Deck 6: Self-Employed Business Income Line 12 of Form 1040 and Schedule C

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/76

Play

Full screen (f)

Deck 6: Self-Employed Business Income Line 12 of Form 1040 and Schedule C

1

The significance of meeting the "travel away from home" standard is that it allows the deduction of meals,lodging,and other incidental expenses such as dry cleaning.

True

2

The §179 expense deduction is limited to earned income.

True

3

The cost of all personal property is recovered using a 200% declining-balance rate under MACRS.

True

4

Transportation costs are deductible when a taxpayer goes to a business meeting away from his or her regular workplace.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

5

Depreciation is allowed for every tangible asset except land)used either in a trade or business or for the production of income.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

6

Taxpayers must use the mid-month convention when more than 40% of the personal property is placed in service during the last three months of the tax year.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

7

A business bad debt is treated as a short-term capital loss and can be deducted only when it becomes completely worthless.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

8

Once the more-than-50% business-use test is met for listed property,it does not matter if the business use falls below 50% in subsequent years.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

9

"Listed property" includes only passenger automobiles.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

10

Meals and entertainment expenses are limited to 50%.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

11

Under MACRS,the half-year convention is used for all real property.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

12

For an expense to be necessary,it must be essential to the taxpayer's business.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

13

If property is inherited,the property's basis for purposes of depreciation is the same as the decedent's basis.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

14

The standard mileage rate encompasses depreciation or lease payments,maintenance and repairs,gasoline,oil,insurance,and vehicle registration fees.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

15

Fines paid that are ordinary and necessary in a trade or business generally are deductible.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

16

Under MACRS,the straight-line method is required for all depreciable real property.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

17

The luxury auto limits on depreciation must be reduced if business use is less than 100%.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

18

For an expense to be ordinary,it must be customary or usual in the taxpayer's particular business.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

19

The standard mileage rate includes parking fees,tolls,and property taxes on the vehicle.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

20

A sole proprietor's trade or business income or loss is reported on Schedule C,Form 1040.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

21

On November 30,2016,Constance purchased an apartment building for $750,000.Determine her cost recovery deduction for 2016 rounded to the nearest dollar.

A)$26,138.

B)$3,413.

C)$2,400.

D)$0.

A)$26,138.

B)$3,413.

C)$2,400.

D)$0.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

22

Education expenses are deductible if the education maintains or improves existing skills or if the education helps the taxpayer qualify for a new trade or business.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

23

In June 2016,Kelly purchased new equipment for $26,000 to be used in her business.Assuming Kelly has net income from her business of $75,000 prior to the deduction,what is the maximum amount of cost recovery Kelly can deduct rounded to the nearest dollar,assuming she does not elect §179 expense or bonus depreciation?

A)$3,715.

B)$13,000.

C)$26,000.

D)$14,858.

A)$3,715.

B)$13,000.

C)$26,000.

D)$14,858.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

24

In July 2016,Cassie purchases equipment for $55,000 to be used in her business.Assuming Cassie has a small net loss from her business prior to the deduction,what is the maximum amount of cost recovery Cassie can deduct?

A)$7,860.

B)$55,000.

C)$27,500.

D)$31,430.

A)$7,860.

B)$55,000.

C)$27,500.

D)$31,430.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

25

On May 26,2012,Jamal purchased machinery for $30,000 to be used in his business.He did not elect to expense the equipment under §179 or the bonus.On October 10,2016,he sells the machinery to a scrap metal dealer.What is his cost recovery deduction for 2016 rounded to the nearest dollar?

A)$1,340.

B)$2,679.

C)$4,287.

D)$0.

A)$1,340.

B)$2,679.

C)$4,287.

D)$0.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

26

If property is converted from personal-use property to business property,the depreciable cost basis is which of the following?

A)Cost of the asset.

B)The cost of a new similar asset at the date of conversion.

C)FMV of the asset.

D)The lower of the cost or FMV at the date of conversion.

A)Cost of the asset.

B)The cost of a new similar asset at the date of conversion.

C)FMV of the asset.

D)The lower of the cost or FMV at the date of conversion.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

27

Sole proprietors must pay self-employment tax on 100% of their self-employment income.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

28

When business property is lost in a fire,storm,shipwreck,theft,or other casualty,the taxpayer normally receives a capital loss deduction.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

29

Trade or business expenses are treated as:

A)Deductible as itemized deductions subject to the 2% AGI floor.

B)Deductible as a for AGI deduction.

C)An itemized deduction if not reimbursed.

D)Deductible only if the activity had substantial income.

A)Deductible as itemized deductions subject to the 2% AGI floor.

B)Deductible as a for AGI deduction.

C)An itemized deduction if not reimbursed.

D)Deductible only if the activity had substantial income.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

30

§179 expense is available for all of the following business assets except:

A)Phone system.

B)Office furniture.

C)Apartment complex.

D)Bulldozer.

A)Phone system.

B)Office furniture.

C)Apartment complex.

D)Bulldozer.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is not a "trade or business" expense?

A)Mortgage interest on a warehouse.

B)Mortgage interest on a personal residence.

C)Cost of goods sold.

D)Depreciation on business equipment.

A)Mortgage interest on a warehouse.

B)Mortgage interest on a personal residence.

C)Cost of goods sold.

D)Depreciation on business equipment.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

32

Della purchased a warehouse on February 25,2016,for $350,000.$45,000 of the price was for the land.What is her cost recovery deduction for 2016 rounded to the nearest dollar?

A)$7,865.

B)$11,137.

C)$9,705.

D)$6,853.

A)$7,865.

B)$11,137.

C)$9,705.

D)$6,853.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

33

Patricia,a professional gambler,had the following income and expenses in her business:  How much net income must Patricia report from this business?

How much net income must Patricia report from this business?

A)$258,000.

B)$239,100.

C)$240,000.

D)$0.

How much net income must Patricia report from this business?

How much net income must Patricia report from this business?A)$258,000.

B)$239,100.

C)$240,000.

D)$0.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

34

The adjusted basis of an asset is:

A)The cost of the asset.

B)The cost basis less any accumulated depreciation.

C)The trade-in value of the asset.

D)The fair market value of the asset.

A)The cost of the asset.

B)The cost basis less any accumulated depreciation.

C)The trade-in value of the asset.

D)The fair market value of the asset.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

35

On July 15,2014,Travis purchased some office furniture for $20,000 to be used in his business.He did not elect to expense the equipment under §179 or bonus.On December 15,2016,he sells the equipment.What is his cost recovery deduction for 2016?

A)$1,749.

B)$2,858.

C)$3,498.

D)$0.

A)$1,749.

B)$2,858.

C)$3,498.

D)$0.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

36

Which expenses incurred in a trade or business are deductible?

A)Fines and penalties.

B)Bribes.

C)Political lobbying expenses.

D)Supplies expenses.

A)Fines and penalties.

B)Bribes.

C)Political lobbying expenses.

D)Supplies expenses.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

37

If an activity is characterized as a hobby,expenses are deductible only to the extent of income from the hobby,subject to certain ordering rules.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

38

Paola purchased an office building on January 5,2014,for $450,000.$30,000 of the price was for the land.On September 25,2016,he sold the office building.What is the cost recovery deduction for 2016 rounded to the nearest dollar?

A)$0.

B)$10,769.

C)$7,628.

D)$7,321.

A)$0.

B)$10,769.

C)$7,628.

D)$7,321.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

39

If inventory is a material amount,what method of accounting is acceptable for a sole proprietorship to use?

A)Accrual method.

B)Both Accrual method and Hybrid method.

C)The cash method.

D)Hybrid method.

A)Accrual method.

B)Both Accrual method and Hybrid method.

C)The cash method.

D)Hybrid method.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

40

For a cash-basis taxpayer,any account receivable that is not collected can be written off as a bad debt.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

41

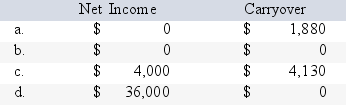

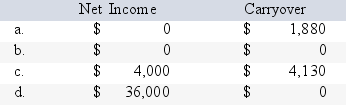

Chris runs a business out of her home.She uses 500 square feet of her home exclusively for the business.Her home is 2500 square feet in total.Chris had $36,000 of business revenue and $32,000 of business expenses from her home business.The following expenses relate to her home:  What is Chris' net income from her business and the amount of expenses carried over to the following year,if any?

What is Chris' net income from her business and the amount of expenses carried over to the following year,if any?

A)Option A

B)Option B

C)Option C

D)Option D

What is Chris' net income from her business and the amount of expenses carried over to the following year,if any?

What is Chris' net income from her business and the amount of expenses carried over to the following year,if any?

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

42

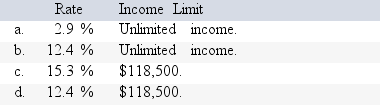

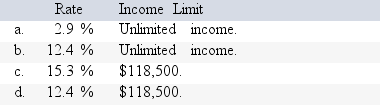

For 2016,what is the social security tax rate and income limit for a self-employed individual?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

43

Cole purchased a car for business and personal use.In 2016,he used the car 60% for business 13,000 total use miles)and used the standard mileage rate to calculate his vehicle expenses.He also paid $1,500 in interest and $360 in county property tax on the car.What is the total business deduction related to business use of the car rounded to the nearest dollar?

A)$1,860.

B)$6,072.

C)$5,328.

D)$4,212.

A)$1,860.

B)$6,072.

C)$5,328.

D)$4,212.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following individuals can deduct his or her education expenses?

A)An accountant who attends law school to get a law degree.

B)An accounting bookkeeper that takes a CPA review course to pass the CPA exam and become a CPA.

C)A medical doctor who attends a review course to obtain a financial consultant license.

D)A lawyer who goes to law school to get a specialized tax degree.

A)An accountant who attends law school to get a law degree.

B)An accounting bookkeeper that takes a CPA review course to pass the CPA exam and become a CPA.

C)A medical doctor who attends a review course to obtain a financial consultant license.

D)A lawyer who goes to law school to get a specialized tax degree.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

45

The standard mileage rate encompasses all of the following auto costs except for:

A)Auto property taxes.

B)Depreciation or lease payments.

C)Gasoline,oil,and insurance.

D)Maintenance and repairs.

A)Auto property taxes.

B)Depreciation or lease payments.

C)Gasoline,oil,and insurance.

D)Maintenance and repairs.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

46

Deductible education expenses include all of the following except:

A)Tuition.

B)Books.

C)Room and board.

D)Travel.

A)Tuition.

B)Books.

C)Room and board.

D)Travel.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

47

In order for an employee to deduct home office expenses,which of the following must occur:

A)The business use of the home must be specifically for trade or business purposes.

B)The taxpayer's most important activities must occur in the home.

C)There must be no other fixed business location.

D)The home office must be for the convenience of his or her employer.

A)The business use of the home must be specifically for trade or business purposes.

B)The taxpayer's most important activities must occur in the home.

C)There must be no other fixed business location.

D)The home office must be for the convenience of his or her employer.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following is incorrect regarding luxury automobile limitations?

A)The luxury limitations do not apply to the Section 179 expense deduction.

B)The limits are reduced further if the business use is less than 100%.

C)Light trucks or vans that are less than 6,000 pounds are subject to the limits.

D)Passenger autos with a gross weight of less than 6,000 pounds are subject to the limits.

A)The luxury limitations do not apply to the Section 179 expense deduction.

B)The limits are reduced further if the business use is less than 100%.

C)Light trucks or vans that are less than 6,000 pounds are subject to the limits.

D)Passenger autos with a gross weight of less than 6,000 pounds are subject to the limits.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

49

Under MACRS,5-year property includes:

A)Fruit-bearing trees.

B)Warehouse.

C)Apartment complex.

D)Automobiles and light trucks used in a trade or business.

A)Fruit-bearing trees.

B)Warehouse.

C)Apartment complex.

D)Automobiles and light trucks used in a trade or business.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

50

Shante is employed by a local pharmaceutical company where she earned $48,000 in 2016.During the year,she also had self-employment income of $18,000.Her self-employment tax rounded to the nearest dollar is:

A)$2,543.

B)$2,754.

C)$0.

D)$2,061.

A)$2,543.

B)$2,754.

C)$0.

D)$2,061.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

51

Marion drives 20 miles a day from his first job to his second job.He worked 125 days during 2016 on both jobs.What is Marion's mileage deduction rounded to the nearest dollar assuming he uses the standard mileage rate and mileage is incurred ratably throughout the year?

A)$1,400.

B)$1,350.

C)$1,438.

D)$70.

A)$1,400.

B)$1,350.

C)$1,438.

D)$70.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following properties is not eligible for the §179 expense election when purchased?

A)Rental property.

B)A business automobile.

C)A business computer.

D)Manufacturing equipment.

A)Rental property.

B)A business automobile.

C)A business computer.

D)Manufacturing equipment.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

53

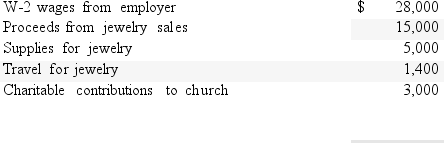

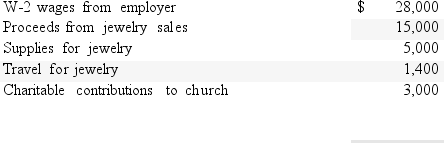

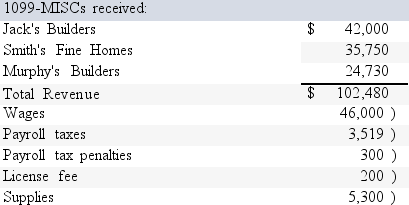

During 2016,Regina,a sole proprietor,had the following income and expenses from her home jewelry business.Regina is also employed as an office assistant at a local business:

a.What income or loss should be reported on Schedule C?

a.What income or loss should be reported on Schedule C?

b.What is Regina's AGI?

a.What income or loss should be reported on Schedule C?

a.What income or loss should be reported on Schedule C?b.What is Regina's AGI?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

54

Marcus has two jobs.He works as a night auditor at the Midnight Motel.When his shift at the motel is over,he works as a short order cook at the Break-An-Egg Restaurant.On a typical day,he drives the following distances: Home to Midnight Motel 4 miles

Midnight Motel to restaurant 12 miles

Restaurant to home 8 miles

How many miles per day would qualify as transportation expenses for tax purposes?

A)12.

B)0)

C)4)

D)24.

Midnight Motel to restaurant 12 miles

Restaurant to home 8 miles

How many miles per day would qualify as transportation expenses for tax purposes?

A)12.

B)0)

C)4)

D)24.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

55

If an activity is considered a hobby,which of the following is true?

A)None of the expenses connected with the activity are deductible.

B)The deductible expenses connected with the activity are limited to the income from the activity.

C)The IRS has the burden to prove an activity is a hobby.

D)None of the income connected with the activity is included in income.

A)None of the expenses connected with the activity are deductible.

B)The deductible expenses connected with the activity are limited to the income from the activity.

C)The IRS has the burden to prove an activity is a hobby.

D)None of the income connected with the activity is included in income.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

56

Katherine earned $100,000 from her job at a local business in 2016.She also had $42,000 in self-employed consulting income.What is the amount of her self-employment tax rounded to the nearest dollar?

A)$6,426.

B)$0.

C)$3,419.

D)$6,333.

A)$6,426.

B)$0.

C)$3,419.

D)$6,333.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

57

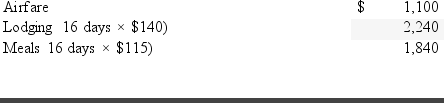

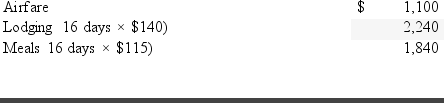

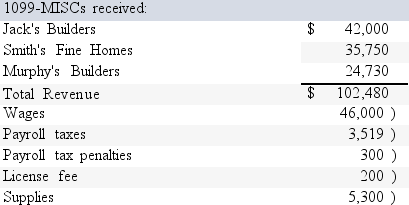

Byron took a business trip from Philadelphia to Rome.He was away 16 days of which he spent 9 days on business including two travel days)and 7 days vacationing.His expenses are as follows:  Byron's total travel including meals and lodging)expense deduction rounded to the nearest dollar is:

Byron's total travel including meals and lodging)expense deduction rounded to the nearest dollar is:

A)$2,878.

B)$2,396.

C)$3,395.

D)$5,180.

Byron's total travel including meals and lodging)expense deduction rounded to the nearest dollar is:

Byron's total travel including meals and lodging)expense deduction rounded to the nearest dollar is:A)$2,878.

B)$2,396.

C)$3,395.

D)$5,180.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

58

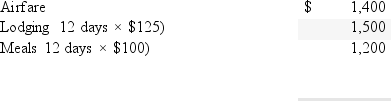

Bart has the following income and expenses for his Schedule C:

What is Bart's self-employment income?

What is Bart's self-employment income?

What is Bart's self-employment income?

What is Bart's self-employment income?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

59

What form is filed to report the self-employment tax?

A)Schedule SE.

B)Form 1040.

C)Schedule C.

D)Schedule D.

A)Schedule SE.

B)Form 1040.

C)Schedule C.

D)Schedule D.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following statements is false with respect to the standard mileage rate?

A)The standard mileage rate encompasses depreciation.

B)Section 179 cannot be used on a standard mileage rate auto.

C)The taxpayer can have an unlimited number of autos and use the mileage rate.

D)The standard mileage rate cannot be used on a taxi.

A)The standard mileage rate encompasses depreciation.

B)Section 179 cannot be used on a standard mileage rate auto.

C)The taxpayer can have an unlimited number of autos and use the mileage rate.

D)The standard mileage rate cannot be used on a taxi.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

61

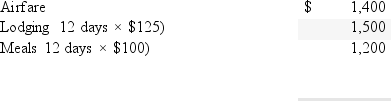

Bob took a business trip from Chicago to London.He was away 12 days of which he spent six days on business including two travel days)and six days vacationing.His expenses are as follows:

Calculate Bob's travel expense deduction.

Calculate Bob's travel expense deduction.

Calculate Bob's travel expense deduction.

Calculate Bob's travel expense deduction.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

62

Oscar bought an $800,000 apartment building on July 28,2016.On August 15,2016,he purchased

$300,000 of 5-year class assets.Oscar elects to take the maximum expense on every asset.What is the maximum cost recovery deduction Oscar can take in 2016?

$300,000 of 5-year class assets.Oscar elects to take the maximum expense on every asset.What is the maximum cost recovery deduction Oscar can take in 2016?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

63

List and define the criteria for an expenditure to be deductible on Schedule C.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

64

Terry,a CPA,flew from Dallas to New York to attend a conference.The conference lasted four days.Then she took three days of vacation to go sightseeing.Terry's expenses for the trip are as follows:

Calculate Terry's travel expense deduction.

Calculate Terry's travel expense deduction.

Calculate Terry's travel expense deduction.

Calculate Terry's travel expense deduction.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

65

Describe each of the depreciation conventions and when each is applicable.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

66

Alice is a high school teacher who enjoys knitting.She knits scarves and sweaters and sells them in a local boutique.Alice spends 10 to 15 hours a week knitting the scarves and sweaters.Alice had sales of $6,000 and expenses of $10,000 related to knitting and selling the goods.Alice's $10,000 of expenses consisted of $800 of interest expense and $1,600 in property taxes for her building and tools,$3,000 in supplies,and $4,600 in depreciation charges.How would Alice's income and expenses be reported on her tax return if her knitting activity is characterized as a hobby?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

67

Tonia acquires the following 5-year class property in 2016:

Asse t

Date of Acquisition Cost

Tonia does not elect §179 or bonus depreciation.Tonia has $300,000 of taxable income from her business.Determine her total cost recovery deduction for the year.

Tonia does not elect §179 or bonus depreciation.Tonia has $300,000 of taxable income from her business.Determine her total cost recovery deduction for the year.

Asse t

Date of Acquisition Cost

Tonia does not elect §179 or bonus depreciation.Tonia has $300,000 of taxable income from her business.Determine her total cost recovery deduction for the year.

Tonia does not elect §179 or bonus depreciation.Tonia has $300,000 of taxable income from her business.Determine her total cost recovery deduction for the year.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

68

Lateefah purchased a new office building on April 1,2016,for $3,000,000.On August 20,2020,the building was sold.What is the cost recovery deduction for the year of purchase and the year of sale?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

69

Ted purchased a vehicle for business and personal use.In 2016,Ted used the vehicle 70% for business 10,000 business miles)and used the standard mileage rate to calculate his vehicle expenses.Ted also paid $1,200 in interest and $380 in county property tax on the car.What is the total business deduction related to business use of the car in 2016?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

70

Sandy is the owner of ABC Loan Company.On June 2,2015,ABC loaned Randy $80,000.In 2016,Randy filed for bankruptcy.At that time,the bankruptcy court indicated that Randy's creditors could expect to receive 30 cents on the dollar.In August 2017 final settlement was made,and ABC received $20,000.ABC's policy is to deduct losses as soon as permitted.How much loss can ABC deduct and in which year?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

71

Nancy purchased a computer on July 15,2016,for $5,000.The computer was used 70% of the time in her business and the rest of the time her children used the computer to surf the Web.In 2017,the computer was used 40% for business and 60% for personal use.What are the cost recovery deductions for 2016 and 2017? No §179 or bonus).Is there any recapture of depreciation in 2017?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

72

On April 23,2016,Bailey purchased an automobile for $25,000.The car is used 80% for business and 20% for personal use.What is the cost recovery deduction for 2016 and 2017 assuming the 50% bonus was taken? Round answers to the nearest dollar)

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

73

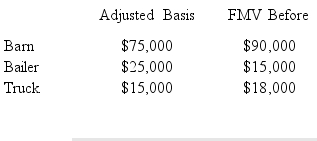

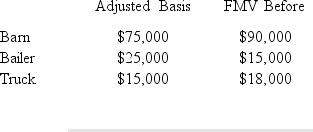

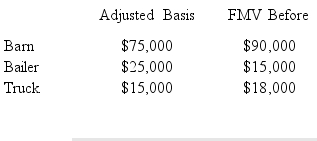

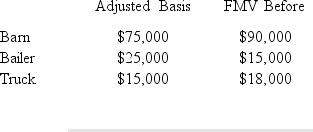

Alan owns a ranch in Kansas.During the year,a tornado damaged one of his barns and destroyed some equipment.The following information provides the details of the losses Alan suffered from the tornado.

FMV

After

After

Insurance Proceeds

$ 40,000 $30,000

$ 0 $15,000

$ 0 $10,000

How much loss from the tornado can he deduct on his tax return for the current year?

FMV

After

AfterInsurance Proceeds

$ 40,000 $30,000

$ 0 $15,000

$ 0 $10,000

How much loss from the tornado can he deduct on his tax return for the current year?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

74

Kiri acquires equipment 7-year property)on August 14,2016,for $80,000.She does not elect to expense the asset under Section 179 or the 50% bonus.She sells the asset on January 15,2020.

a.What is Kiri's cost recovery deduction related to the equipment in 2016 and 2020?

b.What is Kiri's cost recovery deduction related to the equipment in 2016 and 2020 if the 50% bonus is elected?

a.What is Kiri's cost recovery deduction related to the equipment in 2016 and 2020?

b.What is Kiri's cost recovery deduction related to the equipment in 2016 and 2020 if the 50% bonus is elected?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

75

Xavier bought furniture and fixtures 7-year property)on September 15,2016 for $505,000.He elects to expense as much as possible under Section 179 but does not elect the 50% bonus.Xavier's earned income for the year is $500,000.What is the maximum deduction Xavier can take in 2016 for the equipment? Round answers to the nearest dollar)

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

76

Beau earned $25,000 of net earnings from a tax preparation business that he runs during tax season.He also earned a salary of $100,000 from his full-time job.How much self-employment tax must he pay for 2016? Round calculations to the nearest dollar)

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck