Deck 27: Fiscal Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/303

Play

Full screen (f)

Deck 27: Fiscal Policy

1

Automatic stabilizers refer to

A) the money supply and interest rates that automatically increase or decrease along with the business cycle.

B) government spending and taxes that automatically increase or decrease along with the business cycle.

C) changes in the money supply and interest rates that are intended to achieve macroeconomic policy objectives.

D) changes in federal taxes and purchases that are intended to achieve macroeconomic policy objectives.

A) the money supply and interest rates that automatically increase or decrease along with the business cycle.

B) government spending and taxes that automatically increase or decrease along with the business cycle.

C) changes in the money supply and interest rates that are intended to achieve macroeconomic policy objectives.

D) changes in federal taxes and purchases that are intended to achieve macroeconomic policy objectives.

B

2

The largest and fastest-growing category of federal government expenditures is

A) grants to state and local governments.

B) interest on the national debt.

C) national park spending.

D) transfer payments.

A) grants to state and local governments.

B) interest on the national debt.

C) national park spending.

D) transfer payments.

D

3

Social Security began as a "pay-as-you-go" system, meaning that payments to current retirees were paid

A) from taxes collected from current workers.

B) from taxes collected from retired workers.

C) as long as the government had funds available.

D) as the government collected revenues from tariffs and excise taxes in the years Social Security payments were made.

A) from taxes collected from current workers.

B) from taxes collected from retired workers.

C) as long as the government had funds available.

D) as the government collected revenues from tariffs and excise taxes in the years Social Security payments were made.

A

4

The three categories of federal government expenditures, in addition to government purchases, are

A) interest on the national debt, grants to state and local governments, and transfer payments.

B) interest on the national debt, defense spending, and transfer payments.

C) defense spending, budgets of federal agencies, and transfer payments.

D) defense spending, Social Security, and Medicare.

A) interest on the national debt, grants to state and local governments, and transfer payments.

B) interest on the national debt, defense spending, and transfer payments.

C) defense spending, budgets of federal agencies, and transfer payments.

D) defense spending, Social Security, and Medicare.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

5

The largest source of federal government revenue in 2012 was

A) sales taxes.

B) corporate income taxes.

C) individual income taxes.

D) payroll taxes to fund Social Security and Medicare programs.

A) sales taxes.

B) corporate income taxes.

C) individual income taxes.

D) payroll taxes to fund Social Security and Medicare programs.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

6

Fiscal policy refers to changes in

A) state and local taxes and purchases that are intended to achieve macroeconomic policy objectives.

B) federal taxes and purchases that are intended to achieve macroeconomic policy objectives.

C) federal taxes and purchases that are intended to fund the war on terrorism.

D) the money supply and interest rates that are intended to achieve macroeconomic policy objectives.

A) state and local taxes and purchases that are intended to achieve macroeconomic policy objectives.

B) federal taxes and purchases that are intended to achieve macroeconomic policy objectives.

C) federal taxes and purchases that are intended to fund the war on terrorism.

D) the money supply and interest rates that are intended to achieve macroeconomic policy objectives.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

7

Part of the spending on the Caldecott Tunnel project in northern California came from the American Reinvestment and Recovery Act, which is an example of ________ aimed at increasing real GDP and employment.

A) discretionary fiscal policy

B) an automatic stabilizer

C) contractionary fiscal policy

D) a transfer payment

A) discretionary fiscal policy

B) an automatic stabilizer

C) contractionary fiscal policy

D) a transfer payment

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

8

Federal government purchases, as a percentage of GDP,

A) have risen since the early 1950s.

B) have fallen since the early 1950s.

C) have remained roughly the same since the early 1950s.

D) rose from the early 1950s until the mid-1980s, and then fell.

A) have risen since the early 1950s.

B) have fallen since the early 1950s.

C) have remained roughly the same since the early 1950s.

D) rose from the early 1950s until the mid-1980s, and then fell.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

9

If Congress passed a one-time tax cut in order to stimulate the economy in 2014, and tax rate levels returned to their pre-2014 level in 2015, how should this tax cut affect the economy?

A) The tax cut would increase consumption spending less than would a permanent tax cut.

B) The tax cut would increase consumption spending more than would a permanent tax cut.

C) The tax cut would increase consumption spending by the same amount as would a permanent tax cut.

D) The tax cut would raise the price level in 2014.

A) The tax cut would increase consumption spending less than would a permanent tax cut.

B) The tax cut would increase consumption spending more than would a permanent tax cut.

C) The tax cut would increase consumption spending by the same amount as would a permanent tax cut.

D) The tax cut would raise the price level in 2014.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

10

The increase in the amount that the government collects in taxes when the economy expands and the decrease in the amount that the government collects in taxes when the economy goes into a recession is an example of

A) automatic stabilizers.

B) discretionary fiscal policy.

C) discretionary monetary policy.

D) automatic monetary policy.

A) automatic stabilizers.

B) discretionary fiscal policy.

C) discretionary monetary policy.

D) automatic monetary policy.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following provides health-care coverage to people age 65 and over?

A) Medicaid

B) Medicare

C) Social Security

D) Health-Aid

A) Medicaid

B) Medicare

C) Social Security

D) Health-Aid

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

12

The increase in government spending on unemployment insurance payments to workers who lose their jobs during a recession and the decrease in government spending on unemployment insurance payments to workers during an expansion is an example of

A) automatic stabilizers.

B) discretionary fiscal policy.

C) discretionary monetary policy.

D) automatic monetary policy.

A) automatic stabilizers.

B) discretionary fiscal policy.

C) discretionary monetary policy.

D) automatic monetary policy.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following would be classified as fiscal policy?

A) The federal government passes tax cuts to encourage firms to reduce air pollution.

B) The Federal Reserve cuts interest rates to stimulate the economy.

C) A state government cuts taxes to help the economy of the state.

D) The federal government cuts taxes to stimulate the economy.

E) States increase taxes to fund education.

A) The federal government passes tax cuts to encourage firms to reduce air pollution.

B) The Federal Reserve cuts interest rates to stimulate the economy.

C) A state government cuts taxes to help the economy of the state.

D) The federal government cuts taxes to stimulate the economy.

E) States increase taxes to fund education.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

14

Since the Social Security system began in 1935, the number of workers per retiree has

A) stayed roughly the same.

B) continually risen.

C) continually declined.

D) risen and declined with different generations.

A) stayed roughly the same.

B) continually risen.

C) continually declined.

D) risen and declined with different generations.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

15

Government transfer payments include which of the following?

A) interest on the national debt

B) grants to state and local governments

C) Social Security and Medicare programs

D) national defense

A) interest on the national debt

B) grants to state and local governments

C) Social Security and Medicare programs

D) national defense

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

16

Before the Great Depression of the 1930s, the majority of government spending took place at the ________ and after the Great Depression the majority of government spending took place at the ________.

A) state and local levels; federal level

B) local level; federal level

C) federal level; state and local levels

D) federal level; state level

A) state and local levels; federal level

B) local level; federal level

C) federal level; state and local levels

D) federal level; state level

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following would not be considered an automatic stabilizer?

A) legislation increasing funding for job retraining passed during a recession

B) decreasing unemployment insurance payments due to decreased jobless during an expansion

C) rising income tax collections due to rising incomes during an expansion

D) declining food stamp payments due to more persons finding jobs during an expansion

A) legislation increasing funding for job retraining passed during a recession

B) decreasing unemployment insurance payments due to decreased jobless during an expansion

C) rising income tax collections due to rising incomes during an expansion

D) declining food stamp payments due to more persons finding jobs during an expansion

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

18

From the 1960s to 2012, transfer payments

A) have risen from about 25 percent to 46 percent of federal government expenditures.

B) remained the same percentage of total federal government expenditures.

C) have declined by half as a percentage of total federal government expenditures.

D) have grown very slowly as a percentage of total federal government expenditures.

A) have risen from about 25 percent to 46 percent of federal government expenditures.

B) remained the same percentage of total federal government expenditures.

C) have declined by half as a percentage of total federal government expenditures.

D) have grown very slowly as a percentage of total federal government expenditures.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

19

Federal government expenditures, as a percentage of GDP,

A) have risen since the early 1950s to the present.

B) have fallen since the early 1950s to the present.

C) rose from 1950 to 1991, fell from 1992 to 2001, and have risen from 2001 to the present.

D) rose from 1950 to 2001 and then fell from 2001 to the present.

E) rose from 1950 to 1980, fell from 1981 to 2001, and have risen from 2001 to the present.

A) have risen since the early 1950s to the present.

B) have fallen since the early 1950s to the present.

C) rose from 1950 to 1991, fell from 1992 to 2001, and have risen from 2001 to the present.

D) rose from 1950 to 2001 and then fell from 2001 to the present.

E) rose from 1950 to 1980, fell from 1981 to 2001, and have risen from 2001 to the present.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following is an objective of fiscal policy?

A) energy independence from Middle East oil

B) health care coverage for all Americans

C) discovering a cure for AIDs

D) high rates of economic growth

E) homeland security

A) energy independence from Middle East oil

B) health care coverage for all Americans

C) discovering a cure for AIDs

D) high rates of economic growth

E) homeland security

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is a government expenditure, but is not a government purchase?

A) The federal government buys a Humvee.

B) The federal government pays the salary of an FBI agent.

C) The federal government pays out an unemployment insurance claim.

D) The Federal government pays to support research on Aids.

A) The federal government buys a Humvee.

B) The federal government pays the salary of an FBI agent.

C) The federal government pays out an unemployment insurance claim.

D) The Federal government pays to support research on Aids.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

22

________ and ________ are the largest sources of revenue collected by the federal government.

A) Individual income taxes; corporate income taxes

B) Individual income taxes; social insurance taxes

C) Corporate income taxes; excise and other taxes

D) Excise and other taxes; individual income taxes

A) Individual income taxes; corporate income taxes

B) Individual income taxes; social insurance taxes

C) Corporate income taxes; excise and other taxes

D) Excise and other taxes; individual income taxes

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

23

Social Security

A) has not been successful in reducing poverty among elderly Americans.

B) is a system whereby current retirees are paid from taxes collected from current workers.

C) has a greater number of workers per retiree today as compared to when it started.

D) currently pays retirees benefits equal to what they paid into the system.

A) has not been successful in reducing poverty among elderly Americans.

B) is a system whereby current retirees are paid from taxes collected from current workers.

C) has a greater number of workers per retiree today as compared to when it started.

D) currently pays retirees benefits equal to what they paid into the system.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

24

Active changes in tax and spending by government intended to smooth out the business cycle are called ________, and changes in taxes and spending that occur passively over the business cycle are called ________.

A) automatic stabilizers; discretionary fiscal policy

B) discretionary fiscal policy; automatic stabilizers

C) automatic stabilizers; monetary policy

D) discretionary fiscal policy; conscious fiscal policy

A) automatic stabilizers; discretionary fiscal policy

B) discretionary fiscal policy; automatic stabilizers

C) automatic stabilizers; monetary policy

D) discretionary fiscal policy; conscious fiscal policy

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

25

The majority of dollars spent by government prior to the Great Depression was spending at the ________ level. In the post-World War II period, two-thirds to three quarters of all dollars spent by government in the United States are spent at the ________ level.

A) federal; state and local

B) state and local; federal

C) state and local; state

D) local; state

A) federal; state and local

B) state and local; federal

C) state and local; state

D) local; state

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

26

Part of the spending on the Caldecott Tunnel project in northern California came from the American Reinvestment and Recovery Act, which is an example of discretionary fiscal policy aimed at increasing

A) real GDP and employment.

B) tax revenues and the federal budget surplus.

C) disposable income and interest rates.

D) the money supply and money demand.

A) real GDP and employment.

B) tax revenues and the federal budget surplus.

C) disposable income and interest rates.

D) the money supply and money demand.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following is the largest category of federal government expenditures?

A) defense spending

B) transfer payments

C) interest on the debt

D) grants to state and local governments

A) defense spending

B) transfer payments

C) interest on the debt

D) grants to state and local governments

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

28

Forecasts by the Congressional Budget Office show spending on Social Security, Medicare, and Medicaid rising from 9.9 percent of GDP in 2013 to ________ percent of GDP in 2087, and by 2087 the federal government will be spending, as a fraction of GDP, ________ on these three programs as it currently spends on all its programs.

A) 12.3 percent; more

B) 12.3 percent; half as much

C) 23.4 percent; more

D) 23.4 percent; half as much

A) 12.3 percent; more

B) 12.3 percent; half as much

C) 23.4 percent; more

D) 23.4 percent; half as much

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

29

The Social Security and Medicare programs have been a failure in terms of reducing poverty among elderly U.S. citizens.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

30

Fiscal policy is defined as changes in federal ________ and ________ to achieve macroeconomic objectives such as price stability, high rates of economic growth, and high employment.

A) taxes; interest rates

B) taxes; the money supply

C) interest rates; money supply

D) taxes; expenditures

A) taxes; interest rates

B) taxes; the money supply

C) interest rates; money supply

D) taxes; expenditures

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following statements about the Social Security, Medicare, and Medicaid programs is true?

A) Spending on these three programs will rise from 9.7% of GDP currently to 10.2% of GDP by 2050.

B) Costs are being driven up by the fact that Americans are living longer and medical costs are rising substantially.

C) Some economists have argued for decreasing taxes to help with these programs' funding problems.

D) Some economists have argued for increasing benefits to help with these programs' funding problems.

A) Spending on these three programs will rise from 9.7% of GDP currently to 10.2% of GDP by 2050.

B) Costs are being driven up by the fact that Americans are living longer and medical costs are rising substantially.

C) Some economists have argued for decreasing taxes to help with these programs' funding problems.

D) Some economists have argued for increasing benefits to help with these programs' funding problems.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

32

The tax increases necessary to fund future Social Security and Medicare benefit payments would be

A) small, and have little effect on economic growth.

B) small, but could discourage work effort, entrepreneurship and investment, thereby slowing economic growth.

C) large, but would have little effect on economic growth.

D) large, and could discourage work effort, entrepreneurship and investment, thereby slowing economic growth.

A) small, and have little effect on economic growth.

B) small, but could discourage work effort, entrepreneurship and investment, thereby slowing economic growth.

C) large, but would have little effect on economic growth.

D) large, and could discourage work effort, entrepreneurship and investment, thereby slowing economic growth.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

33

Included in government expenditures are government purchases and transfer payments.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

34

The income tax system serves as an automatic stabilizer over the course of the business cycle.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is an example of discretionary fiscal policy?

A) an increase in unemployment insurance payments during a recession

B) an increase in income tax receipts with rising income during an expansion

C) the tax cuts passed by Congress in 2001 to combat the recession

D) a decrease in food stamps issued during an expansion or boom

A) an increase in unemployment insurance payments during a recession

B) an increase in income tax receipts with rising income during an expansion

C) the tax cuts passed by Congress in 2001 to combat the recession

D) a decrease in food stamps issued during an expansion or boom

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

36

The fastest growing category of government expenditure is

A) grants to state and local governments.

B) defense spending.

C) transfer payments.

D) government purchases.

A) grants to state and local governments.

B) defense spending.

C) transfer payments.

D) government purchases.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following would be considered an active fiscal policy?

A) The Fed increases the money supply.

B) Tax incentives are offered to encourage the purchase of fuel efficient cars.

C) Spending on the war in Afghanistan is increased to promote homeland security.

D) A tax cut is designed to stimulate spending passed during a recession.

A) The Fed increases the money supply.

B) Tax incentives are offered to encourage the purchase of fuel efficient cars.

C) Spending on the war in Afghanistan is increased to promote homeland security.

D) A tax cut is designed to stimulate spending passed during a recession.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

38

As a percentage of GDP, federal expenditures ________ from 1950 to the early 1990s, ________ from 1992 to 2001, and have ________ since 2001.

A) rose; fell; risen

B) fell; fell; risen

C) rose; rose; fallen

D) fell; rose; fallen

A) rose; fell; risen

B) fell; fell; risen

C) rose; rose; fallen

D) fell; rose; fallen

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

39

A decrease in the marginal income tax rate is a fiscal policy which will increase aggregate demand.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

40

An increase in the money supply is a discretionary fiscal policy which will increase aggregate demand.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

41

Expansionary fiscal policy involves

A) increasing government purchases or decreasing taxes.

B) increasing taxes or decreasing government purchases.

C) increasing the money supply and decreasing interest rates.

D) decreasing the money supply and increasing interest rates.

A) increasing government purchases or decreasing taxes.

B) increasing taxes or decreasing government purchases.

C) increasing the money supply and decreasing interest rates.

D) decreasing the money supply and increasing interest rates.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

42

What is the difference between federal purchases and federal expenditures?

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

43

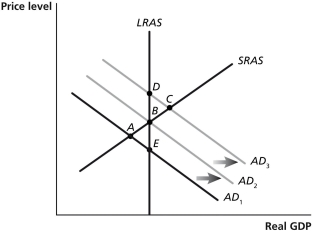

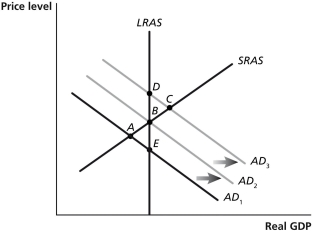

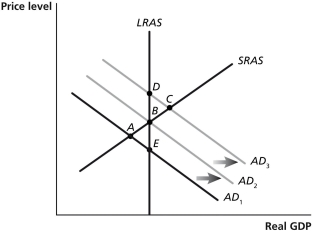

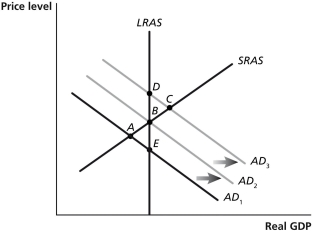

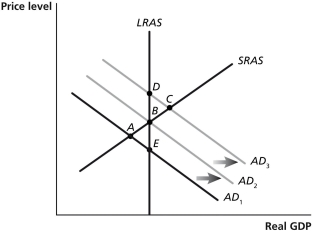

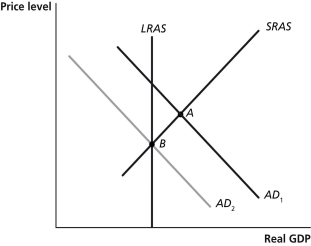

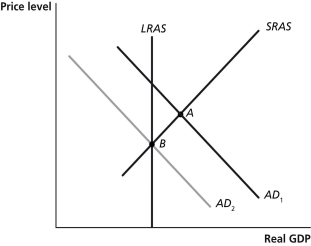

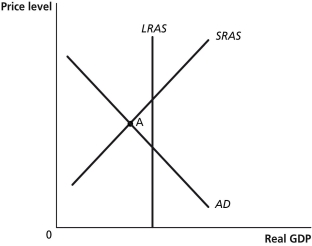

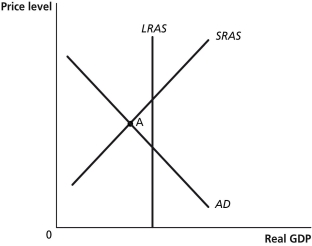

Figure 27-1

Refer to Figure 27-1. Suppose the economy is in short-run equilibrium below potential GDP and no fiscal or monetary policy is pursued. Using the static AD-AS model in the figure above, this would be depicted as a movement from

A) A to B.

B) B to C.

C) C to B.

D) B to A.

E) A to E.

Refer to Figure 27-1. Suppose the economy is in short-run equilibrium below potential GDP and no fiscal or monetary policy is pursued. Using the static AD-AS model in the figure above, this would be depicted as a movement from

A) A to B.

B) B to C.

C) C to B.

D) B to A.

E) A to E.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

44

Figure 27-1

Refer to Figure 27-1. Suppose the economy is in short-run equilibrium above potential GDP and no policy is pursued. Using the static AD-AS model in the figure above, this would be depicted as a movement from

A) D to C.

B) A to E.

C) C to D.

D) C to B.

E) E to A.

Refer to Figure 27-1. Suppose the economy is in short-run equilibrium above potential GDP and no policy is pursued. Using the static AD-AS model in the figure above, this would be depicted as a movement from

A) D to C.

B) A to E.

C) C to D.

D) C to B.

E) E to A.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

45

Figure 27-1

Refer to Figure 27-1. Suppose the economy is in short-run equilibrium below potential GDP and Congress and the president lower taxes to move the economy back to long-run equilibrium. Using the static AD-AS model in the figure above, this would be depicted as a movement from

A) A to B.

B) B to C.

C) C to B.

D) B to A.

E) A to E.

Refer to Figure 27-1. Suppose the economy is in short-run equilibrium below potential GDP and Congress and the president lower taxes to move the economy back to long-run equilibrium. Using the static AD-AS model in the figure above, this would be depicted as a movement from

A) A to B.

B) B to C.

C) C to B.

D) B to A.

E) A to E.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

46

List the five categories of federal government expenditures.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

47

Prior to the 1930s, the majority of dollars spent by government was spent at the state and local levels.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

48

What is fiscal policy, and who is responsible for fiscal policy?

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

49

Give an example of an automatic stabilizer. Explain how automatic stabilizers work in the case of recession.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

50

Tax cuts on business income increase aggregate demand by increasing

A) business investment spending.

B) consumption spending.

C) government spending.

D) wage rates.

A) business investment spending.

B) consumption spending.

C) government spending.

D) wage rates.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

51

An increase in individual income taxes ________ disposable income, which ________ consumption spending.

A) increases; increases

B) increases; decreases

C) decreases; increases

D) decreases; decreases

A) increases; increases

B) increases; decreases

C) decreases; increases

D) decreases; decreases

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

52

Fiscal policy is determined by

A) the Federal Reserve.

B) the president and the Federal Reserve.

C) Congress and the Federal Reserve.

D) Congress and the president.

A) the Federal Reserve.

B) the president and the Federal Reserve.

C) Congress and the Federal Reserve.

D) Congress and the president.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

53

Figure 27-1

Refer to Figure 27-1. Suppose the economy is in short-run equilibrium above potential GDP and wages and prices are rising. If contractionary policy is used to move the economy back to long-run equilibrium, this would be depicted as a movement from ________ using the static AD-AS model in the figure above.

A) D to C

B) C to B

C) A to E

D) B to A

E) E to A

Refer to Figure 27-1. Suppose the economy is in short-run equilibrium above potential GDP and wages and prices are rising. If contractionary policy is used to move the economy back to long-run equilibrium, this would be depicted as a movement from ________ using the static AD-AS model in the figure above.

A) D to C

B) C to B

C) A to E

D) B to A

E) E to A

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

54

Figure 27-1

Refer to Figure 27-1. Suppose the economy is in a recession and expansionary fiscal policy is pursued. Using the static AD-AS model in the figure above, this would be depicted as a movement from

A) A to B.

B) B to C.

C) C to B.

D) B to A.

E) A to E.

Refer to Figure 27-1. Suppose the economy is in a recession and expansionary fiscal policy is pursued. Using the static AD-AS model in the figure above, this would be depicted as a movement from

A) A to B.

B) B to C.

C) C to B.

D) B to A.

E) A to E.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

55

Figure 27-1

Refer to Figure 27-1. An increase in taxes would be depicted as a movement from ________, using the static AD-AS model in the figure above.

A) E to B

B) B to C

C) A to B

D) B to A

E) C to D

Refer to Figure 27-1. An increase in taxes would be depicted as a movement from ________, using the static AD-AS model in the figure above.

A) E to B

B) B to C

C) A to B

D) B to A

E) C to D

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

56

Figure 27-1

Refer to Figure 27-1. Suppose the economy is in short-run equilibrium above potential GDP and automatic stabilizers move the economy back to long-run equilibrium. Using the static AD-AS model in the figure above, this would be depicted as a movement from

A) D to C.

B) A to E.

C) C to B.

D) B to A.

E) E to A.

Refer to Figure 27-1. Suppose the economy is in short-run equilibrium above potential GDP and automatic stabilizers move the economy back to long-run equilibrium. Using the static AD-AS model in the figure above, this would be depicted as a movement from

A) D to C.

B) A to E.

C) C to B.

D) B to A.

E) E to A.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

57

Tax cuts on business income ________ aggregate demand.

A) would decrease

B) would increase

C) would not change

D) may increase or decrease

A) would decrease

B) would increase

C) would not change

D) may increase or decrease

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

58

An increase in government purchases will increase aggregate demand because

A) government expenditures are a component of aggregate demand.

B) consumption expenditures are a component of aggregate demand.

C) the decline in the price level will increase demand.

D) the decline in the interest rate will increase demand.

A) government expenditures are a component of aggregate demand.

B) consumption expenditures are a component of aggregate demand.

C) the decline in the price level will increase demand.

D) the decline in the interest rate will increase demand.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

59

Congress and the president carry out fiscal policy through changes in

A) interest rates and the money supply.

B) taxes and the interest rate.

C) government purchases and the money supply.

D) government purchases and taxes.

A) interest rates and the money supply.

B) taxes and the interest rate.

C) government purchases and the money supply.

D) government purchases and taxes.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

60

What is the difference between fiscal policy and monetary policy?

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

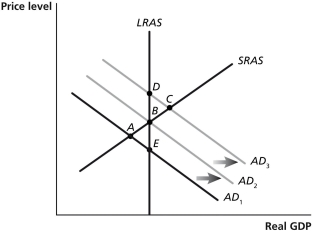

61

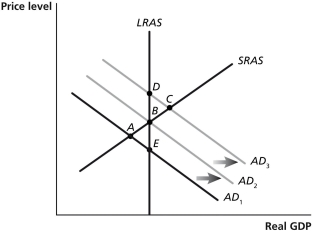

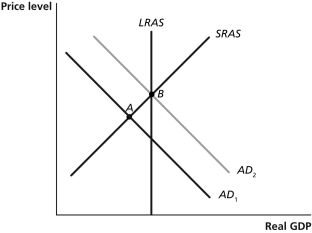

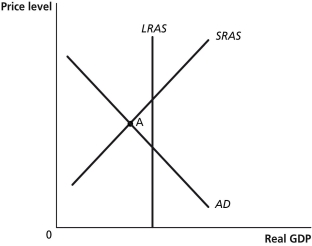

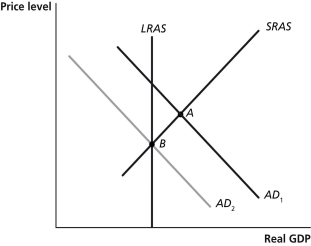

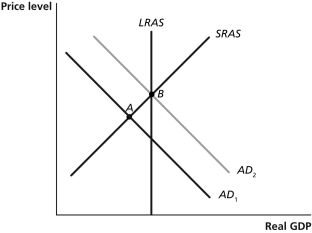

Figure 27-3

Decreasing government spending ________ the price level and ________ equilibrium real GDP.

A) decreases; increases

B) increases; decreases

C) increases; increases

D) decreases; decreases

Decreasing government spending ________ the price level and ________ equilibrium real GDP.

A) decreases; increases

B) increases; decreases

C) increases; increases

D) decreases; decreases

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

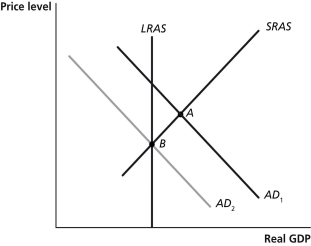

62

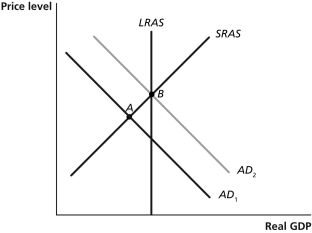

Figure 27-4

Expansionary fiscal policy involves increasing government purchases or increasing taxes.

Expansionary fiscal policy involves increasing government purchases or increasing taxes.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

63

To combat a recession with discretionary fiscal policy, Congress and the president should

A) decrease government spending to balance the budget.

B) decrease taxes to increase consumer disposable income.

C) lower interest rates and increase investment by increasing the money supply.

D) raise taxes on interest and dividends, but not on personal income.

A) decrease government spending to balance the budget.

B) decrease taxes to increase consumer disposable income.

C) lower interest rates and increase investment by increasing the money supply.

D) raise taxes on interest and dividends, but not on personal income.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

64

Expansionary fiscal policy will

A) shift the aggregate demand curve to the left.

B) shift the aggregate demand curve to the right.

C) not shift the aggregate demand curve.

D) shift the short-run aggregate supply curve to the left.

A) shift the aggregate demand curve to the left.

B) shift the aggregate demand curve to the right.

C) not shift the aggregate demand curve.

D) shift the short-run aggregate supply curve to the left.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

65

A decrease in individual income taxes ________ disposable income, which ________ consumption spending.

A) increases; increases

B) increases; decreases

C) decreases; increases

D) decreases; decreases

A) increases; increases

B) increases; decreases

C) decreases; increases

D) decreases; decreases

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following is considered contractionary fiscal policy?

A) Congress increases the income tax rate.

B) Congress increases defense spending.

C) Legislation removes a college tuition deduction from federal income taxes.

D) The New Jersey legislature cuts highway spending to balance its budget.

A) Congress increases the income tax rate.

B) Congress increases defense spending.

C) Legislation removes a college tuition deduction from federal income taxes.

D) The New Jersey legislature cuts highway spending to balance its budget.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

67

Tax increases on business income decrease aggregate demand by decreasing

A) business investment spending.

B) consumption spending.

C) government spending.

D) wage rates.

A) business investment spending.

B) consumption spending.

C) government spending.

D) wage rates.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

68

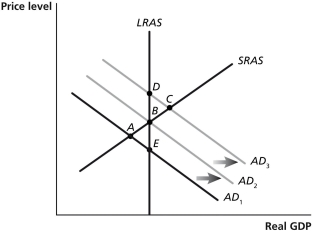

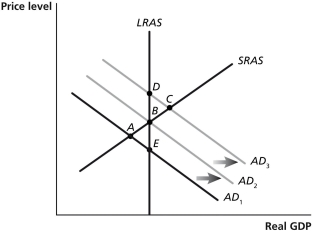

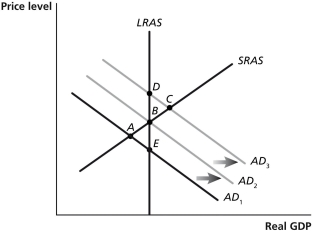

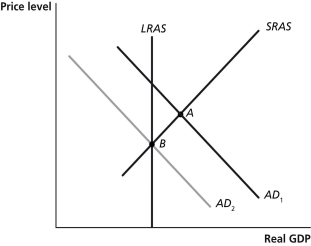

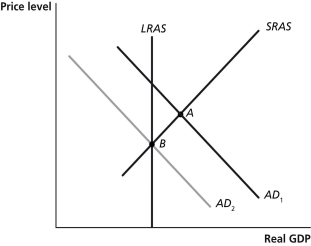

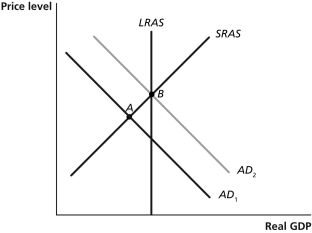

Figure 27-2

Refer to Figure 27-2. In the graph above, if the economy is at point A, an appropriate fiscal policy by the Congress and the president would be to

A) lower the discount rate of interest.

B) execute an open market sale of government securities.

C) increase government transfer payments.

D) increase marginal income tax rates.

Refer to Figure 27-2. In the graph above, if the economy is at point A, an appropriate fiscal policy by the Congress and the president would be to

A) lower the discount rate of interest.

B) execute an open market sale of government securities.

C) increase government transfer payments.

D) increase marginal income tax rates.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

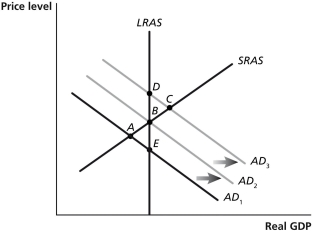

69

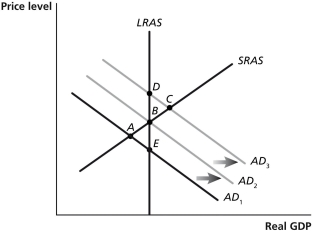

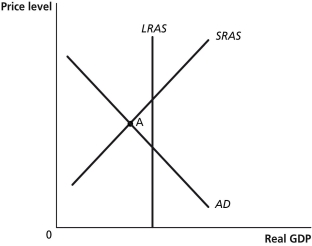

Figure 27-4

The problem causing most recessions is too little

A) money (currency plus checking accounts).

B) spending.

C) unemployment.

D) taxes.

The problem causing most recessions is too little

A) money (currency plus checking accounts).

B) spending.

C) unemployment.

D) taxes.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

70

If the economy is falling below potential real GDP, which of the following would be an appropriate fiscal policy to bring the economy back to long-run aggregate supply? An increase in

A) the money supply and a decrease in interest rates.

B) government purchases.

C) oil prices.

D) taxes.

A) the money supply and a decrease in interest rates.

B) government purchases.

C) oil prices.

D) taxes.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

71

Contractionary fiscal policy is used to decrease aggregate demand in an attempt to fight rising inflation.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

72

Lowering the individual income tax will increase household disposable income and consumption spending.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

73

Figure 27-4

Refer to Figure 27-4. In the graph above, suppose the economy is initially at point A. The movement of the economy to point B as shown in the graph illustrates the effect of which of the following policy actions by the Congress and the president?

A) an increase in transfer payments

B) an increase in interest rates

C) an increase in the marginal income tax rate

D) an open market purchase of Treasury bills

Refer to Figure 27-4. In the graph above, suppose the economy is initially at point A. The movement of the economy to point B as shown in the graph illustrates the effect of which of the following policy actions by the Congress and the president?

A) an increase in transfer payments

B) an increase in interest rates

C) an increase in the marginal income tax rate

D) an open market purchase of Treasury bills

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following is considered expansionary fiscal policy?

A) Congress decreases the income tax rate.

B) Congress increases defense spending.

C) Legislation increases a college tuition deduction from federal income taxes.

D) The Arizona legislature cuts highway spending to balance its budget.

A) Congress decreases the income tax rate.

B) Congress increases defense spending.

C) Legislation increases a college tuition deduction from federal income taxes.

D) The Arizona legislature cuts highway spending to balance its budget.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

75

Figure 27-2

Refer to Figure 27-2. In the graph above, if the economy is at point A, an appropriate fiscal policy by the Congress and the president would be to

A) decrease the required reserve ratio.

B) sell government securities.

C) increase government expenditures.

D) decrease transfer payments.

Refer to Figure 27-2. In the graph above, if the economy is at point A, an appropriate fiscal policy by the Congress and the president would be to

A) decrease the required reserve ratio.

B) sell government securities.

C) increase government expenditures.

D) decrease transfer payments.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

76

If the economy is growing beyond potential real GDP, which of the following would be an appropriate fiscal policy to bring the economy back to long-run aggregate supply? An increase in

A) the money supply and a decrease in interest rates.

B) government purchases.

C) oil prices.

D) taxes.

A) the money supply and a decrease in interest rates.

B) government purchases.

C) oil prices.

D) taxes.

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

77

Contractionary fiscal policy to prevent real GDP from rising above potential real GDP would cause the inflation rate to be ________ and real GDP to be ________.

A) higher; higher

B) higher; lower

C) lower; higher

D) lower; lower

A) higher; higher

B) higher; lower

C) lower; higher

D) lower; lower

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

78

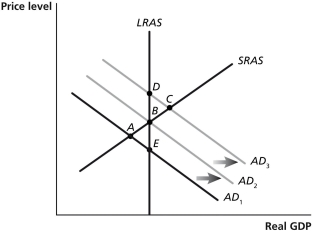

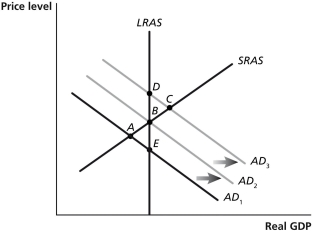

Figure 27-3

Refer to Figure 27-3. In the graph above, suppose the economy is initially at point A. The movement of the economy to point B as shown in the graph illustrates the effect of which of the following policy actions by the Congress and the president?

A) a decrease in income taxes

B) a decrease in interest rates

C) a decrease in government purchases

D) an increase in the money supply

Refer to Figure 27-3. In the graph above, suppose the economy is initially at point A. The movement of the economy to point B as shown in the graph illustrates the effect of which of the following policy actions by the Congress and the president?

A) a decrease in income taxes

B) a decrease in interest rates

C) a decrease in government purchases

D) an increase in the money supply

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following is an appropriate discretionary fiscal policy if equilibrium real GDP falls below potential real GDP?

A) an increase in government purchases

B) an increase in the supply of money

C) an increase in individual income taxes

D) a decrease in transfer payments

A) an increase in government purchases

B) an increase in the supply of money

C) an increase in individual income taxes

D) a decrease in transfer payments

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck

80

Expansionary fiscal policy to prevent real GDP from falling below potential real GDP would cause the inflation rate to be ________ and real GDP to be ________.

A) higher; higher

B) higher; lower

C) lower; higher

D) lower; lower

A) higher; higher

B) higher; lower

C) lower; higher

D) lower; lower

Unlock Deck

Unlock for access to all 303 flashcards in this deck.

Unlock Deck

k this deck