Finished Goods Inventory account

D)Work-in-Process Inventory account

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

25

Pandora Manufacturing purchased $95,000 of raw materials on account and $5,000 of raw materials for cash.The materials will be used to produce furniture.Provide the journal entry for the purchase of materials.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

26

On June 1,Dalton Productions had beginning balances as shown in the T-accounts below.

During June,the following transactions took place:

June 2: Issued $2,200 of direct materials and $700 of indirect materials to production.

What was the balance in the Manufacturing Overhead account following this transaction?

A)$43,900

B)$43,200

C)$41,700

D)$41,000

During June,the following transactions took place:

June 2: Issued $2,200 of direct materials and $700 of indirect materials to production.

What was the balance in the Manufacturing Overhead account following this transaction?

A)$43,900

B)$43,200

C)$41,700

D)$41,000

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

27

Broxsie Fabrication,Inc.issued $60,000 of direct materials and $15,500 of indirect materials to production.Prepare the journal entry to record the transaction.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

28

The accounts of Melissa Manufacturing showed the following balances at the beginning of December: The following transactions took place during the month:

December 2: Issued direct materials $37,000 and indirect materials $4,000 to production.

December 15: Incurred $6,000 and $5,000 toward factory's direct labor cost and indirect labor cost,respectively.

What should be the balance in the Work-in-Process Inventory following these transactions?

A)$124,000

B)$87,000

C)$75,000

D)$86,000

December 2: Issued direct materials $37,000 and indirect materials $4,000 to production.

December 15: Incurred $6,000 and $5,000 toward factory's direct labor cost and indirect labor cost,respectively.

What should be the balance in the Work-in-Process Inventory following these transactions?

A)$124,000

B)$87,000

C)$75,000

D)$86,000

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

29

The journal entry to record $1,600 of direct labor and $200 of indirect labor incurred will include debit(s)to the ________.

A)Manufacturing Overhead account for $1,800

B)Work-in-Process Inventory account for $1,600 and Finished Goods Inventory account for $200

C)Finished Goods Inventory account for $1,800

D)Work-in-Process Inventory account for $1,600 and Manufacturing Overhead account for $200

A)Manufacturing Overhead account for $1,800

B)Work-in-Process Inventory account for $1,600 and Finished Goods Inventory account for $200

C)Finished Goods Inventory account for $1,800

D)Work-in-Process Inventory account for $1,600 and Manufacturing Overhead account for $200

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

30

Adelphia Manufacturing issued $70,000 of direct materials and $10,000 of indirect materials for production.Which of the following journal entries would correctly record the transaction?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

31

Uniq Works purchased raw materials amounting to $126,000 on account and $16,000 for cash.The materials will be used to manufacture upholstery for furniture manufacturers on a contract basis.Which of the following journal entries correctly records this transaction?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

32

Manufacturing Overhead is a temporary account used to ________ indirect production costs during the accounting period.

A)allocate

B)assign

C)accumulate

D)approximate

A)allocate

B)assign

C)accumulate

D)approximate

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

33

The actual direct labor costs are assigned to individual jobs,and the actual direct labor cost is recorded with a debit to Work-in-Process Inventory.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

34

The accounts of Delphinia Dreams,Inc.showed the following balances at the beginning of October: During the month,direct materials amounting to $21,000 and indirect materials amounting to $6,000 were issued to production.What is the ending balance in the Work-in-Process Inventory account following these two transactions?

A)$44,000

B)$65,000

C)$10,000

D)$26,000

A)$44,000

B)$65,000

C)$10,000

D)$26,000

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following accounts would be debited in the journal entry to record the issuance of direct materials?

A)Cost of Goods Sold

B)Work-in-Process Inventory

C)Finished Goods Inventory

D)Raw Materials Inventory

A)Cost of Goods Sold

B)Work-in-Process Inventory

C)Finished Goods Inventory

D)Raw Materials Inventory

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

36

The journal entry to issue $600 of direct materials and $30 of indirect materials to production involves debit(s)to the ________.

A)Work-in-Process Inventory account for $600 and Finished Goods Inventory account for $30

B)Manufacturing Overhead account for $630

C)Work-in-Process Inventory account for $600 and Manufacturing Overhead account for $30

D)Work-in-Process Inventory account for $630

A)Work-in-Process Inventory account for $600 and Finished Goods Inventory account for $30

B)Manufacturing Overhead account for $630

C)Work-in-Process Inventory account for $600 and Manufacturing Overhead account for $30

D)Work-in-Process Inventory account for $630

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

37

On June 1,Westbrook Productions had beginning balances as shown in the T-accounts below.

During June,the following transactions took place:

June 2: Issued $3,300 of direct materials and $600 of indirect materials to production.

June 13: Incurred $7,400 of direct factory labor cost and $14,800 of indirect factory labor cost.

What was the balance in the Manufacturing Overhead account following these transactions?

A)$41,600

B)$56,400

C)$55,800

D)$59,100

During June,the following transactions took place:

June 2: Issued $3,300 of direct materials and $600 of indirect materials to production.

June 13: Incurred $7,400 of direct factory labor cost and $14,800 of indirect factory labor cost.

What was the balance in the Manufacturing Overhead account following these transactions?

A)$41,600

B)$56,400

C)$55,800

D)$59,100

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

38

The entry to record the purchase of direct materials on account would include a ________.

A)debit to the Raw Materials Inventory account

B)debit to the Work-in-Process Inventory account

C)credit to the Work-in-Process Inventory account

D)credit to the Raw Materials Inventory account

A)debit to the Raw Materials Inventory account

B)debit to the Work-in-Process Inventory account

C)credit to the Work-in-Process Inventory account

D)credit to the Raw Materials Inventory account

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

39

Work-in-Process Inventory is debited when indirect labor costs are incurred in a job order costing system.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

40

The cost of indirect materials is transferred out of the Manufacturing Overhead account and accumulated in the Raw Materials Inventory account.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

41

The predetermined overhead allocation rate is calculated by dividing ________.

A)the total estimated overhead costs by total number of days in a year

B)the estimated amount of cost driver by actual total overhead costs

C)the actual overhead costs by actual amount of the cost driver or allocation base

D)the estimated overhead costs by total estimated quantity of the overhead allocation base

A)the total estimated overhead costs by total number of days in a year

B)the estimated amount of cost driver by actual total overhead costs

C)the actual overhead costs by actual amount of the cost driver or allocation base

D)the estimated overhead costs by total estimated quantity of the overhead allocation base

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

42

The Equinox Fabrication Plant suffered a fire incident in August,and most of the records for the year were destroyed.The following accounting data for the year were recovered: The company bases its manufacturing overhead allocation on the number of direct labor hours.What was the predetermined overhead allocation rate for the year? (Round your answer to the nearest cent. )

A)$35.09

B)$1.86

C)$29.58

D)$62.71

A)$35.09

B)$1.86

C)$29.58

D)$62.71

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

43

The total amount of manufacturing overhead costs incurred during the period is recorded on the credit side of the Manufacturing Overhead account.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following correctly describes the term cost driver?

A)the inflation rate that causes costs to rise

B)the average inventory costs incurred at any point of time

C)the primary factor that causes a cost to be incurred

D)the total material,labor,and overhead costs of a completed job

A)the inflation rate that causes costs to rise

B)the average inventory costs incurred at any point of time

C)the primary factor that causes a cost to be incurred

D)the total material,labor,and overhead costs of a completed job

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

45

The accounting for the allocation of overhead costs is a three-step process and occurs at three different points in the accounting cycle.List each of the three steps.For each step indicate when the step occurs and why the step is needed.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

46

Zephyros Corporation had estimated manufacturing overhead costs for the coming year to be $303,000.The total estimated direct labor hours and machine hours for the coming year are 7,000 and 12,000,respectively.Manufacturing overhead costs are allocated based on direct labor hours.What is the predetermined overhead allocation rate? (Round your answer to the nearest cent. )

A)$25.25 per machine hour

B)$15.95 per direct labor hour

C)$43.29 per direct labor hour

D)$1.71 per machine hour

A)$25.25 per machine hour

B)$15.95 per direct labor hour

C)$43.29 per direct labor hour

D)$1.71 per machine hour

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

47

Actual manufacturing overhead costs are credited to the Manufacturing Overhead account.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following will be debited to the Manufacturing Overhead account of a watch manufacturer?

A)office telephone costs

B)salaries paid to accountants

C)factory electricity costs

D)cost of printing brochures

A)office telephone costs

B)salaries paid to accountants

C)factory electricity costs

D)cost of printing brochures

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following describes the allocation base for allocating manufacturing overhead costs?

A)the primary cost driver of indirect manufacturing costs

B)the estimated base amount of manufacturing overhead costs in a year

C)the percentage used to allocate direct labor to Work-in-Process Inventory

D)the main element that causes direct costs

A)the primary cost driver of indirect manufacturing costs

B)the estimated base amount of manufacturing overhead costs in a year

C)the percentage used to allocate direct labor to Work-in-Process Inventory

D)the main element that causes direct costs

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

50

Altec Designs makes fashion clothing and reports the following data for the month of September: What is the journal entry to record the total labor charges incurred during September?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

51

The amount of taxes and insurance incurred and paid for the plant of a manufacturing company should be debited to the Manufacturing Overhead account.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following will be categorized as a manufacturing overhead cost?

A)depreciation on factory plant and equipment

B)wages paid to assembly line workers

C)administration charges of showroom

D)cost of direct materials used

A)depreciation on factory plant and equipment

B)wages paid to assembly line workers

C)administration charges of showroom

D)cost of direct materials used

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

53

When a job order costing system is used,actual manufacturing overhead costs are debited to ________.

A)expense accounts

B)the Manufacturing Overhead account

C)the Cost of Goods Sold account

D)the Work-In-Process Inventory account

A)expense accounts

B)the Manufacturing Overhead account

C)the Cost of Goods Sold account

D)the Work-In-Process Inventory account

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

54

The predetermined overhead allocation rate is the rate used to ________.

A)assign direct material costs to jobs

B)allocate actual manufacturing overhead costs incurred during a period

C)allocate estimated manufacturing overhead costs to jobs

D)trace manufacturing and non-manufacturing costs to jobs

A)assign direct material costs to jobs

B)allocate actual manufacturing overhead costs incurred during a period

C)allocate estimated manufacturing overhead costs to jobs

D)trace manufacturing and non-manufacturing costs to jobs

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

55

The predetermined overhead allocation rate for a given production year is calculated ________.

A)at the end of the production year

B)before the accounting period begins

C)after completion of each job

D)after the preparation of financial statements for the year

A)at the end of the production year

B)before the accounting period begins

C)after completion of each job

D)after the preparation of financial statements for the year

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

56

In a manufacturing operation,depreciation of plant equipment should be debited to the Depreciation Expense account.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

57

Arabica Manufacturing uses a predetermined overhead allocation rate based on the number of machine hours.At the beginning of the year,it estimated total manufacturing overhead costs to be $1,050,000,total number of direct labor hours to be 4,000,and total number of machine hours to be 20,000 hours.What was the predetermined overhead allocation rate? (Round your answer to the nearest cent. )

A)$262.50 per machine hour

B)$43.75 per direct labor hour

C)$52.50 per machine hour

D)$65.63 per direct labor hour

A)$262.50 per machine hour

B)$43.75 per direct labor hour

C)$52.50 per machine hour

D)$65.63 per direct labor hour

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

58

Aaron,Inc.estimates direct labor costs and manufacturing overhead costs for the coming year to be $750,000 and $550,000,respectively.Aaron allocates overhead costs based on machine hours.The estimated total labor hours and machine hours for the coming year are 18,000 hours and 7,000 hours,respectively.What is the predetermined overhead allocation rate? (Round your answer to the nearest cent. )

A)$107.14 per machine hour

B)$30.56 per labor hour

C)$1.36 per labor hour

D)$78.57 per machine hour

A)$107.14 per machine hour

B)$30.56 per labor hour

C)$1.36 per labor hour

D)$78.57 per machine hour

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

59

Specialty Wood Products,Inc.had the following manufacturing labor costs last month:

Provide the journal entry to record the labor costs incurred,which will be paid at a later date.

Provide the journal entry to record the labor costs incurred,which will be paid at a later date.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

60

Norman Manufacturing reports the following data for the month:

Journalize the entries relating to materials and labor.Omit explanations.

Journalize the entries relating to materials and labor.Omit explanations.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

61

Irene Manufacturing uses a predetermined overhead allocation rate based on a percentage of direct labor cost.At the beginning of the year,the company estimated total manufacturing overhead costs at $1,000,000 and total direct labor costs at $830,000.In June,Job 711 was completed.The details of Job 711 are shown below. How much was the cost per unit of finished product? (Round any percentages to two decimal places and your final answer to the nearest cent. )

A)$80.00

B)$101.58

C)$85.20

D)$111.20

A)$80.00

B)$101.58

C)$85.20

D)$111.20

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

62

Jezebel,Inc.completed Job 12 and several other jobs in the last week.The cost details of Job 12 are shown below. What is the cost per unit of finished product produced under Job 12? (Round your answer to the nearest cent. )

A)$42.73

B)$65.91

C)$85.29

D)$108.41

A)$42.73

B)$65.91

C)$85.29

D)$108.41

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

63

Venus Manufacturing uses a predetermined overhead allocation rate based on a percentage of direct labor cost.At the beginning of the year,it estimated the manufacturing overhead rate to be 20% of the direct labor cost.In the month of June,Venus completed Job 13C and its details are as follows: What is the total cost incurred for Job 13C?

A)$27,632

B)$24,000

C)$10,360

D)$30,360

A)$27,632

B)$24,000

C)$10,360

D)$30,360

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

64

Archangel Manufacturing calculated a predetermined overhead allocation rate at the beginning of the year based on a percentage of direct labor costs.The production details for the year are given below:

Calculate the manufacturing overhead allocation rate for the year based on the above data.(Round your final answer to two decimal places. )

A)42.42%

B)257.14%

C)235.71%

D)1,206.90%

Calculate the manufacturing overhead allocation rate for the year based on the above data.(Round your final answer to two decimal places. )

A)42.42%

B)257.14%

C)235.71%

D)1,206.90%

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

65

Jeremy Corporation estimated manufacturing overhead costs for the year to be $510,000.Jeremy also estimated 9,000 machine hours and 3,000 direct labor hours for the year.It bases the predetermined overhead allocation rate on machine hours.On January 31,Job 25 was completed.It required 4 machine hours and 4 direct labor hours.What is the amount of manufacturing overhead allocated to the completed job? (Round your answer to the nearest dollar. )

A)$57

B)$453

C)$228

D)$680

A)$57

B)$453

C)$228

D)$680

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

66

Doric Agricultural Corporation uses a predetermined overhead allocation rate based on the direct labor cost.The manufacturing overhead cost allocated during the year is $300,000.The details of production and costs incurred during the year are as follows: What is the predetermined overhead allocation rate applied by the corporation? (Round your answer to two decimal places. )

A)88.00%

B)64.39 %

C)176.47%

D)36.95%

A)88.00%

B)64.39 %

C)176.47%

D)36.95%

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

67

Manufacturing overhead is allocated by debiting the Work-in-Process Inventory account and crediting the Manufacturing Overhead account.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

68

Gardner Machine Shop estimates manufacturing overhead costs for the coming year at $318,000.The manufacturing overhead costs will be allocated based on direct labor hours.Gardner estimates 5,000 direct labor hours for the coming year.In January,Gardner completed Job A33,which used 70 machine hours and 23 direct labor hours.What was the amount of manufacturing overhead allocated to Job A33? (Round any intermediate calculations to the nearest cent,and your final answer to the nearest dollar. )

A)$1,463

B)$4,452

C)$5,915

D)$4,543

A)$1,463

B)$4,452

C)$5,915

D)$4,543

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

69

Happy Clicks,Inc.uses a predetermined overhead allocation rate of $5.50 per machine hour.Actual overhead costs incurred during the year are as follows: What is the amount of manufacturing overhead cost allocated to Work-in-Process Inventory during the year?

A)$38,747

B)$8,900

C)$29,847

D)$41,800

A)$38,747

B)$8,900

C)$29,847

D)$41,800

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

70

Manufacturing overhead is allocated by debiting the Finished Goods Inventory account.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

71

Iglesias,Inc.completed Job 12 on November 30.The details of Job 12 are given below: What is the total cost of Job 12?

A)$2,470

B)$1,990

C)$1,370

D)$1,580

A)$2,470

B)$1,990

C)$1,370

D)$1,580

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

72

Jordan Manufacturing uses a predetermined overhead allocation rate based on a percentage of direct labor cost.At the beginning of the year,it estimated the manufacturing overhead rate to be 30% times the direct labor cost.In the month of June,Jordan completed Job 13C,and its details are as follows: What is the cost per unit of finished product of Job 13C? (Round your answer to the nearest cent. )

A)$168.50

B)$146.60

C)$137.05

D)$136.50

A)$168.50

B)$146.60

C)$137.05

D)$136.50

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

73

The journal entry to record allocation of manufacturing overhead to a particular job includes a ________.

A)debit to the Finished Goods Inventory account and credit to the Manufacturing Overhead account

B)debit to the Work-in-Process Inventory account and credit to the Cash account

C)debit to the Manufacturing Overhead account and credit to the Finished Goods Inventory account

D)debit to the Work-in-Process Inventory account and credit to the Manufacturing Overhead account

A)debit to the Finished Goods Inventory account and credit to the Manufacturing Overhead account

B)debit to the Work-in-Process Inventory account and credit to the Cash account

C)debit to the Manufacturing Overhead account and credit to the Finished Goods Inventory account

D)debit to the Work-in-Process Inventory account and credit to the Manufacturing Overhead account

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

74

Olympia Manufacturing uses a predetermined overhead allocation rate based on a percentage of direct labor cost.At the beginning of the year,Olympia estimated total manufacturing overhead costs at $1,010,000 and total direct labor costs at $830,000.In June,Job 511 was completed.The details of Job 511 are shown below. What is the amount of manufacturing overhead costs allocated to Job 511? (Round any percentages to two decimal places and your final answer to the nearest dollar. )

A)$13,386

B)$32,247

C)$9,040

D)$21,777

A)$13,386

B)$32,247

C)$9,040

D)$21,777

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

75

Haddows,Inc.completed Job GH6 last month.The cost details of GH6 are shown below. Calculate the cost per unit of the finished product of Job GH6.(Round your answer to the nearest cent. )

A)$2,127.00

B)$12.10

C)$75.10

D)$77.90

A)$2,127.00

B)$12.10

C)$75.10

D)$77.90

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

76

Midtown,Inc.uses a predetermined overhead allocation rate of $67 per direct labor hour.In January,the company completed Job A23 which utilized 18 direct labor hours.Which of the following correctly describes the journal entry to allocate overhead to the job?

A)debit Finished Goods Inventory $1,206 and credit Manufacturing Overhead $1,206

B)debit Manufacturing Overhead $67 and credit Work-in-Process Inventory $67

C)debit Work-in-Process Inventory $1,206 and credit Manufacturing Overhead $1,206

D)debit Cost of Goods Sold $67 and credit Finished Goods Inventory $67

A)debit Finished Goods Inventory $1,206 and credit Manufacturing Overhead $1,206

B)debit Manufacturing Overhead $67 and credit Work-in-Process Inventory $67

C)debit Work-in-Process Inventory $1,206 and credit Manufacturing Overhead $1,206

D)debit Cost of Goods Sold $67 and credit Finished Goods Inventory $67

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

77

Sybil,Inc.uses a predetermined overhead allocation rate to allocate manufacturing overhead costs to jobs.The company recently completed Job 300X.This job used 11 machine hours and 5 direct labor hours.The predetermined overhead allocation rate is calculated to be $43 per machine hour.What is the amount of manufacturing overhead allocated to Job 300X using machine hours as the allocation base?

A)$473

B)$215

C)$688

D)$258

A)$473

B)$215

C)$688

D)$258

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

78

Halcyon,Inc.completed Job 10B last month.The cost details of Job 10B are shown below. Calculate the total job cost for Job 10B.

A)$2,349

B)$4,593

C)$2,145

D)$4,797

A)$2,349

B)$4,593

C)$2,145

D)$4,797

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

79

Manufacturing overhead costs are allocated to the Work-in-Process Inventory account by a debit to the Manufacturing Overhead account.

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck

80

Gill Manufacturing uses a predetermined overhead allocation rate based on a percentage of direct labor cost.At the beginning of the year,Gill estimated total manufacturing overhead costs at $1,010,000 and total direct labor costs at $840,000.In June,Gill completed Job 511.The details of Job 511 are shown below.(Round to 2 decimal places. ) How much was the total job cost of Job 511? (Round any percentages to two decimal places and your final answer to the nearest dollar. )

A)$36,860

B)$52,100

C)$64,700

D)$37,100

A)$36,860

B)$52,100

C)$64,700

D)$37,100

Unlock Deck

Unlock for access to all 170 flashcards in this deck.

Unlock Deck

k this deck