Deck 4: Long-Term Financial Planning and Growthpart Three: Valuation of Future Cash Flows

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/80

Play

Full screen (f)

Deck 4: Long-Term Financial Planning and Growthpart Three: Valuation of Future Cash Flows

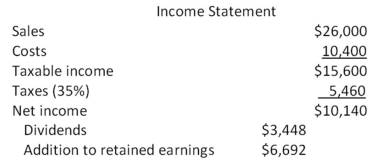

1

Which one of the following correctly defines the retention ratio?

A) one plus the dividend payout ratio

B) addition to retained earnings divided by net income

C) addition to retained earnings divided by dividends paid

D) net income minus additions to retained earnings

E) net income minus cash dividends

A) one plus the dividend payout ratio

B) addition to retained earnings divided by net income

C) addition to retained earnings divided by dividends paid

D) net income minus additions to retained earnings

E) net income minus cash dividends

addition to retained earnings divided by net income

2

Financial planning:

A) focuses solely on the short-term outlook for a firm.

B) is a process that firms employ only when major changes to a firm's operations are anticipated.

C) is a process that firms undergo once every five years.

D) considers multiple options and scenarios for the next two to five years.

E) provides minimal benefits for firms that are highly responsive to economic changes.

A) focuses solely on the short-term outlook for a firm.

B) is a process that firms employ only when major changes to a firm's operations are anticipated.

C) is a process that firms undergo once every five years.

D) considers multiple options and scenarios for the next two to five years.

E) provides minimal benefits for firms that are highly responsive to economic changes.

considers multiple options and scenarios for the next two to five years.

3

When constructing a pro forma statement,net working capital generally:

A) remains fixed.

B) varies only if the firm is currently producing at full capacity.

C) varies only if the firm maintains a fixed debt-equity ratio.

D) varies only if the firm is producing at less than full capacity.

E) varies proportionally with sales.

A) remains fixed.

B) varies only if the firm is currently producing at full capacity.

C) varies only if the firm maintains a fixed debt-equity ratio.

D) varies only if the firm is producing at less than full capacity.

E) varies proportionally with sales.

varies proportionally with sales.

4

A pro forma statement indicates that both sales and fixed assets are projected to increase by 7 percent over their current levels.Given this,you can safely assume that the firm:

A) is projected to grow at the internal rate of growth.

B) is projected to grow at the sustainable rate of growth.

C) currently has excess capacity.

D) is currently operating at full capacity.

E) retains all of its net income.

A) is projected to grow at the internal rate of growth.

B) is projected to grow at the sustainable rate of growth.

C) currently has excess capacity.

D) is currently operating at full capacity.

E) retains all of its net income.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

5

Which one of the following statements is correct?

A) Pro forma statements must assume that no new equity is issued.

B) Pro forma statements are projections,not guarantees.

C) Pro forma statements are limited to a balance sheet and income statement.

D) Pro forma financial statements must assume that no dividends will be paid.

E) Net working capital needs are excluded from pro forma computations.

A) Pro forma statements must assume that no new equity is issued.

B) Pro forma statements are projections,not guarantees.

C) Pro forma statements are limited to a balance sheet and income statement.

D) Pro forma financial statements must assume that no dividends will be paid.

E) Net working capital needs are excluded from pro forma computations.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

6

The sustainable growth rate of a firm is best described as the:

A) minimum growth rate achievable assuming a 100 percent retention ratio.

B) minimum growth rate achievable if the firm maintains a constant equity multiplier.

C) maximum growth rate achievable excluding external financing of any kind.

D) maximum growth rate achievable excluding any external equity financing while maintaining a constant debt-equity ratio.

E) maximum growth rate achievable with unlimited debt financing.

A) minimum growth rate achievable assuming a 100 percent retention ratio.

B) minimum growth rate achievable if the firm maintains a constant equity multiplier.

C) maximum growth rate achievable excluding external financing of any kind.

D) maximum growth rate achievable excluding any external equity financing while maintaining a constant debt-equity ratio.

E) maximum growth rate achievable with unlimited debt financing.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

7

Which one of the following terms is applied to the financial planning method which uses the projected sales level as the basis for determining changes in balance sheet and income statement account values?

A) percentage of sales method

B) sales dilution method

C) sales reconciliation method

D) common-size method

E) trend method

A) percentage of sales method

B) sales dilution method

C) sales reconciliation method

D) common-size method

E) trend method

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

8

Financial planning accomplishes which of the following for a firm?

I.determination of asset requirements

II.development of plans to contend with unexpected events

III.establishment of priorities

IV.analysis of funding options

A) I and III only

B) II and IV only

C) I,III,and IV only

D) I,II,and III only

E) I,II,III,and IV

I.determination of asset requirements

II.development of plans to contend with unexpected events

III.establishment of priorities

IV.analysis of funding options

A) I and III only

B) II and IV only

C) I,III,and IV only

D) I,II,and III only

E) I,II,III,and IV

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

9

Which one of the following ratios identifies the amount of assets a firm needs in order to generate $1 in sales?

A) current ratio

B) equity multiplier

C) retention ratio

D) capital intensity ratio

E) payout ratio

A) current ratio

B) equity multiplier

C) retention ratio

D) capital intensity ratio

E) payout ratio

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

10

When utilizing the percentage of sales approach,managers:

I.estimate company sales based on a desired level of net income and the current profit margin.

II.consider only those assets that vary directly with sales.

III.consider the current production capacity level.

IV.can project both net income and net cash flows.

A) I and II only

B) II and III only

C) III and IV only

D) I,III,and IV only

E) II,III,and IV only

I.estimate company sales based on a desired level of net income and the current profit margin.

II.consider only those assets that vary directly with sales.

III.consider the current production capacity level.

IV.can project both net income and net cash flows.

A) I and II only

B) II and III only

C) III and IV only

D) I,III,and IV only

E) II,III,and IV only

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

11

A firm is currently operating at full capacity.Net working capital,costs,and all assets vary directly with sales.The firm does not wish to obtain any additional equity financing.The dividend payout ratio is constant at 40 percent.If the firm has a positive external financing need,that need will be met by:

A) accounts payable.

B) long-term debt.

C) fixed assets.

D) retained earnings.

E) common stock.

A) accounts payable.

B) long-term debt.

C) fixed assets.

D) retained earnings.

E) common stock.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

12

Which one of the following is correct in relation to pro forma statements?

A) Fixed assets must increase if sales are projected to increase.

B) Net working capital is affected only when a firm's sales are expected to exceed the firm's current production capacity.

C) The addition to retained earnings is equal to net income plus dividends paid.

D) Long-term debt varies directly with sales when a firm is currently operating at maximum capacity.

E) Inventory changes are directly proportional to sales changes.

A) Fixed assets must increase if sales are projected to increase.

B) Net working capital is affected only when a firm's sales are expected to exceed the firm's current production capacity.

C) The addition to retained earnings is equal to net income plus dividends paid.

D) Long-term debt varies directly with sales when a firm is currently operating at maximum capacity.

E) Inventory changes are directly proportional to sales changes.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

13

Which one of the following terms is defined as dividends paid expressed as a percentage of net income?

A) dividend retention ratio

B) dividend yield

C) dividend payout ratio

D) dividend portion

E) dividend section

A) dividend retention ratio

B) dividend yield

C) dividend payout ratio

D) dividend portion

E) dividend section

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

14

The internal growth rate of a firm is best described as the:

A) minimum growth rate achievable assuming a 100 percent retention ratio.

B) minimum growth rate achievable if the firm maintains a constant equity multiplier.

C) maximum growth rate achievable excluding external financing of any kind.

D) maximum growth rate achievable excluding any external equity financing while maintaining a constant debt-equity ratio.

E) maximum growth rate achievable with unlimited debt financing.

A) minimum growth rate achievable assuming a 100 percent retention ratio.

B) minimum growth rate achievable if the firm maintains a constant equity multiplier.

C) maximum growth rate achievable excluding external financing of any kind.

D) maximum growth rate achievable excluding any external equity financing while maintaining a constant debt-equity ratio.

E) maximum growth rate achievable with unlimited debt financing.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

15

You are getting ready to prepare pro forma statements for your business.Which one of the following are you most apt to estimate first as you begin this process?

A) fixed assets

B) current expenses

C) sales forecast

D) projected net income

E) external financing need

A) fixed assets

B) current expenses

C) sales forecast

D) projected net income

E) external financing need

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

16

Atlas Industries combines the smaller investment proposals from each operational unit into a single project for planning purposes.This process is referred to as which one of the following?

A) conjoining

B) aggregation

C) conglomeration

D) appropriation

E) summation

A) conjoining

B) aggregation

C) conglomeration

D) appropriation

E) summation

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

17

Which one of the following statements concerning financial planning for a firm is correct?

A) Financial planning for fixed assets is done on a segregated basis within each division.

B) Financial plans often contain alternative options based on economic developments.

C) Financial plans frequently contain conflicting goals.

D) Financial plans assume that firms obtain no additional external financing.

E) The financial planning process is based on a single set of economic assumptions.

A) Financial planning for fixed assets is done on a segregated basis within each division.

B) Financial plans often contain alternative options based on economic developments.

C) Financial plans frequently contain conflicting goals.

D) Financial plans assume that firms obtain no additional external financing.

E) The financial planning process is based on a single set of economic assumptions.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

18

Phil is working on a financial plan for the next three years.This time period is referred to as which one of the following?

A) financial range

B) planning horizon

C) planning agenda

D) short-run

E) current financing period

A) financial range

B) planning horizon

C) planning agenda

D) short-run

E) current financing period

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

19

You are developing a financial plan for a corporation.Which of the following questions will be considered as you develop this plan?

I.How much net working capital will be needed?

II.Will additional fixed assets be required?

III.Will dividends be paid to shareholders?

IV.How much new debt must be obtained?

A) I and IV only

B) II and III only

C) I,III,and IV only

D) II,III,and IV only

E) I,II,III,and IV

I.How much net working capital will be needed?

II.Will additional fixed assets be required?

III.Will dividends be paid to shareholders?

IV.How much new debt must be obtained?

A) I and IV only

B) II and III only

C) I,III,and IV only

D) II,III,and IV only

E) I,II,III,and IV

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following questions are appropriate to address during the financial planning process?

I.Should the firm merge with a competitor?

II.Should additional shares of stock be sold?

III.Should a particular division be sold?

IV.Should a new product be introduced?

A) I,II,and III only

B) I,II,and IV only

C) I,III,and IV only

D) II,III,and IV only

E) I,II,III,and IV

I.Should the firm merge with a competitor?

II.Should additional shares of stock be sold?

III.Should a particular division be sold?

IV.Should a new product be introduced?

A) I,II,and III only

B) I,II,and IV only

C) I,III,and IV only

D) II,III,and IV only

E) I,II,III,and IV

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

21

If a firm equates its pro forma sales growth to the rate of sustainable growth,and has positive net income and excess capacity,then the:

A) maximum capacity level will have to increase at the same rate as sales growth.

B) total assets will have to increase at the same rate as sales growth.

C) debt-equity ratio will increase.

D) retained earnings will increase.

E) number of common shares outstanding will increase.

A) maximum capacity level will have to increase at the same rate as sales growth.

B) total assets will have to increase at the same rate as sales growth.

C) debt-equity ratio will increase.

D) retained earnings will increase.

E) number of common shares outstanding will increase.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

22

Which one of the following policies most directly affects the projection of the retained earnings balance to be used on a pro forma statement?

A) net working capital policy

B) capital structure policy

C) dividend policy

D) capital budgeting policy

E) capacity utilization policy

A) net working capital policy

B) capital structure policy

C) dividend policy

D) capital budgeting policy

E) capacity utilization policy

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

23

Blasco Industries is currently at full-capacity sales.Which one of the following is limiting sales to this level?

A) net working capital

B) long-term debt

C) inventory

D) fixed assets

E) debt-equity ratio

A) net working capital

B) long-term debt

C) inventory

D) fixed assets

E) debt-equity ratio

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

24

All else constant,which one of the following will increase the internal rate of growth?

A) decrease in the retention ratio

B) decrease in net income

C) increase in the dividend payout ratio

D) decrease in total assets

E) increase in costs of goods sold

A) decrease in the retention ratio

B) decrease in net income

C) increase in the dividend payout ratio

D) decrease in total assets

E) increase in costs of goods sold

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

25

A firm's net working capital and all of its expenses vary directly with sales.The firm is operating currently at 96 percent of capacity.The firm wants no additional external financing of any kind.Which one of the following statements related to the firm's pro forma statements for next year must be correct?

A) Total liabilities will remain constant at this year's value.

B) The maximum rate of sales increase is 4 percent.

C) The firm cannot exceed its internal rate of growth.

D) The projected owners' equity will equal this year's ending equity balance.

E) Fixed assets must remain constant at the current level.

A) Total liabilities will remain constant at this year's value.

B) The maximum rate of sales increase is 4 percent.

C) The firm cannot exceed its internal rate of growth.

D) The projected owners' equity will equal this year's ending equity balance.

E) Fixed assets must remain constant at the current level.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

26

Sales can often increase without increasing which one of the following?

A) accounts receivable

B) cost of goods sold

C) accounts payable

D) fixed assets

E) inventory

A) accounts receivable

B) cost of goods sold

C) accounts payable

D) fixed assets

E) inventory

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

27

The external financing need:

A) will limit growth if unfunded.

B) is unaffected by the dividend payout ratio.

C) must be funded by long-term debt.

D) ignores any changes in retained earnings.

E) considers only the required increase in fixed assets.

A) will limit growth if unfunded.

B) is unaffected by the dividend payout ratio.

C) must be funded by long-term debt.

D) ignores any changes in retained earnings.

E) considers only the required increase in fixed assets.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

28

You are comparing the current income statement of a firm to the pro forma income statement for next year.The pro forma is based on a four percent increase in sales.The firm is currently operating at 85 percent of capacity.Net working capital and all costs vary directly with sales.The tax rate and the dividend payout ratio are fixed.Given this information,which one of the following statements must be true?

A) The projected net income is equal to the current year's net income.

B) The tax rate will increase at the same rate as sales.

C) Retained earnings will increase by four percent over its current level.

D) Total assets will increase by less than four percent.

E) Total liabilities and owners' equity will increase by four percent.

A) The projected net income is equal to the current year's net income.

B) The tax rate will increase at the same rate as sales.

C) Retained earnings will increase by four percent over its current level.

D) Total assets will increase by less than four percent.

E) Total liabilities and owners' equity will increase by four percent.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following can affect a firm's sustainable rate of growth?

I.capital intensity ratio

II.profit margin

III.dividend policy

IV.debt-equity ratio

A) III only

B) I and III only

C) II,III,and IV only

D) I,II,and IV only

E) I,II,III,and IV

I.capital intensity ratio

II.profit margin

III.dividend policy

IV.debt-equity ratio

A) III only

B) I and III only

C) II,III,and IV only

D) I,II,and IV only

E) I,II,III,and IV

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

30

The sustainable growth rate:

A) assumes there is no external financing of any kind.

B) assumes no additional long-term debt is available.

C) assumes the debt-equity ratio is constant.

D) assumes the debt-equity ratio is 1.0.

E) assumes all income is retained by the firm.

A) assumes there is no external financing of any kind.

B) assumes no additional long-term debt is available.

C) assumes the debt-equity ratio is constant.

D) assumes the debt-equity ratio is 1.0.

E) assumes all income is retained by the firm.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

31

Which one of the following capital intensity ratios indicates the largest need for fixed assets per dollar of sales?

A) 0.70

B) 0.86

C) 1.00

D) 1.06

E) 1.15

A) 0.70

B) 0.86

C) 1.00

D) 1.06

E) 1.15

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

32

Which one of the following will increase the maximum rate of growth a corporation can achieve?

A) avoidance of external equity financing

B) increase in corporate tax rates

C) reduction in the retention ratio

D) decrease in the dividend payout ratio

E) decrease in sales given a positive profit margin

A) avoidance of external equity financing

B) increase in corporate tax rates

C) reduction in the retention ratio

D) decrease in the dividend payout ratio

E) decrease in sales given a positive profit margin

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following are needed to determine the amount of fixed assets required to support each dollar of sales?

I.current amount of fixed assets

II.current sales

III.current level of operating capacity

IV.projected growth rate of sales

A) I and III only

B) II and IV only

C) I,II,and III only

D) II,III,and IV only

E) I,II,III,and IV

I.current amount of fixed assets

II.current sales

III.current level of operating capacity

IV.projected growth rate of sales

A) I and III only

B) II and IV only

C) I,II,and III only

D) II,III,and IV only

E) I,II,III,and IV

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

34

The plowback ratio is:

A) equal to net income divided by the change in total equity.

B) the percentage of net income available to the firm to fund future growth.

C) equal to one minus the retention ratio.

D) the change in retained earnings divided by the dividends paid.

E) the dollar increase in net income divided by the dollar increase in sales.

A) equal to net income divided by the change in total equity.

B) the percentage of net income available to the firm to fund future growth.

C) equal to one minus the retention ratio.

D) the change in retained earnings divided by the dividends paid.

E) the dollar increase in net income divided by the dollar increase in sales.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

35

A firm's external financing need is financed by which of the following?

A) retained earnings

B) net working capital and retained earnings

C) net income and retained earnings

D) debt or equity

E) owners' equity,including retained earnings

A) retained earnings

B) net working capital and retained earnings

C) net income and retained earnings

D) debt or equity

E) owners' equity,including retained earnings

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

36

Which one of the following will cause the sustainable growth rate to equal to internal growth rate?

A) dividend payout ratio greater than 1.0

B) debt-equity ratio of 1.0

C) retention ratio between 0.0 and 1.0

D) equity multiplier of 1.0

E) zero dividend payments

A) dividend payout ratio greater than 1.0

B) debt-equity ratio of 1.0

C) retention ratio between 0.0 and 1.0

D) equity multiplier of 1.0

E) zero dividend payments

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

37

Financial plans generally tend to ignore which one of the following?

A) dividend policy

B) manager's goals and objectives

C) risks associated with cash flows

D) operating capacity levels

E) capital structure policy

A) dividend policy

B) manager's goals and objectives

C) risks associated with cash flows

D) operating capacity levels

E) capital structure policy

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

38

Sal's Pizza has a dividend payout ratio of 10 percent.The firm does not want to issue additional equity shares but does want to maintain its current debt-equity ratio and its current dividend policy.The firm is profitable.Which one of the following defines the maximum rate at which this firm can grow?

A) internal growth rate × (1 - 0.10)

B) sustainable growth rate × (1 - 0.10)

C) internal growth rate

D) sustainable growth rate

E) zero percent

A) internal growth rate × (1 - 0.10)

B) sustainable growth rate × (1 - 0.10)

C) internal growth rate

D) sustainable growth rate

E) zero percent

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

39

Martin Aerospace is currently operating at full capacity based on its current level of assets.Sales are expected to increase by 4.5 percent next year,which is the firm's internal rate of growth.Net working capital and operating costs are expected to increase directly with sales.The interest expense will remain constant at its current level.The tax rate and the dividend payout ratio will be held constant.Current and projected net income is positive.Which one of the following statements is correct regarding the pro forma statement for next year?

A) The pro forma profit margin is equal to the current profit margin.

B) Retained earnings will increase at the same rate as sales.

C) Total assets will increase at the same rate as sales.

D) Long-term debt will increase in direct relation to sales.

E) Owners' equity will remain constant.

A) The pro forma profit margin is equal to the current profit margin.

B) Retained earnings will increase at the same rate as sales.

C) Total assets will increase at the same rate as sales.

D) Long-term debt will increase in direct relation to sales.

E) Owners' equity will remain constant.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

40

A firm is operating at 90 percent of capacity.This information is primarily needed to project which one of the following account values when compiling pro forma statements?

A) sales

B) costs of goods sold

C) accounts receivable

D) fixed assets

E) long-term debt

A) sales

B) costs of goods sold

C) accounts receivable

D) fixed assets

E) long-term debt

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

41

The Two Sisters has a 9 percent return on assets and a 75 percent retention ratio.What is the internal growth rate?

A) 6.50 percent

B) 6.75 percent

C) 6.97 percent

D) 7.24 percent

E) 7.38 percent

A) 6.50 percent

B) 6.75 percent

C) 6.97 percent

D) 7.24 percent

E) 7.38 percent

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

42

Gladsden Refinishers currently has $21,900 in sales and is operating at 45 percent of the firm's capacity.What is the full capacity level of sales?

A) $31,755

B) $36,250

C) $48,667

D) $51,333

E) $54,500

A) $31,755

B) $36,250

C) $48,667

D) $51,333

E) $54,500

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

43

Cross Town Express has sales of $137,000,net income of $14,000,total assets of $98,000,and total equity of $45,000.The firm paid $7,560 in dividends and maintains a constant dividend payout ratio.Currently,the firm is operating at full capacity.All costs and assets vary directly with sales.The firm does not want to obtain any additional external equity.At the sustainable rate of growth,how much new total debt must the firm acquire?

A) $0

B) $6,311

C) $6,989

D) $7,207

E) $8,852

A) $0

B) $6,311

C) $6,989

D) $7,207

E) $8,852

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

44

Designer's Outlet has a capital intensity ratio of 0.92 at full capacity.Currently,total assets are $48,900 and current sales are $51,200.At what level of capacity is the firm currently operating?

A) 89.1 percent

B) 91.6 percent

C) 96.3 percent

D) 96.8 percent

E) 98.2 percent

A) 89.1 percent

B) 91.6 percent

C) 96.3 percent

D) 96.8 percent

E) 98.2 percent

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

45

Stop and Go has a 4.5 percent profit margin and an 18 percent dividend payout ratio.The total asset turnover is 1.6 and the debt-equity ratio is 0.45.What is the sustainable rate of growth?

A) 8.13 percent

B) 8.54 percent

C) 8.89 percent

D) 9.26 percent

E) 9.36 percent

A) 8.13 percent

B) 8.54 percent

C) 8.89 percent

D) 9.26 percent

E) 9.36 percent

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

46

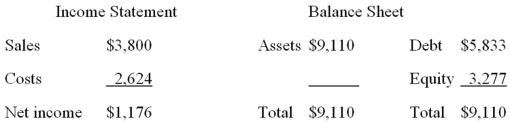

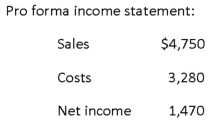

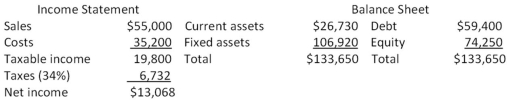

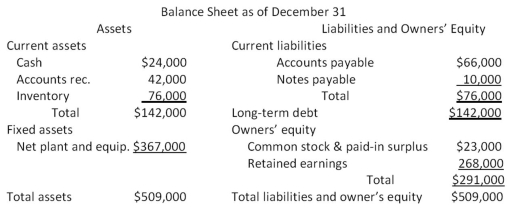

The most recent financial statements for Watchtower,Inc.are shown here (assuming no income taxes):

Assets and costs are proportional to sales.Debt and equity are not.No dividends are paid.Next year's sales are projected to be $4,750.What is the amount of the external financing needed?

A) $797

B) $808

C) $811

D) $818

E) $823

Assets and costs are proportional to sales.Debt and equity are not.No dividends are paid.Next year's sales are projected to be $4,750.What is the amount of the external financing needed?

A) $797

B) $808

C) $811

D) $818

E) $823

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

47

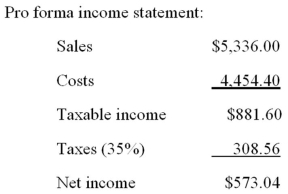

The most recent financial statements for 7 Seas,Inc.are shown here:

Assets,costs,and current liabilities are proportional to sales.Long-term debt and equity are not.The company maintains a constant 50 percent dividend payout ratio.Like every other firm in its industry,next year's sales are projected to increase by exactly 16 percent.What is the external financing need?

A) $1,317.16

B) $1,411.16

C) $1,583.09

D) $2,211.87

E) $2,349.98

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

48

The Dog House has net income of $3,450 and total equity of $8,600.The debt-equity ratio is 0.60 and the payout ratio is 30 percent.What is the internal growth rate?

A) 14.47 percent

B) 17.78 percent

C) 21.29 percent

D) 29.40 percent

E) 33.33 percent

A) 14.47 percent

B) 17.78 percent

C) 21.29 percent

D) 29.40 percent

E) 33.33 percent

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

49

Monika's Dinor is operating at 94 percent of its fixed asset capacity and has current sales of $611,000.How much can the firm grow before any new fixed assets are needed?

A) 4.99 percent

B) 5.78 percent

C) 6.02 percent

D) 6.38 percent

E) 6.79 percent

A) 4.99 percent

B) 5.78 percent

C) 6.02 percent

D) 6.38 percent

E) 6.79 percent

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

50

The Corner Store has $219,000 of sales and $193,000 of total assets.The firm is operating at 87 percent of capacity.What is the capital intensity ratio at full capacity?

A) 0.62

B) 0.68

C) 0.77

D) 1.35

E) 1.47

A) 0.62

B) 0.68

C) 0.77

D) 1.35

E) 1.47

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

51

Wagner Industrial Motors,which is currently operating at full capacity,has sales of $29,000,current assets of $1,600,current liabilities of $1,200,net fixed assets of $27,500,and a 5 percent profit margin.The firm has no long-term debt and does not plan on acquiring any.The firm does not pay any dividends.Sales are expected to increase by 4.5 percent next year.If all assets,short-term liabilities,and costs vary directly with sales,how much additional equity financing is required for next year?

A) -$259.75

B) -$201.19

C) $967.30

D) $1,099.08

E) $1,515.25

A) -$259.75

B) -$201.19

C) $967.30

D) $1,099.08

E) $1,515.25

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

52

A Procrustes approach to financial planning is based on:

A) a policy of producing a financial plan once every five years.

B) developing a plan around the goals of senior managers.

C) a proactive approach to the economic outlook.

D) a flexible capital budget.

E) a flexible capital structure.

A) a policy of producing a financial plan once every five years.

B) developing a plan around the goals of senior managers.

C) a proactive approach to the economic outlook.

D) a flexible capital budget.

E) a flexible capital structure.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

53

A firm has a retention ratio of 45 percent and a sustainable growth rate of 6.2 percent.The capital intensity ratio is 1.2 and the debt-equity ratio is 0.64.What is the profit margin?

A) 6.28 percent

B) 7.67 percent

C) 9.49 percent

D) 12.38 percent

E) 14.63 percent

A) 6.28 percent

B) 7.67 percent

C) 9.49 percent

D) 12.38 percent

E) 14.63 percent

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

54

The Cookie Shoppe expects sales of $437,500 next year.The profit margin is 5.3 percent and the firm has a 30 percent dividend payout ratio.What is the projected increase in retained earnings?

A) $16,231

B) $17,500

C) $18,300

D) $20,600

E) $21,000

A) $16,231

B) $17,500

C) $18,300

D) $20,600

E) $21,000

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

55

The financial planning process tends to place the least emphasis on which one of the following?

A) growth limitations

B) capacity utilization

C) market value of a firm

D) capital structure of a firm

E) dividend policy

A) growth limitations

B) capacity utilization

C) market value of a firm

D) capital structure of a firm

E) dividend policy

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

56

The financial planning process:

I.involves internal negotiations among divisions.

II.quantifies senior manager's goals.

III.considers only internal factors.

IV.reconciles company activities across divisions.

A) III and IV only

B) II and III only

C) I,II,and IV only

D) II,III,and IV only

E) I,II,III,and IV

I.involves internal negotiations among divisions.

II.quantifies senior manager's goals.

III.considers only internal factors.

IV.reconciles company activities across divisions.

A) III and IV only

B) II and III only

C) I,II,and IV only

D) II,III,and IV only

E) I,II,III,and IV

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

57

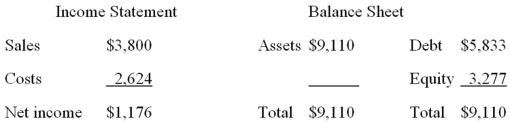

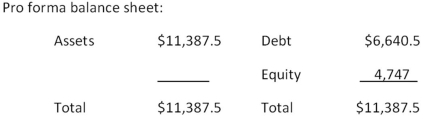

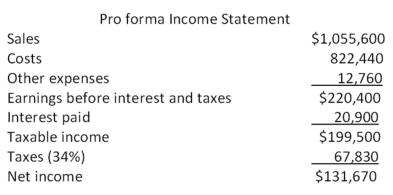

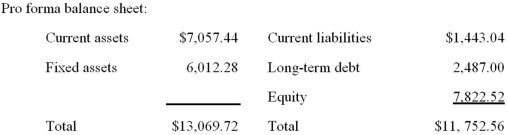

The most recent financial statements for Last in Line,Inc.are shown here:

Assets and costs are proportional to sales.Debt and equity are not.A dividend of $992 was paid,and the company wishes to maintain a constant payout ratio.Next year's sales are projected to be $21,830.What is the amount of the external financing need?

A) $12,711

B) $13,333

C) $13,556

D) $13,809

E) $14,357

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

58

Frasier Cabinets wants to maintain a growth rate of 5 percent without incurring any additional equity financing.The firm maintains a constant debt-equity ratio of .0.55,a total asset turnover ratio of 1.30,and a profit margin of 9.0 percent.What must the dividend payout ratio be?

A) 26.26 percent

B) 38.87 percent

C) 49.29 percent

D) 61.13 percent

E) 73.74 percent

A) 26.26 percent

B) 38.87 percent

C) 49.29 percent

D) 61.13 percent

E) 73.74 percent

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

59

Miller Bros.Hardware is operating at full capacity with a sales level of $689,700 and fixed assets of $468,000.The profit margin is 7 percent.What is the required addition to fixed assets if sales are to increase by 10 percent?

A) $3,276

B) $4,680

C) $28,400

D) $32,760

E) $46,800

A) $3,276

B) $4,680

C) $28,400

D) $32,760

E) $46,800

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

60

Fresno Salads has current sales of $6,000 and a profit margin of 6.5 percent.The firm estimates that sales will increase by 4 percent next year and that all costs will vary in direct relationship to sales.What is the pro forma net income?

A) $303.33

B) $327.18

C) $405.60

D) $438.70

E) $441.10

A) $303.33

B) $327.18

C) $405.60

D) $438.70

E) $441.10

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

61

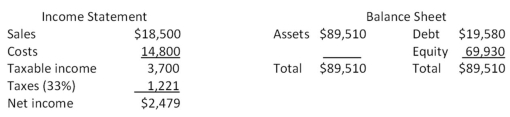

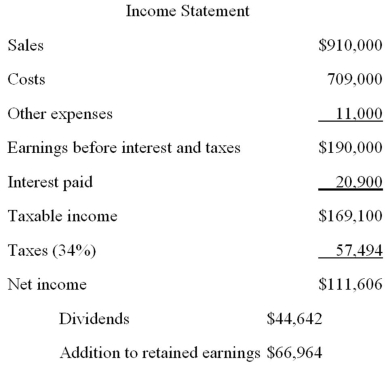

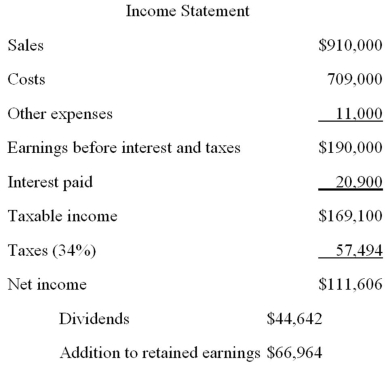

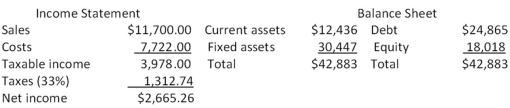

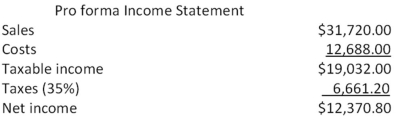

Consider the income statement for Heir Jordan Corporation:

A 22 percent growth rate in sales is projected.What is the pro forma addition to retained earnings assuming all costs vary proportionately with sales?

A) $6,299

B) $7,303

C) $7,890

D) $8,011

E) $8,164

A 22 percent growth rate in sales is projected.What is the pro forma addition to retained earnings assuming all costs vary proportionately with sales?

A) $6,299

B) $7,303

C) $7,890

D) $8,011

E) $8,164

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

62

Why do financial managers need to understand the implications of both the internal and the sustainable rates of growth?

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

63

A firm wishes to maintain an internal growth rate of 11 percent and a dividend payout ratio of 24 percent.The current profit margin is 7 percent and the firm uses no external financing sources.What must the total asset turnover rate be?

A) 0.87 times

B) 0.90 times

C) 1.01 times

D) 1.15 times

E) 1.86 times

A) 0.87 times

B) 0.90 times

C) 1.01 times

D) 1.15 times

E) 1.86 times

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

64

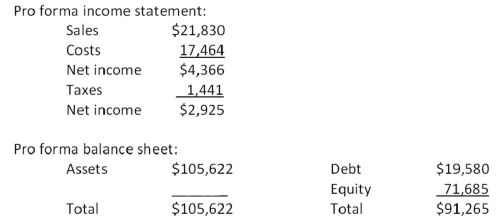

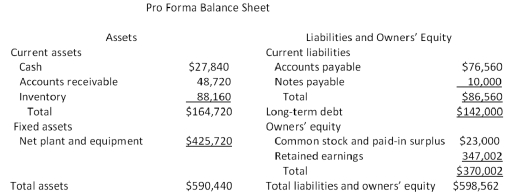

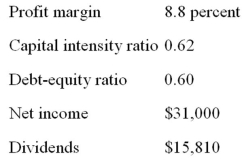

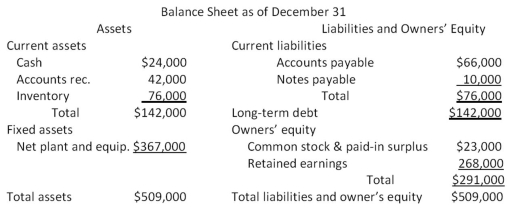

The most recent financial statements for Heng Co.are shown here:

Assets and costs are proportional to sales.The company maintains a constant 45 percent dividend payout ratio and a constant debt-equity ratio.What is the maximum increase in sales that can be sustained next year assuming no new equity is issued?

A) $4,808.12

B) $5,211.17

C) $5,887.48

D) $5,894.60

E) $6,666.67

Assets and costs are proportional to sales.The company maintains a constant 45 percent dividend payout ratio and a constant debt-equity ratio.What is the maximum increase in sales that can be sustained next year assuming no new equity is issued?

A) $4,808.12

B) $5,211.17

C) $5,887.48

D) $5,894.60

E) $6,666.67

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

65

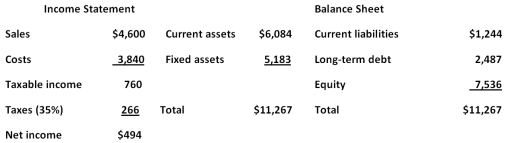

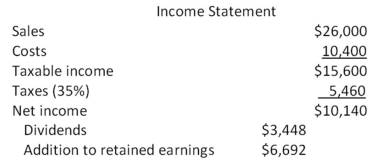

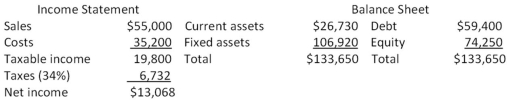

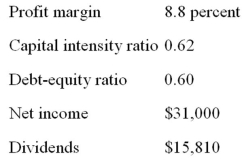

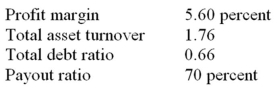

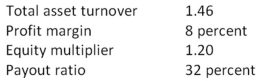

Consider the following information for Kaleb's Kickboxing:

What is the sustainable rate of growth?

A) 11.87 percent

B) 12.29 percent

C) 12.52 percent

D) 13.42 percent

E) 13.58 percent

What is the sustainable rate of growth?

A) 11.87 percent

B) 12.29 percent

C) 12.52 percent

D) 13.42 percent

E) 13.58 percent

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

66

Identify the four primary determinants of a firm's growth and explain how each factor could either add to or limit the growth potential of a firm.

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

67

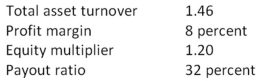

Based on the following information,what is the sustainable growth rate of Hendrix Guitars,Inc.?

A) 7.68 percent

B) 9.52 percent

C) 11.12 percent

D) 13.49 percent

E) 14.41 percent

A) 7.68 percent

B) 9.52 percent

C) 11.12 percent

D) 13.49 percent

E) 14.41 percent

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

68

Fixed Appliance Co.wishes to maintain a growth rate of 8 percent a year,a constant debt-equity ratio of 0.42,and a dividend payout ratio of 50 percent.The ratio of total assets to sales is constant at 1.3.What profit margin must the firm achieve?

A) 12.92 percent

B) 13.46 percent

C) 13.56 percent

D) 14.33 percent

E) 14.74 percent

A) 12.92 percent

B) 13.46 percent

C) 13.56 percent

D) 14.33 percent

E) 14.74 percent

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

69

Seaweed Mfg. ,Inc.is currently operating at only 84 percent of fixed asset capacity.Current sales are $550,000.What is the maximum rate at which sales can grow before any new fixed assets are needed?

A) 17.23 percent

B) 17.47 percent

C) 18.03 percent

D) 18.87 percent

E) 19.05 percent

A) 17.23 percent

B) 17.47 percent

C) 18.03 percent

D) 18.87 percent

E) 19.05 percent

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

70

A firm wishes to maintain a growth rate of 8 percent and a dividend payout ratio of 62 percent.The ratio of total assets to sales is constant at 1,and the profit margin is 10 percent.What must the debt-equity ratio be if the firm wishes to keep that ratio constant?

A) 0.05

B) 0.40

C) 0.55

D) 0.60

E) 0.95

A) 0.05

B) 0.40

C) 0.55

D) 0.60

E) 0.95

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

71

The most recent financial statements for Moose Tours,Inc.follow.Sales for 2009 are projected to grow by 16 percent.Interest expense will remain constant;the tax rate and dividend payout rate will also remain constant.Costs,other expenses,current assets,and accounts payable increase spontaneously will sales.If the firm is operating at full capacity and no new debt or equity is issued,how much external financing is needed to support the 16 percent growth rate in sales?

A) $-10,246

B) -$8,122

C) -$6,708

D) $2,407

E) $3,309

A) $-10,246

B) -$8,122

C) -$6,708

D) $2,407

E) $3,309

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

72

The most recent financial statements for Benatar Co.are shown here:

Assets and costs are proportional to sales.Debt and equity are not.The company maintains a constant 40 percent dividend payout ratio.No external equity financing is possible.What is the internal growth rate?

A) 2.91 percent

B) 3.44 percent

C) 3.87 percent

D) 4.02 percent

E) 4.14 percent

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

73

Smith & Daughters is getting ready to compile pro forma statements for the next few years.How can the managers establish a reasonable range of growth rates that they should consider during this planning process?

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

74

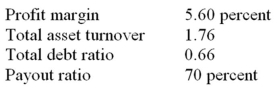

What is the sustainable growth rate assuming the following ratios are constant?

A) 10.30 percent

B) 10.53 percent

C) 10.67 percent

D) 10.89 percent

E) 11.01 percent

A) 10.30 percent

B) 10.53 percent

C) 10.67 percent

D) 10.89 percent

E) 11.01 percent

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

75

Nelson's Landscaping Services just completed a pro forma statement using the percentage of sales approach.The pro forma has a projected external financing need of -$5,500.What are the firm's options in this case?

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

76

A)What are the assumptions that underlie the internal growth rate and B)what are the implications of this rate?

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

77

The Parodies Corp.has a 22 percent return on equity and a 23 percent payout ratio.What is its sustainable growth rate?

A) 18.68 percent

B) 19.25 percent

C) 19.49 percent

D) 20.39 percent

E) 22.00 percent

A) 18.68 percent

B) 19.25 percent

C) 19.49 percent

D) 20.39 percent

E) 22.00 percent

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

78

Country Comfort,Inc.had equity of $150,000 at the beginning of the year.At the end of the year,the company had total assets of $195,000.During the year,the company sold no new equity.Net income for the year was $63,000 and dividends were $44,640.What is the sustainable growth rate?

A) 10.32 percent

B) 10.79 percent

C) 11.78 percent

D) 12.01 percent

E) 12.24 percent

A) 10.32 percent

B) 10.79 percent

C) 11.78 percent

D) 12.01 percent

E) 12.24 percent

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

79

Seaweed Mfg. ,Inc.is currently operating at only 86 percent of fixed asset capacity.Fixed assets are $387,000.Current sales are $510,000 and are projected to grow to $664,000.What amount must be spent on new fixed assets to support this growth in sales?

A) $0

B) $22,654

C) $46,319

D) $79,408

E) $93,608

A) $0

B) $22,654

C) $46,319

D) $79,408

E) $93,608

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck

80

The Soccer Shoppe has a 9 percent return on assets and a 25 percent payout ratio.What is its internal growth rate?

A) 4.72 percent

B) 5.08 percent

C) 5.49 percent

D) 6.23 percent

E) 7.24 percent

Unlock Deck

Unlock for access to all 80 flashcards in this deck.

Unlock Deck

k this deck