Deck 20: Process Costing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/173

Play

Full screen (f)

Deck 20: Process Costing

1

A cellular phone manufacturer is more likely to use a process costing system rather than job order costing.

True

2

Under process costing,the costs incurred by each department are reported in a separate production cost report for each department.

True

3

Process costing is the most appropriate costing method for a restaurant serving specialty cuisine.

False

4

Both job order costing and process costing ________.

A) maintain a single Work-in-Process Inventory account

B) treat all period costs as product costs

C) follow last-in, first-out method for inventory valuation

D) have the same type of product costs

A) maintain a single Work-in-Process Inventory account

B) treat all period costs as product costs

C) follow last-in, first-out method for inventory valuation

D) have the same type of product costs

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

5

Under a process costing system,product costs are accumulated with respect to jobs completed.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

6

A textile manufacturing company is most likely to use job order costing to arrive at the cost per yard of textile manufactured and sold to customers.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

7

For each of the following statements,indicate whether the statement applies to Job Order Costing Systems (JO)or Process Costing Systems (PC).

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

8

Under a process costing system,costs of completed products are transferred to the Finished Goods Inventory at the end of the accounting period.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

9

A process costing system is most suitable for businesses that manufacture batches of unique products or provide specialized services.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following statements is TRUE of process costing?

A) It uses one Work-in-Process Inventory account.

B) It tracks and assigns both period costs and product costs to units produced.

C) It accumulates product costs by production departments.

D) It assigns manufacturing overhead costs to products only in the last production process.

A) It uses one Work-in-Process Inventory account.

B) It tracks and assigns both period costs and product costs to units produced.

C) It accumulates product costs by production departments.

D) It assigns manufacturing overhead costs to products only in the last production process.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

11

Under process costing,direct materials and direct labor are assigned to Work-in-Process Inventory for each process that uses them.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

12

The combined production costs from all departments for completed products are transferred to the Cost of Goods Sold account immediately after the completion of all production processes.The perpetual inventory system is used.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following businesses is most likely to use a process costing system?

A) an accounting firm

B) a law firm

C) a soda manufacturer

D) a construction company

A) an accounting firm

B) a law firm

C) a soda manufacturer

D) a construction company

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

14

Under process costing,a single Work-in-Process Inventory account is maintained for all processes,with a subsidiary ledger containing individual production cost reports for each process.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

15

In a process costing system,each process or department has its own Work-in-Process Inventory account.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

16

A process costing system is generally used by companies that produce homogeneous products.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

17

A process is one of a series of steps in manufacturing,usually associated with making large quantities of similar items.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

18

Both job order costing and process costing track the product costs of direct materials,direct labor,and manufacturing overhead through three inventory accounts on the balance sheet.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

19

Under process costing,the costs incurred by each department are reported in ________.The perpetual inventory system is used.

A) a job cost sheet

B) the Finished Goods Inventory account

C) the Cost of Goods Sold account

D) a production cost report

A) a job cost sheet

B) the Finished Goods Inventory account

C) the Cost of Goods Sold account

D) a production cost report

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

20

Companies that manufacture identical items through a series of uniform production steps use ________ to determine the cost per unit produced.

A) a process costing system

B) a job order costing system

C) both of the above systems

D) neither of the above systems

A) a process costing system

B) a job order costing system

C) both of the above systems

D) neither of the above systems

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

21

The equivalent units of production for direct materials and conversion costs must be the same.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

22

Duran Manufacturing uses a process costing system and manufactures its product in three departments.Which of the following is NOT a way in which Duran can use the cost per unit of each process?

A) Duran can look for ways to cut the costs when actual process costs are more than planned process costs.

B) Duran needs to set the selling price to cover the costs of making the product and provide a profit.

C) Duran can only use the cost per unit of each process if all units are fully completed at the end of the accounting period.

D) Duran needs to know the ending balances in the following accounts: Work-In-Process Inventory, Finished Goods Inventory, and Cost of Goods Sold.

A) Duran can look for ways to cut the costs when actual process costs are more than planned process costs.

B) Duran needs to set the selling price to cover the costs of making the product and provide a profit.

C) Duran can only use the cost per unit of each process if all units are fully completed at the end of the accounting period.

D) Duran needs to know the ending balances in the following accounts: Work-In-Process Inventory, Finished Goods Inventory, and Cost of Goods Sold.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

23

At the end of an accounting period,the costs assigned to a production department can be split into the cost of units fully completed and transferred out,and the cost of units partially completed and remaining in the Work-in-Process Inventory of that department.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

24

A characteristic of products that are produced in a series of steps or processes is that ________.

A) their costs are accumulated on a job cost record

B) they are homogeneous and made in large quantities

C) their costs are transferred to Finished Goods Inventory as jobs are completed

D) their costs are accounted for in one Work-in-Process Inventory account

A) their costs are accumulated on a job cost record

B) they are homogeneous and made in large quantities

C) their costs are transferred to Finished Goods Inventory as jobs are completed

D) their costs are accounted for in one Work-in-Process Inventory account

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

25

What does the concept of equivalent units of production allow businesses to measure?

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

26

In a process costing system with multiple departments,one Work-in-Process Inventory account is maintained and the costs are transferred when a job is completed.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

27

In a process costing system,direct materials,direct labor,and manufacturing overhead are assigned to Work-in-Process Inventory for each process that uses them.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

28

If 34,000 units are 80% complete with respect to direct materials,then the equivalent units of production for direct materials are ________.The weighted-average method is used.

A) 34,000 units

B) 27,200 units

C) 6800 units

D) 40,800 units

A) 34,000 units

B) 27,200 units

C) 6800 units

D) 40,800 units

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

29

In process costing,production costs are accumulated by process.At the end of the period,the total production costs incurred must be split into two components.What are these two components?

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

30

Singh Enterprises manufactures picture frames.Its production operations are divided into two departments - Assembly and Finishing.The company uses a process costing system.Singh incurred the following costs during the year to produce 6000 picture frames: If Singh can only sell 5100 picture frames during the year,what will be the cost per unit of the picture frames produced? (Round your answer to the nearest cent.)

A) $2.34

B) $1.99

C) $1.62

D) $1.90

A) $2.34

B) $1.99

C) $1.62

D) $1.90

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

31

In a process costing system,equivalent units must be calculated separately for materials and conversion costs.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

32

In a process costing system ________.

A) separate work-in-process inventory accounts are maintained for each process or department

B) work-in-process inventory employs one general ledger account with a subsidiary ledger

C) a job cost record is maintained for each job

D) costs are transferred when jobs are complete

A) separate work-in-process inventory accounts are maintained for each process or department

B) work-in-process inventory employs one general ledger account with a subsidiary ledger

C) a job cost record is maintained for each job

D) costs are transferred when jobs are complete

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

33

The Refining Department of SweetBeet,Inc.had 79,000 tons of sugar to account for in July.Of the 79,000 tons,49,000 tons were completed and transferred to the Boiling Department,and the remaining 30,000 tons were 50% complete.The materials required for production are added at the beginning of the process.Conversion costs are added evenly throughout the refining process.The weighted-average method is used.Calculate the total equivalent units of production for direct materials.

A) 64,000 units

B) 49,000 units

C) 15,000 units

D) 79,000 units

A) 64,000 units

B) 49,000 units

C) 15,000 units

D) 79,000 units

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

34

Martinez Products manufactures a line of desk chairs.Martinez's production operations are divided into two departments - Department 1 and Department 2.The company uses a process costing system.Martinez incurred the following costs during the year to produce 25,700 chairs: If Martinez sells 22,600 chairs during the year,what will be the cost per chair produced? (Round your answer to two decimal places.)

A) $33.60

B) $38.21

C) $44.77

D) $50.91

A) $33.60

B) $38.21

C) $44.77

D) $50.91

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following best describes the term equivalent units?

A) partially completed units expressed in terms of fully completed units

B) partially completed units of output that will be sold as is

C) substitute of units that are partially completed

D) different types of units that have same selling price

A) partially completed units expressed in terms of fully completed units

B) partially completed units of output that will be sold as is

C) substitute of units that are partially completed

D) different types of units that have same selling price

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

36

In a process costing system,a department's total production costs incurred in a particular period must equal the total costs transferred out of the department.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

37

Under process costing,the total production costs incurred in each process must be split between the units that have been completed in that process and transferred to the next process and the ________.

A) Finished Goods Inventory if it is the first process

B) units not completed and remaining in Work-in-Process Inventory for that department

C) Cost of Goods Sold when the units are sold

D) Work-in-Process Inventory of the previous department when there are no sales

A) Finished Goods Inventory if it is the first process

B) units not completed and remaining in Work-in-Process Inventory for that department

C) Cost of Goods Sold when the units are sold

D) Work-in-Process Inventory of the previous department when there are no sales

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

38

Under process costing,the unit cost of the completed units is less than the unit cost of the incomplete units.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

39

Jabari Manufacturing,a widgets manufacturing company,divides its production operations into three processes-Department 1,Department 2,and Department 3.The company uses a process costing system.Jabari incurred the following costs during the year to produce 4800 units: If Jabari could sell only 3100 units during the year,what will be the cost per unit of widget produced? (Round your answer to the nearest cent.)

A) $5.00

B) $3.54

C) $10.97

D) $7.08

A) $5.00

B) $3.54

C) $10.97

D) $7.08

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

40

In a process costing system,production costs are ________.

A) adjusted and allocated by jobs

B) not reported in Work-in-Process Inventory or Finished Goods Inventory

C) directly shown on the income statement

D) accumulated by process

A) adjusted and allocated by jobs

B) not reported in Work-in-Process Inventory or Finished Goods Inventory

C) directly shown on the income statement

D) accumulated by process

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

41

List the four steps,in the order of occurrence,that are used in preparing a production cost report.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

42

Alchemy Manufacturing produces a pesticide chemical and uses process costing.There are three processing departments-Mixing,Refining,and Packaging.On January 1,the first department-Mixing-had no beginning inventory.During January,56,000 fl.oz.of chemicals were started in production.Of these,30,000 fl.oz.were completed and 26,000 fl.oz.remained in process.In the Mixing Department,all direct materials are added at the beginning of the production process,and conversion costs are applied evenly throughout the process.The weighted-average method is used. At the end of the month,Alchemy calculated equivalent units.The ending inventory in the Mixing Department was 75% complete with respect to conversion costs.With respect to direct materials,what is the number of equivalent units in the ending inventory?

A) 19,500 equivalent units

B) 30,000 equivalent units

C) 56,000 equivalent units

D) 26,000 equivalent units

A) 19,500 equivalent units

B) 30,000 equivalent units

C) 56,000 equivalent units

D) 26,000 equivalent units

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following is a step in the preparation of a production cost report?

A) assignment of costs to units completed and units in process

B) summarization of the flow of physical units to the suppliers

C) computation of expected units of production

D) computation of amount of materials required for production

A) assignment of costs to units completed and units in process

B) summarization of the flow of physical units to the suppliers

C) computation of expected units of production

D) computation of amount of materials required for production

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

44

Conversion costs include the costs of purchasing and converting raw materials into finished products.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

45

The production cost reports show the calculations for the physical flows and the ________ flows of the products.

A) cash

B) price

C) cost

D) supply

A) cash

B) price

C) cost

D) supply

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

46

Conversion costs include ________.

A) direct labor and manufacturing overhead costs

B) direct material and direct labor costs

C) product and period costs

D) direct material, direct labor, and manufacturing overhead costs

A) direct labor and manufacturing overhead costs

B) direct material and direct labor costs

C) product and period costs

D) direct material, direct labor, and manufacturing overhead costs

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

47

In a production cost report,the number of units to account for must always be greater than the number of units accounted for.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

48

The Refining Department of Crystal Cane Sugar,Inc.had 56,000 tons of sugar to account for in December.Of the 56,000 tons,40,000 tons were completed and transferred to the Boiling Department,and the remaining 16,000 tons were 60% complete.The materials required for production are added at the beginning of the process.Conversion costs are added equally throughout the refining process.The weighted-average method is used.Calculate the total equivalent units of production for conversion costs.

A) 9600 units

B) 40,000 units

C) 49,600 units

D) 56,000 units

A) 9600 units

B) 40,000 units

C) 49,600 units

D) 56,000 units

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

49

A production cost report shows only the calculations for the physical flow of products.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

50

The task of summarizing the flow of physical units is one of the four steps involved in the preparation of the production cost report.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

51

The direct labor costs and manufacturing overhead costs required to produce finished goods from raw materials are called ________.

A) transferred in costs

B) cost of sales

C) finished goods costs

D) conversion costs

A) transferred in costs

B) cost of sales

C) finished goods costs

D) conversion costs

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

52

The weighted-average method determines the cost of equivalent units of production by accounting for beginning inventory costs separately from current period costs.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

53

Insetto Biological Manufacturing produces a pesticide chemical and uses process costing.There are three processing departments-Mixing,Refining,and Packaging.On January 1,the first department-Mixing-had no beginning inventory.During January,40,000 fl.oz.of chemicals were started in production.Of these,31,000 fl.oz.were completed and 9000 fl.oz.remained in process.In the Mixing Department,all direct materials are added at the beginning of the production process,and conversion costs are applied evenly throughout the process.The weighted-average method is used. At the end of the month,Insetto calculated equivalent units.The ending inventory in the Mixing Department was 60% complete with respect to conversion costs.With respect to conversion costs,how many equivalent units were calculated for the product that was completed and for ending inventory?

A) Product completed: 31,000 equivalent units; Products in ending inventory: 5400 equivalent units

B) Product completed: 31,000 equivalent units; Products in ending inventory: 9000 equivalent units

C) Product completed: 40,000 equivalent units; Products in ending inventory: 5400 equivalent units

D) Product completed: 40,000 equivalent units; Products in ending inventory: 9000 equivalent units

A) Product completed: 31,000 equivalent units; Products in ending inventory: 5400 equivalent units

B) Product completed: 31,000 equivalent units; Products in ending inventory: 9000 equivalent units

C) Product completed: 40,000 equivalent units; Products in ending inventory: 5400 equivalent units

D) Product completed: 40,000 equivalent units; Products in ending inventory: 9000 equivalent units

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

54

The number of equivalent units for direct materials and conversion costs must always be equal.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following statements correctly describes the term "conversion costs"?

A) the cost to convert finished goods to sales to customers

B) the cost incurred for direct and indirect materials during production

C) the cost of direct materials, direct labor, and manufacturing overhead costs incurred during production

D) the cost of direct labor combined with manufacturing overhead

A) the cost to convert finished goods to sales to customers

B) the cost incurred for direct and indirect materials during production

C) the cost of direct materials, direct labor, and manufacturing overhead costs incurred during production

D) the cost of direct labor combined with manufacturing overhead

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

56

What are conversion costs? In determining equivalent units of production,why are conversion costs calculated separately from direct materials?

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

57

In a production cost report,________ includes the number of units completed and transferred out of a process and the number of units remaining in ending WIP.The weighted-average method is used.

A) total units estimated for

B) total units budgeted for

C) total units accounted for

D) total units to account for

A) total units estimated for

B) total units budgeted for

C) total units accounted for

D) total units to account for

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

58

Under process costing,the number of units to account for must always be ________ the number of units accounted for.

A) greater than

B) lesser than

C) equal to

D) twice

A) greater than

B) lesser than

C) equal to

D) twice

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

59

A report prepared by a processing department for equivalent units of production,production costs,and the assignment of those costs to the completed and in-process units is called a(n)________.

A) organizational report

B) equivalent units report

C) job costing report

D) production cost report

A) organizational report

B) equivalent units report

C) job costing report

D) production cost report

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

60

In a production cost report,the number of total units to account for consists of ________.The weighted-average method is used.

A) units in process at the beginning of the period and units started or added during the period

B) units in process at the end of the period and units started or added during the period

C) units in process at the beginning of the period and units remaining at the end of the period

D) units of completed and transferred out products and total units produced

A) units in process at the beginning of the period and units started or added during the period

B) units in process at the end of the period and units started or added during the period

C) units in process at the beginning of the period and units remaining at the end of the period

D) units of completed and transferred out products and total units produced

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

61

ChemKill Manufacturing produces a chemical pesticide and uses process costing.There are three processing departments-Mixing,Refining,and Packaging.On January 1,the first department-Mixing-had a zero beginning balance.During January,44,000 gallons of chemicals were started into production.During the month,35,000 gallons were completed,and 9000 remained in process,partially completed.In the Mixing Department,all direct materials are added at the beginning of the production process,and conversion costs are applied evenly throughout the process. During January,the Mixing Department incurred $52,000 in direct materials costs and $211,000 in conversion costs.At the end of the month,the ending inventory in the Mixing Department was 60% complete with respect to conversion costs.The weighted-average method is used.

The total cost of the chemical pesticide in ending inventory was ________.(Round any intermediate calculations two decimal places,and your final answer to the nearest dollar.)

A) $211,000

B) $52,000

C) $38,808

D) $263,000

The total cost of the chemical pesticide in ending inventory was ________.(Round any intermediate calculations two decimal places,and your final answer to the nearest dollar.)

A) $211,000

B) $52,000

C) $38,808

D) $263,000

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

62

Equivalent units of production are calculated because

A) some units in ending work-in-process are incomplete at the end of the period.

B) sometimes departments switch from job order costing to process costing, and must recalculate units.

C) the number of equivalent units must always equal the total number of physical units

D) the equivalent cost per unit is used to determine the manufacturing overhead rate.

A) some units in ending work-in-process are incomplete at the end of the period.

B) sometimes departments switch from job order costing to process costing, and must recalculate units.

C) the number of equivalent units must always equal the total number of physical units

D) the equivalent cost per unit is used to determine the manufacturing overhead rate.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

63

Cost amounts that are transferred out of one department become the transferred in cost for the next department.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

64

The beginning inventory costs and the product costs of the current period are combined to determine the average cost of equivalent units of production under the ________.

A) equivalent units method

B) conversion costs method

C) first-in, first-out method

D) weighted-average method

A) equivalent units method

B) conversion costs method

C) first-in, first-out method

D) weighted-average method

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

65

The equivalent units of production for transferred in units are always 100% because ________.

A) they are the finished goods purchased and transferred to the next department

B) they are considered 100% complete with respect to the entire production process

C) they were 100% complete with respect to the previous department

D) they are not utilized for production in the subsequent department

A) they are the finished goods purchased and transferred to the next department

B) they are considered 100% complete with respect to the entire production process

C) they were 100% complete with respect to the previous department

D) they are not utilized for production in the subsequent department

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

66

The Assembly Department of ByteSize,Inc.,manufacturer of computers,incurred $280,000 in direct material costs and $70,000 in conversion costs.The equivalent units of production for direct materials and conversion costs are 1500 and 600,respectively.The weighted-average method is used.The cost per equivalent unit of production (EUP)for conversion costs is ________.(Round your answer to the nearest cent.)

A) $116.67 per EUP

B) $46.67 per EUP

C) $466.67 per EUP

D) $186.67 per EUP

A) $116.67 per EUP

B) $46.67 per EUP

C) $466.67 per EUP

D) $186.67 per EUP

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following formulas is used to calculate the cost per equivalent unit of production (EUP)for direct materials? The weighted-average method is used.

A) Cost per EUP for direct materials = Total conversion costs / Equivalent units of production for direct materials

B) Cost per EUP for direct materials = Total direct materials costs / Equivalent units of production for direct materials

C) Cost per EUP for direct materials = Total transferred in costs / Equivalent units for transferred in

D) Cost per EUP for direct materials = Total direct materials costs / Equivalent units of production for conversion costs

A) Cost per EUP for direct materials = Total conversion costs / Equivalent units of production for direct materials

B) Cost per EUP for direct materials = Total direct materials costs / Equivalent units of production for direct materials

C) Cost per EUP for direct materials = Total transferred in costs / Equivalent units for transferred in

D) Cost per EUP for direct materials = Total direct materials costs / Equivalent units of production for conversion costs

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

68

The Assembly Department of Binary,Inc.,a manufacturer of computers,had a beginning inventory of 5,000 units.During November,it assembled 2000 units and transferred them to the Packaging Department.It incurred $250,000 in direct materials and $75,000 in conversion costs.The ending inventory in November was 6000 units,which were 100% and 60% complete with respect to materials and conversion costs,respectively.Calculate the total equivalent units of production for conversion costs for November.The weighted-average method is used.

A) 2000 units

B) 8000 units

C) 5600 units

D) 3600 units

A) 2000 units

B) 8000 units

C) 5600 units

D) 3600 units

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

69

The Assembly Department of GigaGo,Inc.,manufacturer of computers,had 4500 units of beginning inventory in September,and 3000 units were transferred to it by the Production Department.The Assembly Department completed 1500 units during the month and transferred them to the Packaging Department.Calculate the total number of units accounted for by the Assembly Department if it had 6000 units in ending inventory.The weighted-average method is used.

A) 6000 units

B) 3000 units

C) 4500 units

D) 7500 units

A) 6000 units

B) 3000 units

C) 4500 units

D) 7500 units

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

70

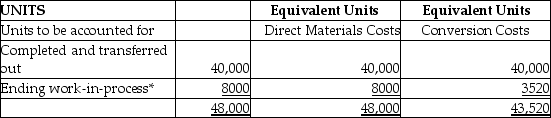

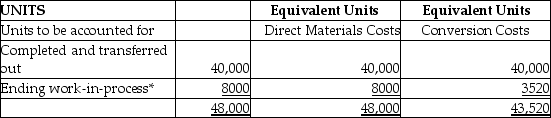

Pestiferous Manufacturing produces a chemical pesticide and uses process costing.There are three processing departments-Mixing,Refining,and Packaging.On January 1,the first department-Mixing-had no beginning inventory.During January,48,000 fl.oz.of chemicals were started in production.Of these,40,000 fl.oz.were completed,and 8000 fl.oz.remained in process.In the Mixing Department,all direct materials are added at the beginning of the production process,and conversion costs are applied evenly throughout the process. At the end of January,the equivalent unit data for the Mixing Department were as follows:

* Percent complete for conversion costs: 44%

* Percent complete for conversion costs: 44%

In addition to the above,the cost per equivalent unit were $1.35 for direct materials and $5.30 for conversion costs.Using this data,calculate the full cost of the ending WIP balance in the Mixing Department.The weighted-average method is used.

A) $43,520

B) $10,800

C) $29,456

D) $64,800

* Percent complete for conversion costs: 44%

* Percent complete for conversion costs: 44%In addition to the above,the cost per equivalent unit were $1.35 for direct materials and $5.30 for conversion costs.Using this data,calculate the full cost of the ending WIP balance in the Mixing Department.The weighted-average method is used.

A) $43,520

B) $10,800

C) $29,456

D) $64,800

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

71

Paraquat Manufacturing produces a chemical herbicide and uses process costing.There are three processing departments-Mixing,Refining,and Packaging.On January 1,the first department-Mixing-had a zero beginning balance.During January,42,000 gallons of chemicals were started into production.During the month,34,000 gallons were completed,and 8000 remained in process,partially completed.In the Mixing Department,all direct materials are added at the beginning of the production process,and conversion costs are applied evenly throughout the process. During January,the Mixing Department incurred $63,000 in direct materials costs and $240,000 in conversion costs.At the end of the month,the ending inventory in the Mixing Department was 60% complete with respect to conversion costs.First,calculate the equivalent units,then calculate the cost per equivalent unit,and then calculate the total cost of the product that was completed and transferred out during January.The weighted-average method is used.

The total cost of product transferred out was ________.(Round any intermediate calculations two decimal places,and your final answer to the nearest dollar.)

A) $51,000

B) $240,000

C) $303,000

D) $261,460

The total cost of product transferred out was ________.(Round any intermediate calculations two decimal places,and your final answer to the nearest dollar.)

A) $51,000

B) $240,000

C) $303,000

D) $261,460

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

72

The costs that were incurred in a previous process and brought into a later process as part of the product's cost are called ________ costs.

A) transferred in

B) transferred out

C) accounted for

D) to account for

A) transferred in

B) transferred out

C) accounted for

D) to account for

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

73

Four steps are necessary in preparing a production cost report: 1.Compute output in terms of equivalent units of production

2)Assign costs to units completed and units in process

3)Summarize the flow of physical units

4)Compute the cost per equivalent unit of production

Place these steps in the correct order.

A) 1, 3, 2, 4

B) 3, 1, 4, 2

C) 2, 1, 4, 3

D) 4, 2, 1, 3

2)Assign costs to units completed and units in process

3)Summarize the flow of physical units

4)Compute the cost per equivalent unit of production

Place these steps in the correct order.

A) 1, 3, 2, 4

B) 3, 1, 4, 2

C) 2, 1, 4, 3

D) 4, 2, 1, 3

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

74

The Assembly Department of Protocol,Inc.,manufacturer of computers,incurred $280,000 in direct material costs and $70,000 in conversion costs.The equivalent units of production for direct materials and conversion costs are 1000 and 900,respectively.The weighted-average method is used.The cost per equivalent unit of production for direct materials is ________.(Round your answer to the nearest cent.)

A) $77.78

B) $70.00

C) $311.11

D) $280.00

A) $77.78

B) $70.00

C) $311.11

D) $280.00

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

75

The equivalent units of production for transferred in units are always 100%.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

76

The Assembly Department of Interface,Inc.,manufacturer of computers,had 4500 units of beginning inventory in September,and 8000 units were transferred to it from the Production Department.The Assembly Department completed 4000 units during the month and transferred them to the Packaging Department.The weighted-average method is used.Calculate the total number of units to account for by the Assembly Department.

A) 3500 units

B) 8000 units

C) 4500 units

D) 12,500 units

A) 3500 units

B) 8000 units

C) 4500 units

D) 12,500 units

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

77

Herbicida Manufacturing produces a chemical herbicide and uses process costing.There are three processing departments-Mixing,Refining,and Packaging.On January 1,the first department-Mixing-had no beginning inventory.During January,40,000 fl.oz.of chemicals were started in production.Of these,34,000 fl.oz.were completed,and 6000 fl.oz.remained in process.In the Mixing Department,all direct materials are added at the beginning of the production process,and conversion costs are applied evenly throughout the process.The weighted-average method is used. At the end of the month,Herbicida calculated equivalent units in the Mixing Department as shown below:

* Percent complete for direct materials costs: 100%

Percent complete of completion for conversion costs: 60%

During January,the Mixing Department incurred $49,000 in direct materials costs and $213,000 in conversion costs.How much was the cost per equivalent unit for materials and for conversion costs?

(Use the weighted-average method and round your answer to the nearest cent.)

A) $8.17 per EUP for direct materials and $5.33 per EUP for conversion costs

B) $1.23 per EUP for direct materials and $6.26 per EUP for conversion costs

C) $1.44 per EUP for direct materials and $6.26 per EUP for conversion costs

D) $1.23 per EUP for direct materials and $5.66 per EUP for conversion costs

* Percent complete for direct materials costs: 100%

Percent complete of completion for conversion costs: 60%

During January,the Mixing Department incurred $49,000 in direct materials costs and $213,000 in conversion costs.How much was the cost per equivalent unit for materials and for conversion costs?

(Use the weighted-average method and round your answer to the nearest cent.)

A) $8.17 per EUP for direct materials and $5.33 per EUP for conversion costs

B) $1.23 per EUP for direct materials and $6.26 per EUP for conversion costs

C) $1.44 per EUP for direct materials and $6.26 per EUP for conversion costs

D) $1.23 per EUP for direct materials and $5.66 per EUP for conversion costs

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

78

Zucchero Sugar,Inc.has six processing departments for refining sugar-Affination,Carbonation,Decolorization,Boiling,Recovery,and Packaging.Conversion costs are added evenly throughout each process.Data from the month of August for the Recovery Department are as follows: The ending Work-in-Process Inventory is 100% and 85% complete with respect to direct materials and conversion costs,respectively.The weighted-average method is used.How many metric tons of sugar were refined and transferred to the Packaging Department in August?

A) 22,000 metric tons

B) 6000 metric tons

C) 16,000 metric tons

D) 28,000 metric tons

A) 22,000 metric tons

B) 6000 metric tons

C) 16,000 metric tons

D) 28,000 metric tons

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

79

The weighted-average method is used.In a process costing system with the first department,provide the formula (1)To account for and (2)Accounted for.

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck

80

Eco-Eliminator Manufacturing produces a chemical pesticide and uses process costing.There are three processing departments-Mixing,Refining,and Packaging.On January 1,the first department-Mixing-had no beginning inventory.During January,41,000 fl.oz.of chemicals were started in production.Of these,32,000 fl.oz.were completed,and 9000 fl.oz.remained in process.In the Mixing Department,all direct materials are added at the beginning of the production process,and conversion costs are applied evenly throughout the process.The weighted-average method is used. At the end of January,the equivalent unit data for the Mixing Department were as follows:

* Percent complete for conversion costs: 40%

In addition to the above,the cost per equivalent unit were $1.80 for direct materials and $5.25 for conversion costs.Using this data,calculate the cost of the units that were transferred out of the Mixing Department and into the Refining Department.

A) $168,000

B) $110,400

C) $225,600

D) $57,600

* Percent complete for conversion costs: 40%

In addition to the above,the cost per equivalent unit were $1.80 for direct materials and $5.25 for conversion costs.Using this data,calculate the cost of the units that were transferred out of the Mixing Department and into the Refining Department.

A) $168,000

B) $110,400

C) $225,600

D) $57,600

Unlock Deck

Unlock for access to all 173 flashcards in this deck.

Unlock Deck

k this deck