Deck 11: Partnerships: Distributions, Transfer of Interests, and Terminations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/144

Play

Full screen (f)

Deck 11: Partnerships: Distributions, Transfer of Interests, and Terminations

1

For Federal income tax purposes, a distribution from a partnership to a partner is treated the same as a distribution from a C corporation to its shareholders.

False

2

Zach's partnership interest basis is $100,000. Zach receives a proportionate, liquidating distribution from a liquidating partnership of $50,000 cash and inventory having a basis of $20,000 to the partnership and a fair market value of $30,000. Zach assigns a basis of $20,000 to the inventory and recognizes a $30,000 loss.

True

3

In a proportionate nonliquidating distribution of cash and a capital asset, the partner recognizes gain to the extent the amount of cash plus the fair market value of property distributed exceeds the partner's basis in the partnership interest.

False

4

The BAM Partnership distributed the following assets to partner Barbie in a proportionate non-liquidating distribution: $10,000 cash, land parcel A (basis of $5,000, fair market value of $30,000) and land parcel B (basis of $25,000, fair market value of $30,000). Barbie's basis in her partnership interest was $40,000 immediately before the distribution. Barbie will allocate a basis of $15,000 each to the two land parcels, and her basis in her partnership interest will be reduced to $0.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

5

Generally, no gain is recognized on a proportionate liquidating or nonliquidating distribution of non-cash property even if the fair market value of property distributed exceeds the partner's basis in the partnership interest.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

6

Randi owns a 40% interest in the capital and profits of the RAY Partnership. Immediately before she receives a proportionate nonliquidating distribution from RAY, the basis for her partnership interest is $60,000. The distribution consists of $45,000 in cash and land with a fair market value of $72,000. RAY's adjusted basis in the land immediately before the distribution is $36,000. As a result of the distribution, Randi recognizes a gain of $21,000.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

7

A cash distribution from a partnership to a partner is generally taxable to the partner.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

8

Loss cannot be recognized on a distribution from a partnership unless cash, unrealized receivables and/or § 1231 assets are the only items distributed.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

9

In a proportionate liquidating distribution, WYX Partnership distributes to partner William cash of $40,000, cash basis accounts receivable (basis of $0, fair market value of $10,000), and land (basis of $30,000, fair market value of $50,000). William's basis was $80,000 before the distribution. On the liquidation, William recognizes a $20,000 gain, and he takes a basis of $10,000 in the accounts receivable, and $50,000 in the land.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

10

In a liquidating distribution, a partnership must distribute all of its property to all of its partners.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

11

Scott owns a 30% interest in the capital and profits of the SOS Partnership. Immediately before he receives a proportionate nonliquidating distribution from SOS, the basis of his partnership interest is $40,000. The distribution consists of $30,000 in cash and land with a fair market value of $80,000. SOS's adjusted basis in the land immediately before the distribution is $50,000. As a result of the distribution, Scott recognizes no gain or loss and his basis in the land is $10,000.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

12

The ELF Partnership distributed $20,000 cash to Emma in a proportionate, nonliquidating distribution. Emma's basis in her partnership interest was $12,000 immediately before the distribution. As a result of the distribution, Emma's basis is reduced to $0 and she recognizes an $8,000 gain.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

13

Matt, a partner in the MB Partnership, receives a proportionate, nonliquidating distribution of property having a fair market value of $16,000 and a partnership basis of $23,000. Matt's basis in the partnership is $10,000 before the distribution. In this situation, Matt will recognize no gain or loss. He will take a $10,000 basis in the property, and his basis in the partnership interest is reduced to zero.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

14

Marcie is a 40% member of the M&A LLC. Her basis is $10,000 immediately before the LLC distributes to her $30,000 of cash and land (basis to the LLC of $20,000 and fair market value of $25,000). As a result of the proportionate, nonliquidating distribution, Marcie recognizes a gain of $20,000 and her basis in the land is $0.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

15

In a proportionate nonliquidating distribution, cash is deemed to be distributed first, followed by capital and § 1231 assets, and last, unrealized receivables and inventory.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

16

A gain will only arise on a distribution from a partnership of cash that exceeds the partner's basis in the partnership interest. For this purpose, only cash, checks, and credit card charges are treated as cash.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

17

In a proportionate liquidating distribution, RST Partnership distributes to partner Riley cash of $30,000, accounts receivable (basis of $0, fair market value of $40,000), and land (basis of $65,000, fair market value of $50,000). Riley's basis was $40,000 before the distribution. On the liquidation, Riley recognizes a gain of $0, and her basis is $10,000 in the land and $0 in the accounts receivable.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

18

Lori, a partner in the JKL partnership, received a proportionate nonliquidating distribution of $10,000 cash, unrealized receivables with a basis of $0 and a fair market value of $15,000, and land with a basis of $6,000 and a fair market value of $10,000. Her basis in the partnership interest immediately before the distributions was $14,000. She will recognize $0 gain on the distribution, and her basis in the receivables and land will be $0 and $4,000 respectively.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

19

Tim and Darby are equal partners in the TD Partnership. Partnership income for the year is $60,000. Tim needs cash in order to pay tax on his share of the partnership income, but Darby wants to leave the cash in the partnership for expansion. If the partners agree, it is acceptable for TD to distribute $8,000 to Tim, and no cash or other property to Darby.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

20

A distribution can be "proportionate" (as defined for purposes of Subchapter K) even if only one partner receives assets from the partnership.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

21

If a partnership incorporates, it is always deemed to first distribute all of its assets and liabilities to the partners in complete liquidation. Then the partners are deemed to contribute those assets to the new corporation (with the corporation assuming the related liabilities) in a transaction that qualifies under § 351.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

22

A disproportionate distribution arises when the partnership distributes a share of partnership hot assets to one or more partners that is not the same as the partner's ownership interest in the partnership.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

23

Taylor's basis in his partnership interest is $140,000, including his $60,000 share of partnership debt. Sandy buys Taylor's partnership interest for $100,000 cash and she assumes Taylor's $60,000 share of the partnership's debt. If the partnership owns no hot assets, Taylor will recognize a capital loss of $40,000.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

24

The MBA Partnership makes a § 736(b) cash payment of $20,000 to partner Amanda in liquidation of her interest in the partnership. The partnership owns no hot assets. Amanda's basis in her partnership interest before the distribution was $50,000. If the partnership has a § 754 election in effect, it will record a $30,000 decrease in its inside basis in partnership assets, affecting all the remaining partners in the partnership.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

25

The JIH Partnership distributed the following assets to partner James in a proportionate liquidating distribution in which the partnership also liquidated: $25,000 cash, land parcel A (basis of $5,000, fair market value of $30,000) and land parcel B (basis of $5,000, fair market value of $15,000). James's basis in his partnership interest was $85,000 immediately before the distribution. James will allocate bases of $40,000 to parcel A and $20,000 to parcel B, and he will have no remaining basis in his partnership interest.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

26

Nick sells his 25% interest in the LMNO Partnership to new partner Katrina for $57,500. The partnership's assets consist of cash ($100,000), land (basis of $90,000, fair market value of $70,000), and inventory (basis of $40,000, fair market value of $60,000). Nick's basis in his partnership interest was $57,500. On the sale, Nick will recognize ordinary income of $5,000 and a capital loss of $5,000.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

27

Jeremy sold his 40% interest in the HIJ Partnership to Ashley for $400,000. The inside basis of all partnership assets was $600,000 at the time of the sale. If the partnership makes a § 754 election, it will record a $160,000 step-up in the basis of the partnership assets, and the step-up will be attributed solely to Ashley.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

28

A partnership has accounts receivable with a basis of $0 and a fair market value of $30,000 and depreciation recapture potential of $20,000. All other assets of the partnership are either cash, capital assets, or § 1231 assets. If a purchaser acquires a 40% interest in the partnership from another partner, the selling partner will be required to recognize ordinary income of $12,000.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

29

The Crimson Partnership is a service provider. Its assets consist of unrealized receivables (basis of $0, fair market value of $400,000), cash of $300,000, and land (basis of $200,000, fair market value of $300,000). Assume 20% general partner Jana has a basis in her partnership interest of $100,000. If the ongoing partnership distributes $200,000 of cash to Jana in liquidation of her interest in the partnership, she will recognize ordinary income of $80,000 and a capital gain of $20,000.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

30

In the year a donor gives a partnership interest to a donee, their share of the partnership's income is prorated between the donor and donee.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

31

Carlos receives a proportionate liquidating distribution consisting of $8,000 cash and inventory with a basis to the partnership of $5,000 and a fair market value of $6,000. His basis in his partnership interest was $15,000 immediately before the distribution. Carlos assigns a basis of $7,000 to the inventory, and recognizes no gain or loss.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

32

Beth sells her 25% partnership interest to Katie for $50,000 cash on July 1 of the current tax year. Katie also assumed Beth's share of the partnership's liabilities. Beth's basis in her partnership interest at the beginning of the year was $40,000, including a $15,000 share of partnership liabilities. The partnership's income for the entire year was $100,000, and Beth's share of partnership debt was $10,000 as of the date she sold the partnership interest. Assume the partnership has no hot assets and that its income is earned evenly throughout the year. Beth recognizes a gain of $12,500 on the sale.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

33

Several years ago, the Jaymo Partnership purchased 2,000 shares of ABCO stock (publicly traded) for $40,000; the stock now has a fair market value of $90,000. If this stock is distributed to Jason in liquidation of his 30% partnership interest, it is treated as a cash distribution of $75,000 and a property distribution of $15,000. Assume Jaymo owns no other securities.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

34

In a proportionate liquidating distribution in which the partnership is also liquidated, Ralph received cash of $30,000, accounts receivable (basis of $0, fair market value of $20,000), and equipment (basis of $0, fair market value of $10,000). Immediately before the distribution, Ralph's basis in the partnership interest was $40,000. Ralph realizes and recognizes a loss of $10,000, and his basis is $0 in both the accounts receivable and the equipment.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

35

A payment to a retiring general partner for his or her share of goodwill of a partnership in which capital is a material incomeproducing factor is classified as a § 736(a) income payment and results in ordinary income to the retiring partner and a current deduction to the partnership, as long as the goodwill payment is provided for in the partnership agreement.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

36

Generally, a distribution of property does not result in gain to a partner on either a current or liquidating distribution. A situation where a gain may arise, however, is when a partner contributed appreciated property to the partnership and that property is distributed back to the contributing partner within seven years of the contribution.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

37

A § 754 election is made for a tax year in which the partner recognizes gain or loss on a distribution from the partnership or the distributee partner's basis in distributed property is increased or decreased from the inside basis the partnership held in those assets. The election is made by the partnership each year in which it is necessary to adjust a partner's share of the inside basis of partnership assets. In a year in which an unfavorable result would arise, the partnership can forego making the election.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

38

Mark contributed property to the MDB Partnership in 2010. At the time of the contribution, the basis in the property was $40,000 and its value was $50,000. In 2014, MDB distributed that property to partner Dara. Because this is a distribution of precontribution gain property, MBD (the partnership) may be required to recognize a gain that is allocated to all of the partners.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

39

A partnership is required to make a downward adjustment to the basis of its assets if a partnership interest is sold and if the total basis of partnership assets exceeds their value by more than $250,000, even if a § 754 election is not in effect.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

40

Normally a distribution of property from a partnership does not result in gain recognition. However, a distribution of marketable securities may be treated, in part, as a distribution of cash that could result in gain recognition.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

41

Frank receives a proportionate nonliquidating distribution from the AEF Partnership. The distribution consists of $10,000 cash and property (adjusted basis to the partnership of $54,000 and fair market value of $60,000). Immediately before the distribution, Frank's adjusted basis in the partnership interest was $50,000. His basis in the noncash property received is:

A) $0.

B) $40,000.

C) $54,000.

D) $60,000.

E) None of the above.

A) $0.

B) $40,000.

C) $54,000.

D) $60,000.

E) None of the above.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

42

Dan receives a proportionate nonliquidating distribution when the basis of his partnership interest is $30,000. The distribution consists of $10,000 in cash and property with an adjusted basis to the partnership of $24,000 and a fair market value of $26,500. Dan's basis in the noncash property is:

A) $26,500.

B) $24,000.

C) $20,000.

D) $10,000.

E) None of the above.

A) $26,500.

B) $24,000.

C) $20,000.

D) $10,000.

E) None of the above.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

43

Nicky's basis in her partnership interest was $150,000, including her $40,000 share of partnership liabilities. The partnership decides to liquidate, and after repaying all liabilities, distributes all remaining assets proportionately to the partners. Nicky receives $30,000 cash and accounts receivable with a $50,000 basis and a $48,000 fair market value to the partnership. What gain or loss does Nicky recognize, and what is her basis in the accounts receivable?

A) $70,000 loss; $50,000 basis.

B) $30,000 loss; $50,000 basis.

C) $32,000 loss; $48,000 basis.

D) $72,000 loss; $48,000 basis.

E) $0 loss; $80,000 basis.

A) $70,000 loss; $50,000 basis.

B) $30,000 loss; $50,000 basis.

C) $32,000 loss; $48,000 basis.

D) $72,000 loss; $48,000 basis.

E) $0 loss; $80,000 basis.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

44

Bob received a proportionate nonliquidating distribution of land from the BZ Partnership. The land had a fair market value of $15,000 and a basis to the partnership of $10,000. The land was held for investment purposes by the partnership. Bob's basis in his partnership interest immediately before the distribution was $6,000. If the partnership has a § 754 election in effect, it will record a $4,000 stepdown in the basis of remaining assets, and the stepdown will be attributed to all partners in the partnership.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

45

A partnership continues in existence unless one of the following happens: 1) all assets are distributed to the partners in liquidation of the partnership, or 2) a majority of the partners vote to adopt a plan of liquidation of the partnership.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

46

Mack has a basis in a partnership interest of $200,000, including his share of partnership debt. At the end of the current year, the partnership distributed to Mack, in a proportionate nonliquidating distribution, cash of $20,000, inventory (basis to the partnership of $30,000 and fair market value of $40,000), and land (basis to the partnership of $40,000 and fair market value of $42,000). In addition, Mack's share of partnership debt decreased by $12,000 during the year. What basis does Mack take in the inventory and land and in the partnership interest (including debt share) following the distribution?

A) $30,000 basis in inventory; $40,000 basis in land, $98,000 basis in partnership.

B) $30,000 basis in inventory; $42,000 basis in land, $110,000 basis in partnership.

C) $40,000 basis in inventory; $40,000 basis in land, $86,000 basis in partnership.

D) $40,000 basis in inventory; $42,000 basis in land, $98,000 basis in partnership.

E) $40,000 basis in inventory; $42,000 basis in land, $110,000 basis in partnership.

A) $30,000 basis in inventory; $40,000 basis in land, $98,000 basis in partnership.

B) $30,000 basis in inventory; $42,000 basis in land, $110,000 basis in partnership.

C) $40,000 basis in inventory; $40,000 basis in land, $86,000 basis in partnership.

D) $40,000 basis in inventory; $42,000 basis in land, $98,000 basis in partnership.

E) $40,000 basis in inventory; $42,000 basis in land, $110,000 basis in partnership.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

47

A limited liability company generally provides limited liability for those owners that are not active in the management of the LLC but requires owner-managers of the LLC to have unlimited personal liability for LLC debts.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

48

Suzy owns a 30% interest in the JSD LLC. In liquidation of the entity, Suzy receives a proportionate distribution of $30,000 cash, inventory (basis of $16,000, fair market value of $18,000), and land (basis of $25,000, fair market value of $30,000). Suzy's basis in the entity immediately before the distribution was $80,000. As a result of the distribution, what is Suzy's basis in the inventory and land, and how much gain or loss does she recognize?

A) $0 basis in inventory; $25,000 basis in land; $0 gain or loss.

B) $16,000 basis in inventory; $34,000 basis in land; $0 gain or loss.

C) $16,000 basis in inventory; $25,000 basis in land; $9,000 loss.

D) $18,000 basis in inventory; $32,000 basis in land; $0 gain.

E) $25,000 basis in inventory; $25,000 basis in land; $0 gain or loss.

A) $0 basis in inventory; $25,000 basis in land; $0 gain or loss.

B) $16,000 basis in inventory; $34,000 basis in land; $0 gain or loss.

C) $16,000 basis in inventory; $25,000 basis in land; $9,000 loss.

D) $18,000 basis in inventory; $32,000 basis in land; $0 gain.

E) $25,000 basis in inventory; $25,000 basis in land; $0 gain or loss.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

49

At the beginning of the year, Elsie's basis in the E&G Partnership interest is $90,000. She receives a proportionate nonliquidating distribution from the partnership consisting of $10,000 of cash, unrealized accounts receivable (basis of $0, fair market value $40,000), and land (basis of $30,000, fair market value of $50,000). After the distribution, Elsie's bases in the accounts receivable, land, and partnership interest are:

A) $0; $30,000; and $50,000.

B) $0; $50,000; and $30,000.

C) $40,000; $30,000; and $10,000.

D) $40,000; $40,000; and $0.

E) None of the above.

A) $0; $30,000; and $50,000.

B) $0; $50,000; and $30,000.

C) $40,000; $30,000; and $10,000.

D) $40,000; $40,000; and $0.

E) None of the above.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

50

Rex and Scott operate a law practice in partnership form. Because Rex and Scott are brothers, the partnership is subject to the family partnership income reallocation rules.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

51

Catherine's basis was $50,000 in the CAR Partnership just before she received a proportionate nonliquidating distribution consisting of land held for investment with a basis to CAR of $40,000 (value of $60,000), and inventory with a basis of $40,000 (value of $40,000). After the distribution, Catherine's bases in the land and inventory are:

A) $40,000 (land); $40,000 (inventory).

B) $40,000 (land); $10,000 (inventory).

C) $10,000 (land); $40,000 (inventory).

D) $25,000 (land); $25,000 (inventory).

E) None of these statements is correct.

A) $40,000 (land); $40,000 (inventory).

B) $40,000 (land); $10,000 (inventory).

C) $10,000 (land); $40,000 (inventory).

D) $25,000 (land); $25,000 (inventory).

E) None of these statements is correct.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

52

Landis received $90,000 cash and a capital asset (basis of $50,000, fair market value of $60,000) in a proportionate liquidating distribution. His basis in his partnership interest was $120,000 prior to the distribution. How much gain or loss does Landis recognize and what is his basis in the asset received?

A) $0 gain or loss; $30,000 basis.

B) $0 gain or loss; $50,000 basis.

C) $0 gain or loss; $60,000 basis.

D) $20,000 gain; $50,000 basis.

E) $30,000 gain; $60,000 basis.

A) $0 gain or loss; $30,000 basis.

B) $0 gain or loss; $50,000 basis.

C) $0 gain or loss; $60,000 basis.

D) $20,000 gain; $50,000 basis.

E) $30,000 gain; $60,000 basis.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

53

Alyce owns a 30% interest in a continuing partnership. The partnership distributes a $35,000 year-end cash payment to Alyce. In a proportionate nonliquidating distribution, the partnership also distributed property (basis of $20,000, fair market value of $30,000) to Alyce. Immediately before the distributions of cash and property, Alyce's basis in the partnership interest was $60,000. As a result of the distribution, Alyce recognizes:

A) No gain or loss.

B) Ordinary loss of $5,000.

C) Capital loss of $5,000.

D) Ordinary gain of $5,000.

E) Capital gain of $5,000.

A) No gain or loss.

B) Ordinary loss of $5,000.

C) Capital loss of $5,000.

D) Ordinary gain of $5,000.

E) Capital gain of $5,000.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

54

Michelle receives a proportionate liquidating distribution when the basis of her partnership interest is $50,000. The distribution consists of $58,000 cash and noninventory property (adjusted basis to the partnership of $10,000 and fair market value of $12,000). The partnership has no hot assets. How much gain or loss does Michelle recognize, and what is her basis in the distributed property?

A) $0 gain or loss; $0 basis in property.

B) $0 gain or loss; $50,000 basis in property.

C) $8,000 ordinary income; $0 basis in property.

D) $8,000 capital gain; $10,000 basis in property.

E) $8,000 capital gain; $0 basis in property.

A) $0 gain or loss; $0 basis in property.

B) $0 gain or loss; $50,000 basis in property.

C) $8,000 ordinary income; $0 basis in property.

D) $8,000 capital gain; $10,000 basis in property.

E) $8,000 capital gain; $0 basis in property.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

55

Anthony's basis in the WAM Partnership interest was $200,000 just before he received a proportionate liquidating distribution consisting of investment land (basis of $90,000, fair market value of $100,000), and inventory (basis of $30,000, fair market value of $70,000). After the distribution, Anthony's recognized gain or loss and his basis in the land and inventory are:

A) $80,000 loss; $90,000 (land); $30,000 (inventory).

B) $70,000 loss; $100,000 (land); $30,000 (inventory).

C) $30,000 loss; $100,000 (land); $70,000 (inventory).

D) $0 gain or loss; $170,000 (land); $30,000 (inventory).

E) None of the above.

A) $80,000 loss; $90,000 (land); $30,000 (inventory).

B) $70,000 loss; $100,000 (land); $30,000 (inventory).

C) $30,000 loss; $100,000 (land); $70,000 (inventory).

D) $0 gain or loss; $170,000 (land); $30,000 (inventory).

E) None of the above.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

56

Jonathon owns a onethird interest in a liquidating partnership. Immediately before the liquidation, Jonathon's basis in the partnership interest is $60,000. The partnership distributes cash of $32,000 and two parcels of land (each with a fair market value of $10,000). Parcel A has a basis of $2,000 to the partnership and Parcel B has a basis of $6,000. Jonathon's basis in the two parcels of land is:

A) Parcel A, $2,000; Parcel B, $6,000.

B) Parcel A, $7,000; Parcel B, $21,000.

C) Parcel A, $10,000; Parcel B, $10,000.

D) Parcel A, $14,000; Parcel B, $14,000.

E) Parcel A, $15,000; Parcel B, $45,000.

A) Parcel A, $2,000; Parcel B, $6,000.

B) Parcel A, $7,000; Parcel B, $21,000.

C) Parcel A, $10,000; Parcel B, $10,000.

D) Parcel A, $14,000; Parcel B, $14,000.

E) Parcel A, $15,000; Parcel B, $45,000.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

57

Misha receives a proportionate nonliquidating distribution when the basis of her partnership interest is $60,000. The distribution consists of $80,000 cash and inventory (adjusted basis to the partnership of $10,000, fair market value of $20,000). How much gain or loss does Misha recognize, and what is her basis in the distributed inventory and in her partnership interest following the distribution?

A) $0 gain or loss; $10,000 basis in inventory; $0 basis in partnership interest.

B) $0 gain or loss; $20,000 basis in inventory; $50,000 basis in partnership interest.

C) $20,000 capital gain; $0 basis in inventory; $0 basis in partnership interest.

D) $20,000 capital gain; $10,000 basis in inventory; $0 basis in partnership interest.

E) $20,000 ordinary income; $0 basis in inventory; $20,000 basis in partnership interest.

A) $0 gain or loss; $10,000 basis in inventory; $0 basis in partnership interest.

B) $0 gain or loss; $20,000 basis in inventory; $50,000 basis in partnership interest.

C) $20,000 capital gain; $0 basis in inventory; $0 basis in partnership interest.

D) $20,000 capital gain; $10,000 basis in inventory; $0 basis in partnership interest.

E) $20,000 ordinary income; $0 basis in inventory; $20,000 basis in partnership interest.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

58

Megan's basis was $120,000 in the MYP Partnership interest just before she received a proportionate nonliquidating distribution consisting of land held for investment (basis of $100,000, fair market value of $130,000) and inventory (basis of $80,000, fair market value of $70,000). After the distribution, Megan's bases in the land and inventory are, respectively:

A) $100,000 (land) and $20,000 (inventory).

B) $120,000 (land) and $0 (inventory).

C) $50,000 (land) and $70,000 (inventory).

D) $40,000 (land) and $80,000 (inventory).

E) None of the above.

A) $100,000 (land) and $20,000 (inventory).

B) $120,000 (land) and $0 (inventory).

C) $50,000 (land) and $70,000 (inventory).

D) $40,000 (land) and $80,000 (inventory).

E) None of the above.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

59

Mark receives a proportionate nonliquidating distribution. At the beginning of the partnership year, the basis of his partnership interest is $100,000. During the year, he received a cash distribution of $40,000 and a property distribution (basis of $30,000, fair market value of $25,000). In addition, Mark's share of partnership liabilities was reduced by $10,000 during the year. How much gain or loss does Mark recognize; what is his basis in the property he received; and what is his remaining basis in the partnership interest?

A) $25,000 loss; $25,000 basis in property; $0 remaining basis.

B) $30,000 loss; $30,000 basis in property; $0 remaining basis.

C) $0 gain or loss; $25,000 basis in property; $25,000 remaining basis.

D) $0 gain or loss; $30,000 basis in property; $20,000 remaining basis.

E) $0 gain or loss; $20,000 basis in property; $30,000 remaining basis.

A) $25,000 loss; $25,000 basis in property; $0 remaining basis.

B) $30,000 loss; $30,000 basis in property; $0 remaining basis.

C) $0 gain or loss; $25,000 basis in property; $25,000 remaining basis.

D) $0 gain or loss; $30,000 basis in property; $20,000 remaining basis.

E) $0 gain or loss; $20,000 basis in property; $30,000 remaining basis.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

60

Beth has an outside basis of $100,000 in the BTDE Partnership as of December 31 of the current year. On that date the partnership liquidates and distributes to Beth a proportionate distribution of $50,000 cash and inventory with an inside basis to the partnership of $10,000 and a fair market value of $16,000. In addition, Beth receives an antique desk (not inventory) which has an inside basis and fair market value of $0 and $5,000, respectively. None of the distribution is for partnership goodwill. How much gain or loss will Beth recognize on the distribution, and what basis will she take in the desk?

A) $0 gain or loss; $5,000 basis.

B) $40,000 loss; $0 basis.

C) $0 gain or loss; $40,000 basis.

D) $35,000 loss; $5,000 basis.

E) None of the above.

A) $0 gain or loss; $5,000 basis.

B) $40,000 loss; $0 basis.

C) $0 gain or loss; $40,000 basis.

D) $35,000 loss; $5,000 basis.

E) None of the above.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

61

A partnership may make an optional election to adjust the basis of its property on a distribution to a partner which liquidates the partner's entire interest in the partnership. If such an election is in effect, the partnership:

A) Generally applies the election to transfers that take place at any later date, unless the election is revoked.

B) Only adjusts the basis of its property for differences in basis between that of the partnership and a distributee partner if a transferor-transferee situation arises within two years after the distribution.

C) Increases the basis of similar retained assets when a distributee partner takes a basis which is greater than the partnership's basis in these assets, assuming the partnership does not have any receivables or inventory.

D) Decreases the basis of similar retained assets when the distributee partner recognizes gain on the distribution.

E) All of the above.

A) Generally applies the election to transfers that take place at any later date, unless the election is revoked.

B) Only adjusts the basis of its property for differences in basis between that of the partnership and a distributee partner if a transferor-transferee situation arises within two years after the distribution.

C) Increases the basis of similar retained assets when a distributee partner takes a basis which is greater than the partnership's basis in these assets, assuming the partnership does not have any receivables or inventory.

D) Decreases the basis of similar retained assets when the distributee partner recognizes gain on the distribution.

E) All of the above.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following transactions will not result in termination of a partnership for Federal tax purposes?

A) The partnership is incorporated.

B) A 70% interest in partnership capital and profits is sold to a third party purchaser.

C) Cash is distributed in liquidation of a 60% partner's interest in a fivepartner partnership.

D) A 40% interest in partnership capital and profits is sold to the other partner in a two-partner partnership.

E) None of the above.

A) The partnership is incorporated.

B) A 70% interest in partnership capital and profits is sold to a third party purchaser.

C) Cash is distributed in liquidation of a 60% partner's interest in a fivepartner partnership.

D) A 40% interest in partnership capital and profits is sold to the other partner in a two-partner partnership.

E) None of the above.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

63

Tom, Tina, Tatum, and Terry are equal owners in the 4-Ts LLC, a cash basis service entity. 4-Ts has unrealized receivables of $400,000 (basis of $0), and no other hot assets. A goodwill payment of $50,000 per partner is provided for in the LLC's operating agreement. If 4Ts distributes cash of $300,000 to Tom in liquidation of his LLC interest, which of the following statements is correct?

A) This is a proportionate distribution with respect to hot assets.

B) The $50,000 payment that relates to LLC goodwill cannot be deducted by the LLC.

C) The partnership will terminate.

D) The $150,000 § 736(a) payment will result in a capital gain to Tom.

E) The $200,000 § 736(b) payment will be taxed to Tom as ordinary income.

A) This is a proportionate distribution with respect to hot assets.

B) The $50,000 payment that relates to LLC goodwill cannot be deducted by the LLC.

C) The partnership will terminate.

D) The $150,000 § 736(a) payment will result in a capital gain to Tom.

E) The $200,000 § 736(b) payment will be taxed to Tom as ordinary income.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

64

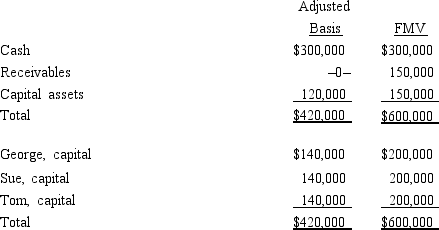

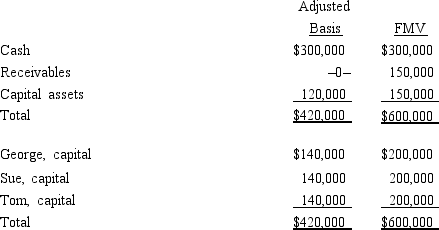

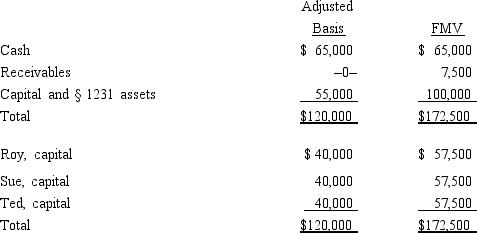

The December 31, 2014, balance sheet of GST Services, LLP reads as follows:  The partners share equally in partnership capital, income, gain, loss, deduction, and credit. Capital is not a material income-producing factor to the partnership, and all partners are active in the business. On December 31, 2014, general partner Sue receives a distribution of $200,000 cash in liquidation of her partnership interest under § 736. Sue's outside basis for the partnership interest immediately before the distribution is $150,000. (Her basis does not correspond to her capital account because she purchased the interest a few years ago at a $10,000 premium.) How much is Sue's gain or loss on the distribution and what is its character?

The partners share equally in partnership capital, income, gain, loss, deduction, and credit. Capital is not a material income-producing factor to the partnership, and all partners are active in the business. On December 31, 2014, general partner Sue receives a distribution of $200,000 cash in liquidation of her partnership interest under § 736. Sue's outside basis for the partnership interest immediately before the distribution is $150,000. (Her basis does not correspond to her capital account because she purchased the interest a few years ago at a $10,000 premium.) How much is Sue's gain or loss on the distribution and what is its character?

A) $50,000 ordinary income.

B) $40,000 ordinary income; $10,000 capital gain.

C) $40,000 capital gain; $10,000 ordinary income.

D) $50,000 capital gain.

E) None of the above.

The partners share equally in partnership capital, income, gain, loss, deduction, and credit. Capital is not a material income-producing factor to the partnership, and all partners are active in the business. On December 31, 2014, general partner Sue receives a distribution of $200,000 cash in liquidation of her partnership interest under § 736. Sue's outside basis for the partnership interest immediately before the distribution is $150,000. (Her basis does not correspond to her capital account because she purchased the interest a few years ago at a $10,000 premium.) How much is Sue's gain or loss on the distribution and what is its character?

The partners share equally in partnership capital, income, gain, loss, deduction, and credit. Capital is not a material income-producing factor to the partnership, and all partners are active in the business. On December 31, 2014, general partner Sue receives a distribution of $200,000 cash in liquidation of her partnership interest under § 736. Sue's outside basis for the partnership interest immediately before the distribution is $150,000. (Her basis does not correspond to her capital account because she purchased the interest a few years ago at a $10,000 premium.) How much is Sue's gain or loss on the distribution and what is its character?A) $50,000 ordinary income.

B) $40,000 ordinary income; $10,000 capital gain.

C) $40,000 capital gain; $10,000 ordinary income.

D) $50,000 capital gain.

E) None of the above.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

65

Last year, Miguel contributed nondepreciable property with a basis of $50,000 and a fair market value of $75,000 to the Starling Partnership in exchange for a 25% interest in the partnership. In the current year, he receives a nonliquidating distribution from the partnership of other property with a basis to the partnership of $50,000 and a fair market value of $62,000. The basis in his partnership interest at the time of the distribution was $60,000. How much gain or loss does Miguel recognize on the distribution? (Assume no other distributions have been made to Miguel, the property he originally contributed is still owned by the partnership, and this is not a disguised sale transaction.)

A) $0 gain or loss.

B) $2,000 loss.

C) $2,000 gain.

D) $8,000 gain.

E) $10,000 gain.

A) $0 gain or loss.

B) $2,000 loss.

C) $2,000 gain.

D) $8,000 gain.

E) $10,000 gain.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following distributions would never result in gain recognition to the recipient partner?

A) A distribution of cash that follows a contribution of appreciated property to the partnership.

B) A distribution of a slightly appreciated marketable security.

C) A distribution of property to a partner who, three years ago, contributed other property with a built-in gain.

D) A distribution to a second partner of property contributed by the first partner two years ago.

E) A proportionate distribution of inventory property.

A) A distribution of cash that follows a contribution of appreciated property to the partnership.

B) A distribution of a slightly appreciated marketable security.

C) A distribution of property to a partner who, three years ago, contributed other property with a built-in gain.

D) A distribution to a second partner of property contributed by the first partner two years ago.

E) A proportionate distribution of inventory property.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

67

In a proportionate liquidating distribution, Sam receives a distribution of $30,000 cash, accounts receivable (basis of $0, fair market value of $50,000), and land (basis of $20,000, fair market value of $50,000). In addition, the partnership repays all liabilities, of which Sam's share was $40,000. Sam's basis in the entity immediately before the distribution was $120,000. As a result of the distribution, what is Sam's basis in the accounts receivable and land, and how much gain or loss does he recognize?

A) $0 basis in accounts receivable; $50,000 basis in land; $0 gain or loss.

B) $0 basis in accounts receivable; $90,000 basis in land; $0 gain or loss.

C) $50,000 basis in accounts receivable; $40,000 basis in land; $0 gain or loss.

D) $50,000 basis in accounts receivable; $50,000 basis in land; $50,000 gain.

E) $0 basis in accounts receivable; $70,000 basis in land; $30,000 loss.

A) $0 basis in accounts receivable; $50,000 basis in land; $0 gain or loss.

B) $0 basis in accounts receivable; $90,000 basis in land; $0 gain or loss.

C) $50,000 basis in accounts receivable; $40,000 basis in land; $0 gain or loss.

D) $50,000 basis in accounts receivable; $50,000 basis in land; $50,000 gain.

E) $0 basis in accounts receivable; $70,000 basis in land; $30,000 loss.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following statements about the transfer of a partnership interest is not true?

A) The seller's adjusted basis for the partnership interest is increased by the seller's share of undistributed partnership income (or reduced by partnership loss) for the portion of the partnership's taxable year ending on the date of the sale.

B) The partnership taxable year generally does not close with respect to a partner who transfers a partnership interest at death; all amounts are allocated to the successor.

C) The amount realized on the sale of a partnership interest is the sum of any money and the fair market value of any property received for the interest, plus the selling partner's share of partnership liabilities under § 752.

D) With respect to a transfer of a partnership interest by gift, all partnership gain, loss, credit, etc., items are allocated between the donor and the donee.

E) All of the above are true statements.

A) The seller's adjusted basis for the partnership interest is increased by the seller's share of undistributed partnership income (or reduced by partnership loss) for the portion of the partnership's taxable year ending on the date of the sale.

B) The partnership taxable year generally does not close with respect to a partner who transfers a partnership interest at death; all amounts are allocated to the successor.

C) The amount realized on the sale of a partnership interest is the sum of any money and the fair market value of any property received for the interest, plus the selling partner's share of partnership liabilities under § 752.

D) With respect to a transfer of a partnership interest by gift, all partnership gain, loss, credit, etc., items are allocated between the donor and the donee.

E) All of the above are true statements.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following is not typically considered to be a "hot asset?"

A) Accounts receivable of a cash basis partnership.

B) Inventory with a basis of $16,000 and a fair market value of $15,000.

C) Depreciation recapture potential.

D) Land held for development.

E) All of the above are typically considered to be "hot assets."

A) Accounts receivable of a cash basis partnership.

B) Inventory with a basis of $16,000 and a fair market value of $15,000.

C) Depreciation recapture potential.

D) Land held for development.

E) All of the above are typically considered to be "hot assets."

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

70

In a proportionate liquidating distribution, Sara receives a distribution of $40,000 cash, accounts receivable (basis of $0, fair market value of $30,000), and inventory (basis of $50,000, fair market value of $60,000). Sara's basis in the entity immediately before the distribution was $120,000. As a result of the distribution, what is Sara's basis in the accounts receivable and inventory, and how much gain or loss does she recognize?

A) $0 basis in accounts receivable; $50,000 basis in inventory; $30,000 loss.

B) $0 basis in accounts receivable; $80,000 basis in inventory; $0 gain or loss.

C) $40,000 basis in accounts receivable; $40,000 basis in inventory; $0 gain or loss.

D) $30,000 basis in accounts receivable; $50,000 basis in inventory; $30,000 loss.

E) $30,000 basis in accounts receivable; $60,000 basis in inventory; $10,000 gain.

A) $0 basis in accounts receivable; $50,000 basis in inventory; $30,000 loss.

B) $0 basis in accounts receivable; $80,000 basis in inventory; $0 gain or loss.

C) $40,000 basis in accounts receivable; $40,000 basis in inventory; $0 gain or loss.

D) $30,000 basis in accounts receivable; $50,000 basis in inventory; $30,000 loss.

E) $30,000 basis in accounts receivable; $60,000 basis in inventory; $10,000 gain.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

71

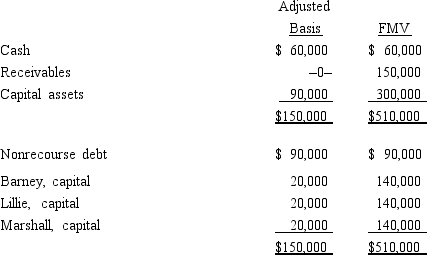

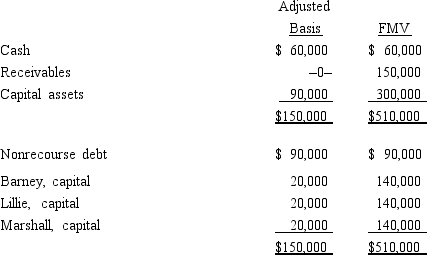

The BLM LLC's balance sheet on August 31 of the current year is as follows.  The nonrecourse debt is shared equally among the LLC members. On that date, Lillie sells her one-third interest to Robyn for $170,000, including cash and relief of Lillie's share of the nonrecourse debt. Lillie's outside basis for her interest in the LLC is $50,000, including her share of the LLC's debt. How much capital gain and/or ordinary income will Lillie recognize on the sale?

The nonrecourse debt is shared equally among the LLC members. On that date, Lillie sells her one-third interest to Robyn for $170,000, including cash and relief of Lillie's share of the nonrecourse debt. Lillie's outside basis for her interest in the LLC is $50,000, including her share of the LLC's debt. How much capital gain and/or ordinary income will Lillie recognize on the sale?

A) $100,000 capital gain; $50,000 ordinary income.

B) $120,000 capital gain; $0 ordinary income.

C) $150,000 capital gain; $0 ordinary income.

D) $70,000 capital gain; $50,000 ordinary income.

E) None of the above.

The nonrecourse debt is shared equally among the LLC members. On that date, Lillie sells her one-third interest to Robyn for $170,000, including cash and relief of Lillie's share of the nonrecourse debt. Lillie's outside basis for her interest in the LLC is $50,000, including her share of the LLC's debt. How much capital gain and/or ordinary income will Lillie recognize on the sale?

The nonrecourse debt is shared equally among the LLC members. On that date, Lillie sells her one-third interest to Robyn for $170,000, including cash and relief of Lillie's share of the nonrecourse debt. Lillie's outside basis for her interest in the LLC is $50,000, including her share of the LLC's debt. How much capital gain and/or ordinary income will Lillie recognize on the sale?A) $100,000 capital gain; $50,000 ordinary income.

B) $120,000 capital gain; $0 ordinary income.

C) $150,000 capital gain; $0 ordinary income.

D) $70,000 capital gain; $50,000 ordinary income.

E) None of the above.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

72

The RST Partnership makes a proportionate distribution of its assets to Ryan, in complete liquidation of his partnership interest. The distribution consists of $40,000 in cash and capital assets with a basis to the partnership of $30,000 and a fair market value of $48,000. None of the payment is for partnership goodwill. At the time of the distribution, Ryan's partnership basis is $45,000 and the partnership has no liabilities and no "hot assets." If the partnership makes an optional basis adjustment election on a timely filed return, it recognizes:

A) Capital gain of $25,000 and increases the basis of its remaining assets by $12,500.

B) Capital loss of $5,000 and decreases the basis of its remaining assets by $5,000.

C) No gain or loss and increases the basis of its remaining assets by $25,000.

D) No gain or loss and decreases the basis of its remaining assets by $58,000.

E) None of the above.

A) Capital gain of $25,000 and increases the basis of its remaining assets by $12,500.

B) Capital loss of $5,000 and decreases the basis of its remaining assets by $5,000.

C) No gain or loss and increases the basis of its remaining assets by $25,000.

D) No gain or loss and decreases the basis of its remaining assets by $58,000.

E) None of the above.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following statements is true regarding the sale of a partnership interest?

A) The selling partner's share of partnership liabilities is disregarded in determining the proceeds from the sale of a partnership interest.

B) For purposes of computing the selling partner's gain or loss, the partner's basis in the partnership interest is determined as of the last day of the partnership tax year ending before the year in which the interest is sold.

C) If a partner sells an interest in a partnership, income related to that interest for the year of the sale is allocated to the purchaser.

D) The selling partner could be required to report both ordinary income and a capital loss on sale of the partnership interest.

E) The partner's share of partnership "hot assets" is disregarded in determining the character of the partner's gain on the sale of the partnership interest.

A) The selling partner's share of partnership liabilities is disregarded in determining the proceeds from the sale of a partnership interest.

B) For purposes of computing the selling partner's gain or loss, the partner's basis in the partnership interest is determined as of the last day of the partnership tax year ending before the year in which the interest is sold.

C) If a partner sells an interest in a partnership, income related to that interest for the year of the sale is allocated to the purchaser.

D) The selling partner could be required to report both ordinary income and a capital loss on sale of the partnership interest.

E) The partner's share of partnership "hot assets" is disregarded in determining the character of the partner's gain on the sale of the partnership interest.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

74

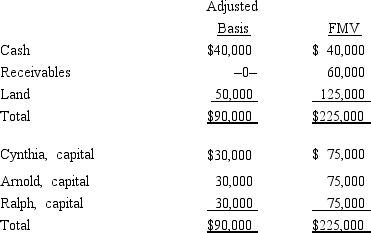

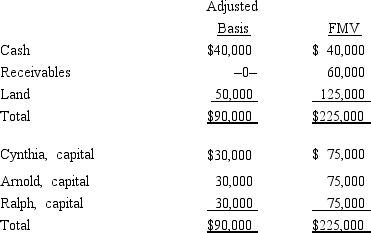

Cynthia sells her 1/3 interest in the CAR Partnership to Brandon for $95,000 cash. On the date of sale, the partnership balance sheet and agreed-upon fair market values were as follows:  If the partnership has a § 754 election in effect, the total "stepup" in basis of partnership assets that will be allocated to Brandon is:

If the partnership has a § 754 election in effect, the total "stepup" in basis of partnership assets that will be allocated to Brandon is:

A) $75,000.

B) $65,000.

C) $45,000.

D) $20,000.

E) $0.

If the partnership has a § 754 election in effect, the total "stepup" in basis of partnership assets that will be allocated to Brandon is:

If the partnership has a § 754 election in effect, the total "stepup" in basis of partnership assets that will be allocated to Brandon is:A) $75,000.

B) $65,000.

C) $45,000.

D) $20,000.

E) $0.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

75

In a proportionate liquidating distribution, Ashleigh receives a distribution of $30,000 cash, accounts receivable (basis of $0, fair market value of $40,000), and land (basis of $40,000, fair market value of $50,000). In addition, the partnership repays all liabilities, of which Ashleigh's share was $70,000. Ashleigh's basis in the entity immediately before the distribution was $60,000. As a result of the distribution, what is Ashleigh's basis in the accounts receivable and land, and how much gain or loss does she recognize?

A) $0 basis in accounts receivable; $0 basis in land; $40,000 gain.

B) $0 basis in accounts receivable; $30,000 basis in land; $0 gain or loss.

C) $0 basis in accounts receivable; $40,000 basis in land; $0 gain or loss.

D) $40,000 basis in accounts receivable; $20,000 basis in land; $0 gain.

E) $40,000 basis in accounts receivable; $20,000 basis in land; $100,000 gain.

A) $0 basis in accounts receivable; $0 basis in land; $40,000 gain.

B) $0 basis in accounts receivable; $30,000 basis in land; $0 gain or loss.

C) $0 basis in accounts receivable; $40,000 basis in land; $0 gain or loss.

D) $40,000 basis in accounts receivable; $20,000 basis in land; $0 gain.

E) $40,000 basis in accounts receivable; $20,000 basis in land; $100,000 gain.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following statements correctly reflects one of the rules regarding proportionate liquidating distributions?

A) Relief of liabilities is treated as a distribution of cash but only to the extent that the cash distribution does not exceed the partner's basis in the partnership interest.

B) A partner's basis in distributed unrealized receivables is the lesser of the partnership's basis in the receivables or their fair market value.

C) The basis of unrealized receivables cannot be stepped up to their fair market value unless the partner has adequate unabsorbed basis.

D) Assets are deemed distributed in the following order: cash, unrealized receivables and inventory and finally, capital assets.

E) The partner can recognize gain, but not loss, on a proportionate liquidating distribution.

A) Relief of liabilities is treated as a distribution of cash but only to the extent that the cash distribution does not exceed the partner's basis in the partnership interest.

B) A partner's basis in distributed unrealized receivables is the lesser of the partnership's basis in the receivables or their fair market value.

C) The basis of unrealized receivables cannot be stepped up to their fair market value unless the partner has adequate unabsorbed basis.

D) Assets are deemed distributed in the following order: cash, unrealized receivables and inventory and finally, capital assets.

E) The partner can recognize gain, but not loss, on a proportionate liquidating distribution.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

77

Nicholas is a 25% owner in the DDBN LLC (a calendar year entity). At the end of the last tax year, Nicholas's basis in his interest was $50,000, including his $20,000 share of LLC liabilities. On July 1 of the current tax year, Nicholas sells his LLC interest to Anna for $80,000 cash. In addition, Anna assumes Nicholas's share of LLC liabilities, which, at that date, was $15,000. During the current tax year, DDBN's taxable income is $120,000 (earned evenly during the year). Nicholas's share of the LLC's unrealized receivables is valued at $6,000 ($0 basis). At the sale date, what is Nicholas's basis in his LLC interest, how much gain or loss must he recognize, and what is the character of the gain or loss?

A) $45,000 basis; $6,000 ordinary income; $44,000 capital gain.

B) $60,000 basis; $6,000 ordinary income; $29,000 capital gain.

C) $60,000 basis; $35,000 capital gain.

D) $75,000 basis; $0 ordinary income; $20,000 capital gain.

E) $75,000 basis; $6,000 ordinary income; $14,000 capital gain.

A) $45,000 basis; $6,000 ordinary income; $44,000 capital gain.

B) $60,000 basis; $6,000 ordinary income; $29,000 capital gain.

C) $60,000 basis; $35,000 capital gain.

D) $75,000 basis; $0 ordinary income; $20,000 capital gain.

E) $75,000 basis; $6,000 ordinary income; $14,000 capital gain.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

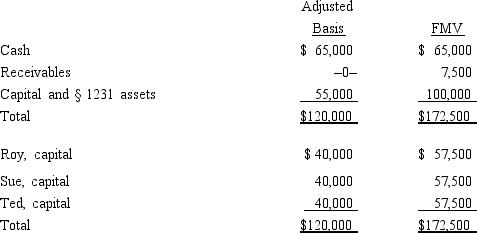

78

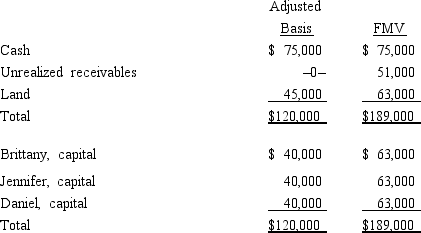

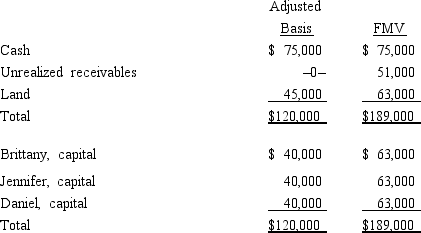

Brittany, Jennifer, and Daniel are equal partners in the BJD Partnership. The partnership balance sheet reads as follows on December 31 of the current year.  Partner Daniel has an adjusted basis of $40,000 for his partnership interest. If Daniel sells his entire partnership interest to new partner Amber for $73,000 cash, how much can the partnership stepup the basis of Amber's share of partnership assets under §§ 754 and 743(b)?

Partner Daniel has an adjusted basis of $40,000 for his partnership interest. If Daniel sells his entire partnership interest to new partner Amber for $73,000 cash, how much can the partnership stepup the basis of Amber's share of partnership assets under §§ 754 and 743(b)?

A) $6,000

B) $17,000

C) $23,000

D) $33,000

E) None of the above

Partner Daniel has an adjusted basis of $40,000 for his partnership interest. If Daniel sells his entire partnership interest to new partner Amber for $73,000 cash, how much can the partnership stepup the basis of Amber's share of partnership assets under §§ 754 and 743(b)?

Partner Daniel has an adjusted basis of $40,000 for his partnership interest. If Daniel sells his entire partnership interest to new partner Amber for $73,000 cash, how much can the partnership stepup the basis of Amber's share of partnership assets under §§ 754 and 743(b)?A) $6,000

B) $17,000

C) $23,000

D) $33,000

E) None of the above

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

79

Last year, Darby contributed land (basis of $60,000, fair market value of $80,000) to the Seagull LLC in exchange for a 25% interest in the LLC. In the current year, the LLC distributes the land (now worth $82,000) to Shelby, who is also a 25% owner. Immediately prior to the distribution, Darby's basis in the LLC was $70,000, while Shelby's basis in the LLC was $110,000. How much gain or loss must be recognized and by whom? What is Shelby's basis in the property she receives and Darby's basis in her partnership interest following the distribution?

A) No gain or loss; Shelby's basis in the property is $80,000; Darby's basis in interest is $70,000.

B) $20,000 gain recognized by Darby; Shelby's basis in the property is $80,000; Darby's basis in interest is $90,000.

C) $22,000 gain recognized by Darby; Shelby's basis in the property is $82,000; Darby's basis in interest is $92,000.

D) $20,000 gain recognized by Shelby; Shelby's basis in the property is $80,000; Darby's basis in interest is $90,000.

E) $22,000 gain recognized by Shelby; Shelby's basis in the property is $82,000; Darby's basis in interest is $92,000.

A) No gain or loss; Shelby's basis in the property is $80,000; Darby's basis in interest is $70,000.

B) $20,000 gain recognized by Darby; Shelby's basis in the property is $80,000; Darby's basis in interest is $90,000.

C) $22,000 gain recognized by Darby; Shelby's basis in the property is $82,000; Darby's basis in interest is $92,000.

D) $20,000 gain recognized by Shelby; Shelby's basis in the property is $80,000; Darby's basis in interest is $90,000.

E) $22,000 gain recognized by Shelby; Shelby's basis in the property is $82,000; Darby's basis in interest is $92,000.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck

80

The December 31, 2014, balance sheet of the RST General Partnership reads as follows.  The partners share equally in partnership capital, income, gain, loss, deduction and credit. Ted's adjusted basis for his partnership interest is $40,000. On December 31, 2014, he retires from the partnership, receiving a $60,000 cash payment in liquidation of his interest. The partnership agreement states that $2,500 of the payment is for goodwill. Which of the following statements about this distribution is false?

The partners share equally in partnership capital, income, gain, loss, deduction and credit. Ted's adjusted basis for his partnership interest is $40,000. On December 31, 2014, he retires from the partnership, receiving a $60,000 cash payment in liquidation of his interest. The partnership agreement states that $2,500 of the payment is for goodwill. Which of the following statements about this distribution is false?

A) If capital is NOT a material incomeproducing factor to the partnership, the § 736(a) payment will be $2,500.

B) If capital IS a material incomeproducing factor, the entire $60,000 payment will be a § 736(b) property payment.

C) The payment for Ted's share of goodwill will create $2,500 of ordinary income to him.

D) The partnership can deduct any amount that is a § 736(a) payment because it will be determined without regard to partnership profits.

E) All statements are false.

The partners share equally in partnership capital, income, gain, loss, deduction and credit. Ted's adjusted basis for his partnership interest is $40,000. On December 31, 2014, he retires from the partnership, receiving a $60,000 cash payment in liquidation of his interest. The partnership agreement states that $2,500 of the payment is for goodwill. Which of the following statements about this distribution is false?

The partners share equally in partnership capital, income, gain, loss, deduction and credit. Ted's adjusted basis for his partnership interest is $40,000. On December 31, 2014, he retires from the partnership, receiving a $60,000 cash payment in liquidation of his interest. The partnership agreement states that $2,500 of the payment is for goodwill. Which of the following statements about this distribution is false?A) If capital is NOT a material incomeproducing factor to the partnership, the § 736(a) payment will be $2,500.

B) If capital IS a material incomeproducing factor, the entire $60,000 payment will be a § 736(b) property payment.

C) The payment for Ted's share of goodwill will create $2,500 of ordinary income to him.

D) The partnership can deduct any amount that is a § 736(a) payment because it will be determined without regard to partnership profits.

E) All statements are false.

Unlock Deck

Unlock for access to all 144 flashcards in this deck.

Unlock Deck

k this deck