Deck 2: Recording Business Transactions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

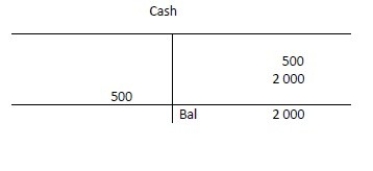

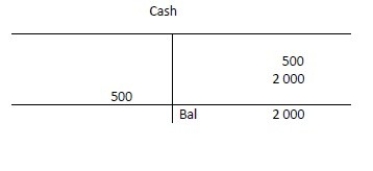

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

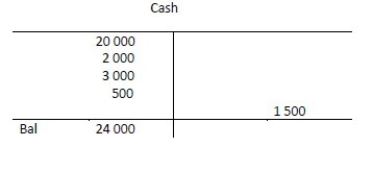

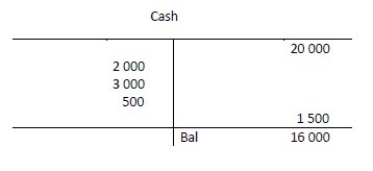

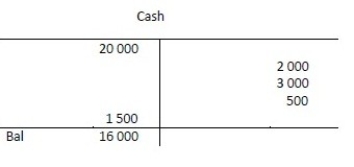

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/95

Play

Full screen (f)

Deck 2: Recording Business Transactions

1

Which of the following accounts is an example of an owners' equity account?

A) Cash

B) Equipment

C) Drawings

D) Accounts payable

A) Cash

B) Equipment

C) Drawings

D) Accounts payable

C

2

Which of the following accounts is NOT an example of an asset?

A) Building

B) Cash

C) Bills payable

D) Accounts receivable

A) Building

B) Cash

C) Bills payable

D) Accounts receivable

C

3

Which of the following accounts is NOT an example of a liability?

A) Accounts receivable

B) Bills payable

C) Accounts payable

D) Wages payable

A) Accounts receivable

B) Bills payable

C) Accounts payable

D) Wages payable

A

4

Which of the following is the detailed record of the changes in a particular asset,liability or owners' equity?

A) Ledger

B) Journal

C) Trial balance

D) Account

A) Ledger

B) Journal

C) Trial balance

D) Account

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following accounts is a liability?

A) Accounts payable

B) Prepaid expenses

C) Service revenue

D) Salary expense

A) Accounts payable

B) Prepaid expenses

C) Service revenue

D) Salary expense

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

6

A trial balance is a list of all of the accounts with their balances.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

7

In a typical chart of accounts,what information is provided along with the account name?

A) Dates of transactions

B) Account number

C) Account balance

D) Transaction amounts

A) Dates of transactions

B) Account number

C) Account balance

D) Transaction amounts

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

8

A listing of all account titles in numerical order is a(n):

A) ledger.

B) journal.

C) chart of accounts.

D) income statement.

A) ledger.

B) journal.

C) chart of accounts.

D) income statement.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following accounts is an owners' equity account?

A) Accrued liability

B) Prepaid expense

C) Accounts payable

D) Capital

A) Accrued liability

B) Prepaid expense

C) Accounts payable

D) Capital

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is NOT part of owners' equity?

A) Bills payable

B) Capital

C) Accounts receivable

D) Both A and C

A) Bills payable

B) Capital

C) Accounts receivable

D) Both A and C

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

11

An account is the detailed record of the changes in a particular asset,liability or owners' equity.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following accounts increases with a credit?

A) Accounts receivable

B) Cash

C) Capital

D) Prepaid expenses

A) Accounts receivable

B) Cash

C) Capital

D) Prepaid expenses

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

13

A book holding all of the accounts is called the:

A) balance sheet.

B) ledger.

C) journal.

D) income statement.

A) balance sheet.

B) ledger.

C) journal.

D) income statement.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following accounts decreases with a credit?

A) Cash

B) Bills payable

C) Accounts payable

D) Capital

A) Cash

B) Bills payable

C) Accounts payable

D) Capital

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following accounts decreases with a debit?

A) Prepaid insurance

B) Bills payable

C) Land

D) Cash

A) Prepaid insurance

B) Bills payable

C) Land

D) Cash

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

16

Accountants first record transactions in the:

A) trial balance.

B) journal.

C) ledger.

D) chart of accounts.

A) trial balance.

B) journal.

C) ledger.

D) chart of accounts.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following accounts is an example of a liability?

A) Bills payable

B) Service revenue

C) Accounts receivable

D) Building

A) Bills payable

B) Service revenue

C) Accounts receivable

D) Building

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following accounts is an asset?

A) Expenses

B) Drawings

C) Bills payable

D) Cash

A) Expenses

B) Drawings

C) Bills payable

D) Cash

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

19

A trial balance is the list of all of a company's accounts along with their account numbers.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

20

In a typical chart of accounts,liabilities appear before assets.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

21

For Revenues,the category of account and its normal balance are:

A) Assets and a debit balance.

B) Liabilities and a credit balance.

C) Owners' equity and a debit balance.

D) Owners' equity and a credit balance.

A) Assets and a debit balance.

B) Liabilities and a credit balance.

C) Owners' equity and a debit balance.

D) Owners' equity and a credit balance.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

22

For Expenses,the category of account and its normal balance are:

A) Assets and a debit balance.

B) Owners' equity and a credit balance.

C) Liabilities and a credit balance.

D) Owners' equity and a debit balance.

A) Assets and a debit balance.

B) Owners' equity and a credit balance.

C) Liabilities and a credit balance.

D) Owners' equity and a debit balance.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

23

The Accounts receivable account of Nuptials Ltd is shown below.

Accounts receivable

20,000

3000

5000

Calculate the ending balance of the account.

A) $18,000, debit

B) $5000, credit

C) $28,000, debit

D) $23,000, debit

Accounts receivable

20,000

3000

5000

Calculate the ending balance of the account.

A) $18,000, debit

B) $5000, credit

C) $28,000, debit

D) $23,000, debit

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

24

For Salary payable,the category of account and its normal balance are:

A) Owners' equity and a credit balance.

B) Liabilities and a credit balance.

C) Assets and a credit balance.

D) Assets and a debit balance.

A) Owners' equity and a credit balance.

B) Liabilities and a credit balance.

C) Assets and a credit balance.

D) Assets and a debit balance.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

25

The accounting process of copying a transaction from the journal to the ledger is called:

A) proofing.

B) footing.

C) posting.

D) journalising.

A) proofing.

B) footing.

C) posting.

D) journalising.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

26

For Accounts payable,the category of account and its normal balance are:

A) Assets and a credit balance.

B) Liabilities and a credit balance.

C) Owners' equity and a credit balance.

D) Assets and a debit balance.

A) Assets and a credit balance.

B) Liabilities and a credit balance.

C) Owners' equity and a credit balance.

D) Assets and a debit balance.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

27

A liability account is increased by a debit.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

28

The drawings account is increased by a debit.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

29

An asset account is increased by a debit.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is the last step of journalising an entry?

A) Determine whether each account has increased or decreased.

B) Identify each account affected and its type.

C) Record the transaction in the journal, including a brief explanation.

D) Post the accounts to the ledger.

A) Determine whether each account has increased or decreased.

B) Identify each account affected and its type.

C) Record the transaction in the journal, including a brief explanation.

D) Post the accounts to the ledger.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following accounts increases with a debit?

A) Cash

B) Accounts payable

C) Interest payable

D) Capital

A) Cash

B) Accounts payable

C) Interest payable

D) Capital

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

32

Journalising a transaction means:

A) recording the transaction, including a brief explanation.

B) calculating the balance in an account.

C) copying the information from the journal to the ledger.

D) finding the account number in the chart of accounts.

A) recording the transaction, including a brief explanation.

B) calculating the balance in an account.

C) copying the information from the journal to the ledger.

D) finding the account number in the chart of accounts.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

33

Debit refers to the right side of the T-account and credit refers to the left side.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

34

When a business collects cash,the Cash account is debited.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is the order of steps to journalise an entry?

A) Identify each account affected, record the transaction, determine increase or decrease in each account.

B) Record the transaction, identify each account affected, determine increase or decrease in each account.

C) Determine increase or decrease in each account, identify each account affected, record the transaction.

D) Identify each account affected, determine increase or decrease in each account, record the transaction.

A) Identify each account affected, record the transaction, determine increase or decrease in each account.

B) Record the transaction, identify each account affected, determine increase or decrease in each account.

C) Determine increase or decrease in each account, identify each account affected, record the transaction.

D) Identify each account affected, determine increase or decrease in each account, record the transaction.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

36

For Supplies,the category of account and its normal balance are:

A) Owners' equity and a credit balance.

B) Assets and a credit balance.

C) Liabilities and a credit balance.

D) Assets and a debit balance.

A) Owners' equity and a credit balance.

B) Assets and a credit balance.

C) Liabilities and a credit balance.

D) Assets and a debit balance.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

37

The first step of journalising an entry is to:

A) identify the transaction from source documents.

B) post the accounts to the ledger.

C) determine whether each account is increased or decreased.

D) record the transaction in the journal, including a brief explanation.

A) identify the transaction from source documents.

B) post the accounts to the ledger.

C) determine whether each account is increased or decreased.

D) record the transaction in the journal, including a brief explanation.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

38

After initially recording a transaction,the data is then copied or posted to the:

A) journal.

B) chart of accounts.

C) trial balance.

D) ledger.

A) journal.

B) chart of accounts.

C) trial balance.

D) ledger.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

39

For Capital,the category of account and its normal balance are:

A) Assets and a debit balance.

B) Assets and a credit balance.

C) Liabilities and a credit balance.

D) Owners' equity and a credit balance.

A) Assets and a debit balance.

B) Assets and a credit balance.

C) Liabilities and a credit balance.

D) Owners' equity and a credit balance.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

40

For Drawings,the category of account and its normal balance are:

A) Owners' equity and a credit balance.

B) Liabilities and a credit balance.

C) Assets and a credit balance.

D) Owners' equity and a debit balance.

A) Owners' equity and a credit balance.

B) Liabilities and a credit balance.

C) Assets and a credit balance.

D) Owners' equity and a debit balance.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following statements about revenue is CORRECT?

A) Revenues increase owners' equity, so a revenue account's normal balance is a credit balance.

B) Revenues decrease owners' equity, so a revenue account's normal balance is a debit balance.

C) Revenues increase owners' equity, so a revenue account's normal balance is a debit balance.

D) Revenues decrease owners' equity, so a revenue account's normal balance is a credit balance.

A) Revenues increase owners' equity, so a revenue account's normal balance is a credit balance.

B) Revenues decrease owners' equity, so a revenue account's normal balance is a debit balance.

C) Revenues increase owners' equity, so a revenue account's normal balance is a debit balance.

D) Revenues decrease owners' equity, so a revenue account's normal balance is a credit balance.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

42

A business makes a cash payment of $12 000 to an account payable.Which account is debited?

A) Accounts payable

B) Cash

C) Service revenue

D) Accounts receivable

A) Accounts payable

B) Cash

C) Service revenue

D) Accounts receivable

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

43

Assets,Drawings and Expenses have a normal balance on the debit side.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following is NOT an example of a source document?

A) Bank deposit slip

B) Purchase invoice

C) Journal

D) Sales invoice

A) Bank deposit slip

B) Purchase invoice

C) Journal

D) Sales invoice

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

45

An account that normally has a debit balance may occasionally have a credit balance.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

46

For liabilities and revenues,a debit increases the account.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

47

A journal entry includes BOTH debit and credit amounts.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

48

A business purchased $200 of supplies on credit and recorded the following journal entry:

Which of the following sets of ledger accounts reflects the posting of this transaction?

A)

B)

C)

D)

Which of the following sets of ledger accounts reflects the posting of this transaction?

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

49

The normal sequence of information flow in an accounting system is:

A) source document, ledger, journal.

B) journal, source document, ledger.

C) source document, journal, ledger.

D) ledger, journal, source document.

A) source document, ledger, journal.

B) journal, source document, ledger.

C) source document, journal, ledger.

D) ledger, journal, source document.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

50

When recording a transaction in a journal,the credit side is entered first,followed by the debit side.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

51

A business purchases equipment by paying $9023 in cash and issuing a loan payable of $16,446.Which of the following occurs?

A) Cash is debited for $9023, equipment is credited for $16,446 and loan payable is debited for $7423.

B) Cash is debited for $9023, equipment is debited for $16,446 and loan payable is credited for $25,469.

C) Cash is credited for $9023, equipment is debited for $25,469 and loan payable is credited for $16,446.

D) Cash is credited for $9023, equipment is credited for $25,469 and loan payable is debited for $16,446.

A) Cash is debited for $9023, equipment is credited for $16,446 and loan payable is debited for $7423.

B) Cash is debited for $9023, equipment is debited for $16,446 and loan payable is credited for $25,469.

C) Cash is credited for $9023, equipment is debited for $25,469 and loan payable is credited for $16,446.

D) Cash is credited for $9023, equipment is credited for $25,469 and loan payable is debited for $16,446.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

52

A business makes a payment of $1440 on a loan payable,consisting of a $110 interest payment and a $1330 principal payment.Which of the following journal entries would be recorded?

A) Loan payable is credited for $1330, Cash is credited for $110 and Interest expense is debited for $1440.

B) Cash is credited for $1440, Loan payable is debited for $1330 and Interest expense is debited for $110.

C) Loan payable is credited for $1440, Cash is debited for $1330 and Interest expense is debited for $110.

D) Cash is credited for $1330, Interest expense is credited for $110 and Loan payable is debited for $1440.

A) Loan payable is credited for $1330, Cash is credited for $110 and Interest expense is debited for $1440.

B) Cash is credited for $1440, Loan payable is debited for $1330 and Interest expense is debited for $110.

C) Loan payable is credited for $1440, Cash is debited for $1330 and Interest expense is debited for $110.

D) Cash is credited for $1330, Interest expense is credited for $110 and Loan payable is debited for $1440.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

53

A business pays $500 cash for supplies.Which account is debited?

A) Service revenue

B) Cash

C) Accounts payable

D) Supplies

A) Service revenue

B) Cash

C) Accounts payable

D) Supplies

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

54

An owner invests $20 000 in her new business by depositing the cash in the business bank account.Which account is credited?

A) Accounts receivable

B) Accounts payable

C) Cash

D) Capital

A) Accounts receivable

B) Accounts payable

C) Cash

D) Capital

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

55

A business makes a cash payment of $12 000 to an account payable.Which account is credited?

A) Service revenue

B) Accounts receivable

C) Accounts payable

D) Cash

A) Service revenue

B) Accounts receivable

C) Accounts payable

D) Cash

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

56

A business renders services to a customer for $16 000 on credit.Which account is credited?

A) Accounts receivable

B) Cash

C) Service revenue

D) Accounts payable

A) Accounts receivable

B) Cash

C) Service revenue

D) Accounts payable

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

57

A business purchases equipment for cash in the amount of $8 000.Which account is debited?

A) Cash

B) Accounts payable

C) Equipment

D) Supplies expense

A) Cash

B) Accounts payable

C) Equipment

D) Supplies expense

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

58

Beetles Ltd recorded the following journal entry on 2 March 2016:

From the journal entry above,identify the transaction on 2 March 2016.

A) Beetles sold goods for $6000 cash.

B) Beetles received $6000 for services to be performed in a later period.

C) Beetles purchased goods worth $6000 and signed a one-year bill for the same.

D) Beetles paid $6000 for services to be received at a later date.

From the journal entry above,identify the transaction on 2 March 2016.

A) Beetles sold goods for $6000 cash.

B) Beetles received $6000 for services to be performed in a later period.

C) Beetles purchased goods worth $6000 and signed a one-year bill for the same.

D) Beetles paid $6000 for services to be received at a later date.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

59

An owner invests $20 000 in her new business by depositing the cash in the business bank account.Which account is debited?

A) Accounts payable

B) Cash

C) Accounts receivable

D) Capital

A) Accounts payable

B) Cash

C) Accounts receivable

D) Capital

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

60

A business renders services for $16 000 and collects cash from the customer.Which account is debited?

A) Service revenue

B) Cash

C) Accounts payable

D) Accounts receivable

A) Service revenue

B) Cash

C) Accounts payable

D) Accounts receivable

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

61

The following transactions for the month of March have been journalised and posted to the proper accounts.

Mar 1 Martinez invested $10,000 cash in his new design services business.

Mar 2 Paid the first month's rent of $500.

Mar 3 Purchased equipment by paying $1000 cash and executing a loan payable for $5000.

Mar 4 Purchased office supplies for $750 cash.

Mar 5 Billed a client for $11,000 of design services completed.

Mar 6 Received $7000 on account for the services previously recorded.

What is the ending balance in the Service revenue account?

A) $17,000

B) $10,000

C) $7000

D) $11,000

Mar 1 Martinez invested $10,000 cash in his new design services business.

Mar 2 Paid the first month's rent of $500.

Mar 3 Purchased equipment by paying $1000 cash and executing a loan payable for $5000.

Mar 4 Purchased office supplies for $750 cash.

Mar 5 Billed a client for $11,000 of design services completed.

Mar 6 Received $7000 on account for the services previously recorded.

What is the ending balance in the Service revenue account?

A) $17,000

B) $10,000

C) $7000

D) $11,000

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

62

The following transactions for the month of March have been journalised and posted to the proper accounts.

Mar 1 Martinez invested $9000 cash in his new design services business.

Mar 2 Paid the first month's rent of $900.

Mar 3 Purchased equipment by paying $4000 cash and executing a loan payable for $9000.

Mar 4 Purchased office supplies for $750 cash.

Mar 5 Billed a client for $8000 of design services completed.

Mar 6 Received $7900 on account for the services previously recorded.

What is the balance in Cash?

A) $12,900

B) $11,250

C) $12,150

D) $15,250

Mar 1 Martinez invested $9000 cash in his new design services business.

Mar 2 Paid the first month's rent of $900.

Mar 3 Purchased equipment by paying $4000 cash and executing a loan payable for $9000.

Mar 4 Purchased office supplies for $750 cash.

Mar 5 Billed a client for $8000 of design services completed.

Mar 6 Received $7900 on account for the services previously recorded.

What is the balance in Cash?

A) $12,900

B) $11,250

C) $12,150

D) $15,250

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

63

A business pays cash back to the owner.Which account is credited?

A) Service revenue

B) Drawings

C) Accounts payable

D) Cash

A) Service revenue

B) Drawings

C) Accounts payable

D) Cash

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

64

A business makes a cash payment to a supplier 'on credit' (for supplies that were purchased earlier).Which account is debited?

A) Service revenue

B) Accounts payable

C) Cash

D) Supplies

A) Service revenue

B) Accounts payable

C) Cash

D) Supplies

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

65

A company received $75 000 from a customer 'on account'.The journal entry would be to:

A) debit Accounts receivable and credit Sales revenue.

B) debit Sales revenue and credit Accounts receivable.

C) debit Cash and credit Accounts receivable.

D) debit Accounts receivable and credit Cash.

A) debit Accounts receivable and credit Sales revenue.

B) debit Sales revenue and credit Accounts receivable.

C) debit Cash and credit Accounts receivable.

D) debit Accounts receivable and credit Cash.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

66

A business pays $500 cash for supplies.Which account is credited?

A) Service revenue

B) Accounts payable

C) Cash

D) Supplies

A) Service revenue

B) Accounts payable

C) Cash

D) Supplies

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

67

A business buys $500 in supplies on credit.Which account is credited?

A) Service revenue

B) Cash

C) Supplies

D) Accounts payable

A) Service revenue

B) Cash

C) Supplies

D) Accounts payable

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

68

A business pays cash back to the owner.Which account is debited?

A) Service revenue

B) Cash

C) Drawings

D) Accounts payable

A) Service revenue

B) Cash

C) Drawings

D) Accounts payable

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

69

A business collects cash from a customer in payment of accounts receivable.Which account is debited?

A) Cash

B) Service revenue

C) Accounts receivable

D) Supplies

A) Cash

B) Service revenue

C) Accounts receivable

D) Supplies

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

70

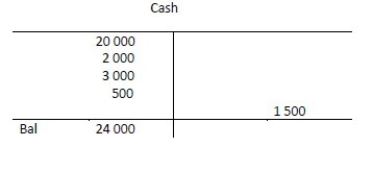

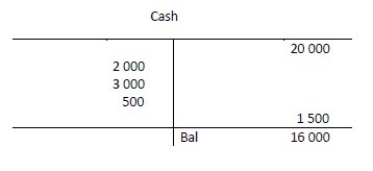

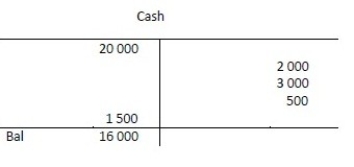

A business has the following transactions: The business is started by receiving $20 000 from the owner.The business purchases $500 in supplies on credit.The business purchases $2 000 in furniture on credit.The business renders services to various clients totalling $9 000 on credit.The business pays out $2 000 for Salary expense and $3 000 for Rent expense.The business pays $500 to a supplier for the supplies purchased earlier.The business collects $1 500 from one of its clients for services rendered earlier in the month.At the end of the month,all journal entries are posted to the ledger.The Cash account will appear as follows:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

71

The following transactions have been journalised and posted to the proper accounts.

1)Mark Call invested $7 000 cash in his new design services business.

2)The business paid the first month's rent with $700 cash.

3)The business purchased equipment by paying a $2 000 deposit and borrowing $4 500.

4)The business purchased supplies for $850 cash.

5)The business billed its clients a total of $4 000 for design services rendered.

6)The business collected $3 000 on credit from one of its clients.

What is the balance in Service revenue?

A) $3 000

B) $3 150

C) $1 000

D) $4 000

1)Mark Call invested $7 000 cash in his new design services business.

2)The business paid the first month's rent with $700 cash.

3)The business purchased equipment by paying a $2 000 deposit and borrowing $4 500.

4)The business purchased supplies for $850 cash.

5)The business billed its clients a total of $4 000 for design services rendered.

6)The business collected $3 000 on credit from one of its clients.

What is the balance in Service revenue?

A) $3 000

B) $3 150

C) $1 000

D) $4 000

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

72

When a business makes a cash payment,the Cash account is always debited.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

73

When a business records an expense incurred,the expense account is always credited.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following journal entries would be recorded if Jane Brown started a business and then deposited cash of $6 000 into the business bank account?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

75

The following transactions for the month of March have been journalised and posted to the proper accounts.

Mar 1 Martinez invested $7000 cash in his new design services business.

Mar 2 Paid the first month's rent of $600.

Mar 3 Purchased equipment by paying $3000 cash and executing a loan payable for $3000.

Mar 4 Purchased office supplies for $550 cash.

Mar 5 Billed a client for $10,000 of design services completed.

Mar 6 Received $8000 on account for the services previously recorded.

What is the balance in Accounts receivable?

A) $2000

B) $10,000

C) $3000

D) $8000

Mar 1 Martinez invested $7000 cash in his new design services business.

Mar 2 Paid the first month's rent of $600.

Mar 3 Purchased equipment by paying $3000 cash and executing a loan payable for $3000.

Mar 4 Purchased office supplies for $550 cash.

Mar 5 Billed a client for $10,000 of design services completed.

Mar 6 Received $8000 on account for the services previously recorded.

What is the balance in Accounts receivable?

A) $2000

B) $10,000

C) $3000

D) $8000

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following journal entries would be recorded if a business purchased $200 in supplies on credit?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following journal entries would be recorded if a business renders services and receives cash of $400 from the customer?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

78

A business collects cash from a customer in payment of accounts receivable.Which account is credited?

A) Supplies

B) Cash

C) Accounts receivable

D) Service revenue

A) Supplies

B) Cash

C) Accounts receivable

D) Service revenue

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following journal entries would be recorded if a business purchased equipment for $3 000 cash?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

80

A business makes a cash payment for advertising expense.Which account is debited?

A) Accounts receivable

B) Cash

C) Advertising expense

D) Service revenue

A) Accounts receivable

B) Cash

C) Advertising expense

D) Service revenue

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck