Deck 8: Intercompany Indebtedness

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/39

Play

Full screen (f)

Deck 8: Intercompany Indebtedness

1

Which of the following eliminating entries might be found on a consolidation workpaper to eliminate the effects of intercompany debt?

A)I

B)II

C)Either I or II

D)Neither I nor II

A)I

B)II

C)Either I or II

D)Neither I nor II

B

2

When one company purchases the debt of an affiliate from an unrelated party,a gain or loss on the constructive retirement of debt is recognized by which of the following?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

A

3

Light Corporation owns 80 percent of Sound Company's voting shares.On January 1,2007,Sound sold bonds with a par value of $300,000 at 95.Light purchased $200,000 par value of the bonds;the remainder was sold to nonaffiliates.The bonds mature in ten years and pay an annual interest rate of 6 percent.Interest is paid semiannually on January 1 and July 1.

Based on the information given above,what amount of interest expense should be reported in the 2008 consolidated income statement?

A)$6,000

B)$6,500

C)$5,000

D)$10,000

Based on the information given above,what amount of interest expense should be reported in the 2008 consolidated income statement?

A)$6,000

B)$6,500

C)$5,000

D)$10,000

B

4

Hunter Corporation holds 80 percent of the voting shares of Moss Company.On January 1,2008,Moss purchased $100,000 par value 12 percent first mortgage bonds of Hunter from Cruse for $115,000.Hunter originally issued the bonds to Cruse on January 1,2006,for $110,000.The bonds have a 8-year maturity from the date of issue.Moss' reported net income of $65,000 for 2008,and Hunter reported income (excluding income from ownership of Moss's stock)of $90,000.

Based on the information given above,what amount of interest income does Moss record for 2008?

A)$12,000

B)$2,500

C)$7,500

D)$9,500

Based on the information given above,what amount of interest income does Moss record for 2008?

A)$12,000

B)$2,500

C)$7,500

D)$9,500

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

5

Hunter Corporation holds 80 percent of the voting shares of Moss Company.On January 1,2008,Moss purchased $100,000 par value 12 percent first mortgage bonds of Hunter from Cruse for $115,000.Hunter originally issued the bonds to Cruse on January 1,2006,for $110,000.The bonds have a 8-year maturity from the date of issue.Moss' reported net income of $65,000 for 2008,and Hunter reported income (excluding income from ownership of Moss's stock)of $90,000.

Based on the information given above,what amount of interest expense does Hunter record annually?

A)$10,750

B)$9,500

C)$2,500

D)$12,000

Based on the information given above,what amount of interest expense does Hunter record annually?

A)$10,750

B)$9,500

C)$2,500

D)$12,000

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

6

At the end of the year,a parent acquires a wholly owned subsidiary's bonds from unaffiliated parties at a cost less than the subsidiary's carrying value.The consolidated net income for the year of acquisition should include the parent's separate operating income plus:

A)the subsidiary's net income increased by the gain on constructive retirement of debt.

B)the subsidiary's net income decreased by the gain on constructive retirement of debt.

C)the subsidiary's net income increased by the gain on constructive retirement of debt,and decreased by the subsidiary's bond interest expense.

D)the subsidiary's net income decreased by the gain on constructive retirement of debt,and decreased by the subsidiary's bond interest expense.

A)the subsidiary's net income increased by the gain on constructive retirement of debt.

B)the subsidiary's net income decreased by the gain on constructive retirement of debt.

C)the subsidiary's net income increased by the gain on constructive retirement of debt,and decreased by the subsidiary's bond interest expense.

D)the subsidiary's net income decreased by the gain on constructive retirement of debt,and decreased by the subsidiary's bond interest expense.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

7

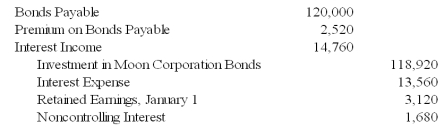

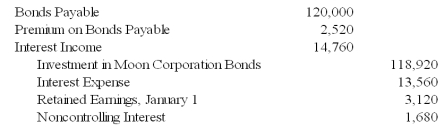

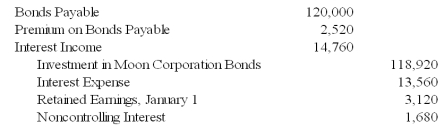

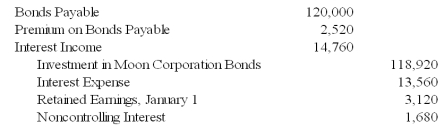

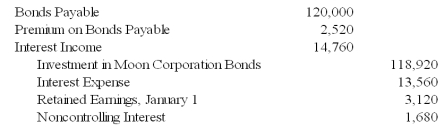

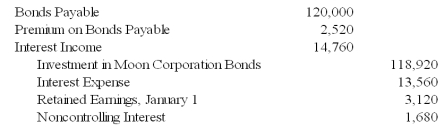

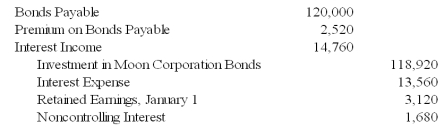

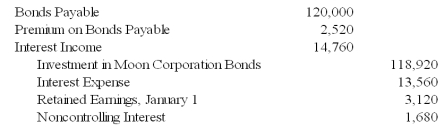

Moon Corporation issued $300,000 par value 10-year bonds at 107 on January 1,2003,which Star Corporation purchased.On July 1,2007,Sun Corporation purchased $120,000 of Moon bonds from Star.The bonds pay 12 percent interest annually on December 31.The preparation of consolidated financial statements for Moon and Sun at December 31,2009,required the following eliminating entry:

Based on the information given above,if 2009 consolidated net income of $50,000 would have been reported without the eliminating entry provided,what amount will actually be reported?

A)$47,900

B)$48,200

C)$49,400

D)$48,800

Based on the information given above,if 2009 consolidated net income of $50,000 would have been reported without the eliminating entry provided,what amount will actually be reported?

A)$47,900

B)$48,200

C)$49,400

D)$48,800

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

8

Moon Corporation issued $300,000 par value 10-year bonds at 107 on January 1,2003,which Star Corporation purchased.On July 1,2007,Sun Corporation purchased $120,000 of Moon bonds from Star.The bonds pay 12 percent interest annually on December 31.The preparation of consolidated financial statements for Moon and Sun at December 31,2009,required the following eliminating entry:

Based on the information given above,what amount of gain or loss on bond retirement is included in the 2007 consolidated income statement?

A)$6,600

B)$4,800

C)$6,000

D)$5,400

Based on the information given above,what amount of gain or loss on bond retirement is included in the 2007 consolidated income statement?

A)$6,600

B)$4,800

C)$6,000

D)$5,400

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

9

Moon Corporation issued $300,000 par value 10-year bonds at 107 on January 1,2003,which Star Corporation purchased.On July 1,2007,Sun Corporation purchased $120,000 of Moon bonds from Star.The bonds pay 12 percent interest annually on December 31.The preparation of consolidated financial statements for Moon and Sun at December 31,2009,required the following eliminating entry:

Based on the information given above,what percentage of the subsidiary's ownership does the parent company hold?

A)75 percent

B)65 percent

C)80 percent

D)95 percent

Based on the information given above,what percentage of the subsidiary's ownership does the parent company hold?

A)75 percent

B)65 percent

C)80 percent

D)95 percent

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

10

Light Corporation owns 80 percent of Sound Company's voting shares.On January 1,2007,Sound sold bonds with a par value of $300,000 at 95.Light purchased $200,000 par value of the bonds;the remainder was sold to nonaffiliates.The bonds mature in ten years and pay an annual interest rate of 6 percent.Interest is paid semiannually on January 1 and July 1.

Based on the information given above,what amount of interest receivable will be recorded by Light Corporation on December 31,2008,in its separate financial statements?

A)$5,000

B)$6,500

C)$10,000

D)$6,000

Based on the information given above,what amount of interest receivable will be recorded by Light Corporation on December 31,2008,in its separate financial statements?

A)$5,000

B)$6,500

C)$10,000

D)$6,000

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

11

ABC,a holder of a $400,000 XYZ Inc.bond,collected the interest due on June 30,2008,and then sold the bond to DEF Inc.for $365,000.On that date,XYZ,a 90 percent owner of DEF,had a $450,000 carrying amount for this bond.

Based on the information given above,what was the effect of DEF's purchase of XYZ's bond on the noncontrolling interest amount reported in XYZ's June 30,2008,consolidated balance sheet?

A)No effect

B)$35,000 increase

C)$8,500 decrease

D)$8,500 increase

Based on the information given above,what was the effect of DEF's purchase of XYZ's bond on the noncontrolling interest amount reported in XYZ's June 30,2008,consolidated balance sheet?

A)No effect

B)$35,000 increase

C)$8,500 decrease

D)$8,500 increase

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

12

Light Corporation owns 80 percent of Sound Company's voting shares.On January 1,2007,Sound sold bonds with a par value of $300,000 at 95.Light purchased $200,000 par value of the bonds;the remainder was sold to nonaffiliates.The bonds mature in ten years and pay an annual interest rate of 6 percent.Interest is paid semiannually on January 1 and July 1.

Based on the information given above,what amount of interest expense will be eliminated in the preparation of the 2008 consolidated financial statements?

A)$13,000

B)$13,500

C)$10,000

D)$15,000

Based on the information given above,what amount of interest expense will be eliminated in the preparation of the 2008 consolidated financial statements?

A)$13,000

B)$13,500

C)$10,000

D)$15,000

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

13

Hunter Corporation holds 80 percent of the voting shares of Moss Company.On January 1,2008,Moss purchased $100,000 par value 12 percent first mortgage bonds of Hunter from Cruse for $115,000.Hunter originally issued the bonds to Cruse on January 1,2006,for $110,000.The bonds have a 8-year maturity from the date of issue.Moss' reported net income of $65,000 for 2008,and Hunter reported income (excluding income from ownership of Moss's stock)of $90,000.

Based on the information given above,what amount of consolidated net income should be reported for 2008?

A)$163,750

B)$161,250

C)$146,250

D)$148,750

Based on the information given above,what amount of consolidated net income should be reported for 2008?

A)$163,750

B)$161,250

C)$146,250

D)$148,750

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

14

Moon Corporation issued $300,000 par value 10-year bonds at 107 on January 1,2003,which Star Corporation purchased.On July 1,2007,Sun Corporation purchased $120,000 of Moon bonds from Star.The bonds pay 12 percent interest annually on December 31.The preparation of consolidated financial statements for Moon and Sun at December 31,2009,required the following eliminating entry:

Based on the information given above,what amount did Sun pay when it purchased the bonds on July 1,2007?

A)$118,020

B)$118,920

C)$118,620

D)$117,220

Based on the information given above,what amount did Sun pay when it purchased the bonds on July 1,2007?

A)$118,020

B)$118,920

C)$118,620

D)$117,220

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

15

Cutler Company owns 80 percent of the common stock of Marina Inc.Cutler acquires some of Marina's bonds from an unrelated party for less than the carrying value on Marina's books and holds and holds them as a long-term investment.For consolidated reporting purposes,how is the acquisition of Marina's bonds treated?

A)As a decrease in the Bonds Payable account on Marina's books.

B)As an increase in noncurrent assets.

C)Everything related to the bonds is eliminated in the consolidation workpaper,and nothing related to the bonds appears in the consolidated financial statements.

D)As a retirement of bonds.

A)As a decrease in the Bonds Payable account on Marina's books.

B)As an increase in noncurrent assets.

C)Everything related to the bonds is eliminated in the consolidation workpaper,and nothing related to the bonds appears in the consolidated financial statements.

D)As a retirement of bonds.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

16

Hunter Corporation holds 80 percent of the voting shares of Moss Company.On January 1,2008,Moss purchased $100,000 par value 12 percent first mortgage bonds of Hunter from Cruse for $115,000.Hunter originally issued the bonds to Cruse on January 1,2006,for $110,000.The bonds have a 8-year maturity from the date of issue.Moss' reported net income of $65,000 for 2008,and Hunter reported income (excluding income from ownership of Moss's stock)of $90,000.

Based on the information given above,what gain or loss on the retirement of bonds should be reported in the 2008 consolidated income statement?

A)$6,250 gain

B)$7,500 gain

C)$7,500 loss

D)$6,250 loss

Based on the information given above,what gain or loss on the retirement of bonds should be reported in the 2008 consolidated income statement?

A)$6,250 gain

B)$7,500 gain

C)$7,500 loss

D)$6,250 loss

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

17

A loss on the constructive retirement of a parent's bonds by a subsidiary is effectively recognized in the accounting records of the parent and its subsidiary: I.at the date of constructive retirement.

II)over the remaining term of the bonds.

A)I

B)II

C)Both I and II

D)Neither I nor II

II)over the remaining term of the bonds.

A)I

B)II

C)Both I and II

D)Neither I nor II

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

18

Culver owns 80 percent of the common stock of Fowler Company.Culver also purchases some of Fowler's bonds directly from Fowler and holds the bonds as a long-term investment.How is the acquisition of the bonds treated for consolidated reporting purposes?

A)As a retirement of bonds.

B)As an increase in the Bonds Payable account on Fowler's books.

C)Everything related to the bonds is eliminated in the consolidation workpaper,and nothing related to the bonds appears in the consolidated financial statements.

D)As an increase in noncurrent assets.

A)As a retirement of bonds.

B)As an increase in the Bonds Payable account on Fowler's books.

C)Everything related to the bonds is eliminated in the consolidation workpaper,and nothing related to the bonds appears in the consolidated financial statements.

D)As an increase in noncurrent assets.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

19

ABC,a holder of a $400,000 XYZ Inc.bond,collected the interest due on June 30,2008,and then sold the bond to DEF Inc.for $365,000.On that date,XYZ,a 90 percent owner of DEF,had a $450,000 carrying amount for this bond.

Based on the information given above,what was the effect of DEF's purchase of XYZ's bond on the amount of retained earnings reported in XYZ's June 30,2008,consolidated balance sheet?

A)No effect

B)$85,000 increase

C)$85,000 decrease

D)$35,000 decrease

Based on the information given above,what was the effect of DEF's purchase of XYZ's bond on the amount of retained earnings reported in XYZ's June 30,2008,consolidated balance sheet?

A)No effect

B)$85,000 increase

C)$85,000 decrease

D)$35,000 decrease

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

20

Master Corporation owns 85 percent of Servant Corporation's voting shares.On January 1,2008,Master Corporation sold $200,000 par value 8 percent bonds to Servant for $245,000.The bonds mature in 10 years and pay interest semiannually on January 1 and July 1.

Based on the information given above,in the preparation of the 2008 consolidated financial statements,premium on bonds payable will be:

A)debited for $45,000 in the eliminating entries.

B)credited for $40,500 in the eliminating entries.

C)debited for $40,500 in the eliminating entries.

D)credited for $45,000 in the eliminating entries.

Based on the information given above,in the preparation of the 2008 consolidated financial statements,premium on bonds payable will be:

A)debited for $45,000 in the eliminating entries.

B)credited for $40,500 in the eliminating entries.

C)debited for $40,500 in the eliminating entries.

D)credited for $45,000 in the eliminating entries.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

21

Master Corporation owns 85 percent of Servant Corporation's voting shares.On January 1,2008,Master Corporation sold $200,000 par value 8 percent bonds to Servant for $245,000.The bonds mature in 10 years and pay interest semiannually on January 1 and July 1.

Based on the information given above,in the preparation of the 2008 consolidated financial statements,interest income will be:

A)debited for $11,500 in the eliminating entries.

B)credited for $11,500 in the eliminating entries.

C)debited for $16,000 in the eliminating entries.

D)credited for $16,000 in the eliminating entries.

Based on the information given above,in the preparation of the 2008 consolidated financial statements,interest income will be:

A)debited for $11,500 in the eliminating entries.

B)credited for $11,500 in the eliminating entries.

C)debited for $16,000 in the eliminating entries.

D)credited for $16,000 in the eliminating entries.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

22

Granite Company issued $200,000 of 10 percent first mortgage bonds on January 1,2004,at 105.The bonds mature in 10 years and pay interest semiannually on January 1 and July 1.Mortar Corporation purchased $140,000 of Granite's bonds from the original purchaser on December 31,2008,for $125,000.Mortar owns 75 percent of Granite's voting common stock.

Based on the information given above,what amount of premium on bonds payable will be eliminated in the preparation of the 2009 consolidated financial statements?

A)$3,500

B)$2,800

C)$5,000

D)$2,500

Based on the information given above,what amount of premium on bonds payable will be eliminated in the preparation of the 2009 consolidated financial statements?

A)$3,500

B)$2,800

C)$5,000

D)$2,500

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

23

Dundee Company issued $1,000,000 par value 10-year bonds at 102 on January 1,2005,which Mega Corporation purchased.The coupon rate on the bonds is 9 percent.Interest payments are made semiannually on July 1 and January 1.On July 1,2008,Perth Company purchased $500,000 par value of the bonds from Mega for $492,200.Perth owns 65 percent of Dundee's voting shares.

Required:

a.What amount of gain or loss will be reported in Dundee's 2008 income statement on the retirement of bonds?

b.Will a gain or loss be reported in the 2008 consolidated financial statements for Perth for the constructive retirement of bonds? What amount will be reported?

c.How much will Perth's purchase of the bonds change consolidated net income for 2008?

d.Prepare the workpaper eliminating entry or entries needed to remove the effects of the intercorporate bond ownership in preparing consolidated financial statements at December 31,2008.

e.Prepare the workpaper eliminating entry or entries needed to remove the effects of the intercorporate bond ownership in preparing consolidated financial statements at December 31,2009.

Required:

a.What amount of gain or loss will be reported in Dundee's 2008 income statement on the retirement of bonds?

b.Will a gain or loss be reported in the 2008 consolidated financial statements for Perth for the constructive retirement of bonds? What amount will be reported?

c.How much will Perth's purchase of the bonds change consolidated net income for 2008?

d.Prepare the workpaper eliminating entry or entries needed to remove the effects of the intercorporate bond ownership in preparing consolidated financial statements at December 31,2008.

e.Prepare the workpaper eliminating entry or entries needed to remove the effects of the intercorporate bond ownership in preparing consolidated financial statements at December 31,2009.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

24

Granite Company issued $200,000 of 10 percent first mortgage bonds on January 1,2004,at 105.The bonds mature in 10 years and pay interest semiannually on January 1 and July 1.Mortar Corporation purchased $140,000 of Granite's bonds from the original purchaser on December 31,2008,for $125,000.Mortar owns 75 percent of Granite's voting common stock.

Based on the information given above,what amount of interest expense will be eliminated in the preparation of the 2009 consolidated financial statements?

A)$17,000

B)$13,300

C)$18,500

D)$22,200

Based on the information given above,what amount of interest expense will be eliminated in the preparation of the 2009 consolidated financial statements?

A)$17,000

B)$13,300

C)$18,500

D)$22,200

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

25

On January 1,2007,Gild Company acquired 60 percent of the outstanding common stock of Leeds Company at the book value of the shares acquired.On that date,the fair value of noncontrolling interest was equal to 40 percent of book value of Leeds.At the time of purchase,Leeds had common stock of $1,000,000 outstanding and retained earnings of $800,000.

On December 31,2007,Gild purchased 50 percent of Leeds' bonds outstanding which were originally issued on January 2,2004,at 99.The total bond issue has a face value of $600,000,pays 10 percent interest annually,and has a 10-year maturity.Any premium or discount is amortized on a straight-line basis.Gild paid $306,000 for its investment in Leeds' bonds and intends to hold the bonds until maturity.

Income and dividends for Gild and Leeds for 2007 and 2008 are as follows:

Required:

A)Present the workpaper elimination entries necessary to prepare consolidated financial statements for 2007 assuming Gild accounts for its investment in Leeds stock using the fully adjusted equity method.

B)Present the workpaper elimination entries necessary to prepare consolidated financial statements for 2008,assuming Gild accounts for its investment in Leeds stock using the cost method.

On December 31,2007,Gild purchased 50 percent of Leeds' bonds outstanding which were originally issued on January 2,2004,at 99.The total bond issue has a face value of $600,000,pays 10 percent interest annually,and has a 10-year maturity.Any premium or discount is amortized on a straight-line basis.Gild paid $306,000 for its investment in Leeds' bonds and intends to hold the bonds until maturity.

Income and dividends for Gild and Leeds for 2007 and 2008 are as follows:

Required:

A)Present the workpaper elimination entries necessary to prepare consolidated financial statements for 2007 assuming Gild accounts for its investment in Leeds stock using the fully adjusted equity method.

B)Present the workpaper elimination entries necessary to prepare consolidated financial statements for 2008,assuming Gild accounts for its investment in Leeds stock using the cost method.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

26

A subsidiary issues bonds.The parent can then acquire the bonds either directly from the subsidiary or from a nonaffiliate that had originally acquired the subsidiary's bonds.

Required:

a)Discuss the parent's accounting as it relates to the preparation of consolidated financial statements,for their acquisition of the bonds:

from the nonaffiliate.

directly from the subsidiary.

b)Why does it matter who the bonds are acquired from?

Required:

a)Discuss the parent's accounting as it relates to the preparation of consolidated financial statements,for their acquisition of the bonds:

from the nonaffiliate.

directly from the subsidiary.

b)Why does it matter who the bonds are acquired from?

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

27

Master Corporation owns 85 percent of Servant Corporation's voting shares.On January 1,2008,Master Corporation sold $200,000 par value 8 percent bonds to Servant for $245,000.The bonds mature in 10 years and pay interest semiannually on January 1 and July 1.

Based on the information given above,what amount of investment in bonds will be eliminated in the preparation of the 2008 consolidated financial statements?

A)$240,500

B)$200,000

C)$245,000

D)$211,500

Based on the information given above,what amount of investment in bonds will be eliminated in the preparation of the 2008 consolidated financial statements?

A)$240,500

B)$200,000

C)$245,000

D)$211,500

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

28

Granite Company issued $200,000 of 10 percent first mortgage bonds on January 1,2004,at 105.The bonds mature in 10 years and pay interest semiannually on January 1 and July 1.Mortar Corporation purchased $140,000 of Granite's bonds from the original purchaser on January 1,2008,for $122,000.Mortar owns 75 percent of Granite's voting common stock.

Based on the information given above,what amount of premium on bonds payable will be eliminated in the preparation of the 2009 consolidated financial statements?

A)$3,500

B)$2,800

C)$5,000

D)$2,500

Based on the information given above,what amount of premium on bonds payable will be eliminated in the preparation of the 2009 consolidated financial statements?

A)$3,500

B)$2,800

C)$5,000

D)$2,500

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

29

Granite Company issued $200,000 of 10 percent first mortgage bonds on January 1,2004,at 105.The bonds mature in 10 years and pay interest semiannually on January 1 and July 1.Mortar Corporation purchased $140,000 of Granite's bonds from the original purchaser on January 1,2008,for $122,000.Mortar owns 75 percent of Granite's voting common stock.

Based on the information given above,what amount of interest income will be eliminated in the preparation of the 2009 consolidated financial statements?

A)$17,000

B)$13,300

C)$18,500

D)$22,200

Based on the information given above,what amount of interest income will be eliminated in the preparation of the 2009 consolidated financial statements?

A)$17,000

B)$13,300

C)$18,500

D)$22,200

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

30

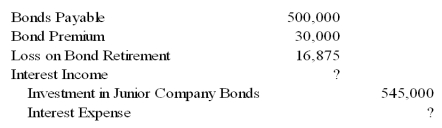

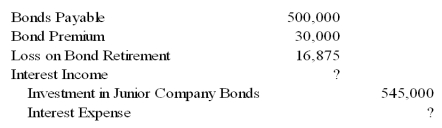

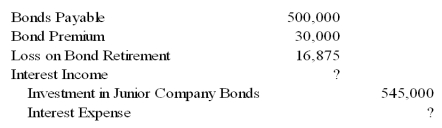

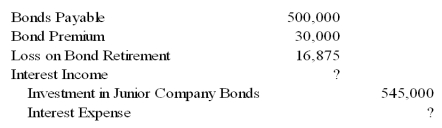

Senior Corporation acquired 80 percent of Junior Company's voting shares on January 1,2008,at underlying book value.On that date,it also purchased $500,000 par value 8 percent Junior bonds,which had been issued on January 1,2005,with a 12-year maturity.During preparation of the consolidated financial statements for December 31,2008,the following eliminating entry was made in the workpaper:

Based on the information given above,what price did Senior pay to purchase the Junior bonds?

A)$530,000

B)$516,875

C)$533,750

D)$550,625

Based on the information given above,what price did Senior pay to purchase the Junior bonds?

A)$530,000

B)$516,875

C)$533,750

D)$550,625

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

31

Granite Company issued $200,000 of 10 percent first mortgage bonds on January 1,2004,at 105.The bonds mature in 10 years and pay interest semiannually on January 1 and July 1.Mortar Corporation purchased $140,000 of Granite's bonds from the original purchaser on December 31,2008,for $125,000.Mortar owns 75 percent of Granite's voting common stock.

Based on the information given above,what amount of premium on bonds payable will be eliminated in the preparation of the 2008 consolidated financial statements?

A)$3,500

B)$2,800

C)$5,000

D)$2,500

Based on the information given above,what amount of premium on bonds payable will be eliminated in the preparation of the 2008 consolidated financial statements?

A)$3,500

B)$2,800

C)$5,000

D)$2,500

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

32

Senior Corporation acquired 80 percent of Junior Company's voting shares on January 1,2008,at underlying book value.On that date,it also purchased $500,000 par value 8 percent Junior bonds,which had been issued on January 1,2005,with a 12-year maturity.During preparation of the consolidated financial statements for December 31,2008,the following eliminating entry was made in the workpaper:

Based on the information given above,what was the carrying amount of the bonds on Junior's books on the date of purchase?

A)$533,750

B)$516,875

C)$545,000

D)$550,625

Based on the information given above,what was the carrying amount of the bonds on Junior's books on the date of purchase?

A)$533,750

B)$516,875

C)$545,000

D)$550,625

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

33

Granite Company issued $200,000 of 10 percent first mortgage bonds on January 1,2004,at 105.The bonds mature in 10 years and pay interest semiannually on January 1 and July 1.Mortar Corporation purchased $140,000 of Granite's bonds from the original purchaser on December 31,2008,for $125,000.Mortar owns 75 percent of Granite's voting common stock.

Based on the information given above,what amount of interest income will be eliminated in the preparation of the 2009 consolidated financial statements?

A)$17,000

B)$13,300

C)$18,500

D)$22,200

Based on the information given above,what amount of interest income will be eliminated in the preparation of the 2009 consolidated financial statements?

A)$17,000

B)$13,300

C)$18,500

D)$22,200

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

34

Granite Company issued $200,000 of 10 percent first mortgage bonds on January 1,2004,at 105.The bonds mature in 10 years and pay interest semiannually on January 1 and July 1.Mortar Corporation purchased $140,000 of Granite's bonds from the original purchaser on December 31,2008,for $125,000.Mortar owns 75 percent of Granite's voting common stock.

Based on the information given above,what amount of gain or loss on bond retirement will be reported in the 2008 consolidated financial statements?

A)$17,000 loss

B)$12,800 loss

C)$18,500 gain

D)$22,200 gain

Based on the information given above,what amount of gain or loss on bond retirement will be reported in the 2008 consolidated financial statements?

A)$17,000 loss

B)$12,800 loss

C)$18,500 gain

D)$22,200 gain

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

35

Granite Company issued $200,000 of 10 percent first mortgage bonds on January 1,2004,at 105.The bonds mature in 10 years and pay interest semiannually on January 1 and July 1.Mortar Corporation purchased $140,000 of Granite's bonds from the original purchaser on January 1,2008,for $122,000.Mortar owns 75 percent of Granite's voting common stock.

Based on the information given above,what amount of premium on bonds payable will be eliminated in the preparation of the 2008 consolidated financial statements?

A)$3,500

B)$2,800

C)$5,000

D)$2,500

Based on the information given above,what amount of premium on bonds payable will be eliminated in the preparation of the 2008 consolidated financial statements?

A)$3,500

B)$2,800

C)$5,000

D)$2,500

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

36

Granite Company issued $200,000 of 10 percent first mortgage bonds on January 1,2004,at 105.The bonds mature in 10 years and pay interest semiannually on January 1 and July 1.Mortar Corporation purchased $140,000 of Granite's bonds from the original purchaser on December 31,2008,for $125,000.Mortar owns 75 percent of Granite's voting common stock.

Based on the information given above,what amount of constructive gain will be allocated to noncontrolling interest in 2008 consolidated financial statements?

A)$4,925

B)$5,550

C)$5,625

D)$4,625

Based on the information given above,what amount of constructive gain will be allocated to noncontrolling interest in 2008 consolidated financial statements?

A)$4,925

B)$5,550

C)$5,625

D)$4,625

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

37

Granite Company issued $200,000 of 10 percent first mortgage bonds on January 1,2004,at 105.The bonds mature in 10 years and pay interest semiannually on January 1 and July 1.Mortar Corporation purchased $140,000 of Granite's bonds from the original purchaser on January 1,2008,for $122,000.Mortar owns 75 percent of Granite's voting common stock.

Based on the information given above,what amount of gain or loss on bond retirement will be reported in the 2008 consolidated financial statements?

A)$17,000

B)$12,800

C)$18,500

D)$22,200

Based on the information given above,what amount of gain or loss on bond retirement will be reported in the 2008 consolidated financial statements?

A)$17,000

B)$12,800

C)$18,500

D)$22,200

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

38

On January 1,2006,Nichols Corporation issued 10-year bonds at par to unrelated parties.The bonds pay interest of $15,000 every June 30 and December 31.On December 31,2009,Harn Corporation purchased all of Nichols' bonds in the open market at a $6,000 discount.Harn is Nichols' 80 percent owned subsidiary.Harn uses the straight line method of amortization.The consolidated income statement for the year 2009 should report with respect to the bonds: I.interest expense of $30,000.

II)an extraordinary gain of $6,000.

A)I

B)II

C)Either I or II

D)Neither I nor II

II)an extraordinary gain of $6,000.

A)I

B)II

C)Either I or II

D)Neither I nor II

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following statements is (are)correct? I.The amount assigned to the noncontrolling interest may be affected by a constructive retirement of bonds.

II)A constructive retirement of bonds normally results in an extraordinary gain or loss.

III)In constructive retirement,the bonds are considered outstanding,even though they are treated as if they were retired in preparing consolidated financial statements.

A)I

B)II

C)I and III

D)I,II,and III

II)A constructive retirement of bonds normally results in an extraordinary gain or loss.

III)In constructive retirement,the bonds are considered outstanding,even though they are treated as if they were retired in preparing consolidated financial statements.

A)I

B)II

C)I and III

D)I,II,and III

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck