Deck 7: Accounting for Receivables

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/83

Play

Full screen (f)

Deck 7: Accounting for Receivables

1

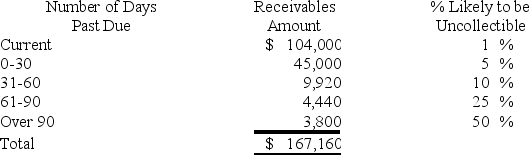

Domino Company ages its accounts receivable to estimate uncollectible accounts expense.Domino began Year 2 with balances in Accounts Receivable and Allowance for Doubtful Accounts of $76,500 and $5,800,respectively.During Year 2,the company wrote off $4,640 in uncollectible accounts.In preparation for the company's estimate of uncollectible accounts expense for Year 2,Domino prepared the following aging schedule:

What amount will be reported as uncollectible accounts expense on the Year 2 income statement?

A)$6,132

B)$1,512

C)$7,292

D)$4,640

What amount will be reported as uncollectible accounts expense on the Year 2 income statement?

A)$6,132

B)$1,512

C)$7,292

D)$4,640

$6,132

2

Hoff Company uses the allowance method.An account that had been previously written-off as uncollectible was recovered.How do the two parts of the recovery (reinstate receivable and collect the receivable)affect the elements of the financial statements when the two parts are considered together?

A)Increase total assets and stockholders' equity

B)Increase total assets and decrease total liabilities

C)Decrease total liabilities and increase stockholders' equity

D)Has no effect on total assets,total liabilities or stockholders' equity

A)Increase total assets and stockholders' equity

B)Increase total assets and decrease total liabilities

C)Decrease total liabilities and increase stockholders' equity

D)Has no effect on total assets,total liabilities or stockholders' equity

Has no effect on total assets,total liabilities or stockholders' equity

3

The balance in Accounts Receivable at the beginning of the year amounted to $16,000.During the year,$64,000 of credit sales were made to customers.If the ending balance in Accounts Receivable amounted to $10,000,and uncollectible accounts expense amounted to $4,000,what is the amount of cash inflow from customers that would appear in the operating activities section of the cash flow statement?

A)$66,000.

B)$64,000.

C)$80,000.

D)None of these answers are correct.

A)$66,000.

B)$64,000.

C)$80,000.

D)None of these answers are correct.

None of these answers are correct.

4

Which of the following is a true statement about a company that uses the allowance method?

A)Uncollectible Accounts Expense is recorded when a receivable is written off.

B)Uncollectible accounts are not recorded until the amount becomes significant.

C)The net realizable value of its accounts receivable is shown on the balance sheet.

D)None of these answer choices are correct.

A)Uncollectible Accounts Expense is recorded when a receivable is written off.

B)Uncollectible accounts are not recorded until the amount becomes significant.

C)The net realizable value of its accounts receivable is shown on the balance sheet.

D)None of these answer choices are correct.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

5

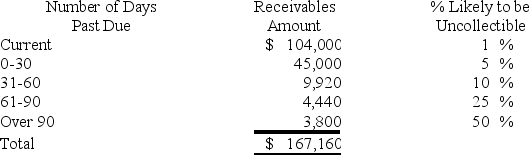

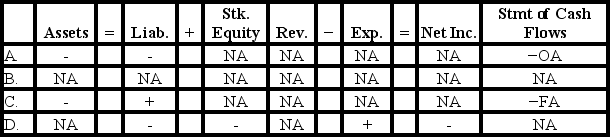

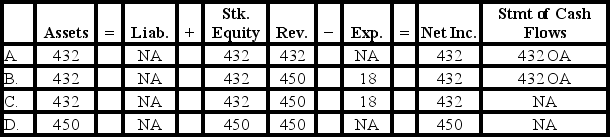

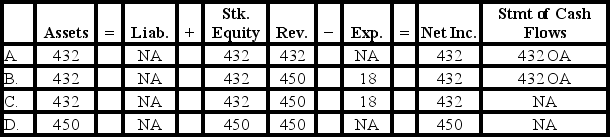

Which of the following reflects the effect of the year-end adjusting entry to record estimated uncollectible accounts expense using the allowance method?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

6

[The following information applies to the questions displayed below.]

On January 1, Year 2 Grande Company had a $16,000 balance in the Accounts Receivable account and a zero balance in the Allowance for Doubtful Accounts account. During Year 2, Grande provided $104,000 of service on account. The company collected $97,000 cash from accounts receivable. Uncollectible accounts are estimated to be 2% of sales on account.

-What is the amount of cash flow from operating activities that would appear on the Year 2 statement of cash flows?

A)$97,000

B)$104,000

C)$89,520

D)$95,060

On January 1, Year 2 Grande Company had a $16,000 balance in the Accounts Receivable account and a zero balance in the Allowance for Doubtful Accounts account. During Year 2, Grande provided $104,000 of service on account. The company collected $97,000 cash from accounts receivable. Uncollectible accounts are estimated to be 2% of sales on account.

-What is the amount of cash flow from operating activities that would appear on the Year 2 statement of cash flows?

A)$97,000

B)$104,000

C)$89,520

D)$95,060

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

7

[The following information applies to the questions displayed below.]

On January 1, Year 2 Grande Company had a $16,000 balance in the Accounts Receivable account and a zero balance in the Allowance for Doubtful Accounts account. During Year 2, Grande provided $104,000 of service on account. The company collected $97,000 cash from accounts receivable. Uncollectible accounts are estimated to be 2% of sales on account.

-What is the amount of uncollectible accounts expense recognized on the Year 2 income statement?

A)$320

B)$1,000

C)$2,080

D)$1,940

On January 1, Year 2 Grande Company had a $16,000 balance in the Accounts Receivable account and a zero balance in the Allowance for Doubtful Accounts account. During Year 2, Grande provided $104,000 of service on account. The company collected $97,000 cash from accounts receivable. Uncollectible accounts are estimated to be 2% of sales on account.

-What is the amount of uncollectible accounts expense recognized on the Year 2 income statement?

A)$320

B)$1,000

C)$2,080

D)$1,940

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

8

[The following information applies to the questions displayed below.]

The Miller Company earned $190,000 of revenue on account during Year 1. There was no beginning balance in the accounts receivable and allowance accounts. During Year 1, Miller collected $136,000 of cash from its receivables accounts. The company estimates that it will be unable to collect 3% of its sales on account.

-What is the net realizable value of Miller's receivables at the end of Year 1?

A)$54,000

B)$49,920

C)$59,700

D)$48,300

The Miller Company earned $190,000 of revenue on account during Year 1. There was no beginning balance in the accounts receivable and allowance accounts. During Year 1, Miller collected $136,000 of cash from its receivables accounts. The company estimates that it will be unable to collect 3% of its sales on account.

-What is the net realizable value of Miller's receivables at the end of Year 1?

A)$54,000

B)$49,920

C)$59,700

D)$48,300

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

9

Allegheny Company ended Year 1 with balances in Accounts Receivable and Allowance for Doubtful Accounts of $23,000 and $900,respectively.During Year 2,Allegheny wrote off $1,500 of Uncollectible Accounts.Using the percent of receivables method,Allegheny estimates that the ending Allowance for Doubtful Accounts balance should be $1,600.What amount will Allegheny report as Uncollectible Accounts Expense on its Year 2 income statement?

A)$2,200

B)$1,500

C)$700

D)$1,600

A)$2,200

B)$1,500

C)$700

D)$1,600

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

10

[The following information applies to the questions displayed below.]

The Miller Company earned $190,000 of revenue on account during Year 1. There was no beginning balance in the accounts receivable and allowance accounts. During Year 1, Miller collected $136,000 of cash from its receivables accounts. The company estimates that it will be unable to collect 3% of its sales on account.

-What is the amount of uncollectible accounts expense that will be recognized on the Year 1 income statement?

A)$5,700

B)$1,320

C)$4,080

D)$54,000

The Miller Company earned $190,000 of revenue on account during Year 1. There was no beginning balance in the accounts receivable and allowance accounts. During Year 1, Miller collected $136,000 of cash from its receivables accounts. The company estimates that it will be unable to collect 3% of its sales on account.

-What is the amount of uncollectible accounts expense that will be recognized on the Year 1 income statement?

A)$5,700

B)$1,320

C)$4,080

D)$54,000

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

11

Hancock Medical Supply Co. ,earned $160,000 of revenue on account during Year 1,its first year of operation.During Year 1,Hancock collected $128,000 of cash from its receivables accounts.The company did not write-off any uncollectible accounts.It estimates that it will be unable to collect 1% of revenue on account.What is the net realizable value of receivables that will be reported on the balance sheet at December 31,Year 1?

A)$30,400

B)$30,720

C)$32,000

D)$30,000

A)$30,400

B)$30,720

C)$32,000

D)$30,000

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

12

How would accountants estimate the amount of a company's uncollectible accounts expense?

A)Consider new circumstances that are anticipated to be experienced in the future.

B)Compute as a percentage of credit sales.

C)Consult with trade association and business associates.

D)All of these answer choices are correct.

A)Consider new circumstances that are anticipated to be experienced in the future.

B)Compute as a percentage of credit sales.

C)Consult with trade association and business associates.

D)All of these answer choices are correct.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

13

How does the year-end adjusting entry to recognize uncollectible accounts expense affect the elements of the financial statements?

A)Decrease total assets and decrease stockholders' equity.

B)Increase total assets and decrease stockholders' equity.

C)Increase total liabilities and increase stockholders' equity.

D)Decrease total liabilities and increase stockholders' equity.

A)Decrease total assets and decrease stockholders' equity.

B)Increase total assets and decrease stockholders' equity.

C)Increase total liabilities and increase stockholders' equity.

D)Decrease total liabilities and increase stockholders' equity.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

14

What is the term used to describe the amount of accounts receivable that is actually expected to be collected?

A)Allowance for doubtful accounts

B)Uncollectible accounts expense

C)The present value of accounts receivable

D)Net realizable value

A)Allowance for doubtful accounts

B)Uncollectible accounts expense

C)The present value of accounts receivable

D)Net realizable value

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

15

[The following information applies to the questions displayed below.]

On January 1, Year 2, Kincaid Company's Accounts Receivable and the Allowance for Doubtful Accounts carried balances of $31,000 and $500, respectively. During Year 2, Kincaid reported $72,500 of credit sales, wrote off $550 of receivables as uncollectible, and collected cash from receivables amounting to $74,550. Kincaid estimates that it will be unable to collect one percent (1%) of credit sales.

-What is the net realizable value of receivables that will be reported on Kincaid's Year 2 balance sheet?

A)$29,075

B)$27,725

C)$28,950

D)$28,400

On January 1, Year 2, Kincaid Company's Accounts Receivable and the Allowance for Doubtful Accounts carried balances of $31,000 and $500, respectively. During Year 2, Kincaid reported $72,500 of credit sales, wrote off $550 of receivables as uncollectible, and collected cash from receivables amounting to $74,550. Kincaid estimates that it will be unable to collect one percent (1%) of credit sales.

-What is the net realizable value of receivables that will be reported on Kincaid's Year 2 balance sheet?

A)$29,075

B)$27,725

C)$28,950

D)$28,400

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

16

[The following information applies to the questions displayed below.]

On January 1, Year 2, Kincaid Company's Accounts Receivable and the Allowance for Doubtful Accounts carried balances of $31,000 and $500, respectively. During Year 2, Kincaid reported $72,500 of credit sales, wrote off $550 of receivables as uncollectible, and collected cash from receivables amounting to $74,550. Kincaid estimates that it will be unable to collect one percent (1%) of credit sales.

-What effect will the entry to recognize the uncollectible accounts expense for Year 2 have on the elements of the financial statements?

A)Increase total assets and retained earnings.

B)Decrease total assets and increase retained earnings.

C)Decrease total assets and net income.

D)Increase total assets and decrease net income.

On January 1, Year 2, Kincaid Company's Accounts Receivable and the Allowance for Doubtful Accounts carried balances of $31,000 and $500, respectively. During Year 2, Kincaid reported $72,500 of credit sales, wrote off $550 of receivables as uncollectible, and collected cash from receivables amounting to $74,550. Kincaid estimates that it will be unable to collect one percent (1%) of credit sales.

-What effect will the entry to recognize the uncollectible accounts expense for Year 2 have on the elements of the financial statements?

A)Increase total assets and retained earnings.

B)Decrease total assets and increase retained earnings.

C)Decrease total assets and net income.

D)Increase total assets and decrease net income.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

17

[The following information applies to the questions displayed below.]

On January 1, Year 2, Kincaid Company's Accounts Receivable and the Allowance for Doubtful Accounts carried balances of $31,000 and $500, respectively. During Year 2, Kincaid reported $72,500 of credit sales, wrote off $550 of receivables as uncollectible, and collected cash from receivables amounting to $74,550. Kincaid estimates that it will be unable to collect one percent (1%) of credit sales.

-What is the amount of uncollectible accounts expense that will be reported on the Year 2 income statement?

A)$310

B)$725

C)$745.50

D)$550

On January 1, Year 2, Kincaid Company's Accounts Receivable and the Allowance for Doubtful Accounts carried balances of $31,000 and $500, respectively. During Year 2, Kincaid reported $72,500 of credit sales, wrote off $550 of receivables as uncollectible, and collected cash from receivables amounting to $74,550. Kincaid estimates that it will be unable to collect one percent (1%) of credit sales.

-What is the amount of uncollectible accounts expense that will be reported on the Year 2 income statement?

A)$310

B)$725

C)$745.50

D)$550

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

18

[The following information applies to the questions displayed below.]

On January 1, Year 2, Kincaid Company's Accounts Receivable and the Allowance for Doubtful Accounts carried balances of $31,000 and $500, respectively. During Year 2, Kincaid reported $72,500 of credit sales, wrote off $550 of receivables as uncollectible, and collected cash from receivables amounting to $74,550. Kincaid estimates that it will be unable to collect one percent (1%) of credit sales.

-Which of the following describes the effects of Kincaid's entry to recognize the write-off of the uncollectible accounts?

A)Increase assets and stockholders' equity.

B)Increase assets and decrease stockholders' equity.

C)Decrease assets and stockholders' equity.

D)Does not affect assets or stockholders' equity.

On January 1, Year 2, Kincaid Company's Accounts Receivable and the Allowance for Doubtful Accounts carried balances of $31,000 and $500, respectively. During Year 2, Kincaid reported $72,500 of credit sales, wrote off $550 of receivables as uncollectible, and collected cash from receivables amounting to $74,550. Kincaid estimates that it will be unable to collect one percent (1%) of credit sales.

-Which of the following describes the effects of Kincaid's entry to recognize the write-off of the uncollectible accounts?

A)Increase assets and stockholders' equity.

B)Increase assets and decrease stockholders' equity.

C)Decrease assets and stockholders' equity.

D)Does not affect assets or stockholders' equity.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

19

On January 1,Year 1,the Accounts Receivable balance was $37,000 and the balance in the Allowance for Doubtful Accounts was $2,800.On January 15,Year 1,an $800 uncollectible account was written-off.What is the net realizable value of accounts receivable immediately after the write-off?

A)$36,200

B)$33,400

C)$35,000

D)$34,200

A)$36,200

B)$33,400

C)$35,000

D)$34,200

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following is the term commonly used to describe the practice of reporting the net realizable value of receivables in the financial statements?

A)Cash flow method.

B)Allowance method.

C)Direct write-off method.

D)Accrual method.

A)Cash flow method.

B)Allowance method.

C)Direct write-off method.

D)Accrual method.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

21

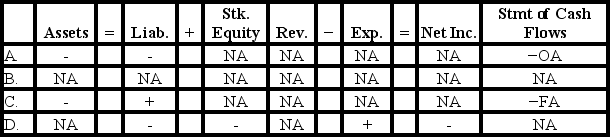

[The following information applies to the questions displayed below.]

On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050.

-Assume that the Loudoun Corporation uses the direct write-off method.Which of the following correctly describes the effect of the write-off of the customer's account on Loudoun's financial statements?

![<strong>[The following information applies to the questions displayed below.] On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050. -Assume that the Loudoun Corporation uses the direct write-off method.Which of the following correctly describes the effect of the write-off of the customer's account on Loudoun's financial statements? </strong> A)Option A B)Option B C)Option C D)Option D](https://storage.examlex.com/TB6522/11ea8a6f_8d7a_a74b_a2a1_a182c91af4fe_TB6522_00.jpg)

A)Option A

B)Option B

C)Option C

D)Option D

On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050.

-Assume that the Loudoun Corporation uses the direct write-off method.Which of the following correctly describes the effect of the write-off of the customer's account on Loudoun's financial statements?

![<strong>[The following information applies to the questions displayed below.] On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050. -Assume that the Loudoun Corporation uses the direct write-off method.Which of the following correctly describes the effect of the write-off of the customer's account on Loudoun's financial statements? </strong> A)Option A B)Option B C)Option C D)Option D](https://storage.examlex.com/TB6522/11ea8a6f_8d7a_a74b_a2a1_a182c91af4fe_TB6522_00.jpg)

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

22

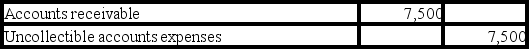

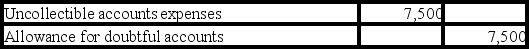

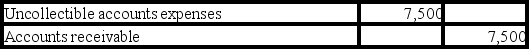

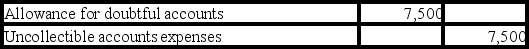

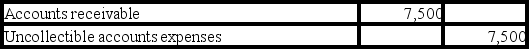

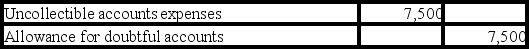

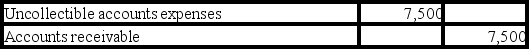

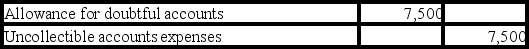

Which of the following general journal entries would be used to recognize $7,500 of uncollectible accounts expense under the direct write-off method?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

23

Buttercup Florist uses the allowance method to account for uncollectible accounts.Unable to collect a $150 account from a customer,Buttercup determined it was uncollectible.How would the write-off of this account affect the elements of the company's financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

24

[The following information applies to the questions displayed below.]

The Yankee Corporation has recently begun to accept credit cards. On July 7, Year 1, Yankee made a credit card sale of $600. The credit card company charges a fee of 3% for handling a credit card transaction.

-Which of the following correctly shows the effects of the sale on July 7?

![<strong>[The following information applies to the questions displayed below.] The Yankee Corporation has recently begun to accept credit cards. On July 7, Year 1, Yankee made a credit card sale of $600. The credit card company charges a fee of 3% for handling a credit card transaction. -Which of the following correctly shows the effects of the sale on July 7? </strong> A)Option A B)Option B C)Option C D)Option D](https://storage.examlex.com/TB6522/11ea8a6f_8d7b_91b1_a2a1_817b6999ca6d_TB6522_00.jpg)

A)Option A

B)Option B

C)Option C

D)Option D

The Yankee Corporation has recently begun to accept credit cards. On July 7, Year 1, Yankee made a credit card sale of $600. The credit card company charges a fee of 3% for handling a credit card transaction.

-Which of the following correctly shows the effects of the sale on July 7?

![<strong>[The following information applies to the questions displayed below.] The Yankee Corporation has recently begun to accept credit cards. On July 7, Year 1, Yankee made a credit card sale of $600. The credit card company charges a fee of 3% for handling a credit card transaction. -Which of the following correctly shows the effects of the sale on July 7? </strong> A)Option A B)Option B C)Option C D)Option D](https://storage.examlex.com/TB6522/11ea8a6f_8d7b_91b1_a2a1_817b6999ca6d_TB6522_00.jpg)

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

25

Which accounting concept can be used by some companies to justify the use of the direct write-off method?

A)The entity concept

B)The materiality concept

C)The going concern concept

D)The monetary principle

A)The entity concept

B)The materiality concept

C)The going concern concept

D)The monetary principle

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following is a cost of extending credit to customers?

A)Uncollectible accounts expense

B)Lost sales

C)Fees paid to credit card companies

D)Explicit interest

A)Uncollectible accounts expense

B)Lost sales

C)Fees paid to credit card companies

D)Explicit interest

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

27

If the allowance method is used,how do the two entries recorded in connection with the recovery of an uncollectible account affect the elements of the financial statements? (Hint: Consider the effect of both entries taken together.)

A)No effect on total assets or stockholders' equity

B)Increase stockholders' equity

C)Decrease total assets

D)Increase total assets and stockholders' equity

A)No effect on total assets or stockholders' equity

B)Increase stockholders' equity

C)Decrease total assets

D)Increase total assets and stockholders' equity

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following is not a significant difference between the allowance method and the direct write-off method?

A)One method requires writing off of uncollectible accounts and the other does not.

B)One method conforms to GAAP and the other typically does not.

C)One method reports net realizable value on the balance sheet and the other does not.

D)One method requires the estimation of uncollectible accounts and the other does not.

A)One method requires writing off of uncollectible accounts and the other does not.

B)One method conforms to GAAP and the other typically does not.

C)One method reports net realizable value on the balance sheet and the other does not.

D)One method requires the estimation of uncollectible accounts and the other does not.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

29

Which one of the following is not an accurate description of the Allowance for Doubtful Accounts?

A)The account is a contra account.

B)The account is a temporary account.

C)The amount of the Allowance for Doubtful Accounts decreases the net realizable value of a company's receivables.

D)The account is increased by an estimate of uncollectible accounts expense.

A)The account is a contra account.

B)The account is a temporary account.

C)The amount of the Allowance for Doubtful Accounts decreases the net realizable value of a company's receivables.

D)The account is increased by an estimate of uncollectible accounts expense.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

30

Rosewood Company made a loan of $16,000 to one of the company's employees on April 1,Year 1.The one-year note carried a 6% rate of interest.What is the amount of interest revenue that Rosewood would report in Year 1 and Year 2,respectively?

A)$960 in Year 1 and $0 in Year 2

B)$0 in Year 1 and $960 in Year 2

C)$240 in Year 1 and $720 in Year 2

D)$720 in Year 1 and $240 in Year 2

A)$960 in Year 1 and $0 in Year 2

B)$0 in Year 1 and $960 in Year 2

C)$240 in Year 1 and $720 in Year 2

D)$720 in Year 1 and $240 in Year 2

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is not an advantage of accepting credit cards from retail customers?

A)The acceptance of credit cards tends to increase sales.

B)The credit card company performs credit worthiness assessments.

C)There are fees charged for the privilege of accepting credit cards.

D)The credit card company assumes the cost of slow collections and write-offs.

A)The acceptance of credit cards tends to increase sales.

B)The credit card company performs credit worthiness assessments.

C)There are fees charged for the privilege of accepting credit cards.

D)The credit card company assumes the cost of slow collections and write-offs.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following best describes the percent of receivables method?

A)Income statement approach

B)Direct write-off approach

C)Credit sales approach

D)Balance sheet approach

A)Income statement approach

B)Direct write-off approach

C)Credit sales approach

D)Balance sheet approach

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

33

When is it acceptable to use the direct write-off method?

A)If the dollar amount of uncollectible accounts is not material.

B)If most uncollectible accounts do not occur in the period of sale.

C)If most sales are made to other businesses.

D)All of these answer choices are correct.

A)If the dollar amount of uncollectible accounts is not material.

B)If most uncollectible accounts do not occur in the period of sale.

C)If most sales are made to other businesses.

D)All of these answer choices are correct.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

34

Elliston Company accepted credit card payments for $10,000 of services provided to customers.The credit card company charges a 3% fee for handling the transaction.Which of the following describes the effect of this transaction?

A)Increase revenue by $9,700

B)Increase assets by $10,000

C)Increase stockholders' equity (retained earnings)by $9,700

D)Increase net income by $10,000

A)Increase revenue by $9,700

B)Increase assets by $10,000

C)Increase stockholders' equity (retained earnings)by $9,700

D)Increase net income by $10,000

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

35

[The following information applies to the questions displayed below.]

The Yankee Corporation has recently begun to accept credit cards. On July 7, Year 1, Yankee made a credit card sale of $600. The credit card company charges a fee of 3% for handling a credit card transaction.

-Which of the following correctly describes the effect of the collection of cash from the credit card company on the financial statements of Yankee Corporation?

![<strong>[The following information applies to the questions displayed below.] The Yankee Corporation has recently begun to accept credit cards. On July 7, Year 1, Yankee made a credit card sale of $600. The credit card company charges a fee of 3% for handling a credit card transaction. -Which of the following correctly describes the effect of the collection of cash from the credit card company on the financial statements of Yankee Corporation? </strong> A)Option A B)Option B C)Option C D)Option D](https://storage.examlex.com/TB6522/11ea8a6f_8d7b_b8c2_a2a1_a176a06e3b53_TB6522_00.jpg)

A)Option A

B)Option B

C)Option C

D)Option D

The Yankee Corporation has recently begun to accept credit cards. On July 7, Year 1, Yankee made a credit card sale of $600. The credit card company charges a fee of 3% for handling a credit card transaction.

-Which of the following correctly describes the effect of the collection of cash from the credit card company on the financial statements of Yankee Corporation?

![<strong>[The following information applies to the questions displayed below.] The Yankee Corporation has recently begun to accept credit cards. On July 7, Year 1, Yankee made a credit card sale of $600. The credit card company charges a fee of 3% for handling a credit card transaction. -Which of the following correctly describes the effect of the collection of cash from the credit card company on the financial statements of Yankee Corporation? </strong> A)Option A B)Option B C)Option C D)Option D](https://storage.examlex.com/TB6522/11ea8a6f_8d7b_b8c2_a2a1_a176a06e3b53_TB6522_00.jpg)

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following is (are)the term(s)used to describe the person responsible for making payment on the due date of a promissory note?

A)Lender or maker

B)Maker or debtor

C)Borrower

D)Borrower or maker or debtor

A)Lender or maker

B)Maker or debtor

C)Borrower

D)Borrower or maker or debtor

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

37

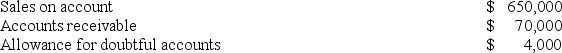

[The following information applies to the questions displayed below.]

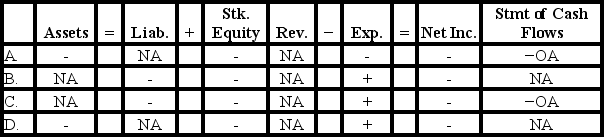

On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050.

-Which of the following correctly states the effect of Loudoun Company's February Year 2 entry to write off the customer's account?

![<strong>[The following information applies to the questions displayed below.] On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050. -Which of the following correctly states the effect of Loudoun Company's February Year 2 entry to write off the customer's account? </strong> A)Option A B)Option B C)Option C D)Option D](https://storage.examlex.com/TB6522/11ea8a6f_8d7a_3218_a2a1_01725a834009_TB6522_00.jpg)

A)Option A

B)Option B

C)Option C

D)Option D

On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050.

-Which of the following correctly states the effect of Loudoun Company's February Year 2 entry to write off the customer's account?

![<strong>[The following information applies to the questions displayed below.] On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050. -Which of the following correctly states the effect of Loudoun Company's February Year 2 entry to write off the customer's account? </strong> A)Option A B)Option B C)Option C D)Option D](https://storage.examlex.com/TB6522/11ea8a6f_8d7a_3218_a2a1_01725a834009_TB6522_00.jpg)

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

38

[The following information applies to the questions displayed below.]

On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050.

-Which of the following correctly states the effect of the adjusting entry,dated December 31,Year 1,on the elements of the financial statements of the Loudoun Corporation?

![<strong>[The following information applies to the questions displayed below.] On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050. -Which of the following correctly states the effect of the adjusting entry,dated December 31,Year 1,on the elements of the financial statements of the Loudoun Corporation? </strong> A)Option A B)Option B C)Option C D)Option D](https://storage.examlex.com/TB6522/11ea8a6f_8d7a_0b07_a2a1_67e8b300ac08_TB6522_00.jpg)

A)Option A

B)Option B

C)Option C

D)Option D

On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050.

-Which of the following correctly states the effect of the adjusting entry,dated December 31,Year 1,on the elements of the financial statements of the Loudoun Corporation?

![<strong>[The following information applies to the questions displayed below.] On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050. -Which of the following correctly states the effect of the adjusting entry,dated December 31,Year 1,on the elements of the financial statements of the Loudoun Corporation? </strong> A)Option A B)Option B C)Option C D)Option D](https://storage.examlex.com/TB6522/11ea8a6f_8d7a_0b07_a2a1_67e8b300ac08_TB6522_00.jpg)

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

39

[The following information applies to the questions displayed below.]

On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050.

-Which of the following correctly states the effect of recording the collection of the reestablished receivable on April 4,Year 2?

![<strong>[The following information applies to the questions displayed below.] On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050. -Which of the following correctly states the effect of recording the collection of the reestablished receivable on April 4,Year 2? </strong> A)Option A B)Option B C)Option C D)Option D](https://storage.examlex.com/TB6522/11ea8a6f_8d7a_803a_a2a1_2949790e4543_TB6522_00.jpg)

A)Option A

B)Option B

C)Option C

D)Option D

On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050.

-Which of the following correctly states the effect of recording the collection of the reestablished receivable on April 4,Year 2?

![<strong>[The following information applies to the questions displayed below.] On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050. -Which of the following correctly states the effect of recording the collection of the reestablished receivable on April 4,Year 2? </strong> A)Option A B)Option B C)Option C D)Option D](https://storage.examlex.com/TB6522/11ea8a6f_8d7a_803a_a2a1_2949790e4543_TB6522_00.jpg)

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

40

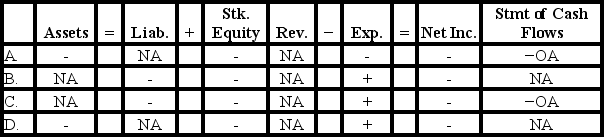

[The following information applies to the questions displayed below.]

On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050.

-Which of the following correctly states the effect of Loudoun's recording the reestablishment of the receivable on April 4,Year 2?

![<strong>[The following information applies to the questions displayed below.] On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050. -Which of the following correctly states the effect of Loudoun's recording the reestablishment of the receivable on April 4,Year 2? </strong> A)Option A B)Option B C)Option C D)Option D](https://storage.examlex.com/TB6522/11ea8a6f_8d7a_5929_a2a1_556b622b6955_TB6522_00.jpg)

A)Option A

B)Option B

C)Option C

D)Option D

On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050.

-Which of the following correctly states the effect of Loudoun's recording the reestablishment of the receivable on April 4,Year 2?

![<strong>[The following information applies to the questions displayed below.] On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050. -Which of the following correctly states the effect of Loudoun's recording the reestablishment of the receivable on April 4,Year 2? </strong> A)Option A B)Option B C)Option C D)Option D](https://storage.examlex.com/TB6522/11ea8a6f_8d7a_5929_a2a1_556b622b6955_TB6522_00.jpg)

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

41

The collection of an account receivable is an asset source transaction.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

42

What does the accounts receivable turnover ratio measure?

A)How quickly accounts receivable turn into cash

B)How quickly the accounts receivable balance increases

C)Average balance of accounts receivables

D)How quickly inventory turns into accounts receivable

A)How quickly accounts receivable turn into cash

B)How quickly the accounts receivable balance increases

C)Average balance of accounts receivables

D)How quickly inventory turns into accounts receivable

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

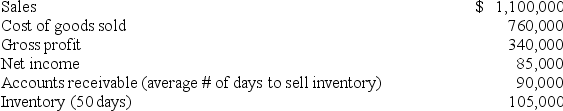

43

Rhodes Company reports the following information for the Year 1 fiscal year:

Determine the average number of days it takes Rhodes to collect its accounts receivable.(Round intermediate calculations to 2 decimal places. )

A)37

B)14

C)39

D)20

Determine the average number of days it takes Rhodes to collect its accounts receivable.(Round intermediate calculations to 2 decimal places. )

A)37

B)14

C)39

D)20

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

44

How is a company's operating cycle determined?

A)Adding the inventory turnover ratio to the receivables turnover ratio divided into 365 days.

B)Adding the average days in inventory to the average days in receivables.

C)Dividing cost of goods sold by average inventory.

D)Dividing 365 days by the difference in the inventory turnover and receivable turnover.

A)Adding the inventory turnover ratio to the receivables turnover ratio divided into 365 days.

B)Adding the average days in inventory to the average days in receivables.

C)Dividing cost of goods sold by average inventory.

D)Dividing 365 days by the difference in the inventory turnover and receivable turnover.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

45

The face value of Accounts Receivable plus the balance in the Allowance for Doubtful Accounts is equal to the net realizable value of the receivables.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following businesses would most likely have the longest operating cycle?

A)A chain of coffee shops

B)A national sporting goods chain

C)An antiques dealer

D)A Christmas tree farm

A)A chain of coffee shops

B)A national sporting goods chain

C)An antiques dealer

D)A Christmas tree farm

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

47

Glebe Company accepted a credit card account receivable in exchange for $1,100 of services provided to a customer.The credit card company charges a 5% fee for handling the transaction.What effect will the collection of cash from the credit card company have on the elements of the financial statements?

A)Increase assets by $1,045

B)Decrease assets and stockholders' equity by $55

C)Increase assets by $1,100

D)None of these answer choices are correct

A)Increase assets by $1,045

B)Decrease assets and stockholders' equity by $55

C)Increase assets by $1,100

D)None of these answer choices are correct

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

48

The net realizable value of accounts receivable is the amount of receivables a company expects to collect.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

49

Most companies report receivables on their balance sheets at the net realizable value.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

50

Alberta Company accepts a credit card as payment for $450 of services provided for the customer.The credit card company charges a 4% fee for handling the transaction.How does this this transaction affect the elements of the financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

51

Using the allowance method of accounting for uncollectible receivables requires an estimate of the amount of receivables that will not be collected.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

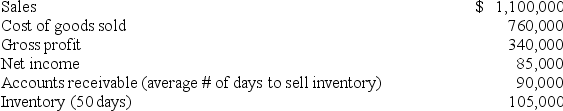

52

The following information is available for Blankenship Company for the most recent year.

What was Blankenship's operating cycle for the most recent year? (Round to the nearest whole day. )

A)30 days

B)50 days

C)80 days

D)120 days

What was Blankenship's operating cycle for the most recent year? (Round to the nearest whole day. )

A)30 days

B)50 days

C)80 days

D)120 days

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

53

Some accountants believe that the percent of revenue method for estimating uncollectible accounts expense is superior to the percent of receivables method because it is more conservative.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following is not considered a "cost" of extending credit to customers?

A)The opportunity cost of lost interest

B)Keeping the records for accounts receivable

C)The increased sales resulting from the extension of credit

D)The possibility of unpaid accounts

A)The opportunity cost of lost interest

B)Keeping the records for accounts receivable

C)The increased sales resulting from the extension of credit

D)The possibility of unpaid accounts

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

55

How is the accounts receivable turnover ratio computed?

A)Sales ÷ Net accounts receivable

B)Net accounts receivable ÷ Sales

C)Cost of goods sold ÷ Inventory

D)365 days ÷ Net accounts receivable

A)Sales ÷ Net accounts receivable

B)Net accounts receivable ÷ Sales

C)Cost of goods sold ÷ Inventory

D)365 days ÷ Net accounts receivable

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

56

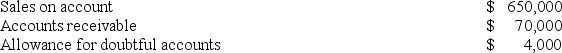

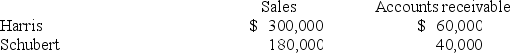

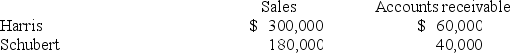

The accounting records of the Harris and Schubert Companies contained the following account balances:

Which of the following statements is true?

A)Schubert Company has a lower likelihood of lost income resulting from credit costs.

B)The company with the higher accounts receivable turnover ratio will also have the longer average number of days to collect accounts receivable.

C)The accounts receivable for Schubert Company turns over 6 times each year.

D)The average number of days to collect accounts receivable for Harris is 73 days.

Which of the following statements is true?

A)Schubert Company has a lower likelihood of lost income resulting from credit costs.

B)The company with the higher accounts receivable turnover ratio will also have the longer average number of days to collect accounts receivable.

C)The accounts receivable for Schubert Company turns over 6 times each year.

D)The average number of days to collect accounts receivable for Harris is 73 days.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

57

Willis Company had $200,000 in credit sales for Year 1,and it estimated that 2% of the credit sales would not be collected.The balance in Accounts Receivable at the end of the year was $38,000.Willis had never used the allowance method to account for its receivables until Year 1.The net realizable value of its accounts receivable at the end of the year was $34,000.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

58

The best estimate of the amount of cash a company expects to collect from its accounts receivable is the face value of the receivables.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

59

How is the average number of days to collect accounts receivable computed?

A)Accounts Receivable ÷ Net income

B)365 ÷ Accounts receivable turnover ratio

C)Accounts Receivable ÷ 365

D)Sales ÷ Net accounts receivable

A)Accounts Receivable ÷ Net income

B)365 ÷ Accounts receivable turnover ratio

C)Accounts Receivable ÷ 365

D)Sales ÷ Net accounts receivable

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

60

The direct write-off method does a better job of matching revenues and expenses than does the allowance method.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

61

If a company uses the percent of receivables method to estimate uncollectible accounts,the company will first determine the required ending balance in Allowance for Doubtful Accounts;the Uncollectible Accounts Expense will be the difference between that amount and the unadjusted credit balance in the Allowance for Doubtful Accounts.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

62

If a company estimates uncollectible accounts based on a percentage of receivables,the resulting estimate will be presented on the balance sheet as the ending balance in Allowance for Doubtful Accounts.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

63

The adjusting entry to recognize uncollectible accounts expense does not affect the net realizable value of receivables.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

64

The adjusting entry to recognize uncollectible accounts expense is an asset use transaction.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

65

Many businesses find it more efficient to offer credit directly to customers rather than to accept third-party credit cards.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

66

Making a loan to another party is considered an investing activity on the statement of cash flows.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

67

The longer an account receivable has been outstanding,the less likely it is to be collected.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

68

Collecting a credit card receivable is an asset source transaction.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

69

On June 1,Year 2,Carolina Company collected a $24,000 note receivable that had been issued on June 1,Year 1.The note carried a 6% interest rate.On June 1,Year 2,the company will recognize interest revenue in the amount of $1,440.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

70

When a company accepts a credit card payment for a sale,the amount of sales revenue to be recorded is reduced by the amount of the credit card company's fee.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

71

When a company receives payment from a customer whose account was previously written off,the account is reinstated and the net realizable value of Accounts Receivable increases.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

72

The direct write-off method overstates assets on the balance sheet.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

73

The net realizable value of accounts receivable decreases when an account receivable is written off.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

74

A company that uses the direct write-off method must still prepare a year-end adjusting entry to estimate its uncollectible accounts.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

75

When an uncollectible account receivable is written off,the amount of total assets is unchanged.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

76

The year-end adjusting entry to accrue interest on a note receivable is an asset source transaction.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

77

For a company that uses the allowance method,the write-off of an uncollectible account receivable is an asset use transaction.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

78

When a company receives payment from a customer whose account was previously written off,the customer's account should be reinstated.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

79

Chadwick Company's sales for Year 1 were $8,700,000.The ending balance of accounts receivable was $801,000 at the end of the year.During Year 1,Chadwick collected $8,400,000 on its accounts receivable.The accounts receivable turnover ratio for the year was 10.5.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck

80

With the direct write-off method,writing off an account receivable is an asset use transaction.

Unlock Deck

Unlock for access to all 83 flashcards in this deck.

Unlock Deck

k this deck