Deck 7: Intercompany Transfers of Services and Noncurrent Assets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/57

Play

Full screen (f)

Deck 7: Intercompany Transfers of Services and Noncurrent Assets

1

Big Corporation receives management consulting services from its 92 percent owned subsidiary, Small Inc. During 20X7, Big paid Small $125,432 for its services. For the year 20X8, Small billed Big $140,000 for such services and collected all but $7,900 by year-end. Small's labor cost and other associated costs for the employees providing services to Big totaled $86,000 in 20X7 and $121,000 in 20X8. Big reported $2,567,000 of income from its own separate operations for 20X8, and Small reported net income of $695,000.

Based on the preceding information,what amount of consolidated net income should be reported in 20X8?

A) $3,262,000

B) $4,050,000

C) $3,254,100

D) $3,122,000

Based on the preceding information,what amount of consolidated net income should be reported in 20X8?

A) $3,262,000

B) $4,050,000

C) $3,254,100

D) $3,122,000

A

2

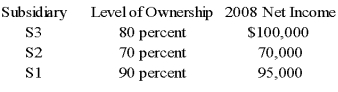

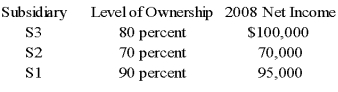

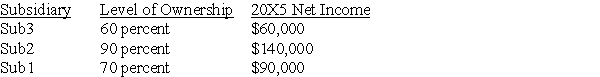

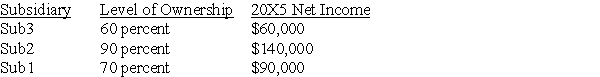

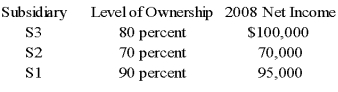

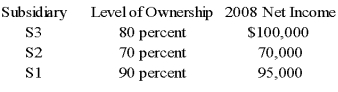

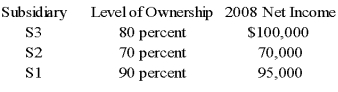

Parent Corporation purchased land from S1 Corporation for $220,000 on December 26, 20X8. This purchase followed a series of transactions between P-controlled subsidiaries. On February 15, 20X8, S3 Corporation purchased the land from a nonaffiliate for $160,000. It sold the land to S2 Company for $145,000 on October 19, 20X8, and S2 sold the land to S1 for $197,000 on November 27, 20X8. Parent has control of the following companies:

Parent reported income from its separate operations of $200,000 for 20X8.

Based on the preceding information,what amount of gain or loss on sale of land should be reported in the consolidated income statement for 20X8?

A) $60,000

B) $0

C) $75,000

D) $23,000

Parent reported income from its separate operations of $200,000 for 20X8.

Based on the preceding information,what amount of gain or loss on sale of land should be reported in the consolidated income statement for 20X8?

A) $60,000

B) $0

C) $75,000

D) $23,000

B

3

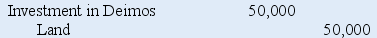

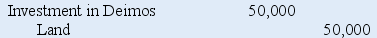

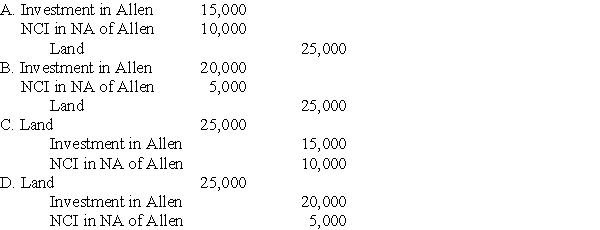

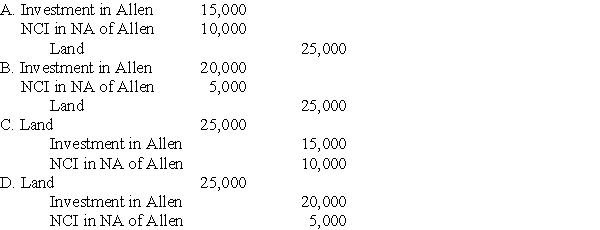

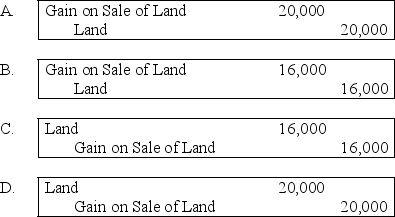

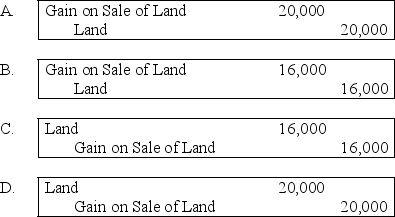

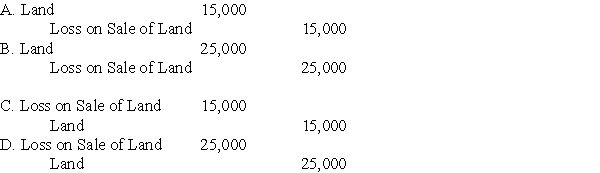

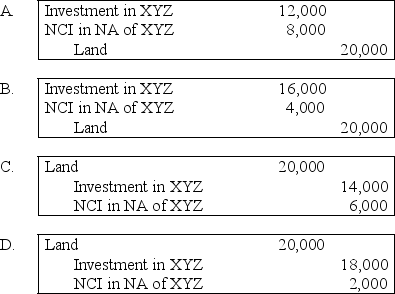

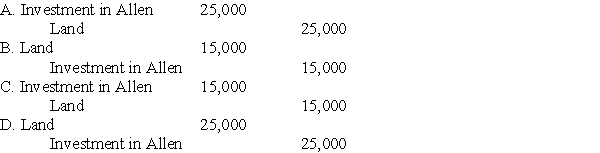

Phobos Company holds 80 percent of Deimos Company's voting shares.During the preparation of consolidated financial statements for 20X9,the following consolidating entry was made:

Which of the following statements is correct?

A) Phobos Company purchased land from Deimos Company during 20X9.

B) Phobos Company purchased land from Deimos Company before January 1, 20X9.

C) Deimos Company purchased land from Phobos Company during 20X9.

D) Deimos Company purchased land from Phobos Company before January 1, 20X9.

Which of the following statements is correct?

A) Phobos Company purchased land from Deimos Company during 20X9.

B) Phobos Company purchased land from Deimos Company before January 1, 20X9.

C) Deimos Company purchased land from Phobos Company during 20X9.

D) Deimos Company purchased land from Phobos Company before January 1, 20X9.

D

4

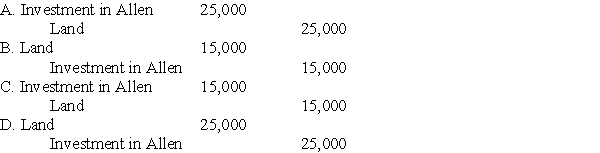

Which worksheet consolidation entry will be made on December 31,20X3,if Allen Corporation had initially purchased the land for $60,000 and then sold it to Hilldale on August 7,20X2,for $35,000?

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

5

Blue Company owns 70 percent of Black Company's outstanding common stock.On December 31,20X8,Black sold equipment to Blue at a price in excess of Black's carrying amount,but less than its original cost.On a consolidated balance sheet at December 31,20X8,the carrying amount of the equipment should be reported at:

A) Blue's original cost.

B) Black's original cost.

C) Blue's original cost less Black's recorded gain.

D) Blue's original cost less 70 percent of Black's recorded gain.

A) Blue's original cost.

B) Black's original cost.

C) Blue's original cost less Black's recorded gain.

D) Blue's original cost less 70 percent of Black's recorded gain.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

6

Big Corporation receives management consulting services from its 92 percent owned subsidiary, Small Inc. During 20X7, Big paid Small $125,432 for its services. For the year 20X8, Small billed Big $140,000 for such services and collected all but $7,900 by year-end. Small's labor cost and other associated costs for the employees providing services to Big totaled $86,000 in 20X7 and $121,000 in 20X8. Big reported $2,567,000 of income from its own separate operations for 20X8, and Small reported net income of $695,000.

Based on the preceding information,what amount of income should be assigned to the noncontrolling shareholders in the consolidated income statement for 20X8?

A) $47,700

B) $44,400

C) $55,600

D) $60,000

Based on the preceding information,what amount of income should be assigned to the noncontrolling shareholders in the consolidated income statement for 20X8?

A) $47,700

B) $44,400

C) $55,600

D) $60,000

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

7

Big Corporation receives management consulting services from its 92 percent owned subsidiary, Small Inc. During 20X7, Big paid Small $125,432 for its services. For the year 20X8, Small billed Big $140,000 for such services and collected all but $7,900 by year-end. Small's labor cost and other associated costs for the employees providing services to Big totaled $86,000 in 20X7 and $121,000 in 20X8. Big reported $2,567,000 of income from its own separate operations for 20X8, and Small reported net income of $695,000.

Based on the preceding information,what amount of receivable/payable should be eliminated in the 20X8 consolidated financial statements?

A) $125,432

B) $7,900

C) $5,560

D) $140,000

Based on the preceding information,what amount of receivable/payable should be eliminated in the 20X8 consolidated financial statements?

A) $125,432

B) $7,900

C) $5,560

D) $140,000

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

8

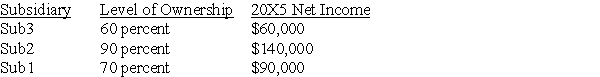

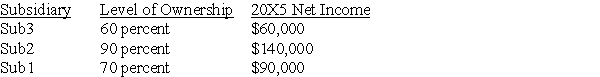

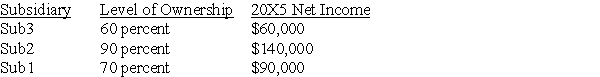

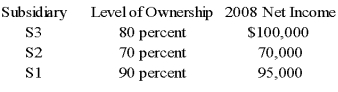

Patch Corporation purchased land from Sub1 Corporation for $350,000 on December 3, 20X5. This purchase followed a series of transactions between Patch-controlled subsidiaries. On January 23, 20X5, Sub3 Corporation purchased the land from a nonaffiliate for $240,000. It sold the land to Sub2 Company for $220,000 on July 15, 20X5, and Sub2 sold the land to Sub1 for $305,000 on September 5, 20X5. Patch has control of the following companies:

Patch reported income from its separate operations of $345,000 for 20X5.

Patch reported income from its separate operations of $345,000 for 20X5.

Based on the preceding information,what amount of gain or loss on the sale of land should be reported in the consolidated income statement for 20X5?

A) $0

B) $20,000 loss

C) $110,000 gain

D) $130,000 gain

Patch reported income from its separate operations of $345,000 for 20X5.

Patch reported income from its separate operations of $345,000 for 20X5.Based on the preceding information,what amount of gain or loss on the sale of land should be reported in the consolidated income statement for 20X5?

A) $0

B) $20,000 loss

C) $110,000 gain

D) $130,000 gain

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

9

Any intercompany gain or loss on a downstream sale of land should be recognized in consolidated net income:

I)in the year of the downstream sale.

II)over the period of time the subsidiary uses the land.

III)in the year the subsidiary sells the land to an unrelated party.

A) I

B) II

C) III

D) I or II

I)in the year of the downstream sale.

II)over the period of time the subsidiary uses the land.

III)in the year the subsidiary sells the land to an unrelated party.

A) I

B) II

C) III

D) I or II

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

10

A parent and its 80 percent owned subsidiary have made several intercompany sales of noncurrent assets during the past two years.The amount of income assigned to the noncontrolling interest for the second year should include the noncontrolling interest's share of gains:

A) unrealized in the second year from upstream sales made in the second year.

B) realized in the second year from downstream sales made in both years.

C) realized in the second year from upstream sales made in both years.

D) both realized and unrealized from upstream sales made in the second year.

A) unrealized in the second year from upstream sales made in the second year.

B) realized in the second year from downstream sales made in both years.

C) realized in the second year from upstream sales made in both years.

D) both realized and unrealized from upstream sales made in the second year.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

11

ABC Corporation purchased land on January 1, 20X6, for $50,000. On July 15, 20X8, it sold the land to its subsidiary, XYZ Corporation, for $70,000. ABC owns 80 percent of XYZ's voting shares.

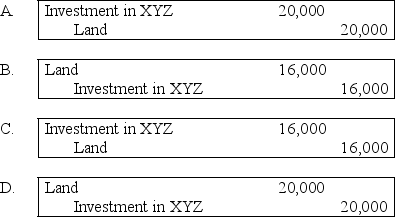

Based on the preceding information,what will be the worksheet consolidating entry to remove the effects of the intercompany sale of land in preparing the consolidated financial statements for 20X8?

A) Option A

B) Option B

C) Option C

D) Option D

Based on the preceding information,what will be the worksheet consolidating entry to remove the effects of the intercompany sale of land in preparing the consolidated financial statements for 20X8?

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

12

Patch Corporation purchased land from Sub1 Corporation for $350,000 on December 3, 20X5. This purchase followed a series of transactions between Patch-controlled subsidiaries. On January 23, 20X5, Sub3 Corporation purchased the land from a nonaffiliate for $240,000. It sold the land to Sub2 Company for $220,000 on July 15, 20X5, and Sub2 sold the land to Sub1 for $305,000 on September 5, 20X5. Patch has control of the following companies:

Patch reported income from its separate operations of $345,000 for 20X5.

Patch reported income from its separate operations of $345,000 for 20X5.

Based on the preceding information,what should be the amount of income assigned to the controlling shareholders in the consolidated income statement for 20X5?

A) $110,000

B) $474,000

C) $525,000

D) $635,000

Patch reported income from its separate operations of $345,000 for 20X5.

Patch reported income from its separate operations of $345,000 for 20X5.Based on the preceding information,what should be the amount of income assigned to the controlling shareholders in the consolidated income statement for 20X5?

A) $110,000

B) $474,000

C) $525,000

D) $635,000

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

13

Patch Corporation purchased land from Sub1 Corporation for $350,000 on December 3, 20X5. This purchase followed a series of transactions between Patch-controlled subsidiaries. On January 23, 20X5, Sub3 Corporation purchased the land from a nonaffiliate for $240,000. It sold the land to Sub2 Company for $220,000 on July 15, 20X5, and Sub2 sold the land to Sub1 for $305,000 on September 5, 20X5. Patch has control of the following companies:

Patch reported income from its separate operations of $345,000 for 20X5.

Patch reported income from its separate operations of $345,000 for 20X5.

Based on the preceding information,at what amount should the land be reported in the consolidated balance sheet as of December 31,20X5?

A) $220,000

B) $240,000

C) $305,000

D) $350,000

Patch reported income from its separate operations of $345,000 for 20X5.

Patch reported income from its separate operations of $345,000 for 20X5.Based on the preceding information,at what amount should the land be reported in the consolidated balance sheet as of December 31,20X5?

A) $220,000

B) $240,000

C) $305,000

D) $350,000

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

14

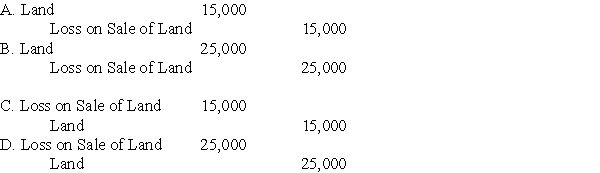

Hilldale Corporation purchased land on January 1, 20X0, for $60,000. On August 7, 20X2, it sold the land to its subsidiary, Allen Corporation, for $35,000. Hilldale owns 60 percent of Allen's voting shares

Based on the preceding information,what will be the worksheet consolidation entry to remove the effects of the intercompany sale of land in preparing the consolidated financial statements for 20X2?

Based on the preceding information,what will be the worksheet consolidation entry to remove the effects of the intercompany sale of land in preparing the consolidated financial statements for 20X2?

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

15

ABC Corporation purchased land on January 1, 20X6, for $50,000. On July 15, 20X8, it sold the land to its subsidiary, XYZ Corporation, for $70,000. ABC owns 80 percent of XYZ's voting shares.

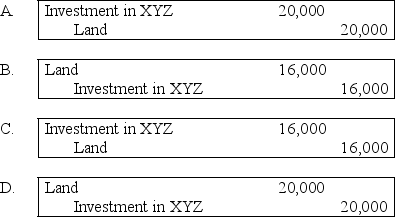

Based on the preceding information,what will be the worksheet consolidating entry to remove the effects of the intercompany sale of land in preparing the consolidated financial statements for 20X9?

A) Option A

B) Option B

C) Option C

D) Option D

Based on the preceding information,what will be the worksheet consolidating entry to remove the effects of the intercompany sale of land in preparing the consolidated financial statements for 20X9?

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

16

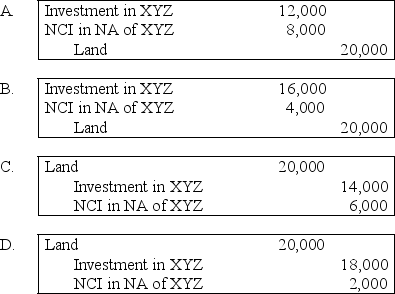

Which worksheet consolidating entry will be made on December 31,20X9,if XYZ Corporation had initially purchased the land for $50,000 and then sold it to ABC on July 15,20X8,for $70,000?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

17

Hilldale Corporation purchased land on January 1, 20X0, for $60,000. On August 7, 20X2, it sold the land to its subsidiary, Allen Corporation, for $35,000. Hilldale owns 60 percent of Allen's voting shares

Based on the preceding information,what will be the worksheet consolidation entry to remove the effects of the intercompany sale of land in preparing the consolidated financial statements for 20X3?

Based on the preceding information,what will be the worksheet consolidation entry to remove the effects of the intercompany sale of land in preparing the consolidated financial statements for 20X3?

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

18

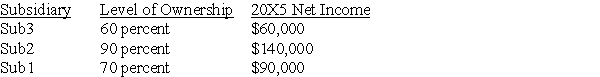

Parent Corporation purchased land from S1 Corporation for $220,000 on December 26, 20X8. This purchase followed a series of transactions between P-controlled subsidiaries. On February 15, 20X8, S3 Corporation purchased the land from a nonaffiliate for $160,000. It sold the land to S2 Company for $145,000 on October 19, 20X8, and S2 sold the land to S1 for $197,000 on November 27, 20X8. Parent has control of the following companies:

Parent reported income from its separate operations of $200,000 for 20X8.

Based on the preceding information,at what amount should the land be reported in the consolidated balance sheet as of December 31,20X8?

A) $145,000

B) $220,000

C) $197,000

D) $160,000

Parent reported income from its separate operations of $200,000 for 20X8.

Based on the preceding information,at what amount should the land be reported in the consolidated balance sheet as of December 31,20X8?

A) $145,000

B) $220,000

C) $197,000

D) $160,000

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

19

A wholly owned subsidiary sold land to its parent during the year at a gain.The parent continues to hold the land at the end of the year.The amount to be reported as consolidated net income for the year should equal:

A) the parent's separate operating income, plus the subsidiary's net income.

B) the parent's separate operating income, plus the subsidiary's net income, minus the intercompany gain.

C) the parent's separate operating income, plus the subsidiary's net income, plus the intercompany gain.

D) the parent's net income, plus the subsidiary's net income, minus the intercompany gain.

A) the parent's separate operating income, plus the subsidiary's net income.

B) the parent's separate operating income, plus the subsidiary's net income, minus the intercompany gain.

C) the parent's separate operating income, plus the subsidiary's net income, plus the intercompany gain.

D) the parent's net income, plus the subsidiary's net income, minus the intercompany gain.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

20

Parent Corporation purchased land from S1 Corporation for $220,000 on December 26, 20X8. This purchase followed a series of transactions between P-controlled subsidiaries. On February 15, 20X8, S3 Corporation purchased the land from a nonaffiliate for $160,000. It sold the land to S2 Company for $145,000 on October 19, 20X8, and S2 sold the land to S1 for $197,000 on November 27, 20X8. Parent has control of the following companies:

Parent reported income from its separate operations of $200,000 for 20X8.

Based on the preceding information,what should be the amount of income assigned to the controlling shareholders in the consolidated income statement for 20X8?

A) $369,400

B) $405,000

C) $465,000

D) $60,000

Parent reported income from its separate operations of $200,000 for 20X8.

Based on the preceding information,what should be the amount of income assigned to the controlling shareholders in the consolidated income statement for 20X8?

A) $369,400

B) $405,000

C) $465,000

D) $60,000

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

21

Neptune Corporation owns 70 percent of Pluto Company's stock. On July 1, 20X4, Neptune sold a piece of equipment to Pluto for $56,350. Neptune had purchased this equipment on January 1, 20X1, for $63,000. The equipment's original 15-year estimated total economic life remains unchanged. Both companies use straight-line depreciation. The equipment's residual value is considered negligible.

Based on the information provided,while preparing the 20X4 consolidated income statement,depreciation expense will be

A) credited for $350 in the consolidation entries.

B) debited for $350 in the consolidation entries.

C) credited for $700 in the consolidation entries.

D) debited for $700 in the consolidation entries.

Based on the information provided,while preparing the 20X4 consolidated income statement,depreciation expense will be

A) credited for $350 in the consolidation entries.

B) debited for $350 in the consolidation entries.

C) credited for $700 in the consolidation entries.

D) debited for $700 in the consolidation entries.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

22

Mortar Corporation acquired 80 percent of Granite Corporation's voting common stock on January 1, 20X7. On December 31, 20X8, Mortar received $390,000 from Granite for equipment Mortar had purchased on January 1, 20X5, for $400,000. The equipment is expected to have a 10-year useful life and no salvage value. Both companies depreciate equipment on a straight-line basis.

Based on the preceding information,in the preparation of consolidation entries related to the equipment transfer for the 20X9 consolidated financial statements,the net effect on accumulated depreciation will be:

A) a decrease of $160,000.

B) an increase of $160,000.

C) an increase of $135,000.

D) a decrease of $135,000.

Based on the preceding information,in the preparation of consolidation entries related to the equipment transfer for the 20X9 consolidated financial statements,the net effect on accumulated depreciation will be:

A) a decrease of $160,000.

B) an increase of $160,000.

C) an increase of $135,000.

D) a decrease of $135,000.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

23

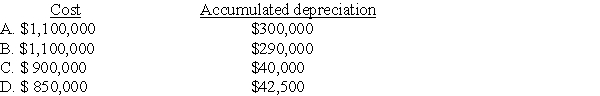

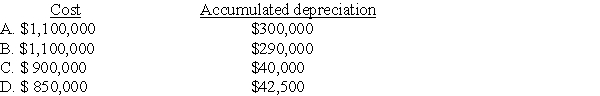

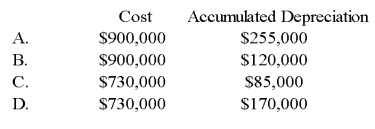

On January 1,20X1,Poe Corp.sold a machine for $900,000 to Saxe Corp.,its wholly-owned subsidiary.Poe paid $1,100,000 for this machine,which had accumulated depreciation of $250,000.Poe estimated a $100,000 salvage value and depreciated the machine on the straight-line method over 20 years,a policy which Saxe continued.In Poe's December 31,20X1,consolidated balance sheet,this machine should be included in cost and accumulated depreciation as:

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

24

Mortar Corporation acquired 80 percent of Granite Corporation's voting common stock on January 1, 20X7. On December 31, 20X8, Mortar received $390,000 from Granite for equipment Mortar had purchased on January 1, 20X5, for $400,000. The equipment is expected to have a 10-year useful life and no salvage value. Both companies depreciate equipment on a straight-line basis.

Based on the preceding information,in the preparation of the 20X9 consolidated income statement,depreciation expense will be:

A) debited for $25,000 in the consolidating entries.

B) credited for $15,000 in the consolidating entries.

C) debited for $15,000 in the consolidating entries.

D) credited for $25,000 in the consolidating entries.

Based on the preceding information,in the preparation of the 20X9 consolidated income statement,depreciation expense will be:

A) debited for $25,000 in the consolidating entries.

B) credited for $15,000 in the consolidating entries.

C) debited for $15,000 in the consolidating entries.

D) credited for $25,000 in the consolidating entries.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

25

Mortar Corporation acquired 80 percent of Granite Corporation's voting common stock on January 1, 20X7. On January 1, 20X8, Mortar received $350,000 from Granite for equipment Mortar had purchased on January 1, 20X5, for $400,000. The equipment is expected to have a 10-year useful life and no salvage value. Both companies depreciate equipment on a straight-line basis.

Based on the preceding information,in the preparation of the 20X8 consolidated financial statements,equipment will be:

A) debited for $50,000.

B) debited for $40,000.

C) credited for $70,000.

D) debited for $25,000.

Based on the preceding information,in the preparation of the 20X8 consolidated financial statements,equipment will be:

A) debited for $50,000.

B) debited for $40,000.

C) credited for $70,000.

D) debited for $25,000.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

26

Neptune Corporation owns 70 percent of Pluto Company's stock. On July 1, 20X4, Neptune sold a piece of equipment to Pluto for $56,350. Neptune had purchased this equipment on January 1, 20X1, for $63,000. The equipment's original 15-year estimated total economic life remains unchanged. Both companies use straight-line depreciation. The equipment's residual value is considered negligible.

Based on the information provided,in the preparation of the 20X5 consolidated income statement,depreciation expense will be

A) debited for $350 in the consolidation entries.

B) credited for $350 in the consolidation entries.

C) debited for $700 in the consolidation entries.

D) credited for $700 in the consolidation entries.

Based on the information provided,in the preparation of the 20X5 consolidated income statement,depreciation expense will be

A) debited for $350 in the consolidation entries.

B) credited for $350 in the consolidation entries.

C) debited for $700 in the consolidation entries.

D) credited for $700 in the consolidation entries.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

27

A parent sold land to its partially owned subsidiary during the year at a loss.The subsidiary continues to hold the land at the end of the year.The amount to be reported as consolidated net income for the year should equal:

A) the parent's separate operating income, plus the intercompany loss.

B) the parent's separate operating income, plus the intercompany loss, plus the subsidiary's net income.

C) the parent's separate operating income, minus the intercompany loss.

D) the parent's separate operating income, minus the intercompany loss, plus the subsidiary's net income.

A) the parent's separate operating income, plus the intercompany loss.

B) the parent's separate operating income, plus the intercompany loss, plus the subsidiary's net income.

C) the parent's separate operating income, minus the intercompany loss.

D) the parent's separate operating income, minus the intercompany loss, plus the subsidiary's net income.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

28

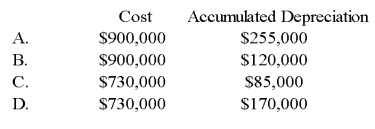

On January 1,20X9,Light Corporation sold equipment for $400,000 to Star Corporation,its wholly owned subsidiary.Light had paid $900,000 for this equipment,which had accumulated depreciation of $170,000.Light estimated a $50,000 salvage value and depreciated the tractor using the straight-line method over 10 years,a policy that Star continued.In Light's December 31,20X9,consolidated balance sheet,this tractor should be included in fixed-asset cost and accumulated depreciation as:

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

29

Sky Corporation owns 75 percent of Earth Company's stock. On July 1, 20X8, Sky sold a building to Earth for $33,000. Sky had purchased this building on January 1, 20X6, for $36,000. The building's original eight-year estimated total economic life remains unchanged. Both companies use straight-line depreciation. The equipment's residual value is considered negligible.

Based on the information provided,the gain on sale of the building eliminated in the consolidated financial statements for 20X8 is:

A) $8,250.

B) $10,500.

C) $6,000.

D) $11,250.

Based on the information provided,the gain on sale of the building eliminated in the consolidated financial statements for 20X8 is:

A) $8,250.

B) $10,500.

C) $6,000.

D) $11,250.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

30

Sky Corporation owns 75 percent of Earth Company's stock. On July 1, 20X8, Sky sold a building to Earth for $33,000. Sky had purchased this building on January 1, 20X6, for $36,000. The building's original eight-year estimated total economic life remains unchanged. Both companies use straight-line depreciation. The equipment's residual value is considered negligible.

Based on the information provided,in the preparation of the 20X9 consolidated income statement,depreciation expense will be:

A) debited for $750 in the consolidating entries.

B) credited for $750 the consolidating entries.

C) credited for $1500 in the consolidating entries.

D) debited for $1500 in the consolidating entries.

Based on the information provided,in the preparation of the 20X9 consolidated income statement,depreciation expense will be:

A) debited for $750 in the consolidating entries.

B) credited for $750 the consolidating entries.

C) credited for $1500 in the consolidating entries.

D) debited for $1500 in the consolidating entries.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

31

Mortar Corporation acquired 80 percent of Granite Corporation's voting common stock on January 1, 20X7. On December 31, 20X8, Mortar received $390,000 from Granite for equipment Mortar had purchased on January 1, 20X5, for $400,000. The equipment is expected to have a 10-year useful life and no salvage value. Both companies depreciate equipment on a straight-line basis.

Based on the preceding information,in the preparation of the 20X8 consolidated financial statements,equipment will be:

A) debited for $1,000.

B) debited for $10,000.

C) credited for $15,000.

D) debited for $25,000.

Based on the preceding information,in the preparation of the 20X8 consolidated financial statements,equipment will be:

A) debited for $1,000.

B) debited for $10,000.

C) credited for $15,000.

D) debited for $25,000.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

32

Parent Company owns 70% of Son Company's outstanding stock.During 20X1 Son Company sold land to Parent Company for a gain of $25,000.Parent company held the land all of 20X1.The gain on the sale to Parent should be:

A) recorded on Son's books as a gain of $25,000 and then eliminated during the consolidation process.

B) deferred by Son until Parent sells the land to an outside party.

C) recorded on Son's books as a gain of $17,500 and eliminated during the consolidation process.

D) recorded on Parent's book as a gain of $17,500 and eliminated during the consolidation process.

A) recorded on Son's books as a gain of $25,000 and then eliminated during the consolidation process.

B) deferred by Son until Parent sells the land to an outside party.

C) recorded on Son's books as a gain of $17,500 and eliminated during the consolidation process.

D) recorded on Parent's book as a gain of $17,500 and eliminated during the consolidation process.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

33

Mortar Corporation acquired 80 percent of Granite Corporation's voting common stock on January 1, 20X7. On December 31, 20X8, Mortar received $390,000 from Granite for equipment Mortar had purchased on January 1, 20X5, for $400,000. The equipment is expected to have a 10-year useful life and no salvage value. Both companies depreciate equipment on a straight-line basis.

Based on the preceding information,in the preparation of the 20X9 consolidated financial statements,equipment will be:

A) debited for $1,000.

B) debited for $10,000.

C) credited for $15,000.

D) debited for $25,000.

Based on the preceding information,in the preparation of the 20X9 consolidated financial statements,equipment will be:

A) debited for $1,000.

B) debited for $10,000.

C) credited for $15,000.

D) debited for $25,000.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

34

Mortar Corporation acquired 80 percent of Granite Corporation's voting common stock on January 1, 20X7. On January 1, 20X8, Mortar received $350,000 from Granite for equipment Mortar had purchased on January 1, 20X5, for $400,000. The equipment is expected to have a 10-year useful life and no salvage value. Both companies depreciate equipment on a straight-line basis.

Based on the preceding information,the gain on sale of equipment recorded by Mortar for 20X8 is:

A) $70,000.

B) $65,000.

C) $50,000.

D) $40,000.

Based on the preceding information,the gain on sale of equipment recorded by Mortar for 20X8 is:

A) $70,000.

B) $65,000.

C) $50,000.

D) $40,000.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

35

Using the fully adjusted equity method,an intercompany gain on an upstream sale of land is:

A) recognized by the parent and the deferral is shared between the controlling and noncontrolling stockholders of the subsidiary.

B) recognized by the subsidiary and the deferral is shared between the controlling and noncontrolling stockholders of the subsidiary.

C) deferred by the subsidiary until the land is sold to an entity outside the consolidated group.

D) recognized by the subsidiary and the deferral is completely allocated to the controlling stockholders of the subsidiary.

A) recognized by the parent and the deferral is shared between the controlling and noncontrolling stockholders of the subsidiary.

B) recognized by the subsidiary and the deferral is shared between the controlling and noncontrolling stockholders of the subsidiary.

C) deferred by the subsidiary until the land is sold to an entity outside the consolidated group.

D) recognized by the subsidiary and the deferral is completely allocated to the controlling stockholders of the subsidiary.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

36

Sky Corporation owns 75 percent of Earth Company's stock. On July 1, 20X8, Sky sold a building to Earth for $33,000. Sky had purchased this building on January 1, 20X6, for $36,000. The building's original eight-year estimated total economic life remains unchanged. Both companies use straight-line depreciation. The equipment's residual value is considered negligible.

Based on the information provided,in the preparation of the 20X8 consolidated financial statements,building will be _____ in the consolidating entries.

A) debited for $33,000

B) debited for $36,000

C) credited for $36,000

D) debited for $3,000

Based on the information provided,in the preparation of the 20X8 consolidated financial statements,building will be _____ in the consolidating entries.

A) debited for $33,000

B) debited for $36,000

C) credited for $36,000

D) debited for $3,000

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

37

Neptune Corporation owns 70 percent of Pluto Company's stock. On July 1, 20X4, Neptune sold a piece of equipment to Pluto for $56,350. Neptune had purchased this equipment on January 1, 20X1, for $63,000. The equipment's original 15-year estimated total economic life remains unchanged. Both companies use straight-line depreciation. The equipment's residual value is considered negligible.

Based on the information provided,in the preparation of the 20X4 consolidated financial statements,equipment will be ______ in the consolidation entries.

A) debited for $6,650

B) debited for $56,350

C) debited for $63,000

D) credited for $63,000

Based on the information provided,in the preparation of the 20X4 consolidated financial statements,equipment will be ______ in the consolidation entries.

A) debited for $6,650

B) debited for $56,350

C) debited for $63,000

D) credited for $63,000

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

38

Neptune Corporation owns 70 percent of Pluto Company's stock. On July 1, 20X4, Neptune sold a piece of equipment to Pluto for $56,350. Neptune had purchased this equipment on January 1, 20X1, for $63,000. The equipment's original 15-year estimated total economic life remains unchanged. Both companies use straight-line depreciation. The equipment's residual value is considered negligible.

Based on the information provided,the gain on the sale of the equipment eliminated in the consolidated financial statements for 20X4 is

A) $5,950.

B) $8,050

C) $10,150

D) $14,700

Based on the information provided,the gain on the sale of the equipment eliminated in the consolidated financial statements for 20X4 is

A) $5,950.

B) $8,050

C) $10,150

D) $14,700

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

39

Sky Corporation owns 75 percent of Earth Company's stock. On July 1, 20X8, Sky sold a building to Earth for $33,000. Sky had purchased this building on January 1, 20X6, for $36,000. The building's original eight-year estimated total economic life remains unchanged. Both companies use straight-line depreciation. The equipment's residual value is considered negligible.

Based on the information provided,while preparing the 20X8 consolidated income statement,depreciation expense will be:

A) debited for $750 in the consolidating entries.

B) credited for $750 in the consolidating entries.

C) credited for $1,500 in the consolidating entries.

D) debited for $1,500 in the consolidating entries.

Based on the information provided,while preparing the 20X8 consolidated income statement,depreciation expense will be:

A) debited for $750 in the consolidating entries.

B) credited for $750 in the consolidating entries.

C) credited for $1,500 in the consolidating entries.

D) debited for $1,500 in the consolidating entries.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

40

Mortar Corporation acquired 80 percent of Granite Corporation's voting common stock on January 1, 20X7. On December 31, 20X8, Mortar received $390,000 from Granite for equipment Mortar had purchased on January 1, 20X5, for $400,000. The equipment is expected to have a 10-year useful life and no salvage value. Both companies depreciate equipment on a straight-line basis.

Based on the preceding information,the gain on sale of the equipment recorded by Mortar for 20X8 is:

A) $150,000

B) $65,000

C) $110,000

D) $40,000

Based on the preceding information,the gain on sale of the equipment recorded by Mortar for 20X8 is:

A) $150,000

B) $65,000

C) $110,000

D) $40,000

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

41

Mortar Corporation acquired 80 percent of Granite Corporation's voting common stock on January 1, 20X7. On January 1, 20X8, Mortar received $350,000 from Granite for equipment Mortar had purchased on January 1, 20X5, for $400,000. The equipment is expected to have a 10-year useful life and no salvage value. Both companies depreciate equipment on a straight-line basis.

Based on the preceding information,in the preparation of consolidation entries related to the equipment transfer for the 20X8 consolidated financial statements,net effect on accumulated depreciation will be:

A) a decrease of $50,000.

B) an increase of $110,000.

C) an increase of $120,000.

D) a decrease of $160,000.

Based on the preceding information,in the preparation of consolidation entries related to the equipment transfer for the 20X8 consolidated financial statements,net effect on accumulated depreciation will be:

A) a decrease of $50,000.

B) an increase of $110,000.

C) an increase of $120,000.

D) a decrease of $160,000.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

42

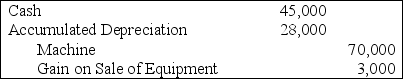

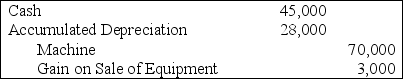

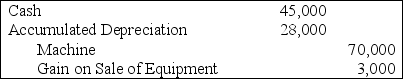

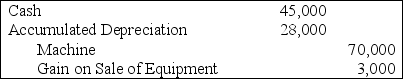

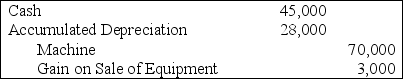

On January 1, 20X7, Servant Company purchased a machine with an expected economic life of five years. On January 1, 20X9, Servant sold the machine to Master Corporation and recorded the following entry:

Master Corporation holds 75 percent of Servant's voting shares. Servant reported net income of $50,000, and Master reported income from its own operations of $100,000 for 20X9. There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.

Master Corporation holds 75 percent of Servant's voting shares. Servant reported net income of $50,000, and Master reported income from its own operations of $100,000 for 20X9. There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.

Based on the preceding information,consolidated net income for 20X9 will be:

A) $150,000.

B) $100,000.

C) $148,000.

D) $130,000.

Master Corporation holds 75 percent of Servant's voting shares. Servant reported net income of $50,000, and Master reported income from its own operations of $100,000 for 20X9. There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.

Master Corporation holds 75 percent of Servant's voting shares. Servant reported net income of $50,000, and Master reported income from its own operations of $100,000 for 20X9. There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.Based on the preceding information,consolidated net income for 20X9 will be:

A) $150,000.

B) $100,000.

C) $148,000.

D) $130,000.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

43

Blue Corporation holds 70 percent of Black Company's voting common stock. On January 1, 20X3, Black paid $500,000 to acquire a building with a 10-year expected economic life. Black uses straight-line depreciation for all depreciable assets. On December 31, 20X8, Blue purchased the building from Black for $180,000. Blue reported income, excluding investment income from Black, of $140,000 and $162,000 for 20X8 and 20X9, respectively. Black reported net income of $30,000 and $45,000 for 20X8 and 20X9, respectively.

Based on the preceding information,the amount to be reported as consolidated net income for 20X8 will be:

A) $190,000.

B) $170,000.

C) $175,000.

D) $150,000.

Based on the preceding information,the amount to be reported as consolidated net income for 20X8 will be:

A) $190,000.

B) $170,000.

C) $175,000.

D) $150,000.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

44

PeopleMag sells a plot of land for $100,000 to Seven Star Company,its 100 percent owned subsidiary,on January 1,20X7.The cost of the land was $75,000,when it was purchased in 20X6.In 20X9,Seven Star sells the land to Hot Properties Inc.,an unrelated entity,for $120,000.How is the land reported in the consolidated financial statements for 20X7,20X8 and 20X9?

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

45

Big Company acquired 75 percent of Little Company's stock at underlying book value on January 1,20X8.At that date,the fair value of the noncontrolling interest was equal to 25 percent of the book value of Little Company.Little Company reported shares outstanding of $350,000 and retained earnings of $100,000.During 20X8,Little Company reported net income of $60,000 and paid dividends of $3,000.In 20X9,Little Company reported net income of $90,000 and paid dividends of $15,000.The following transactions occurred between Big Company and Little Company in 20X8 and 20X9:

Little Co.sold equipment to Big Co.for a $42,000 gain on December 31,20X8.Little Co.had originally purchased the equipment for $140,000 and it had a carrying value of $28,000 on December 31,20X8.At the time of the purchase,Big Co.estimated that the equipment still had a seven-year remaining useful life.

Big sold land costing $90,000 to Old Company on June 28,20X9,for $110,000.

Required:

Give all consolidating entries needed to prepare a consolidation worksheet for 20X9 assuming that Big Co.uses the modified equity method to account for its investment in Old Company.

Problem 56 (continued):

Little Co.sold equipment to Big Co.for a $42,000 gain on December 31,20X8.Little Co.had originally purchased the equipment for $140,000 and it had a carrying value of $28,000 on December 31,20X8.At the time of the purchase,Big Co.estimated that the equipment still had a seven-year remaining useful life.

Big sold land costing $90,000 to Old Company on June 28,20X9,for $110,000.

Required:

Give all consolidating entries needed to prepare a consolidation worksheet for 20X9 assuming that Big Co.uses the modified equity method to account for its investment in Old Company.

Problem 56 (continued):

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

46

Blue Corporation holds 70 percent of Black Company's voting common stock. On January 1, 20X3, Black paid $500,000 to acquire a building with a 10-year expected economic life. Black uses straight-line depreciation for all depreciable assets. On December 31, 20X8, Blue purchased the building from Black for $180,000. Blue reported income, excluding investment income from Black, of $140,000 and $162,000 for 20X8 and 20X9, respectively. Black reported net income of $30,000 and $45,000 for 20X8 and 20X9, respectively.

Based on the preceding information,the amount of income assigned to the controlling shareholders in the consolidated income statement for 20X8 will be:

A) $190,000.

B) $170,000.

C) $175,000.

D) $150,000.

Based on the preceding information,the amount of income assigned to the controlling shareholders in the consolidated income statement for 20X8 will be:

A) $190,000.

B) $170,000.

C) $175,000.

D) $150,000.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

47

Pie Company acquired 75 percent of Strawberry Company's stock at the underlying book value on January 1,20X8.At that date,the fair value of the noncontrolling interest was equal to 25 percent of the book value of Strawberry Company.Strawberry Company reported shares outstanding of $350,000 and retained earnings of $100,000.During 20X8,Strawberry Company reported net income of $60,000 and paid dividends of $3,000.In 20X9,Strawberry Company reported net income of $90,000 and paid dividends of $15,000.The following transactions occurred between Pie Company and Strawberry Company in 20X8 and 20X9:

Strawberry Co.sold equipment to Pie Co.for a $42,000 gain on December 31,20X8.Strawberry Co.had originally purchased the equipment for $140,000 and it had a carrying value of $28,000 on December 31,20X8.At the time of the purchase,Pie Co.estimated that the equipment still had a seven-year remaining useful life.

Pie Co.sold land costing $90,000 to Strawberry Co.on June 28,20X9,for $110,000.

Required:

Give all consolidating entries needed to prepare a consolidation worksheet for 20X9 assuming that Pie Co.uses the fully adjusted equity method to account for its investment in Strawberry Company.

Problem 55 (continued):

Strawberry Co.sold equipment to Pie Co.for a $42,000 gain on December 31,20X8.Strawberry Co.had originally purchased the equipment for $140,000 and it had a carrying value of $28,000 on December 31,20X8.At the time of the purchase,Pie Co.estimated that the equipment still had a seven-year remaining useful life.

Pie Co.sold land costing $90,000 to Strawberry Co.on June 28,20X9,for $110,000.

Required:

Give all consolidating entries needed to prepare a consolidation worksheet for 20X9 assuming that Pie Co.uses the fully adjusted equity method to account for its investment in Strawberry Company.

Problem 55 (continued):

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

48

Mortar Corporation acquired 80 percent of Granite Corporation's voting common stock on January 1, 20X7. On January 1, 20X8, Mortar received $350,000 from Granite for equipment Mortar had purchased on January 1, 20X5, for $400,000. The equipment is expected to have a 10-year useful life and no salvage value. Both companies depreciate equipment on a straight-line basis.

Based on the preceding information,in the preparation of consolidation entries related to the equipment transfer for the 20X9 consolidated financial statements,net effect on accumulated depreciation will be:

A) a decrease of $110,000.

B) an increase of $110,000.

C) an increase of $100,000.

D) a decrease of $100,000.

Based on the preceding information,in the preparation of consolidation entries related to the equipment transfer for the 20X9 consolidated financial statements,net effect on accumulated depreciation will be:

A) a decrease of $110,000.

B) an increase of $110,000.

C) an increase of $100,000.

D) a decrease of $100,000.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

49

Blue Corporation holds 70 percent of Black Company's voting common stock. On January 1, 20X3, Black paid $500,000 to acquire a building with a 10-year expected economic life. Black uses straight-line depreciation for all depreciable assets. On December 31, 20X8, Blue purchased the building from Black for $180,000. Blue reported income, excluding investment income from Black, of $140,000 and $162,000 for 20X8 and 20X9, respectively. Black reported net income of $30,000 and $45,000 for 20X8 and 20X9, respectively.

Based on the preceding information,the amount to be reported as consolidated net income for 20X9 will be:

A) $207,000.

B) $202,000.

C) $212,000.

D) $190,000.

Based on the preceding information,the amount to be reported as consolidated net income for 20X9 will be:

A) $207,000.

B) $202,000.

C) $212,000.

D) $190,000.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

50

Peter Architectural Services owns 100 percent of Smith Manufacturing.During the course of 20X8 Peter provides $100,000 of architectural services associated with Smith's new manufacturing facility,which will open January 4,20X9,and has a 5 year useful life.Explain the impact providing this service has on Peter Architectural Services' 20X8 and 20X9 consolidated financial statements.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

51

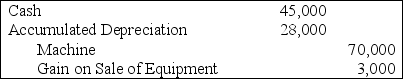

On January 1, 20X7, Servant Company purchased a machine with an expected economic life of five years. On January 1, 20X9, Servant sold the machine to Master Corporation and recorded the following entry:

Master Corporation holds 75 percent of Servant's voting shares. Servant reported net income of $50,000, and Master reported income from its own operations of $100,000 for 20X9. There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.

Master Corporation holds 75 percent of Servant's voting shares. Servant reported net income of $50,000, and Master reported income from its own operations of $100,000 for 20X9. There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.

Based on the preceding information,in the preparation of the 20X9 consolidated balance sheet,machine will be:

A) debited for $1,000.

B) debited for $15,000.

C) credited for $45,000.

D) debited for $25,000.

Master Corporation holds 75 percent of Servant's voting shares. Servant reported net income of $50,000, and Master reported income from its own operations of $100,000 for 20X9. There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.

Master Corporation holds 75 percent of Servant's voting shares. Servant reported net income of $50,000, and Master reported income from its own operations of $100,000 for 20X9. There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.Based on the preceding information,in the preparation of the 20X9 consolidated balance sheet,machine will be:

A) debited for $1,000.

B) debited for $15,000.

C) credited for $45,000.

D) debited for $25,000.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

52

Blue Corporation holds 70 percent of Black Company's voting common stock. On January 1, 20X3, Black paid $500,000 to acquire a building with a 10-year expected economic life. Black uses straight-line depreciation for all depreciable assets. On December 31, 20X8, Blue purchased the building from Black for $180,000. Blue reported income, excluding investment income from Black, of $140,000 and $162,000 for 20X8 and 20X9, respectively. Black reported net income of $30,000 and $45,000 for 20X8 and 20X9, respectively.

Based on the preceding information,the amount of income assigned to the controlling shareholders in the consolidated income statement for 20X9 will be:

A) $207,000.

B) $202,000.

C) $212,000.

D) $190,000.

Based on the preceding information,the amount of income assigned to the controlling shareholders in the consolidated income statement for 20X9 will be:

A) $207,000.

B) $202,000.

C) $212,000.

D) $190,000.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

53

Peanut Company acquired 75 percent of Snoopy Company's stock at underlying book value on January 1,20X8.At that date,the fair value of the noncontrolling interest was equal to 25 percent of the book value of Snoopy Company.Snoopy Company reported shares outstanding of $350,000 and retained earnings of $100,000.During 20X8,Snoopy Company reported net income of $60,000 and paid dividends of $3,000.In 20X9,Snoopy Company reported net income of $90,000 and paid dividends of $15,000.The following transactions occurred between Peanut Company and Snoopy Company in 20X8 and 20X9:

Snoopy Co.sold equipment to Peanut Co.for a $42,000 gain on December 31,20X8.Snoopy Co.had originally purchased the equipment for $140,000 and it had a carrying value of $28,000 on December 31,20X8.At the time of the purchase,Peanut Co.estimated that the equipment still had a seven-year remaining useful life.

Peanut sold land costing $90,000 to Snoopy Company on June 28,20X9,for $110,000.

Required:

Give all consolidating entries needed to prepare a consolidation worksheet for 20X9 assuming that Peanut Co.uses the cost method to account for its investment in Snoopy Company.

Problem 57 (continued):

Snoopy Co.sold equipment to Peanut Co.for a $42,000 gain on December 31,20X8.Snoopy Co.had originally purchased the equipment for $140,000 and it had a carrying value of $28,000 on December 31,20X8.At the time of the purchase,Peanut Co.estimated that the equipment still had a seven-year remaining useful life.

Peanut sold land costing $90,000 to Snoopy Company on June 28,20X9,for $110,000.

Required:

Give all consolidating entries needed to prepare a consolidation worksheet for 20X9 assuming that Peanut Co.uses the cost method to account for its investment in Snoopy Company.

Problem 57 (continued):

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

54

Mortar Corporation acquired 80 percent of Granite Corporation's voting common stock on January 1, 20X7. On January 1, 20X8, Mortar received $350,000 from Granite for equipment Mortar had purchased on January 1, 20X5, for $400,000. The equipment is expected to have a 10-year useful life and no salvage value. Both companies depreciate equipment on a straight-line basis.

Based on the preceding information,in the preparation of the 20X9 consolidated income statement,depreciation expense will be:

A) Debited for $40,000 in the consolidating entries.

B) Credited for $10,000 in the consolidating entries.

C) Debited for $10,000 in the consolidating entries.

D) Credited for $40,000 in the consolidating entries.

Based on the preceding information,in the preparation of the 20X9 consolidated income statement,depreciation expense will be:

A) Debited for $40,000 in the consolidating entries.

B) Credited for $10,000 in the consolidating entries.

C) Debited for $10,000 in the consolidating entries.

D) Credited for $40,000 in the consolidating entries.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

55

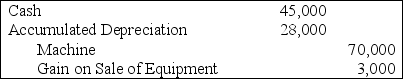

On January 1, 20X7, Servant Company purchased a machine with an expected economic life of five years. On January 1, 20X9, Servant sold the machine to Master Corporation and recorded the following entry:

Master Corporation holds 75 percent of Servant's voting shares. Servant reported net income of $50,000, and Master reported income from its own operations of $100,000 for 20X9. There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.

Master Corporation holds 75 percent of Servant's voting shares. Servant reported net income of $50,000, and Master reported income from its own operations of $100,000 for 20X9. There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.

Based on the preceding information,in the preparation of the 20X9 consolidated income statement,depreciation expense will be:

A) Debited for $1,000 in the consolidating entries.

B) Credited for $1,000 in the consolidating entries.

C) Debited for $15,000 in the consolidating entries.

D) Credited for $15,000 in the consolidating entries.

Master Corporation holds 75 percent of Servant's voting shares. Servant reported net income of $50,000, and Master reported income from its own operations of $100,000 for 20X9. There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.

Master Corporation holds 75 percent of Servant's voting shares. Servant reported net income of $50,000, and Master reported income from its own operations of $100,000 for 20X9. There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.Based on the preceding information,in the preparation of the 20X9 consolidated income statement,depreciation expense will be:

A) Debited for $1,000 in the consolidating entries.

B) Credited for $1,000 in the consolidating entries.

C) Debited for $15,000 in the consolidating entries.

D) Credited for $15,000 in the consolidating entries.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

56

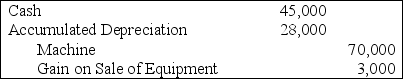

On January 1, 20X7, Servant Company purchased a machine with an expected economic life of five years. On January 1, 20X9, Servant sold the machine to Master Corporation and recorded the following entry:

Master Corporation holds 75 percent of Servant's voting shares. Servant reported net income of $50,000, and Master reported income from its own operations of $100,000 for 20X9. There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.

Master Corporation holds 75 percent of Servant's voting shares. Servant reported net income of $50,000, and Master reported income from its own operations of $100,000 for 20X9. There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.

Based on the preceding information,income assigned to the noncontrolling interest in the 20X9 consolidated income statement will be:

A) $12,000.

B) $14,000.

C) $12,500.

D) $48,000.

Master Corporation holds 75 percent of Servant's voting shares. Servant reported net income of $50,000, and Master reported income from its own operations of $100,000 for 20X9. There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.

Master Corporation holds 75 percent of Servant's voting shares. Servant reported net income of $50,000, and Master reported income from its own operations of $100,000 for 20X9. There is no change in the estimated economic life of the equipment as a result of the intercorporate transfer.Based on the preceding information,income assigned to the noncontrolling interest in the 20X9 consolidated income statement will be:

A) $12,000.

B) $14,000.

C) $12,500.

D) $48,000.

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck

57

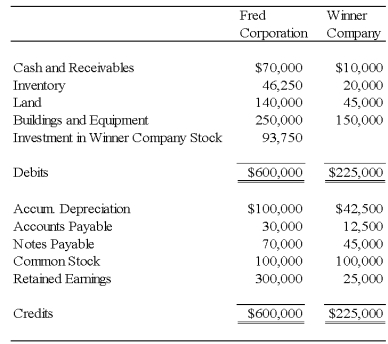

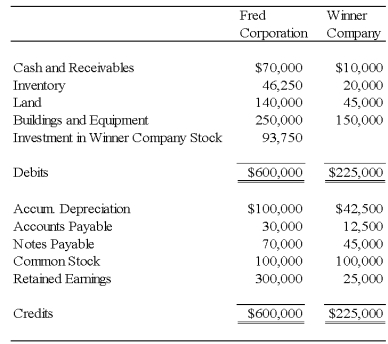

Fred Corporation owns 75 percent of Winner Company's voting shares,acquired on March 21,20X5,at book value.At that date,the fair value of the noncontrolling interest was equal to 25 percent of the book value of Winner Company.

On January 1,20X4,Fred paid $150,000 for equipment with a 10-year expected total economic life.The equipment was depreciated on a straight-line basis with no residual value.Winner purchased the equipment from Fred on December 31,20X6,for $140,000.Winner sold land it had purchased for $75,000 on February 18,20X4,to Fred for $60,000 on October 10,20X7.

Required: Prepare the consolidation entries for 20X8 related to the sale of depreciable assets and land if Fred uses the fully adjusted equity method to account for its investment in Winner.

Problem 54 (continued):

On January 1,20X4,Fred paid $150,000 for equipment with a 10-year expected total economic life.The equipment was depreciated on a straight-line basis with no residual value.Winner purchased the equipment from Fred on December 31,20X6,for $140,000.Winner sold land it had purchased for $75,000 on February 18,20X4,to Fred for $60,000 on October 10,20X7.

Required: Prepare the consolidation entries for 20X8 related to the sale of depreciable assets and land if Fred uses the fully adjusted equity method to account for its investment in Winner.

Problem 54 (continued):

Unlock Deck

Unlock for access to all 57 flashcards in this deck.

Unlock Deck

k this deck