Deck 5: Accounting for Inventories

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/86

Play

Full screen (f)

Deck 5: Accounting for Inventories

1

What happens when a company is operating in an inflationary environment?

A)The company's net income will be higher if it uses LIFO than if it uses FIFO.

B)The company's cost of goods sold will be lower if it uses LIFO as opposed to FIFO.

C)The company's net income will be the same regardless of whether LIFO or FIFO is used.

D)The company's assets will be lower if it uses LIFO as opposed to FIFO cost flow.

A)The company's net income will be higher if it uses LIFO than if it uses FIFO.

B)The company's cost of goods sold will be lower if it uses LIFO as opposed to FIFO.

C)The company's net income will be the same regardless of whether LIFO or FIFO is used.

D)The company's assets will be lower if it uses LIFO as opposed to FIFO cost flow.

The company's assets will be lower if it uses LIFO as opposed to FIFO cost flow.

2

Anton Co.uses the perpetual inventory system and FIFO cost flow method.During the year,Anton purchased 400 units of inventory that cost $12.00 each and then purchased an additional 600 units of inventory that cost $16.00 each.If Anton sells 700 units of inventory,what is the amount of cost of goods sold?

A)$11,200

B)$10,400

C)$8,400

D)$9,600

A)$11,200

B)$10,400

C)$8,400

D)$9,600

$9,600

3

When prices are rising,which method of inventory,if any,will result in the lowest relative net cash outflow (including the effects of taxes,if any)?

A)LIFO

B)FIFO

C)Weighted average

D)None of these;the choice of inventory methods does not affect cash flows.

A)LIFO

B)FIFO

C)Weighted average

D)None of these;the choice of inventory methods does not affect cash flows.

LIFO

4

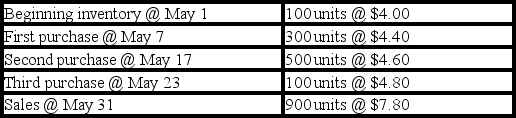

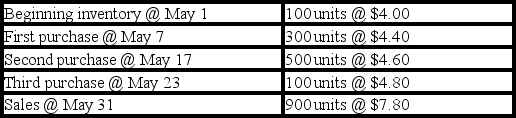

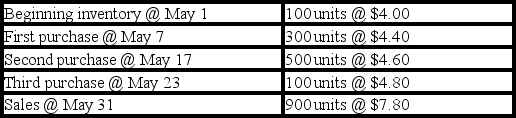

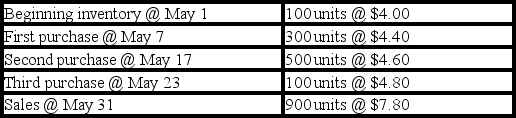

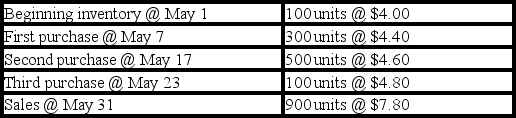

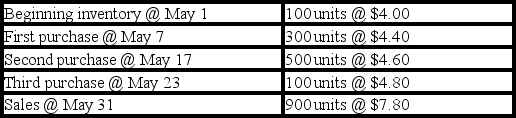

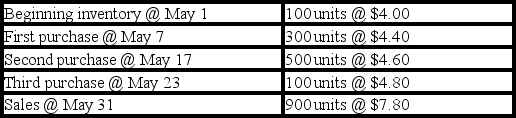

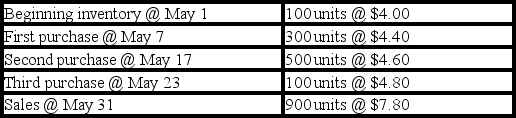

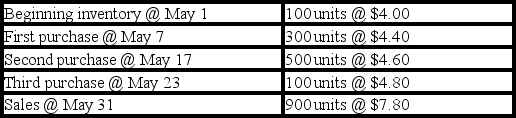

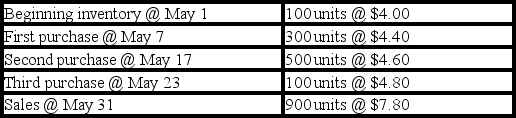

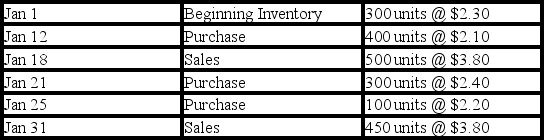

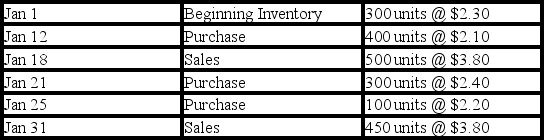

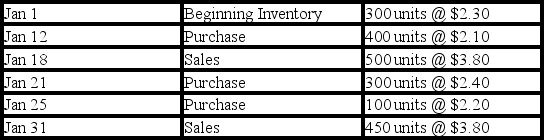

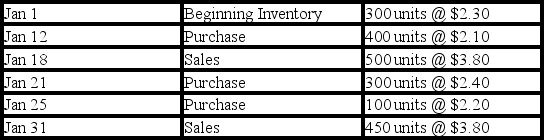

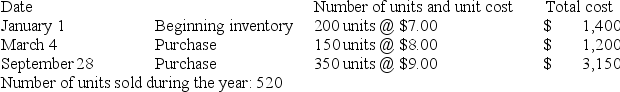

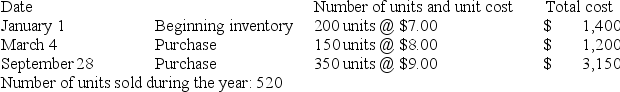

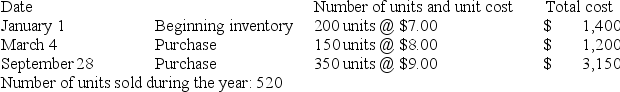

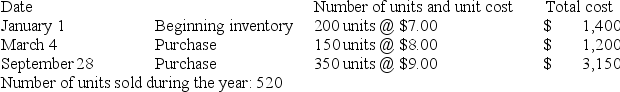

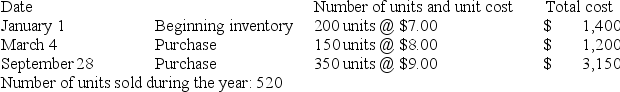

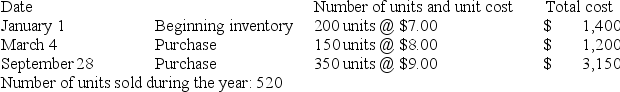

The inventory records for Radford Co.reflected the following:

-What is the amount of gross margin assuming the FIFO cost flow method?

A)$2,920

B)$3,420

C)$3,000

D)$4,020

-What is the amount of gross margin assuming the FIFO cost flow method?

A)$2,920

B)$3,420

C)$3,000

D)$4,020

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

5

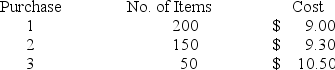

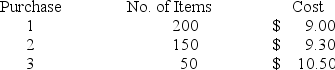

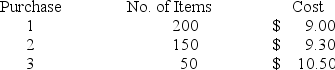

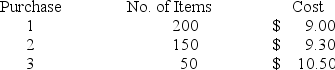

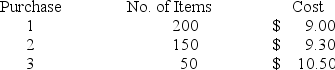

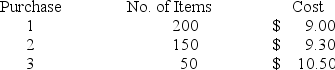

Glasgow Enterprises started the period with 80 units in beginning inventory that cost $7.50 each.During the period,the company purchased inventory items as follows:

Glasgow sold 220 units after purchase 3 for $17.00 each.

Glasgow sold 220 units after purchase 3 for $17.00 each.

-What is Glasgow's ending inventory under LIFO?

A)$2,730

B)$2,460

C)$2,220

D)$1,950

Glasgow sold 220 units after purchase 3 for $17.00 each.

Glasgow sold 220 units after purchase 3 for $17.00 each.-What is Glasgow's ending inventory under LIFO?

A)$2,730

B)$2,460

C)$2,220

D)$1,950

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

6

The inventory records for Radford Co.reflected the following:

-What is the amount of cost of goods sold assuming the LIFO cost flow method?

A)$4,100

B)$4,320

C)$2,360

D)$3,600

-What is the amount of cost of goods sold assuming the LIFO cost flow method?

A)$4,100

B)$4,320

C)$2,360

D)$3,600

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

7

Blake Company purchased two identical inventory items.The item purchased first cost $16.00,and the item purchased second cost $18.00.Blake sold one of the items for $24.00.Which of the following statements is true?

A)Ending inventory will be lower if Blake uses the weighted-average rather than the FIFO inventory cost flow method.

B)Cost of goods sold will be higher if Blake uses the FIFO rather than the weighted-average inventory cost flow method.

C)The dollar amount assigned to ending inventory will be the same no matter which inventory cost flow method is used.

D)Gross margin will be higher if Blake uses LIFO rather than the FIFO inventory cost flow method.

A)Ending inventory will be lower if Blake uses the weighted-average rather than the FIFO inventory cost flow method.

B)Cost of goods sold will be higher if Blake uses the FIFO rather than the weighted-average inventory cost flow method.

C)The dollar amount assigned to ending inventory will be the same no matter which inventory cost flow method is used.

D)Gross margin will be higher if Blake uses LIFO rather than the FIFO inventory cost flow method.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

8

Hoover Company purchased two identical inventory items.The item purchased first cost $33.00.The item purchased second cost $35.00.Then Hoover sold one of the inventory items for $62.00.Based on this information,which of the following statements is true?

A)The ending inventory is $35.00 if Hoover uses the LIFO cost flow method.

B)The gross margin is $28.00 if Hoover uses the weighted-average cost flow method.

C)The cost of goods sold is $35.00 if Hoover uses the FIFO cost flow method.

D)The cost of goods sold is $33.00 if Hoover uses the LIFO cost flow method.

A)The ending inventory is $35.00 if Hoover uses the LIFO cost flow method.

B)The gross margin is $28.00 if Hoover uses the weighted-average cost flow method.

C)The cost of goods sold is $35.00 if Hoover uses the FIFO cost flow method.

D)The cost of goods sold is $33.00 if Hoover uses the LIFO cost flow method.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

9

Poole Company purchased two identical inventory items.One of the items,purchased in January,cost $4.50.The other,purchased in February,cost $4.75.One of the items was sold in March at a selling price of $7.50.Poole uses LIFO.Which of the following statements is true?

A)The balance in ending inventory would be $4.75.

B)The amount of gross margin would be $2.75.

C)The amount of ending inventory would be $4.625.

D)The amount of cost of goods sold would be $4.50.

A)The balance in ending inventory would be $4.75.

B)The amount of gross margin would be $2.75.

C)The amount of ending inventory would be $4.625.

D)The amount of cost of goods sold would be $4.50.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

10

Which inventory costing method will produce an amount for cost of goods sold that is closest to current market value?

A)Weighted average

B)Specific identification

C)LIFO

D)FIFO

A)Weighted average

B)Specific identification

C)LIFO

D)FIFO

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

11

The inventory records for Radford Co.reflected the following:

-If the company uses the weighted-average inventory cost flow method,what is the average cost per unit (rounded)for May?

A)$4.45

B)$4.50

C)$5.12

D)$6.34

-If the company uses the weighted-average inventory cost flow method,what is the average cost per unit (rounded)for May?

A)$4.45

B)$4.50

C)$5.12

D)$6.34

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

12

The inventory records for Radford Co.reflected the following:

-What is the amount of gross margin assuming the weighted-average inventory cost flow method?

A)$3,015

B)$2,412

C)$1,314

D)$2,970

-What is the amount of gross margin assuming the weighted-average inventory cost flow method?

A)$3,015

B)$2,412

C)$1,314

D)$2,970

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

13

Glasgow Enterprises started the period with 80 units in beginning inventory that cost $7.50 each.During the period,the company purchased inventory items as follows:

Glasgow sold 220 units after purchase 3 for $17.00 each.

Glasgow sold 220 units after purchase 3 for $17.00 each.

-What is Glasgow's ending inventory under weighted-average (rounded)?

A)$2,361

B)$2,340

C)$1,980

D)$1,998

Glasgow sold 220 units after purchase 3 for $17.00 each.

Glasgow sold 220 units after purchase 3 for $17.00 each.-What is Glasgow's ending inventory under weighted-average (rounded)?

A)$2,361

B)$2,340

C)$1,980

D)$1,998

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

14

Barker Company paid cash to purchase two identical inventory items.The first purchase cost $18.00 cash and the second cost $20.00 cash.Barker sold one inventory item for $30.00 cash.Based on this information alone,without considering the effect of income taxes,which of the following statements is correct?

A)Cash flow from operating activities is $11.00 assuming the weighted-average inventory cost flow method is used.

B)Cash flow from operating activities is $12.00 assuming the FIFO inventory cost flow method is used.

C)Cash flow from operating activities is $10.00 assuming the LIFO inventory cost flow method is used.

D)The amount of cash flow from operating activities is not affected by the inventory cost flow method chosen.

A)Cash flow from operating activities is $11.00 assuming the weighted-average inventory cost flow method is used.

B)Cash flow from operating activities is $12.00 assuming the FIFO inventory cost flow method is used.

C)Cash flow from operating activities is $10.00 assuming the LIFO inventory cost flow method is used.

D)The amount of cash flow from operating activities is not affected by the inventory cost flow method chosen.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

15

The inventory records for Radford Co.reflected the following:

-What is the amount of ending inventory assuming the FIFO cost flow method?

A)$480

B)$440

C)$400

D)$940

-What is the amount of ending inventory assuming the FIFO cost flow method?

A)$480

B)$440

C)$400

D)$940

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

16

What happens when prices are falling?

A)LIFO will result in lower net income and a lower inventory valuation than will FIFO.

B)LIFO will result in lower net income and a higher inventory valuation than will FIFO.

C)LIFO will result in higher net income and a higher inventory valuation than will FIFO.

D)LIFO will result in higher net income and a lower inventory valuation than will FIFO.

A)LIFO will result in lower net income and a lower inventory valuation than will FIFO.

B)LIFO will result in lower net income and a higher inventory valuation than will FIFO.

C)LIFO will result in higher net income and a higher inventory valuation than will FIFO.

D)LIFO will result in higher net income and a lower inventory valuation than will FIFO.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

17

If prices are rising,which inventory cost flow method will produce the lowest amount of cost of goods sold?

A)LIFO

B)FIFO

C)Weighted average

D)LIFO,FIFO,and the weighted-average inventory cost flow methods will all produce equal amounts of cost of goods sold.

A)LIFO

B)FIFO

C)Weighted average

D)LIFO,FIFO,and the weighted-average inventory cost flow methods will all produce equal amounts of cost of goods sold.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

18

At a time of declining prices,which inventory cost flow method will result in the highest ending inventory?

A)Weighted-average

B)FIFO

C)LIFO

D)Either weighted-average or FIFO

A)Weighted-average

B)FIFO

C)LIFO

D)Either weighted-average or FIFO

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

19

Glasgow Enterprises started the period with 80 units in beginning inventory that cost $7.50 each.During the period,the company purchased inventory items as follows:

Glasgow sold 220 units after purchase 3 for $17.00 each.

Glasgow sold 220 units after purchase 3 for $17.00 each.

-What is Glasgow's cost of goods sold under FIFO?

A)$1,650

B)$1,860

C)$2,310

D)$2,100

Glasgow sold 220 units after purchase 3 for $17.00 each.

Glasgow sold 220 units after purchase 3 for $17.00 each.-What is Glasgow's cost of goods sold under FIFO?

A)$1,650

B)$1,860

C)$2,310

D)$2,100

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

20

When the cost of purchasing inventory is declining,which inventory cost flow method will produce the highest amount of cost of goods sold?

A)Weighted-average

B)LIFO

C)FIFO

D)LIFO,FIFO,and weighted-average will all produce the same amount of cost of goods sold.

A)Weighted-average

B)LIFO

C)FIFO

D)LIFO,FIFO,and weighted-average will all produce the same amount of cost of goods sold.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

21

If a company is using the lower-of-cost-or-market rule and a write-down is required,how will that write-down affect the elements of the company's financial statements?

A)Net income will increase.

B)Gross margin will decrease.

C)Total assets will decrease.

D)Gross margin and total assets will both decrease.

A)Net income will increase.

B)Gross margin will decrease.

C)Total assets will decrease.

D)Gross margin and total assets will both decrease.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following businesses is most likely to use a specific identification cost flow method?

A)Car dealership

B)Grocery store

C)Hardware store

D)Roofing company

A)Car dealership

B)Grocery store

C)Hardware store

D)Roofing company

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

23

Why are the inventory and cost of goods sold accounts attractive targets for managerial fraud?

A)There are few if any procedures that can check for fraud in these accounts.

B)There are no adequate methods of record keeping for inventory.

C)These accounts are more significant than most other accounts.

D)Cost of goods sold and Inventory accounts are not attractive targets of fraud.

A)There are few if any procedures that can check for fraud in these accounts.

B)There are no adequate methods of record keeping for inventory.

C)These accounts are more significant than most other accounts.

D)Cost of goods sold and Inventory accounts are not attractive targets of fraud.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

24

Melbourne Company uses the perpetual inventory system and LIFO cost flow method.Melbourne purchased 500 units of inventory that cost $4.00 each.At a later date,the company purchased an additional 600 units of inventory that cost $5.00 each.If the company sells 800 units of inventory,what amount of ending inventory will appear on a balance sheet prepared immediately after the sale?

A)$3,800

B)$1.350

C)$1,500

D)$1,200

A)$3,800

B)$1.350

C)$1,500

D)$1,200

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

25

The lower-of-cost-or-market rule can be applied to which of the following?

A)Major classes or categories of inventory

B)The entire stock of inventory in the aggregate

C)Each individual inventory item

D)All of these answer choices are correct.

A)Major classes or categories of inventory

B)The entire stock of inventory in the aggregate

C)Each individual inventory item

D)All of these answer choices are correct.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

26

What is meant by "market" in the lower-of-cost-or-market rule?

A)The amount of gross margin earned by selling merchandise.

B)The amount the goods were sold for during the period.

C)The amount that would have to be paid to replace the merchandise.

D)The amount originally paid for the merchandise.

A)The amount of gross margin earned by selling merchandise.

B)The amount the goods were sold for during the period.

C)The amount that would have to be paid to replace the merchandise.

D)The amount originally paid for the merchandise.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

27

Vargas Company uses the perpetual inventory system and the FIFO cost flow method.During the current year,Vargas purchased 400 units of inventory that cost $15.00 each.At a later date during the year,the company purchased an additional 800 units of inventory that cost $18.00 each.Vargas sold 500 units of inventory for $27.00.What is the amount of cost of goods sold that will appear on the current year's income statement?

A)$7,800

B)$6,000

C)$4,500

D)$5,700

A)$7,800

B)$6,000

C)$4,500

D)$5,700

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

28

At the end of the Year 2 accounting period,DeYoung Company determined that the market value of its inventory was $79,800.The historical cost of this inventory was $81,400.DeFazio uses the perpetual inventory method.Assuming the amount is material,how will the entry necessary to reduce the inventory to the lower of cost or market affect the elements of the company's financial statements?

A)Decrease total assets and gross margin

B)Decrease total assets and net income

C)Increase total assets and net income

D)Decrease total assets,gross margin,and net income

A)Decrease total assets and gross margin

B)Decrease total assets and net income

C)Increase total assets and net income

D)Decrease total assets,gross margin,and net income

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

29

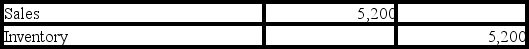

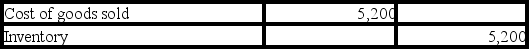

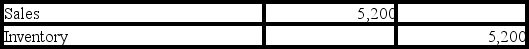

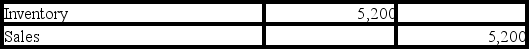

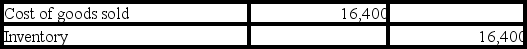

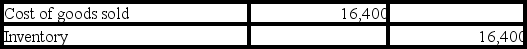

The Bradford Company was recently required to record an inventory write-down of $5,200 because the market value of its inventory was less than cost.Assuming the amount of the write-down is immaterial,which of the following journal entries would be recorded?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

30

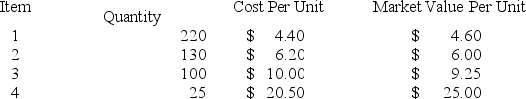

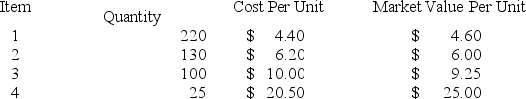

Rowan Company has four different categories of inventory.The quantity,cost,and market value for each of the inventory categories are as follows:

The company carries inventory at lower-of-cost-or-market applied to the entire stock of inventory in the aggregate.How would the implementation of the lower-of-cost-or-market rule impact the elements of the company's financial statements?

A)Increase total assets and stockholders' equity by $55.50.

B)Decrease total assets and stockholders' equity by $101.00.

C)Decrease total assets and stockholders' equity by $79.00.

D)Have no effect on total assets or stockholders' equity.

The company carries inventory at lower-of-cost-or-market applied to the entire stock of inventory in the aggregate.How would the implementation of the lower-of-cost-or-market rule impact the elements of the company's financial statements?

A)Increase total assets and stockholders' equity by $55.50.

B)Decrease total assets and stockholders' equity by $101.00.

C)Decrease total assets and stockholders' equity by $79.00.

D)Have no effect on total assets or stockholders' equity.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

31

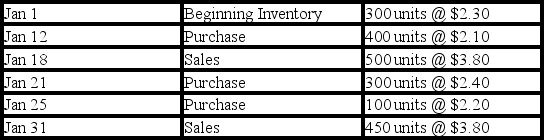

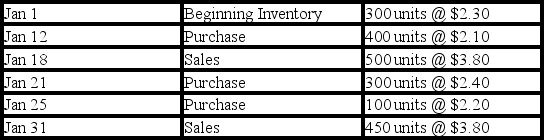

Chase Co.uses the perpetual inventory method.The inventory records for Chase reflected the following information:

-Assuming Chase uses a LIFO cost flow method,what is the amount of cost of goods sold for the sales transaction on January 18?

A)$1,150

B)$1,050

C)$1,070

D)$1,130

-Assuming Chase uses a LIFO cost flow method,what is the amount of cost of goods sold for the sales transaction on January 18?

A)$1,150

B)$1,050

C)$1,070

D)$1,130

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

32

Chase Co.uses the perpetual inventory method.The inventory records for Chase reflected the following information:

-Assuming Chase uses a FIFO cost flow method,what is the cost of goods sold for the sales transaction on January 31?

A)$1,020

B)$1,005

C)$1,045

D)$340

-Assuming Chase uses a FIFO cost flow method,what is the cost of goods sold for the sales transaction on January 31?

A)$1,020

B)$1,005

C)$1,045

D)$340

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

33

Stubbs Company uses the perpetual inventory method and the weighted-average cost flow method.On January 1,Year 2,Stubbs purchased 400 units of inventory that cost $8.00 each.On January 10,Year 2,the company purchased an additional 600 units of inventory that cost $9.00 each.If the company sells 700 units of inventory for $16.00 each,what is the amount of gross margin reported on the income statement?

A)$5,180

B)$5,250

C)$5,000

D)$6,020

A)$5,180

B)$5,250

C)$5,000

D)$6,020

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

34

Koontz Company uses the perpetual inventory method and the weighted-average method.On January 1,Year 1,the company's first day of operations,Koontz purchased 400 units of inventory that cost $7.50 each.On January 10,Year 1,the company purchased an additional 600 units of inventory that cost $9.00 each.If the company sells 550 units of inventory,what is the amount of inventory that would appear on the balance sheet immediately following the sale?

A)$3,780

B)$4,738

C)$3,080

D)$3,713

A)$3,780

B)$4,738

C)$3,080

D)$3,713

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

35

Chase Co.uses the perpetual inventory method.The inventory records for Chase reflected the following information:

-Assuming Chase uses a FIFO cost flow method,what is the ending inventory on January 31?

A)$345

B)$340

C)$330

D)$1,020

-Assuming Chase uses a FIFO cost flow method,what is the ending inventory on January 31?

A)$345

B)$340

C)$330

D)$1,020

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

36

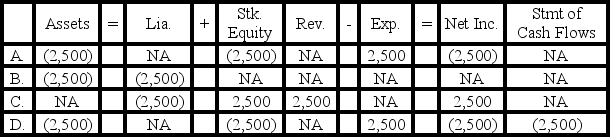

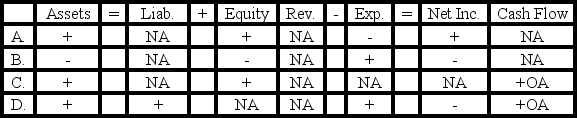

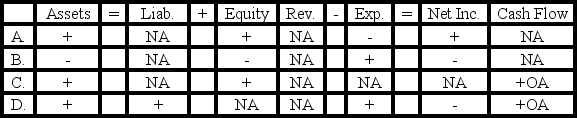

Nelson Corporation is required to record an inventory write-down of $2,500 as a result of using the lower-of-cost-or-market rule.Which of the following shows how this entry would affect the financial statements?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

37

West Corporation's Year 1 ending inventory was overstated by $20,000;however,ending inventory for Year 2 was correct.Which of the following statements is correct?

A)Net income for Year 1 is understated.

B)Retained earnings at the end of Year 2 is overstated.

C)Cost of goods sold for Year 1 is overstated.

D)Cost of goods sold for Year 2 is overstated.

A)Net income for Year 1 is understated.

B)Retained earnings at the end of Year 2 is overstated.

C)Cost of goods sold for Year 1 is overstated.

D)Cost of goods sold for Year 2 is overstated.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

38

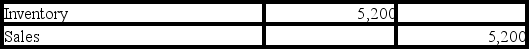

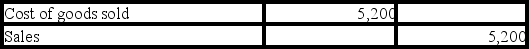

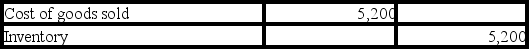

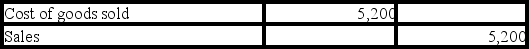

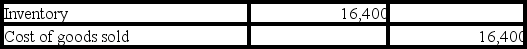

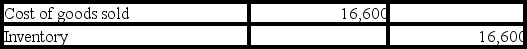

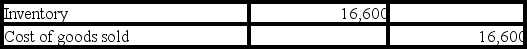

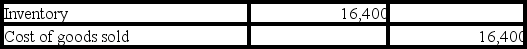

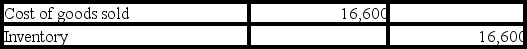

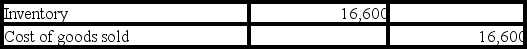

Tetra Co.uses the perpetual inventory system and a FIFO cost flow method.On January 1,the company purchased 2,000 units of inventory that cost $4.00 each.On January 12,the company purchased an additional 3,000 units of inventory at a cost of $4.20 each.On January 20,Tetra Company sold 4,000 units of inventory.Which of the following entries would be required to recognize the cost of goods sold on that date?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

39

Phipps Corporation overstated its ending inventory on December 31,Year 1.Which of the following correctly identifies the effect of the error on Year 2 financial statements?

A)Cost of goods sold is overstated.

B)Gross margin overstated.

C)Ending inventory is understated.

D)Net income is overstated.

A)Cost of goods sold is overstated.

B)Gross margin overstated.

C)Ending inventory is understated.

D)Net income is overstated.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following methods of applying the lower-of-cost-or-market rule will result in the fewest number of inventory write-downs?

A)Each individual inventory item

B)Average of cost of goods sold for the past three years

C)Major classes or categories of inventory

D)The entire stock of inventory in the aggregate

A)Each individual inventory item

B)Average of cost of goods sold for the past three years

C)Major classes or categories of inventory

D)The entire stock of inventory in the aggregate

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

41

Landis Company is preparing its financial statements.Gross margin is normally 40% of sales.Information taken from the company's records revealed sales of $25,000;beginning inventory of $2,500 and purchases of $17,500.What is the estimated amount of ending inventory at the end of the period?

A)$15,000

B)$5,000

C)$8,000

D)$10,000

A)$15,000

B)$5,000

C)$8,000

D)$10,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following statements is not correct regarding the importance of inventory turnover to a company's profitability?

A)Companies will prefer to have a low inventory turnover rather than a high inventory turnover.

B)It is sometimes more desirable to sell a large amount of merchandise with a small amount of gross margin than a small amount of merchandise with a large amount of gross margin.

C)A company's profitability is affected by how rapidly inventory sells.

D)A company's profitability is affected by the spread between cost and selling price.

A)Companies will prefer to have a low inventory turnover rather than a high inventory turnover.

B)It is sometimes more desirable to sell a large amount of merchandise with a small amount of gross margin than a small amount of merchandise with a large amount of gross margin.

C)A company's profitability is affected by how rapidly inventory sells.

D)A company's profitability is affected by the spread between cost and selling price.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

43

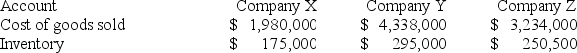

-What is the average number of days to sell inventory for Company Y?

A)15.3

B)24.8

C)23.9

D)25.6

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

44

Misty Mountain Outfitters is a merchandiser of specialized fly fishing gear.Its cost of goods sold for Year 2 was $295,000,and sales were $690,000.The amount of merchandise on hand was $50,000,and total assets amounted to $585,000.What is the average number of days to sell inventory? (Round to the nearest day. )

A)26 days

B)62 days

C)31 days

D)40 days

A)26 days

B)62 days

C)31 days

D)40 days

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following is not required to apply the gross margin method?

A)Total sales for the current period

B)The amount of inventory on hand at the end of the current period

C)Amount of purchases during the current period

D)The beginning inventory for the current period

A)Total sales for the current period

B)The amount of inventory on hand at the end of the current period

C)Amount of purchases during the current period

D)The beginning inventory for the current period

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

46

When using the gross margin method to estimate inventory,which of the following is a step in the computation?

A)Add the amount goods available for sale to estimated cost of goods sold

B)Add estimated gross margin to sales

C)Subtract estimated goods available for sale from beginning inventory

D)Subtract estimated cost of goods sold from the amount of goods available for sale

A)Add the amount goods available for sale to estimated cost of goods sold

B)Add estimated gross margin to sales

C)Subtract estimated goods available for sale from beginning inventory

D)Subtract estimated cost of goods sold from the amount of goods available for sale

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

47

What effect will an overstatement of ending inventory at the end of Year 1 have on the amounts reported on the Year 1 financial statements?

A)Overstatement of cost of goods sold

B)Overstatement of total assets

C)Understatement of net income

D)Understatement of retained earnings

A)Overstatement of cost of goods sold

B)Overstatement of total assets

C)Understatement of net income

D)Understatement of retained earnings

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

48

How is inventory turnover calculated?

A)Cost of goods sold divided by inventory

B)Sales divided by inventory

C)Beginning inventory divided by the ending inventory

D)Inventory divided by cost of goods sold

A)Cost of goods sold divided by inventory

B)Sales divided by inventory

C)Beginning inventory divided by the ending inventory

D)Inventory divided by cost of goods sold

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

49

When the perpetual inventory system is used,where can the best estimate of the amount of inventory on hand be found?

A)On the previous period's balance sheet

B)In the Inventory account in the general ledger

C)By applying the gross margin method

D)By subtracting sales for the period from the beginning Inventory account balance

A)On the previous period's balance sheet

B)In the Inventory account in the general ledger

C)By applying the gross margin method

D)By subtracting sales for the period from the beginning Inventory account balance

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

50

One of the disadvantages of the specific identification inventory cost flow method is that it can allow managers of a business to manipulate the amount of income the business reports.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

51

Carson Company has an inventory turnover of 12.75,and its inventory amounts to $2,400,000.What is the amount of cost of goods sold?

A)$30,600,000

B)$188,235

C)$26,666,667

D)$51,000

A)$30,600,000

B)$188,235

C)$26,666,667

D)$51,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

52

Assuming that longer inventory holding periods act to increase expenses,which of the three companies would be expected to have the lowest inventory holding costs?

A)All three companies have equal holding costs

B)Company X

C)Company Y

D)Company Z

A)All three companies have equal holding costs

B)Company X

C)Company Y

D)Company Z

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

53

On December 31,Year 1,Owings Corporation overstates the ending inventory by $5,000.How will this affect the amount of retained earnings shown on the balance sheet at December 31,Year 2?

A)Retained Earnings will be correctly stated.

B)Retained Earnings will be understated by $5,000.

C)Retained Earnings will be overstated by $5,000.

D)Cannot be determined with the above information.

A)Retained Earnings will be correctly stated.

B)Retained Earnings will be understated by $5,000.

C)Retained Earnings will be overstated by $5,000.

D)Cannot be determined with the above information.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

54

Zinke Company understated its ending inventory at the end of Year 1.Which of the following correctly states the effect of the error on the amounts shown on the Year 1 financial statements?

A)Overstatement of total assets and cost of goods sold.

B)Overstatement of cost of goods sold and retained earnings.

C)Understatement of liabilities and retained earnings.

D)Understatement of total assets and gross margin.

A)Overstatement of total assets and cost of goods sold.

B)Overstatement of cost of goods sold and retained earnings.

C)Understatement of liabilities and retained earnings.

D)Understatement of total assets and gross margin.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

55

Taylor Co.had beginning inventory of $400 and ending inventory of $600.Taylor Co.had cost of goods sold amounting to $1,800.What is the amount of inventory that was purchased during the period?

A)$1,600

B)$2,800

C)$2,000

D)$2,400

A)$1,600

B)$2,800

C)$2,000

D)$2,400

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

56

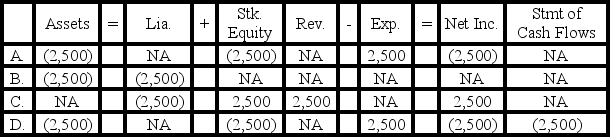

How does an error that results in an overstatement of ending inventory affect the elements of the company's financial statements in the current year?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

57

The last-in,first-out cost flow method assigns the cost of the items purchased first to ending inventory.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following circumstances would be a valid reason to estimate the amount of inventory that is on hand at the end of the period?

A)To complete the company's annual income tax return

B)To avoid taking a physical count of inventory

C)To test for financial statement manipulation

D)All of the answer choices are valid reasons for estimating the ending inventory.

A)To complete the company's annual income tax return

B)To avoid taking a physical count of inventory

C)To test for financial statement manipulation

D)All of the answer choices are valid reasons for estimating the ending inventory.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

59

The specific identification inventory method is not practical for companies that sell many low-priced,high turnover items.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

60

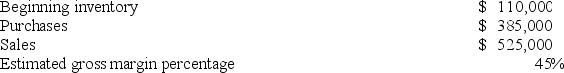

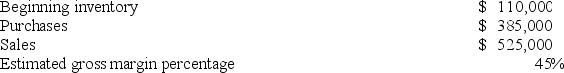

When preparing its quarterly financial statements,Pace Co.uses the gross margin method to estimate ending inventory.The following information is available for the quarter ending March 31,Year 2:

What is the estimated amount of inventory that is on hand on March 31,Year 2?

A)$236,250

B)$288,750

C)$206,250

D)$258,750

What is the estimated amount of inventory that is on hand on March 31,Year 2?

A)$236,250

B)$288,750

C)$206,250

D)$258,750

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

61

Singleton Company's perpetual inventory records included the following information:

-If Singleton uses the weighted-average cost flow method,its average cost per unit would be $8.00.

-If Singleton uses the weighted-average cost flow method,its average cost per unit would be $8.00.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

62

If a company uses the FIFO cost flow method for its income tax return it must also use FIFO for financial reporting.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

63

Singleton Company's perpetual inventory records included the following information:

-If Singleton uses the LIFO cost flow method,its ending inventory would be $1,260.

-If Singleton uses the LIFO cost flow method,its ending inventory would be $1,260.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

64

Generally accepted accounting principles restrict or limit a company's freedom to change inventory cost flow methods from one year to the next.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

65

During a period of rising inventory prices the LIFO cost flow method will result in higher total assets than FIFO.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

66

Singleton Company's perpetual inventory records included the following information:

-If Singleton uses the FIFO cost flow method,its cost of goods sold would be $4,490.

-If Singleton uses the FIFO cost flow method,its cost of goods sold would be $4,490.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

67

During a period of declining prices,a company would report a lower gross margin using the FIFO cost flow method than with LIFO.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

68

A company uses a cost flow method (such as LIFO or FIFO)to allocate product costs between cost of goods sold and beginning inventory.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

69

A company's gross margin reported on the income statement is not affected by the inventory cost flow method it uses.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

70

The Internal Revenue Service allows a company to use LIFO for income tax purposes only if it also uses LIFO for financial reporting.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

71

If the replacement cost of inventory is greater than its historical cost,the increase in value does not affect the company's financial statements.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

72

In a period of rising inventory prices,use of the FIFO cost flow method would cause a company to pay more income taxes than would use of LIFO.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

73

Generally accepted accounting principles often allows companies to account for the same types of events in different ways.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

74

Warner Company purchased two units of a product for $36 and later purchased one more for $40.If the company uses the weighted average cost flow method,and it sold one unit of the product for $60,its gross margin would be $22.00.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

75

During a period of rising inventory prices,a company's cost of goods sold would be higher using the LIFO cost flow method than with FIFO.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

76

International Financial Reporting Standards (IFRS)do not permit the use of the LIFO inventory cost flow method.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

77

During a period of rising inventory prices,the amount of ending inventory reported on the balance sheet will be lower using the LIFO cost flow method than with FIFO.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

78

If a company uses the LIFO cost flow method,it is not required by generally accepted accounting principles to apply the lower-of-cost-or-market rule.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

79

Generally accepted accounting principles do not allow the cost flow pattern for merchandise inventory to differ from the physical flow of merchandise within the business.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

80

In most businesses,the physical flow of goods occurs on a FIFO basis,but a different cost flow method is allowed under generally accepted accounting principles.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck