Deck 21: Capital Budgeting and Cost Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/150

Play

Full screen (f)

Deck 21: Capital Budgeting and Cost Analysis

1

Capital budgeting is the process of making long-run planning decisions for investments in projects.

True

2

Which of the following is a stage of the capital budgeting process during which a plant manager is queried for assembly time?

A) make decisions by choosing among alternatives stage

B) obtain information stage

C) make predictions stage

D) implement the decision, evaluate performance, and learn stage

A) make decisions by choosing among alternatives stage

B) obtain information stage

C) make predictions stage

D) implement the decision, evaluate performance, and learn stage

B

3

Match each one of the examples below with one of the stages of the capital budgeting decision model.

Stages:

Stages:

4

List the capital budgeting methods used to analyze financial information.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is a stage of the capital budgeting process that forecasts all potential cash flows attributable to the alternative projects?

A) identify projects stage

B) make decisions by choosing among alternatives stage

C) implement the decision, evaluate performance, and learn stage

D) make predictions stage

A) identify projects stage

B) make decisions by choosing among alternatives stage

C) implement the decision, evaluate performance, and learn stage

D) make predictions stage

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is the first stage to the capital budgeting process?

A) forecast all potential cash flows attributable to the alternative projects

B) determine which investment yields the greatest benefit and the least cost to the organization

C) obtain funding and make the investments selected

D) identify potential capital investments that agree with the organization's strategy

A) forecast all potential cash flows attributable to the alternative projects

B) determine which investment yields the greatest benefit and the least cost to the organization

C) obtain funding and make the investments selected

D) identify potential capital investments that agree with the organization's strategy

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is a stage of the capital budgeting process in which a firm obtains funding for the project?

A) make decisions by choosing among alternatives stage

B) identify projects stage

C) obtain information stage

D) implement the decision, evaluate performance, and learn stage

A) make decisions by choosing among alternatives stage

B) identify projects stage

C) obtain information stage

D) implement the decision, evaluate performance, and learn stage

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

8

In the "Identify projects" stage of capital budgeting,companies gather information from all parts of the value chain to evaluate alternative projects.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

9

In the "make decisions by choosing among alternatives" stage of the capital budgeting process,a company determines which investment yields the greatest benefit and the least cost to the organization.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

10

In the "obtain information" stage of capital budgeting,a company gathers information from all parts of the value chain to evaluate alternative projects.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

11

Which capital budgeting technique measures all expected future cash inflows and outflows as if they occurred at a single point in time?

A) net present value method

B) accrual accounting rate-of-return method

C) payback method

D) sensitivity analysis

A) net present value method

B) accrual accounting rate-of-return method

C) payback method

D) sensitivity analysis

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

12

In the "make predictions" stage of the capital budgeting process,a company forecasts all potential net income additions those are attributable to the alternative projects.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is a stage of the capital budgeting process that determines which investment yields the greatest benefit and the least cost to an organization?

A) make decisions by choosing among alternatives stage

B) make predictions stage

C) identify projects stage

D) implement the decision, evaluate performance, and learn stage

A) make decisions by choosing among alternatives stage

B) make predictions stage

C) identify projects stage

D) implement the decision, evaluate performance, and learn stage

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is a stage of the capital budgeting process that indicates potential capital investments that agree with an organization's strategy?

A) identify projects stage

B) make predictions stage

C) obtain information stage

D) implement the decision, evaluate performance, and learn stage

A) identify projects stage

B) make predictions stage

C) obtain information stage

D) implement the decision, evaluate performance, and learn stage

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

15

A capital budget spans only a one-year period.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

16

The final activity in the capital budgeting process is to obtain funding and make the investments identified in the make decisions by choosing among alternatives stage of the process.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

17

The accounting system that corresponds to the project dimension in capital budgeting is the ________.

A) net present value method

B) internal rate of return

C) accrual accounting rate of return

D) life-cycle costing

A) net present value method

B) internal rate of return

C) accrual accounting rate of return

D) life-cycle costing

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is a stage of the capital-budgeting process that tracks realized cash flows and compares those against estimated numbers?

A) implement the decision, evaluate performance, and learn stage

B) make predictions stage

C) identify projects stage

D) make decisions by choosing among alternatives stage

A) implement the decision, evaluate performance, and learn stage

B) make predictions stage

C) identify projects stage

D) make decisions by choosing among alternatives stage

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following involves the process of making decisions for significant financial investments in projects to develop new products,expand production capacity,or remodel current production facilities?

A) capital budgeting

B) working capital management

C) master budgeting

D) capitalization

A) capital budgeting

B) working capital management

C) master budgeting

D) capitalization

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

20

Capital budgeting is a process of ________.

A) tracing overhead costs to products by focusing on the activities that drive costs

B) assigning identified costs to specific cost objectives or cost centers

C) measuring an organization's operations, products, and services against those of competitors recognized as market leaders

D) making long-run planning decisions for investments in projects

A) tracing overhead costs to products by focusing on the activities that drive costs

B) assigning identified costs to specific cost objectives or cost centers

C) measuring an organization's operations, products, and services against those of competitors recognized as market leaders

D) making long-run planning decisions for investments in projects

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

21

Net present value is calculated using the ________.

A) internal rate of return

B) discount rate

C) risk-free rate

D) predetermined overhead cost rate

A) internal rate of return

B) discount rate

C) risk-free rate

D) predetermined overhead cost rate

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

22

If the net present value for a project is positive,________.

A) the project should be accepted

B) its internal rate of return is more than its cost of capital

C) its expected rate of return is below the required rate of return

D) its internal rate of return is less than its cost of capital

A) the project should be accepted

B) its internal rate of return is more than its cost of capital

C) its expected rate of return is below the required rate of return

D) its internal rate of return is less than its cost of capital

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

23

Discounted cash flow methods for capital budgeting focus on ________.

A) cash inflows and required rate of return

B) operating income and required rate of return

C) operating income and cost of capital

D) working capital and cost of capital

A) cash inflows and required rate of return

B) operating income and required rate of return

C) operating income and cost of capital

D) working capital and cost of capital

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

24

Answer the following questions using the information below:

Diemia Hospital has been considering the purchase of a new x-ray machine. The existing machine is operable for five more years and will have a zero disposal price. If the machine is disposed now, it may be sold for $80,000. The new machine will cost $600,000 and an additional cash investment in working capital of $25,000 will be required. The new machine will reduce the average amount of time required to take the x-rays and will allow an additional amount of business to be done at the hospital. The investment is expected to net $50,000 in additional cash inflows during the year of acquisition and $200,000 each additional year of use. The new machine has a five-year life, and zero disposal value. These cash flows will generally occur throughout the year and are recognized at the end of each year. Income taxes are not considered in this problem. The working capital investment will not be recovered at the end of the asset's life.

What is the net present value of the investment,assuming the required rate of return is 11%? Would the hospital want to purchase the new machine?

A) $(59,050); no

B) $55,430 no

C) $59,050; yes

D) $55,430; yes

Diemia Hospital has been considering the purchase of a new x-ray machine. The existing machine is operable for five more years and will have a zero disposal price. If the machine is disposed now, it may be sold for $80,000. The new machine will cost $600,000 and an additional cash investment in working capital of $25,000 will be required. The new machine will reduce the average amount of time required to take the x-rays and will allow an additional amount of business to be done at the hospital. The investment is expected to net $50,000 in additional cash inflows during the year of acquisition and $200,000 each additional year of use. The new machine has a five-year life, and zero disposal value. These cash flows will generally occur throughout the year and are recognized at the end of each year. Income taxes are not considered in this problem. The working capital investment will not be recovered at the end of the asset's life.

What is the net present value of the investment,assuming the required rate of return is 11%? Would the hospital want to purchase the new machine?

A) $(59,050); no

B) $55,430 no

C) $59,050; yes

D) $55,430; yes

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

25

Explain capital budgeting and then briefly discuss each of the five stages of a capital budgeting project?

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following capital budgeting methods uses discounted cash flows?

A) accrual accounting rate-of-return method

B) net present value method

C) projected income method

D) payback method

A) accrual accounting rate-of-return method

B) net present value method

C) projected income method

D) payback method

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

27

Cast Iron Stove Company wants to buy a molding machine that can be integrated into its computerized manufacturing process.It has received three bids for the machine and related manufacturer's specifications.The bids range from $3,500,000 to $3,550,000.The estimated annual savings of the machines range from $260,000 to $270,000.The payback periods are almost identical and the net present values are all within $8,000 of each other.The president just doesn't know what to do about which vendor to choose since all of the selection criteria are so close together.

Required:

What suggestions do you have for the president?

Required:

What suggestions do you have for the president?

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

28

Assume your goal in life is to retire with 3 million dollars.How much would you need to save at the end of each year if investment rates average 8% and you have a 14-year work life?

A) $41,159

B) $ 123,891

C) $ 175,706

D) $ 82,582

A) $41,159

B) $ 123,891

C) $ 175,706

D) $ 82,582

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

29

The net present value method focuses on ________.

A) cash flows and discount rate

B) inventory cost and cost of capital

C) working capital and cost of capital

D) operating income and required rate of return

A) cash flows and discount rate

B) inventory cost and cost of capital

C) working capital and cost of capital

D) operating income and required rate of return

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

30

Answer the following questions using the information below:

Diemia Hospital has been considering the purchase of a new x-ray machine. The existing machine is operable for five more years and will have a zero disposal price. If the machine is disposed now, it may be sold for $80,000. The new machine will cost $600,000 and an additional cash investment in working capital of $25,000 will be required. The new machine will reduce the average amount of time required to take the x-rays and will allow an additional amount of business to be done at the hospital. The investment is expected to net $50,000 in additional cash inflows during the year of acquisition and $200,000 each additional year of use. The new machine has a five-year life, and zero disposal value. These cash flows will generally occur throughout the year and are recognized at the end of each year. Income taxes are not considered in this problem. The working capital investment will not be recovered at the end of the asset's life.

What is the net present value of the investment,assuming the required rate of return is 18%? Would the hospital want to purchase the new machine?

A) $33,910; yes

B) $(46,650); no

C) $(46,650); yes

D) $50,800; yes

Diemia Hospital has been considering the purchase of a new x-ray machine. The existing machine is operable for five more years and will have a zero disposal price. If the machine is disposed now, it may be sold for $80,000. The new machine will cost $600,000 and an additional cash investment in working capital of $25,000 will be required. The new machine will reduce the average amount of time required to take the x-rays and will allow an additional amount of business to be done at the hospital. The investment is expected to net $50,000 in additional cash inflows during the year of acquisition and $200,000 each additional year of use. The new machine has a five-year life, and zero disposal value. These cash flows will generally occur throughout the year and are recognized at the end of each year. Income taxes are not considered in this problem. The working capital investment will not be recovered at the end of the asset's life.

What is the net present value of the investment,assuming the required rate of return is 18%? Would the hospital want to purchase the new machine?

A) $33,910; yes

B) $(46,650); no

C) $(46,650); yes

D) $50,800; yes

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

31

In using the net present value method,only projects with a zero or positive net present value are acceptable because ________.

A) the return from these projects equals or exceeds the cost of capital

B) a positive net present value on a particular project guarantees company profitability

C) the company will be able to pay the necessary payments on any loans secured to finance the project

D) it results in high payback period

A) the return from these projects equals or exceeds the cost of capital

B) a positive net present value on a particular project guarantees company profitability

C) the company will be able to pay the necessary payments on any loans secured to finance the project

D) it results in high payback period

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following projects is rejected on the basis of net present value method?

A) Project A with an NPV of $5,000

B) Project B with an NPV of $(7,000)

C) Project C with an NPV of $15,000

D) Project D with an NPV of $500

A) Project A with an NPV of $5,000

B) Project B with an NPV of $(7,000)

C) Project C with an NPV of $15,000

D) Project D with an NPV of $500

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

33

The capital budgeting method which calculates the expected monetary gain or loss from a project by discounting all expected future cash inflows and outflows to the present point in time using the required rate of return is the ________.

A) payback method

B) accrual accounting rate-of-return method

C) sensitivity method

D) net present value method

A) payback method

B) accrual accounting rate-of-return method

C) sensitivity method

D) net present value method

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

34

An annuity is ________.

A) a noncash expense

B) a series of equal cash flows at equal time intervals

C) an investment product whose funds are invested in the stock market

D) a rate at which an investment's present value of all expected cash inflows equals the present value of project's expected cash outflows.

A) a noncash expense

B) a series of equal cash flows at equal time intervals

C) an investment product whose funds are invested in the stock market

D) a rate at which an investment's present value of all expected cash inflows equals the present value of project's expected cash outflows.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

35

Answer the following questions using the information below:

Difend Cleaners has been considering the purchase of an industrial dry-cleaning machine. The existing machine is operable for three more years and will have a zero disposal price. If the machine is disposed now, it may be sold for $100,000. The new machine will cost $350,000 and an additional cash investment in working capital of $100,000 will be required. The new machine will reduce the average amount of time required to wash clothing and will decrease labor costs. The investment is expected to net $110,000 in additional cash inflows during the first year of acquisition and $250,000 each additional year of use. The new machine has a three-year life, and zero disposal value. These cash flows will generally occur throughout the year and are recognized at the end of each year. Income taxes are not considered in this problem. The working capital investment will not be recovered at the end of the asset's life.

What is the net present value of the investment,assuming the required rate of return is 20%? Would the company want to purchase the new machine?

A) $(62,600); yes

B) $(59,880); no

C) $59,880; yes

D) $62,600; no

Difend Cleaners has been considering the purchase of an industrial dry-cleaning machine. The existing machine is operable for three more years and will have a zero disposal price. If the machine is disposed now, it may be sold for $100,000. The new machine will cost $350,000 and an additional cash investment in working capital of $100,000 will be required. The new machine will reduce the average amount of time required to wash clothing and will decrease labor costs. The investment is expected to net $110,000 in additional cash inflows during the first year of acquisition and $250,000 each additional year of use. The new machine has a three-year life, and zero disposal value. These cash flows will generally occur throughout the year and are recognized at the end of each year. Income taxes are not considered in this problem. The working capital investment will not be recovered at the end of the asset's life.

What is the net present value of the investment,assuming the required rate of return is 20%? Would the company want to purchase the new machine?

A) $(62,600); yes

B) $(59,880); no

C) $59,880; yes

D) $62,600; no

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

36

Assume your goal in life is to retire with two million dollars.How much would you need to save at the end of each year if interest rates average 6% and you have a 25-year work life?

A) $43,118

B) $55,596

C) $36,453

D) $75,503

A) $43,118

B) $55,596

C) $36,453

D) $75,503

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

37

Concose Park Department is considering a new capital investment.The following information is available on the investment.The cost of the machine will be $330,000.The annual cost savings if the new machine is acquired will be $85,000.The machine will have a 5-year life,at which time the terminal disposal value is expected to be $32,000.Concose Park Department is assuming no tax consequences.If Concose Park Department has a required rate of return of 11%,which of the following is closest to the present value of the project?

A) $8,245

B) $24,836

C) $3,136

D) $15,840

A) $8,245

B) $24,836

C) $3,136

D) $15,840

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following is also called required rate of return?

A) hurdle rate

B) total cost rate

C) variance rate

D) predetermined overhead rate

A) hurdle rate

B) total cost rate

C) variance rate

D) predetermined overhead rate

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

39

Answer the following questions using the information below:

Difend Cleaners has been considering the purchase of an industrial dry-cleaning machine. The existing machine is operable for three more years and will have a zero disposal price. If the machine is disposed now, it may be sold for $100,000. The new machine will cost $350,000 and an additional cash investment in working capital of $100,000 will be required. The new machine will reduce the average amount of time required to wash clothing and will decrease labor costs. The investment is expected to net $110,000 in additional cash inflows during the first year of acquisition and $250,000 each additional year of use. The new machine has a three-year life, and zero disposal value. These cash flows will generally occur throughout the year and are recognized at the end of each year. Income taxes are not considered in this problem. The working capital investment will not be recovered at the end of the asset's life.

What is the net present value of the investment,assuming the required rate of return is 10%? Would the company want to purchase the new machine?

A) $144,240 ; yes

B) $180,000 ; yes

C) $(180,000); no

D) $(144,240); no

Difend Cleaners has been considering the purchase of an industrial dry-cleaning machine. The existing machine is operable for three more years and will have a zero disposal price. If the machine is disposed now, it may be sold for $100,000. The new machine will cost $350,000 and an additional cash investment in working capital of $100,000 will be required. The new machine will reduce the average amount of time required to wash clothing and will decrease labor costs. The investment is expected to net $110,000 in additional cash inflows during the first year of acquisition and $250,000 each additional year of use. The new machine has a three-year life, and zero disposal value. These cash flows will generally occur throughout the year and are recognized at the end of each year. Income taxes are not considered in this problem. The working capital investment will not be recovered at the end of the asset's life.

What is the net present value of the investment,assuming the required rate of return is 10%? Would the company want to purchase the new machine?

A) $144,240 ; yes

B) $180,000 ; yes

C) $(180,000); no

D) $(144,240); no

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

40

Assume your goal in life is to retire with $2,500,000.How much would you need to save at the end of each year if interest rates average 7% and you have a 20-year work life?

A) $30,130

B) $60,983

C) $250,205

D) $832,952

A) $30,130

B) $60,983

C) $250,205

D) $832,952

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

41

Midize Flower Company provides flowers and other nursery products for decorative purposes in medium to large sized restaurants and businesses.The company has been investigating the purchase of a new specially equipped van for deliveries.The van has a value of $66,645 with a seven-year life.The expected additional cash inflows are $15,000 per year.What is the internal rate of return?

A) 10%

B) 13%

C) 15%

D) 20%

A) 10%

B) 13%

C) 15%

D) 20%

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

42

The net present value method of capital budgeting is preferred over the internal rate-of-return method because ________.

A) the net present value method is expressed as a percentage of initial investment

B) the net present values of individual projects can be added to determine the effects of accepting a combination of projects

C) the percentage return computed under the net present value method is very easy to compare

D) the calculation under the net present value method is easy as it does not use time value of money

A) the net present value method is expressed as a percentage of initial investment

B) the net present values of individual projects can be added to determine the effects of accepting a combination of projects

C) the percentage return computed under the net present value method is very easy to compare

D) the calculation under the net present value method is easy as it does not use time value of money

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

43

The capital budgeting method that calculates the discount rate at which the present value of expected cash inflows from a project equals the present value of expected cash outflows is the ________.

A) net present value method

B) accrual accounting rate-of-return method

C) payback method

D) internal rate of return method

A) net present value method

B) accrual accounting rate-of-return method

C) payback method

D) internal rate of return method

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

44

Diamond Manufacturing Company provides glassware machines for major department store retailers.The company has been investigating a new piece of machinery for its production department.The old equipment has a remaining life of four years and the new equipment has a value of $87,776 with a four-year life.The expected additional cash inflows are $32,000 per year.What is the internal rate of return?

A) 10%

B) 12%

C) 17%

D) 20%

A) 10%

B) 12%

C) 17%

D) 20%

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

45

The Comil Corporation recently purchased a new machine for its factory operations at a cost of $390,875.The investment is expected to generate $125,000 in annual cash flows for a period of five years.The required rate of return is 12%.The old machine has a remaining life of five years.The new machine is expected to have zero value at the end of the five-year period.The disposal value of the old machine at the time of replacement is zero.What is the internal rate of return?

A) 15%

B) 16%

C) 17%

D) 18%

A) 15%

B) 16%

C) 17%

D) 18%

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

46

Locil Corporation recently purchased a new machine for $415,275 with a nine-year life.The old equipment has a remaining life of nine years and no disposal value at the time of replacement.Net cash flows will be $75,000 per year.What is the internal rate of return?

A) 11%

B) 16%

C) 20%

D) 24%

A) 11%

B) 16%

C) 20%

D) 24%

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

47

The net present value method assumes that project cash flows can be reinvested at the company's ________.

A) internal rate of return

B) required rate of return

C) growth rate

D) accounting rate of return

A) internal rate of return

B) required rate of return

C) growth rate

D) accounting rate of return

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

48

In capital budgeting,a project is accepted only if the internal rate of return equals or ________.

A) exceeds the required rate of return

B) exceeds the inflation rate

C) exceeds the risk-free rate

D) exceeds the accrual accounting rate of return

A) exceeds the required rate of return

B) exceeds the inflation rate

C) exceeds the risk-free rate

D) exceeds the accrual accounting rate of return

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

49

In situations where the required rate of return is not constant for each year of the project,it is advantageous to use ________.

A) the nominal rate-of-return method

B) the internal rate-of-return method

C) the net present value method

D) the projected income method

A) the nominal rate-of-return method

B) the internal rate-of-return method

C) the net present value method

D) the projected income method

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

50

Soda Manufacturing Company provides vending machines for soft-drink manufacturers.The company has been investigating a new piece of machinery for its production department.The old equipment has a remaining life of four years and the new equipment has a value of $91,110 with a four-year life.The expected additional cash inflows are $30,000 per year.What is the internal rate of return?

A) 12%

B) 16%

C) 10%

D) 8%

A) 12%

B) 16%

C) 10%

D) 8%

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

51

Forge Company wants to purchase a new cutting machine for its sewing plant.The investment is expected to generate annual cash inflows of $120,000.The required rate of return is 10% and the current machine is expected to last for four years.What is the maximum dollar amount the company would be willing to spend for the machine,assuming its life is also four years? Income taxes are not considered.

A) $273,500

B) $460,800

C) $355,950

D) $380,280

A) $273,500

B) $460,800

C) $355,950

D) $380,280

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

52

The Zeron Corporation wants to purchase a new machine for its factory operations at a cost of $380,000.The investment is expected to generate $125,000 in annual cash flows for a period of four years.The required rate of return is 12%.The old machine can be sold for $20,000.The machine is expected to have zero value at the end of the four-year period.What is the net present value of the investment? Would the company want to purchase the new machine? Income taxes are not considered.

A) $19,750; yes

B) $35,775; no

C) $360,000; yes

D) $163,005; no

A) $19,750; yes

B) $35,775; no

C) $360,000; yes

D) $163,005; no

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following is an advantage of internal rate of return method?

A) Sum of IRRs of individual projects gives an IRR of a combination or portfolio of projects.

B) The percentage returns computed under the IRR method are easy to understand and compare.

C) It can be expressed as a unique number.

D) It can be used when the required rate of return varies over the life of a project.

A) Sum of IRRs of individual projects gives an IRR of a combination or portfolio of projects.

B) The percentage returns computed under the IRR method are easy to understand and compare.

C) It can be expressed as a unique number.

D) It can be used when the required rate of return varies over the life of a project.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

54

The minimum annual acceptable rate of return on an investment is the ________.

A) accrual accounting rate of return

B) hurdle rate

C) internal rate of return

D) net present value

A) accrual accounting rate of return

B) hurdle rate

C) internal rate of return

D) net present value

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

55

A "what-if" technique that examines how a result will change if the original predicted data are NOT achieved or if an underlying assumption changes is called ________.

A) sensitivity analysis

B) net present value analysis

C) internal rate-of-return analysis

D) adjusted rate-of-return analysis

A) sensitivity analysis

B) net present value analysis

C) internal rate-of-return analysis

D) adjusted rate-of-return analysis

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

56

Hypore Darby Park Department is considering a new capital investment.The following information is available on the investment.The cost of the machine will be $251,130.The annual cost savings if the new machine is acquired will be $110,000.The machine will have a 3-year life,at which time the terminal disposal value is expected to be zero.Hypore Park Department is assuming no tax consequences.What is the internal rate of return for Hypore Park Department?

A) 10%

B) 15%

C) 14%

D) 16%

A) 10%

B) 15%

C) 14%

D) 16%

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

57

Investment A requires a net investment of $1,400,000.The required rate of return is 10% for the five-year annuity.What are the annual cash inflows if the net present value equals 0? (rounded)

A) $378,966

B) $369,296

C) $345,696

D) $251,466

A) $378,966

B) $369,296

C) $345,696

D) $251,466

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

58

The internal rate-of-return (IRR)method calculates ________.

A) the discount rate at which an investment's present value of the total of all expected cash inflows equals the present value of its expected cash outflows.

B) the discount rate at which an investment's future value of all expected cash inflows equals the present value of its expected cash outflows.

C) the discount rate at which an investment's total of all expected cash inflows equals the present value of its expected cash outflows.

D) the discount rate at which sum of an investment's present value of all expected cash inflows equals the present value of its expected cash outflows.

A) the discount rate at which an investment's present value of the total of all expected cash inflows equals the present value of its expected cash outflows.

B) the discount rate at which an investment's future value of all expected cash inflows equals the present value of its expected cash outflows.

C) the discount rate at which an investment's total of all expected cash inflows equals the present value of its expected cash outflows.

D) the discount rate at which sum of an investment's present value of all expected cash inflows equals the present value of its expected cash outflows.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

59

Forise Water Company drills small commercial water wells.The company is in the process of analyzing the purchase of a new drill.Information on the proposal is provided below. Initial investment:

Operations (per year for four years):

Disinvestment:

What is the net present value of the investment? Assume there is no recovery of working capital.

A) $(124,280)

B) $21,400

C) $82,724

D) $149,400

Operations (per year for four years):

Disinvestment:

What is the net present value of the investment? Assume there is no recovery of working capital.

A) $(124,280)

B) $21,400

C) $82,724

D) $149,400

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

60

The internal rate of return method assumes that project cash flows can be reinvested at the project's ________.

A) internal rate of return

B) required rate of return

C) growth rate

D) accounting rate of return

A) internal rate of return

B) required rate of return

C) growth rate

D) accounting rate of return

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

61

The payback method of capital budgeting approach to an investment decision ________.

A) considers cash flows over the life of the investment

B) highlights liquidity of the investment

C) considers time value of money

D) ignores the initial investment

A) considers cash flows over the life of the investment

B) highlights liquidity of the investment

C) considers time value of money

D) ignores the initial investment

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

62

ABC Boat Company is interested in replacing a molding machine with a new improved model.The old machine has a salvage value of $10,000 now and a predicted salvage value of $4,000 in six years,if rebuilt.If the old machine is kept,it must be rebuilt in one year at a predicted cost of $20,000.

The new machine costs $80,000 and has a predicted salvage value of $12,000 at the end of six years.If purchased,the new machine will allow cash savings of $20,000 for each of the first three years,and $10,000 for each year of its remaining six-year life.

Required:

What is the net present value of purchasing the new machine if the company has a required rate of return of 14%?

The new machine costs $80,000 and has a predicted salvage value of $12,000 at the end of six years.If purchased,the new machine will allow cash savings of $20,000 for each of the first three years,and $10,000 for each year of its remaining six-year life.

Required:

What is the net present value of purchasing the new machine if the company has a required rate of return of 14%?

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

63

The NPV method is the preferred method over IRR for selecting projects because ________.

A) its use leads to shareholder value maximization

B) it accounts for the time value of money

C) it assumes that cash flows are reinvested at the internal rate of return

D) it gives a project ranking consistent with that of IRR

A) its use leads to shareholder value maximization

B) it accounts for the time value of money

C) it assumes that cash flows are reinvested at the internal rate of return

D) it gives a project ranking consistent with that of IRR

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

64

Discounted cash flow methods focus on operating income.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

65

A capital budgeting project is accepted if the required rate of return equals or exceeds the internal rate of return.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

66

The Required Rate of Return (RRR)is set externally by creditors as the interest rate on long term liabilities.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

67

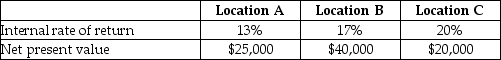

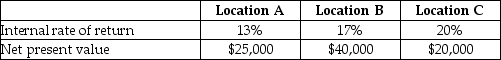

Retail Outlet is looking for a new location near a shopping mall.It is considering purchasing a building rather than leasing,as it has done in the past.Three retail buildings near a new mall are available but each has its own advantages and disadvantages.The owner of the company has completed an analysis of each location that includes considerations for the time value of money.The information is as follows:

The owner does not understand how the location with the highest percentage return has the lowest net present value.

The owner does not understand how the location with the highest percentage return has the lowest net present value.

Required:

Explain to the owner what is (are)the probable cause(s)of the comparable differences.

The owner does not understand how the location with the highest percentage return has the lowest net present value.

The owner does not understand how the location with the highest percentage return has the lowest net present value.Required:

Explain to the owner what is (are)the probable cause(s)of the comparable differences.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

68

The net present value method accurately assumes that project cash flows can only be reinvested at the company's required rate of return.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

69

The net present value method can be used in situations where the required rate of return varies over the life of the project.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

70

Network Service Center is considering purchasing a new computer network for $82,000.It will require additional working capital of $13,000.Its anticipated eight-year life will generate additional client revenue of $33,000 annually with operating costs,excluding depreciation,of $15,000.At the end of eight years,it will have a salvage value of $9,500 and return $5,000 in working capital.Taxes are not considered.

Required:

a.If the company has a required rate of return of 14%,what is the net present value of the proposed investment?

b.What is the internal rate of return?

Required:

a.If the company has a required rate of return of 14%,what is the net present value of the proposed investment?

b.What is the internal rate of return?

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

71

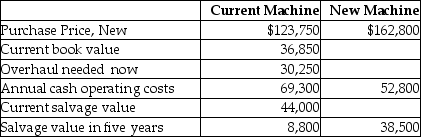

Flilane Tire Company needs to overhaul its auto lift system or buy a new one.The facts have been gathered,and they are as follows:

Required:

Required:

Which alternative is the most desirable with a current required rate of return of 15%? Show computations,and assume no taxes.

Required:

Required:Which alternative is the most desirable with a current required rate of return of 15%? Show computations,and assume no taxes.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

72

The net initial investment for a piece of construction equipment is $3,000,000.Annual cash inflows are expected to increase by $500,000 per year.The equipment has an 8-year useful life.What is the payback period?

A) 8 years

B) 6.5 years

C) 6 years

D) 5 years

A) 8 years

B) 6.5 years

C) 6 years

D) 5 years

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

73

The three common discounted cash flow methods are net present value,internal rate of return,and payback.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

74

The net present value (NPV)method calculates the expected monetary gain or loss from a project by discounting all expected future cash inflows and outflows back to the present point in time using the required rate of return.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

75

Managers prefer projects with higher IRRs to projects with lower IRRs,if all other things are equal.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

76

Internal rate of return is a method of calculating the expected net monetary gain or loss from a project by discounting all expected future cash inflows and outflows to the present point in time.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

77

The method that measures the time it will take to recoup,in the form of future cash inflows,the total dollars invested in a project is called ________.

A) the accrued accounting rate-of-return method

B) the payback method

C) the internal rate-of-return method

D) the book-value method

A) the accrued accounting rate-of-return method

B) the payback method

C) the internal rate-of-return method

D) the book-value method

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

78

If internal rate of return is less than required rate of return,the net present value is positive.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

79

The Enor Machine Company is evaluating a capital expenditure proposal that requires an initial investment of $99,360 and has predicted cash inflows of $20,000 per year for 8 years.It will have no salvage value.

Required:

a.Using a required rate of return of 10%,determine the net present value of the investment proposal.

b.Determine the proposal's internal rate of return.

Required:

a.Using a required rate of return of 10%,determine the net present value of the investment proposal.

b.Determine the proposal's internal rate of return.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck

80

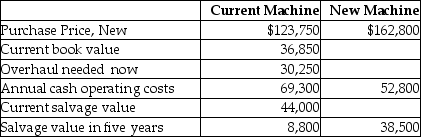

EIF Manufacturing Company needs to overhaul its drill press or buy a new one.The facts have been gathered,and they are as follows:

Required:

Required:

Which alternative is the most desirable with a current required rate of return of 20%? Show computations,and assume no taxes.

Required:

Required:Which alternative is the most desirable with a current required rate of return of 20%? Show computations,and assume no taxes.

Unlock Deck

Unlock for access to all 150 flashcards in this deck.

Unlock Deck

k this deck