Deck 7: Activity Based Costing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/184

Play

Full screen (f)

Deck 7: Activity Based Costing

1

Companies often refine their cost allocation systems to minimize the amount of cost distortion caused by the simpler cost allocation systems.

True

2

To determine the amount of overhead allocated, the overhead rate is divided by the cost driver.

False

3

With increased competition, managers need more accurate estimates of product costs in order to set prices and to identify the most profitable products.

True

4

Refined costing systems can only be used by manufacturers to allocate manufacturing overhead.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

5

The allocation base selected for each department should be the cost driver of the costs in the departmental overhead pool.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

6

The plantwide overhead cost allocation rate is computed by dividing the estimated total manufacturing overhead costs by the estimated total quantity of the cost allocation base.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

7

A departmental overhead rate is calculated by multiplying the estimated total manufacturing overhead costs of the department by the estimated total quantity of the department's cost allocation base.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

8

Refined costing systems can be used to allocate any indirect costs to any cost objects.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

9

Direct labour hours would be the most appropriate cost allocation base for a Machining Department that uses machine robotics extensively.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

10

Using departmental overhead rates is generally more accurate than using a single plantwide overhead rate.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

11

One condition that favours using a plantwide overhead rate, rather than departmental overhead rates, is that different departments incur different amounts and types of manufacturing overhead.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

12

If a company uses departmental overhead allocation rates, then the amount of manufacturing overhead allocated to the job is equal to the plantwide overhead rate multiplied by the actual use of the cost allocation base.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

13

The estimated total manufacturing overhead costs that will be incurred in each department in the coming year are often referred to as activity cost pools.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

14

Merchandising and service companies, as well as governmental agencies, can use refined cost allocation systems to provide their managers with better cost information.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

15

Companies that use departmental overhead rates trace direct materials and direct labour to cost objects just as in a traditional costing systems.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

16

Cost distortion occurs when some products are overcosted while other products are undercosted by the cost allocation system.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

17

As a result of cost distortion, either all products will be overcosted, or all products will be undercosted.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

18

Plantwide overhead rates typically do a better job of matching each department's overhead costs to the products that use the department's resources than do departmental overhead rates.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

19

The departmental overhead cost allocation rate is computed by dividing the estimated total manufacturing overhead costs of the department by the estimated total quantity of the department's cost allocation base.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

20

If a company's plantwide overhead rate is allocated based on direct labour hours, then each job will be allocated manufacturing overhead based on the total direct labour hours incurred on the job, regardless of the manufacturing department in which those hours were incurred.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

21

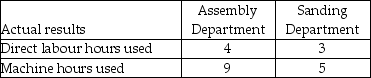

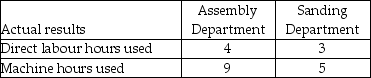

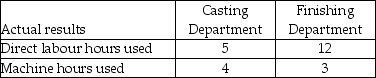

Use the information below to answer the following question(s):

Bond Industries uses departmental overhead rates to allocate its manufacturing overhead to jobs. The company has two departments, Assembly and Sanding. The Assembly Department uses a departmental overhead rate of $20 per machine hour, while the Sanding Department uses a departmental overhead rate of $15 per direct labour hour. Job 542 used the following direct labour hours and machine hours in the two departments:

The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 542 is $1,200.

The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 542 is $1,200.

How much manufacturing overhead would be allocated to Job 542 using the departmental overhead rates?

A) $125

B) $155

C) $225

D) $245

Bond Industries uses departmental overhead rates to allocate its manufacturing overhead to jobs. The company has two departments, Assembly and Sanding. The Assembly Department uses a departmental overhead rate of $20 per machine hour, while the Sanding Department uses a departmental overhead rate of $15 per direct labour hour. Job 542 used the following direct labour hours and machine hours in the two departments:

The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 542 is $1,200.

The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 542 is $1,200.How much manufacturing overhead would be allocated to Job 542 using the departmental overhead rates?

A) $125

B) $155

C) $225

D) $245

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

22

The use of departmental overhead rates will generally result in the use of a

A) single cost allocation base.

B) separate cost allocation base for each department in the factory.

C) single overhead cost pool for the factory.

D) separate cost allocation base for each activity in the factory.

A) single cost allocation base.

B) separate cost allocation base for each department in the factory.

C) single overhead cost pool for the factory.

D) separate cost allocation base for each activity in the factory.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

23

Use the information below to answer the following question(s):

Green Bags Company manufactures cloth grocery bags to be sold to grocery stores and other retailers. Green Bags Company sells the bags in cases of 1,000 bags. The bags come in three sizes: Large, Medium, and Small. Currently, Green Bags Company uses a single plantwide overhead rate to allocate its $7,141,100 of annual manufacturing overhead. Of this amount, $1,875,000 is associated with the Large Bag line, $2,992,500 is associated with the Medium Bag line, and $2,273,600 is associated with the Small Bag line. Green Bags Company is currently running a total of 37,000 machine hours; 12,500 in the Large Bag line, 13,300 in the Medium Bag line, and 11,200 in the Small Bag line. Green Bags Company uses machine hours as the cost driver for manufacturing overhead costs.

Which product line(s) at Green Bags Company have been overcosted or undercosted by using the plantwide manufacturing overhead rate?

A) Large Bags has been overcosted; Medium and Small have been undercosted.

B) Large, Medium, and Small Bags have all been overcosted.

C) Large, Medium, and Small Bags have all been undercosted.

D) Large Bags has been undercosted; Medium and Small have been overcosted.

Green Bags Company manufactures cloth grocery bags to be sold to grocery stores and other retailers. Green Bags Company sells the bags in cases of 1,000 bags. The bags come in three sizes: Large, Medium, and Small. Currently, Green Bags Company uses a single plantwide overhead rate to allocate its $7,141,100 of annual manufacturing overhead. Of this amount, $1,875,000 is associated with the Large Bag line, $2,992,500 is associated with the Medium Bag line, and $2,273,600 is associated with the Small Bag line. Green Bags Company is currently running a total of 37,000 machine hours; 12,500 in the Large Bag line, 13,300 in the Medium Bag line, and 11,200 in the Small Bag line. Green Bags Company uses machine hours as the cost driver for manufacturing overhead costs.

Which product line(s) at Green Bags Company have been overcosted or undercosted by using the plantwide manufacturing overhead rate?

A) Large Bags has been overcosted; Medium and Small have been undercosted.

B) Large, Medium, and Small Bags have all been overcosted.

C) Large, Medium, and Small Bags have all been undercosted.

D) Large Bags has been undercosted; Medium and Small have been overcosted.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

24

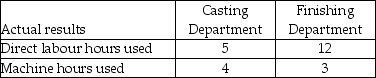

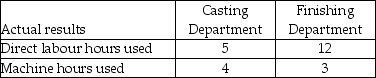

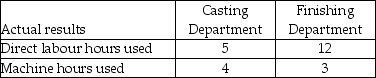

Use the information below to answer the following question(s):

Ryan Fabrication allocates manufacturing overhead to each job using departmental overhead rates. Ryan's operations are divided into a metal casting department and a metal finishing department. The casting department uses a departmental overhead rate of $52 per machine hour, while the finishing department uses a departmental overhead rate of $28 per direct labour hour. Job A216 used the following direct labour hours and machine hours in the two departments:

The cost for direct labour is $32 per direct labour hour and the cost of the direct materials used by Job A216 is $1,800.

The cost for direct labour is $32 per direct labour hour and the cost of the direct materials used by Job A216 is $1,800.

How much manufacturing overhead would be allocated to Job A216 using the departmental overhead rates?

A) $544

B) $596

C) $1,360

D) $454

Ryan Fabrication allocates manufacturing overhead to each job using departmental overhead rates. Ryan's operations are divided into a metal casting department and a metal finishing department. The casting department uses a departmental overhead rate of $52 per machine hour, while the finishing department uses a departmental overhead rate of $28 per direct labour hour. Job A216 used the following direct labour hours and machine hours in the two departments:

The cost for direct labour is $32 per direct labour hour and the cost of the direct materials used by Job A216 is $1,800.

The cost for direct labour is $32 per direct labour hour and the cost of the direct materials used by Job A216 is $1,800.How much manufacturing overhead would be allocated to Job A216 using the departmental overhead rates?

A) $544

B) $596

C) $1,360

D) $454

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

25

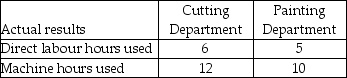

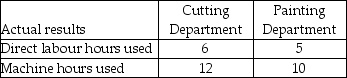

The Highland Corporation uses departmental overhead rates to allocate its manufacturing overhead to jobs. The company has two departments-cutting and painting. The Cutting Department uses a departmental overhead rate of $15 per machine hour, while the Painting Department uses a departmental overhead rate of $9 per direct labour hour. Job 586 used the following direct labour hours and machine hours in the two departments:

The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 586 is $900.

Required: What was the total cost of Job 586 if the Highland Corporation used the departmental overhead rates to allocate manufacturing overhead?

The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 586 is $900.

Required: What was the total cost of Job 586 if the Highland Corporation used the departmental overhead rates to allocate manufacturing overhead?

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

26

High Rise Display Company manufactures display cases to be sold to retail stores. The cases come in three sizes: Large, Medium, and Small. Currently, High Rise Display Company uses a single plantwide overhead rate to allocate its $3,357,800 of annual manufacturing overhead. Of this amount, $820,000 is associated with the Large Case line, $1,276,800 is associated with the Medium Case line, and $1,261,000 is associated with the Small Case line. Clearview Display Company is currently running a total of 33,000 machine hours: 10,000 in the Large Case line, 13,300 in the Medium Case line, and 9,700 in the Small Case line. High Rise Display Company uses machine hours as the cost driver for manufacturing overhead costs.

Required:

a. Calculate the plantwide manufacturing overhead rate.

b. Calculate the departmental overhead rate for each of the three departments listed.

c. Which product line(s) have been overcosted by using the plantwide manufacturing overhead rate? By how much per machine hour? Which product line(s) have been undercosted by using the plantwide manufacturing overhead rate? By how much per machine hour?

Required:

a. Calculate the plantwide manufacturing overhead rate.

b. Calculate the departmental overhead rate for each of the three departments listed.

c. Which product line(s) have been overcosted by using the plantwide manufacturing overhead rate? By how much per machine hour? Which product line(s) have been undercosted by using the plantwide manufacturing overhead rate? By how much per machine hour?

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

27

Use the information below to answer the following question(s):

Green Bags Company manufactures cloth grocery bags to be sold to grocery stores and other retailers. Green Bags Company sells the bags in cases of 1,000 bags. The bags come in three sizes: Large, Medium, and Small. Currently, Green Bags Company uses a single plantwide overhead rate to allocate its $7,141,100 of annual manufacturing overhead. Of this amount, $1,875,000 is associated with the Large Bag line, $2,992,500 is associated with the Medium Bag line, and $2,273,600 is associated with the Small Bag line. Green Bags Company is currently running a total of 37,000 machine hours; 12,500 in the Large Bag line, 13,300 in the Medium Bag line, and 11,200 in the Small Bag line. Green Bags Company uses machine hours as the cost driver for manufacturing overhead costs.

-The departmental manufacturing overhead rate for the Small Bag line would be closest to

A) $203.00 per machine hour.

B) $150.00 per machine hour.

C) $193.00 per machine hour.

D) $225.00 per machine hour.

Green Bags Company manufactures cloth grocery bags to be sold to grocery stores and other retailers. Green Bags Company sells the bags in cases of 1,000 bags. The bags come in three sizes: Large, Medium, and Small. Currently, Green Bags Company uses a single plantwide overhead rate to allocate its $7,141,100 of annual manufacturing overhead. Of this amount, $1,875,000 is associated with the Large Bag line, $2,992,500 is associated with the Medium Bag line, and $2,273,600 is associated with the Small Bag line. Green Bags Company is currently running a total of 37,000 machine hours; 12,500 in the Large Bag line, 13,300 in the Medium Bag line, and 11,200 in the Small Bag line. Green Bags Company uses machine hours as the cost driver for manufacturing overhead costs.

-The departmental manufacturing overhead rate for the Small Bag line would be closest to

A) $203.00 per machine hour.

B) $150.00 per machine hour.

C) $193.00 per machine hour.

D) $225.00 per machine hour.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

28

When calculating a departmental overhead rate, the numerator should be the

A) total estimated departmental overhead cost pool.

B) total estimated amount of the departmental allocation base.

C) total estimated amount of manufacturing overhead for the factory.

D) actual quantity of the departmental allocation base used by the job.

A) total estimated departmental overhead cost pool.

B) total estimated amount of the departmental allocation base.

C) total estimated amount of manufacturing overhead for the factory.

D) actual quantity of the departmental allocation base used by the job.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

29

Use the information below to answer the following question(s):

Cooper's Bags Company manufactures cloth grocery bags to be sold to grocery stores and other retailers. Cooper's Bags Company sells the bags in cases of 1,000 bags. The bags come in three sizes: Large, Medium, and Small. Currently, Cooper's Bags Company uses a single plantwide overhead rate to allocate its $8,088,000 of annual manufacturing overhead. Of this amount, $2,210,000 is associated with the Large Bag line, $3,418,800 is associated with the Medium Bag line, and $2,459,200 is associated with the Small Bag line. Cooper's Bags Company is currently running a total of 40,000 machine hours; 13,000 in the Large Bag line, 15,400 in the Medium Bag line, and 11,600 in the Small Bag line. Cooper's Bags Company uses machine hours as the cost driver for manufacturing overhead costs.

At Cooper's Bags the plantwide manufacturing overhead rate would be closest to

A) $55.25 per machine hour.

B) $170.00 per machine hour.

C) $222.00 per machine hour.

D) $202.20 per machine hour.

Cooper's Bags Company manufactures cloth grocery bags to be sold to grocery stores and other retailers. Cooper's Bags Company sells the bags in cases of 1,000 bags. The bags come in three sizes: Large, Medium, and Small. Currently, Cooper's Bags Company uses a single plantwide overhead rate to allocate its $8,088,000 of annual manufacturing overhead. Of this amount, $2,210,000 is associated with the Large Bag line, $3,418,800 is associated with the Medium Bag line, and $2,459,200 is associated with the Small Bag line. Cooper's Bags Company is currently running a total of 40,000 machine hours; 13,000 in the Large Bag line, 15,400 in the Medium Bag line, and 11,600 in the Small Bag line. Cooper's Bags Company uses machine hours as the cost driver for manufacturing overhead costs.

At Cooper's Bags the plantwide manufacturing overhead rate would be closest to

A) $55.25 per machine hour.

B) $170.00 per machine hour.

C) $222.00 per machine hour.

D) $202.20 per machine hour.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following condition(s) favours using departmental overhead rates in place of a plantwide overhead rate?

A) Manufacturing overhead represents a small proportion of total cost.

B) Different jobs or products use the departments to a different extent.

C) Departments use a similar amount of indirect costs.

D) Products spend the same amount of time in each department.

A) Manufacturing overhead represents a small proportion of total cost.

B) Different jobs or products use the departments to a different extent.

C) Departments use a similar amount of indirect costs.

D) Products spend the same amount of time in each department.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

31

Use the information below to answer the following question(s):

Bond Industries uses departmental overhead rates to allocate its manufacturing overhead to jobs. The company has two departments, Assembly and Sanding. The Assembly Department uses a departmental overhead rate of $20 per machine hour, while the Sanding Department uses a departmental overhead rate of $15 per direct labour hour. Job 542 used the following direct labour hours and machine hours in the two departments:

The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 542 is $1,200.

The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 542 is $1,200.

What was the total cost of Job 542 if Bond Industries used the departmental overhead rates to allocate manufacturing overhead?

A) $1,375

B) $1,425

C) $1,500

D) $1,600

Bond Industries uses departmental overhead rates to allocate its manufacturing overhead to jobs. The company has two departments, Assembly and Sanding. The Assembly Department uses a departmental overhead rate of $20 per machine hour, while the Sanding Department uses a departmental overhead rate of $15 per direct labour hour. Job 542 used the following direct labour hours and machine hours in the two departments:

The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 542 is $1,200.

The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 542 is $1,200.What was the total cost of Job 542 if Bond Industries used the departmental overhead rates to allocate manufacturing overhead?

A) $1,375

B) $1,425

C) $1,500

D) $1,600

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

32

Cost distortion results in the

A) overcosting of all products.

B) undercosting of all products.

C) overcosting of some products and undercosting of other products.

D) accurate costing of all products.

A) overcosting of all products.

B) undercosting of all products.

C) overcosting of some products and undercosting of other products.

D) accurate costing of all products.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

33

Use the information below to answer the following question(s):

Cooper's Bags Company manufactures cloth grocery bags to be sold to grocery stores and other retailers. Cooper's Bags Company sells the bags in cases of 1,000 bags. The bags come in three sizes: Large, Medium, and Small. Currently, Cooper's Bags Company uses a single plantwide overhead rate to allocate its $8,088,000 of annual manufacturing overhead. Of this amount, $2,210,000 is associated with the Large Bag line, $3,418,800 is associated with the Medium Bag line, and $2,459,200 is associated with the Small Bag line. Cooper's Bags Company is currently running a total of 40,000 machine hours; 13,000 in the Large Bag line, 15,400 in the Medium Bag line, and 11,600 in the Small Bag line. Cooper's Bags Company uses machine hours as the cost driver for manufacturing overhead costs.

-The departmental manufacturing overhead rate for the Small Bag line would be closest to

A) $202.20 per machine hour.

B) $212.00 per machine hour.

C) $170.00 per machine hour.

D) $222.00 per machine hour.

Cooper's Bags Company manufactures cloth grocery bags to be sold to grocery stores and other retailers. Cooper's Bags Company sells the bags in cases of 1,000 bags. The bags come in three sizes: Large, Medium, and Small. Currently, Cooper's Bags Company uses a single plantwide overhead rate to allocate its $8,088,000 of annual manufacturing overhead. Of this amount, $2,210,000 is associated with the Large Bag line, $3,418,800 is associated with the Medium Bag line, and $2,459,200 is associated with the Small Bag line. Cooper's Bags Company is currently running a total of 40,000 machine hours; 13,000 in the Large Bag line, 15,400 in the Medium Bag line, and 11,600 in the Small Bag line. Cooper's Bags Company uses machine hours as the cost driver for manufacturing overhead costs.

-The departmental manufacturing overhead rate for the Small Bag line would be closest to

A) $202.20 per machine hour.

B) $212.00 per machine hour.

C) $170.00 per machine hour.

D) $222.00 per machine hour.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

34

Use the information below to answer the following question(s):

Cooper's Bags Company manufactures cloth grocery bags to be sold to grocery stores and other retailers. Cooper's Bags Company sells the bags in cases of 1,000 bags. The bags come in three sizes: Large, Medium, and Small. Currently, Cooper's Bags Company uses a single plantwide overhead rate to allocate its $8,088,000 of annual manufacturing overhead. Of this amount, $2,210,000 is associated with the Large Bag line, $3,418,800 is associated with the Medium Bag line, and $2,459,200 is associated with the Small Bag line. Cooper's Bags Company is currently running a total of 40,000 machine hours; 13,000 in the Large Bag line, 15,400 in the Medium Bag line, and 11,600 in the Small Bag line. Cooper's Bags Company uses machine hours as the cost driver for manufacturing overhead costs.

-Which product line(s) have been overcosted or undercosted by using the plantwide manufacturing overhead rate?

A) Large Bags has been undercosted; Medium and Small have been overcosted.

B) Large, Medium, and Small Bags have all been overcosted.

C) Large, Medium, and Small Bags have all been undercosted.

D) Large Bags has been overcosted; Medium and Small have been undercosted.

Cooper's Bags Company manufactures cloth grocery bags to be sold to grocery stores and other retailers. Cooper's Bags Company sells the bags in cases of 1,000 bags. The bags come in three sizes: Large, Medium, and Small. Currently, Cooper's Bags Company uses a single plantwide overhead rate to allocate its $8,088,000 of annual manufacturing overhead. Of this amount, $2,210,000 is associated with the Large Bag line, $3,418,800 is associated with the Medium Bag line, and $2,459,200 is associated with the Small Bag line. Cooper's Bags Company is currently running a total of 40,000 machine hours; 13,000 in the Large Bag line, 15,400 in the Medium Bag line, and 11,600 in the Small Bag line. Cooper's Bags Company uses machine hours as the cost driver for manufacturing overhead costs.

-Which product line(s) have been overcosted or undercosted by using the plantwide manufacturing overhead rate?

A) Large Bags has been undercosted; Medium and Small have been overcosted.

B) Large, Medium, and Small Bags have all been overcosted.

C) Large, Medium, and Small Bags have all been undercosted.

D) Large Bags has been overcosted; Medium and Small have been undercosted.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

35

Use the information below to answer the following question(s):

Green Bags Company manufactures cloth grocery bags to be sold to grocery stores and other retailers. Green Bags Company sells the bags in cases of 1,000 bags. The bags come in three sizes: Large, Medium, and Small. Currently, Green Bags Company uses a single plantwide overhead rate to allocate its $7,141,100 of annual manufacturing overhead. Of this amount, $1,875,000 is associated with the Large Bag line, $2,992,500 is associated with the Medium Bag line, and $2,273,600 is associated with the Small Bag line. Green Bags Company is currently running a total of 37,000 machine hours; 12,500 in the Large Bag line, 13,300 in the Medium Bag line, and 11,200 in the Small Bag line. Green Bags Company uses machine hours as the cost driver for manufacturing overhead costs.

-At Green Bags Company the plantwide manufacturing overhead rate would be closest to

A) $50.68 per machine hour.

B) $150.00 per machine hour.

C) $193.00 per machine hour.

D) $225.00 per machine hour.

Green Bags Company manufactures cloth grocery bags to be sold to grocery stores and other retailers. Green Bags Company sells the bags in cases of 1,000 bags. The bags come in three sizes: Large, Medium, and Small. Currently, Green Bags Company uses a single plantwide overhead rate to allocate its $7,141,100 of annual manufacturing overhead. Of this amount, $1,875,000 is associated with the Large Bag line, $2,992,500 is associated with the Medium Bag line, and $2,273,600 is associated with the Small Bag line. Green Bags Company is currently running a total of 37,000 machine hours; 12,500 in the Large Bag line, 13,300 in the Medium Bag line, and 11,200 in the Small Bag line. Green Bags Company uses machine hours as the cost driver for manufacturing overhead costs.

-At Green Bags Company the plantwide manufacturing overhead rate would be closest to

A) $50.68 per machine hour.

B) $150.00 per machine hour.

C) $193.00 per machine hour.

D) $225.00 per machine hour.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

36

Using a departmental overhead rate reduces the cost distortion from allocating direct costs.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

37

When calculating the total amount of manufacturing overhead to allocate to a particular job, the company would multiply each departmental overhead rate by ________ and then ________ together the allocated amounts from each department.

A) the actual amount of the departmental allocation base used by the job; add

B) the actual amount of the plantwide allocation base used by the job; add

C) the actual amount of the departmental allocation base used by the job; multiply

D) the actual amount of the plantwide allocation base used by the job; multiply

A) the actual amount of the departmental allocation base used by the job; add

B) the actual amount of the plantwide allocation base used by the job; add

C) the actual amount of the departmental allocation base used by the job; multiply

D) the actual amount of the plantwide allocation base used by the job; multiply

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

38

Use the information below to answer the following question(s):

Ryan Fabrication allocates manufacturing overhead to each job using departmental overhead rates. Ryan's operations are divided into a metal casting department and a metal finishing department. The casting department uses a departmental overhead rate of $52 per machine hour, while the finishing department uses a departmental overhead rate of $28 per direct labour hour. Job A216 used the following direct labour hours and machine hours in the two departments:

The cost for direct labour is $32 per direct labour hour and the cost of the direct materials used by Job A216 is $1,800.

The cost for direct labour is $32 per direct labour hour and the cost of the direct materials used by Job A216 is $1,800.

-What was the total cost of Job A216 if Ryan Fabrication used the departmental overhead rates to allocate manufacturing overhead?

A) $2,434

B) $2,344

C) $2,888

D) $2,940

Ryan Fabrication allocates manufacturing overhead to each job using departmental overhead rates. Ryan's operations are divided into a metal casting department and a metal finishing department. The casting department uses a departmental overhead rate of $52 per machine hour, while the finishing department uses a departmental overhead rate of $28 per direct labour hour. Job A216 used the following direct labour hours and machine hours in the two departments:

The cost for direct labour is $32 per direct labour hour and the cost of the direct materials used by Job A216 is $1,800.

The cost for direct labour is $32 per direct labour hour and the cost of the direct materials used by Job A216 is $1,800.-What was the total cost of Job A216 if Ryan Fabrication used the departmental overhead rates to allocate manufacturing overhead?

A) $2,434

B) $2,344

C) $2,888

D) $2,940

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

39

Clearview Display Company manufactures display cases to be sold to retail stores. The cases come in three sizes-Large, Medium, and Small. Currently, Clearview Display Company uses a single plantwide overhead rate to allocate its $7,141,100 of annual manufacturing overhead. Of this amount, $1,875,000 is associated with the Large Case line, $2,992,500 is associated with the Medium Case line, and $2,273,600 is associated with the Small Case line. Clearview Display Company is currently running a total of 37,000 machine hours: 12,500 in the Large Case line, 13,300 in the Medium Case line, and 11,200 in the Small Case line. Clearview Display Company uses machine hours as the cost driver for manufacturing overhead costs.

Required:

a. Calculate the plantwide manufacturing overhead rate.

b. Calculate the departmental overhead rate for each of the three departments listed.

c. Which product line(s) have been overcosted by using the plantwide manufacturing overhead rate? By how much per machine hour? Which product line(s) have been undercosted by using the plantwide manufacturing overhead rate? By how much per machine hour?

Required:

a. Calculate the plantwide manufacturing overhead rate.

b. Calculate the departmental overhead rate for each of the three departments listed.

c. Which product line(s) have been overcosted by using the plantwide manufacturing overhead rate? By how much per machine hour? Which product line(s) have been undercosted by using the plantwide manufacturing overhead rate? By how much per machine hour?

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

40

The Braveheart Corporation uses departmental overhead rates to allocate its manufacturing overhead to jobs. The company has two departments: cutting and painting. The Cutting Department uses a departmental overhead rate of $12 per machine hour, while the Painting Department uses a departmental overhead rate of $17 per direct labour hour. Job 422 used the following direct labour hours and machine hours in the two departments:

The cost for direct labour is $20 per direct labour hour and the cost of the direct materials used by Job 422 is $800.

Required: What was the total cost of Job 422 if the Braveheart Corporation used the departmental overhead rates to allocate manufacturing overhead?

The cost for direct labour is $20 per direct labour hour and the cost of the direct materials used by Job 422 is $800.

Required: What was the total cost of Job 422 if the Braveheart Corporation used the departmental overhead rates to allocate manufacturing overhead?

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

41

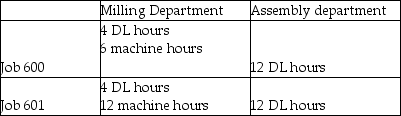

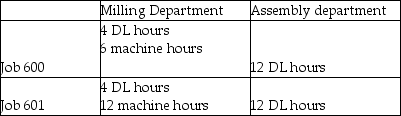

Murphy's Machine Works manufactures custom equipment. Murphy's Machine Works currently uses a plantwide overhead rate, based on direct labour hours, to allocate its $2,500,000 of manufacturing overhead to individual jobs. However, Sean Murphy, owner and CEO, is considering refining the company's costing system by using departmental overhead rates. Currently, the Machining Department incurs $1,500,000 of MOH while the Assembly Department incurs $1,000,000 of MOH. Sean has identified machine hours (MH) as the primary MOH cost driver in the Machining Department and direct labour (DL) hours as the primary cost driver in the Assembly Department. Murphy's completed job numbers 600 and 601 on July 15. Both jobs incurred a total of 9 DL hours throughout the entire production process. Job 600 incurred 5 MH in the Machining Department and 6 DL hours in the Assembly Department (the other 3 DL hour occurred in the Machining Department). Job 601 incurred 8 MH in the Machining Department and 7 DL hours in the Assembly Department (the other two DL hours occurred in the Machining Department).

Requirements

1. Compute departmental overhead rates, assuming Sector expects to incur 30,000 MH in the Machining Department and 40,000 DL hours in the Finishing Department during the year.

2. Using the departmental rates how much manufacturing overhead would be allocated to Job 600 and to Job 601.

Requirements

1. Compute departmental overhead rates, assuming Sector expects to incur 30,000 MH in the Machining Department and 40,000 DL hours in the Finishing Department during the year.

2. Using the departmental rates how much manufacturing overhead would be allocated to Job 600 and to Job 601.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

42

The cost to research and develop, design and market new models would be considered a unit-level cost.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

43

The cost allocation rate for each activity is equal to the estimated total manufacturing overhead costs of the activity multiplied by the estimated total quantity of the cost allocation base.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

44

Machine set-up would be considered a batch-level cost.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

45

The four categories of activity costs in cost hierarchy are determined by the underlying factor that drives its costs.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

46

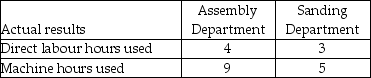

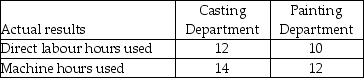

Credit Valley Products manufactures its products in two separate departments: milling and assembly. Total manufacturing overhead costs for the year are budgeted at $1,600,000. Of this amount Milling Department incurs $960,000 (primarily for machine operation and depreciation) while the Assembly Department incurs $640,000. Credit Valley Products estimates that it will incur 8,000 machines hours (all in the Milling Department) and 25,000 direct labour hours (5,000 in the Milling Department and 20,000 in the Assembly Department) during the year.

Credit Valley Products currently uses a plantwide overhead rate based on direct labour hours to allocate overhead. However, the company is considering refining its overhead allocation system by using departmental overhead rates. The Milling Department would allocate its overhead using machine hours (MH), but the Assembly Department would allocate its overhead using direct labour (DL) hours.

The following chart shows the machine hours (MH) and direct labour (DL) hours incurred by Jobs 400 and 401 in each production department:

Both Jobs 400 and 401 used $4,000 of direct materials. Wages and benefits total $35 per direct labour hour. Credit Valley Products prices its products at 120% of total manufacturing costs.

Required:

1. Compute Credit Valley Products' current plantwide overhead rate.

2. Compute refined departmental overhead rates.

3. Compute the total amount of overhead allocated to each job if Credit Valley Products uses its current plantwide overhead rate.

4. Compute the total amount of overhead allocated to each job if Credit Valley Products uses departmental overhead rates.

5. Do both allocation systems accurately reflect the resources that each job used? Explain.

6. Compute the total manufacturing cost and sales price of each job using Credit Valley Products' current plantwide overhead rate.

7. Compute the total manufacturing cost and sales price of each job using Credit Valley Products' refined departmental overhead rates

8. Based on the current (plantwide) allocation system, how much profit did Credit Valley Products think it earned on each job?

9. Based on the departmental overhead rates and the sales price determined in Requirement 7, how much profit did it really earn on each job?

Credit Valley Products currently uses a plantwide overhead rate based on direct labour hours to allocate overhead. However, the company is considering refining its overhead allocation system by using departmental overhead rates. The Milling Department would allocate its overhead using machine hours (MH), but the Assembly Department would allocate its overhead using direct labour (DL) hours.

The following chart shows the machine hours (MH) and direct labour (DL) hours incurred by Jobs 400 and 401 in each production department:

Both Jobs 400 and 401 used $4,000 of direct materials. Wages and benefits total $35 per direct labour hour. Credit Valley Products prices its products at 120% of total manufacturing costs.

Required:

1. Compute Credit Valley Products' current plantwide overhead rate.

2. Compute refined departmental overhead rates.

3. Compute the total amount of overhead allocated to each job if Credit Valley Products uses its current plantwide overhead rate.

4. Compute the total amount of overhead allocated to each job if Credit Valley Products uses departmental overhead rates.

5. Do both allocation systems accurately reflect the resources that each job used? Explain.

6. Compute the total manufacturing cost and sales price of each job using Credit Valley Products' current plantwide overhead rate.

7. Compute the total manufacturing cost and sales price of each job using Credit Valley Products' refined departmental overhead rates

8. Based on the current (plantwide) allocation system, how much profit did Credit Valley Products think it earned on each job?

9. Based on the departmental overhead rates and the sales price determined in Requirement 7, how much profit did it really earn on each job?

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

47

The cost to design and market new models would be considered a facility-level cost.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

48

ABC costing is generally more accurate than traditional cost systems.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

49

Sector's Machine Works manufactures custom equipment. Sector's Machine Works currently uses a plantwide overhead rate, based on direct labour hours, to allocate its $2,000,000 of manufacturing overhead to individual jobs.

Sector's plant completed Jobs 550 and 555 on May 15. Both jobs incurred a total of 7 DL hours throughout the entire production process. Job 550 incurred 3 MH in the Machining Department and 6 DL hours in the Assembly Department (the other DL hour occurred in the Machining Department). Job 555 incurred 4 MH in the Machining Department and 5 DL hours in the Assembly Department (the other two DL hours occurred in the Machining Department).

Requirements

1. Compute the plantwide overhead rate, assuming Garvey expects to incur 40,000 total DL hours during the year.

2. How much manufacturing overhead would be allocated to each job if Sector uses the plant wide rate?

Sector's plant completed Jobs 550 and 555 on May 15. Both jobs incurred a total of 7 DL hours throughout the entire production process. Job 550 incurred 3 MH in the Machining Department and 6 DL hours in the Assembly Department (the other DL hour occurred in the Machining Department). Job 555 incurred 4 MH in the Machining Department and 5 DL hours in the Assembly Department (the other two DL hours occurred in the Machining Department).

Requirements

1. Compute the plantwide overhead rate, assuming Garvey expects to incur 40,000 total DL hours during the year.

2. How much manufacturing overhead would be allocated to each job if Sector uses the plant wide rate?

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

50

Companies that use ABC trace direct materials and direct labour to cost objects just as in traditional costing systems.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

51

Product-level activities and costs are incurred for a particular product, regardless of the number of units or batches of the product produced.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

52

The cost of inspecting and packaging each unit the company produces would be considered a unit-level activity cost.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

53

Murphy's Machine Works manufactures custom equipment. Sector's Machine Works currently uses a plantwide overhead rate, based on direct labour hours, to allocate its $2,500,000 of manufacturing overhead to individual jobs.

Murphy's plant completed Jobs 600 and 601 on July 15. Both jobs incurred a total of 9 DL hours throughout the entire production process. Job 600 incurred 5 MH in the Machining Department and 6 DL hours in the Assembly Department (the other 3 DL hour occurred in the Machining Department). Job 601 incurred 8 MH in the Machining Department and 7 DL hours in the Assembly Department (the other two DL hours occurred in the Machining Department).

Requirements

1. Compute the plantwide overhead rate, assuming Murphy expects to incur 50,000 total DL hours during the year.

2. How much manufacturing overhead would be allocated to each job if Murphy uses the plant wide rate?

Murphy's plant completed Jobs 600 and 601 on July 15. Both jobs incurred a total of 9 DL hours throughout the entire production process. Job 600 incurred 5 MH in the Machining Department and 6 DL hours in the Assembly Department (the other 3 DL hour occurred in the Machining Department). Job 601 incurred 8 MH in the Machining Department and 7 DL hours in the Assembly Department (the other two DL hours occurred in the Machining Department).

Requirements

1. Compute the plantwide overhead rate, assuming Murphy expects to incur 50,000 total DL hours during the year.

2. How much manufacturing overhead would be allocated to each job if Murphy uses the plant wide rate?

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

54

It is easier to allocate indirect costs to the products that caused those costs if you use the ABC system rather than traditional costing systems.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

55

Unit-level activities and costs are incurred once for every batch.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

56

Sector's Machine Works manufactures custom equipment. Sector's Machine Works currently uses a plantwide overhead rate, based on direct labour hours, to allocate its $2,000,000 of manufacturing overhead to individual jobs. However, Franco Sector, owner and CEO, is considering refining the company's costing system by using departmental overhead rates. Currently, the Machining Department incurs $1,400,000 of MOH while the Assembly Department incurs $600,000 of MOH. Franco has identified machine hours (MH) as the primary MOH cost driver in the Machining Department and direct labour (DL) hours as the primary cost driver in the Assembly Department. Sector completed job numbers 550 and 555 on May 15. Both jobs incurred a total of 7 DL hours throughout the entire production process. Job 550 incurred 3 MH in the Machining Department and 6 DL hours in the Assembly Department (the other DL hour occurred in the Machining Department). Job 555 incurred 4 MH in the Machining Department and 5 DL hours in the Assembly Department (the other two DL hours occurred in the Machining Department).

Requirements

1. Compute departmental overhead rates, assuming Sector expects to incur 25,000 MH in the Machining Department and 30,000 DL hours in the Finishing Department during the year.

2. Using the departmental rates how much manufacturing overhead would be allocated to Job 550 and to Job 555.

Requirements

1. Compute departmental overhead rates, assuming Sector expects to incur 25,000 MH in the Machining Department and 30,000 DL hours in the Finishing Department during the year.

2. Using the departmental rates how much manufacturing overhead would be allocated to Job 550 and to Job 555.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

57

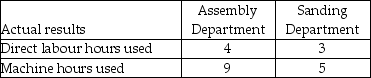

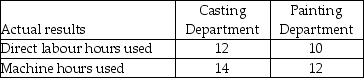

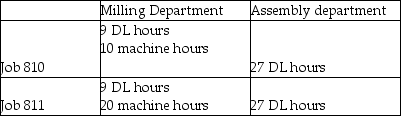

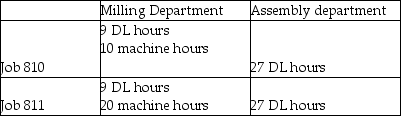

Speedy Machine Products manufactures its products in two separate departments, Machining and Painting. Total manufacturing overhead costs for the year are budgeted at $2,500,000. Of this amount the Machining Department incurs $1,500,000 (primarily for machine operation and depreciation) while the Painting Department incurs $1,000,000. Speedy Machine Products estimates that it will incur 12,000 machines hours (all in the Milling Department) and 40,000 direct labour hours (15,000 in the Milling Department and 25,000 in the Assembly Department) during the year.

Speedy Machine Products currently uses a plantwide overhead rate based on direct labour hours to allocate overhead. However, the company is considering refining its overhead allocation system by using departmental overhead rates. The Machining Department would allocate its overhead using machine hours (MH), but the Painting Department would allocate its overhead using direct labour (DL) hours.

The following chart shows the machine hours (MH) and direct labour (DL) hours incurred by Jobs 810 and 811 in each production department:

Both Jobs 810 and 811 used $7,500 of direct materials. Wages and benefits total $30 per direct labour hour. Speedy Machine Products prices its products at 120% of total manufacturing costs.

Required:

1. Compute Speedy Machine Products' current plantwide overhead rate.

2. Compute refined departmental overhead rates.

3. Compute the total amount of overhead allocated to each job if Speedy Machine Products uses its current plantwide overhead rate.

4. Compute the total amount of overhead allocated to each job if Speedy Machine Products uses departmental overhead rates.

5. Do both allocation systems accurately reflect the resources that each job used? Explain.

6. Compute the total manufacturing cost and sales price of each job using Speedy Machine Products' current plantwide overhead rate.

7. Compute the total manufacturing cost and sales price of each job using Speedy Machine Products' refined departmental overhead rates

8. Based on the current (plantwide) allocation system, how much profit did Speedy Machine Products think it earned on each job?

9.Based on the departmental overhead rates and the sales price determined in Requirement 7, how much profit did it really earn on each job?

Speedy Machine Products currently uses a plantwide overhead rate based on direct labour hours to allocate overhead. However, the company is considering refining its overhead allocation system by using departmental overhead rates. The Machining Department would allocate its overhead using machine hours (MH), but the Painting Department would allocate its overhead using direct labour (DL) hours.

The following chart shows the machine hours (MH) and direct labour (DL) hours incurred by Jobs 810 and 811 in each production department:

Both Jobs 810 and 811 used $7,500 of direct materials. Wages and benefits total $30 per direct labour hour. Speedy Machine Products prices its products at 120% of total manufacturing costs.

Required:

1. Compute Speedy Machine Products' current plantwide overhead rate.

2. Compute refined departmental overhead rates.

3. Compute the total amount of overhead allocated to each job if Speedy Machine Products uses its current plantwide overhead rate.

4. Compute the total amount of overhead allocated to each job if Speedy Machine Products uses departmental overhead rates.

5. Do both allocation systems accurately reflect the resources that each job used? Explain.

6. Compute the total manufacturing cost and sales price of each job using Speedy Machine Products' current plantwide overhead rate.

7. Compute the total manufacturing cost and sales price of each job using Speedy Machine Products' refined departmental overhead rates

8. Based on the current (plantwide) allocation system, how much profit did Speedy Machine Products think it earned on each job?

9.Based on the departmental overhead rates and the sales price determined in Requirement 7, how much profit did it really earn on each job?

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

58

Facility-level activities and costs are incurred no matter how many units, batches, or products are produced in the plant.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

59

Two main benefits of ABC are: (1) more accurate product cost information, and (2) more detailed information on the costs of activities and the drivers of those costs.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

60

Batch-level activities and costs are incurred again each time a unit is produced.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

61

Machine set-up would most likely be classified as a

A) unit-level activity.

B) batch-level activity.

C) product-level activity.

D) facility-level activity.

A) unit-level activity.

B) batch-level activity.

C) product-level activity.

D) facility-level activity.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

62

What is the last step in developing an ABC system?

A) Identify the primary activities and estimate a total cost pool for each.

B) Allocate the costs to the cost object using the activity cost allocation rates.

C) Select an allocation base for each activity.

D) Calculate an activity cost allocation rate for each activity.

A) Identify the primary activities and estimate a total cost pool for each.

B) Allocate the costs to the cost object using the activity cost allocation rates.

C) Select an allocation base for each activity.

D) Calculate an activity cost allocation rate for each activity.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

63

Traditional costing that uses a plantwide overhead allocation rate is considered to be most accurate when each product uses specific resources.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following describes how, in ABC, the activity allocation rate is computed?

A) The total estimated activity cost pool is divided by the total estimated activity allocation base.

B) The total estimated activity allocation base is divided by the total estimated activity cost pool.

C) The total estimated activity allocation base is multiplied by the total estimated activity cost pool.

D) You take the total estimated activity allocation base and subtract the total estimated total activity cost pool.

A) The total estimated activity cost pool is divided by the total estimated activity allocation base.

B) The total estimated activity allocation base is divided by the total estimated activity cost pool.

C) The total estimated activity allocation base is multiplied by the total estimated activity cost pool.

D) You take the total estimated activity allocation base and subtract the total estimated total activity cost pool.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

65

The cost of depreciation, insurance, and property tax on the entire production plant would be considered a unit-level cost.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

66

All of the following are activities in an activity-based costing system that determine the cost of a manufactured product except for

A) accounting.

B) inspecting.

C) machining.

D) materials handling.

A) accounting.

B) inspecting.

C) machining.

D) materials handling.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

67

In ABC it is assumed that it is activities that drive costs, rather than cost objects such as inventory.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

68

ABC costing might lead to

A) cutting back on high-volume products that appear unprofitable.

B) expanding low-volume products that appear profitable.

C) raising the sale price of high-volume products.

D) raising the sale price of low-volume products.

A) cutting back on high-volume products that appear unprofitable.

B) expanding low-volume products that appear profitable.

C) raising the sale price of high-volume products.

D) raising the sale price of low-volume products.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

69

Research and development would most likely be classified as a

A) unit-level activity.

B) batch-level activity.

C) product-level activity.

D) facility-level activity.

A) unit-level activity.

B) batch-level activity.

C) product-level activity.

D) facility-level activity.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following statements is TRUE regarding activity-based costing systems?

A) ABC systems accumulate overhead costs by departments.

B) ABC costing systems are less complex and, therefore, less costly than traditional systems.

C) ABC costing systems can be used in manufacturing firms only.

D) ABC costing systems have separate indirect cost allocation rates for each activity.

A) ABC systems accumulate overhead costs by departments.

B) ABC costing systems are less complex and, therefore, less costly than traditional systems.

C) ABC costing systems can be used in manufacturing firms only.

D) ABC costing systems have separate indirect cost allocation rates for each activity.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

71

Four basic steps are used in an ABC system. List the proper order of these steps, which are currently scrambled below: a. Identify the primary activities and estimate a total cost pool for each.

B) Allocate the costs to the cost object using the activity cost allocation rates.

C) Select an allocation base for each activity.

D) Calculate an activity cost allocation rate for each activity.

A) a, c, d, b

B) c, a, b, d

C) b, a, c, d

D) a, d, c, b

B) Allocate the costs to the cost object using the activity cost allocation rates.

C) Select an allocation base for each activity.

D) Calculate an activity cost allocation rate for each activity.

A) a, c, d, b

B) c, a, b, d

C) b, a, c, d

D) a, d, c, b

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

72

Using factory utilities would most likely be classified as a

A) unit-level activity.

B) batch-level activity.

C) product-level activity.

D) facility-level activity.

A) unit-level activity.

B) batch-level activity.

C) product-level activity.

D) facility-level activity.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

73

The ________ system focuses on activities as the fundamental cost objects. It uses the costs of those activities as building blocks for compiling the indirect costs of products and other cost objects.

A) activities-based costing

B) job costing

C) process costing

D) product costing

A) activities-based costing

B) job costing

C) process costing

D) product costing

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

74

Molding and sanding each unit of product would most likely be classified as a

A) unit-level activity.

B) batch-level activity.

C) product-level activity.

D) facility-level activity.

A) unit-level activity.

B) batch-level activity.

C) product-level activity.

D) facility-level activity.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

75

The cost of maintenance on the entire production plant would be considered a batch-level cost.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

76

The use of which of the following costing systems is most likely to reduce cost distortion to a minimum?

A) Plantwide overhead rate

B) Departmental overhead allocation rates

C) Activity-based costing

D) Traditional costing system

A) Plantwide overhead rate

B) Departmental overhead allocation rates

C) Activity-based costing

D) Traditional costing system

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following statements does NOT describe an ABC system?

A) ABC systems can create more accurate product costs.

B) ABC systems may only be used by service companies.

C) ABC systems are more complex and costly than traditional costing systems.

D) ABC systems are used in both manufacturing and non manufacturing companies.

A) ABC systems can create more accurate product costs.

B) ABC systems may only be used by service companies.

C) ABC systems are more complex and costly than traditional costing systems.

D) ABC systems are used in both manufacturing and non manufacturing companies.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following is NOT likely to be a cost driver of activities associated with determining product cost?

A) Number of accountant's labour hours

B) Number of material requisitions

C) Number of product inspections

D) Number of production orders

A) Number of accountant's labour hours

B) Number of material requisitions

C) Number of product inspections

D) Number of production orders

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following is MOST likely to be the cost driver for the packaging and shipping activity?

A) Number of orders shipped

B) Number of setups

C) Number of units produced

D) Hours of testing

A) Number of orders shipped

B) Number of setups

C) Number of units produced

D) Hours of testing

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck

80

In using an ABC system, which of the following steps is NOT performed before the company's year begins?

A) Identify the primary activities and estimate a total cost pool for each.

B) Allocate the costs to the cost object using the activity cost allocation rates.

C) Select an allocation base for each activity.

D) Calculate an activity cost allocation rate for each activity.

A) Identify the primary activities and estimate a total cost pool for each.

B) Allocate the costs to the cost object using the activity cost allocation rates.

C) Select an allocation base for each activity.

D) Calculate an activity cost allocation rate for each activity.

Unlock Deck

Unlock for access to all 184 flashcards in this deck.

Unlock Deck

k this deck